Let's get acquainted with the balance sheet items for 2020: their codes and explanations

New balance sheet assets (line 1100, 1150, 1160, 1170, 1180, 1190, 1200, 1210, 1220, 1230, 1240, 1250, 1260, 1600)

New balance liabilities (lines 1300, 1360, 1370 1410, 1420, 1500, 1510, 1520, 1530, 1540, 1550, 1700)

Assets of the old balance sheet (lines 120, 140, 190, 210, 220, 230, 240, 250, 290, 300) and its liabilities (lines 470, 490, 590, 610, 620, 700)

How to decipher balance sheet asset lines

Interpretation of individual balance sheet liability indicators

Line 12605 - what is it?

Where is line 2110 for revenue?

Results

Let's get acquainted with the balance sheet items for 2020: their codes and explanations

Everyone who has ever held a balance sheet in their hands, much less drawn it up, paid attention to the “Code” column. Thanks to this column, statistical authorities are able to systematize the information contained in the balance sheets of all companies. Therefore, it is necessary to indicate codes in the balance sheet only when this report is submitted to state statistics bodies and other executive authorities (Article 18 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, clause 5 of the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n). If the balance is not annual and is needed only by owners or other users, it is not necessary to indicate the codes.

Note! From 06/01/2019, the balance sheet form is valid as amended by Order of the Ministry of Finance dated 04/19/2019 No. 61n.

The key changes in it (as well as in other financial statements) are as follows:

- now reporting can only be prepared in thousand rubles, millions can no longer be used as a unit of measurement;

- OKVED in the header has been replaced by OKVED 2;

- The balance sheet must contain information about the audit organization (auditor).

The auditor mark should only be given to those companies that are subject to mandatory audit. Tax authorities will use it both to impose a fine on the organization itself if it ignored the obligation to undergo an audit, and in order to know from which auditor they can request information on the organization in accordance with Art. 93 Tax Code of the Russian Federation.

In the balance sheet, line codes from 2014 must correspond to the codes specified in Appendix 4 to Order No. 66n. At the same time, outdated codes from the expired order No. 67n with the same name, dated July 22, 2003, are no longer applied.

It is not difficult to distinguish previously used codes from modern ones - by the number of digits: modern codes are 4-digit (for example, lines 1230, 1170 of the balance sheet), while outdated ones contained only 3 digits (for example, 700, 140).

For information on what the form of the current balance sheet with line codes looks like, read the article “Filling out Form 1 of the balance sheet (sample)” .

What kind of reporting is submitted?

If you are an individual entrepreneur and work in a simplified taxation system, filing payroll reports will not be particularly difficult.

Income and expenses of the wage fund are traditionally reflected in the corresponding book.

In the seventh column of the document, the income received during the month and the expenses that the company incurred in the same period are recorded, and the resulting difference is taken into account.

The book is submitted for control in December of each financial year.

Quarterly reporting on payroll involves filling out forms from the social insurance fund and pension fund. But there is no separate form for the health insurance fund.

Calculation by categories of this fund is also submitted to the Pension Fund.

If this month your individual entrepreneur suffered losses, for example, income was 10 thousand rubles, and expenses were 15 thousand, in the “difference” line, indicate 1% of the amount received, the minimum profit, or simply “zero”.

If your company operates under the general taxation system, reporting will be more difficult.

You will have to draw up a balance sheet, report on funds received and losses incurred, and at the end of the reporting period, submit an appendix to the balance sheet, reports on the flow of money and the intended use of all funds.

When reporting wages, you can use the same forms as individual entrepreneurs working under a simplified method.

The only difference will be in the timing of reporting.

How to decipher balance sheet asset lines

Before deciphering an asset item, let’s consider its code - it carries certain information. So, the first digit shows that this line refers to the balance sheet (and not to another accounting report); 2nd - indicates the section of the asset (for example, 1 - non-current assets, etc.); The 3rd digit reflects assets in increasing order of their liquidity. The last digit of the code (initially it is 0) is intended to help in line-by-line detailing of indicators considered significant - this allows you to fulfill the requirement of PBU 4/99 (clause 11).

NOTE! The requirement for detail may not be fulfilled by small businesses (clause 6 of Order No. 66n).

Read about what distinguishes accounting carried out by small businesses in the material “Features of accounting in small enterprises” .

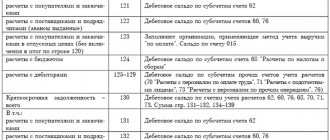

The asset lines of the balance sheet with codes and explanations are shown in the table:

| Line name | Code | Decoding the string | |

| By order No. 66n | By order No. 67n | ||

| Fixed assets | 1100 | 190 | The total amount of non-current assets is reflected |

| Intangible assets | 1110 | 110 | The information reflected in lines 1110–1170 is explained in the notes to the statements (information on the availability of assets at the reporting dates and changes for the period is disclosed) |

| Fixed assets | 1150 | 120 | |

| Profitable investments in material assets | 1160 | 135 | |

| Financial investments | 1170 | 140 | |

| Deferred tax assets | 1180 | 145 | The debit balance of account 09 is indicated |

| Other noncurrent assets | 1190 | 150 | Filled in if there is information about non-current assets that are not reflected in the previous lines |

| Current assets | 1200 | 290 | The final result of current assets is determined |

| Reserves | 1210 | 210 | The total balance of inventories is given (debit balance of accounts 10, 11, 15, 16, 20, 21, 23, 28, 29, 41, 43, 44, 45, 97 without taking into account the credit balance of accounts 14, 42) |

| Value added tax on purchased assets | 1220 | 220 | Indicate account balance 19 |

| Accounts receivable | 1230 | 240 | The result of adding the debit balances of accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 minus account 63 is reflected |

| Financial investments (excluding cash equivalents) | 1240 | 250 | The debit balance of accounts 55, 58, 73 (minus account 59) is given - information on financial investments with a circulation period of no more than a year |

| Cash and cash equivalents | 1250 | 260 | The line contains the balance of accounts 50, 51, 52, 55, 57, 58 and 76 (in terms of cash equivalents) |

| Other current assets | 1260 | 270 | Filled in if data is available (for the amount of current assets not indicated in other lines of the section) |

| Total assets | 1600 | 300 | Total of all assets |

You can see line-by-line comments on filling out the balance sheet, including asset lines, in the ConsultantPlus system. Get trial access to the system for free and proceed to the explanations.

Deadlines

The deadlines for submitting mandatory reporting on the wage fund are established by regulatory government bodies. Typically, reporting is submitted based on the following results:

- next quarter;

- calendar year.

Note:

When preparing reports on payroll, it is necessary to draw up a tax return for the Unified Social Tax no later than 30.03 of the year following the reporting period.

When preparing and submitting reports, the company goes through the following stages:

- The accountant sends regulatory documents establishing the form of the report and including instructions for generating reports in the automation department.

- Technicians update and customize reporting forms.

- The accountant prepares, consolidates and verifies data for reporting.

- The accountant generates reports for the current reporting period.

- The accountant checks the accuracy of the generated reports.

- The accountant prints a set number of copies of reports.

- Prepared reports undergo a second review cycle.

- The accountant submits reports signed by clients to regulatory authorities.

- The enterprise receives reports with a mark from the regulatory authority on delivery.

To summarize, we note that payroll is a fixed salary for employees.

The employer must pay 26% of the payroll, 13% (personal income tax) - the employee from his income.

Payroll reporting is almost the same for all small businesses, regardless of the form of organization.

Only the tax regimes differ, but this difference is insignificant.