In modern society, rental relations are still widespread. This applies not only to companies, but also to individuals. Enterprises often operate on rented premises. As the work progresses, improvements to the space are made according to needs.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

General information about integral improvements

The group of inseparable improvements includes changes in quality, due to which the object becomes more valuable. What are these types of improvements aimed at?

- Availability of a wider range of functionality.

- Better technical properties and parameters.

- Improvement.

After the repair is completed, the objects in this case do not acquire any new qualities. And the technical characteristics do not undergo significant improvements. Therefore, repairs are not considered inseparable improvements.

These improvements are considered:

- Technical equipment.

- Modernization.

- Reconstruction.

- Completion.

- Retrofitting.

How to evict a person from an apartment? What reasons are needed for this, read the material at the link.

Inseparable changes are considered to be those types of improvements that cannot later be dismantled or removed without serious destruction of the object.

Rules for accounting for tenant improvements

In this case, the main requirement is written consent from the landlord . Such consent is drawn up in the form of a separate document or as an additional agreement.

Among the most favorable situations is the owner’s consent not only to the repair itself, but also to compensation of funds, at least partially.

Then it is the owner who has the responsibility to calculate depreciation. At the end of the lease period, the property is returned by the owners, including any improvements made. What about taxes?

How to register a dacha as your property? See this article for the procedure.

This point is important, even taking into account that initially the owner of the inseparable improvements is the lessor.

In this case, the tax authorities require several actions:

- Charge VAT on the cost of improvements according to market indicators.

- Inclusion of compensation amounts in sales revenue. This is done on the same day when the act confirming acceptance of the work is signed.

Permanent leasehold improvements.

If expenses are not reimbursed, is it worth continuing to rent the property?

Then the tenant credits the inseparable improvements to his own balance sheet . Depreciation does not stop as long as the lease is in effect. Separately, they are engaged in establishing the useful life, based on a specially introduced classifier.

Depreciable capital investments do not imply the application of a special bonus. But this provision can be challenged in court.

Is the balcony included in the total area of the apartment? In which case this needs to be taken into account, you will find out in the link.

You can extend the lease agreement:

- Renewing the contract with a new one.

- Extending the validity period of the original document. This is resolved by drawing up an additional agreement, after which the tenant continues to operate the property.

In the second case, depreciation continues according to the usual scheme. Otherwise, such accruals cease to be calculated when the first contract terminates. Even if an act on the direct transfer of the inseparable improvements themselves was not drawn up.

When renting real estate, contracts with a period of 12 months or more require mandatory state registration. This is necessary even if the agreement is concluded for 11 months and then extended.

Otherwise, it is impossible to recognize expenses associated with this agreement. But in court it can be proven that registration for extended documents is not necessary.

What about losses in residual value?

A typical example is the end of the lease period in the presence of improvements that have not fully undergone depreciation. Then the residual value of the improvements cannot be taken into account in income tax expenses.

There are several options for terminating a contract.

- Dismantling improvements. But even in such situations, you should not wait for balances to appear on your account.

- When improvements are given to the owner free of charge. In this case, an act of acceptance and transfer is drawn up. The cost of valuables transferred free of charge is not included in expenses.

What can cottage insurance protect against? See the insurance procedure and conditions here.

Property subject to redemption

At the end of the lease, the property is often purchased by the tenants . Do depreciation processes continue for permanent improvements in this case? At one time, officials had only a negative answer to this question.

But in 2012, the conclusion in such situations changed, for the better. But resolving the issue involves combining under-depreciated amounts with the original cost of the object for which the redemption is being issued.

Work in rented premises.

Cost recovery or improvement department

When considering the consequences of implementing different types of improvements, one should proceed from three main possible types of situations in relations between counterparties to a transaction:

- the tenant has received the landlord’s consent to carry out improvements (the so-called acceptance), and the latter is not against reimbursement of their cost in cash;

- the tenant has received acceptance for the changes, but the owner of the property does not want to reimburse their cost;

- the tenant did not receive the landlord's acceptance for the improvements.

The last case is the simplest and most clearly regulated by the legislator. In the case of separable improvements, the tenant has the right to dismantle them and secure them on his private property. At the same time, he provides (returns) the exploited property to the lessor in the form in which it was originally accepted after the conclusion of the transaction. From a legal point of view, the situation with inseparable improvements is more complex for the tenant. It is important to pay attention to the moment of loss of property and damage. The tenant cannot take them back, but he cannot claim compensation for the costs incurred. Therefore, before physically carrying out improvements, it is very important that the owner of the property or the person leasing it accepts it. Improvements made with the consent of the lessor can be recognized as depreciable property in accordance with Article 256 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation). However, it should be noted that the owner of these improvements will be the landlord. According to Article 623 of the Civil Code of the Russian Federation, improvements made with the consent of the lessor are his property. A more complex situation is when the tenant has made some improvements to the leased property with the consent of the lessor, but the latter does not express a desire to reimburse their cost or give the latter, if they are separable, to the lessee (regardless of the verbal agreements of the counterparties established previously). In this case, the employer will not be able to receive reimbursement of costs. However, a solution can be found by analyzing tax legislation. In general, the taxation process for properties that have undergone improvements varies depending on three main criteria:

- type of improvement (separable or not);

- the presence of the landlord's acceptance for improvements;

- availability of the lessor's acceptance to reimburse the tenant's expenses.

How is the landlord's accounting carried out if the tenant decides to improve the property?

Expenses on this issue are reflected in documents according to the same rules as expenses associated with the reconstruction, completion, and modernization of facilities.

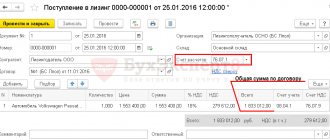

Such improvements have a cost that may increase the original price of the property. Then they are written off as a debit to account 01. Accounting on this account can be carried out separately. In this case, you need to open a separate inventory card.

If there is compensation, expenses must be recorded with a debit to account 08 and a credit to account 60 (76). It is mandatory to indicate the amount of compensation. If there is no compensation, then the general procedure is applied.

Where is a certificate of ownership of an apartment issued? Read the link to find out where to go to receive it.

Such improvements are not taken into account when calculating income taxes. The lessor receives these improvements free of charge. Therefore, he does not have the right to deduct the amount of VAT.

What about accounting?

Separate inventory items will be considered inseparable improvements that are the property of the tenant. To put them into operation, the head of the enterprise issues a separate order.

Using the transfer and acceptance certificate OS-1 as a supplement. And an OS6 inventory card. An important requirement is compliance between improvements and fixed asset criteria.

- Debit 001. The main leased asset is reflected on the balance sheet.

- Account 08 is used to collect the initial cost. The indicator has the form of costs incurred, actual amounts.

- Then the debit will be 08. And the credit has the numbers 69, 70, 10, 76, 60, 23.

- After this, they proceed to commissioning. And they put debit 01 - credit 08.

Beneficial use is determined depending on general grounds. Or it will be approximately the same as the rental period of the object.

The property, along with improvements, is transferred back to the landlords when the main agreement ends. Tenants themselves are advised to include the cost of balances as other expenses.

Improvements for which compensation has not been provided may become a separate accounting object. This issue can be resolved by increasing the initial cost of the objects.

How to restore documents for an apartment in case of damage, loss or theft? Step-by-step instructions in this publication.

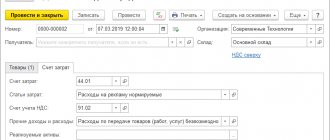

Then the wiring looks like this.

- When the property is returned to the lessor, Credit 01 is issued.

- The disposal of fixed assets is carried out according to Debit 01. Credit 01 is applied by writing off the initial improvements.

- When writing off initial depreciation, set Debit 02 – Credit 01.

- The cost of balances from improvements is written off as follows: Debit 91-2, Credit 01.

- If VAT is charged for the market value - Debit 91 - Credit 68.

Accounting scheme.

What risks are associated with VAT?

They follow from part of the provisions in Article 256 of the Tax Code . If, when calculating tax, the costs of an inseparable improvement are not taken into account, then it will be very problematic to prove that the funds should be recognized as VAT objects. Control authorities closely monitor how calculations are carried out in this area.

Accounting and tax accounting of inseparable improvements to leased property

Can the tenant register a fire alarm costing 98,691 rubles as part of fixed assets and write off its cost in accounting during the lease period - 11 months? Is it possible to immediately write off its cost as material expenses in tax accounting? The landlord agrees to inseparable improvements; the costs will not be compensated.

Fedik Inna Leontievna, expert in accounting, tax and management accounting of the reference and legal service Kontur.Normative

conclusions

Often owners are interested in indicating the full cost. For example, if it is necessary to legalize profits before the owner goes to foreign countries. In this regard, the costs of notary services associated with the object and the preparation of documents for it increase.

It is possible to receive compensation for carrying out inseparable improvements. But only if the issue is properly regulated, even at the time of negotiations.

The tenant must coordinate each decision with the owner of the property. Especially if the need for improvements arose after the lease was concluded. Otherwise, no compensation is provided by law.

The main thing is not to forget that the capital improvement of the premises is not included in the category of inseparable improvements. This condition changes only if the parties themselves have provided for other solutions in the contract.

You will learn about what permanent improvements to a leased property are from this video:

VAT deduction on inseparable improvements: position of the Plenum of the Supreme Arbitration Court

If the tenant plans to carry out work to improve the leased property, first of all he needs to find out whether the landlord agrees to them. If yes, then it is recommended to include in the lease agreement (or an additional agreement to it, if the lease agreement has already been drawn up):

- description of the work associated with improving the rental property (remember, here we distinguish between separable and inseparable improvements - Article 623 of the Civil Code of the Russian Federation);

- source of financing for the work (further we will talk about inseparable improvements);

- the procedure for determining the cost of inseparable improvements (in case of compensation).

All this is important, because the deduction of “input” VAT on goods (work, services) used to create inseparable improvements to the rental property will depend on the terms of the contract.

Not long ago, the Plenum of the Supreme Arbitration Court drew attention to this in Resolution No. 33 of May 30, 2014 “On some issues that arise in arbitration courts when considering cases related to the collection of value added tax.” The conclusions made in paragraph 26 of this document are the focus of our attention today.

So, the deduction of “input” VAT on inseparable improvements will depend on the terms of the contract. In paragraph 26 of Resolution No. 33 , the Plenum of the Supreme Arbitration Court considered three possible situations:

- the lessor compensates for the cost of inseparable improvements;

- inseparable improvements are part of the rent;

- The tenant makes capital investments in the leased object in addition to paying rent to the lessor, and their cost is not compensated.