Who are small businesses?

A small enterprise is a small company registered as a peasant farm, LLC or individual entrepreneur and meets several parameters established by law.

After the Federal Law “On Amendments...” dated June 29, 2015 came into force, the conditions for classification as small businesses changed significantly and additional benefits appeared. Table 1: Small enterprise: inclusion criteria in 2020 and 2014

| Condition | Was (2014) | Became (2015-2016) |

| The amount of revenue from the sale of goods for the previous year | No more than 400 million rubles. | Not higher than 800 million rubles. |

| Average number of employees | No more than 100 people | |

| Share of foreign organizations in the authorized capital | Maximum 25% | Increased to 49% |

Thus, for small businesses, only the number of employees has remained unchanged, and increasing the size of investments provides a number of undoubted advantages:

- The opportunity to purchase the most modern technology and other equipment for the development of the company in the event that the previously established fixed capital was not designed for this.

- Increased profits and turnover.

- Improving product quality.

- Wider opportunities for business development.

Recently, the Government of the Russian Federation has taken a course towards popularizing small innovative enterprises engaged in the development and implementation of new programs and technologies, the creation and production of goods, the provision of services and work. Most often, such organizations are located at various universities and research institutes, work in the economic or scientific and technical fields, and foreign investors prefer to invest their money in them.

https://youtu.be/Wlypoa1pm1M

Basic criteria for small business

To be considered a small, medium or micro enterprise in 2020, you must meet this definition according to three main parameters:

• fall within the income limit;

• fall within the limit on the number of employees (the number of small businesses should not exceed 100 people);

• fall within the limit on the share of participation of other companies in the authorized capital.

Companies and entrepreneurs are considered small business representatives, regardless of the tax regime, if they meet the conditions. These can be companies and individual entrepreneurs using the simplified tax system, UTII, patent, OSN.

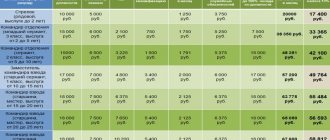

From 08/01/2016, the calculation of the maximum amount of income for the past year includes not just all cash receipts, but all income according to the tax return. We present the criteria for classifying an enterprise as small in the form of a table.

Basic criteria for small business

To be considered a small, medium or micro enterprise in 2020, you must meet this definition according to three main parameters:

• fall within the income limit;

• fall within the limit on the number of employees (the number of small businesses should not exceed 100 people);

• fall within the limit on the share of participation of other companies in the authorized capital.

Companies and entrepreneurs are considered small business representatives, regardless of the tax regime, if they meet the conditions. These can be companies and individual entrepreneurs using the simplified tax system, UTII, patent, OSN.

From 08/01/2016, the calculation of the maximum amount of income for the past year includes not just all cash receipts, but all income according to the tax return. We present the criteria for classifying an enterprise as small in the form of a table.

Basic criteria for small business

To be considered a small, medium or micro enterprise in 2020, you must meet this definition according to three main parameters:

• fall within the income limit;

• fall within the limit on the number of employees (the number of small businesses should not exceed 100 people);

• fall within the limit on the share of participation of other companies in the authorized capital.

Companies and entrepreneurs are considered small business representatives, regardless of the tax regime, if they meet the conditions. These can be companies and individual entrepreneurs using the simplified tax system, UTII, patent, OSN.

From 08/01/2016, the calculation of the maximum amount of income for the past year includes not just all cash receipts, but all income according to the tax return. We present the criteria for classifying an enterprise as small in the form of a table.

Another significant factor is the share of capital participation. Let's supplement the criteria for small businesses 2020.

The number of employees in 2020 is determined based on the average number of employees, a report on which is submitted annually to the tax office.

As for shares in the authorized capital, Federal Law No. 209 of July 24, 2007 provides for exceptions. Limits do not apply to:

• shareholders of the high-tech (innovative) sector of the economy;

• participants of the Skolkovo project;

• companies that practically apply the latest technologies developed by their founders - budgetary or scientific institutions;

• companies whose founders are included in the government list of persons providing state support for innovation activities.

But income for the past tax period is estimated based on tax returns.

The Federal Tax Service clarified what a small and medium-sized business is: the 2020 classification criteria are contained in letter No. 14-2-04 dated August 18, 2016/ [email protected]

Microenterprise and small enterprise: the difference

A microenterprise is a subgroup of a small business entity that meets certain criteria.

You can trace the difference between micro and small enterprise here: Table 2: Difference between micro and small business

| Condition | Microenterprise | Small business |

| Maximum number of employees | 15 people | 100 people |

| Maximum revenue value | 120 million rubles. | 800 million rubles. |

| Share of foreign investments | 49% | |

Advantages of creating micro-enterprises:

- Reduced tax rate (9%) for individual entrepreneurs.

- There is no need to provide the opinion of a sworn auditor when submitting annual reports to the Federal Tax Service.

- No obligations for advance payments of income tax.

- Possibility of part-time work at several business entities for employees of a micro-company.

There are also some downsides here:

- Some benefits are closed to employees.

- The same accounting rules for all forms of corporate tax payments.

- Changing the status from a micro-enterprise tax payer to a personal or company income tax payer is possible only after the end of the tax period.

- When an employee works only in a micro-enterprise, the amount of benefits from the Social Insurance Service is reduced.

Speaking about small business, the list of advantages expands significantly:

- Maintaining financial statements in a simplified form.

- Exemption from VAT if the amount of revenue from the sale of goods for the last quarter exceeds RUB 2,000,000.

- Possibility of using simplified tax system.

The transition to the simplified tax system frees you from accounting, but it can only be carried out if over the last 9 months the individual entrepreneur has received no more than 15,000,000 rubles. revenue, and the residual value of intangible assets and fixed assets is no more than 100,000,000 rubles. There are no exemptions for legal entities.

Disadvantages of creating a small business entity:

- Greater dependence on larger organizations.

- Unstable exchange rates.

- Difficulties in attracting investors from other countries, because in most cases they are interested in larger investments and, accordingly, profits.

Multiply by two

The government is currently considering changing the criteria for classifying companies as small and medium-sized businesses. This order was given by President Vladimir Putin in early April. In this regard, “Opora Rossii” proposes to almost double the thresholds for the average number of employees and revenue by which firms are classified as SMEs:

— for microenterprises — up to 30 people and annual revenue up to 200 million rubles;

— for small enterprises — up to 200 people and annual revenue up to 1.6 billion rubles;

— for medium-sized enterprises — up to 500 people and annual revenue up to 4 billion rubles.

Such adjustments will allow more organizations to qualify for anti-crisis government support measures and develop in the existing economic conditions, the letter says.

Izvestia Help

Today, SMEs include micro-enterprises with revenues of up to 120 million rubles and the number of employees up to 15 people, small firms with revenues of up to 800 million rubles and the number of employees up to 100 people, as well as medium-sized companies with revenues of up to 2 billion rubles and no more than 250 employees . According to the Unified Register of SMEs, the number of such firms in Russia is 5.9 million as of the beginning of April 2020.

However, for certain industries the thresholds should be expanded even further, as follows from the appeal of “Opora Rossii” to the Cabinet of Ministers. For example, it is proposed to include hotels with up to 700 employees and producers of handicrafts with up to 1 thousand employees as medium-sized businesses. However, the exception should be “human-intensive” cleaning and cleaning activities: micro-enterprises in this area should number up to 200 employees, small firms - up to 1 thousand people, and medium-sized ones - up to 3 thousand. According to the letter from Opora Russia, duty-free shops with revenues of up to 10 billion rubles per year should also be considered medium-sized enterprises.

Wider circle: The State Duma is preparing a third package of anti-crisis laws

Deputies are discussing tax cuts and wage subsidies with the government

In addition, the business association proposes to consider SMEs as business entities whose only participants are consumer associations and unions related to large businesses. This will allow them to receive government support and will generally have a positive impact on the business climate, Opora Russia is confident.

The Cabinet of Ministers and the Ministry of Economic Development did not answer Izvestia’s question about how they evaluate the initiatives of the business association. The Ministry of Finance forwarded the question to the Ministry of Economy.

Previously, the government approved the sectors of the economy that were most affected by the introduction of quarantine. These included air travel, tourism, culture, physical education and recreation, hotel business, catering, additional education, exhibitions, personal services, zoos, cinemas, dentistry and non-food retail.

It is for small and medium-sized enterprises in these areas that state support measures announced by the president apply. Among them are a deferment of taxes (except VAT) and insurance premiums, a moratorium on bankruptcy at the request of creditors, the opportunity to receive a preferential loan for employee salaries at 0%, as well as a free subsidy in the amount of the minimum wage for employee compensation. All measures will cost the budget 2 trillion rubles (1.8% of GDP).

However, this list may be expanded if the epidemiological situation worsens, the authorities noted. Thus, on April 21, Minister of Economic Development Maxim Reshetnikov said that the government was preparing both the third and fourth packages of anti-crisis support measures. He emphasized that even in a favorable scenario, the lifting of quarantine will occur in stages, which means that businesses will have to work in limited conditions for a long time.

Do small businesses need confirmation of their status?

To be classified as a small business, it is enough that the company meets the specified criteria, i.e. no confirmation is needed: when submitting annual reports, the Federal Tax Service sees the results of financial activities.

If a legal entity needs to confirm the composition of the participants of an LLC, this can be done using a decision on establishment or an extract from the Unified State Register of Legal Entities, which can be ordered on the website of the Federal Tax Service.

Features of the activities of a small enterprise

The legislation does not establish any specific features of the activities of SMEs. Accordingly, such nuances can arise only due to the use of certain benefits by the taxpayer.

For example, if a small business decides to use the cash method for accounting, then in this case accounts receivable will actually cease to be reflected in the accounting. This means that you will have to monitor this parameter based on information from other sources.

In addition, you need to remember that the cash method in accounting is not at all equivalent to the cash method for the purposes of the simplified tax system. Thus, the amounts of advances received do not form accounting income, whereas under the simplified tax system they will be income at the time of receipt to the account or cash desk (clause 1 of Article 346.17 of the Tax Code of the Russian Federation). Accordingly, such discrepancies must also be taken into account so as not to underestimate the amount of tax or advance payments for it.

In conclusion, we note that all small and medium-sized businesses must periodically check the availability of information about them in a special register maintained by the Federal Tax Service. You can correct incorrect information through the form on the service website. And, of course, it is necessary to track the main criteria that give the right to be considered an SSE in 2020 - revenue, average headcount and restrictions on the composition of participants.

What benefits are provided for small businesses?

Subject to compliance with the criteria established by law, subjects receive many benefits:

- The absence of a cash limit and the ability to store any amount in the cash register: for this, it is enough to issue an order from the head of the company.

- Increased likelihood of receiving subsidies from local authorities.

- Until July 1, 2020, it is possible to purchase municipal or state real estate on a preferential basis.

- Reducing the time frame for non-tax audits.

- Tax holidays for organizations working in the social, industrial or scientific spheres.

Also, a bill was introduced to the State Duma exempting all entrepreneurs from January 1, 2020 from supervisory inspections, if they had not previously been deprived of their licenses and did not commit gross violations in the process of conducting their activities.

You can find out more in this video: