In accordance with the norms of current Russian legislation, employers are obligated to inform their employees about what the amount of their wages consists of. Despite this, not all employers know how to issue pay slips to employees for the current year.

In this article we will talk about what pay slips are and why they are needed. In addition, we will touch upon issues such as: the issuance of pay slips in 2020, the rules for storing this document, and what responsibility awaits the employer for the absence of a slip, taking into account the clarifications of the Ministry of Labor (Letter of the Ministry of Labor No. 14-1/OOG-1560 dated 21.02. 2017).

What is a payroll slip?

A payslip is a document in which the employer informs the employee about the salary received, as well as about the deductions made from it. In addition, the document reflects the amount of income tax and some other data (for example, bonuses for length of service).

A payslip is a statement that must be given to an employee upon receipt of a salary. Based on the Labor Code of the Russian Federation, any organization or enterprise is required to accompany the payment of wages to employees with a pay slip.

Contents of the payslip

A payslip is a document of a regulated form. In it you can see all the information regarding the monetary allowance of a particular person, as well as all deductions made (for example, for alimony).

In the calculation of an employee of the RF Ministry of Defense (military and civilian), you can see the following information:

- Personnel Number;

- salary according to military rank and position;

- amount of payments;

- information about withheld taxes (NDFL);

- information about the deductions provided;

- information about various deductions.

Additionally, the sheet contains information about all one-time payments made to the military man, for example, it includes allowances for the military man and his family. Every year in this document you can also see information about the payment of financial assistance.

When creating the calculation, it also includes information about compensation for unused days of additional rest, various types of allowances (for example, for working with secret documents, for special conditions of service).

Accruals are displayed both broken down by individual types of payments and as a total. This allows you to evaluate what the money was paid for.

Why is the document needed?

As mentioned above, issuing a pay slip to an employee is not a right, but an obligation of the employer. The document is necessary, first of all, to protect the rights of the employee, since he must receive documentary evidence that he received his wages on time and in full.

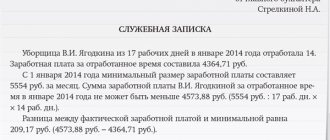

Please note that if the specified salary, without any reason, does not correspond to the amount reflected in the employment contract, then the employee has the right to challenge this in court.

According to Russian labor legislation, employers are required to notify their employees about the accrual of their wages. For this purpose, they issue a pay slip.

At the same time, the procedure for notifying an employee to employers about the components of his salary is not regulated by the Labor Code; many questions often arise regarding the correct execution and procedure for issuing pay slips.

How to correctly issue pay slips

The employer is obliged to issue a payslip on the day of payment of wages. This is stated in Article 136 of the Labor Code of the Russian Federation. Salaries must be paid to employees on the day established by the employment contract and labor regulations of the organization or company.

Please note that the sheet should not be issued to the employee in the following situations:

- on the day of the advance;

- when calculating funds for vacation.

Let us add that when an employee receives the main part of his salary, the payslip must indicate the accruals that were made earlier. Money earned by an employee must be given to him or her or transferred to a bank card (this is indicated in the employment contract).

It should be borne in mind that the fact in what form the employee receives wages (in hand or on a card) does not in any way affect the issuance of a pay slip.

What is a Salary Sheet?

A payslip is a statement that must be given to an employee upon receipt of a salary. Based on the Labor Code of the Russian Federation, any organization or enterprise is required to accompany the payment of wages to employees with a pay slip.

Please note that the sheet should not be issued to the employee in the following situations:

- on the day of the advance;

- when calculating funds for vacation.

Let us add that when an employee receives the main part of his salary, the payslip must indicate the accruals that were made earlier. Money earned by an employee must be given to him or her or transferred to a bank card (this is indicated in the employment contract).

It should be borne in mind that the fact in what form the employee receives wages (in hand or on a card) does not in any way affect the issuance of a pay slip.

Issue payslips to employees at least once a month. Employers do not need to issue payslips to employees twice a month. There is no such obligation in the Labor Code. To inform the employee about the components of the salary, it is enough to issue a pay slip once a month. This conclusion was reached by the Ministry of Labor in letter dated May 24, 2018 No. 14-1/OOG-4375

The form of the payslip must be approved by local regulations. The form of the sheet is not normatively approved, so the employer has the right to approve it independently by a separate order. You can use a certificate form from an accounting program or develop your own. The main thing is to approve the form used in the manner established for the adoption of local regulations. The use of an unapproved form is the basis for collecting a fine for violation of labor laws.

A payslip is issued for the corresponding period only indicating all amounts accrued to the employee and deducted from income. Incomplete filling is a violation of the Labor Code of the Russian Federation.

The pay slip indicates (Article 136 of the Labor Code of the Russian Federation):

- Components of salary for the corresponding period (salary, allowances, bonuses, coefficients, etc.);

- Other accruals (sick leave, compensation for delayed salaries or other payments);

- Deductions from wages and their reasons (personal income tax, alimony, etc.);

- Total amount to be paid.

Pay slips can be issued both in paper and electronic form. The Labor Code does not contain rules that would determine the procedure for issuing salary notices to employees, so sheets can be issued in printed (paper) form or sent by e-mail, if such a procedure is enshrined in an employment contract, collective agreement or other local regulatory act (letter from the Ministry of Labor dated February 21, 2017 No. 14-1/OOG-1560).

There is no need to certify pay slips with a seal or signature. The Labor Code does not require affixing a seal or signatures to them. However, if the employee asks or you present documents as evidence in court, then you can certify them. This is not a violation.

https://www.youtube.com/watch?v=ytdevru

There is no need to issue a payslip when paying vacation pay. Vacation pay is not a salary, so the employer is not required to issue a notice. But upon dismissal, the employee is paid all due amounts, including salary, so it is mandatory to issue a sheet on the day of dismissal.

The fact of issuing pay slips must be documented. There are three options here:

- keep a journal for issuing pay slips, where employees will sign;

- add a separate column to the payroll for employees to sign for receipt;

- make a form of a sheet of two parts - one of them with the employee’s signature remains with the organization.

For failure to issue salary slips to employees, the organization faces a fine of 30 to 50 thousand rubles, and the employer-individual entrepreneur (company official) – from 1 to 5 thousand rubles (Clause 1 of Article 5.27 of the Administrative Code).

The Labor Code obliges the employer to inform the employee in writing (Part 1 of Article 136 of the Labor Code of the Russian Federation):

- on the components of wages and other charges;

- the amount and reasons for deductions from wages;

- amount to be paid in hand.

Salary notification form - pay slip. If the accountant does not issue slips to employees when paying wages, the labor inspectorate will charge the company a fine of up to 50,000 rubles. (Part 1 of Article 5.27 of the Labor Code of the Russian Federation).

Composition of the document

The payroll slip must include the following mandatory items:

1. Full name employee. 2. Amount of time worked. 3. All components of the employee’s salary. 4. Total amount excluding taxes and withholdings. 5. Payment upon dismissal.

You can download your salary slip using the button below:

The amount of deductions from wages should not exceed 20%. But there are cases (their list is provided for by the federal laws of the Russian Federation) when penalties can reach 50%.

The following must be indicated in separate items on the payslip:

- various awards;

- fines;

- overtime;

- additional payment for hazardous working conditions;

- work on weekends.

Possible deductions typically include:

- personal income tax;

- contributions to insurance companies and trade union committees;

- an advance that was issued at the expense of wages (but provided that it was not worked out);

- amounts that were accrued in error (for example, due to system failures);

- alimony.

Due to the fact that the payslip is issued to the employee during the main salary, it must include all amounts that the employee received for the month. You can download a sample salary slip using the following button:

How not to make a mistake when issuing a pay slip

When issuing pay slips to employees in 2020, you must adhere to the following rules:

1. Pay slips must be issued to employees at least twice a month (based on Article 136 of the Labor Code of the Russian Federation).

At the same time, Rostrud expressed the opinion that the document can be issued to the employee at the time of payment of the second part of the salary. The department motivated this by the fact that if a pay slip is issued when an advance is paid, the information in this case will not be complete.

2. The form of the salary slip must be approved by the local regulations of the organization.

The head of the enterprise must approve the form of the pay slip by a separate order. You can use a form from accounting programs or your own form of the document.

3. The document can only be issued for the corresponding period. It must indicate all amounts that have been accrued and withheld from the employee’s income. The fact is that if the document does not reflect all the required amounts, then this is a violation of the Labor Code.

4. Pay slips can be issued:

- electronic;

- on paper.

There are no rules in the Labor Code of the Russian Federation defining the procedure for issuing notices to employees regarding wages. That is why both forms of document are allowed. A payslip on paper is given to the employee in hand, and in electronic form the slip can be sent to the employee’s email.

5. Pay slips do not need to be signed or sealed.

The Labor Code of the Russian Federation does not require a mandatory seal or signature on this document. In this case, at the request of the employee, the sheet will need to be certified (for example, if the document is needed for court).

6. The fact of issuing a pay slip to the employee should be documented.

In such a situation, there are three confirmation options:

- keep a journal for issuing pay slips (employees will sign in it);

- make a sheet of paper in two parts (one part is given to the employee, and the other remains with the enterprise);

- add a separate column to the payroll (so that the employee can sign for receipt).

For security reasons, it is recommended that the organization’s local regulations immediately prescribe the procedure for working with payroll sheets. In particular, this can be done in the regulations on wages, where the following can be approved:

- employee notification form;

- frequency of issue;

- method of issuing the document.

The form of the pay slip must be approved by order.

We offer you a sample of such an order:

If there is a trade union committee, before approving the form of the pay slip, it must familiarize itself with its form.

What should be on the payslip

The procedure for approving the form of a pay slip is prescribed in Article 372 of the Labor Code of the Russian Federation.

The employer is obliged to develop a draft form of the document and send it for consideration to the trade union committee, which, in turn, has 5 working days from the moment the draft was received to approve the proposed form or reject it.

The trade union committee reflects its consent together with the employer in the relevant regulatory act.

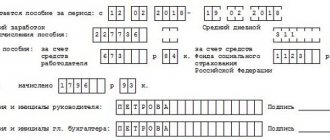

On the right side of the statement, the accounting department indicates the amount and name of deductions, and on the left side - the amount and name of charges.

Although an enterprise can set the form individually, there are mandatory points:

- Full name of the employee and his personnel number;

- the period to which accruals and deductions correspond;

- the time the employee worked per month - days or hours;

- what does the salary consist of?

- on what basis and in what amount were deductions made;

- the amount to be paid.

The seal of the organization and the signature of the head of the enterprise are not required on the document, however, at the request of the employee they can be affixed.

By law, the totality of all deductions from an employee’s salary cannot exceed 20% of the salary. There are exceptions fixed by law: according to them, the amount of deductions can be up to 50%.

Legal deductions include:

- income tax or personal income tax;

- insurance premiums;

- union dues;

- advance payment - only if it has not been worked off;

- erroneous accruals that occurred due to failures in the program;

- the amount of alimony ordered by the court.

In addition to the main accruals made to the employee over the past month, the payslip must include all accrued bonuses, overtime payments, additional pay and payment for work on weekends and holidays - in separate items.

A pay slip must be issued to the employee every time he receives his salary. If this does not happen, this is a gross violation of labor laws.

Each director of an enterprise must independently ensure the maintenance of records of the issuance of a document.

The most common practice is to issue pay slips against signature by an employee in a special journal.

Regardless of how the salary is issued - through the company's cash desk in cash or to a bank card - a pay slip must be created and issued to the employee.

For non-compliance with the requirements of the law, a fine is imposed on the head of the enterprise.

This is reflected in Article 27 of the Code of Administrative Offences:

- For a primary violation, individual entrepreneurs with hired employees are required to pay a fine of 1,000 to 5,000 rubles.

The same is true for officials. If a repeated violation occurs, the amount of the fine increases - from 10,000 to 20,000 rubles, and the official will be suspended from office for 3 years;

- For the first violation, legal entities will pay a fine of 30,000 to 50,000 rubles, and in the event of a subsequent violation, this fine will increase - from 50,000 to 70,000 rubles.

When receiving wages on a set day, any worker must be notified of its amount in the form of a pay slip.

But quite often in practice it happens that the directors of enterprises do not want to issue a pay slip, and the accounting department does not want to print the document because of saving paper, and issue the form only at the personal request of the worker.

How exactly information should be provided is not clearly outlined in regulatory documentation at the federal level (except for the fact that information is conveyed to the employee in writing).

The certificate is issued upon payment of the final part of the salary (after the advance).

Regardless of the method of transferring funds to subordinates for work done (cash or non-cash payment), the employer provides a payslip, including when dismissing an employee. How can an employee understand it?

Violations of labor laws are common. Often employees do not know their rights, but sometimes they are simply in no hurry to take advantage of them, so as not to spoil relations with their superiors or even lose their job.

The employer must issue a pay slip to each employee separately. This is one of the most frequently violated provisions of the law.

It will be useful for accountants, HR officers and just employees to learn everything about the payroll slip: what it looks like, how to issue it, why is it needed and what is the penalty for violation?

Not so long ago there was a period in the country when people worked for working days, simply put, for “ticks.” Fortunately, this time has passed, and now skilled work is decently paid.

The state today more than persistently recommends getting a job where they pay a “white” salary.

What is this connected with? First of all, with tax deductions and subsequent guarantees for the employee.

Salary is an employee’s remuneration for work, which includes compensation and incentive payments. It is discussed with the employee before taking up the position and cannot be less than the subsistence level.

The Labor Code obliges the employer to notify the employee in writing about what his salary includes for a certain period. Those. Each employee must receive a document detailing the components of his salary for the period (usually a month).

Such an information document is the employee’s pay slip.

Why is this necessary?

Documents in an organization are always a sensitive issue. On the one hand, it is very “boring”, on the other, it is important.

It’s good if the employee responsible for them (an accountant or HR officer) understands this, always guards order and is ready to enter into a constructive dispute even with management, defending the interests of the company from the point of view of the law.

So, labor legislation requires all employers to issue each employee a pay slip. Why is it needed:

- to obtain information about the components and amounts of salaries;

- to be presented in court as evidence in the event of a dispute.

Why is it important for an employer to issue a pay slip to an employee:

- to avoid troubles in the event of a labor audit, since it is required to be issued;

- to protect yourself from possible litigation. The fact is that, by law, an employee can go to court within three months after a labor dispute arises based on financial grounds. If he applies later, the court will not consider his application. This period is counted from the moment the employee is notified of his salary. Those. if he received a payslip, then he will only have three months, and if he was not given one, the employee can come even a year later and say that he only found out yesterday (from any source) that he was underpaid.

It is noteworthy that there is no special unified form of pay slip. Each employer has the right to independently decide what the payroll slip at his enterprise should look like. Of course, there are a number of recommendations that are worth considering when preparing your form.

First of all, it is necessary to develop regulations and approve the form of the payslip, enshrining them in a local regulatory act.

The director and the trade union body sign the sample; if there is none, the form must contain the following entry: “At the time of approval of the form, no workers’ trade union body has been created.”

Columns that a payroll slip must certainly contain:

- name of the document (pay slip for the “period”);

- name of the organization, full name and position of the employee who issued the sheet, as well as full name and position of the employee who received the document;

- Next, it is more convenient to place everything in a table, which will include several main columns: accrued, withheld, issued;

- The number of hours (days) worked, dates of payments and amounts in the appropriate columns must also be indicated.

- The “Accrued” column will be divided into payments that were accrued for the period: salary, vacation pay, bonuses, allowances, compensation, etc.

- The “Withheld” field can be divided into personal income tax, alimony, fines, etc.

- In the “Paid” column there will be information about the funds actually issued, taking into account all deductions: advance payment, salary, vacation pay, sick leave.

By the way, the seal and signature of the management are not mandatory, but if they are present (on all sheets or at the request of certain employees), this is not a violation.

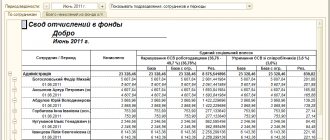

Below is a salary slip (form) from one of the Russian companies as a sample.

Pay slips must be issued along with your salary.

But since it is paid, as a rule, twice a month (advance and balance), the sheet can be issued once at the last payment.

But it must contain information about all transactions with the employee’s earnings for the period.

To avoid controversial situations, it is better to issue a pay slip against the employee’s signature.

By the way, there are now enterprises that do not issue pay slips in printed form, but send them to the employee’s email.

The law does not prohibit this method of notification (more precisely, it does not say anything about it). Although Rostrud insistently recommends giving everyone only printed sheets.

The main thing here is to think through everything to the smallest detail, and perhaps obtain the written consent of the employee.

The pay slip is always generated before the payment is issued. This document is mandatory and is issued to the employee along with the money earned.

Everyone who has at least once worked not for themselves, but in an organization, has had to deal with such a document as a payslip. However, not everyone has seen this paper in person.

But since the payroll sheet is a mandatory part of the work process, you need to know what it is, what the sample looks like, when it is required to be issued and who is issuing it.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

Explanations of the Ministry of Labor in letter dated February 21, 2017 No. 14–1/OOG-1560

In letter dated 02/21/2017 No. 14–1/OOG-1560, the Ministry of Labor provides clarification regarding the issuance of pay slips in electronic form by sending them to the email addresses of the organization’s employees. It should be noted that officials took court decisions as a basis.

They considered that it is imperative for the employer to establish the procedure for issuing pay slips in the local regulations of their organization. Thus, if the organization’s regulatory act establishes the procedure for issuing pay slips in electronic form, then the employer can, without fear of a fine, send the document to the employees’ email addresses.

But if the employer and employees decide that the paper form of the document is more convenient, then it can be used.

Explanations from the Ministry of Labor on the preparation of pay slips are in document No. 14–1/ОOG-1560 dated 02/21/2017, which can be found here:

Is it possible to use paper and electronic versions at the same time?

A situation may arise that there is nowhere to send the payslip - the employee does not have access to the Internet, and therefore does not have an email address. Then the company should provide in its internal document containing the procedure for issuing pay slips that it is possible to use a paper form and an electronic one at the same time.

Thus, the law does not prohibit the use of electronic document management when notifying personnel about wages. The company has the right to use an electronic form, but first it will need to bring all personnel documents into compliance with the accepted procedure.

Source: Modern Entrepreneur

Features of issuing electronic payslips

If it has been decided to issue payslips electronically, then it is necessary:

1. Enshrine this procedure in a local regulatory legal act (for example, in the Regulations on remuneration).

2. Familiarize employees with the form of the document and the procedure for issuing it (under signature).

3. Make a list of employee email addresses (to which pay slips will be sent).

If employees do not have a corporate email, then it is necessary to obtain from them a written application (addressed to the head of the enterprise or chief accountant) about the email address to which pay slips should be sent.

Features of providing employees with an electronic pay slip

Previously, it was assumed that payslips could only be provided in paper form. The employer could not provide employees with an electronic option, even with the active spread of computer technology. The Labor Code of the Russian Federation still does not contain any information regarding the method of providing a pay slip, which the Ministry of Labor drew attention to.

This led to the emergence of the right to provide subordinates with an electronic version of the document. However, the manager must set out in the local regulations the procedure for notifying the subject about the components of his income. It is expected that the collective agreement or other similar act will indicate the company's right to provide payslips in electronic format.

Based on Art. 372 of the Labor Code of the Russian Federation, the paper form is developed within the company, taking into account the opinion of the local employee union.

Based on Resolution of the Supreme Court of the Russian Federation No. 75/AD10/3 dated December 23, 2010. the use of an unregulated form of pay slip in practical activities is a violation of the provisions of the Labor Code of the Russian Federation, which, in turn, serves as a prerequisite for prosecution.

Responsibility of the employer for failure to issue a pay slip

Due to the fact that issuing pay slips is the responsibility of employers, violations may result in penalties:

- for individual entrepreneurs - from 1000 to 5000 rubles;

- for legal entities - from 30,000 to 50,000 rubles with a possible suspension of the organization’s activities for up to 90 days;

- for officials - from 1000 to 5000 rubles (based on clause 1 of Article 5.27 of the Administrative Code).

If a repeated violation is committed, a fine may be imposed on the official, which prohibits him from engaging in entrepreneurial activity for up to three years.

The employer has the right not to store pay slips. But it is still necessary to keep a log of the issue of this document, because labor inspectors may require it in the event of an inspection.

The article was updated in accordance with current legislation 12/06/2019

Correct design

The employer is responsible for complying with legal requirements. For violations, fines of up to 50,000 rubles are provided. for companies and up to 5000 rub. for individual entrepreneurs (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). Therefore, before sending pay slips by email, you need to complete everything correctly. To do this, the company's management will have to:

● Make changes to an employment or collective agreement, or reflect a change in the form of notice in another local document of the organization.

● Notify employees of the new notification procedures adopted. Introduce the innovations of each of them under signature.

● Collect statements from employees - sending payslips by email must be done with the consent of employees.

To avoid unnecessary conflicts, you will first have to properly complete all personnel documents, and only then can you send electronic information.

This might also be useful:

- Order on approval of the staffing table

- How to obtain a duplicate work book

- Local regulations in 2020

- Model employment contract in 2020

- Stamps in work books are canceled

- Bonus payment deadlines in 2020

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Comments

11/22/2017 at 15:53 # Reply

confirm the fact of issuing a pay slip to the employee via email. mail

6. The fact of issuing a pay slip to the employee should be documented. How to document confirmation when sending via email?

11/22/2017 at 4:44 pm # Reply

Good afternoon. Payslips can only be sent to remote workers by email (paragraph 5 of Article 312.1 of the Labor Code of the Russian Federation). Email capabilities allow you to send a letter with a sheet as an attachment marked “confirm receipt.” Keep these letters in your mailbox, this will allow you to prove that pay slips were sent and that the employee received them.

12/05/2017 at 02:29 # Reply

What to do.

Never in 8 years of work have we been given a pay slip. We didn't sign anywhere. What can be done?

12/05/2017 at 01:40 pm # Reply

Good afternoon. First, contact your employer regarding the non-issuance of pay slips with a free-form application. Moreover, make one copy of the application for yourself, in which the employer will put a mark that he received the application from you. Then wait for a written response, and if the issue is not resolved, contact the labor inspectorate, accompanying your letter with a copy of the application.