As always, we will try to answer the question “Does Zero RSV need to be filled out in Section 3 for the 1st quarter of 2020?” You can also consult with lawyers for free online directly on the website without leaving your home.

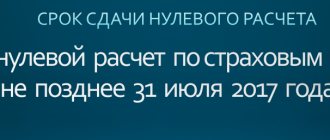

The zero calculation for insurance premiums submitted in 2020 for the previous year is compiled according to the same rules as the zero calculations that policyholders submitted in 2020. An example of a zero calculation compiled in electronic form is given on the page.

As stated in Letter of the Federal Tax Service dated 04/03/2020 No. BS-4-11/6174, the Tax Code of the Russian Federation does not provide for an exemption from the obligation to submit a calculation in the event that an organization or individual entrepreneur fails to carry out financial and economic activities. The Tax Department explains that by submitting calculations with zero indicators, payers thereby declare to the tax authority that there are no payments and amounts of insurance premiums to be paid in a particular period. This, in turn, allows the tax authorities to separate payers who do not make payments to individuals and do not carry out financial and economic activities from payers who violate the deadline for submitting the Calculation established by the Tax Code of the Russian Federation.

Composition of zero calculation for insurance premiums 2020

If during the reporting period the organization (IP) did not make payments to individuals and, therefore, did not accrue insurance premiums, the following sheets and sections must be filled out in the zero calculation for insurance premiums in 2020 (Letter of the Federal Tax Service dated April 12, 2020 No. BS-4-11/ [email protected] ):

Also write down the company's phone number on the title page. Moreover, you can write down the number of a landline telephone, or the corporate number of the chief accountant. This way, during the audit, tax officials will easily contact the organization and clarify certain data. Enter the numbers starting with “8” with the code, then add a space and the remaining numbers.

Who submits the RSV

All employers submit calculations for insurance premiums: organizations and separate divisions, individual entrepreneurs, farmers and individuals without individual entrepreneur status. Be sure to submit a calculation if you have insured persons:

- employees registered under employment contracts;

- employees registered under civil law contracts (contractor agreement, service agreement);

- director of the organization, even if he is the only founder.

If the employer did not pay wages in the reporting quarter, he is still required to submit a report in zero format - the title page and empty sections 1, 1.1, 1.2 and 3. If the report is not submitted, the tax office will impose a fine of 1,000 rubles.

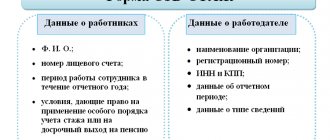

Who fills out the calculation of contributions for employees

DAM (calculation of insurance premiums for employees) came into force in 2020. Officials have added a new chapter 34 to the Tax Code of the Russian Federation, which regulates the procedure for calculating and paying insurance premiums, as well as the rules for filing reports.

In accordance with paragraph 7 of Art. 431 RSV is submitted to the Federal Tax Service by payers of insurance premiums. But not by all, but only by those listed in subparagraph. 1 clause 1 stat. 419 NK. These are the following categories of employers:

- Legal entities.

- Individual entrepreneurs.

- Individuals who are not individual entrepreneurs, but pay remuneration to other individuals.

As for individual entrepreneurs without hired specialists, the situation is as follows. The law divided entrepreneurs into 2 types: those who pay payments to employees, and those who work “alone” and pay fixed payments “for themselves.” The former are policyholders in relation to hired personnel: in this case, the calculation of individual entrepreneur contributions for employees is filled out.

The latter are also recognized as policyholders, but only in relation to themselves. According to regulatory requirements, calculations for insurance premiums in the absence of employees are not submitted. But in some cases it is still necessary to do this.

Read: How to check insurance premium calculations

When and where to submit insurance premium payments

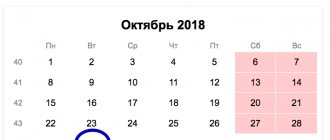

RSV - quarterly report to the tax office. Submit your payment no later than the 30th day of the month following the reporting period. The reporting periods for insurance premiums are quarterly, half-yearly, nine months and calendar year. The calculation we submit includes indicators from the beginning of the year to the end of the reporting quarter. That is, the DAM for the second quarter includes data for six months, and for the third quarter - data for 9 months of 2020. The deadlines for submitting the calculation are as follows:

- 1st quarter - April 30, 2020;

- 2nd quarter (half year) - July 30, 2020;

- 3rd quarter (9 months) – October 30, 2020;

- for the 4th quarter (2020) - February 1, 2021.

If the delivery day falls on a weekend or holiday, the due date is postponed to the next closest working day.

The day on which you submitted the report to the tax inspector and received the acceptance stamp on the second copy is considered the day the calculation is submitted. When sent by mail, the day the post office accepted the package and stamped it. When sending by telecommunications - the day on which your TCS operator recorded the sending of the calculation.

Individual entrepreneurs submit their calculations to the tax office at their place of residence. Organizations and separate divisions that pay salaries to employees or performers report at their location.

RSV - what is this form? Who should submit the report and when?

Appendix 2. It describes the calculation of social insurance contributions. On this sheet there is line 001 “Payment attribute”. If Social Insurance directly pays benefits to your employees, enter 1. If you make these payments yourself and then offset them, then enter 2.

Section 1

First of all, on the title page, fill in the name and TIN/KPP of the organization or individual entrepreneur. If you are filling out the RSV on behalf of a separate division that independently pays salaries to its staff, then indicate the checkpoint of the specific division.

The new opportunity is especially relevant for organizations with high staff turnover or those companies that conduct seasonal work. It is convenient to load new employees on the basis of SZV-M, because this report is monthly and, as a rule, it contains the most current data on employees.

Payment methods

Since the beginning of 2020, there have been changes in the methods of submitting calculations - the number of employees for submitting paper calculations has been reduced.

It can be submitted on paper “by hand” to the tax office or by mail, but only if the average number of employees for the reporting period is not more than 10 people. Otherwise, the company faces a fine for violating the format.

If in the last reporting period the average number of employees was more than 10 people, submit an electronic payment via the Internet using an enhanced qualified electronic signature.

In 2020, the limit was set for employers with 25 employees.

Filling out section No. 1 of the form

In section No. 1 of the calculation, information on accrued insurance premiums is reflected on an accrual basis.

The amounts accrued for:

- Pension insurance

- Medical insurance

- Pension insurance at an additional rate

- Additional social security

- Compulsory social insurance

- Excess of social insurance expenses by the amount of calculated contributions

Each such block provides data on the applied BCC and accruals for each month of the reporting quarter, and displays the total amount of contributions from the beginning of the year.

Fines for violations when submitting payments

For violation of the delivery format, when an organization with more than 10 employees submits calculations on paper, the tax office imposes a fine of 200 rubles.

If errors are made in the calculation (incorrect personal data or discrepancies in indicators), the tax office will send a notification of errors with a request to correct the calculation. The policyholder has 5 business days from the date the electronic notice is sent or 10 business days from the date the paper notice is sent to send an adjusted estimate. If these deadlines are violated, the calculation will be considered unsubmitted, which will result in a fine of 5% of the amount of contributions due.

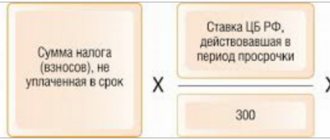

If the payment is late, the tax office will fine the policyholder for each full or partial month of delay in the amount of 5% of the premiums payable. The total amount of the fine cannot be less than 1,000 rubles and more than 30% of the amount of contributions payable. For failure to submit a zero report, the fine will be 1,000 rubles.

How to submit payments for 9 months of 2020

- Amounts of accrued benefits in favor of insured citizens.

- Amounts of payments that are excluded from taxation by insurance premiums.

- Base for calculating voluntary pension insurance contributions. It is calculated as the difference between total accruals and non-taxable payments.

- Separately indicate the amounts of the taxable base for which the TCI limit is exceeded.

- Amounts of contributions accrued for payment to the budget. We indicate the aggregate figure for the half-year. We separately detail the information for April, May and June.

- We detail the data on contributions from a base that does not exceed the OPS limit and that exceeds the limit.

Section No. 1

The resulting value of page 090 is reflected exclusively in a positive value. If it is greater than or equal to 0, the attribute of line 090 has the value 1. If the result is negative, indicate the attribute - 2. Indicators from page 090 with the attribute “1” are transferred to section 1 of the calculation on pages 110 - 113, and with the attribute “2” on pp. 120 - 123 RSV. Please pay special attention that simultaneous completion of lines 110 and 120 is not allowed. Such clarifications are enshrined in Letters of the Federal Tax Service of Russia dated 04/09/2020 N BS-4-11/ [email protected] , dated 08/23/2020 N BS-4-11/ [email protected]

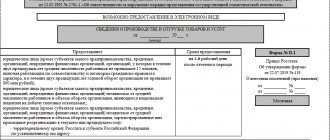

New RSV form from April 1, 2020

The calculation form for insurance premiums in 2020 was updated by order of the Federal Tax Service of the Russian Federation dated September 18, 2019 No. ММВ-7-11 / [email protected] The form has a KND number - 1151111. Detailed instructions for filling out the DAM are in Appendix No. 2 to the order. Filling out the form will require accuracy and attention, since errors in the calculation can lead to fines and the need to re-submit the DAM.

The main changes in the calculation affected the design of the form. It has become simpler and reduced by almost 1/3. Let's look at the innovations in more detail:

- Title page. Fields have appeared for information about separate divisions that were closed or deprived of authority.

- The sheet with data for citizens without a registered individual entrepreneur has been removed. Now they submit reports according to the same rules as entrepreneurs.

- The “Payer type” field has been added to section 1 Those who made payments to individuals during the last quarter put “1”, those who did not make payments put “2”. The lines for calculating the total amounts of contributions payable have been removed. Instead of subsection 1.4, Appendix No. 1.1 was added to the first section.

- In Appendix 2, the field “Payer Tariff Code” and the line “Number of individuals from whose payments insurance premiums were calculated” were added.

- In subsections 1.1 and 1.2, lines have been added for deductions under copyright agreements or intellectual property agreements.

- In subsection 1.3.2 it is no longer necessary to indicate the code of the reasons for filling out the calculation. The danger of workplaces is classified based on the results of a special assessment.

- In Appendix 1 to Section 2, farmers are required to indicate the identification code and data from it. If a peasant farm has several chapters, then information is entered for each.

- In section 3 , field 010 was added with a sign of cancellation of information about the insured. It is filled out when an employee’s personal data needs to be cancelled.

If the organization has one founder who is a director

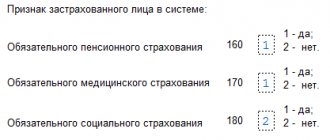

Despite the fact that the director does not enter into an employment contract, an employment relationship arises with him. In this case, in line 010 of 1.1 and 1.2 of subsection 2 of the application, the number of insured persons is indicated, that is, 1, the remaining lines should be zeros. If section 3 is not filled out, then the report will not be accepted, therefore, in lines 160-180 of subsection 3.1, indicate - 1.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

How to fill out the RSV

Fill out the fields in the calculation from left to right, starting with the first acquaintance. Indicate monetary amounts in rubles and kopecks. If you fill out the calculation manually, use blue, black or purple ink. If there are no indicators, put zeros (for amounts) or dashes (for text) in the cells. If you fill out the calculation on a computer, use capital block letters, Courier New font size 16-18; if there are no indicators, there is no need to put dashes and zeros.

Those dismissed in the DAM report are indicated in section 3 of the calculation: it lists all persons in whose favor payments were made in the reporting period and employees dismissed in the previous reporting period. The attribute of the insured person for dismissed employees “1” must also be indicated.

After filling out the calculation, number the pages consecutively, regardless of the absence of sections to be filled in or their number. At the end of the article we provide a sample of a completed calculation for an organization with two employees.

Easy to fill in zero RSV

The Tax Code does not exempt you from the obligation to submit the DAM if an organization or individual entrepreneur does not conduct financial and economic activities (see “The LLC does not pay salaries and does not conduct business: is it necessary to submit a zero DAM?”). By presenting calculations with zero indicators, payers thereby declare the absence of payments and amounts of insurance premiums to be paid in a particular period. This allows the tax authorities to separate payers who do not make payments to individuals and do not carry out financial and economic activities from payers who violate the deadline for submitting calculations established by the Tax Code of the Russian Federation. If the taxpayer did not make contributions for employees during the reporting period, prepare a zero calculation for insurance premiums in Kontur.Externa. This can be done in one click.

Import data of all employees from SZV-M or 2-NDFL in one click

Also in “Kontur.Extern” it became possible to filter employees based on several criteria at once. You can also choose which employees to search for: all employees or those selected by the “Selected in the report” checkbox.

Organizations always provide zero reporting on insurance premiums, since there is at least one person on staff under any circumstances - the sole executive body. The only exception can be the case when a management company acts as such a body. But in order to avoid disputes with tax authorities, it is better to file a zero report in such a situation.

Calculation of insurance premiums without a base for their calculation can only conditionally be called zero. It will still contain important information - data for calculating the employee’s length of service in the pension fund in the personalized accounting section.

Example of filling out a zero calculation

The Tax Code does not provide for an exemption from the obligation to report to the state if there is no basis for calculating insurance premiums in a certain reporting period. It is in these cases that a zero calculation must be submitted.

In the calculation of insurance premiums (DAM), there is a title page and three main sections. In turn, they consist of subsections and applications. Among these components of the report, there are those that are mandatory to fill out; the rest should be included in the report only if the company or individual entrepreneur has indicators for them.

How to report to the tax authorities

All entrepreneurs are required to pay annual insurance premiums for themselves and their employees. If an individual entrepreneur works alone, then he pays a mandatory fixed amount of insurance premiums. In 2020, this amount is 36,238 rubles. Those. if the amount of annual income does not exceed 603,966 rubles, then the income tax is zero and you will have to pay only to the insurance fund. For individual entrepreneurs whose annual income exceeds 300 thousand rubles, the amount increases by 1% of the excess amount.

Online cash register for individual entrepreneurs without employees

The general tax system provides for the payment of personal income tax in the amount of 13% of the amount of income received, adjusted by the amount of confirmed expenses or by 20% of income if there is nothing to confirm expenses. Individual entrepreneurs also have the right to use other types of deductions provided for by law.

If the average number of individuals in whose favor payments are made for the previous settlement (reporting) period exceeded 25 people, and also if the newly created organization has more than 25 people, the calculation must be submitted to the tax office electronically.

Do they give zero calculation?

Individual entrepreneur reporting on the simplified tax system - what and when needs to be submitted using a simplified procedure

Such forms are submitted in any case, regardless of whether the main activity was carried out or not.

The calculation of salaries and other similar remunerations also does not matter. The obligation to provide DAM is not relieved even if the duties of the general director are assigned to the sole owner, without an employment contract. And even when the individual entrepreneur simply does not have any other employees. Section 3 of the report described above simply provides personal information about the CEO.

Some features of calculating insurance premiums

Previously, the basis for calculation was only profit. Now this is the income received and the main thing is not to confuse the concepts with each other.

Under different taxation regimes, the following income is classified as income:

- Under OSNO, accounting is kept for all income that is subject to standard taxes.

- In the case of the simplified tax system, we are talking about profits from the provision of services and the sale of goods; non-operating income is also included in the scheme. An example is payments received for renting premises. It is prohibited to reduce such income by the amount of expenses, even if the appropriate regime is applied. This scheme does not apply to social payments.

- Previously imputed income for the year is summed up under UTII. For quarterly declarations, the indicators included in line No. 100 are added up.

- Taxes are charged under the patent system on the amount of income actually received during the validity of the relevant document. To do this, all receipts with official documentation are considered.

What are the responsibilities?

Some organizations prefer to remain in the shadows and not appear before the tax authorities at all. In particular, they do not submit zero calculations for insurance premiums. We do not exclude that such companies will not submit a zero calculation for insurance premiums for the 3rd quarter of 2017. Let us explain what risks they take on in this case.

Blocking accounts

On our website we said that for failure to submit zero calculations for insurance premiums, current bank accounts can be blocked. The Federal Tax Service of Russia insisted on this. However, the Ministry of Finance did not agree with this.

Closer to the submission of reports for the 2nd quarter, tax authorities and financiers apparently came to an agreement on this issue. By letter of the Federal Tax Service dated May 10, 2017 No. AS-4-15/8659, an explanation from the Ministry of Finance was sent to the inspectorate stating that it is impossible to suspend transactions on accounts for late payment.

Fines

Since 2020, insurance premiums are regulated by the Tax Code of the Russian Federation. Therefore, for failure to submit a zero calculation for the 3rd quarter of 2020, the Federal Tax Service may fine you under paragraph 1 of Article 119 of the Tax Code of the Russian Federation. There are no accruals in “zero points”, so the fine will be minimal – 1000 rubles.

The calculation of the fine will not depend on the number of complete and partial months of failure to submit reports. However, in our opinion, it makes sense to send reports to controllers with zero indicators and protect the company from possible financial sanctions.

Some organizations prefer to remain in the shadows and not appear before the tax authorities at all. In particular, they do not submit zero calculations for insurance premiums. We do not rule out that such companies will not submit zero calculations for insurance premiums for 9 months of 2017. Let us explain what risks they take on in this case.

Fines

Since 2020, insurance premiums are regulated by the Tax Code of the Russian Federation. Therefore, for failure to submit a zero calculation for 9 months of 2020, the Federal Tax Service may fine you under paragraph 1 of Article 119 of the Tax Code of the Russian Federation. There are no accruals in “zero points”, so the fine will be minimal – 1000 rubles.

Also see “Insurance contributions to the Federal Tax Service: criminal liability since 2017.”

Which sections to include in the zero calculation

Let’s assume that the accountant decided not to take risks and submit a zero calculation for the 3rd quarter of 2020 to the Federal Tax Service. But what sections should it include? Letter No. BS-4-11/6940 of the Federal Tax Service of Russia dated April 12, 2020 states that the empty calculation should include:

- title page;

- Section 1 “Summary of the obligations of the payer of insurance premiums”;

- Subsection 1.1 “Calculation of the amounts of insurance contributions for compulsory pension insurance” and subsection 1.2 “Calculation of the amounts of insurance contributions for compulsory health insurance” of Appendix 1 to Section 1;

- Appendix 2 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity” to Section 1;

- Section 3 “Personalized information about insured persons.”

How to use the calculator

Instructions for using the individual entrepreneur insurance premium calculator

- By default, calculations are made for the selected whole year. If you registered an individual entrepreneur this year, or you closed it, then select a more specific start and end date for the period.

- If your income for the selected period was no more than 300,000 rubles, then you can leave the “Income for this period” field empty. The entered amount will not affect the final result.

- Click "CALCULATE". You can save the result with all the calculation details to a doc file.

About benefits

Some categories of entrepreneurs-employers can count on lower tariff rates. The specific numbers are different for different companies. They are usually determined by the type of activity that has become the main one for a particular market participant. No. 212-FZ contains a list of entities for which benefits are applicable; this is a fairly extensive list.

Interesting: some entrepreneurs are allowed not to charge health and social insurance contributions. For contributions to the Pension Fund, a reduced rate of 20% is established. To calculate deductions, the maximum income is at the level of 711 thousand rubles. Contributions are not accrued if income is received in excess of this figure.

Summarizing the above, it can be unequivocally stated that the entrepreneur will not only have to pay insurance premiums for individual entrepreneurs without employees, but also submit competently prepared reports on time.