Definition

The remuneration system is being improved everywhere. Every organization strives to improve the quality of motivation of its employees. The goal of this work is to make more profit. Companies strive to implement a system that would reward the work of company employees as fairly as possible.

Foreign sources interpret the term remuneration as the price paid by an enterprise for the use of a certain amount of time and effort by an employee. Compensation can be paid in various forms (salary, bonus, fee, etc.), but it is always the cost of a unit of services at which the worker’s activities are valued.

The Russian Labor Code defines wages as remuneration paid for labor. It depends on qualifications, quantity, complexity and quality of execution, as well as working conditions. The concept of wages also includes compensation (additional payments, allowances) and incentive payments.

Wages in a market economy represent the cost of workers' labor. It directly affects the standard of living of the population. Wages in a market economy can be nominal and real. In the first case, we are talking about a monetary form of motivation. It is calculated per hour, day or other time periods. Real wages represent the number of services and goods that a worker can purchase with the funds he receives.

For a company, wage costs are one of the main components of variable costs. They make it possible to attract a sufficient number of qualified employees to fulfill the assigned production tasks.

Cases of payment of wages in kind

The form of remuneration under consideration is used at enterprises whose products the employee can regularly and effectively use. For example, quite often at enterprises in the agricultural sector of the economy, in conditions of an unstable situation of the organization, it is practiced to pay part of wages in food products.

Products issued as wages must be suitable for use. As a general rule, the organization makes payments in kind in the form of consumer goods. Wages in kind are given to personnel taking into account qualifications, quality of work, number of hours worked, and can be used as an incentive measure.

System development

After the collapse of the USSR, the wage system was transformed in modern conditions. The organizational approach to the formation of wages depends on the social and cultural environment. In Russia, the labor market was formed under the influence of a number of contradictions that arose under the influence of old and new views on reality.

The starting point for the creation of a modern system was the organization of wages from Soviet times. She had both advantages and disadvantages. The advantages of this model were full employment of the population, as well as their confidence in the future. The disadvantage of this system is low wages, as well as a shortage of labor of different skill levels.

Previously, remuneration was inextricably linked with its social organization. It was implemented using a tariff system for workers and salaries for governing bodies and employees. This was the first systematic approach that made it possible to reward the activities of employees in a differentiated manner.

In the Soviet Union, the tariff system took into account the level of qualifications of employees, as well as working conditions. These principles formed the basis of the modern tariff organization of payment. The salary system took into account what qualifications the employee has, what experience, and education. The volume of work, as well as the degree of responsibility of the employee, was also taken into account.

The amount of remuneration for one’s activities was determined not only by the quality, but also by the quantity of labor. It was also compared with established plans. The employee had to not only fulfill, but also exceed the established norm.

Today, modern wage systems distinguish between several types of wages. What makes it different is the presence (among other things) of a tariff-free incentive system. Various bonus approaches to paying employees for their activities have also appeared. Modern systems motivate people more than before to complete the tasks set by management.

Modern effective remuneration systems

Author: Ratner Gennady Source: General Director

Increasing work efficiency and high employee motivation is one of the main problems of any company, said one of the greatest managers of the past, John Rockefeller.

Rational work

Inability to manage people is one of the main reasons for the unstable performance of many domestic companies. And the leader here, as a rule, is the lack of an effective system of material incentives. According to a study conducted in Ukraine in 2003 by the SEVEN Consulting and Training Center, in a developing market economy, the most powerful incentive for highly productive work is wages (80–90%).

Modern approaches to solving this problem involve abandoning traditional time-based or complexity-based pay systems and replacing them with compensation consisting of a base rate and additional incentive payments (depending on individual results and/or department/company performance).

Today, most workers are dissatisfied with the injustice of salary distribution, the lack of connection with labor results, the chaos in the ratio of salaries of specialists in different departments, and the large difference in wages for similar specialists at enterprises in the same region .

This leads to staff turnover, team instability, and enterprise losses associated with training constantly changing specialists.

In many countries of Western Europe and the USA, considerable attention is paid to the motivational aspects of personnel management in companies and firms. The methodology and experience are successfully transferred to domestic soil. In the last decade, post-Soviet countries, in particular Ukraine, have seen economic growth and relative stabilization; These changes also affected the area to which this publication is devoted.

Developers of modern remuneration systems, with all the diversity of approaches, are unanimous in that:

- the tariff and salary system is outdated and does not meet the realities of today;

- the focus of the incentive system must correspond to the tactics and strategy of managing the enterprise, its divisions and personnel;

- incentive payments should be more closely linked to individual and collective performance;

- wage growth relative to labor productivity growth (sales performance) must be regulated in accordance with planning objectives;

- The incentive system should be perceived by employees as clear and fair.

These problems are successfully solved with the help of flexible non-tariff systems of remuneration (flexible - because the system can be transformed in accordance with almost any tasks of operational planning and incentives; non-tariff - because the basic parameters of wages (hereinafter referred to as wages) are rates, salaries, tariffs, minimum salaries are determined based on labor market conditions in the region, the nature, goals and objectives of the business, and personnel policy of management).

In recent years, financial incentive programs have become quite complex systems that take into account many factors, patterns and variables. Let's consider the basic principles of their construction.

| According to American Management Association , in the US, 72% of companies use flexible systems. Productivity increases by "-, the number of employee complaints decreases by 83%, the number of absenteeism by 84%, cases leading to lost work time by 69%, and employee turnover is reduced by 70-75%. Russian analysts note that with the implementation of flexible systems, profitability increases by 5–50%, and employee income increases by 3–30%. |

Structure of the planned salary

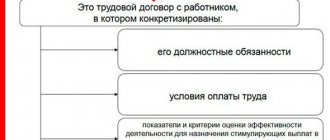

The main thing is to determine whether planned (nominal) salaries (not rigid “salaries” paid regardless of anything!), often called rates , which most closely matches the meaning of the concept (Fig. 1).

Rice. 1. Salary structure

The rate is determined taking into account the cost of the employee in the target labor market in a particular region and, in fact, is a payment for competence , i.e. for the knowledge, skills, personal qualities and potential of the employee, and not just for the position held. Its value must be sufficient to attract a worker with the required qualifications and training.

Next, it is necessary to determine the employee’s share of participation in achieving certain performance results (results of the enterprise, division, individual results).

To do this, the bet is divided into two parts:

- payment for the cost of labor expended - PTA (time contribution);

- payment for the results (results) of labor - VPI (variable piecework contribution).

At the next stage, it is specified which results include the variable piece-rate contribution of each employee: fulfillment of personal plans (PPL) and/or corporate results (division/subcontractor/entire organization).

And lastly: for each it is necessary to establish the value of the minimum salary (ZPmin), which will be paid regardless of anything (in the traditional payment system, salary plays this role).

Salary min depends on the status of the employee, his value to the organization and should be so high that the necessary specialists do not have the desire to look for a new job. As a rule, ZPmin is set at 50–70% of the rate.

It is extremely important that the combination of parameters and components of the salary correspond to the functional responsibilities and indicators of the employee, on which he must have real influence and for which he is responsible .

Payment for the implementation of personal plans (the PPL component) is the most effective component of incentives. It is based on the direct result of labor: the employee receives additional earnings for exceeding the plan.

This same form of labor incentives includes the so-called percentage of sales , which today is still used in remuneration of sales personnel.

Group performance incentive schemes (components of ZPO and ZPS) are focused on the interests and needs of the organization .

This scheme is most appropriate when the group works as one team, performing interrelated tasks (team work “in one pot”), and it is quite difficult to measure the individual contribution of everyone.

Next, we will consider salary schemes using the example of typical positions.

Head of department:

- part of the salary (70–80%) depends on the results of the work of his department (ZPO), part (20–30%) - on the results of the work of the entire company or a related department (ZPS). Such feedback between departments has a significant impact on increasing the level of corporate responsibility for results .

Chief accountant, accountant, office manager, head of a functional department, system administrator, etc. , whose task is to perform mainly technological functions:

- The salary depends only on the time worked (time-based payment for the salary), or part of the rate (20–30%) depends on the results of the work of one’s division/entire company/related division.

Sales manager, workers of main specialties:

- As a rule, the salary depends on individual results, or part of it (15–25%) depends on the results of the work of the department (shop).

Percentage of sales: absolute futility

We cannot help but mention the misconception that we inherited from the “wild” market of the 90s of the last century, when the salary of sellers was a percentage of turnover . At that time it was completely justified, but the further you go, the more difficult it is to maintain this form of payment. It would seem that it is quite logical, and the scheme is quite simple. However, both managers and salespeople/managers are constantly faced with significant disadvantages of this incentive method:

- The percentage is set subjectively, based on market analogues, without sufficient reference to the company’s business processes.

- Sales volume and labor intensity of transactions, as a rule, have nothing in common with each other: with almost the same expenditure of time and effort, the amount of turnover can differ significantly:

- large transactions increase the salary exorbitantly and undeservedly;

- with small sales, the manager also undeservedly loses in earnings, and management has to artificially increase the percentage, “adjust” it to the planned salary;

- with seasonal fluctuations in sales, the salary does not correspond to the labor expended: at the peak of sales it is unfairly high, in unfavorable periods it is unfairly small.

- Salespeople are reluctant to take on small sales or work with new clients, fearing that they will not be able to “bargain” from the manager a percentage worthy of their qualifications.

- It is also incorrect to make salary dependent on income because the size of the income of enterprises in the same field can differ significantly (even by orders of magnitude).

- What to do if sales were to a certain extent prepared not by the seller, but by the manager? How to regulate the percentage of pay for advertising space sales managers during periods of unpredictable political and economic conflicts?

- An employee always has a bar for overfulfillment , which he, working in a certain way or method, will not overcome, no matter how much he is paid.

Each entrepreneur can quite accurately determine the limits of the possible range of fulfillment of planned tasks by an employee through his own efforts . This means that it is necessary to limit the maximum payment (see below). This is not only a requirement of the company’s financial manager, who plans, in particular, the maximum size of the wage fund (payroll), but also the understanding that paying for unearned money corrupts the staff and in a short time destroys any system of material incentives .

Even the listed shortcomings are enough to agree with the conclusion of Alevtina Kavtreva (“TRIZ-chance”): “Payment as a percentage of sales, profits, etc. has no useful relationship to motivating employees .

Therefore, the only correct solution would be to pay for the completed complex task .

Planning based on goals, payment based on results

The traditional incentive scheme for one criterion (for example, only for sales volume) has long become obsolete, since in conditions of rapidly developing competition and a variety of marketing techniques, many, sometimes equally important criteria for their work are not taken into account in the sales performance of managers :

- ability to retain regular customers;

- simultaneously with traditional sales - developing new markets, working with new clients;

- sales of today's priority types of goods (services);

- reduction of accounts receivable.

Paying only for sales volume would seem to involve no risk for the employer. But it is easier and more profitable for a salesperson to work where the maximum income is expected, and he ignores other, sometimes more important, but less profitable tasks under any plausible pretext.

When using flexible systems, planning is carried out not only for several tasks , but also with prioritization ( significance coefficients, specific weight). Therefore, even having exceeded the plan, for example, in terms of sales, the manager may lose in salary due to failure to complete other tasks (including small but business-important sales in a new market) or, if priorities change, he may earn more, despite that the total sales volume has not been met.

The method is extremely effective as a tool for personnel management and increasing productivity at all levels - from ordinary performers to senior management. With this approach, managers have the opportunity to effectively manage the product, sales, and financial policies of the enterprise, and not leave it to the performers.

Salary mathematics

When determining the planned level of results (productivity), you need to keep the following in mind:

1. The minimum acceptable level of results, below which it is inappropriate to pay salary to an employee, is 50–70%.

Less productive work is unprofitable for the company: the salary paid, the costs of maintaining the workplace, losses from what was planned but not completed are not compensated by the income received.

2. the maximum achievable level of performance and salary within the following limits:

- with technically justified standards - 120–135%;

- with consolidated standards - 150–200%.

If this level is exceeded, payment in proportion to it is illogical and unjustified, since results above such levels are the result of external that do not depend on the employee’s efforts : errors and standardization errors, the use of new equipment and technology, a new market situation, etc.

Piece/piece-regressive form of remuneration (Fig. 2) with a constant/variable percentage of sales. The economically sound dynamics of the relationship between salary and results is realized by a variable percentage of bonuses for exceeding the plan.

Rice. 2. Piecework/piecework-regressive form of payment

In essence, this is a piece-rate regressive (with “braking”) form of remuneration. In this case, one of the main economic laws of payroll budgeting is fulfilled: the growth rate of totals (labor productivity) is faster than the growth rate of salary (1% increase in the total should account for 0.5-0.8% increase in salary).

In a department, with different forms of remuneration for individual workers (piece-rate/regressive, bonus) and different results of their work, when for some the salary growth is ahead of the total growth, while for others lags behind , the range of salary profitability as a whole must be maintained. This is one of the main benchmarks for the economically sound use of the unit’s payroll.

Application of the principle of piecework-bonus form of remuneration (Fig. 3) when exceeding the plan to stimulate a large volume of important work (bonus percentage is variable) allows:

- raise the salary of conscientious and productive workers, get rid of slackers using economic rather than administrative methods;

- significantly reduce the dependence of salary on external factors that the employee does not influence, especially during periods of decline in sales, production, etc., i.e., for the fulfillment of planned tasks, he should receive the payment he actually earned.

Rice. 3. Piece-bonus form of payment

To sum up what has been said, we can confidently say the following.

The flexibility of the relationship between planning and remuneration systems fully complies with the most modern requirements for effective material incentives for personnel and significantly increases the company's technological effectiveness.

It is possible to modernize any existing payroll system at an enterprise into a more modern and efficient one quickly and painlessly.

Forms and systems

Modern forms and systems of remuneration make it possible to evaluate and reward an employee for the resources he expended in completing assigned tasks. There are different approaches to organizing this process. Remuneration is based on two main categories – time and quantity of work. Forms of remuneration can be of two types.

This is piecework and time-based payment. In the first case, remuneration is paid to the employee for the actual amount of work he performed. The time-based form involves payments for time worked. This takes into account his qualifications and the complexity of the operations performed.

The piecemeal approach to the formation of remuneration can be of the following types:

- simple;

- piecework-bonus;

- indirect piecework;

- chord;

- piecework-progressive (can be collective or individual).

The time-based payment system can be of the following types:

- simple;

- time-bonus;

- hourly;

- Monday;

- monthly.

According to current legislation, organizations in our country can independently choose payment systems. At the same time, they choose the amount of incentives, additional payments, and the ratio between them and individual categories of employees. The principles that guide the organization in this matter are enshrined in the contract, as well as local documentation.

Modern remuneration systems in Russia can be of two main types. This is a tariff and non-tariff form. Also today, an approach such as a bonus payment system is used.

Forms of remuneration

Currently, depending on the economic indicators in which labor costs are measured, various forms of remuneration are used. Piece wages are set depending on the quantity and quality of labor expended. Time wages are set depending on the time the worker works and his qualifications. With piecework wage systems, the employee’s income is determined by multiplying the price by the volume of production. The rate is the product of the hourly tariff rate, corresponding to the level of complexity of the technological operation or work being performed, by the time standard. Lump-sum wages are established not for each production operation, but for the entire cycle of work, i.e., for a lump-sum task.

Currently, in the practice of companies, the general trend in improving payment systems and stimulating the work of personnel is the use of time-based systems in combination with additional payments and bonuses for the employee’s personal contribution to increasing the company’s income.

With a simple time-based system, an employee is paid only depending on the length of time he works for a given period. The contract form of remuneration involves payment for work performed with instructions: general position, duties of the employee, duties of the company, wages, working hours and rest hours (irregularity of work is indicated here), social security, social service benefits (vouchers, etc.) . p.), liability of the parties for failure to fulfill obligations. Commission wages are based on the commission agreement, which is concluded between the commission agent and the principal.

Tariff methodology

Modern remuneration systems in an organization can be based on a tariff approach. For this purpose, tariff rates, tariff schedules and coefficients, as well as official salaries are developed. These categories are an integral part of the presented approach.

The tariff schedule is formed by a list of positions or professions that are assessed in terms of complexity of work and qualifications. For this, appropriate coefficients are used.

The tariff category is a value that reflects the complexity of the employee’s work and the level of his professional training. In contrast to this indicator, the qualification category is a value that reflects the level of qualifications of the employee. It is received at the educational institution after a training course.

Tariffication of work is the process of comparing the type of work and the tariff or qualification category. This allows you to assess the complexity of the employee’s activities. This procedure is carried out under the influence of the Unified Qualification Directory.

Modern remuneration systems (including the tariff approach) are stipulated in contracts, local agreements, and organizational regulations. Different approaches to remuneration are used for managers and subordinate personnel. This is explained by the peculiarities of their motivation.

Organization of remuneration

The organization of remuneration is understood as a set of measures aimed at remuneration for work depending on its quantity and quality. When organizing labor, the following measures should be taken into account related to labor standardization, tariff standardization of wages, development of forms and systems of remuneration and bonuses for workers. Labor rationing is based on establishing certain proportions in labor costs required to produce a unit of product or to perform a given amount of work under certain organizational and technical conditions. The main task of labor regulation is the development and application of progressive norms and standards.

The main elements of tariff regulation of wages: tariff rates, tariff schedules, tariff and qualification reference book.

Tariff rate is the absolute amount of wages expressed in monetary terms per unit of working time (there are hourly, daily, monthly).

Tariff scale is a scale consisting of tariff categories and tariff coefficients that allow you to determine the wages of any employee. Different industries have different scales.

Tariff and qualification reference book is a normative document, according to which each tariff category is subject to certain qualification requirements, i.e., all main types of work and professions and the necessary knowledge to perform them are listed.

Time payment

Time-based wages are a form of organizing remuneration for various categories of company employees. It can be used to reward managers and their deputies, employees, support staff, as well as non-production employees.

This approach has proven its effectiveness in conditions of automation and mechanization of the production process. In such areas, the operating mode and technological cycle are strictly regulated. There is no need to exceed the plan here. Workers are required to monitor the operation of equipment that performs a clear sequence of actions at set intervals.

Time-based labor is the best option for businesses that produce precision products with standardized specifications. At the same time, such motivation is combined with the establishment of certain tasks, the volume of which is strictly standardized.

Most often, modern industries use a simple and time-based bonus payment system. In the first approach, the employee is paid for his work in the form of a tariff rate. It is calculated in accordance with the salary scheme adopted by the organization. This fixed amount of funds is paid to the employee if he has worked all the time established by the standard.

This system can be organized on an hourly or daily basis. To calculate wages for one employee, the daily or hourly rate is multiplied by the number of time periods actually worked. To do this, use a time sheet.

Time-bonus method

When analyzing modern remuneration systems, you should consider them in comparison. Thus, the time-bonus system is distinguished by the presence of an incentive bonus. In this case, there is a certain rate, tariff. But they add extra encouragement to it. It can be monthly or quarterly. Some companies pay such a bonus every six months or a year.

The bonus is calculated as a percentage of the established salary. Sometimes fixed, fixed amounts of money are used. The choice depends on the characteristics of the company’s activities and the motivation policy of its personnel.

Bonuses can be given for achieving the required quantitative or qualitative indicators.

So, you can consider the calculation method of a simple and time-based bonus system. For example, an employee’s salary is 12 thousand rubles. Out of 22 working days in a month, he worked only 20 days. His salary will be as follows:

Salary = 12000: 22 * 20 = 10909 rub.

In the same situation, with a time-based bonus payment system, the calculation would be different. In this case, the employee could have a monthly bonus of 25% of his salary. If an employee, for a good reason, did not go to work for 2 days in a month, but fulfilled the set standard (for quality or quantity of products), his salary will be as follows:

Salary = (12000: 22 * 20) + (12000 * 25%) = 13909 rub.

It is more important for the company that the employee fulfills the requirements set for him regarding the quality of his work. At the same time, he may not go to work for 2 days (for a good reason) and receive more money than with a simple time-based payment system.

Piecework method

Modern remuneration systems may be built on a slightly different principle. The piece-rate methodology is used to remunerate the activities of employees of the main production. This payment option will be appropriate in areas where quantitative indicators of labor results are important. This allows you to more accurately reflect the effort and time spent by workers in the process of their activities.

The piecework system opens up the possibility of establishing certain standards that reflect the actual output of each employee during a specified time. This allows you to calculate how many parts of the required quality a specific employee produced per shift, and whether he completed a certain amount of work.

Most often, piecework wages are used in combination with bonuses. Moreover, there is encouragement for fulfilling and exceeding the established norm. Improving the quality of finished products or saving resources (raw materials, supplies, energy, etc.) may also be encouraged.

Piece-rate wages are one of the most common systems for motivating employees in such industries. It has been around for many years, so it has been able to prove its effectiveness.

When calculating, both individual and collective work of a team or site can be taken into account. It depends on what kind of activity the enterprise encourages. If teamwork is required from employees, the entire site will receive a bonus, but only if the overall plan is fulfilled. If this is not required, each employee strives to exceed the established norm to receive a bonus. In this case, a certain rivalry arises between all employees of the site. It must be present within reasonable limits.

Piecework

This payment option depends on the amount of work the employee has performed in his position. This option is used in those industries of production or service where the quantitative characteristics of performing a particular job are important.

In order for piecework wages to be used as efficiently as possible, special standards can be established, based on the results of which the employee receives increased pay for exceeding the established standards. The salary part, as in time-based wages, is not provided for in the piecework mechanism.

Piecework remuneration is a mechanism that allows you to achieve good quantitative results, since it is aimed at directly stimulating the employee due to the fact that the level of wages depends directly on the quantitative indicator of the work performed.

Chord system

Lump-sum payment is one of the most common methods of calculating wages using a piece-rate system. During the calculation, prices are determined for each specific volume of work, taking into account the deadlines established by the standard. The amount of payment is determined in advance, that is, even before the start of work.

Accordal remuneration is a very effective system of motivating employees whose work involves creating as many products or services as possible. Payroll is calculated based on calculations. In this case, established production standards are taken into account, as well as prices for each specific level.

The presented system is often used to motivate an entire team, workshop or site. The assessment is made based on the actual work performed. When the work is completed, the total amount will be divided proportionally among all team members. At the same time, they take into account how much time each employee worked. For this purpose, the labor participation coefficient can also be used. This allows the total profit to be distributed among employees fairly, that is, in accordance with the personal achievements of each.

Direct, piecework-bonus system

With a direct payment system, an employee is charged a cost for each type of service performed or goods manufactured. For example, an employee receives 90 rubles per hour of work. In 2 hours he makes one part. Therefore, a unit of production costs 90 * 2 = 180 rubles. If a worker produces 4 parts in a day, he receives 180*4 = 720 rubles.

This system has certain disadvantages. Therefore, it is used less often today. This is only possible for industries in which the worker has little influence on production technology. Automation of lines controlled by workers makes it possible to achieve high quality parts. The tasks of employees whose work is paid according to a direct piece-rate system include monitoring the operation of the line and preventing its failures.

Piece-bonus wages are one of the most commonly used methods. It consists of payment at the basic rate and a bonus. For example, for one part a worker receives 60 rubles. If the entire batch was produced without defects, the worker receives a 10% bonus. So, a worker produced 100 units of product. He gets:

Salary = 60*100 + (60*100*10%) = 6600 rub.

This allows employees to be encouraged to produce high quality products. If parts must meet a certain standard, this allows us to obtain not only the required quantity of workpieces, but also achieve their high quality.