Documenting

The amount of compensation for delayed wages is established in the collective or employment agreement.

For example, you can indicate that compensation is 0.06 percent of the amount owed for each day of delay in salary. If the amount of compensation is not established by an employment or collective agreement, then it is calculated based on 1/300 of the refinancing rate for each day of delay. Such rules are established in Article 236 of the Labor Code of the Russian Federation. Attention: the amount of compensation established by the organization for delayed salaries cannot be less than 1/300 of the refinancing rate. Otherwise, this condition of the collective (labor) agreement will be invalid (Article 8 of the Labor Code of the Russian Federation).

Pay compensation for the delay along with repayment of arrears of wages.

Situation: is it necessary to pay compensation for delayed wages in an increased amount (exceeding 1/300 of the refinancing rate), if such a condition is established by a regional agreement?

Yes, it is necessary if the organization has joined the regional agreement.

An increased amount of compensation for delayed wages may be established by regional agreement. Such agreements are concluded by regional executive authorities in agreement with trade unions and employers.

All organizations in the region can join the regional agreement, even if they did not participate in its conclusion. A proposal to join a regional agreement is officially published along with the text of the agreement. If within 30 calendar days the organization does not send a written reasoned refusal, it is considered that it agrees with the regional agreement. Consequently, the organization will be obliged, from the moment of official publication of the regional agreement, to establish compensation for delayed wages in an amount not lower than the regional one. If the organization decides not to join the agreement, it sends a written refusal to the executive body of the constituent entity of the Russian Federation.

This procedure is provided for in Article 48 of the Labor Code of the Russian Federation.

How to calculate monetary compensation?

It can be defined as follows:

- In law;

- According to the terms of the employment contract.

In the first case, Art. 236 of the Labor Code of the Russian Federation determines the amount of compensation for each day in the amount of 1/150 of the key refinancing rate of the Central Bank. It is taken from the total amount of wages owed.

The calculated compensation is not subject to personal income tax (NDFL) by law.

If, under the terms of the employment contract, the amount of compensation for delayed wages is higher than the law, part of the penalty is subject to personal income tax. For this:

- The amount of compensation is determined by law.

- The required penalty is calculated according to the terms of the employment contract.

- The difference between these values is established, with which personal income tax is calculated.

Let’s find out whether compensation for delayed wages is subject to insurance premiums by reading this article.

Percent based formula

To independently calculate the penalty that the employer is obliged to pay to staff for delayed wages, the formula K = Rdzp × Dzp × Ksrf / 150 is used, where :

- K – amount of compensation;

- Рдзп – amount of salary debt;

- Dzp – the number of days during which the debt exists;

- Ksrf is the refinancing rate of the Central Bank.

The calculation is carried out for each month separately, the amount of debt is taken for the billing month for which the delay occurred. With a constant salary, this value does not change, but you need to be more careful with other values.

For example, the number of days is not a constant value if the penalty is calculated over a period of two months or more. If the debt was formed over a quarter or more, then the first penalty is calculated with a value of 90 days or more, and the third penalty is calculated with a value of 30 days or more. Shown in more detail below.

The key or interest rate for refinancing is a variable value, it can change every two to three months; it needs to be clarified during calculations. So, in 2020 its meaning is:

- From January 1 to February 11 – 7.75%;

- From February 12 to March 25 – 7.5%;

- From March 26 to June 15 – 7.25%.

Therefore, when calculating penalties for March, the penalty is calculated for the periods:

- From March 16 to March 25 – 10 days and Ksrf = 7.5%;

- From March 25 to April 15 – 21 days and Ksrf = 7.25%.

The sum of the values obtained is the penalty for March 2020.

If you are interested in this issue, we recommend that you familiarize yourself with the interest calculator for late payment of wages.

Example 1

Salaries were paid one month late (30 days). The employment contract does not stipulate special conditions for the payment of penalties due to late payments. Accordingly, the above formula is applied with a value of 1/150 of the key refinancing rate of the Bank of Russia, which remained unchanged and amounted to 8%.

The salary arrears are equal to 45 thousand rubles. excluding personal income tax. Compensation is: 45000×30×0.09/150=810 rub.

Example 2

In accordance with the terms of the collective agreement, for each day of delay in wages, 0.1% of the unpaid amount is due. The refinancing rate is 7.75%, which is lower than the value specified in the agreement. Accordingly, the terms and conditions specified in the document apply.

Salaries were not paid for 45 days. The debt accumulated in two months - 50 thousand rubles each. for every. Late payment amounts to :

- For 1 month – 45 days;

- For 2 months – 15 days.

We calculate compensation for the first month: 50000×45×0.1/150=1500 rub. For the second month: 50000×15×0.1/150=500 rub. The total value of the penalty: 1500+500=2 tr.

Avoid mistakes

In cases similar to the last example, a mistake is often made. They take the total debt, in this case 100 thousand rubles, and the total duration of the delay is 45 days. Next, apply the formula, getting 100000 × 45 × 0.1/150 = 3 tr.

That is, the value increased by one and a half times. Of course, in court they will help to correct the calculations , but the plaintiff can count on one amount (sometimes we are talking about tens of thousands of rubles), but in the end he will receive a significantly smaller amount.

Deadline for salary delay

The organization must set a specific date for payment of salaries. It is impossible to establish a period during which wages should be paid, rather than a specific day of payment. When determining the set payment date, keep in mind that if the payment day coincides with a non-working day, the salary must be paid the day before.

Such conclusions follow from Article 136 of the Labor Code of the Russian Federation and are confirmed by paragraph 3 of the letter of the Ministry of Labor of Russia dated November 28, 2013 No. 14-2-242.

Accordingly, define the period of salary delay as the number of days by which the payment is overdue. The first day of delay is the day following the due date for payment of wages. The last day of delay is the date of actual payment of wages. This procedure is established in Article 236 of the Labor Code of the Russian Federation.

Situation: how to determine the duration of the salary delay - in calendar or working days?

When calculating compensation, determine the duration of the delay in payment of wages in calendar days. Article 236 of the Labor Code of the Russian Federation states that compensation must be calculated for each day of delay. There is no reason to exclude weekends and holidays from this period.

Compensation options

Before you begin calculating compensation, you must be sure to familiarize yourself with the conditions written down in the employment or collective agreement. It is quite possible that the contracts provide for other compensation rates. The fact is that Article 236 of the Civil Code stipulates the minimum amount of compensation, while the employment contract may provide for higher percentages.

Please note: It does not matter to the employee why the payments were delayed. This could be the illness of the accountant or the dishonesty of the employer’s business partner, that is, the delay may occur through no fault of the employer. But this does not relieve him of the obligation to pay compensation.

Compensation calculation

Calculate compensation for delayed wages using the formula:

| Compensation for delayed wages | = | Salary arrears | × | 1/300 of the refinancing rate (or a greater percentage established by the organization) | × | Number of days of delay |

An example of calculating compensation for delayed wages. The amount of compensation is established in the collective agreement

The collective agreement adopted by the organization establishes the following terms for payment of wages:

- On the 20th – an advance of 40 percent of the salary;

- 5th – final payment.

According to the collective agreement, compensation for delayed wages is 0.06 percent for each day of delay.

The organization paid the final payment for December 2020, as well as the entire salary amount for January 2020, on February 16, 2016.

The amounts owed and the delay period were:

- 300,000 rub. (final payment for December 2020) – 47 days (from January 1 to February 16, 2020 (January 1–8, 2020 are holidays, so salaries for December must be paid on December 31, 2020));

- 250,000 rub. (advance payment for January 2020) – 27 days (from January 21 to February 16, 2020);

- 300,000 rub. (final calculation for January 2020) – 11 days (from February 6 to February 16, 2020).

Along with the arrears of wages, the organization paid compensation for the delay. The amount of compensation was: 300,000 rubles. × 47 days × 0.06% + 250,000 rub. × 27 days × 0.06% + 300,000 rub. × 11 days × 0.06% = 14,490 rub.

Situation: how to calculate the amount of debt owed to an employee, with which compensation must be paid for delayed payment of wages - taking into account personal income tax or without taking into account?

Determine the amount of wage arrears from which compensation is calculated without taking into account personal income tax.

When paying wages, the organization is obliged to withhold personal income tax from it, which means it should not pay it to the employee (clause 4 of article 226 of the Tax Code of the Russian Federation). Personal income tax is not part of unpaid wages. And compensation for the delay must be calculated based on the actual amount of the debt (Article 236 of the Labor Code of the Russian Federation).

Situation: how to calculate compensation for delayed wages if the refinancing rate changed several times during the period of delay? According to the collective (labor) agreement, compensation is calculated based on the refinancing rate.

Calculate the amount of compensation, taking into account all changes in the refinancing rate. Divide the period of late payment of wages into periods in which different refinancing rates were in effect and calculate compensation for each of these periods. This conclusion follows from the literal interpretation of Article 236 of the Labor Code of the Russian Federation. It says that the amount of compensation for delayed wages is not less than one three hundredth of the refinancing rate in force at that time (i.e., during the period of delay).

An example of calculating compensation for delayed wages. The amount of compensation is not established by the collective (employment) agreement

The collective agreement adopted by the organization establishes the following terms for payment of wages:

- On the 20th – an advance of 40 percent of the salary;

- 5th – final payment.

The organization paid the final payment for December 2020, as well as the entire salary amount for January 2020, on February 26, 2016.

The amounts owed and the delay period were:

- 300,000 rub. (final payment for December 2020) – 57 days (from January 1 to February 26, 2020 (January 1–8, 2020 are holidays, so salaries for December must be paid on December 31, 2020));

- 250,000 rub. (advance payment for January 2020) – 37 days – from January 21 to February 26, 2020;

- 300,000 rub. (final calculation for January 2020) – 21 days – from February 6 to February 26, 2020.

Along with the arrears of wages, the organization paid compensation for the delay. Its size is not established in the collective agreement, so the calculation is made based on 1/300 of the refinancing rate, which is 11 percent.

Therefore, the amount of compensation was:

– for late wages for December 2020: RUB 6,270. (RUB 300,000 × 57 days × 1/300 × 11%);

– for late advance payment for January 2020: RUB 3,391.67. (RUB 250,000 × 37 days × 1/300 × 11%);

– for late wages for January 2020: 2310 rubles. (RUB 300,000 × 21 days × 1/300 × 11%).

The total amount of compensation was 11,971.67 rubles. (6270 rubles + 3391.67 rubles + 2310 rubles).

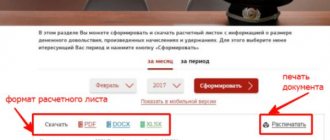

Calculator for calculating compensation for delayed wages (Article 236 of the Labor Code of the Russian Federation)

If you have not been paid your wages, you can go to court to protect your rights. Along with the recovery of wages, you can demand payment of interest for delayed wages in accordance with Art. 236 of the Labor Code of the Russian Federation, as well as moral damage. Moreover, in order to collect interest, it is necessary to provide the court with a calculation of this interest.

Instructions for filing a claim for unpaid wages

If you are not paid your wages, and you work or worked officially, then in order to get your honestly earned money, you have to go to court. Let us immediately note that the statute of limitations for this category of cases is only 3 months from the day you learned or should have learned of a violation of your right. (Article 392 of the Labor Code of the Russian Federation)

An employee has the right to go to court to resolve an individual labor dispute within three months from the day he learned or should have learned about a violation of his rights, and in disputes about dismissal - within one month from the date he was given a copy of the dismissal order or the day of issue of the work book.

The employer has the right to go to court in disputes regarding compensation by the employee for damage caused to the employer within one year from the date of discovery of the damage caused.

If, for good reason, the deadlines established by parts one and two of this article are missed, they may be restored by the court.)

What does it mean to miss the statute of limitations?

The essence of this concept is as follows: if you file a claim in court after missing this deadline and the defendant asks to apply the consequences of missing the statute of limitations, then the court will reject the claim (although in fact you were not paid wages). Of course, you can hope that the defendant (your employer) will not come to court and write a review, but this is a huge risk and no lawyer will give you a guarantee of a positive court decision in this situation. That is why it is necessary to file a claim, preferably without missing the statute of limitations.

Countdown of the limitation period

Let us explain a little that the date from which this period is calculated is determined by law as follows: when he learned or should have learned about the violation of his right . That is, if you receive wages on the 5th and 20th of each month and on the 5th you were not given your next wage, this will be the beginning of the limitation period (you learned that you were not paid wages).

It should be noted that to protect your rights as an employee, you can contact the labor inspectorate and even the prosecutor's office , but unlike these structures, only a court decision can be enforced. Therefore, if the labor inspectorate issues an order to the employer, which indicates the need to pay wages to such and such employees, then administrative liability will arise for the employer for failure to comply with this order, but the employee in this case remains unprotected. Moreover, contacting the labor inspectorate does not extend the statute of limitations .

For example, you were not paid your wages on June 5 - you contacted the labor inspectorate. After 2 months, we learned that an order had been issued against your employer indicating the need to pay you a salary, but the employer did not pay and after another 1 month did not pay. As a result, when a person plans to go to court (since the employer does not pay wages), the statute of limitations has already expired.

Which court should I go to?

Currently, labor disputes fall under the jurisdiction of district courts . Moreover, the claim is filed at the location of the defendant (that is, the employer). There is one exception to this rule : an application for a court order is submitted to the magistrate (also at the location of the defendant), if wages have already been accrued, that is, you have a pay slip indicating the amount of your salary for a given month, but you have not received it got.

Documents for filing a claim for unpaid wages

For this category of cases, the state fee is not paid, so the following documents are needed to file a claim:

- Statement of claim;

- Employment contract;

- Employment history;

- Calculation of collected wages;

- Interest calculation;

- Other documents (for example, confirming legal services, pay slips, etc.).

Let us add that the number of claims must correspond to the number of persons participating in the case. For example, if we have 1 plaintiff and 1 defendant, then we make 3 copies: 1 for the court, the second for the defendant and, if desired, 1 for ourselves. If the defendant has documents that you attach to the claim, then you can not make copies of these documents for the defendant, but simply write that the defendant has these documents.

The list of documents that are attached to the claim is established by Art. 132 Code of Civil Procedure of the Russian Federation

Article 132. Documents attached to the statement of claim

The following are attached to the statement of claim:

its copies in accordance with the number of defendants and third parties;

a document confirming payment of the state duty;

power of attorney or other document certifying the authority of the plaintiff’s representative;

documents confirming the circumstances on which the plaintiff bases his claims, copies of these documents for defendants and third parties, if they do not have copies;

evidence confirming the implementation of the mandatory pre-trial dispute resolution procedure, if such a procedure is provided for by federal law or agreement;

calculation of the collected or disputed amount of money, signed by the plaintiff, his representative, with copies in accordance with the number of defendants and third parties.

Filing a claim for unpaid wages in court

When the statement of claim is ready and all documents have been collected, you can go to court. The statement of claim can be submitted directly to the court (in this case, you will be given a mark indicating acceptance of the claim on your copy of the claim) or can be sent by registered mail with a list of attachments. After this, you will only have to wait for the court to notify you of the date of the court hearing.

Accounting

Payment of compensation for delayed wages is not related to expenses for ordinary activities. Compensation is a sanction for violation of the terms of an employment (collective) agreement.

In accounting, take this payment into account in other expenses (clause 11 of PBU 10/99). The accrual of compensation is not related to calculations of wages, so reflect it on account 73 “Settlements with personnel for other operations” (Instructions for the chart of accounts).

In accounting, reflect the accrual of compensation by posting:

Debit 91-2 Credit 73

– compensation for delayed wages has been accrued.

Compensation is calculated on the day the salary is paid. Only at this moment can the amount of expenditure be accurately determined, and, accordingly, the requirements of paragraph 16 of PBU 10/99 will be met.

How to count the number of days of delay

According to Article 236 of the Labor Code of the Russian Federation, the first day of delay is the day following the expected date of payment of wages. The last day of delay is considered to be the day of actual payment of wages. In this case, compensation must be calculated for each day of delay plus holidays and weekends.

Let's look at the calculation rules using the following examples:

- 30 days have passed from the moment the salary was calculated to the day it was actually paid. The company's regulations indicate the amount of compensation for delay in the amount of 1/150 of the key rate (10%). The amount of unpaid wages (excluding personal income tax) as of the date of calculation of compensation is 30,000 rubles. Let's calculate compensation: 30,000 x 0.067 (1/150 x 10) = 603.00 rubles.

- In accordance with the collective agreement, compensation associated with delayed wages is equal to 0.08 percent of the amount of debt for each day of delay. The delay in payment of wages is 40 days. The amount of unpaid wages is 200,000 rubles. We calculate the compensation: 200,000 x 0.08/100 x 40 = 6,400 rubles.

- The amount of compensation associated with delayed wages is not provided for in the enterprise’s collective agreement; therefore, the calculation should be made based on 1/150 of the key rate. The key rate in force for the period of non-payment is 10% (from December 1, 2020 to January 31, 2020) and 8% (presumably from February 1 to February 10, 2020). The amount of unpaid wages is 190 thousand rubles. We calculate the total compensation: (190,000 x 0.067/100 x 62) + (190,000 x 0.05/100 x 10) = 7892.6 + 950 = 8842.6 rubles.

Making up transactions

It should always be borne in mind that the determination of the amount of compensation for delayed wages can only be made at the time of repayment of the existing wage arrears.

Therefore, compensation should be calculated in accounting directly on the expected payday. In accounting, the compensation in question is taken into account in other expenses. Since the calculation of compensation does not concern calculations related to wages, it is shown on the 73rd account “Settlements with personnel for other operations.”

In this case, the following accounting entries are relevant:

- Dt 91 – Kt 73 – compensation was accrued for delayed payment of wages;

- Dt73 – Kt 51/50 – payment of compensation related to delayed wages was made.

Personal income tax and insurance premiums

The amount of compensation cannot be less than 1/300 of the refinancing rate in force during the period of delay of the amounts not paid on time for each day of delay (Article 236 of the Labor Code of the Russian Federation). That is, the organization has the right to pay compensation in a larger amount. The procedure for taxation of personal income tax will depend on the registration of such compensation. The table will help you figure this out.

| Compensation amount | Provided for by the collective (labor) agreement | Obligation to withhold and remit personal income tax |

| 1/300 refinancing rate | doesn't matter | No |

| more than 1/300 of the refinancing rate | Yes | No |

| more than 1/300 of the refinancing rate | No | yes, from the amount exceeding the minimum amount of compensation |

This follows from the provisions of paragraph 3 of Article 217 of the Tax Code of the Russian Federation, Article 236 of the Labor Code. The correctness of this approach is confirmed by letters of the Ministry of Finance of Russia dated April 18, 2012 No. 03-04-05/9-526, dated November 28, 2008 No. 03-04-05-01/450, dated August 6, 2007 No. 03- 04-05-01/261 and the Federal Tax Service of Russia dated June 4, 2013 No. ED-4-3/10209 (the document is posted on the official website of the tax service in the section “Explanations mandatory for use by tax authorities”).

Situation: is it necessary to charge insurance premiums for compensation for delayed payment of wages?

Yes need.

This is due to the fact that such compensation is not named in the closed lists of payments not subject to insurance premiums, namely:

– in Article 9 of the Law of July 24, 2009 No. 212-FZ – in relation to contributions to compulsory pension (social, medical) insurance;

– in Article 20.2 of the Law of July 24, 1998 No. 125-FZ – in relation to contributions for insurance against industrial accidents and occupational diseases.

This means that it must be regarded as a payment made to employees within the framework of labor relations, and subject to insurance premiums in the general manner (Part 1, Article 7 of the Law of July 24, 2009 No. 212-FZ, Part 1 of Article 20.1 of the Law dated July 24, 1998 No. 125-FZ).

A similar conclusion was made in letters from the Ministry of Labor of Russia dated August 6, 2014 No. 17-4/B-369, and the Ministry of Health and Social Development of Russia dated March 15, 2011 No. 784-19.

Advice: there are arguments for not charging insurance premiums for compensation. They are as follows.

Compensation for delayed payment of wages cannot be regarded as an employee's remuneration, but is considered the financial responsibility of the employer. It is an independent type of legally established compensation payments related to the performance of a person’s labor duties. Consequently, compensation for delayed payment of wages is not subject to insurance premiums on the basis of:

- paragraph “i” of Part 2 of Article 9 of the Law of July 24, 2009 No. 212-FZ - in relation to contributions to compulsory pension (social, medical) insurance;

- subclause 2 of part 1 of Article 20.2 of the Law of July 24, 1998 No. 125-FZ - in relation to contributions for insurance against industrial accidents and occupational diseases.

This approach is confirmed by arbitration practice (see, for example, the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 10, 2013 No. 11031/13, the ruling of the Supreme Court of the Russian Federation dated December 18, 2014 No. 307-KG14-5726, the decisions of the Arbitration Court of the North-Western District dated October 2, 2014 No. A56-3173/2014, FAS Volga District dated July 21, 2014 No. A06-6685/2013, Far Eastern District dated May 15, 2013 No. F03-1527/2013, Moscow District dated March 27, 2013 No. A41-28843/12, Volga-Vyatka District dated October 25, 2012 No. A31-11529/2011).

The procedure for calculating other taxes depends on what taxation system the organization uses.

Accounting for compensation for late wages in income tax expenses

Regarding income tax, the situation is somewhat more complicated. The Tax Code of the Russian Federation does not contain any provisions regarding whether such compensation can be taken into account as expenses or not.

The code only says that a company can include in its expenses compensation, the payment of which to employees is related to any working conditions (Article 255 of the Tax Code of the Russian Federation).

In addition, paragraph 13 of Art. 265 of the Tax Code of the Russian Federation allows sanctions for violation of contracts to be taken into account in expenses. However, no restrictions or sanctions have been established. There are also no special conditions regarding whether this rule applies only to civil contracts or to employment contracts as well.

Therefore, on the one hand, it is possible to consider compensation for the delay of the PO as a sanction and take it into account as part of the expenses. Previously, the courts agreed with this logic (resolutions of the Federal Antimonopoly Service of the Volga District dated August 30, 2010 in case No. A55-35672/2009).

At the same time, later the regulatory authorities took the position that such compensation cannot be included in expenses, since it is not related to working conditions (Article 255 of the Tax Code of the Russian Federation does not apply), and the norms of Art. 265 of the Tax Code of the Russian Federation does not apply to this compensation (letter of the Ministry of Finance of the Russian Federation dated October 31, 2011 No. 03-03-06/2/164).

Therefore, today it is quite risky to take into account compensation for delays in salary payments in expenses.

Income tax

Payment of compensation for delayed wages is provided for by labor legislation. It is a sanction for violating the terms of an employment (collective) agreement. This follows from Article 236 of the Labor Code of the Russian Federation. Despite this, the Russian Ministry of Finance prohibits taking such payments into account as expenses.

Situation: is it possible to take into account the amount of compensation for delayed wages as part of non-operating expenses or labor costs? The organization applies a general taxation system.

No you can not.

Expenses for payment of compensation for delayed wages are not considered non-operating expenses in the form of sanctions for violation of contractual obligations (subclause 13, clause 1, article 265 of the Tax Code of the Russian Federation). The obligation to pay compensation for delayed wages is provided for by labor legislation, and subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation applies to civil law relations.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated October 31, 2011 No. 03-03-06/2/164 and dated April 17, 2008 No. 03-03-05/38.

Labor costs taken into account when calculating income tax include compensation charges related to work hours or working conditions provided for by Russian legislation and labor (collective) agreements (Article 255 of the Tax Code of the Russian Federation). Compensation for delayed wages is not related to the working hours and working conditions (Article 236 of the Labor Code of the Russian Federation). Therefore, these payments do not reduce taxable profit as labor costs.

Such clarifications are given in letters of the Ministry of Finance of Russia dated October 31, 2011 No. 03-03-06/2/164 and dated April 17, 2008 No. 03-03-05/38, as well as in the resolution of the Federal Antimonopoly Service of the Central District dated February 21, 2008 No. A09-7868/05-15.

Advice: there are arguments that allow you to take into account the amount of compensation for delayed wages as part of expenses (non-operating or labor costs). They are as follows.

The basis for including compensation for delayed wages in non-operating expenses is that subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation does not directly indicate in case of violation of which contractual obligations - civil or labor - it is applied. Therefore, this subclause can also be applied to compensation for delayed wages. In addition, such compensation is not named in Article 270 of the Tax Code of the Russian Federation as expenses not taken into account when taxing profits. Therefore, it can be taken into account as part of non-operating expenses. This position is confirmed by judicial practice (see, for example, decisions of the Federal Antimonopoly Service of the Volga-Vyatka District dated August 11, 2008 No. A29-5775/2007, Ural District dated April 14, 2008 No. F09-2239/08-S3, Volga District dated June 8, 2007 No. A49-6366/2006).

Compensation for delayed wages can also be taken into account as part of labor costs. It is explained this way. Taxable profit is reduced by any payments to employees in cash and (or) in kind, including compensation accruals provided for by labor and (or) collective agreements (paragraph 1, paragraph 3 of Article 255 of the Tax Code of the Russian Federation). The exception is the payments listed in Article 270 of the Tax Code of the Russian Federation. When calculating the tax base for income tax, they cannot be taken into account under any circumstances. In addition, the list of labor costs that are taken into account when taxing profits is open (clause 25 of Article 255 of the Tax Code of the Russian Federation). Therefore, compensation for delayed wages can also be taken into account as part of labor costs. This conclusion is confirmed by the Federal Antimonopoly Service of the Moscow District in its resolution dated March 11, 2009 No. KA-A40/1267-09.

Under such circumstances, the organization can independently decide which group of expenses to include the costs associated with the payment of compensation for delayed wages (clause 4 of Article 252 of the Tax Code of the Russian Federation).

An example of how to take into account compensation for delayed wages. General organization

In August, Alpha LLC delayed payment of salaries to employees. The amount of debt (minus personal income tax) is 300,000 rubles. The amount of calculated compensation was 1650 rubles.

For the amount of compensation, the accountant calculated contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases.

The total amount of insurance premiums was 495 rubles. (RUB 1,650 × 30%), including:

- to the Pension Fund of Russia – 363 rubles. (RUB 1,650 × 22%);

- in the Federal Social Insurance Fund of Russia – 47.85 rubles. (RUB 1,650 × 2.9%);

- in the Federal Compulsory Medical Insurance Fund – 84.15 rubles. (RUB 1,650 × 5.1%).

The contribution rate for insurance against accidents and occupational diseases is 0.2 percent. The amount of accrued contributions was 3.30 rubles. (RUB 1,650 × 0.2%).

On the day of payment of the debt, the following entries were made in the organization’s accounting:

Debit 70 Credit 50 – 300,000 rub. – salaries were paid to employees;

Debit 91-2 Credit 73 – 1650 rub. – compensation was accrued for delayed salaries to employees;

Debit 73 Credit 50 – 1650 rub. – compensation was paid to employees for delayed salaries;

Debit 44 Credit 69 subaccount “Settlements with the Pension Fund” – 363 rubles. – pension contributions have been accrued;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 47.85 rubles. – insurance premiums have been accrued to the Federal Social Insurance Fund of Russia;

Debit 44 Credit 69 subaccount “Settlements with FFOMS” – 84.15 rubles. – insurance premiums to the Federal Compulsory Compulsory Medical Insurance Fund have been calculated;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” – 3.30 rubles. – premiums for insurance against accidents and occupational diseases are calculated.

In tax accounting, the amount of compensation for delayed wages is not taken into account. Alfa does not withhold personal income tax from the compensation amount.

Formula and example for calculating compensation for delayed wages

Using the above formula, you can independently calculate the compensation you are entitled to,

The amount of the employee's advance is 15,000 rubles.

His payment was delayed by 6 days.

Using the formula we get: 15,000 x 1/150 x 7.75% x 6 = 46.50 rubles.

Amount of debt / 300 * refinancing rate of the Central Bank of the Russian Federation as of the current date / 100 * number of days of delay in payment.

The days of delay that have passed from the date of accrual of wages to the day of their actual payment are 30. The refinancing rate valid for the period of non-payment is 11%. The amount of unpaid wages as of the date of calculation of compensation amounted to 50,000 rubles.

Calculation: 50000/300*11/100*30 = 550 rubles.

Thus, the compensation to the employee amounted to 550 rubles.

Compensation is paid starting from the day following the day of advance or salary stipulated by the labor regulations or other local regulations, for each day of delay until the day of actual transfer of wages or other types of payments to the employee’s account or delivery to him.

Such compensation is subject to personal income tax in accordance with Art. 217 of the Tax Code of the Russian Federation (clause 3, paragraph 11) is not taxed, but only within the limits not exceeding those established by the Labor Code.

If a collective agreement or other industry tariff agreement provides for an amount of compensation greater than that established by law, then the difference is subject to personal income tax.

It is important that if the day of payment of wages falls on a weekend or a day of a generally established state or regional holiday, then the salary must be paid on the working day that is the last before the weekend or holiday.

For example, if salary payment is set on the 5th, and the 5th is Saturday, then the salary must be paid on Friday, the 4th. Payment on Monday, the 7th, will be considered late, and the head of the company will have an obligation to pay compensation.

It should be taken into account that banking practice involves annual capitalization of interest. This means that once a year the accrued interest is added to the total amount of debt, and new interest is accrued on the existing debt with the added interest for the past year. You need to be aware of this right and demand exactly this calculation of payments if they are delayed by more than a year.

Compensation for delayed wages

=

Salary arrears

X

1/150 of the key rate (or a greater percentage set by the organization)

X

Number of days of delay

• on the 20th – an advance in the amount of 40 percent of the salary;

• 5th – final payment.

According to the collective agreement, compensation for delayed wages is 0.06 percent for each day of delay.

The organization paid the final payment for December 2013, as well as the entire salary amount for January 2014, on February 16, 2014.

• 300,000 rub. (final payment for December 2013) – 47 days (from January 1 to February 16, 2014 (January 1–8, 2014 are holidays, so wages for December must be paid on December 31, 2013));

• 250,000 rub. (advance payment for January 2014) – 27 days (from January 21 to February 16, 2014);

• 300,000 rub. (final calculation for January 2014) – 11 days (from February 6 to February 16, 2014).

Along with the arrears of wages, the organization paid compensation for the delay.

The amount of compensation for delayed wages was: RUB 300,000. × 47 days × 0.06% RUB 250,000 × 27 days × 0.06% RUB 300,000 × 11 days × 0.06% = 14,490 rub.

The Labor Code of the Russian Federation does not establish in what specific amount the company must pay compensation to employees for delays in wages. The legislator gave organizations the right to independently determine this in a collective agreement.

MRK = ZPnach × Kl.St. / 150 × Dpr,

where: MRK is the minimum that the employer is obliged to pay to the employee for a delay in salary;

ZPnach - the amount of wages that should have been paid to the employee on a strictly established day (minus personal income tax);

Class.St. — refinancing rate (key rate) of the Central Bank of the Russian Federation for the period of delay;

DPR - the number of days for which the employer was late in paying employees wages.

In the collective agreement, the company can only increase the amount of compensation for delay; the organization does not have the right to set it in a smaller amount than according to the above formula.

IMPORTANT! For information on the size of the key rate (refinancing rate), see here.

Example 2

Salary in the company is paid, according to the collective agreement, on the 5th (for the second half of the previous month) and the 20th (for the first half of the current month) of the month. The collective agreement does not contain special provisions regarding compensation for late wages.

For the first half of February, the employee was accrued salary in the amount of 30,000 rubles. However, it was actually paid only on March 6.

The refinancing rate in force during the period under review (conditionally) was 7.5%.

MRC = 30,000 × (100% – 13%) × 7.5% / 150 × 15 = 195.75 (rub.)

However, it is not enough to simply correctly calculate the amount of compensation for late salary payments. It is also important for an organization to clearly know whether personal income tax should be withheld from such compensation, whether insurance premiums should be charged and paid for such an amount, and what to do with expenses for profit tax purposes.

simplified tax system

If an organization applies a simplification with the object of taxation being income, do not take into account compensation for delayed wages when calculating the single tax (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

Situation: is it possible to take into account the amount of compensation for delayed payment of wages as part of labor costs? The organization applies a simplification; it pays a single tax on the difference between income and expenses.

No you can not.

An organization can reduce the income received by paying for labor costs (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation). Labor costs include, among other things, compensation accruals related to the work schedule or working conditions provided for by the norms of Russian legislation and labor (collective) agreements (Article 255, paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation).

Compensation for delayed payment of wages is not related to the working hours and working conditions (Article 236 of the Labor Code of the Russian Federation). Therefore, it is impossible to take into account compensation for delayed payment of wages as part of labor costs. A similar conclusion is contained in the letter of the Federal Tax Service for Moscow dated August 6, 2007 No. 28-11/074572.

The same explanations are given in letters of the Ministry of Finance of Russia dated October 31, 2011 No. 03-03-06/2/164 and dated April 17, 2008 No. 03-03-05/38. Despite the fact that the explanations of the specialists of the financial department are addressed to income tax payers, simplified organizations can also be guided by them (Clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

Advice: there are arguments that allow you to take into account the amount of compensation for delayed wages as part of labor costs. They are as follows.

Labor costs include any accruals to employees in cash and (or) in kind, including compensation accruals provided for by labor and (or) collective agreements (paragraph 1, paragraph 3 of Article 255, paragraph 2 of Article 346.16 Tax Code of the Russian Federation). In addition, the list of labor costs that are taken into account when taxing profits is open (clause 25, article 255, clause 2, article 346.16 of the Tax Code of the Russian Federation). Therefore, compensation for delayed wages can be taken into account as part of labor costs when calculating the single tax under simplification.

This conclusion is confirmed by the Federal Antimonopoly Service of the Moscow District in its resolution dated March 11, 2009 No. KA-A40/1267-09. This resolution is dedicated to organizations on the general taxation system. However, simplified organizations can also be guided by the conclusions drawn in it (clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

An example of how to take into account compensation for delayed wages. The organization applies a simplification (“income minus expenses”)

Alpha LLC applies a simplified tax system and pays a single tax on the difference between income and expenses. In August, Alpha delayed payment of salaries to employees. The amount of debt (minus personal income tax) is 300,000 rubles. The amount of calculated compensation was 1650 rubles.

For the amount of compensation, the accountant calculated contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases. The total amount of insurance premiums was 495 rubles. (RUB 1,650 × 30%), including:

- to the Pension Fund of Russia – 363 rubles. (RUB 1,650 × 22%);

- in the Federal Social Insurance Fund of Russia – 47.85 rubles. (RUB 1,650 × 2.9%);

- in the Federal Compulsory Medical Insurance Fund – 84.15 rubles. (RUB 1,650 × 5.1%).

The contribution rate for insurance against accidents and occupational diseases is 0.2 percent. The amount of accrued contributions was 3.30 rubles. (RUB 1,650 × 0.2%).

On the day of payment of the debt, the following entries were made in the organization’s accounting:

Debit 70 Credit 50 – 300,000 rub. – salaries were paid to employees;

Debit 91-2 Credit 73 – 1650 rub. – compensation was accrued for delayed salaries to employees;

Debit 73 Credit 50 – 1650 rub. – compensation was paid to employees for delayed salaries;

Debit 44 Credit 69 subaccount “Settlements with the Pension Fund” – 363 rubles. – pension contributions have been accrued;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 47.85 rubles. – insurance premiums have been accrued to the Federal Social Insurance Fund of Russia;

Debit 44 Credit 69 subaccount “Settlements with FFOMS” – 84.15 rubles. – insurance premiums to the Federal Compulsory Compulsory Medical Insurance Fund have been calculated;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” – 3.30 rubles. – premiums for insurance against accidents and occupational diseases are calculated.

When calculating the single tax, compensation for delayed wages is not taken into account in expenses. Alfa does not withhold personal income tax from the compensation amount.

Compensation for delayed payment of wages under the Labor Code of the Russian Federation

In times of crisis, many Russian companies, often small businesses, are increasingly delaying wages (hereinafter referred to as wages) to their employees. In most cases, this is not the fault of the company: each of them is a link in a dependent chain of counterparties. Consequently, as soon as payment interruptions (payment under contracts from customers/purchasers are not received on time) occur in one link, this is automatically reflected in all subsequent ones. As a result, this may lead to the fact that employees of one, or perhaps several levels, will not receive salaries on time.

If this happens and the employees do not receive the wages due to them on time, then the employing company will subsequently be obliged to pay the employees not only their wages, but also compensation (which in its content represents interest on late payments). This is stated in Art. 236 Labor Code of the Russian Federation.

IMPORTANT! Failure to pay wages on time, among other things, gives the employee the right to temporarily suspend the performance of his labor functions, as well as apply for compensation for moral damage (Articles 142, 237 of the Labor Code of the Russian Federation).

Compensation for late payment of wages is accrued from the day following the established payment deadline until the day the employer repays the debt to employees, inclusive.

Example 1

If the salary, for example, was supposed to be paid on the 5th, but was actually paid on the 12th, then the compensation will be calculated for 7 days (from the 6th to the 12th inclusive).

If a delay did occur, the employing company will have to pay the employee appropriate compensation, regardless of whether it is directly to blame for the delay in the salary or not.

NOTE! Today, the situation is especially relevant when, due to the revocation of the license, the bank did not transfer the salary to the employees of the organization - the payroll client. This circumstance does not relieve the employer of the risk of falling under Art. 236 of the Labor Code of the Russian Federation, since the fact of guilt does not matter. Therefore, in order to minimize this risk, the company should more carefully select a bank for its salary project.

Moreover, if, for example, the bank is to blame for the delay (in particular, it did not fulfill the payment order of the client organization on time to transfer the salary to employees), then the company should remember that it has the right to make a recourse claim to the bank for the fact that it did not timely transferred the salary to the employees, which means he violated the terms of the salary project with the company. However, you will still need to pay workers' compensation first.

UTII

If an organization pays UTII, the amount of compensation for delayed salaries will not affect the tax calculation in any way. UTII is calculated based on imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

An example of how to take into account compensation for delayed wages. The organization pays UTII

Alpha LLC is a UTII payer. In August, Alpha delayed payment of salaries to employees. The amount of debt (minus personal income tax) is 300,000 rubles. The amount of calculated compensation was 1650 rubles.

For the amount of compensation, the accountant calculated contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases. The total amount of insurance premiums was 495 rubles. (RUB 1,650 × 30%), including:

- to the Pension Fund of Russia – 363 rubles. (RUB 1,650 × 22%);

- in the Federal Social Insurance Fund of Russia – 47.85 rubles. (RUB 1,650 × 2.9%);

- in the Federal Compulsory Medical Insurance Fund – 84.15 rubles. (RUB 1,650 × 5.1%).

The contribution rate for insurance against accidents and occupational diseases is 0.2 percent. The amount of accrued contributions was 3.30 rubles. (RUB 1,650 × 0.2%).

On the day of payment of the debt, the following entries were made in the organization’s accounting:

Debit 70 Credit 50 – 300,000 rub. – salaries were paid to employees;

Debit 91-2 Credit 73 – 1650 rub. – compensation was accrued for delayed salaries to employees;

Debit 73 Credit 50 – 1650 rub. – compensation was paid to employees for delayed salaries;

Debit 44 Credit 69 subaccount “Settlements with the Pension Fund” – 363 rubles. – pension contributions have been accrued;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 47.85 rubles. – insurance premiums have been accrued to the Federal Social Insurance Fund of Russia;

Debit 44 Credit 69 subaccount “Settlements with FFOMS” – 84.15 rubles. – insurance premiums to the Federal Compulsory Compulsory Medical Insurance Fund have been calculated;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” – 3.30 rubles. – premiums for insurance against accidents and occupational diseases are calculated.

Alfa does not withhold personal income tax from the compensation amount.

Responsibility for delayed wages

Administrative liability is provided for late wages:

- for an organization – a fine in the amount of 30,000 to 50,000 rubles;

- for officials (for example, a manager) - a warning or a fine from 1000 to 5000 rubles;

- for entrepreneurs – a fine of 1,000 to 5,000 rubles.

Repeated violation entails:

- for an organization – a fine from 50,000 to 70,000 rubles;

- for officials (for example, a manager) – a fine of 10,000 to 20,000 rubles. or disqualification for a period of one to three years;

- for entrepreneurs – a fine from 10,000 to 20,000 rubles.

These are the requirements of parts 1 and 4 of Article 5.27 of the Code of the Russian Federation on Administrative Offenses.

In addition, criminal liability is provided for officials (Article 145.1 of the Criminal Code of the Russian Federation) and disciplinary liability (Article 192 of the Labor Code of the Russian Federation).

Criminal liability of the manager

The head of an organization may be held criminally liable provided that he was directly or indirectly interested in the delay in wages. It does not matter how many employees’ payments were delayed (one is enough). The deadlines for delaying wages, in case of violation of which the manager may be brought to criminal liability, are as follows:

- complete non-payment – over two months;

- payment of wages in an amount below the minimum wage (minimum wage) - more than two months;

- partial non-payment – over three months.

For a manager who has allowed partial non-payment of wages for more than three months, the following types of criminal liability are provided:

- a fine of up to 120,000 rubles. (or in the amount of salary or other income of the convicted person for a period of up to one year);

- deprivation of the right to hold certain positions or engage in certain activities for a period of up to one year;

- forced labor for up to two years;

- imprisonment for up to one year.

The head of an organization in which wages were not paid in full for two months or were paid in an amount below the minimum wage is subject to more stringent criminal liability measures. Namely:

- a fine in the amount of 100,000 to 500,000 rubles. (or in the amount of salary or other income of the convicted person for a period of up to three years);

- forced labor for a period of up to three years, while the court may additionally impose deprivation of the right to hold certain positions or engage in certain activities for a period of up to three years;

- imprisonment for a term of up to three years, while the court may additionally impose deprivation of the right to hold certain positions or engage in certain activities for a term of up to three years.

These types of liability are listed in parts 1 and 2 of Article 145.1 of the Criminal Code of the Russian Federation.

If the delay in wages entailed serious consequences, then the punishment will be even more severe (Part 3 of Article 145.1 of the Criminal Code of the Russian Federation).

Criminal liability can be avoided if the cause of the delay did not depend on the will of the manager.

Manager's responsibility for late payments to employees

The law establishes the responsibility of the head of an organization for delays in payment of wages and for refusal to pay compensation. We are talking about the following types of responsibility:

- It all starts with the easiest type of responsibility - disciplinary . It is established by 134, 195 and 342 articles of the Labor Code. In accordance with the norms of these articles, the employer (the state for state-owned companies, shareholders or founders for private companies), upon application of a trade union organization or other representative body of persons working at the enterprise, is obliged to apply to the manager or his deputy who has committed delays all disciplinary measures provided for by law - from reprimand before dismissal. The choice of punishment option is at the discretion of the owner of the organization. Of course, we must take into account that in order to make such an application, you must first create a representative body that unites workers.

- If the manager’s violation of the terms of payment of wages and the subsequent payment of compensation caused material damage , then the employer can go to court so that the amount of this damage is recovered from the violating manager and returned to the organization. If the manager is truly guilty, then the court may decide to impose penalties.

- Administrative liability is also provided . In accordance with Article 5.27 of the Administrative Code, an administrative fine may be imposed on the head of an enterprise for delaying wages and refusing to accrue compensation. The amount of the fine is quite significant; it varies from 30 to 50 thousand rubles. If a manager, after a one-time penalty, commits such a violation again, he may be disqualified in court, that is, deprived of the right to work in managerial positions for a period of up to 3 years.

- Well, in egregious cases, the labor inspectorate can send materials against the violator to the prosecutor’s office, which will submit them to the court to bring this manager to criminal liability .

Financial responsibility of the organization

The financial liability of the organization in the form of payment of compensation for delayed wages is established by Article 236 of the Labor Code of the Russian Federation. The organization is obliged to pay the specified compensation to employees even if the delay in wages occurred due to reasons beyond its control. The amount of compensation for delayed payment of wages must be reflected in pay slips (Article 136 of the Labor Code of the Russian Federation).

If an organization does not pay compensation voluntarily, then the court can force it (clause 55 of the resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2).

When and to whom is compensation due?

The Labor Code of the Russian Federation establishes that salaries must be paid at least twice a month. Specialists with whom employment contracts have been concluded will receive payment in two tranches: an advance payment for the first half of the month and a final payment for the second half. Please note that the employer has the right to increase the frequency of transfers in favor of employees. For example, provide weekly payments.

Specific dates for making transfers are fixed in the collective agreement, in the internal regulations, and are specified in the employment agreement with the employee. Let us remind you that the maximum permissible period for which the transfer can be postponed is 15 calendar days from the end of the period for which the accruals were made. For example, salaries for June are transferred no later than July 15. If the employer has delayed or overdue payments, then he is obliged to pay compensation for late payment of wages in 2020 (Article 236 of the Labor Code of the Russian Federation).

IMPORTANT! Compensation payments are due not only for delayed salary payments, but also for vacation pay (regular work, educational, additional), bonuses and incentives, allowances, scholarships and other transfers for which specific deadlines are established.

Bankruptcy

Let’s say that due to insufficient funds, the employer has an outstanding debt for payments due to employees (wages, severance pay, etc.) for more than three months. In this case, the head of the debtor organization or the individual entrepreneur himself must apply to the arbitration court with an application for bankruptcy. This is provided for in paragraph 1 of Article 9 of the Law of October 26, 2002 No. 127-FZ.

In addition, employees (including former employees) can apply to the arbitration court to declare the employer bankrupt for debts on wages and other payments. This is stated in paragraph 1 of Article 7 of the Law of October 26, 2002 No. 127-FZ.

Employees have the right to hold a meeting. Deadline – no later than five working days before the date of the meeting of creditors. The organization and holding of the meeting of employees is entrusted to the arbitration manager. At the meeting, employees elect their representative who will protect their interests in the bankruptcy process of the employer. The procedure for holding a meeting is described in detail in Article 12.1 of the Law of October 26, 2002 No. 127-FZ.

Claims for payment of arrears of wages and other remuneration to employees (including former employees) are included in the register of creditors' claims by the insolvency administrator or the registrar upon the proposal of the insolvency administrator. If such claims are disputed, they are included in the register on the basis of a judicial act establishing the composition and amount of these claims (clause 6 of Article 16 of the Law of October 26, 2002 No. 127-FZ).

Employee rights

An employee has the right to stop working if the salary is delayed for more than 15 days. In this case, the amount of debt and the guilt of the organization (lack of guilt) in the delay do not matter (clause 57 of the resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2). The maximum period of termination of work is until the debt is fully repaid. Before stopping work, employees are required to notify their supervisor in writing of their actions. After this, they have the right not to come to work at all (Part 3 of Article 142 of the Labor Code of the Russian Federation, Clause 57 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2). In this case, employees are required to return to work only the next day after receiving written notification from the organization of their readiness to repay their arrears. At the same time, the organization must pay the delayed salary on the day they return to work.

Such conditions are provided for in Article 142 of the Labor Code of the Russian Federation. There is also a list of cases when stopping work due to delayed wages is prohibited.

During the period of suspension of work due to delays in salary, the employee is paid in the amount of average earnings. They also pay compensation for late payment.

These are the requirements of Part 4 of Article 142 and Article 236 of the Labor Code of the Russian Federation.

How to calculate compensation associated with delayed wages

To calculate wage arrears, we use a simple formula:

Amount of debt x Interest for each day of delay x Value equal to the number of days of delay

Next, we recommend that you consider in detail each of the components of the above formula.

What amount of debt is used to calculate compensation?

Quite often, when calculating compensation, many people have a question related to the amount of salary arrears: how to apply - with personal income tax or without personal income tax? Since Article 236 of the Labor Code of the Russian Federation provides for the calculation of compensation for delayed wages based on the actual amount of the debt, the amount of the debt is taken without taking into account personal income tax.

When paying wages, the company is obliged to withhold personal income tax from it, which means there is no need to pay it to the employee. Personal income tax is not considered as part of unpaid wages.

What percentage/amount is used for each day of delay?

First of all, you should determine the amount of compensation for delayed wages that the company is willing to pay to its employees. To do this, the amount of compensation can be established in an employment or collective agreement, taking into account that it cannot be lower than 1/150 of the key rate. Otherwise, the amount of compensation is calculated by referring to Article 236 of the Labor Code of the Russian Federation, according to which, when calculating, a percentage is used based on 1/150 of the key rate for each day of delay.

It should be noted that the law also allows regional authorities to establish their own percentage, in connection with which a special agreement is published, agreed upon with employers and trade unions. Along with the text of such an agreement, as a rule, a proposal for accession is published. According to Article 48 of the Labor Code of the Russian Federation, if employers have not submitted a reasoned written refusal to such an offer within 30 days, the agreement automatically applies to them.

Key rate and its size

The key rate is understood as the interest rate at which the Central Bank of the Russian Federation issues loans to commercial credit institutions for one week, and accepts deposits from them for the same period. The key rate may affect the level of inflation and interest rates on loans from banking institutions.

From January 1, 2020, the value of the rate under consideration is equal to the value of the refinancing rate and, accordingly, is 10% per annum.

If the change in the value of the key rate occurred during the time period covering the delay in wages, when calculating compensation, all changes in the rate that occurred are taken into account.