Differentiation of the level of remuneration for work depending on the complexity of the actions performed, level of qualifications, and the presence of certain skills makes it possible to motivate employees for self-development, training, and improvement of their quality indicators in the process of work. It is for this purpose that tariffication of work should be introduced into practice, assigning different categories to workers depending on their professionalism. Article 143 of the Labor Code of the Russian Federation defines the basis of the tariff system of remuneration.

Article 143 of the Labor Code of the Russian Federation: tariff system

Labor Code of the Russian Federation in Art. 143 defines the basic concepts and rules of the tariff system of remuneration. Gradation of the level of labor income of employees depending on their professional skills is achieved by introducing a tariff system of payment for work performed at the enterprise.

What is the tariff system of remuneration?

It provides the following main points:

- for working specialties, hourly wage rates are established, which are grouped by specialty and directly depend on the complexity of the work performed;

- engineering and technical personnel receive wages based on monthly salaries (they are also grouped by specialization and increase as the category increases);

- it is allowed to introduce a range of official salaries, when for one specialty and category the employer has the opportunity to set different official salaries;

- You can set a single level of tariff rate (salary), and all other employee salaries can be calculated by multiplying by tariff coefficients provided for by the tariff payment system implemented in the organization.

Typically, the tariff system is established on the basis of the wage fund available at the enterprise, the volume, complexity of the actions performed, taking into account the average state level of payment for work in similar specialties. Typically, the wage fund is calculated based on the company's projected income.

Remember, a properly structured tariff system of labor remuneration will motivate employees to professional growth, and the level of payment above the market average will ensure low turnover of personnel in the main professions.

It is necessary to understand that it is advisable to inflate the level of compensation for labor activity only in relation to acute shortages of highly intelligent specialties. All other employees will feel comfortable if their income level is 10–30% higher than similar specialties in other companies.

My own lawyer

Official text: Article 143. Tariff systems of remuneration Tariff systems of remuneration are systems of remuneration based on a tariff system of differentiation of wages for workers of different categories.

The tariff system for differentiating wages for workers of different categories includes: tariff rates, salaries (official salaries), tariff schedule and tariff coefficients. Tariff schedule is a set of tariff categories of work (professions, positions), determined depending on the complexity of the work and the requirements for the qualifications of workers using tariff coefficients. Tariff category is a value that reflects the complexity of work and the level of qualifications of the employee. Qualification category is a value that reflects the level of professional training of an employee. Tariffication of work is the assignment of types of labor to tariff categories or qualification categories depending on the complexity of the work. The complexity of the work performed is determined based on their pricing. Tariffication of work and assignment of tariff categories to employees are carried out taking into account the unified tariff and qualification directory of works and professions of workers, the unified qualification directory of positions of managers, specialists and employees, or taking into account professional standards. These reference books and the procedure for their use are approved in the manner established by the Government of the Russian Federation. Tariff systems of remuneration are established by collective agreements, agreements, local regulations in accordance with labor legislation and other regulatory legal acts containing labor law standards. Tariff systems of remuneration are established taking into account the unified tariff and qualification directory of works and professions of workers, the unified qualification directory of positions of managers, specialists and employees or professional standards, as well as taking into account state guarantees for remuneration. Lawyer's comment: The Labor Code allows for a variety of tariff systems for remuneration. The basis of the tariff system of remuneration is the differentiation of wages for workers of different categories. At the same time, the tariff system of wage differentiation is a set of norms that ensure differences in wages depending on its qualifications, complexity, intensity, conditions, and nature. The tariff system in accordance with the Labor Code includes the following main elements: tariff rates, salaries (official salaries), tariff schedule, tariff coefficients, as well as tariff and qualification reference books. Tariff rate is an element of the tariff system that determines the fixed amount of remuneration for fulfilling a standard of work (job duties) of a certain complexity (qualification) per unit of time (hour, day, month). The amount of payment for the simplest work is determined by the tariff rate of the 1st category (the basic wage rate). It then increases with increasing complexity of the work. Salary (official salary) is the amount of wages per month established by workers whose work cannot be regulated, or by managers, specialists and employees. The tariff schedule establishes the ratio of wages depending on the complexity of the work and its qualifications. It consists of tariff rates and tariff (qualification) categories. The 1st category includes the simplest work, the last - the most complex. The ratio of the tariff rates of each category is determined by the tariff coefficient. The more complex the work, the higher the category and, accordingly, the higher the tariff rate, which is determined by multiplying the tariff rate of the 1st category by the corresponding tariff coefficient. Tariffication of work and assignment of categories to employees is carried out taking into account tariff and qualification reference books containing qualification characteristics of various types of work depending on their complexity, indicating which category a particular job corresponds to, as well as the requirements for the knowledge and skills of the employee. In accordance with Articles 143 and 195.1 of the Labor Code, this work will now have to be carried out taking into account professional standards. The procedure for their application, as well as for establishing the identity of job titles, professions and specialties, is established by the Government of the Russian Federation. Currently, there is a Qualification Directory for positions of managers, specialists and other employees, approved by Resolution of the Ministry of Labor of Russia dated 08/21/1998 No. 37 (as amended on 03/14/2011), which is of a recommendatory nature. The directory consists of qualification characteristics of positions of managers, specialists and employees, it describes job responsibilities and lists the requirements for the level of knowledge and qualifications of these categories of workers. The names of positions in the Directory are established in accordance with the All-Russian Classifier of Worker Occupations, Employee Positions and Tariff Classes OK 016-94 (OKPDTR), which came into force on January 1, 1996. The directory can be used by both budgetary and commercial organizations, regardless of organizational and legal forms, to resolve issues related to personnel management, in particular when delineating functions, powers and responsibilities between these categories of employees. The use of the Handbook should contribute to the establishment of uniform approaches to determining the job responsibilities of employees and the qualification requirements for them. On March 30, 2004, the Procedure for applying the Unified Qualification Directory for positions of managers, specialists and employees, approved on behalf of the Government of the Russian Federation, came into force (Resolution of the Government of the Russian Federation dated October 31, 2002 No. 787 “On the procedure for approving the Unified Tariff and Qualification Directory of Work and Professions of Workers, the Unified Qualification List directory of positions of managers, specialists and employees" (as amended on December 20, 2003)). In particular, this Procedure stipulates that the Unified Qualification Directory of positions for managers, specialists and employees is intended to resolve issues related to the regulation of labor relations, ensuring an effective personnel management system for organizations, regardless of the form of ownership and organizational and legal forms of activity. The positions of employees in the Directory are divided into three categories: managers (mainly perform organizational and administrative work), specialists (mainly perform analytical and constructive work) and employees (mainly perform information and technical work). At the same time, the Directory does not contain qualification characteristics of positions of deputy managers, since the job responsibilities of such employees, the requirements for their knowledge and qualifications are determined on the basis of the requirements contained in the characteristics of the corresponding basic positions of managers specified in the Directory. The distribution of job responsibilities between deputy managers in an organization is carried out, as a rule, on the basis of internal organizational and administrative documents. Based on qualification characteristics, organizations can develop job descriptions for specific employees. The job description, in contrast to the qualification characteristics given in the Handbook, must contain a specific list of the employee’s job responsibilities, his rights and responsibilities, taking into account the peculiarities of the organization of production, labor and management in a given organization. The compliance of the actual duties performed and the qualifications of employees with the requirements of qualification characteristics is determined by the certification commission of the organization. Persons who do not have special training or work experience established in the section “Qualification Requirements”, but have sufficient practical experience and perform their job duties efficiently and in full, on the recommendation of the certification commission, as an exception, may be appointed to relevant positions as well as persons with special training and work experience. When commercial organizations apply a tariff system of remuneration, the tariffication of work and the assignment of tariff categories to employees, established taking into account the complexity of the work and the qualifications of the workers, must be carried out taking into account the Directory.

Tariff category

The minimum unit for determining the basic level of employee income is the tariff category. It serves to establish a fixed level of payment (rate, salary) for work performed.

The tariff category is determined by the level of knowledge, experience and qualifications of the employee

The tariff category is formed based on the following criteria:

- complexity of the actions performed;

- having prior work experience in similar conditions;

- the level of available special training;

- a list of works available to be performed by a specific employee.

The basic document for forming a category and assigning it to a specific worker is the tariff and qualification directory, which contains all the necessary key information for the employer. The assignment of a specific category to a certain level of payment for fully completed work is carried out by the employer together with trade unions. As a result, all this should be reflected in the collective agreement (company agreement).

Remember, employees with the same ranks, but in different specialties, may belong to different pay groups. Here everything will depend on the complexity, responsibility of the actions performed, as well as their role in the overall technological process of the company.

To establish a higher rank during the employment of an employee, the latter must document that his experience, qualifications, and level of knowledge are sufficient to perform the entire list of work provided for such rank. In the future, the employer can initiate a commission check of the employee’s compliance with the rank assigned to him.

Commentary on Article 143 of the Criminal Code of the Russian Federation

Commentary edited by A.V. Brilliantova

The social danger of the crime lies in the violation of the constitutional right to work in conditions that meet the requirements of safety and hygiene (Part 3 of Article 37 of the Constitution of the Russian Federation). The crime in question impedes the implementation of state policy in the field of labor protection, one of the directions of which is to ensure the priority of preserving the life and health of workers (Article 210 of the Labor Code of the Russian Federation).

The main object of the crime under consideration is relations in the field of ensuring labor protection, working conditions that meet safety and hygiene requirements. An additional object is human life and health.

The objective side of the crime includes:

1) an act in the form of action or inaction, consisting of a violation of labor protection requirements;

2) socially dangerous consequences in the form of serious harm to health (in the main element of the crime), the death of an employee (in a qualified personnel with aggravating circumstances) or the death of two or more persons in a specially qualified personnel;

3) a causal relationship between an action (inaction) and socially dangerous consequences.

Labor protection requirements are understood as state regulatory labor protection requirements contained in federal laws and other regulatory legal acts of the Russian Federation, laws and other regulatory legal acts of the constituent entities of the Russian Federation.

Labor protection should be understood as a system for preserving the life and health of workers in the process of work, including legal, socio-economic, organizational and technical, sanitary and hygienic, treatment and preventive, rehabilitation and other measures (Part 1 of Article 209 of the Labor Code of the Russian Federation ).

The objective side of violation of labor protection requirements is formed by the action or inaction of subjects who deviate from general industry or local standards that ensure the safety of workers. This may be, for example, not providing instructions on compliance with safety regulations; permission to work on faulty equipment, disruption of the technological process, failure to provide special protective equipment, etc.

Considering that the disposition of Art. 143 of the Criminal Code is blanket, therefore, in order to establish signs of a crime, it is necessary to be guided by the provisions of regulations that specify safety rules and other labor protection requirements when performing specific work.

In cases of this category, it is necessary to limit the crimes provided for in Art. 143 of the Criminal Code of the Russian Federation, from crimes provided for in Art. 216 of the Criminal Code of the Russian Federation, taking into account that when resolving this issue, one should proceed from the specific work in which safety requirements were violated. If a violation of these requirements (including labor safety rules) was committed during mining or construction work, then the offense must be qualified under Art. 216 of the Criminal Code of the Russian Federation

It should be borne in mind that the legal liability for violations of labor protection requirements for persons obliged to ensure compliance with these rules occurs regardless of the form of ownership of the enterprises at which they work.

The corpus delicti is material. The act is completed from the moment the socially dangerous consequences occur.

In a number of cases, the objective side of the crime is formed by a series or system of actions of several different subjects. For example, when working in a mine, each of the teams consistently did not take measures to reduce methane levels after the shift. The critical point of gas concentration and the explosion followed the actions of the members of the last brigade, which died in the explosion. In this and similar cases, the question arises about the presence of a crime in the actions (inaction) of persons who had not previously taken the necessary measures, which created the conditions for the commission of a criminal act at the final stage. From our point of view, in such situations, the persons who created the conditions are not subject to criminal liability, since there is no direct and immediate causal connection between their act and the socially dangerous consequences that have occurred.

The subjective side of the crime is characterized only by a careless form of guilt in the form of frivolity or negligence. The culprit, violating labor safety requirements, foresees that thereby he could cause harm to health or death, but without sufficient grounds for this he expects to prevent these consequences (frivolity) or does not foresee the possibility of the occurrence of these consequences, but should have and could have foreseen (negligence) .

In the case where the intent of the perpetrator was aimed at achieving a criminal result, and the method of implementing such intent was a violation of labor protection and work safety rules, the act must be qualified under the relevant article of the Criminal Code of the Russian Federation, which provides for liability for committing an intentional crime.

If the perpetrator, by violating these requirements, pursued the goal of causing certain consequences, and his attitude towards the occurrence of other consequences was in the form of careless guilt, the act should be classified according to the totality of crimes committed intentionally and through negligence.

A special subject of a crime is a person who, by virtue of their official position or by special order, is directly entrusted with the obligation to ensure compliance with labor protection requirements in a certain area of work, as well as heads of enterprises and organizations, their deputies, chief engineers, chief specialists of enterprises, if they did not take measures to eliminate violations of labor safety requirements known to them, or gave instructions that contradict these rules, or, having taken on direct management of certain types of work, did not ensure compliance with the same rules.

In other cases, officials guilty of improper performance of their official duties to ensure safe working conditions may be held liable for malfeasance (for example, for failure to take measures to develop appropriate instructions, to create conditions for compliance with labor safety rules and regulations, to implement proper monitoring their compliance).

At the same time, the subjects of these crimes can be citizens of the Russian Federation, foreign citizens, as well as stateless persons. If a violation of labor safety rules and regulations was committed by an employee who was not a person specified in Art. 143 of the Criminal Code of the Russian Federation, and entailed the consequences listed in this article, the act should be considered as a crime against the person, regardless of whether the victim is related to this proceeding or not.

Tariffication of works

In order to correctly determine the relationship between the list of actions performed and the employee’s ability to do it at a high professional level, all work is charged. Tariffing refers to the sorting of specific actions that an employee with a certain level of qualifications must be able to perform. The set of such actions increases in proportion to the level of increase in the level of work assigned to the employee.

It is important to take into account the following nuances:

- The minimum set of requirements falls into the first category.

- For each subsequent rank, an increase in the skills required to perform is provided. At the same time, the expansion of skills is carried out without reducing the list of skills at lower levels.

- To gain skills in certain types of work, special training and education may be required, followed by passing tests or exams.

Based on a correctly completed work tariff, the employer has the opportunity to assign the employee the correct rank, clearly covering the level of his qualifications, past training, and existing experience in performing similar actions. Accordingly, a fair ranking of pay for work performed is established, and motivation appears for other workers to develop in order to move to the next level in rank, and therefore in pay.

Remember, the pricing of work is also taken into account in the process of developing and approving labor standards, prices for piecework, and determining the coefficients of individual labor participation if the work of ordinary workers is carried out collectively.

Commentary to Art. 143 of the Criminal Code of the Russian Federation

Commentary edited by Esakova G.A.

1. The victim can only be an employee who has an employment relationship with the employer (legal entity (organization) or individual) where labor protection requirements were violated. Causing harm to the health of other persons due to violation of labor protection requirements must be qualified under Art. 109, 118 or 293 of the Criminal Code.

2. The objective side is characterized by an act in the form of action or inaction, constituting a violation of the current labor protection requirements, including the rules of industrial sanitation and hygiene, special safety rules regarding minors, pregnant women, etc.

Responsibility under Art. 143 of the Criminal Code also occurs in the event of inaction by the head of the organization, the employer - individual entrepreneur to create, in cases established by law, a labor protection service, a full-time labor protection specialist, or the appointment of an employee authorized in the field of labor protection, or inaction in developing appropriate instructions or ensuring proper control over the implementation of the rules safety precautions, other labor protection rules.

According to the note, labor protection requirements are state regulatory labor protection requirements contained in federal laws and other regulatory legal acts of the Russian Federation, laws and other regulatory legal acts of constituent entities of the Russian Federation. The criminal law is silent about the labor protection requirements established by local regulations, however, Art. 209 of the Labor Code of the Russian Federation classifies local acts as sources of labor protection requirements. Thus, through the action of Art. 209 of the Labor Code of the Russian Federation, violation of these requirements is also criminally punishable.

3. The crime is considered completed from the moment the consequences occur in the form of serious harm to the victim’s health.

4. The subjective side is characterized by a careless form of guilt. Deliberate violation of relevant requirements should be qualified under the articles of Chapter. 16 of the Criminal Code, which provides for liability for committing an intentional crime against life and health.

5. Special subject: an employee who is in an employment relationship with an employer (legal entity (organization) or individual), who has been duly assigned responsibilities to comply with the relevant requirements, the head of an organization or the employer - an individual.

The actions of other persons who violated the relevant requirements, in the event of consequences in the form of serious harm to health or death of the victim, should be qualified under Art. 109, 118 CC.

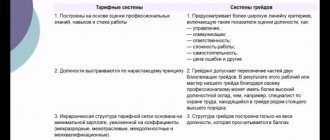

Advantages and disadvantages

The tariff system has its advantages and even some disadvantages. Among the positive and negative aspects of this method of stimulating highly productive labor, the following points should be highlighted:

| Advantages | Flaws |

| there is a clear gradation of the level of payment for a specific amount of work; | in order to receive the next rank or category, you must pass a test by a special commission (or undergo training); |

| it is possible to divide employees based on their qualifications; | to move from one category to another you need to wait a certain time; |

| each employee understands what he is paid for, or can be paid wages; | in some cases, the basis for assigning a category is the presence of a certain education. Therefore, young students with minimal work experience may be more likely to advance in their careers than older, experienced employees with no education; |

| there is always motivation for development in order to move up the career ladder; | The existing monetary gap between ranks (categories) does not always correspond to the level of necessary labor costs that are required from the worker. |

| the gap between the pay of highly skilled workers and low-skilled workers significantly reduces staff turnover. |

Remember, the introduction of a tariff system of remuneration, even with some of its shortcomings, ultimately has a positive effect for the company as a whole. Especially if the company is aimed at long-term existence and active development.

Part 1 art. 143 of the Criminal Code of the Russian Federation

Violation of labor protection requirements committed by a person entrusted with the obligation to comply with them, if this entailed through negligence the infliction of serious harm to human health, is punishable by a fine in the amount of up to four hundred thousand rubles or in the amount of the wages or other income of the convicted person for a period of up to eighteen months. , or compulsory labor for a period of one hundred eighty to two hundred and forty hours, or correctional labor for a term of up to two years, or forced labor for a term of up to one year, or imprisonment for the same term with deprivation of the right to hold certain positions or engage in certain activities for up to one year or without it.

Article 140 of the Labor Code of the Russian Federation

Art. 140 of the Labor Code regulates the payment of wages and severance pay due to an employee after official dismissal. But the norms of any legal act can be interpreted differently. And before commenting on this issue, let us introduce the article itself. 140 Labor Code of Russia.

Art. 140 of the Labor Code regulates the procedure for direct payment of a resigned employee. In accordance with this article, all payments must be made on the day of dismissal of such an employee, that is, on the day of termination of the employment agreement between the employer and employee.

If, for some specific reason, the employee was absent on the day of his last official work, then the payment must be paid within the next day after such employee made a demand to pay him legally earned money.

If the company and the employee cannot agree on the amount of compensation, then the representative of the enterprise pays the amount within the agreed period only within the amount in which the parties reached an agreement.

Each author gives his own formulations and explanations to the norms of the Labor Code. And then a few comments from experienced lawyers and personnel officers on such an issue as the dismissal of employees: Article 140 of the Labor Code of the Russian Federation with comments in 2020