Registration of gift transfer

When the value of a gift from an organization exceeds 3,000 rubles, an agreement for the donation of movable property is drawn up in writing (Articles 572, 574 of the Civil Code of the Russian Federation). It indicates the value of the gift. To avoid risks regarding insurance premiums, you should not refer to employment relationships. If gifts are given to several employees at once, you can conclude a multilateral agreement in which each recipient will sign. To confirm the fact of the gift, additionally prepare an acceptance certificate or a statement in which all employees who received gifts will sign.

Inspectors often equate gifts for which a gift agreement has not been drawn up with bonuses and payments under an employment contract and charge additional insurance premiums

https://youtu.be/kvNlkHWvUVI

Documentation procedure

Each organization may have its own approach to the basic algorithm for donating material assets and writing them off. The main thing is that he:

- Took into account the requirements of tax legislation.

- Took into account the norms of civil legislation.

- Accounted for by the accounting department on off-balance sheet account 07.

- It was taken into account when the organization paid the required insurance contributions to the pension fund.

- Was reflected in the company's accounting policies.

But under no circumstances can you do without an act for writing off gifts.

Contributions to funds

Insurance premiums are not charged for gifts transferred under a gift agreement (Part 3, Article 7 of Law No. 212-FZ of July 24, 2009). Gifts worth less than RUB 3,000 can also be given without concluding a written agreement. However, we still recommend that you formalize it, since in practice inspectors often equate gifts for which a gift agreement has not been formalized with bonuses and payments under an employment contract and charge additional insurance premiums. You can do without a written contract if the recipient is not an employee of the organization. In this case, insurance premiums are not charged.

What taxes will you have to calculate and pay?

Let's move on to taxes. And let us say right away that this cannot be done without transfers to the budget. We will tell you further what taxes to pay and in what amount. About each one separately.

Personal income tax

First of all, personal income tax must be paid on the value of the donated valuables. This is strictly required by paragraph 1 of Article 210 of the Tax Code of the Russian Federation.

Fortunately, the tax must be calculated only if the amount of all gifts to a specific employee during a calendar year exceeds 4,000 rubles. And from the amount above this limit, calculate personal income tax. And you can withhold tax on the first payment of income to an employee. If the cost of the gift does not exceed the limit, then there is no need to transfer anything to the budget at all. One of the recent letters from the Ministry of Finance of Russia is about this - dated February 1, 2013 No. 03-04-05/9-90.

Value added tax

But when it comes to VAT, you can’t count on any non-taxable limits. After all, the gratuitous transfer of values is always nothing more than implementation. This means that it is also subject to VAT taxation in accordance with subparagraph 1 of paragraph 1 of Article 146 of the Code.

Define the tax base as the value of the donated valuables excluding VAT. This is precisely the procedure established by paragraph 2 of Article 154 of the Code. Take this amount from the same statement or from the manager’s order. And it, in turn, should not be lower than market prices. Representatives of the Russian Ministry of Finance insist on this in a letter dated October 4, 2012 No. 03-07-11/402.

In addition, when transferring goods free of charge, invoices will have to be drawn up. True, there are no special rules for this case. Is it possible to issue one document for all gift recipients at once. Otherwise, there are no exceptions. Make one copy of the invoice and record it in the sales ledger.

Well, you have the right to deduct the amount of tax paid to the seller. Of course, if you have a properly executed invoice. As well as documents confirming payment of VAT.

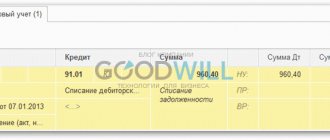

Income tax

Amounts spent on gifts cannot be taken into account when calculating income tax. After all, we are talking about property transferred free of charge. And here the rules of paragraph 16 of Article 270 of the Tax Code of the Russian Federation apply. Officials from the Russian Ministry of Finance warned about this not long ago in a letter dated October 8, 2012 No. 03-03-06/1/523.

In addition, gifts for holidays do not qualify as incentive payments, since they are not related to the employees’ work achievements. This means that the amounts spent on the occasion of the celebration, alas, cannot be taken into account as labor costs.

It turns out that you recognize the cost of gifts as expenses in accounting, but you cannot do this in tax accounting. And if your enterprise is not a small one, a permanent difference will arise and, as a result, a permanent tax liability (clauses 4, 7 of PBU 18/02).

Insurance premiums

Insurance premiums will not have to be charged on the cost of gifts only if such gifts are not provided for in employment contracts or civil agreements with employees. And in addition, written gift agreements have been concluded with employees.

It is unlikely that your contracts stipulate bouquets or souvenirs for employees. And if so, then their transfer formally takes place within the framework of a gift agreement - especially if you signed such an agreement with the employees on paper. Therefore, there is no need to pay fees. This follows from Article 7 of the Federal Law of July 24, 2009 No. 212-FZ. A similar conclusion is found in letters from the Ministry of Health and Social Development of Russia dated March 5, 2010 No. 473-19 and dated August 12, 2010 No. 2622-19.

Lina Stavitskaya

- expert of the magazine "Glavbukh"

Obligation to pay VAT

The organization can deduct the input VAT indicated in the invoice of the gift seller on a general basis, regardless of the amount or the recipient.

For VAT payers, the transfer of a gift is recognized as a sale and is subject to VAT at a rate of 18% (Clause 1, Article 39, Paragraph 2, Clause 1, Clause 1, Article 146 of the Tax Code of the Russian Federation). The invoice is drawn up in a single copy and registered in the organization's sales book. The basis for calculating VAT is the cost of purchasing a gift (excluding VAT) or, if the gift is a product of the organization, its cost.

For “simplified” recipients, the transfer of a gift to an individual is taxed in accordance with the applicable taxation system. There is no obligation to subject this transaction to VAT and to issue an invoice.

Accounting for New Year's gifts

A common practice for enterprises is to buy New Year's souvenirs for partners and gifts for children of employees. Accounting for expenses in this case is carried out on the basis of an agreement with the selling company. Such a document is drawn up in accordance with generally accepted standards; it should provide for the possibility of returning goods, a mechanism for mutual settlements, and the preparation of primary accounting documents, such as:

- checks;

- invoices;

- acts of acceptance and transfer.

When presenting gifts for the New Year, confirmation of this act is allowed both in writing and orally. Since it would never occur to anyone, when presenting a business partner with a souvenir with branded symbols, to require him to sign the document, it is worth buying inexpensive souvenirs for this purpose. As required by paragraph 2 of Article 574 of the Civil Code of the Russian Federation, it is not necessary to draw up a gift agreement if the value of the gift is less than 3,000 rubles. The low price of souvenirs will save you from completing additional paperwork.

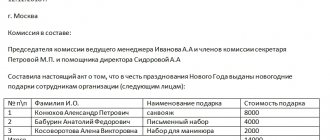

Most businesses buy New Year's gifts for their employees' children. In accounting, these expenses are confirmed by the following documents:

- Order from the head of the enterprise.

- List of employees with children under 14 years of age, indicating their age.

- Statement for accounting of children's gifts issued.

There is no specific form of order and statement; the enterprise develops these documents at its own discretion. You may find recommendations to draw up a gift agreement for each employee who receives a gift for their child. But practically no one prepares such documentation.

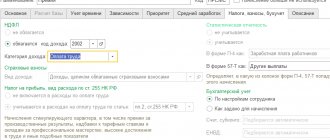

Personal income tax accrual

A gift is an employee's income received in kind. It is subject to personal income tax from the moment when the total amount of gifts received during the tax period (year) exceeds 4,000 rubles (clause 28 of article 217 of the Tax Code of the Russian Federation). For example, an organization gave an employee five gifts over the course of a year, each worth 2,000 rubles. Personal income tax is calculated starting from the third gift. The tax rate is 13% for resident donees and 30% for non-residents. The basis for calculating personal income tax on the value of a gift is its market value including VAT (clause 1 of Article 211 of the Tax Code of the Russian Federation):

Personal income tax = (cost of gifts – 4,000 ₽) × personal income tax rate

For monetary gifts, personal income tax is withheld upon issuance and transferred to the budget on the same day; for non-monetary gifts, personal income tax is withheld on the day of the next salary payment.

We put gifts under the Christmas tree for business partners

Santa Claus, did you bring us gifts? The tradition of congratulating their counterparties on the upcoming New Year has already become firmly established in the business practices of many companies. This is done in order to maintain existing business relationships and establish new connections. Some people prefer to give their own products, while others limit themselves to a gentleman's set: sweets and champagne. But the essence of the matter does not change. The gift is made, which means it requires accounting.

Khvorost Dina Viktorovna

Completed the initial report - reflect it in accounting

An event to congratulate partners must be formalized by an organizational and administrative document of the manager, for example an order. It is advisable to indicate in it the list of companies that will receive gifts, the persons responsible for this event, the timing, and the form of congratulations. To document the fact of a business transaction, you can use both unified forms of primary documents (invoices, requirements) and those independently developed by the organization in accordance with paragraph 2 of Article 9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”.