We draw up an act of acceptance of the transfer of an apartment under a gift agreement

That is, you can use ready-made forms that you just need to fill out. This process is not difficult and takes very little time.

The most important thing is a preliminary check of the condition of the property, including the reliability of its location. What should you pay attention to first?

- Availability of renovations that satisfy the taste of the new owner.

- The condition of the pipes, the availability of hot and cold water, electricity and gas in the apartment (if the house is connected to the gas network).

- Condition of sockets, lighting fixtures, windows.

- Technical condition of the apartment (a house in disrepair, which may soon be demolished, can be transferred).

In the contract, state that the act will not be drawn up, the state duty is specified in the Tax Code of the Russian Federation. The gift agreement is an unconditional transaction and the act of acceptance of the transfer has no force. . The recipient either accepts the apartment as a gift or not.

In practice, such gifts are either cash or household items (TVs, microwave ovens, electric kettles, etc.).

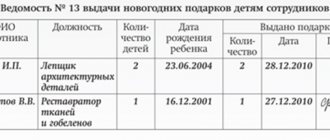

How to give New Year's gifts to employees

New Year's gifts are an integral part of the winter holidays, and every self-respecting manager strives to give them to his employees and their children. It is worth noting that even symbolic and seemingly insignificant gifts must be formalized in the established manner (agreement, order and statement of gift issuance).

Important : If the gifts in question to employees are formalized by the employer as remuneration that operates within the boundaries of a civil contract (Article 572 of the Civil Code), then, in accordance with the standards established in paragraph 3, paragraph 7 of Article of Federal Law No. 212, adopted on July 24, 2009 years - they will not be subject to mandatory insurance contributions.

Also, when calculating income tax and under the simplified tax system, given gifts, or more precisely, the costs of their acquisition, cannot reduce the tax base. In addition, the employer must charge VAT on the cost of gifts for employees and their children.

What equipment may the document concern?

By and large, a decommissioning act can be drawn up in relation to any equipment used by the organization’s employees to carry out their activities. This can be equipment from production lines, from service systems (plumbing, sewerage, ventilation, heating) and other devices and structures.

FILES

“Decommissioning” usually means the cessation of use of any equipment or devices due to their damage, breakdowns, obsolescence and other reasons that prevent their further use. Equipment can be taken out of service either temporarily (for example, for repairs) or permanently.

Is it possible to give vouchers to employees?

Another fairly common gift for employees at enterprises in 2020 is various vouchers for vacations in sanatoriums and resorts, which are issued to employees and members of their families to improve the health of the body. At the same time, as with the types of gifts described above, the process of registering this type of incentive affects such features as:

- payment of personal income tax by an employee;

- payment of insurance premiums, etc.

Important : In the event that vouchers to health care institutions are presented, according to the conditions described in Article 572 of the Civil Code, the cost of this gift should not be included in the base for calculating insurance premiums, because these payments, according to the law, do not apply to objects which are subject to mandatory insurance contributions (more information can be found in Article 7 of Federal Law No. 212, which was adopted on July 24, 2009). However, the described rule does not apply if the employer compensates for the cost of the voucher.

We remind you that the agreement for donating a trip to an employee, the cost of which exceeds 3,000 Russian rubles, is subject to mandatory written execution (according to the standards described in paragraph 2 of Article 574 of the Civil Code of the Russian Federation), and ignoring this condition leads to the nullity of the agreement and cancellation of the transaction.

Having decided to receive a voucher worth more than 4,000 Russian rubles as a gift from the employer, the employee must pay 13% of its total cost (clause 28, article 217 of the Tax Code of the Russian Federation).

In cases where the employer compensates for the voucher at the expense of money that is not included in the expenses taken into account when calculating income tax, rather than donating it, this income, according to paragraph 9 of Article 217 of the Tax Code, is exempt from personal income tax.

What to do if you find an error

Like any document, the act should not contain spelling, grammatical, punctuation and factual errors. If the latter are detected, you need to follow the standard algorithm for correction:

- The fragment with an error must be carefully crossed out so that it can be seen and read.

- Next write the correct option.

- Above or next to it they write: “Believe the corrected.”

- And they sign as a sign of confirmation of the authenticity of the changes made.

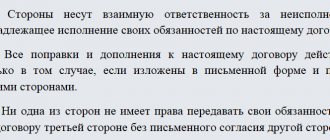

Both parties must be notified of changes made. If there are many errors found, it is better to draw up a new report and destroy the old one.

Is an act of acceptance and transfer of an apartment required under a gift agreement?

This document is optional, but significantly increases the legality of the deed of gift. If it is stated in the deed of gift that both parties have no controversial issues, and the deed confirms the fact of transfer of property, then the donation process will be considered completed. The last step will be registering property through the Roregister or MFC.

What data does the document contain?

- Data of all participants in the process.

- Addresses and dates.

- Information about the property with its full description.

- No complaints against each other.

- All documents for the gift are listed.

- The donor indicates that he is transferring the property voluntarily.

Where to contact?

Once the arrangements for the acceptance and transfer of property have taken place, the transaction can be considered completed. Formally, the property no longer belongs to the donor. All that remains is to re-register the property to the new owner.

To do this, you need to contact Rosreestr or the MFC with the appropriate application and the necessary documentation. Only after registration of rights will he be able to fully dispose of the donated property.

Let's celebrate! The addresses and telephone numbers of these institutions can be found on the Internet or using the city information service. It is worth checking their work schedule.

Where to contact?

If there is a need to inspect the transfer and acceptance certificate of an apartment or other similar property, you should contact the authorities dealing with such issues. This could be a notary office or another legal body providing services to the public.

Sample apartment donation agreement: example of filling

What information should be reflected in the act?

The transfer deed must include the following information:

- date of compilation (written clearly in printed numbers and letters);

- place of compilation;

- names and personal data of the parties to the transaction;

- passport data;

- addresses where the participants in the transfer procedure are registered and actually live;

- the address where the gift is located (apartment, house, etc.);

- what is the area of the alienated real estate;

- the name of the organization within whose walls the act was drawn up and signed;

- signatures.

At the request of the parties, other points clarifying the procedure are also introduced.

Verified by CIAN

- When re-registering for people who are closely related by blood (grandmother, grandfather, mother, father, sister, brother, etc.), they are not charged a single income tax. “Income received as a gift is exempt from taxation if the donor and donee are family members and (or) close relatives in accordance with the Family Code of the Russian Federation (spouses, parents and children, including adoptive parents and adopted children, grandfather, grandmother and grandchildren, full and half (having a common father or mother) brothers and sisters)” paragraph 18 of Article 217 of the Tax Code of the Russian Federation.

- Termination, annulment or revocation of an agreement requires the mutual consent of both parties or a court order. This cannot be done unilaterally.

- The deed of gift is drawn up in writing and is necessarily subject to state registration.

Cash

Components

The act of writing off gifts does not have an established unified template. In accordance with the existing legislative framework, it is drawn up in free form. The main thing is that it is spelled out in the accounting policies of the organization and complies with accepted standards. All of them are spelled out in Article 9 of the Accounting Law.

The form and sample document offered for downloading contain the following parts:

- A cap. It includes: company details at the top (ideally, the act is printed on the organization’s letterhead), name of the document, its number, date of signing and city.

- Listing the composition of the commission. It must consist of at least five persons who have put their signatures on the paper. Your last name, initials and position will be enough (if the commission includes employees).

- A table describing the gifts, their value and who they were given to.

- An occasion for presenting gifts. In the attached example it is New Year.

- How many units were issued and for what amount.

- Mention of the possibility of writing off the listed values from the register.

- Signatures of the commission members. If possible, the seal of the organization.

It is worth noting that the write-off act will not have legal force without a statement of issue with the signatures of the donee.

Is a deed of transfer required when donating real estate: an apartment, a house, a share in an apartment or land?

When several people claim an object of real or movable property at once, the most profitable and attractive way for both parties is to conclude a gift agreement. The conclusion of such an agreement is characterized by simplicity, speed of execution, price and reliability.

The transfer of an apartment into the ownership of another person can be confirmed by three official documents:

- gift agreement;

- the acceptance certificate, which is an annex to the agreement;

- state-issued proprietary certificate.

In addition to these papers, the package of documents must include a statement from the donor that he is ready to transfer the property as a gift, as well as state registration of the agreement.

There are aspects that are characteristic of the donation procedure:

- Real estate is alienated free of charge. It should be noted that this norm is mandatory: the donor cannot demand that the recipient fulfill any conditions in exchange for the gift received.

- When real estate is gifted to a close relative, he does not have to pay income tax. The Family Code defines the circle of persons who belong to this category, among them: parents, children, parents of parents, grandchildren, brothers and sisters.

- The agreement cannot be terminated unilaterally. This can be done by mutual consent or through a judicial authority. In a similar way, the legislator protects the rights of the parties to the transaction.

- The agreement must be in writing. This may be a handwritten or printed document.

- The donee acquires property rights immediately after the contract is signed.

To register an agreement with Rosreestr, you need to provide the following papers:

Organization of BSO circulation: issuing forms to employees

The issuance of BSO to employees who accept money from clients is, as a rule, carried out by the accounting department of the enterprise. In this case, the following documents are generated:

- agreement on the financial responsibility of the employee who accepts money from customers;

- order appointing a company employee as a financially responsible person (MOL);

- requirement-invoice for the transfer of forms to the MOL.

The first 2 documents are drawn up on the basis of established internal corporate standards for the execution of relevant acts, the third can be drawn up on the basis of a unified form No. M-11. But since this form is quite complex in its structure, a simpler document is often used instead - the act of transferring BSO to employees.

Issuing BSO to clients is a procedure that also has a number of nuances.