The concept of travel allowances

Travel expenses are expenses recorded by an employee that are necessary for the correct completion of a business trip. Legislative norms and acts regulate the procedure for their calculation.

According to Article 167 of the Labor Code of the Russian Federation, the employer undertakes to maintain the official position of the person under his charge and his average salary, and it is also necessary to reimburse the money spent by him during a business trip.

The above-described guarantees in an equal amount are imposed on employees who combine several positions and are officially employed in an organization, as demonstrated by part 2 of Article 287 of the Labor Code.

It is recommended that the chronological sequence of reimbursement of financial expenses and their volumes be established by a local regulatory document or a generally accepted agreement agreed upon with the workforce. However, you can resort to alternative options if they do not violate the norms of the Labor Code, legal acts and laws of the Russian Federation.

The employer has the right to change local regulations. It regulates the amount of reimbursement of travel expenses for various categories of employees. With the help of the innovation, the amount of payments will vary.

Business trip

To perform various types of production tasks, in some cases, an employee or employees of an organization need to leave their place specified in the employment contract and job description and go to another locality.

In this case, they talk about a business trip or business trip. A business trip allows you to solve a wide variety of problems:

- conduct training or advanced training for an employee/employees of the organization;

- participate in a meeting, congress, conference;

- conduct an audit of a branch or other remote structural unit;

- transport inventory, passengers, cargo, etc.

If an employee’s work schedule involves constant movement between populated areas, for example, working as a delivery driver, then such a trip will not be considered a business trip.

An employee sent on a business trip retains his job and average earnings. In addition, travel expenses are subject to reimbursement in the manner established by Art. 166 of the Labor Code of the Russian Federation.

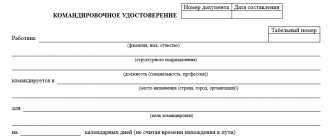

Organizations, as a rule, develop a local regulatory act (Regulations on Business Travel), which also regulates the procedure for sending an employee on a business trip, the need to prepare certain documents, as well as the procedure for reimbursement of expenses.

Sending an employee on a business trip always implies some purpose. The fact of failure to achieve the goal presupposes the employee’s failure to fulfill the job duties assigned to him and, in some cases, may become the reason for the application of disciplinary measures to the employee.

Procedure for paying travel allowances

When paying travel allowances, all nuances are taken into account.

According to current laws and regulations, the employer undertakes to pay the ward money for the following periods:

- disability caused by being on a business trip;

- every day you are on a business trip, including:

- Days of forced interruption of a vehicle;

- Weekends and non-working days;

- Days spent on the road.

If a person is sent to a state entity located fairly close to his place of permanent residence, travel expenses are not reimbursed. The conditions of transport communications and the nature of the work tasks performed should allow for daily return without damage to them.

Report on the disbursement of money

Any organization allows a person to receive funds on account before a business trip. To do this, you must submit an application in the prescribed form.

The document is necessary not only to confirm the fact of transfer of money, but also allows you to oblige the citizen to provide reporting documentation.

The official document is sent to management, but the application is processed by the accounting department.

The certificate contains a note indicating that there are no debt obligations before previous trips.

The form contains a link to the order, which is considered the basis for sending the citizen on a business trip. And in the text of the letter, the employee demands the release of funds, but at the same time he undertakes to provide all supporting documents about expenses. He also gets acquainted with all the design rules.

The form contains separate marks that are provided for responsible persons.

The main condition is repayment of debt on previously issued funds for previous business trips. It is possible to receive funds either by bank card or in cash.

By personal transport

Current legislation allows you to choose your own mode of transport for your trip.

There is no strict framework for implementation in either the Labor Code or the Tax Code. Only this point must be agreed upon with the employer’s management.

Transport can include:

- railway transport;

- buses;

- air transport;

- business or personal car.

As a rule, management always chooses the most profitable financial option.

When traveling with your own transport, gasoline costs may be taken into account in the form of travel expenses.

To do this, it is necessary to provide the applicant with a passport of the technical device, which will confirm the owner, and also write an application for a business trip using your own transport.

Do you need an example of a memo about the need for a business trip? See here.

At the expense of the receiving party

In accordance with the Labor Code of Russia, all employee expenses must be reimbursed. That is, these could be the cost of travel to the destination, accommodation and food, and other expenses. And both the sending party and the receiving party have the right to reimburse these costs.

In any case, when sending an employee, both parties enter into an agreement, which specifies the party indemnifying the losses.

Payment is made only after providing all documentation that confirms the employee’s expenses.

An application for a business trip in 2020 can be cancelled. Cancellation is possible for several reasons:

- employee illness;

- change in general circumstances;

- inability to travel.

There are no special nuances when designing this. But if the funds have already been issued, then the money must be returned. If they are not spent, the employee undertakes to return them within three days.

But the law allows for other situations. If money is spent on a ticket or payment for real estate, then they classify it as business expenses or losses.

In what cases is an application required?

An application for reimbursement of travel expenses must be submitted personally by the returning employee. The HR specialist must be sure that the document was drawn up by him.

Despite the proliferation of fax signatures and electronic media, the presence of handwritten confirmation still plays a significant role. Therefore, a statement must be drawn up and signed in all cases where the established budget is exceeded.

What should the application contain?

There is no generally accepted application form for travel reimbursement in the government system. In most cases, it is compiled in electronic form or in handwritten form.

In the latter case, the applicant is recommended to leave his signature and the date of submission of the document. The form must include the following elements:

- Content. The essence of the application is described;

- Title. Contains the initials and position of the recipient;

- Bottom line. The date and time the document was written is indicated. By signing it, the applicant agrees with the stated requirements.

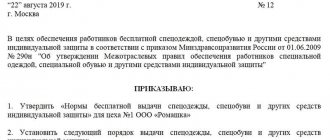

Order on accrual of travel allowances

Often, employees exceed the standard amount of financial expenses while on a business trip. To receive a refund, you will need to issue an appropriate order. It contains the following information:

- Sender's full name;

- place of business trip;

- position held;

- dates of business trip;

- authorized person executing the order;

- reasons for cash payments.

The information described above is indicated in a separate document, which allows you to reimburse funds spent in excess of the norm.

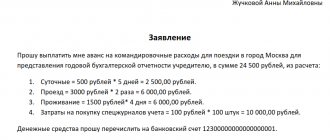

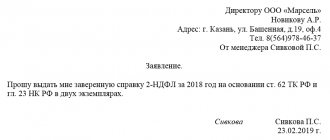

Sample application for reimbursement of travel expenses.

Tax accounting

Documentary evidence and economic justification for the costs of reimbursement of travel allowances to an employee allows them to be included in the tax base. Among the required papers, it is worth noting the following:

- Personnel package of documents;

- Documents that take into account the time spent on a business trip and remuneration for the position held by the person;

- Certificates from accounting department;

- Documents demonstrating the accuracy of the expenses described in the application.

Expenses acquire the status of justified if they are made as part of activities carried out to achieve the goals and objectives established by management.

To calculate tax, expenses are taken into account in the following order:

- Employee salary expenses;

- Other expenses necessary for production and sales.

When an organization uses a simplified taxation system, the described expense items are documented in the following order:

- on the day of approval of advance reports;

- on the day the funds are issued to the employee

Other expenses

As mentioned above, the list of travel expenses is open, and the employer can establish in a local act the expenses, amount, and reporting procedure for typical expenses for the organization. For example, in relation to entertainment expenses, limits, a list and forms of documents necessary to confirm travel and entertainment expenses may be established. Moreover, for recognition as expenses for profit tax purposes, there has always been increased attention to entertainment expenses, and with regard to negotiations on business trips, the recognition procedure and requirements for documents are similar (Letter of the Ministry of Finance of Russia dated November 16, 2009 No. 03-03-06/1/ 759). The Ministry of Finance of Russia in its Letters dated November 13, 2007 N 03-03-06/1/807, dated November 1, 2010 N 03-03-06/1/675 provides an approximate list of documents. Therefore, the application for travel expenses may include an attachment, for example, of estimates and programs for entertainment events. And also subsequently, a report on the event should be attached to the advance report, indicating the participants, the venue, the issues discussed at the meeting, and the results achieved.

Is it possible to “accelerate” the issuance of a salary advance by applying?

First you need to understand what is meant by an advance, because there is no definition of this concept in the legislation:

- If this is the first part of the salary (and it is in this context that the word “advance” is traditionally used), then a shift in the timing of its payment is clearly unacceptable: neither earlier nor later than established by the employer’s local documents, any part of the salary cannot be issued (Article 136 Labor Code of the Russian Federation). And even if there is an employee’s application for early payment of the advance, the employer may be recognized as a violator and fined under Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Read more about what an advance is and how it is paid here.

- The word “advance” is also used in another meaning - as payment of salary (or part of it) ahead of schedule on account of future earnings. The lack of money is familiar to many: for example, an employee has to spend money on a wedding or renovation, and he asks for a salary in advance - several weeks or even months in advance. According to the Ministry of Labor, the employer can satisfy this request, but he must prescribe the procedure for making such payments in his internal regulations (letter of the Ministry of Labor of the Russian Federation dated May 10, 2017 No. 14-1/OOG-3602).

IMPORTANT! Whatever the context in which the word “advance” is used, failure to meet the deadline for its issuance is fraught with risk. Despite the fact that today the Ministry of Labor formally authorized the issuance of money at the request of an employee against future earnings, there are also completely opposite explanations. For example, letter No. PG/4067-6-1 of Rostrud of the Russian Federation dated May 30, 2012, in which the agency indicated that establishing deadlines for payment of wages not provided for by the Labor Code of the Russian Federation is not allowed, even if there is an application from the employee.

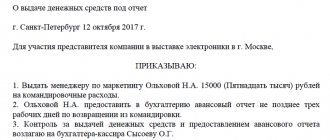

Issuing money for a business trip in cash and on a card

The initiative for an employee to go on a business trip always comes from the employer, because in the process work issues will be resolved (based on the definition of a business trip in Article 166 of the Labor Code). Therefore, the organization must provide the employee with everything necessary for the trip, first of all, money. The rights of workers are protected by the Labor Code, where Article 168 states that a business traveler must be given money for a business trip - for travel, rental housing and daily allowances. How much to pay depends on the expected expenses and duration of the trip.

Business trips are also covered by the Government Decree of October 13, 2008. No. 749, where clause 10 directly stipulates that the issuance of an advance for a business trip is mandatory. Those. The employee should not travel at his own expense.

The specific amount issued should be based on a preliminary estimate of the costs of tickets and accommodation, as well as the daily allowance established by the organization’s local regulations.

The content of the article:

1. Application for an advance payment for travel expenses

2. Application for issuance of a report from the director

3. Application for an advance on the card

4. Issuance of travel expenses from the cash register

5. Postings for advance payments for travel expenses

6. Business trip without advance payment

So, let's go in order. If you don't have time to read a long article, watch the short video below, from which you will learn all the most important things about the topic of the article.

(if the video is not clear, there is a gear at the bottom of the video, click it and select 720p Quality)

We will discuss the topic of advance payment for a business trip in more detail than in the video later in the article.

Application for advance payment for travel expenses

So, if an employee is going on a business trip, then he needs to be given money. But you can’t just take the money and give it to the employee.

The first step that needs to be taken, and which we are told about in clause 6.3 of the Central Bank Directive dated March 11, 2014. No. 3210-U, this is writing a statement . Since the issuance of money for a business trip is carried out with the preparation of an expense cash order (RKO), and it is issued only according to the application, on its basis.

There is no standard form for such a statement. The instruction only tells us that it must contain :

The application is written as usual, addressed to the director or the person delegated to make decisions on the issuance of funds on account. The application must also indicate for what purposes the money should be issued. Calculations may also be used to justify the amount.

How an application for an advance for travel expenses can be filled out can be seen in the example below.

To the Director of Albatros LLC

from engineer Orlov O.O.

I request you to issue cash in the amount of 10,000 (ten thousand) rubles for travel expenses for a period of 7 (seven) calendar days.

06/27/2016 Orlov Orlov O.O.

Status of settlements with the employee for previously issued amounts:

Accountant Karaseva Karaseva K.K.

Director Yastrebov Yastrebov Ya.Ya.

Before the manager signs the application, it is necessary to determine whether the employee has any debt on previous accountable amounts. If yes, then the application cannot be accepted. First, the employee must repay the debt on the previous advance.

In this regard, on the application sheet it is appropriate to provide a visa for an accounting employee who will mark the presence or absence of the employee’s debt on previous advances.

After the application has received a visa from the accounting department, the manager can sign it.

Advance payment for a business trip to the director - do you need an application?

Not only ordinary employees of the organization go on business trips, but also the director himself. The Directive does not make any exceptions for him, from which we can conclude that for him writing an application is a mandatory procedure.

Then it turns out that he writes and signs himself? Because the Directive also states that the application must have the manager’s signature. In such situations, it would be more logical to draw up an order, but its drafting is not provided for in the Directive, but is written directly - a statement.

Therefore, an application for issuing a report from the director is necessary; he writes it and signs it. It may look strange, but it is definitely not an error. And besides, the wording in the statement can be adjusted a little and it will look much more logical. Example below.

At Albatross LLC

from director Yastrebov Ya.Ya.

Application for the release of money on account

It is necessary to issue cash in the amount of 10,000 (ten thousand) rubles for travel expenses for a period of 7 (seven) calendar days.

director Orlov Orlov O.O.

Things are simpler in large companies, where the general director himself does not sign the reporting statement, and the authority on this issue is delegated to another employee, for example, the financial director. Therefore, in such a situation, the general director will write a statement, and the financial director will sign it.

Remember that the application is a mandatory document. If money is issued for a business trip without it, then there is a risk of a fine of up to 50 thousand rubles. according to Art. 15.1 Code of Administrative Offences.

Application for an advance on a card

In some cases, it is more convenient for an employee to receive accountable money not in cash, but on a plastic card. The question arises, is it necessary to write an application for this? If you follow the Directive literally, then the application is required only if the money is issued in cash (clause 6.3 of the Directive).

But the Ministry of Finance in its clarifications (letter dated 08.25.14 No. 03-11-11/42288) has a different opinion and clarifies that you need to take a written application even if the money is transferred to the card. If only because it will contain the details for the transfer.

from engineer Chaikin A.A.

I request you to transfer funds to my bank card against a report in the amount of 10,000 (ten thousand) rubles for travel expenses for a period of 7 (seven) calendar days.

Bank card details:

Bank name: PJSC Promsvyazbank

Personal account number: 40817840500409007051

06/27/2016 Chaikin Chaikin A.A.

The employee has no debt for previously issued accountable amounts.

In addition, such a statement will confirm that it is accountable money that is transferred , and not other income. And personal income tax must be withheld from income. Also, when transferring, do not forget to indicate in the purpose of payment that this is accountable money.

If you have a Regulation on the issuance of funds on account, then state in it that funds can be issued to employees both in cash and on cards. An example of wording is below.

Reported funds for business trips and business expenses are issued in cash from the cash register or transferred to employees’ bank cards.

The method of issuing funds is regulated by the director in each specific case.

Regardless of the method of receiving money (cash or card), employees return unspent amounts in cash to the company cash desk.

Issuance of travel expenses from the cash register

So, you have completed your application. The next step is to directly issue money for a business trip from the cash register. Based on the application, the accountant draws up and signs an expense cash order in form KO-2 (approved by Resolution of the State Statistics Committee dated August 18, 1998 No. 88).

See also: Accounting balance sheet and accounting reporting

The RKO also has a field for the manager’s signature. But if the manager has already signed the application and issuance is authorized, then his signature on the cash register is not required. But for the sake of order, you can put it too.

The procedure for issuing is described in detail in clauses 6.1-6.3 of the Instructions.

Funds are issued either personally to the posted employee, or to another person by proxy, upon presentation of a passport. A power of attorney for a one-time issue is attached to the RKO. A power of attorney for several issues, then a certified copy is attached to the cash register, and the original is kept by the cashier.

The passport details of the person who received the money are indicated in the RKO. Even if the recipient is the employee himself, the passport details must still be indicated.

Once the recipient has been identified, the procedure is as follows:

Next, the issuance operation is reflected in the cash book.

Travel allowances from the organization’s cash desk can be issued from funds:

It is impossible to issue an advance for a business trip from funds accepted from citizens as payments in favor of other persons.

Transfer of accountable money to the card is made by sending a payment order to the bank, which indicates the recipient's details reflected in the employee's application, and the purpose defines this payment as an accountable amount.

Postings for advance payments for travel expenses

Now let's look at how the issuance of money for a business trip is reflected in accounting. Postings for advance payments for travel expenses will be very simple:

Debit 71 – Credit 50

Debit 71 – Credit 51

Deputy Director of Albatros LLC Filinov S.S. On June 27, funds were issued from the cash register to report for a business trip on the basis of a business trip order and application.

June 27: Debit 71 – Credit 50 – in the amount of 8,000 rubles.

Please note that in addition to regular bank cards (mostly salary cards), corporate cards can also be used for issuing employee reports. Money is transferred to it from the current account and accounted for in a separate special account:

Debit 55 – Credit 51

In this case, at the time the card is issued to the employee, no entry is made for the issuance for reporting. And only when the employee pays for something with this card or withdraws money from it, a transaction will appear for the issuance of money for reporting:

Debit 71 – Credit 55

The procedure for working with corporate cards is prescribed in the local regulatory act of the organization.

Example

To the head of the supply service of Albatros LLC, P.P. Perepelkin. On June 27, a corporate card was issued to pay for travel expenses. On June 28, he withdrew cash from the card in the amount of 2,000 rubles. On June 29, the card paid for a hotel of 5,000 rubles. A bank statement confirms the debiting of funds from the card.

Accounting entries made:

July 28: Debit 71 – Credit 55 – in the amount of 2000 rubles.

July 29: Debit 71 – Credit 55 – in the amount of 5,000 rubles.

Business trip without advance payment

However, issuing money for a business trip does not always go perfectly smoothly. The following situations can ruin things:

- The organization does not have cash on hand to issue due to:

- temporary financial difficulties

- emergency business trip, when there is no time to withdraw cash from the account.

- There was money in the cash register, but the director urgently needed to go on a business trip, and there was no time to resolve the issue of issuing an advance.

In this case, it turns out that the employee is not given an advance from the cash register and he travels at his own expense, i.e. This is a business trip without advance payment. Subsequently, upon arrival, expenses will be reimbursed. Is this a violation?

Yes, this is a violation of Article 168 of the Labor Code, since it is mandatory to issue an advance for travel expenses before the trip. A business trip without advance payment may result in liability for violation of labor legislation (Article 5.27 of the Administrative Code):

- administrative fine for an official or individual entrepreneur: in the amount of 1000-5000 rubles;

— administrative fine for a legal entity: in the amount: 30,000-50,000 rubles.

How to issue money from the cash register for a business trip in the 1C program: Accounting 8th ed. 3.0, watch the video tutorial:

How is money issued for a business trip in your organization - in cash or on a card? Have you encountered any difficulties in obtaining an issue? Please share in the comments!

Memo for receiving advance payment example

We draw up an application for an advance on salary

An employee can also submit an application for financial assistance if the reason is serious enough. Examples for financial assistance: The application is quite simple.

On a blank sheet of paper in the upper corner, write the data of the addressee - the head of the organization (his full name, position), the name of the organization. It is indicated from whom the appeal is being written. In the center of the form is the name of the document.

The text contains a free form request to the manager, for example:

“I ask you to issue an advance in the amount of 5,000 (five thousand rubles) towards wages for August 2020”

Next, for greater persuasiveness, you can indicate why money is needed.

For example, in connection with obligations to pay utilities, rent, loan repayment, treatment, etc. The application must be signed, dated and handed over

Rules for drawing up a memo for the issuance of funds: sample and filling details

At various enterprises today, situations often arise when employees find themselves forced to write various memos (“memos” - in common parlance), in which they set out their requests for reimbursement of expenses and the issuance of certain amounts.

In our article we will look in detail at samples of the design of memos on the allocation and return of funds, as well as examples of documents for other needs. As mentioned above, there are several types of memos in question, for example: The legislation of the Russian Federation does not specify a clear form for the execution of such a document, so each employee can draw it up in free form or according to a template established in the organization in which he works.

Sample note for advance payment

Let's find out when and how advance amounts are issued.

Such a request must be addressed to the head of the enterprise by submitting a written request. When substantiating good reasons, management will never refuse an employee and will always meet them halfway. After the manager considers the application, he puts a visa on the document, thus expressing his consent, and returns the application to the employee.

Overview of types of memos and guidance on how to write them

A memo is an internal tool of any organization. A memo is drawn up in any form, but, nevertheless, must include a number of mandatory elements: the position and full name of the addressee in the dative case are indicated in the upper right corner; then the name of the document itself is indicated, that is, “service memo”; further indicates the date of preparation of the document and registration number; the title of the document must contain information about the subject of the memo (the title is indicated in the prepositional case);

Advance payment for travel expenses

The employer not only reimburses the employee’s expenses, but is also obliged to provide an advance before departure (clause 10 of the Regulations). The amount is determined based on estimated travel and accommodation costs and daily allowance. Expenses can be paid by the employer in cash when the transport organization or hotel issues an invoice for travel expenses, or issued to the employee in cash. An application for an advance may contain a calculation, but the estimate can also be drawn up as a separate document with the calculation of daily allowance based on the duration of the trip and the amount established in the organization. The form is not established by law, and the organization independently determines who draws up the documents and how exactly the amount of travel expenses is confirmed.

An advance for travel expenses is given to the employee in cash or transferred to the employee’s bank card.

Sample letter about 100 prepayment

Notice of termination of the lease agreement Issuing an invoice for prepayment does not create obligations for the counterparty. All responsibilities are fixed in the contract; if there is a prepayment condition in it, an invoice for the advance payment is needed, a sample of which is developed by enterprises independently. After the money is received, the organization issues an advance invoice and records the transaction with accounting entries. An invoice for advance amounts must be issued within 5 days after the date of receipt by the supplier of funds Art. The deadline is tracked in calendar terms. It is allowed to do without an invoice if the goods were delivered within the first 5 days after receipt of payment. Such clarifications are given in the Letter of the Ministry of Finance, dated How to issue an invoice for prepayment, a sample of which was drawn up by the supplier: transfer to the counterparty at the stage of agreeing on the terms of cooperation and signing the contract; send a letter with an invoice form attached to the address of the counterparty; make a scanned copy of the signed document and send it by email; use to send account details by fax.

Sample application for a business trip - expenses, time off

So, you must write the application in person, even if the employee does not write it by hand, then at least he must put the date and signature at the end of the application with his own hand.

The personnel officer should know whether a statement is written at all when applying for a business trip and what it should be according to labor legislation and personnel standards.

The head of the enterprise is obliged to approve the employee’s application if it indicates that the posted subordinate worked on a day off.

Even if on a day off the employee only went on a business trip or, conversely, returned from it, these days can also subsequently be used as time off.

And all this because days off must be taken off by the employee according to labor law and according to the Charter of the enterprise.

In an application for time off for a business trip, the head of the enterprise must put his resolution, which will indicate not only permission for the employee to rest, but also a legislative act allowing the boss to make such a decision.

Find out what: Where to get a copy of the writ of execution

In each case, the application for a business trip may differ in certain significant details if there are any circumstances or social status of the employee that make it possible to write non-standard applications.

But otherwise, such primary documents are all drawn up in the same way, indicating the name and position of the manager, the name of the enterprise, the position and last name with the initials of the applicant, the text of the application, the signature and resolution of the authorities.

All this confirms the fact that the business trip application is written in any form and does not have a unified standard form approved by the State Statistics Committee or other government agency.

How to write?

Business travel is a difficult matter. Registration takes several hours. After all, you need to take into account travel expenses. And if the funds have already been issued, but the business trip has been cancelled, then you need to write it off on the balance sheet.

That is why it is necessary to correctly fill out an application for sending an employee on a business trip.

Requirements

Documentation may be in electronic form, printed on a computer.

Current legislation does not prohibit writing an application by hand. In both options, the date and signature are affixed manually by the applicant.

Form

The application has the following form:

- the header states who is sending the document and to whom;

- the request is stated in the text;

- At the end, the date and signature of the employee are affixed.

The “To” column contains the position and full name. “From” is the position and full name of the employee. The body contains a statement and a text requesting the issuance of funds. Next, the date and signature with a transcript are affixed.

Read how a business trip on a day off is paid.

How is daily allowance calculated on a business trip? Information here.

How to write an order to extend a business trip? Details in this article.

Sample

To minimize the chances of incorrect completion, it is better to fill out the application according to the sample.

A sample application for a business trip is here.

Rules for writing and completing an application for an advance

Today, there is no mandatory, unified sample of this statement, so employees can write it in any form or according to a template developed and approved within the enterprise. Regardless of which option is chosen, the document must meet certain requirements. It must indicate the addressee :

- Company name,

- job title

- and full name of the manager,

as well as similar information about the applicant : his position and full name. In addition, the document itself must include the request for an advance , indicating its reasons.

The main text should be consistent and sufficiently succinct - usually the main idea fits into one - a maximum of three sentences.

If there are any circumstances in connection with which the employee wants to receive an advance and which he can document, this must also be reflected in this document in the form of a clause on attachments.

Finally, the application must be signed by the applicant (with a transcript of the signature) and dated on the day of submission.

The application is drawn up in two copies :

- one of which is endorsed by the secretary and subsequently remains in the hands of the employee,

- and the second is transferred to the organization.

After its consideration, depending on the decision made by the manager, a resolution is written on the application. If it is positive, based on this document, the accounting department calculates and issues the required amount. In any case, after the application loses its relevance, it is transferred for storage to the archive of the enterprise.

Return of the accountable amount to the cashier if there is a balance

In the event that not the entire amount of the advance was spent on the trip, it must be returned to the organization in accordance with the procedure prescribed in clauses 3.1 and 3.2 of the Regulations.

The return of the accountable amount to the cash desk is carried out according to cash receipt order 0310001 (PKO) by the cashier of the enterprise (Regulations clause 3.4). In this case, you should check the primary documents confirming the expenditure of money and reflected in the cash receipt order.

It is necessary to accept bills and coins individually in the presence of an accountable person, so that unnecessary questions do not arise if there is a difference in the amount. The recalculated amount should be compared with the amount reflected in the PQR. And if there is no difference, the recipient signs and puts a seal (stamp), and returns the receipt to the accountable person to the recipient. If the amount is less, then the reporting employee must pay the missing amount.

What to do if an employee refuses to pay the missing amount:

- The deposited amount is returned.

- The receipt is crossed out and handed over to the manager or chief accountant, and then the PKO is re-issued according to the actual amount of money.

The employer has the right to return the missing amount of money from the employee’s salary if this does not happen within the established time frame.

If the employee voluntarily agreed to repay the debt, then, upon appropriate application, no more than 20% of the accrued salary can be withheld from his salary to pay off the debt (Labor Code of the Russian Federation, Article 137, Part 2, Article 138, Part 1). In this case, it is necessary to issue an order by the manager, but no later than a month from the established deadline for the return of the unspent advance amount (Labor Code of the Russian Federation, Article 248 Part 1).

If an employee refuses to return the unspent amount voluntarily, this can only be done in court by filing a claim for damages. The amounts are collected according to writs of execution.

Examples of writing request letters with explanations

So, we have understood that a request letter is a letter that contains a request to the recipient. The purpose of the text is to induce the recipient to perform an action that is beneficial to the sender. The letter must contain a formulated request and its rationale. It is advisable to formulate the request in such a way as to justify why it should be beneficial for the recipient to comply with the request. The sender must not only know the rules for composing the text, but also take into account psychological nuances. Next, we will consider specific example templates depending on the situation.

How to cancel a business trip?

Trip cancellation is possible for many reasons:

- employee illness;

- change of circumstances;

- no need to travel.

No special actions are required on the part of the employer.

The only point is to return the money if it has already been issued. If the money is not spent, the employee must return it within 3 days. But other situations are also possible. For example, this money was used to buy tickets, pay for housing, purchase materials or equipment, and so on. In this case, depending on the expense item, they can be classified as business expenses or a company loss.

Features of writing an application to reschedule a business trip

A trip can be postponed for a certain or indefinite period for a number of reasons (force majeure, changes in the market situation, illness, family circumstances). In this case, the money (if it has already been issued) is left with the employee.

Writing a justification for postponing the trip is not necessary, but is advisable. It should indicate the reasons that make the trip impossible at the present time, as well as the possible dates for which it can be postponed. It is with these deadlines in mind that the

and the issue of returning the funds issued was resolved.

Thus, the process of sending a person to work outside his place of permanent residence must be properly formalized by the personnel department. Competent writing of all required documents will allow you to avoid controversial issues and ensure the timely issuance of money for travel expenses.

Sample memo for issuing funds for various needs

Does the employer have the right to refuse an advance? An employer has the right to refuse an advance to an employee, but not always. Sample memo for issuing an advance Attention According to Russian labor legislation, wages must be paid twice a month. The exact procedure and amounts of payments are fixed in the employment contract. Info One of these parts is called an advance payment, while the law does not give an unambiguous definition of this concept. For example, it is customary to consider such a payment against future earnings, that is, the issuance of funds that have not actually been earned yet. In what cases is an advance required? An employee may need an advance in case of urgent need, in situations that involve urgent or large expenses. This could be a wedding or the birth of a child, an employee’s illness, the need to pay off a loan, a large purchase, etc. A separate reason for an employee to receive an advance is a business trip, which involves spending on housing and transportation. Sample memo for advance payment In this case, you can receive funds on a report: actual expenses must be documented, the excess must be returned to the cash desk, the deficiency must be reimbursed to the employee. What needs to be done to receive an advance The employee will need to correctly fill out the appropriate application for an advance on wages: in writing addressed to the manager.

Application for transfer of accountables to the card

To pay for both upcoming and already incurred travel expenses by the employee or for the purchase of goods and work in the interests of the employing organization, the employee is given funds on account. We talked about how accounting of settlements with accountable persons is kept in our consultation.

Cash on account can be issued both in cash and in non-cash form, incl. by transfer to the employee’s bank card.

Should an employee write an application to transfer accountable amounts to the card?

Transfer of accountable amounts to bank cards

The legislation does not prohibit giving an employee funds on account by transferring them to the bank card of such an employee. It does not matter whether it is a personal card of the employee, opened by him independently, or a so-called “salary” card issued to the employee as part of an agreement between the employer and the bank for the transfer of wages to it (Letters of the Ministry of Finance dated July 21, 2017 No. 09-01 -07/46781, dated 08/25/2014 No. 03-11-11/42288, dated 10/05/2012 No. 14-03-03/728, Letter of the Ministry of Finance No. 02-03-10/37209, Treasury No. 42-7.4-05/ 5.2-554 dated September 10, 2013).

See also: Requirements for site structure 05.29.2020

It would be advisable to provide for the possibility of transferring accountable funds to an employee’s card in local regulations. For example, in the Regulations on Business Travel.

The transfer of funds to the accountable person on the card is made on the basis of an order from the employer, a memo or an application from the employee, endorsed by the manager. In this document you will need to indicate the details of the card to which the accountable amounts should be transferred.

An employee’s application for the transfer of accountable amounts to a bank card can be either unlimited and relate to all accountable amounts due to him, or relate only to a specific business trip or the purchase of goods and materials for the employer.

In the payment order itself, in the purpose of payment, you will need to indicate that the funds are transferred for reporting. For example, mark “payment of travel expenses.”

Here is an example of an application for the transfer of imprest amounts to a salary card.

How to correctly write an application for an advance payment of a loan

And in the second case, the manager simply does not have the right to refuse the application, since the additional need for funds arose due to instructions from his superiors. The application is written by the employee, most often simply by hand, and submitted for consideration. The manager must familiarize himself with the essence of the document and make the right decision, in his opinion.

But, more often than not, there are no refusals in such situations. But the employee, in turn, cannot constantly use this method, but use it only in emergency situations. Structure of an application for an advance Much attention should be paid to writing the request. It must be drawn up correctly and competently.

This often significantly increases the employee's chances of receiving an increased advance payment.

Determining the amount of advance for a business trip

The amount of the advance is determined independently by the organization, taking into account the duration of the business trip, the norms of expenses for renting housing, daily expenses, as well as the cost of travel to the destination and back. The amount of daily allowance and standards must be specified in a collective agreement or in the local regulations of the organization.

Currently, the daily allowance is set at 700 rubles for trips within Russia and 2,500 rubles for trips abroad. Please note that the organization has the right to set the amount either less or more than the established amounts. The question is about additional taxes on daily allowances, so if these amounts are exceeded, income tax will be charged to the employee.

What happens if the daily allowance is less than 700 rubles? Daily allowances can be set in a smaller amount; the organization has such a right. The established norms do not oblige them to be adhered to; the established value affects taxation. However, you should take a reasonable approach to determining the amount of daily allowance, because an employee leaves on a train to perform the organization’s tasks, and not of his own free will, and setting small amounts means that he will have to spend his personal money on food, travel, etc.

Read more about how to send an employee on a business trip under the new rules here.