What days are considered holidays?

There are actually not that many days that are holidays in our official calendar. All of them are listed in the current Labor Code (more precisely, in its 112th article). These, in particular, are in January:

- from the 1st to the 7th;

- 8th (Christmas).

Next comes February 23 - on this day we honor the defenders of the Fatherland. Women's Day is celebrated on March 8th.

There are no special dates in April, but in May these are:

- 1st (Labor Day and Spring)

- 9th (celebration of Victory in the Great Patriotic War).

In June, on the 12th, Russia Day is celebrated. Despite the fact that people’s attitude towards it is not very clear, it is considered a holiday throughout the country.

The days that the legislator recognizes as non-working holidays are listed in Art. 112 of the Labor Code of the Russian Federation: January 1–8, February 23, March 8, May 1 and 9, June 12 and November 4. At the same time, in certain territories, at the request of religious associations, other days may also be declared holidays.

You also need to take into account that holidays may fall on weekends. In this case, the day off is transferred to the first working day after the holiday. Moreover, when calculating wages, you need to remember that it is the day off that is being postponed, and payment for a holiday falls on exactly the date that is marked as red in the calendar.

Is payment for holidays included in the calculation upon dismissal?

Non-working holidays on the territory of Russia, in accordance with Art.

112 of the Labor Code of the Russian Federation are: January 1-6 and 8 New Year holidays January 7 Christmas Day February 23 Defender of the Fatherland Day March 8 International Women's Day May 1 Spring and Labor Day May 9 Victory Day June 12 Russia Day November 4 National Unity Day Laws of individual subjects The Federation may be assigned additional holidays. Thus, in the Republic of Tatarstan, regional law No. 1448-XII dated February 19, 1992 on the territory of a constituent entity of the Federation additionally established the following regional days off:

- Eid al-Adha is a floating date, in 2020.

- Republic Day of Tatarstan - August 30;

- Eid al-Fitr is a floating date, in 2020 it is June 15;

- Constitution Day of the Republic of Tatarstan - November 6;

Info The method for calculating them is not defined by law, but in practice several methods are used:

How is payment according to the Labor Code?

If the basis of the salary is the official salary, then non-working holidays do not in any way affect the amount accrued for the performance of official duties. Therefore, both for January, in which only 12 days are considered working days, and for July, where there are 22, you will receive the same amount of money.

In addition, if an employee was called to the enterprise due to necessity on holidays, then these hours are also additionally paid in a special manner. The rules for calculating compensation are given in Article 153 of the Labor Code.

An employee forced to work on a day off must:

- or pay double for all hours spent;

- or provide 1 day off on another day.

The rule described above is universal and applies regardless of the remuneration system. The following is used as a basis for calculations:

- basic piece rates;

- daily or hourly rates;

- rates calculated from a fixed salary.

In addition, each organization has the right to independently establish its own amounts of compensation for going to work on a holiday. The amount of such payments cannot be lower than the threshold fixed by law. It is permissible to formalize this point separately:

- local regulatory acts;

- clauses in individual or collective labor contracts.

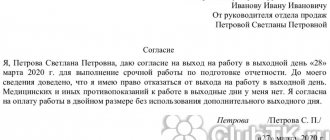

Art. 113 of the Labor Code of the Russian Federation, work on holidays and weekends is prohibited, except in cases where, for example, unforeseen situations arose on which the further performance of the organization depends. In this case, the employer can involve the employee, but only with his written consent. There are also exceptions when an employee can be involved without written consent. For example, to prevent a catastrophe, natural disaster or industrial accident.

In cases where, for one reason or another, an employee is called to work, payment for holidays in January 2020 will be made in accordance with the requirements of Art. 153 of the Labor Code of the Russian Federation - double. Days subject to double payment in January 2020 are 1 and 7 - holidays, 2-6 and 8 - weekends.

Please note that in addition to the double rate, the employee may be offered an alternative option - another day for rest. In this case, the payment is made in a single amount, and the provided day of rest is not paid. But the initiative for such a replacement should come from the employee, and not from the employer.

In addition to how to pay for the New Year holidays in 2020, the employer needs to remember that in accordance with the general requirements of the Labor Code of the Russian Federation (Article 136), if the payment period for wages falls on the New Year holidays, the salary is paid on the eve of this day. For example, earnings for December 2020 had to be transferred on December 29, 2018, since December 31 was a non-working day.

Work at night and on holidays must be paid separately. Thus, even if the employee’s shift occurs at night, and the date is a holiday, the employer must pay wages according to separate items: for night hours and for holidays. It also happens that you have to involve employees who work on a daily daytime schedule to work at night. Most often this occurs when it is necessary to eliminate the consequences of an accident at an enterprise, take inventory, etc.

Important

Night on a business trip If an employee must work at night while on a business trip, this does not change the mandatory additional payment. The only difference is that the employer is not obliged to pay extra for night hours spent on the way to the business trip, although he can do this on his own initiative and desire. What if it's overtime? It’s one thing when night hours are included in the work schedule, and a slightly different situation when they end up being worked beyond the norm, even with a shift schedule.

How to make payment in such cases? It is necessary to apply both the extra pay per night and the overtime factor, which is 1.5 for the first two hours of overtime and 2 for the subsequent time. Examples of calculations of remuneration for night hours Example 1. Payment for night hours with a fixed salary Employee Polivanov K.I. with a salary of 25 thousand rubles. per month

The work is performed on the basis of summarized working time recording. The shift begins at 20:00 on April 30 and ends at 20:00 on May 1. The hourly tariff rate is 50 rubles. Since the employee is entitled to three one-hour breaks for rest and food, including one break at night, he worked a total of 21 hours during this shift, which should be paid based on the hourly tariff rate: 50 rubles.

If we talk specifically about remuneration on a holiday with a salary, then here it is also worth referring to the Labor Code.

Thus, Article 153 of the Labor Code of the Russian Federation states that work on a weekend holiday must be paid, and no less than double the amount, based on the average daily earnings in your organization.

Thus, this rule applies to the calculation of payment only for those employees who receive an official salary, according to the employment contract.

But it also happens that when the norm for working hours in a given month is not exceeded, and there is no overtime of working hours, then the salary for the holiday worked is guaranteed to be paid only in a single amount.

Payment for a shift work schedule

Let's decide how to pay for New Year's holidays in 2020 for those working on a shift schedule. It all depends on what day the shift falls on. Legislators have provided several options:

- If the entire work shift or only part of it falls on a Saturday or Sunday that is not a holiday, then earnings for the shift are calculated in the general manner, that is, in a single amount (Article 111 of the Labor Code of the Russian Federation).

- If the scheduled shift falls on a holiday, then the calculations are made at least double the amount. Moreover, the shift worker is not entitled to time off. This day is included in the employee’s normal working hours.

- If you have to work on a day that is considered a day off according to the schedule, then the person has the right to time off. If he takes time off, then work not according to schedule is paid in a single amount. And if you refuse additional rest, you must pay at least twice as much.

Remuneration for employees working according to a standard schedule

Issues of payment for work on holidays for all categories of employees are regulated by Art. 153 of the Labor Code of the Russian Federation - and shift workers are no exception. The difference between shift work is that a holiday in this case is not additional work beyond the norm, but a regular shift within the monthly schedule. It’s just that the schedule was drawn up in such a way that someone got the job on a holiday.

However, the fact that working on a holiday was planned in advance and was not the result of an emergency situation does not mean that this should not affect wages. As a general rule, work on a holiday is paid at double the rate, and for shift workers this rule is the same, only it is implemented somewhat differently.

For working on a holiday, such an employee receives his daily/hourly rate (for regular work), plus at least one more daily/hourly rate (for going to work on a holiday). The result is a double payment.

Payment for holidays with a shift work schedule is made approximately as follows: Ivanov works 10 shifts per month with a salary of 30,000 rubles (the daily rate is 30,000 / 10 = 3,000 rubles), worked all 10 shifts in the month, but one of them fell on holiday. As a result, he receives his 30,000 rubles (monthly salary) and 3,000 rubles (daily rate) for working on a holiday - a total of 33,000 rubles.

All employees who work according to a standard schedule rest on holidays, since for them they are non-working days. Such an employee can be called to work on a holiday only after a prior order from management and only in emergency situations. Going to work on a holiday is paid, in accordance with the same article. 153 of the Labor Code of the Russian Federation, in double size.

For those workers who receive piecework wages, double piecework rates apply on a holiday. For example: Ivanov receives 100 rubles for making 1 part; on a holiday he managed to make 10 parts. The payment for this will be 10 × 100 × 2 = 2000 rubles. On a normal day, he would have received only 1,000 rubles for the same amount of work done.

Employees who were called to work on a holiday and whose work is paid according to daily/hourly tariff rates receive double the rate for that day. It should also be taken into account that such a day should not have been counted as a working day in the month.

As mentioned above, if work on a holiday is caused by an emergency situation, then they are involved in it by written order of the manager. This can be done, for example, in the form of an order, which the employee is introduced to under his signature. In this case, the signature under the order will simultaneously serve as confirmation of the employee’s consent to go to work on a holiday. Although such consent may well be formalized in a separate statement.

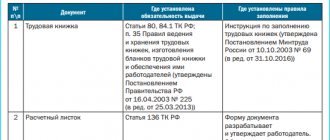

The employee responsible for recording working hours uses a time sheet in the unified form T-13 (not mandatory since January 1, 2013, but continues to be used in most enterprises) to mark going to work on a holiday. The timesheet is a primary reporting document and is subsequently used to calculate salaries.

Therefore, when this bonus “sits” in the watchman’s salary, it cannot be specified. Additional pay must be increased for each hour worked at night, and the number of such hours will be different for each month. The salary is set as a specific amount, which does not allow the monthly difference to be taken into account in full.

Attention

In accordance with labor legislation, not all categories of workers can be involved in night work, so it is prohibited to work at night:

- pregnant women;

- women with children under three years of age;

- minor workers;

- single parents with children under five years of age.

Women and men with small children or raising them alone can sometimes work at night, but only with their written consent. Moreover, the employer is also required to familiarize them in writing with the right to refuse night activities. The minimum amount of additional payments for work at night is established by Decree of the Government of the Russian Federation No. 554 of July 22, 2008 “On the minimum amount of increase in wages for work at night.”

Nuances of “holiday” payment

First of all, we note that the day before the holiday, employees work 1 hour less (Article 95 of the Labor Code of the Russian Federation). For example, with an 8-hour working day on Friday, November 3, 2017, workers can work for 7 hours and then go home. If the employer demands to work 8 hours, then the eighth hour of the employee’s work will become overtime. You will either have to pay it at one and a half times the rate, or give the employee additional rest time of 1 hour.

Despite the fact that, as a rule, employees do not work on holidays, the employer can call employees without their consent:

- to prevent or eliminate the consequences of an industrial accident or emergency;

- preventing accidents, as well as preventing the destruction or damage of property;

- performing work under conditions of emergency or martial law (Article 113 of the Labor Code of the Russian Federation).

Payment for work on a holiday in such cases is carried out according to the general rule: at least double the amount or single plus unpaid time off.

NOTE! The law establishes the minimum amount of payment for holidays. The legislation does not contain a maximum limit for wages on a holiday. A local regulatory act, a collective agreement, or an industry agreement on remuneration may provide for a different procedure for paying for holidays, but no worse than that provided for in Art. 153 Labor Code of the Russian Federation.

You can find a sample of a local wage regulation here.

What about regional holidays? These include holidays established by the constituent entities of the Russian Federation (Radonitsa, Kurban Bayram, Uraza Bayram, Easter). Since in Art. 153 of the Labor Code of the Russian Federation does not indicate that only the dates listed in Art. 112 of the Labor Code of the Russian Federation, in our opinion, for work on a regional holiday, employers have the right to charge double pay. But provided that the employee did not choose time off. This position is confirmed by the recommendations of the Federal Service for Labor and Employment dated June 2, 2014. However, in practice, employers most often strictly follow the rule “double pay or time off on holidays” only regarding national holidays.

How to calculate wages on holidays if you have a salary

Thus, transport enterprises, when establishing the amount of pay for night work for employees working in two- and three-shift modes, can be guided by the Resolution of the Central Committee of the CPSU, the Council of Ministers of the USSR, the All-Russian Central Council of Trade Unions dated February 12, 1987 N 194 “On the transfer of associations, enterprises and organizations of industry and other sectors national economy for a multi-shift operating mode in order to increase production efficiency” (hereinafter referred to as Resolution No. 194).

This regulatory act is applied if the work schedule clearly defines a multi-shift regime (working during the day in two or more shifts) (Letter of the USSR Ministry of Communications dated 09/08/1989 No. 185-D). The specific amounts of increased wages for night work are established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of workers, and an employment contract.

Example 3. Driver Vorobiev I.S.

The law allows working at night Despite the fact that most organizations work during the day, the specifics of certain types of work require night (and sometimes round-the-clock) functioning. Just for such enterprises, there is a shift work schedule, according to which part of the shift or the entire shift falls during hours usually intended for sleep and rest.

The regulations for the organization and payment of such work are prescribed in Art. 96 and 154 of the Labor Code of the Russian Federation. What shifts are considered night shifts The law proclaims night work hours from 10 p.m. (10 p.m.) to 6 a.m. A shift will be considered a night shift if at least half of it consists of work within the specified time period. Payment at the night rate will be only for the hours that make up this period; the rest will be rewarded, as is customary in day shifts.

If this condition is provided for in the contract, the employer is free to involve some employees in work duties during non-working hours. Such involvement is formalized by order of the head. Based on the provisions of Article 116 and Article 119 of the Labor Code, overtime during an irregular schedule is compensated by the provision of additional vacation time, the duration of which is established by a collective agreement or the internal rules of the organization.

At the same time, payment for work at night applies to all categories of workers and there are no restrictions. That is, if an employee performs his duties at night, then he should receive the required bonus, even if his schedule is not standardized.

Quite often, employees have difficulties calculating the part of their salary accrued for holidays if they receive a fixed official salary. There is actually nothing complicated here - you just need to find out how many working hours he has on average per month.

To do this, use the annual time standard given in the production calendar. This indicator must be divided by 12 (the number of months).

Next, they find out whether the standard number of working hours during the accounting period was exceeded as a result of going to work on a holiday. If this does not happen, then compensation is paid in a single amount. Here you need:

- divide the salary by the previously determined average number of hours;

- multiply the result by the time spent at work on the weekend.

Additional payment for nights and holidays, calculated by the guards

If a production need arises, a person can be called to work virtually at any time. However, there is one important nuance here - the employee must agree, and certainly in writing. The law does not force the employer to issue a special order in this regard, but, as practice shows, this document will not hurt.

There are many cases when an employee can be called upon to perform official duties on holidays. For example, this happens if:

- suspension of the enterprise’s activities is impossible, since production operates on a continuous cycle;

- the organization’s tasks include serving the basic needs of the population (for example, passenger transportation);

- there is a need to carry out urgent repairs, without which the enterprise will not be able to function normally in the future.

The employee’s consent is not required only when his presence in the institution is necessary for:

- emergency response;

- accident prevention, etc.

When the period worked results in exceeding the standard time, another method is used. Here the calculations are carried out in the same way as described above, but the result is then multiplied by two more.

The long-awaited time for Russians will soon come: the month when the whole country celebrates not only public holidays, but also church holidays - Christmas. After all, January has the largest number of non-working days.

And naturally, every employee is interested in how holidays are paid in January 2020 in Russia.

The last working day of this year will be Saturday December 29th. But Monday, December 31st, was made a day off. And the New Year holidays themselves will last until January 8 inclusive. Accordingly, we will begin work on January 9.

Let’s take a closer look at how New Year’s holidays are paid in January 2020, and also tell you:

- how will they pay for work during this time;

- How will wages be calculated under different remuneration systems?

On 31 calendar days in January 2020, there are a total of 17 working days and 14 holidays and weekends.

How are New Year holidays paid in 2020, depending on the payment system?

Salaried employees are paid wages for January 2019 in the same amount as in other calendar months, even though January is a short month in terms of the number of working days. For this purpose, the production calendar established a standard working time of 136 hours.

According to the general requirements of Art. 112 of the Labor Code of the Russian Federation, employees who have a fixed tariff rate, as well as piece workers, are paid additional remuneration for the January holidays. The payment procedure and amount of remuneration may be determined by an employment contract, wage regulations or collective agreement of the organization.

In Art. 112 of the Labor Code of the Russian Federation enshrines state guarantees prohibiting the employer from infringing on the rights of employees regarding payment and reducing wages due to holidays.

To summarize the above, let us repeat how New Year's holidays are paid for:

- for piece workers - no less than double piece rates;

- persons paid at tariff rates - at least double the tariff rate;

- for persons receiving a salary - no less than a single rate, if work on a weekend or non-working holiday was carried out within the limits of the monthly working time standard. And when working beyond normal working hours, in accordance with the requirements of Art. 152 of the Labor Code of the Russian Federation, overtime pay is added to the salary - for the first 2 hours payment is made at one and a half times, for subsequent hours - at double.

If the employer refuses to pay for work on New Year holidays in accordance with the law, employees have the right to apply for protection of their labor rights to the State Labor Inspectorate or to court.

But when calculating the amount of the bonus, the category of the employee should be taken into account. For example, if guards are given an additional payment for night work in the amount of twenty percent of the daily rate, this will be a direct violation of the law. The above-described form for calculating surcharges is established by law.

Info

But sometimes commercial organizations conduct “their own” calculations that absolutely do not comply with the norms. If an employee does not agree with the amount of bonuses, he has the right to appeal this in court and demand the due payments. To prove that you are right, you must have an employment contract in your hands, which clearly states the work schedule, method of payment and tariffs.

In the absence of an official document on employment, it will not be possible to prove anything. If activities at night are predetermined directly by the work schedule, for example, when a shift schedule includes several shifts during the night period, then you can once, at the time the work schedule is established, introduce the employee to a document confirming his right to not accept night shifts.

If the performance of labor functions occurs occasionally, then each time it is necessary to provide the employee with the right to refuse and obtain his written consent to work at night. For women Women who are pregnant and women with children under three years of age are not entitled to work at night.

How are New Year holidays paid for in 2020?

January 06, 2020 at 11:23 How New Year's holidays are paid in January 2020 is a question that worries not only employees, but also their employers, since it is necessary to plan the budget for the next year in advance. At the beginning of 2020, we traditionally have long New Year's days of rest and many questions always arise about how New Year's holidays are paid for in 2020. We will tell you in our material whether it is possible to reduce employees’ salaries for a shortened month and how to properly pay for scheduled workdays, as well as weekends and holidays.

Related Articles Table of Contents If you find an error in the text, please let us know by highlighting it and pressing Ctrl+Enter All official holidays are listed in . As for the New Year holidays, in January the non-working holidays are as follows: 1, 2, 3, 4, 5, 6 and 8 - New Year holidays; 7 - Christmas

How to calculate the salary of guards working on a flexible schedule?

Some categories of citizens cannot be involved in work outside normal hours. So, in particular, Article 268 of the Labor Code of Russia prohibits calling minor workers on holidays. The same norm, but in relation to pregnant employees, is given in Art. 259 of the same code of laws.

Also, workers who have certain limitations due to poor health or life circumstances cannot be disturbed. This category includes:

- mothers with children under 3 years of age;

- single parents (or guardians) who have children under 5;

- disabled people;

- citizens caring for sick relatives (after presenting a medical report confirming that a loved one is not able to care for themselves);

- persons who are dependent on disabled children.

It is permissible to call these people at odd hours only in emergency situations, and even then only with their consent.

Another feature of working during holidays is the fact that an employee may be required to work at night. Here, when calculating wages, allowances for both night time and holidays are taken into account. In accordance with the Government Decree “On the minimum increase in wages for work at night” No. 554 of July 22, 2008, the answer to the question of how work at night on holidays is paid is as follows: from 22 to 6 o’clock, 20 is added to the hourly tariff rate %.

Here again there are two calculation options:

- Those employees who went to work at night on a holiday according to schedule (i.e., within the framework of the monthly work standard) receive an additional payment of 100% for going to work on a holiday and an additional payment of 20% of the hourly rate for night time .

- Those employees for whom work on a holiday was not scheduled will receive a double tariff rate, taking into account an allowance for night time.

It should be noted that 20% is just the minimum level of the premium. The management of the enterprise may well make it higher by enshrining such a decision in a collective agreement and other local acts.

Payment for time off taken by an employee is calculated in the same way.

Instead of receiving monetary compensation for working on a holiday, the employee has the right to take time off. In this case, the holiday is paid as usual, the doubling of payment is canceled, and the selected day is not paid.

The legislator has not regulated the procedure for choosing a day of rest instead of a worked holiday, but do not forget that the employee must notify the manager or accounting department about his choice before the end of the month (after all, by default he will simply be charged double pay). In addition, the rest day itself must be agreed upon with management.

We pay for work during the New Year holidays

The article from the magazine “MAIN BOOK” is relevant as of December 21, 2012. Questions were answered by E.A. Shapoval, lawyer, PhD. n. The January holidays are a wonderful reason to relax after a busy working year.

But someone has to work even these days.

We'll tell you how to pay for the work in this case. A.R. Gudareva, Magnitogorsk The organization works on a five-day basis with two days off on Saturday and Sunday. The employee whose salary was established worked due to emergency circumstances from December 30, 2012 to January 8, 2013. Wants to take time off. How much time off does he get?

: He is entitled to additional days of rest for all days of work on weekends and non-working holidays. The period from December 30, 2012 to January 8, 2013 includes: 2 days off - December 30 and 31 (from Saturday December 29, 2012

the day off was moved to Monday 31 December)

Recycling on the pre-holiday day

According to the norms of Art. 95 of the Labor Code of the Russian Federation, the duration of the working day preceding a holiday is reduced by 1 hour. Thus, if the employee has to work a standard amount of time that day, the last hour will be counted as overtime. Also, this hour will be considered overtime for employees working in shifts who, due to the nature of their activities, cannot finish work earlier.

Compensation for this hour can be of two types:

- In the form of providing additional rest time (for example, going to work one hour later one day).

- In the form of monetary compensation, the amount of which is calculated as per hour of overtime work.

Overtime pay means that the employee receives one and a half times the hourly rate for the first two hours of overtime work and double the rate for each subsequent hour.

How the weekend was postponed in 2018

Article 112 of the Labor Code of the Russian Federation provides that the transfer of days off is carried out for the purpose of rational planning of working time in organizations and taking into account the interests of various categories of citizens of the Russian Federation in creating conditions for proper rest. For these purposes, Decree of the Government of the Russian Federation of October 14, 2020 No. 1250 “On the transfer of weekends in 2020” provides for the following shift of weekends:

As a result, in January 2020 the following transfers of weekend days are provided:

- from Saturday 6 January to Friday 9 March

- from Sunday 7 January to Wednesday 2 May.

Who can be called upon to work on weekends and holidays?

The norms of Article Art. 113 of the Labor Code of the Russian Federation regulates the procedure for attracting people to work on a holiday. There are two ways to organize the workflow mentioned here:

- Continuous production or round-the-clock provision of services. In such companies, the work of employees (all or only part of the team) is usually based on shift work.

- A typical work schedule is where employees work five days a week, working eight hours each day. Although there may be options with a six-day week or extended/shortened working hours.

If an employee gets a job working shifts, then even before signing the employment contract, he is warned about the need to work on holidays, if so provided for in the schedule.

For other employees, going to work on a holiday is an exceptional situation, which is possible only after a written order from management and obtaining the written consent of the employee himself.

IMPORTANT! Pregnant women and minors should not be hired to work on holidays. Women who have children under 3 years of age, disabled children of any age, as well as single mothers with children under 5 years of age can be asked to go to work on a holiday only if they have no medical contraindications for this.

An employee is guaranteed to receive compensation for working on holidays. It can be expressed in the provision of time off instead of a worked holiday or in doubling the pay for going to work. Company management can increase the amount of monetary compensation and offer the employee more pay. In this case, the appropriate procedure for calculating wages on holidays should be enshrined in the company’s local act. But which days are considered holidays in the state are established only at the legislative level.

Are holidays paid?

Work at night and on holidays must be paid separately. Thus, even if the employee’s shift occurs at night, and the date is a holiday, the employer must pay wages according to separate items: for night hours and for holidays. It also happens that you have to involve employees who work on a daily daytime schedule to work at night. Most often this occurs when it is necessary to eliminate the consequences of an accident at an enterprise, take inventory, etc.