Zero reporting “Calculation of insurance premiums”: who must submit

Persons paying remuneration to employees are required, in accordance with the requirements of paragraph 7 of Article 431, to submit relevant reports quarterly. The absence of payments to employees does not exempt the organization from submitting the DAM to the inspection.

The Ministry of Finance, as well as the Federal Tax Service, explain in their explanations that in this situation the organization must submit a zero calculation report for insurance premiums (Letters of the Ministry of Finance dated 03/24/2017 No. 03-15-07/17273, Federal Tax Service dated 04/02/2018 No. GD-4-11 / [email protected] ).

https://www.youtube.com/watch{q}v=m4ECgq3PRuc

The obligation to submit the DAM is not canceled even if the duties of the general director are performed by the sole owner without concluding an employment contract, and there are no other employees in the organization yet. In this case, the report must contain the information of the general director in section 3.

Is it possible to rent out the DAM to a legal entity without a contract with the director?

In any case, a legal entity must have a director - otherwise it will not be able to enter into any legal relations on its own behalf. If the founder of a business company and the director are different people, then an employment contract must be concluded with the latter. Without a contract, the work of a manager will be considered forced, which is prohibited by Art. 4 Labor Code of the Russian Federation.

A civil law contract with the director should not be concluded - since, due to the specifics of the manager’s position, he performs a labor function constantly, and this presupposes the conclusion of an employment contract in accordance with the Labor Code of the Russian Federation. If the Labor Inspectorate learns about a different form of contract concluded with the general director, it can fine the company for not properly formalizing the employment contract - up to 100 thousand rubles. (clause 4 of article 5.27 of the Code of Administrative Offenses of the Russian Federation).

If an employment contract has been concluded with the director, then the general rule under Art. 419 of the Tax Code of the Russian Federation - the company will be recognized as “making” payments to an individual and, as a result, will be required to declare it under the DAM.

But if the director is the only founder, then an employment contract may not be concluded (letter of Rostrud dated 09/04/2015 No. 2065-6-1, determination of the Supreme Arbitration Court of the Russian Federation dated 06/05/2009 No. VAS-6362/09). The founder's income will be dividends, for which insurance premiums are not charged. What to do with the delivery of the DAM in this case (if it is agreed that the director is the only founder and does not hire employees or contractors for the company)?

On a literal reading of Art. 419 of the Tax Code of the Russian Federation, it is legitimate to assume that legal entities become obliged to submit the DAM, like individual entrepreneurs, strictly if they are considered to be “making payments.” That is, if they have a valid contract with an individual or several individuals. However, this criterion in the case of legal entities cannot be considered in its pure form.

In letter dated 05/06/2016 No. 08-22/6356, the Pension Fund of the Russian Federation (which previously accepted forms similar to the DAM) refers to clause 2.2 of Art. 11 of the Law “On Individual Accounting” dated April 1, 1996 No. 27-FZ. It says that reporting is submitted for each “employed person” (which may include a director - the only founder, even without an employment contract).

The Pension Fund, therefore, recommended submitting reports in this situation. By analogy, this advice applies to the RSV form. In addition, the Federal Tax Service, in its clarifications, recommends that legal entities submit the form in any case - even if there was no economic activity at all (letter of the Federal Tax Service of Russia dated April 2, 2018 No. GD-4-11 / [email protected] ).

Thus, a business company with a founding director decides for itself whether to strictly follow the norms of the Tax Code of the Russian Federation (and not submit a report) or, following the recommendations of government departments, spend a little time preparing a zero DAM.

Who is required to take zero marks?

All policyholders must submit calculations of insurance premiums for 9 months of 2020 to the Federal Tax Service. In particular:

- organizations and their separate structures;

- private entrepreneurs.

Also see “Reporting and settlement period for insurance premiums from 2017”.

Is it necessary to report for 9 months of 2020 if the organization or individual entrepreneur did not conduct any activities in the reporting period - from January to September inclusive{q} Is it required to submit a blank calculation to the Federal Tax Service if no one was paid a salary during this period{q} Finally -there were clear official clarifications on this matter, which brought more clarity to these issues.

From letters of the Ministry of Finance dated March 24, 2020 No. 03-15-07/17273 and the Federal Tax Service of Russia dated April 12, 2020 No. BS-4-11/6940, we can conclude that the above circumstances do not relieve an organization or individual entrepreneur from the obligation to report to the Federal Tax Service for the past 9 months of 2020. After all, the policyholder is still the payer of the premiums. Even if he does not conduct any activities. Here are key quotes from these letters.

| “If the payer of insurance premiums does not have payments in favor of individuals during a particular settlement (reporting) period, the payer is obliged to submit a calculation with zero indicators to the tax authority within the prescribed period.” |

| It turns out that the regulatory authorities clearly believe that a zero calculation for insurance premiums for 9 months of 2020 should be submitted to the tax office. Also see “Zero calculation of insurance premiums to the Federal Tax Service: is it necessary to submit in 2020.” Calculation of insurance premiums is submitted to the tax authorities by all organizations, without exception, and individual entrepreneurs who have concluded at least one employment contract or civil servants' agreement with individuals. It shows the amounts of contributions accrued for wages and other payments in favor of employees. The report should be made on the form put into effect by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551. The same order also established the procedure for filling out the calculation. The due date falls on the 30th day of the month following the reporting period. These include: first quarter, half year, 9 months, year.

IMPORTANT! The choice of delivery method depends on the average number of employees of the policyholder. If it does not exceed 25 people, then you can choose any form of delivery. If the SSC is more than 25 people, then there is no choice - you need to submit the calculation electronically. Is it necessary to report for the 3rd quarter of 2020 if the organization or individual entrepreneur did not conduct any activities in the reporting period - from January to September inclusive{q} Is it required to submit a blank calculation to the Federal Tax Service if no one was paid a salary during this period{q} Finally -there were clear official clarifications on this matter, which brought more clarity to these issues. From letters of the Ministry of Finance dated March 24, 2020 No. 03-15-07/17273 and the Federal Tax Service of Russia dated April 12, 2020 No. BS-4-11/6940, we can conclude that the above circumstances do not relieve an organization or individual entrepreneur from the obligation to report to the Federal Tax Service for past 3rd quarter of 2020. After all, the policyholder is still the payer of the premiums. Even if he does not conduct any activity. Here are key quotes from these letters. It turns out that the regulatory authorities clearly believe that a zero calculation for insurance premiums for the 3rd quarter of 2020 should be submitted to the tax office. |

Reporting on insurance premiums to the Social Insurance Fund

Since 2020, the administration of insurance premiums has been transferred to the tax office, which currently accepts reporting for periods starting from this moment. Its form was approved by Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/ [email protected]

It is necessary to submit a calculation of insurance premiums (DAM), which includes information from previous reports - RSV-1 and 4-FSS, to the Federal Tax Service. This document must contain information about contributions to pension, medical and social insurance (except for “injury”), as well as personalized information about employees.

As for individual information, its volume is slightly larger than in the previous RSV-1. They include the full name of each employee, passport details, and registration address.

For an example of filling out the RSV for submission to the Federal Tax Service, see this article.

The DAM must be submitted based on the results of each quarter no later than the 30th day of the next month (Clause 7, Article 431 of the Tax Code of the Russian Federation). In 2018, the deadlines for transferring the DAM are as follows:

- 05.2018 - for the 1st quarter;

- 07.2018 - for half a year;

- 10.2018 - for 9 months;

- 01.2019 - for 2020.

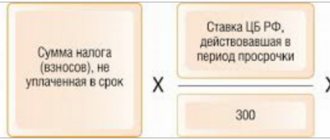

If the DAM is untimely submitted to the Federal Tax Service, the company will receive a fine (minimum amount - 1 thousand rubles), provided that the insurance premiums themselves are transferred to the state budget (clause 1 of Article 119 of the Tax Code of the Russian Federation). If this condition is not met, that is, the premiums are not paid, then a larger fine is provided - 5% for each full and incomplete calendar month of delay, but not more than 30% of the amount of insurance premiums in the DAM.

Payments for insurance premiums are submitted electronically if the company has more than 25 employees. If there are fewer employees in the organization, then the DAM can be submitted on paper.

According to Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016 No. 381, it is necessary to submit an updated 4-FSS reporting format to the fund. It excludes information on insurance in case of illness or maternity, but the following information must be provided:

- calculated base for contributions “for injuries”;

- information on the accrual, payment, offset (or non-offset) of insurance premiums;

- expenses associated with accidents and occupational diseases, as well as information about the affected persons;

- data from a special assessment of working conditions.

The 4-FSS must be submitted within a time frame that depends on the method of generating and submitting the report:

- if in electronic form with more than 25 employees, then no later than the 25th day of the month following the reporting quarter;

- if in paper form and the number of employees is 25 people or less, then the period becomes shorter by 5 days.

If companies fail to submit 4-FSS on time, a fine of 5% of the amount of insurance premiums for each full and incomplete calendar month is provided. The minimum fine is 1 thousand rubles, and the maximum is 30% of the amount of insurance premiums.

The report is regulated by Resolution of the Pension Fund Board of February 1, 2016 No. 83p. It must include information on all full-time employees and performers under GPC agreements. The SZV-M must be submitted no later than the 15th day of the month following the reporting month. If the deadline is violated, the organization is subject to penalties in accordance with Art. 17 of the Federal Law of April 1, 1996 No. 27-FZ, namely 500 rubles. for each person.

The report can be submitted in paper form (for fewer than 25 people) and must be submitted electronically (for 25 people or more). If this point is not taken into account, a fine of 1 thousand rubles is possible;

- SZV-STAZH

— if an employee quits and requests information about his work experience. The report is issued on the last working day of the resigning person or within 5 calendar days upon the usual request of employees;

- if the employee retires. SZV-STAZH must be sent to the Pension Fund within 3 calendar days;

- after the end of the calendar year. The report is submitted for all employees, and for 2020 - no later than March 1, 2020.

| Report | How often to take it | When to take it |

| Inspectorate of the Federal Tax Service | ||

| Calculation of insurance premiums (order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551) | Quarterly | No later than the 30th day of the month following the reporting or billing period |

| FSS | ||

| Calculation of 4-FSS for contributions for injuries (FSS order dated September 26, 2016 No. 381) | Quarterly | On paper no later than the 20th day of the month following the reporting or billing period. Electronically no later than the 25th of the same month |

| Pension Fund | ||

| Information about employees of SZV-M (PFR resolution No. 83p dated 02/01/2016) | Monthly | No later than the 15th day of the month following the reporting period |

| Information on the length of service of SZV-STAZH employees (PFR Resolution No. 3p dated January 11, 2017) | Annually | No later than March 1 of the year following the reporting year |

The 4-FSS report must be submitted to:

- all legal entities (and their separate divisions) - since they are automatically registered with the Social Insurance Fund as payers of contributions for injuries (subclauses 1 and 2 of Article 6 of the Law “On Accident Insurance” dated July 24, 1998 No. 125-FZ);

- Individual entrepreneurs who are registered with the Social Insurance Fund as payers of contributions for injuries (subclauses 3 and 4 of clause 1 of Article 6 of Law 125-FZ).

An individual entrepreneur ceases to be an insurer under injury programs if he is removed from registration with the Social Insurance Fund as a payer of contributions for injuries (subclauses 3 and 4 of clause 3 of Article 6 of Law 125-FZ). It does not matter whether there is a concluded contract with the employee and whether there are payments under it. As long as an individual entrepreneur is registered with the FSS, he needs to submit Form 4-FSS (even if he does not need to submit the DAM).

In turn, the need to submit Form 4-FSS does not establish an obligation for individual entrepreneurs to submit the DAM. It happens that certain regional offices of the Federal Tax Service request from individual entrepreneurs the calculation of contributions in question, based on the fact that such individual entrepreneurs report to the FSS, since for some other reason they have current registration there.

It is important for the employer not only to choose the correct address and meet the deadlines for submitting calculations for insurance premiums for 2020, but also to submit the report in the required format. It can be paper or electronic.

1. Title page.

2. Section 1 in its entirety, as well as:

- subsections 1.1 and 1.2, which relate to Appendix No. 1 to this section;

- Appendix No. 2 to this section.

3. Section 3 in full.

That is, if the DAM is zero (for example, in the absence of salary payments or economic indicators of the organization in general), then only its specified components are filled in.

Section 2 has a “narrow specialization”: it is filled out (in full) only by the heads of peasant (farm) households.

READ MORE: Reducing tax under the simplified tax system on insurance premiums

If the employer pays insurance premiums using additional tariffs (Article 428 of the Tax Code of the Russian Federation), then he also fills out subsection 1.3 relating to Appendix No. 1 to the first section. And if a preferential tariff is applied (Article 427 of the Tax Code of the Russian Federation), then in addition to the above mandatory elements of the report, appendices 5 to 8 are added to the first section.

If the employer paid sick leave or maternity leave, then he adds to the report:

- Appendix No. 3 to the first section;

- Appendix No. 4 to the first section - if special payments were made at the expense of the federal budget, assigned in excess of the normal amount of benefits established by the legislation on social insurance.

For example, such special payments include additional leave for persons injured as a result of the Chernobyl accident (Clause 5, Article 14 of the Law “On Social Protection of Citizens Victims of the Chernobyl Accident” dated May 15, 1991 No. 1244-1).

You can get acquainted with an example of calculating insurance premiums in 2020 by reading a special article on this topic.

Do they rent out RSV to individual entrepreneurs without employees?

Not only organizations, but also individual entrepreneurs are recognized as payers of social contributions. An entrepreneur can hire employees, or he can conduct business without hiring employees. An individual entrepreneur is not required to submit calculations for insurance premiums if there are no employees.

In this case, tax authorities may demand an explanation. Explain to them in writing that you are working without hiring employees.

If there are employees, but not working (on leave without pay, on maternity leave), then you will have to submit a single calculation for insurance premiums of zero.

Why do tax authorities need a zero calculation?

In letter No. 03-15-07/17273 of the Ministry of Finance of Russia dated March 24, 2020, it is explained that when submitting settlements with zero indicators to the Federal Tax Service, a company or individual entrepreneur declares the absence of payments and remuneration in a specific reporting period in favor of individuals who are subject to taxation insurance premiums. And accordingly - about the absence of amounts of contributions to be transferred for the same reporting period.

In addition, the submitted calculations with zero indicators allow tax inspectors to separate payers who do not make payments and other remunerations to individuals in a specific reporting period and do not conduct financial and economic activities from payers who violate the established deadline for submitting calculations. And, therefore, do not hold them accountable.

In our opinion, the logic of the representatives of the Russian Ministry of Finance is very strange. After all, in essence, they encourage those who cannot even be recognized as payers of insurance premiums to submit zero reports. The fact is that an organization or individual entrepreneur is considered a “payer of insurance premiums” only if it makes payments and rewards in favor of individuals. This is stated in regulations.

However, in this article we will not argue with the position of the Ministry of Finance and the Federal Tax Service. We will rely on the official position and assume that a zero calculation for insurance premiums for 9 months of 2020 must be submitted. Moreover, if a businessman does not have employees and pays insurance premiums only for himself, then he is not required to submit quarterly zero calculations for contributions to the tax office. Accordingly, entrepreneurs without employees do not have to worry about passing zeros. Also see “Insurance premiums of individual entrepreneurs “for themselves” in 2020: how much to pay to the Federal Tax Service.” However, in this article we will not argue with the position of the Ministry of Finance and the Federal Tax Service. We will rely on the official position and assume that a zero calculation for insurance premiums for the 3rd quarter of 2020 must be submitted. Moreover, if a businessman does not have employees and pays insurance premiums only for himself, then he is not required to submit quarterly zero calculations for contributions to the tax office. Accordingly, entrepreneurs without employees do not have to worry about passing zeros. |

Responsibility for failure to submit a calculation

Failure to submit a calculation with zero indicators entails the collection of a minimum fine under this article - in the amount of 1000 rubles. In addition, the authors of the letter explain why we still need to calculate insurance premiums with zero indicators. It helps tax authorities separate bona fide payers from unscrupulous ones.

Expert “NA” S.M. Lvovsky

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe

In what form is the RSV submitted?

The form in which you need to submit a report on social contributions payable to the budget is approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/ [email protected] It also details the rules and procedure for filling out the reporting form in Appendix 2.

Form RSV 2019

The reporting form is submitted to the tax office at the location of the organization. In addition to this report, payers of insurance premiums must submit two more personalized accounting forms to the Pension Fund of the Russian Federation:

- monthly SZV-M;

- annually SZV-STAZH.

As already noted, the calculation is filled in with data on insurance premiums accrued from wages, etc. However, it happens that salaries are not paid, for example, due to the suspension of activities. What to do in such a situation{q}

- Organizations must submit calculations in any case - whether they have payroll accruals or if they do not. It is believed that the company always has one insured person - the director. When the salary is not accrued or paid even to him, the report is filled in with zero indicators and sent to the tax authorities.

- Individual entrepreneurs working alone are not required to submit a zero calculation. However, if they have at least one unterminated employment contract, then they will have to report on contributions. At the same time, the entrepreneur’s employees may be on unpaid leave.

Based on all of the above, there may be several options for submitting zero settlements. Next, let's look at how to correctly draw up zero payments for contributions.

The ERSV form was approved by order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/ [email protected] If there are no numerical values of the calculated values to be transferred, not all of its sections are filled out. Letter of the Federal Tax Service dated April 12, 2017 No. BS-4-11/ [email protected] lists the required pages for such calculations. This:

- title page;

- section No. 1, combining information about the company’s obligations;

- Appendix 1 to Section 1 and its subsections:

- No. 1.1 (amount of contributions to compulsory pension insurance);

- No. 1.2 (contributions for compulsory medical insurance);

- Appendix No. 2 to Section 1 (calculation for OSS);

- Section No. 3 (personalized data of employees).

If such a calculation is made by the heads of peasant farms, then they will have to fill out the 2nd section and the 1st appendix to it.

RSV for the 2nd quarter of 2020: sample filling

Filing the DAM for the 2nd quarter of 2020 is mandatory for all employers - they must regularly report on the income of their employees, the amount of insurance contributions transferred to the budget from staff earnings and the amount of accrued and paid social benefits. The report is submitted to the tax office, which is the administrator of insurance premiums, with the exception of deductions for injuries.

Subsection 1.1 reflects information on contributions to pension insurance. The number of personnel and the amount of payments to employees is indicated here. So, in lines 010 and 020 you need to put the value “30”, which corresponds to the number of insured workers. Columns 030 show the amounts of payments to employees from the beginning of the year, for the last quarter and separately for each month of the past quarter. In the example in the DAM for the 2nd quarter of 2020, the amounts of accruals on employee income will be identical to the base for collecting insurance premiums, since there were no non-taxable payments, social benefits, or exceeding the maximum bases. In line 060 enter the values of calculated contributions for the half-year, for the 2nd quarter as a whole and with a monthly breakdown.

When the company has only a director

Is it necessary to submit a zero calculation for insurance premiums in 2020 if the organization has only a general director, and the company does not operate and does not pay salaries{q}

As we have already found out, according to the logic of officials, the Tax Code of the Russian Federation does not contain exceptions that would exempt an organization from the obligation to submit reports, even if it did not accrue any payments to anyone. Workers under an employment contract remain insured, despite the fact that they did not receive money. Following this, we can come to the conclusion that if only the director is on staff - the only founder, then the zero calculation for 9 months of 2020 still needs to be submitted.

As we have already found out, according to the logic of officials, the Tax Code of the Russian Federation does not contain exceptions that would exempt an organization from the obligation to submit reports, even if it did not accrue any payments to anyone. Workers under an employment contract remain insured, despite the fact that they did not receive money. Following this, we can come to the conclusion that if only the director is on staff - the only founder, then the zero calculation for the 3rd quarter of 2020 still needs to be submitted.

What is the deadline for submitting a single calculation of insurance premiums 2020 zero

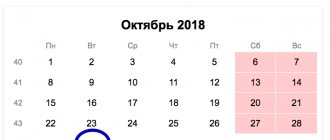

The deadlines for the provision of DAM are established by paragraph 7 of Article 431 of the Tax Code of the Russian Federation. ERSVR (zero calculation of insurance premiums) is submitted to the tax office no later than the 30th day of the month following the reporting quarter. If the deadline for delivery falls on a non-working weekend or holiday, then the deadline for delivery is postponed to the first next working day (clause 7 of Article 6.1 of the Tax Code of the Russian Federation).

| Period | Last day of delivery |

| 2018 | |

| 1st quarter | 03.05.2018 |

| Half year | 30.07.2018 |

| 9 months | 30.10.2018 |

| Year | 30.01.2019 |

| 2019 | |

| 1st quarter | 30.04.2019 |

| Half year | 30.07.2019 |

| 9 months | 30.10.2019 |

| Year | 30.01.2020 |

When to submit the “zero” for the 3rd quarter

The law does not provide for special deadlines for submitting a zero calculation for insurance premiums for the 3rd quarter of 2020. That is, the zero calculation must be submitted within the same time frame as the report that contains the information.

As a general rule, payments must be submitted to the Federal Tax Service no later than the 30th day of the month that follows the reporting period (Clause 7, Article 431 of the Tax Code of the Russian Federation). If the day of delivery falls on a weekend or holiday, you can submit the payment later - on the next working day (Article 6.1 of the Tax Code of the Russian Federation).

RSV: paper or electronic?

If the average number of individuals in whose favor payments are made for the previous settlement (reporting) period exceeded 25 people, and also if the newly created organization has more than 25 people, the calculation must be submitted to the tax office electronically.

However, a more common situation is when the number of employees of the organization (IP) submitting the zero calculation is less than 25 people. Consequently, she can submit the report on paper (clause 10 of Article 431 of the Tax Code of the Russian Federation).

1. In electronic form - if the average number of recipients of payments for the year preceding the reporting year (or for the reporting year, if the payer of contributions is a newly created organization) exceeds 25 people.

What are the sanctions for failure to submit the DAM?

Some organizations prefer to remain in the shadows and not appear before the tax authorities at all. In particular, they do not submit zero calculations for insurance premiums. We do not rule out that such companies will not submit a zero calculation for insurance premiums for the 3rd quarter of 2020. Let us explain what risks they take on in this case.

Blocking accounts

On our website we said that for failure to submit zero calculations for insurance premiums, current bank accounts can be blocked. The Federal Tax Service of Russia insisted on this. However, the Ministry of Finance did not agree with this.

Closer to the submission of reports for the 2nd quarter, tax authorities and financiers apparently came to an agreement on this issue. By letter of the Federal Tax Service dated May 10, 2017 No. AS-4-15/8659, an explanation from the Ministry of Finance was sent to the inspectorate stating that it is impossible to suspend transactions on accounts for late payment.

Fines

Since 2020, insurance premiums are regulated by the Tax Code of the Russian Federation. Therefore, for failure to submit a zero calculation for the 3rd quarter of 2020, the Federal Tax Service may fine you under paragraph 1 of Article 119 of the Tax Code of the Russian Federation. There are no accruals in “zero points”, so the fine will be minimal – 1000 rubles.

The calculation of the fine will not depend on the number of complete and partial months of failure to submit reports. However, in our opinion, it makes sense to send reports to controllers with zero indicators and protect the company from possible financial sanctions.

Some organizations prefer to remain in the shadows and not appear before the tax authorities at all. In particular, they do not submit zero calculations for insurance premiums. We do not rule out that such companies will not submit zero calculations for insurance premiums for 9 months of 2017. Let us explain what risks they take on in this case.

Fines

Since 2020, insurance premiums are regulated by the Tax Code of the Russian Federation. Therefore, for failure to submit a zero calculation for 9 months of 2020, the Federal Tax Service may fine you under paragraph 1 of Article 119 of the Tax Code of the Russian Federation. There are no accruals in “zero points”, so the fine will be minimal – 1000 rubles.

Also see “Insurance contributions to the Federal Tax Service: criminal liability since 2017.”

In general cases, failure to submit or delay in sending a contribution calculation may result in the imposition of various sanctions by the tax authorities. But what will happen if you don’t submit a zero calculation in a timely manner{q} Will a person be able to do without a fine in this case, because there are no charges in it{q} Answer: no, he won’t be able to. The fine will be mandatory, the tax authorities will simply impose it in the minimum amount - 1000 rubles, as provided for in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation.

Taking into account the above, an organization that does not pay any remuneration to individuals, like all others, must report to controllers on time. In addition, if you are more than 10 days late in submitting your report, the tax authorities will block the organization’s account—now they have the right to do so.

For failure to provide or untimely provision of DAM, the legislation of the Russian Federation establishes penalties. Even though a company that does not carry out activities reflects zero indicators in the report, the following sanctions may be applied to it:

- The minimum fine for failure to submit a report is RUB 1,000. (Article 119 of the Tax Code of the Russian Federation);

- administrative fine for an official of an organization - from 300 to 500 rubles. (Article 15.5 of the Code of Administrative Offenses of the Russian Federation);

- suspension of transactions on bank accounts (clause 6 of Article 6.1, clause 3.2 of Article 76 of the Tax Code of the Russian Federation);

- fine for failure to comply with the electronic form for submitting a report - 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation).

How to correctly fill out insurance premium calculations

We detail the information that needs to be included in the zero calculation of insurance premiums in 2020.

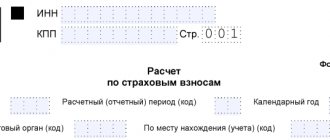

The title of the calculation reflects the following information:

- about the payer (payer status, his details - INN/KPP, OKVED code, contact phone number);

- about the tax authority to which the document is submitted;

- about the reporting period.

The title page is signed by a company representative (or authorized representative), which serves as confirmation of the information provided.

Section No. 1 records data on all types of insurance - compulsory and additional, for which the company pays premiums. Here the OKTMO code of the enterprise is indicated, and the corresponding BCCs are filled in by type of deduction. In section 1 and its subsections 1.1 and 1.2, instead of numbers, zeros are entered in the columns of accrual amounts for contributions and data for calculating the base.

Section No. 3 combines accounting information separately for each employee. The insured person's category code is assigned in accordance with the company's organizational form and tax regime. Their list is available in the above letter from the Federal Tax Service. Months are filled in in accordance with their generally accepted numbering, but only those in which the employee was employed by the insured.

The general rule for processing the calculation is continuous numbering of pages, filled-in INN/KPP fields on all pages, signature of the head (authorized representative) of the company and date. We offer our readers a sample of filling out a zero calculation for insurance premiums.

It is mandatory to fill out a zero calculation for insurance premiums for 2019 and include the following sections in the report:

- title page;

- section 1;

- subsections 1.1 and 1.2 of Appendix 1 to Section 1;

- appendix 2 to section 1;

- section 3.

The report must indicate: the name, INN and KPP of the organization, the period for which the DAM is submitted, and the tax authority code. All fields with totals must be filled in with zeros. Section 3 indicates the data of the organization’s employees (at least the general director). At the same time, due to the lack of accruals, subsection 3.2 does not need to be filled out.

Registration of ERSV for 2020

The report consists of 3 sections and 24 sheets, which display information about all insurance premiums, except for “accidental” ones. But you only need to fill out those that are mandatory and for which you have indicators.

Let's consider who should fill out which sheets when preparing reports for the 4th quarter of 2020.

| Sheet | Is it necessary to fill out | Who fills it out |

| Title | Yes | All policyholders |

| Sheet “Information about an individual who is not an individual entrepreneur” | No | Only individuals who are not registered as entrepreneurs |

| Section 1 | Yes | All |

| Annex 1 | Yes | Subsections 1.1 and 1.2 - filled out by all policyholders, Subsections 1.3, 1.3.1., 1.3.2, 1.4 are completed only if there are payments of contributions for additional tariffs |

| Appendix 2 | Yes | All employers indicate information about insurance premiums in case of temporary disability and maternity |

| Annexes 3 and 4 | No | Fill out only those employers who paid sick leave benefits in the reporting period |

| Appendix 5 | No | Filled out by IT firms that have the right to apply reduced tariffs |

| Appendix 6 | No | They are drawn up by simplifiers who have the right to apply reduced tariffs in accordance with paragraphs. 5 p. 1 art. 427 Tax Code of the Russian Federation |

| Appendix 7 | No | NPOs engaged in activities named in paragraphs. 7 clause 1 art. 427 of the Tax Code of the Russian Federation, which allows you to pay contributions at reduced rates |

| Appendix 8 | No | Businessmen apply for a patent, with the exception of those who work in catering, retail or rent out real estate |

| Appendix 9 | No | Designed for those employers who pay income to foreigners and/or persons temporarily staying in the Russian Federation |

| Appendix 10 | No | Issued only in relation to payments to students working in student teams under a GPC or labor agreement |

| Section 2 and Appendix 1 | No | Only heads of peasant farms in relation to contributions for themselves and members of the farm |

| Section 3 | Yes | Employers record pers. information on all hired persons |

FILLING SEQUENCE

Start with the title page. Then form Section. 3 for each employee who was registered with you in the 4th quarter. After this, fill out the Appendices to Section. 1. And last but not least, Section itself. 1.

Which sections to include in the zero calculation

Let’s assume that the accountant decided not to take risks and submit a zero calculation for the 3rd quarter of 2020 to the Federal Tax Service. But what sections should be included in it{q} In the letter of the Federal Tax Service of Russia dated April 12, 2020 No. BS-4-11/6940 it is reported that the empty calculation should include:

- title page;

- Section 1 “Summary of the obligations of the payer of insurance premiums”;

- Subsection 1.1 “Calculation of the amounts of insurance contributions for compulsory pension insurance” and subsection 1.2 “Calculation of the amounts of insurance contributions for compulsory health insurance” of Appendix 1 to Section 1;

- Appendix 2 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity” to Section 1;

- Section 3 “Personalized information about insured persons.”

The title page contains the details of the policyholder (TIN, KPP, name/full name, OKVED code, telephone numbers), and the tax authority accepting the settlement (code). It also reflects whether the original form or the corrective one is submitted (if necessary, the adjustment number), the reporting period and the year to which it relates.

All data is certified by the signature of an authorized person indicating the date of preparation or submission of the report.

Section 1 with all the subsections and appendices we have indicated will contain zeros on all lines with summative and quantitative indicators and dashes on the remaining familiarities. It is best to register the BCC in the fields provided for this in order to avoid problems with the generation of electronic reporting.

We will tell you what information needs to be entered into section 3 of the zero calculation in the next section.

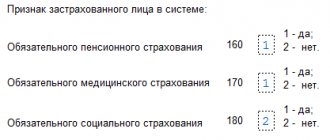

Section 3 contains information on each person insured in the compulsory health insurance system. In this case, it does not matter whether there were accruals in his favor during the reporting period or not (clause 22.1 of the Filling Out Procedure). Thus, the zero calculation for insurance premiums in Section 3 may include either employees who do not receive remuneration from their employer, for example due to being on unpaid leave, or a director - the only founder who also does not receive wages.

Subsection 3.1 contains information about whether the form is initial or corrective, the reporting period code, year, serial number and date of submission of information. Next comes the indication of all the data of the individual: TIN, SNILS, full name, date of birth, gender, code and details of the identity document, sign of the insured person in the OPS and Compulsory Medical Insurance systems.

Subsection 3.2 contains information about the amounts:

- remuneration in favor of individuals;

- accrued contributions to compulsory pension insurance.

According to clause 22.2 of the above Procedure, when submitting a zero calculation, subsection 3.2 is not filled out. However, you can also fill it out with zero values. The standard settings of most accounting programs are such that when you leave at your own expense, subsection 3.2 is automatically generated. The program will put down:

- in line 190 - months of the reporting period;

- in line 200 - code “НР”;

- Lines 210–240 print zeros.

Calculations with this design undergo format and logical control and are accepted by tax authorities.

Also see “Calculation of insurance premiums (DAM) for the 2nd quarter of 2017: example of filling out.”

Calculation of contributions for compulsory health insurance and compulsory health insurance – subsections 1.1 – 1.2 of Appendix 1 to section. 1

Complete section 3 separately for each employee. Please specify:

- in field 040 – a serial number that you define yourself. This can be either the number of personalized information in order (1, 2, 3, etc.) or the employee’s personnel number (Letter of the Federal Tax Service dated January 10, 2017 N BS-4-11/);

- in field 050 – the date of payment;

- in line 120 - for a Russian employee the code is “643”, for a foreigner - the code of his country from OKSM;

- in line 140 - code of the type of document identifying the employee. If it is a Russian passport, write “21”.

The category code of the insured person (column 200) for citizens of the Russian Federation is “NR”. Codes for foreigners: temporarily staying - VPNR, temporarily residing - VZHNR. If you pay contributions at reduced rates on the simplified tax system, the codes will be different: citizens of the Russian Federation - PNEED, temporarily staying foreigners - VPED, temporarily residing foreigners - VZhED.

In columns 210 - 250, show payments to the employee and accrued contributions to compulsory pension insurance from a base not exceeding the limit for the 4th quarter of 2018 - monthly and in total.

If payments were not accrued to the employee in the 4th quarter of 2020, then do not fill out subsection 3.2 (Letter of the Ministry of Finance dated September 21, 2017 No. 03-15-06/61030).

Payments to Potapov, a citizen of the Russian Federation, and contributions accrued from them to the compulsory pension insurance for the 4th quarter of 2020.

| Index | October | november | December | 4th quarter |

| All payments, rub. | 28 000 | 28 181,45 | 28 000 | 84 181,45 |

| Non-taxable payments, rub. | – | 4 602,90 | – | 4 602,90 |

| Contribution base, rub. | 28 000 | 23 578,55 | 28 000 | 79 578,55 |

| Contributions to community pension insurance, rub. | 6 160 | 5 187,28 | 6 160 | 17 507,28 |

In Appendix 3, reflect only benefits at the expense of the Social Insurance Fund accrued in 2020. The date of payment of the benefit and the period for which it was accrued do not matter. For example, reflect a benefit accrued at the end of December and paid in January 2020 in the calculation for 2020. Reflect the sick leave benefit, which is open in December and closed in January, only in the calculation for the 1st quarter of 2020 (Letter Federal Tax Service dated June 14, 2018 N BS-4-11/11512).

Enter all data on a cumulative basis from the beginning of 2020 to December 31 (clauses 12.2 – 12.4 of the Procedure for filling out the calculation).

In column 1, indicate on lines 010 – 031, 090 the number of cases for which benefits were accrued. For example, in line 010 - the number of sick days, and in line 030 - maternity leave. On lines 060 – 062, indicate the number of employees to whom benefits were accrued (clause 12.2 of the Procedure for filling out the calculation).

In column 2, reflect (clause 12.3 of the Procedure for filling out the calculation):

- in lines 010 – 031 and 070 – the number of days for which benefits were accrued at the expense of the Social Insurance Fund;

- in lines 060 – 062 – the number of monthly child care benefits. For example, if you paid benefits to two employees throughout the year, enter 24 in line 060;

- in lines 040, 050 and 090 - the number of benefits.

For 2020 the organization:

- paid for 3 sick days. At the expense of the Social Insurance Fund, 15 days were paid, the amount was 22,902.90 rubles;

- awarded one employee an allowance for caring for her first child for October, November, December, 7,179 rubles each. The amount of benefits for 3 months amounted to 21,537.00 rubles.

The total amount of benefits accrued is RUB 44,439.90. (22,902.90 rub. 21,537.00 rub.).

Basic tariff codes (line 001):

- 01 – organization on a general regime, charging contributions according to basic tariffs;

- 02 – organization on the simplified tax system with basic tariffs;

- 08 – organization on the simplified tax system with reduced tariffs, conducting preferential activities;

- 03 – UTII payer with basic tariffs.

The number of insured persons (line 010) – all employees registered in your organization, as well as those who work under the GPA. Line 010 may be larger than line 020. After all, line 010 will take into account workers on maternity leave who do not have payments subject to contributions.

The data on payments and contributions in subsection 1.1 must correspond to the data in section. 3 for all employees (clause 7 of Article 431 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated December 13, 2017 # GD-4-11/25417).

The organization in the general mode charges contributions at the basic tariffs. It employs 10 people, one of whom is on maternity leave. The amounts of payments and contributions for 2020 are shown in the table.

| Index | 9 months | October | november | December | year |

| Payments | 1 153 000 | 303 837 | 304 018,45 | 328 696 | 2 089 551,45 |

| Non-taxable payments | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

| Contribution base | 1 134 700 | 296 658 | 292 236,55 | 321 517 | 2 045 111,55 |

| Contributions: – to OPS | 249 634 | 65 264,76 | 64 292,04 | 70 733,74 | 449 924,54 |

| – on compulsory medical insurance | 57 869,70 | 15 129,56 | 14 904,06 | 16 397,37 | 104 300,69 |

In the “Payment attribute” field, put “2” (offset system), if you calculate and pay employee benefits yourself. If employees receive benefits directly from the Social Insurance Fund, put “1” (direct payments).

In line 070, indicate accrued benefits at the expense of the Social Insurance Fund. The date of payment of the benefit and the period for which it was accrued do not matter. For example, child care benefits for December were accrued on December 29 and paid on January 9. It must be shown in column 5 of line 070.

The amount in column 1 of line 070 of Appendix 2 must be equal to the amount in column 3 of line 100 of Appendix 3 to section. 1.

If the result is with the sign “ ”, that is, contributions to VNiM exceeded benefits from the Social Insurance Fund, in column 1 of line 090, put the sign “1”. If the value of the indicator turns out to have a “-“ sign, put the sign “2” (Letter of the Federal Tax Service dated 04/09/2018 No. BS-4-11/).

In the same order, calculate and fill out columns 4, 6, 8, 10 of line 090.

There are 10 people in the organization; the organization calculates and pays benefits to them itself. The amounts of payments, contributions to VNiM and benefits accrued from the Social Insurance Fund for all employees for 2020 are shown in the table.

| Index | 9 months | October | november | December | year |

| Payments | 1 153 000 | 303 837 | 304 018,45 | 328 696 | 2 089 551,45 |

| Non-taxable payments | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

| Contribution base | 1 134 700 | 296 658 | 292 236,55 | 321 517 | 2 045 111,55 |

| Contributions to VNiM | 32 906,30 | 8 603,08 | 8 474,86 | 9 323,99 | 59 308,23 |

| Benefits from the Social Insurance Fund | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

READ MORE: Accounting for CASCO and OSAGO expenses

Line indicator 090 of Appendix 2 to section. 1 is equal to:

- in column 2 – 14,868.33 rubles. (RUB 59,308.23 – RUB 44,439.90);

- in column 4 – 262.03 rubles. (RUB 26,401.93 – RUB 26,139.90);

- in column 6 – 1,424.08 rubles. (RUB 8,603.08 – RUB 7,179);

- in column 8 – -3,307.04 rub. (RUB 8,474.86 – RUB 11,781.90);

- in column 10 – RUB 2,144.99. (RUB 9,323.99 – RUB 7,179).

Transfer into it the data from subsections 1.1 – 1.2 of Appendix 1 and Appendix 2 to section. 1.

Sample

LLC "Company" did not operate in 2020. The organization has only one employee with whom an employment contract has been concluded - the general director, who has been on vacation at his own expense all year. No accruals or payments were made to the director during the year. Thus, taking into account the above arguments, the organization must submit the DAM quarterly, as well as at the end of the year.

https://www.youtube.com/watch{q}v=BFwul52PSN8

The following shows approximately what a zero calculation for insurance premiums for 9 months of 2020 looks like. Taking into account our sample, you can easily generate your own version of the zero report.

If you find an error, please highlight a piece of text and press Ctrl Enter.