Home / News and changes

Back

Published: 04/19/2019

Reading time: 3 min

0

72

Value added tax is an indirect duty that is paid by the seller of goods, works, services or property rights upon their sale. Its use is regulated by the Tax Code of the Russian Federation (Articles 143-178).

- Legislative changes in 2020

- Who is affected by the VAT rate change?

- New VAT rate

- What tariffs remain unchanged in 2020

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

Who will be affected by the new law?

The innovations will affect entrepreneurs who charge their clients and counterparties VAT . Obviously, these are companies subject to the general tax regime - OSN. Payers of UTII, PSN and simplified taxes will not be affected in any way by the innovation. They will not have to change accounting, reconfigure online cash registers or update software.

Also, nothing changes for those who work at a reduced VAT rate - 10% or 0%. These are sellers of medical and children's goods, books (10% rate) and those who issue licenses and collect duties (0% rate).

However, if you do not work with VAT, do not rush to rejoice. Even if technically everything remains in place, there are some things you should prepare for. This is the next point.

VAT reporting

The VAT return is submitted based on the results of each quarter no later than the 25th day of the following month.

Note: starting from 2014, VAT returns are submitted only in electronic form. Submitting reports on paper while being required to submit them electronically will be equated by the tax authority to failure to submit a return at all.

In addition to the tax return, VAT payers are required to maintain tax accounting registers: books of purchases and sales.

https://youtu.be/-QrJfCVCPyM

What all entrepreneurs need to do, regardless of tax regime

What is a VAT increase on the fingers? This is a price increase. From January 1, 2020, everything you buy and order from contractors who charge value added tax will become 2% more expensive . This is on average. Some of the suppliers will quietly raise prices higher, others will sacrifice their profits and raise prices, say, by a percentage. But it is a fact that purchasing prices will generally increase.

Therefore , the first thing you need to do is prepare for additional expenses . It will be the hardest for those who conduct business at the limit, penny to penny. In any case, reserves need to be found. Then this money will come back - after all, you yourself will most likely raise retail prices for your goods or services. But at first you will have to spend a little more.

Who is included in the VAT payers?

At first glance it seems that the subject, i.e. The VAT payer is the party selling the product or service. From a legal point of view this is true, but in fact the buyer pays the tax. To understand why this happens, you should consider the algorithm for its formation in practice.

So, for example, a certain enterprise purchases raw materials from a counterparty for its own production. After settlement with the supplier, the company determines the cost of the future product, including VAT. However, at this stage it is not accrued, but is only included in the “tax credit” category.

After the product has been manufactured, its selling price is assigned, which includes production costs, excise taxes, a markup constituting “net” profit, as well as VAT. Thus, the tax is included in the sales price that the buyer ultimately pays.

After selling a batch of goods, the company determines the amount of “net” profit, *20% of which will be value added tax.

*20% — VAT

Thus, the category of VAT payers includes:

- legal entities and individual entrepreneurs engaged in the paid sale of goods, works or services;

- companies and individuals bringing goods to Russia by crossing the customs borders of the state.

Objects of taxation

Based on Article 146 of the Tax Code of the Russian Federation, the following items are subject to VAT:

- provision of services;

- manufacturing jobs;

- sale of goods;

- import of movable objects.

The main condition under which a business transaction is subject to VAT is its sale on the territory of the Russian Federation.

VAT rates and calculation

Despite the fact that calculating this tax is quite difficult, subjects do it on their own. The calculation is made in the following order:

- the amount of mandatory collection is determined for all transactions carried out in the reporting period;

- the amount of deduction for each operation is determined;

- The amount to be paid to the budget is calculated.

Read also: Payroll fund

As for rates, today entities pay VAT in the amount of:

- 10%;

- 20% (18% until 2020);

- 0%.

A rate of 10% is applied when selling:

- agricultural products;

- fish and other marine products;

- some products for children;

- medicines, medical equipment and equipment;

- printing products.

The zero rate “works” in relation to:

- some types of transport operations, including international transport;

- works and services for organizing and holding sporting events;

- imported goods;

- forwarding activities;

- mining of precious and rare earth metals;

- work related to servicing the foreign diplomatic corps;

- export sales of fuels and lubricants.

In all other situations, the standard rate applies - 20% (18% until 2020).

How to prepare for a VAT increase

Update software. This applies to the 1C Accounting program and similar ones. From January 1, 2020, the system should begin to charge value added tax at 20%. If you have a licensed version of the program, this will not be difficult - just download and install the appropriate updates. If you encounter any difficulties, please contact technical support.

If you don’t have time and don’t want to upgrade programs, you can turn to specialists. This is especially true for non-standard 1C configurations. There are plenty of offers for this service on the market. An experienced programmer or system administrator will easily solve this problem.

For those who use online accounting

Many online stores use online accounting provided by banks, fiscal data operators and other companies. These are the luckiest of all. Service providers are already working hard on this issue and, for the most part, are ready for the transition. Users of online accounting are beginning to receive notifications with detailed instructions for the transition.

If you use online accounting, contact your online accounting partner and request a plan of action. In most cases this will be free. All systems will automatically switch to a 20% VAT rate from January 1 next year.

What should I do if I do my accounting the old fashioned way - in an Excel spreadsheet?

The program will need to change all formulas and templates. Instead of 18 percent, we set 20 (or 120 instead of 118), after which the system itself will begin to calculate prices in a new way. You can do this yourself or contact a specialist. If you have an accountant or system administrator on staff, entrust this work to them.

The only nuance here is to catch the right moment. We explain: the program should start calculating VAT at 20% from the first of January . If in the case of 1C or online accounting this happens automatically, then with Excel everything will have to be done manually. That is, you will have to change formulas with templates on the night of December 31 to January 1. Or before the first working day after the New Year holidays.

The situation with a tax agent: changes in 2020

If a foreign company has a tax agent who participates in payments, the obligation to calculate and pay VAT lies with the intermediaries.

If several intermediaries are involved in payments, then the tax agent will be the intermediary through whom payments are directly made to clients. If this intermediary turns out to be a foreign company that is not registered with the Russian tax authorities, such a company will be required to register with the Russian tax authorities.

If a foreign company provides some of its electronic services through agents, then the agents will calculate, pay and report VAT on those services.

What are the features of the application of the VAT rate by tax agents purchasing goods (work, services), the place of sale of which is recognized as the Russian Federation, from foreign entities not registered with the tax authorities, as well as by tax agents leasing their property from government authorities? (clauses 1-3 of Article 161 of the Tax Code of the Russian Federation).

If payment was made before 01/01/2019, then the 18/118 rate applies regardless of when the goods (work, services) were shipped by the seller - before 01/01/2019 or after the specified date.

If payment is made after 01/01/2019, then for goods (work, services) shipped before 01/01/2019, the rate of 18/118 is applied, and for those shipped after - 20/120 (clause 2.1 of the Letter of the Federal Tax Service dated 10/23/2018 No. SD -4-3/ [email protected] ).

What to do with the online cash register

The cash register must punch a receipt with a VAT rate of 20% from January 1, 2020. To do this, the device needs to be updated . The change in the VAT rate is also tied to a change in the format of fiscal documents - FFD. For those who are not in the know: a cash receipt is a fiscal document. And from next year it will be different - the composition of the details indicated on the check will change.

Nowadays, most cash registers work with FFD version 1.0. To switch to work at the new rate, they need to be updated to version 1.05. After updating, the receipt will automatically indicate the new VAT rate - 20%.

How can you find out the version of the FFD your cash register uses? There are several ways to do this:

- look at the shift opening report. This is a small receipt that the cash register prints out when it starts at the beginning of the working day. The current version of the format of fiscal documents is indicated there;

- There is also an indication of the FFD in the online cash register settings. Study the menu and find the item “FFD version number”;

- go to your personal account on the website of your fiscal data operator - OFD. There, the FFD version number can be found in any cash receipt;

- in the personal account of the cash register, the version of the fiscal data format can also be indicated. Go to the “Terminals” item and see if the FFD number is there.

If the version number of your FFD is 1.0, the cash register needs to be updated to version 1.05 . You can set up the cashier’s workplace yourself or contact the company that sold you the cash register. When working independently, be careful: incorrect actions can block the cash register or lead to the replacement of the fiscal drive.

If you have FFD version 1.05, you don’t need to do anything. Everything will happen automatically and from January 1, VAT rates on cash receipts will change from 18 to 20 percent.

In addition to the format of fiscal receipts, you may have to reflash the cash register itself . Check with the supplier or manufacturer of the cash register device whether the device is ready to work under the new law and changes in the VAT amount. Also carefully monitor notifications from the fiscal data operator and the online cash register manufacturer. Important information regarding the transition may appear there. Information can be sent to your email, to your personal cash register account, or to the cash register itself.

1.4. Application of the VAT tax rate when returning goods from 01/01/2019.

Application of VAT by the seller

In accordance with paragraph 5 of Article 171 of the Code, tax amounts presented by the seller to the buyer and paid by the seller to the budget when selling goods are subject to deductions in the event of the return of these goods (including during the warranty period) to the seller or refusal of them.

According to paragraph 4 of Article 172 of the Code, deductions of the specified tax amounts are made in full after the corresponding adjustment operations in connection with the return of goods or refusal of goods are reflected in the accounting records, but no later than one year from the date of return or refusal.

Based on the provisions of paragraph 13 of Article 171 and paragraph 10 of Article 172 of the Code, when the cost of shipped goods changes downwards, including in the case of a decrease in the number of goods shipped, the basis for deducting VAT from the seller is the adjustment invoice issued by the seller.

In connection with the above, when returning from 01/01/2019 the entire batch (or part) of goods, both accepted and not accepted by buyers, it is recommended that the seller issue adjustment invoices for the cost of goods returned by the buyer, regardless of the period of shipment of the goods, that is, until 01/01/2019 or from the specified date.

Moreover, if in column 7 of the invoice for which the adjustment invoice was drawn up, a tax rate of 18 percent is indicated, then in column 7 of the adjustment invoice the tax rate of 18 percent is also indicated.

When returning from 01.01.2019 goods paid for by persons who are not VAT taxpayers and (or) taxpayers exempt from fulfilling taxpayer obligations related to the calculation and payment of tax, to whom invoices are not issued, and shipped (transferred) to the specified persons before 01/01/2019, an adjustment document is registered in the purchase book containing summary (consolidated) data on return transactions made during the calendar month (quarter), regardless of the readings of cash register equipment.

Application of VAT by the buyer

By virtue of paragraph 1 of Article 172 of the Code, deductions of VAT amounts presented by the seller to the buyer when he purchases goods are made on the basis of invoices issued by sellers upon shipment of these goods, after accepting these goods for registration and in the presence of relevant primary documents.

According to subparagraph 4 of paragraph 3 of Article 170 of the Code, tax amounts accepted for deduction by the taxpayer on goods (work, services), including fixed assets and intangible assets, property rights in the manner prescribed by Chapter 21 of the Code, are subject to restoration by the taxpayer in the event of a change in value of shipped goods (work, services), transferred property rights in a downward direction, including in the case of a decrease in price (tariff) and (or) a decrease in the quantity (volume) of shipped goods (work, services), transferred property rights.

Taking into account the above, if the buyer has accepted for deduction the amounts of tax presented to him for the goods he accepted for registration, then the restoration of the VAT amounts in accordance with subparagraph 4 of paragraph 3 of Article 170 of the Code is carried out by the buyer on the basis of an adjustment invoice received from the seller, regardless of the period shipment of goods, that is, until 01/01/2019 or from the specified date.

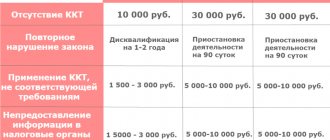

What happens if you don't update your cash register?

Nothing good. Firstly, if you do not change the format of fiscal documents to the current version, the cash register may generally stop sending OFD data to the tax office . In the worst case scenario, this could be classified as operating without an online cash register at all. The fines for such tricks are the highest - from 30 thousand rubles for legal entities. Individual entrepreneurs will pay a little less - from 10 thousand. If the VAT rate is not changed from 18 to 20%, the violation falls under the article on the use of cash register equipment that does not meet the established requirements. For this, an individual entrepreneur will pay from 1.5 to 3 thousand rubles, and an organization will pay from 5 to 10 thousand.

Don’t forget that the cash register is online to keep all entrepreneurs under control. The tax office will see immediately that you have not changed the VAT amount - it only needs to make a request to the fiscal data operator.

But there is also good news. According to a letter from the Federal Tax Service dated December 13, 2020, no one will be fined during the first quarter . This time is given to those who did not have time to update their cash registers to work with the new VAT rate. According to some data, there are about 40% of the total number of registered online cash registers.

In this case, the VAT rate of 18 percent will be indicated on the cash receipt, but in all reporting documents the tax must be 20%. Selling goods and providing services also requires VAT of 20%.

Correction in 2020 of the invoice for goods shipped before 01/01/2019

What to do if goods (work, services) were shipped with VAT at a rate of 18% before 01/01/2019, and after this date there was a change in value (including in the case of a change in price or clarification of the quantity of goods)? In this case, the seller issues an adjustment invoice to the buyer.

The tax rate on the adjustment invoice is the one in effect on the date of shipment. Consequently, in column 7 “Tax rate” of the adjustment invoice, the rate is 18%, not 20% (clause 1.2 of the Federal Tax Service Letter No. SD-4-3/ [email protected] dated ).

Let us remind you that the invoice is corrected by drawing up a new copy in which the invoice number and date are not changed, but line 1a is filled in, where the serial number of the correction is indicated and the date of the correction is indicated. Column 7 “Tax rate” of the amended invoice indicates the VAT rate that was in effect on the date of shipment.

Let’s assume that the seller shipped goods subject to a VAT rate of 18% before 01/01/2019. When the buyer returns goods after 01/01/2019, the seller must issue an adjustment invoice for the cost of the returned goods. At the same time, in column 7 “Tax rate” of the adjustment invoice, the VAT rate of 18% is indicated.

Please note that it does not matter whether the buyer accepted the goods for registration or not. Accordingly, the buyer recovers VAT on returned goods based on the adjustment invoice received from the seller (clause 1.4 of the Federal Tax Service Letter No. SD-4-3/ [email protected] ).

- foodstuffs;

- Products for children;

- printed publications and books;

- medical goods of domestic and foreign production;

- transportation services.

A 10% rate can be applied to the sale of such goods and services both when sold within the country and when imported into Russia from other countries. Specific names of goods are specified in the code. And for food and children's products, the Government additionally approves special lists with names and codes (Decree No. 908 dated December 31, 2004, with additions and amendments).

How to switch to payments to suppliers? What to do with contracts?

Everything would be fine, if not for one “but”. Mutual settlements with suppliers, contracts and balance sheets are not reset to zero at the click of a finger from December 31 to January 1. There are a million options related to deferred payments, advances and prepayments. What to do if the goods were shipped in 2020 at a tax rate of 18%, and you will only pay for it next year, when VAT of 20% will apply to everything? And vice versa, did you pay in advance for products that will only be delivered to you next year? At what rate is it calculated?

The tax office itself answered these and many other questions in its explanatory letter dated October 23. The document explains the specifics of applying tax rates during the transition from 18% to 20. We will provide several examples from this letter.

Example 1 - the supplier delivers goods, fully paid for in 2020, only at the beginning of 2020. In this case, the tax on advance payment is calculated at the old rate of 18%, and the tax on shipment is calculated at 20%. In this case, the advance tax should be reduced.

Example 2 - the goods were delivered in 2018, but in 2019 the price for the already delivered products changes. In this case, as before, the seller makes changes to the adjustment form, and the tax is calculated based on the rate of 18 percent.

Example 3 - the buyer refuses the goods paid for in 2020 at the beginning of 2020. An adjustment form is also needed here. The seller issues an invoice for the refund amount using the old VAT rate of 18%.

How is VAT calculated?

VAT on the amount at a rate of 20% is calculated using the formula:

VAT = amount_without_VAT × 20 / 100

or using a simpler formula:

VAT = amount_without_VAT * 0.2

If you need to allocate VAT 20% from the amount that already contains VAT is determined using the expression:

VAT = amount_with_VAT / 1.20 × 0.20

What transactions are not subject to VAT?

The list of transactions not subject to value added tax includes:

- relations arising from real estate lease agreements with foreign citizens or non-resident companies officially operating on the territory of the Russian Federation;

- sale of prosthetic and orthopedic equipment, as well as raw materials and components for its production;

- sale of equipment and transport designed for the movement, rehabilitation and socialization of disabled people;

- production and sale of glasses, lenses for vision correction and related frames;

- provision of compulsory health insurance services;

- provision of paid medical care related to the detection and treatment of diseases, including services for collecting donor blood, caring for bedridden patients, pregnancy management, etc.;

- services of teachers and nannies of kindergartens, as well as teachers of clubs and sections of out-of-school education.

An exhaustive list of transactions exempt from value added tax is specified in Art. 149 of the Tax Code of the Russian Federation.

Important features of VAT calculation

When determining the amount of VAT to be paid, the entity must take into account some important points. In particular, if the object of taxation is goods imported from abroad and paid for in foreign currency, their value is recalculated into rubles at the rate of the Central Bank of the Russian Federation. Moreover, the exchange rate is taken into account at the time of filing the declaration.

When calculating VAT on other categories of goods and services, the prices indicated in the invoices are taken as calculation data. As for declarations for this tax, they are submitted electronically using specialized computer programs.

Read also: What do you pay when you resign at your own request?

VAT calculation methods

Tax legislation offers three methods for calculating VAT:

- addition - VAT is defined as the product of the tax rate, the salary of one employee, “net” income and interest on each category of goods. This method has a noticeable drawback, namely the impossibility of total control over the calculation and payment of tax. Because of this, addition is rarely used as a primary method;

- deduction - the amount of tax payable is calculated as the product of the rate by the difference between revenue and the cost of goods sold. This method is more often used in enterprises because it allows the use of counter-checks to control tax payment.

- invoice method – considered the main method of calculating VAT. When using it, VAT is reflected in the invoice as the product of the commodity value and the tax rate. The seller provides the invoice to the buyer, and keeps one copy of it. The VAT payable is determined as the difference in taxes indicated on the invoices of the seller and the buyer.

Some tips on how to act during the transition period

Tip 1 - close all transactions as much as possible before the end of the year. Pay suppliers for shipped goods before the end of the year. If possible, do not make advance payments so as not to get confused later.

Tip 2 - ask suppliers to deliver all orders by the end of the year. From the letter from the Federal Tax Service it is clear that goods supplied in 2020 are subject to 20% VAT, even if they were paid for in 2018. To avoid these difficulties, agree with your counterparties on shipment before the end of the current year.

Tip 3 - hire an accountant for the transition period. You can easily get confused yourself. If there are many suppliers and lots of goods, there is a risk of confusion with VAT rates during the transition period. An experienced specialist will take into account all the nuances and calculate taxes correctly. A very good option is to connect online accounting. Check with your bank to see if they provide this service.

Let us remind you: if you open an online store on the InSales platform, you don’t have to worry about accounting . Your website will have hundreds of ready-made integrations, including with online accounting. If you do this before the new year, then there will be no problems with the transition to new VAT rates. You can also transfer an already operating online store to the InSales platform, and then connect online accounting.

Betting options in 2020

In 2020, there will be a gradation of rates: 0, 10, 20%. And settlement rates will also function: 20/120.10/110, 16.67%.

The table shows the main gradations of rates for changes in 2019. (click to expand)

| Bid | Link to law | Situation until 2020 | The situation after 2020 | Notes |

| 20% | Clause 3.Article 164 of the Tax Code of the Russian Federation | It was 18%. | From 10/01/2019, what was previously taxed at a rate of 18% will be taxed at 20% | Applies to most operations. |

| 10% | Clause 2.Article 164 of the Tax Code of the Russian Federation | 10% | 10% | For certain products: food, children's products, medical products, socially significant products |

| 0% | Clause 1 of Article 164 of the Tax Code of the Russian Federation | 0% | 0% | For export, international transport |

| 16,67% | clause 4 of article 158, clause 5 of article 174.2 of the Tax Code of the Russian Federation | 15,25% | 16,67% | Applies to the implementation of: an enterprise as a whole as a property complex, when foreign companies provide services to individuals in electronic form. |

The table below shows the features of the 20/220 and 10/110 bets.

| Bid | Link to law | Note | Application |

| 20/120 | Clause 4.Article 164 of the Tax Code of the Russian Federation | Apply when the tax base already includes VAT (advances, VAT withholding by the agent). | When goods are taxed at 20% |

| 10/110 | When goods are subject to 10% tax |

The meaning of these rates is the possibility of isolating the amount of VAT.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |