A mortgage loan is always a story about saving money for a down payment, you say. In fact, this is not so, experts will answer and give the example of a mortgage without paying a starting amount. Domofond.ru decided to look into the situation and find out what kind of offer this is, whether it is profitable and what is worth considering if you need to take out a mortgage, but don’t yet have savings for a down payment.

In the modern real estate market, there are offers for mortgages without a down payment, but there are practically few of them. The explanation for the limited number of such programs is very simple - it is not profitable for banks to issue loans without any guarantees. After all, if the borrower goes bankrupt, the credit institution will have to bear the costs associated with the sale of the collateral real estate, to which the costs of litigation may be added.

“Banks really have reason not to trust borrowers who do not have the required amount for a down payment: if a person has not been able to save a small part of the cost of real estate, the seriousness of his intentions and financial discipline are in doubt,” says managing partner of VectorStroyFinance Andrei Kolochinsky.

That is why banks that provide the opportunity to obtain a mortgage loan without savings insure their risks as much as possible. For example, they increase the lending rate or impose additional insurance requirements.

Mortgage conditions without down payment

For a “mortgage without a down payment,” some banks often issue an ordinary consumer loan secured by real estate, not purchased, but existing, and the rate can easily exceed 15% per annum, comments Anton Barulin, commercial director of Seven Suns Development.

In addition, the value of the collateral property should not be less than the amount of the loan issued. Therefore, you will need to prove to the bank, especially if you have a secondary home, that in the worst case scenario they can actually sell it and get their money back. Confirmation is usually an appraiser's report, for which the owner - you - will have to pay.

Another guarantor of collateral can be a plot of land, a car, precious metals, or securities. But each such asset must be highly liquid and attractive to the bank in the event of its sale.

Ways to get a mortgage without a down payment

To become the owner of real estate without large savings, they use various programs and offers from banks.

These options include:

- Registration of current real estate from the secondary market into additional collateral.

- Attracting guarantors.

- Participation in projects with state support, when the state subsidy is accepted as a down payment.

- Promotional offers from developers and banks.

In addition to zero-payment lending programs, it is possible to obtain a separate non-targeted loan to contribute the amount towards the mortgage or borrow from third parties. There are many ways to solve the housing problem. There would be a desire to make an effort and take advantage of the opportunities provided.

Secured by real estate

When a bank talks about the possibility of getting a mortgage with a zero down payment by pledging real estate as collateral, we are not talking about a mortgaged apartment or room. It is important for the lender to take as additional collateral another piece of property already registered in the name of the borrower.

Like mortgaged housing, the object of additional collateral must be highly liquid, i.e., in case of problems with payments, it can be quickly sold to pay off the debt. Restrictions have also been established on the minimum estimated value of such collateral.

If the client already has his own residential property, you can try to coordinate a loan for existing housing with Rosselkhozbank, Sberbank, VTB, etc.

Borrow money

When there is no extra amount to make a contribution, the easiest way is to use the help of relatives. The problem may be a small shortfall in the amount required for the mortgage payment.

If there are no such wealthy citizens among those around you, they often use a scheme where money is borrowed from another banking institution for the first installment. When taking out a consumer loan, the client transfers them to pay the down payment, and then is forced to repay the debt on a non-targeted loan with a high interest overpayment.

Realizing the possibility of using such a scheme, some banks are ready to provide consumer loans themselves to form capital for the down payment. For example, DeltaCredit would prefer to make a profit on a consumer loan itself rather than require a contribution from the client to be credited by another institution.

If you need to find profitable non-targeted programs, it makes sense to study offers from Surgutneftegazbank, Rosevrobank, Alfa-Bank. From time to time, each credit institution launches preferential offers with record low rates.

Maternal certificate

Many large financial institutions work with government programs. These include the family capital program. If the bank cooperates with the Pension Fund of the Russian Federation and is ready to use amounts from a family certificate instead of personal funds to make a down payment, all that remains is to agree on the conditions under which the transaction can take place:

- requirements for the property put forward by the Pension Fund and the lender;

- the amount within the funds on the family certificate;

- allocation of shares to all family members in the purchased property guaranteed through a notarial obligation.

After approval of the application and disbursement of the entire amount (100% of the transaction price), the client contacts the Pension Fund and agrees to repay part of the loan with funds from maternal capital. It takes about 2 months to resolve the issue.

Subsidies and benefits from the state

In addition to maternity capital, there are many other socially oriented programs. Each region has its own subsidy and preferential real estate registration programs.

For example, in the Moscow region, a teacher from the region has the right to count on a social mortgage, freed from the need to pay a down payment. There are similar programs for other public sector workers – doctors, scientists.

Persons under 35 years of age have a chance to take part in programs for young families, when part of the rent (up to 35%) is contributed from the budget.

Citizens who apply to social security authorities in the regions and receive the required status can take advantage of the benefits.

For military personnel, preferential military mortgages are widely used, when, after a certain period, an amount allocated by the state accumulates in a separate account. Subsequently, these funds are subject to targeted use for the purchase of housing, including for a contribution on a military mortgage.

Promotions from the developer

In the context of the decline in demand for real estate, developers have been especially affected, forced to fight for each new buyer. Construction companies offer preferential terms to their clients in the form of:

- installments for the payment of the first installment;

- receiving a discount on the contribution amount.

This offer allows buyers of housing under construction to complete a transaction on the most favorable terms; they just need to regularly monitor the products offered by construction organizations.

Loan from the developer

It will be easier to agree on a mortgage only for a new building if you involve a developer to help. Interested in a new client, a construction organization enters into an agreement with banks in order to implement unique offers issued through the developer.

The advantages of such cooperation include:

- favorable loan parameters;

- individual selection taking into account the capabilities of the future owner;

- quick response to your application with a high chance of approval.

The absence of the need to provide documents confirming the borrower’s income increases the chances of a positive consideration of the application, and the optionality of insurance provides additional annual savings.

The disadvantages of such cooperation include the too short loan period: no more than 2-3 years, and more often within a year, which allows us to talk not about a mortgage loan, but about installment payment.

All kinds of bank programs

The fall in demand for bank credit services is caused by the general debt burden of the population and the lack of free money supply. Nevertheless, the need to solve housing issues remains, and clients are looking for the most profitable option for formalizing a credit relationship with a minimal overpayment to the bank.

Among the mortgage programs you can find promotional or individual offers designed for certain categories of citizens, taking into account their profession and age, etc.

Special requirements

Due to existing risks, banks are placing increased demands on borrowers who want to get a mortgage without a down payment. Thus, it is necessary to have a stable income, which is confirmed by a 2-NDFL certificate from the place of work. Individual entrepreneurs and business owners are unlikely to be able to get approval for such a loan, notes Andrey Kolochinsky.

Also, to obtain this mortgage, it is important to have an ideal credit history for the last 10 years.

“You must have closed loans without arrears in amounts from 500 thousand rubles and there must be no loans from microfinance organizations or frequent requests for them. Close attention will also be paid to the number of loans (if any) during the period of consideration of the mortgage application and the number of dependents in the family,” says Andrey Kolpakov, executive director of the credit agency KM Center.

Procedure and documents

The procedure for obtaining a mortgage without a down payment is no different from the procedure for obtaining a regular mortgage: selecting an object and bank - collecting documents - submitting an application - reviewing the application/approval - transaction and its closure.

As for the necessary documents, there is also a standard package of papers (passport, certified copy of the work book, documents confirming marital status), to which are added a 2-NDFL certificate and documents for collateral housing. Most likely, you will need papers confirming ownership of this property, as well as a real estate appraisal report.

State support programs

Another maneuver for obtaining a mortgage without a “down payment” can be called situations in which the bank’s requirements are met with the help of government support, for example, by raising funds under the “Young Family” program or maternity capital.

“On the one hand, this is not a zero-payment mortgage. On the other hand, the client minimizes the amount of his own invested funds. The same thing happens with the mechanism of military mortgages. Both the initial contribution and payments are formed from funds received into the serviceman’s individual account,” says Natalia Kuznetsova, General Director of the BON TON Academy of Sciences.

Down payment on mortgage

A down payment on a mortgage is the portion of the purchase price of a home that a borrower must have in cash to be approved for a mortgage loan.

This part is paid to the home seller by the borrower himself, and for the remaining part of the cost of the home he draws up a loan agreement for a home mortgage. Using borrowed funds from the bank, the borrower will pay off the home seller, and the residential premises will be pledged to the bank for the entire period of validity of the mortgage agreement and the encumbrance will be lifted only after full payment of the mortgage loan.

The minimum down payment on a mortgage at the moment is 20%, the average is 30%. Moreover, when considering an application for a loan, the minimum amount may be increased by the bank depending on the prevailing lending conditions.

Mortgages without a down payment are offered with rare exceptions.

The size of the down payment significantly influences the conditions for approving a mortgage loan: the higher the down payment, the greater the chances of obtaining a loan, since the bank’s risks are reduced on the one hand, and the burden of monthly payments is reduced on the other, which ultimately results in decent savings for borrower.

Recently, social mortgage programs have developed, both at the federal and regional levels. Their main advantage is that preferential categories of borrowers who do not have sufficient funds for a down payment on a mortgage have the opportunity to make it with the help of government social payments, for example:

- Young families - participants in the subprogram “Providing housing for young families” of the federal target program “Housing” for 2015 - 2021 are entitled to social payments in the amount of at least 30% of the estimated cost of housing for a young family without children, and at least 35% for young family with children.

- Young teachers who participate in regional preferential mortgage lending programs have the right to social benefits to pay the down payment on a mortgage in the amount of no more than 20% of the estimated cost of housing.

- Owners of a certificate for maternity capital , the amount of which is revised annually taking into account inflation and from January 1, 2021 is 453,026.0 rubles.

As for the holders of a maternity capital certificate, the adopted legislative changes dated May 23, 2015, Part 6, Article 10 of the Federal Law of December 29, 2006 No. 256-FZ “On additional measures of state support for families with children” extended the possibility of directing maternity capital funds to pay down payment on a loan (loan), without waiting for the child to reach three years of age, in connection with whose birth (adoption) the right to additional measures of state support has arisen.

"6. Funds (part of the funds) of maternal (family) capital can be used to pay the down payment and (or) repay the principal debt and pay interest on credits or borrowings for the purchase (construction) of residential premises, including mortgage loans provided to citizens under a loan agreement (loan agreement ), concluded with an organization, including a credit organization, regardless of the period that has expired from the date of birth (adoption) of the second, third child or subsequent children.”

Previously, until the child was three years old, maternity capital funds could only be used to repay the principal debt and pay interest on an already received housing mortgage loan.

Also, at present, almost all regions have established regional maternity capital at the birth of a third child, which can also be used to improve the family’s living conditions, including the down payment on a mortgage loan.

There are a number of other preferential categories of citizens who are provided with social support measures for mortgage lending. Regional preferential mortgage lending programs can be found on our portal in the “Social Mortgage in the Regions” section for your region of residence.

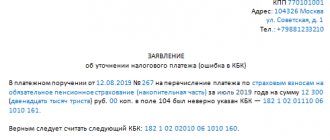

Inflated cost of housing in the contract

In the secondary housing market, you can often find a scheme with an inflated value of real estate in the contract. The example is simple: an apartment is sold for 4 million rubles, but on paper you write that it costs 5 million. Next, the seller writes a receipt that he allegedly received the money with a difference of 1 million. The bank considers this amount as a down payment and issues a mortgage for balance on standard terms.

“You need to understand that this is illegal. All analytical documents will act as evidence of such deception. And there is a big risk that the bank will expose you. There are a lot of options for what will happen next: from blacklisting you to opening a case of fraud,” warns construction company owner Maxim Lazovsky.

Whether you should take out a mortgage without a down payment or not is up to you to decide. However, before you make your final decision, consider all your options. Including preferential mortgages at 6.5%.

Which banks provide a mortgage without a down payment for a new building?

Young families prefer to take out a mortgage loan for an apartment in a new building, since the conditions here are more favorable. For example, the interest rate is an order of magnitude lower than when applying for a loan from a bank for a secondary home. In addition, there is now a real opportunity to take out a loan for housing without a down payment in a new building, and even for a bank this option is more preferable (this is due to the reduction of possible risks associated with insuring the property). Below are the banks that offer the most profitable programs:

- Zapsibkombank;

- Transcapitalbank;

- ActiveCapital Bank;

- Asia-Pacific Bank.

The conditions here are as follows: the minimum interest rate is from 11% per year, the maximum cost of housing purchased on credit is 20,000,000 rubles.

The following list offers lower interest rates for no down payment mortgages:

- Binbank;

- Russian Capital;

- Bank "Saint-Petersburg";

- Bank "FC Otkritie";

- Niko-Bank.

The rate - 9.75%, of course, is more attractive, however, in order to get a loan for a new building at such a percentage, you need to provide other real estate as collateral.

Necessary documents for obtaining a home loan without a down payment (the list is identical for both lists of banks):

- passport of a citizen of the Russian Federation,

- SNILS,

- proof of income.

In addition, each bank puts forward its own additional conditions for obtaining a housing loan.

It is necessary to note some more features of modern mortgage lending:

- All loans are issued exclusively in national currency. This allows you to avoid all the misunderstandings that arose between banks and borrowers during the 2008 crisis, after which the dollar exchange rate sharply increased and the value of real estate decreased (read about what will happen to foreign currency mortgages this year here:);

- Solving the housing problem with the help of a mortgage without a down payment is available only to citizens of the Russian Federation;

- It is most profitable to take out a mortgage for an apartment in a building under construction, no matter how strange it may sound. The thing is that by purchasing housing that has not yet been built, a person saves about 30-40% of its cost. This will compensate for the losses that the borrower will incur due to the inability to use the apartment until the building is put into operation (payments will be required according to the schedule from the moment the contract is signed). But here you also need to remember that in such situations, banks usually require existing real estate as collateral.