Organizations have the right to independently choose their remuneration systems. Being a reward for work, wages are an incentive to increase labor productivity. Also, the choice of a remuneration system can act as a basis for development, since saving on wages and its optimization can give impetus to the evolution of both the enterprise and the personnel, depending on the goals. The contribution of each employee, who will act as part of a single mechanism, plays an important role. Based on these motives for activity, management has the right to opt for a variable salary system. Let's take a closer look at how wages are calculated under this system.

Regulatory regulation of floating salaries

The Labor Code of the Russian Federation does not regulate the system of floating salaries, therefore the establishment of such a system must be properly regulated by local regulations, for example: a collective agreement. If possible, it is better to install a piecework or piecework-bonus system, since it is more tied to Art. 132 of the Labor Code of the Russian Federation in terms of linkage to the employee’s qualifications. Art. 132 of the Labor Code of the Russian Federation determines that wages must be tied to the employee’s contribution to the common cause, without any discrimination.

Thus, in accordance with Art. 135 of the Labor Code of the Russian Federation, the employer determines the system of remuneration for employees independently. Therefore, the greatest role in establishing a floating salary system at an enterprise is played by local acts, wage regulations, etc.

Important! The employee's salary must be agreed upon when concluding an employment contract.

When installing a floating system, the organization’s local documents must reflect:

- basic salary

- salary change indicators

- salary change factors

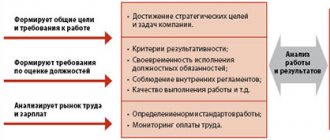

The result of the work on developing a remuneration system based on Key Performance Indicators

The result of the work is a comprehensively tested and ready-to-implement KPI-based remuneration system , which, depending on the type of activity of the customer, as well as depending on the specifics of jobs, may include:

- Grade system . Includes a methodology for developing a salary system based on grades (grade - degree, rank), requirements for each rank, and a methodology for regularly assessing the competencies of employees of each rank. If necessary, consultants will offer a competency assessment methodology or conduct this assessment themselves.

- A system of KPI indicators for each job position. Includes a methodology for calculating and measuring KPIs, a description of job positions in “product” terms. Consultants will check the indicators for consistency with each other, consistency with the key success factors of the company and KP I of the business for the short, medium and long term.

- Bonus system . Includes various options for the remuneration system, including bonuses for sales managers, commercial directors, top managers and other employees whose activities directly affect the company’s turnover, as well as a methodology for calculating bonuses.

- Group bonus system . Includes options for a remuneration system to create a team approach in the work of employees and responsibility for the overall result.

- Tools for long-term motivation . Proposals for various incentive options in the form of options, the formation of long-term bonus funds, etc.

An obligatory part of the consultants’ work is the preparation of internal documents regulating the new system of remuneration and personnel assessment at the enterprise.

The consultation process for developing a KPI-based motivation system may include, among other things, training managers in the method of regularly assessing personnel based on performance indicators.

https://youtu.be/SZze_28F1-8

Choosing a remuneration system

With all the variety of remuneration systems, employers sometimes opt for a non-tariff system, one of the most complex in terms of regulatory regulation and transparency of calculations.

Guided by the areas of core activity and the organization of the production process, individual departments and services at the enterprise can be tied to a system of floating salaries (bonuses to employees paid monthly become a habit and this is not motivation). This allows management to incentivize employees who depend on, for example, sales, where all employees do the same work, but everyone's contribution is visible.

To motivate employees to improve their performance, it is necessary to pay them decent wages.

Expert of the Russian Tax Courier magazine, Ph.D. L.A. Maslennikova

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Indicators used when using a floating salary system

This system must have clearly defined baseline performance indicators, that is:

- objective measurable goals

- specific deadlines

- performance indicators

The contribution of an individual employee who is interested in his income plays a key role in the overall performance of the team. This system is being implemented in organizations in the service or sales sector.

An important role is played by recording working hours, which reflects one of the reasons for failure to fulfill the plan - absenteeism, tardiness, etc. Enterprises may use standardized forms, for example T-13 or T-12. T-13 is more convenient to fill out, because payroll calculation is now more convenient to do using software, which reduces labor costs in the time aspect.

An employee needs to set work goals correctly. Each type of work is assigned an appropriate coefficient depending on the complexity. That is, a fixed wage fund is established for the job as a whole, which may change.

The concept of grades in a company

Employee grading is a technique for evaluating positions, based on the results of which salaries (grades) are formed. They are distributed vertically (hierarchy of authority and degree of importance for the enterprise). They are usually designated by numbers 1, 2, 3, etc., where the first grade is the highest rank. To “split” personnel by functionality, there are intergrade zones (horizontal zoning). They are designated by letters of the Russian or English alphabet, where A is the most significant functionality for the company. Thus, the CEO will occupy level 1A. His deputies are cells below under numbers 2A (deputy for production), 2B (chief accountant), 2C (head of the personnel department) and 2D (deputy director for general issues, as the head of the least important department). This gradation forms a system of grades that combines all positions in the enterprise, indicating salaries and bonuses in each cell. The objectivity of personnel distribution is achieved through the use of several evaluation criteria:

- performing HR management responsibilities;

- number of employees subordinate;

- share of participation in the company's profits;

- experience;

- level of independence in decision making;

- the cost of an employee’s mistake (what losses the company may incur in the event of erroneous actions or decisions of a particular employee).

The criteria for evaluating personnel are different, depending on the field of activity of the company (their number and nature may change). But regardless of the chosen method, using grades you can flexibly adjust the level of remuneration for each employee, based on the size of his contribution to the development of the company.

Basic principle of payroll calculation

By order of the manager, an increase coefficient (possibly a decrease) is established, which depends on:

- Revenue received

- Amounts of funds allocated to pay salaries

This coefficient of change (increase or decrease) is calculated as the ratio of the amount allocated for the payment of wages and the wage fund in accordance with the staffing table. And the salary will be equal to the product of the employee’s salary and the coefficient of change (increase or decrease) in salary.

An example of calculating wages for department employees using a floating salary system

The sales department has 3 employees working on a tariff-free wage system.

For June, the department was ordered to establish a wage fund in the amount of 70,000 rubles.

Based on the results of the work, the following labor participation coefficients for each person were assigned: Bakirova N.V. – 1.15, Gareeva N.P. – 1.2, Sharipova A.R. – 1.3.

To calculate wages, all coefficients are taken into account and the share of each is determined:

| Full name | Coefficient | Calculation | Sum |

| Bakirova N.V. | 1,15 | 70000 / 3,65 * 1,15 | 22054,79 |

| Gareeva N.P. | 1,2 | 70000 / 3,65 * 1,2 | 23013,70 |

| Sharipova A.R. | 1,3 | 70000 / 3,65 * 1,3 | 24931,51 |

| Total | 3,65 | – | 70000,00 |

Money doesn't motivate. Money controls.

This is exactly what you need: for the piecework wage system to control all (or almost all) of your Company’s employees. Every working day. From morning until evening. So that they constantly think and, moreover, make serious efforts to ensure, to a greater extent and better, the achievement of those key results and Company Goals, on which the success of your business and its income largely depends.

Conduct an express audit of the sales department yourself using 23 criteria and identify points of sales growth!

With the successful implementation of piecework payment systems, both employees and the Company benefit at the same time. The use of a piece-rate wage system can provide employees and the Company with many very tangible benefits:

1. The interests of the employee are directly related to the interests of the Company

.

2. The employee is interested in showing initiative and taking responsibility at his workplace, acting in the interests of the Company.

3. The employee knows by what indicators the results of his work are assessed and to what extent the plan established by the Company has been fulfilled.

4. An employee's income level is largely determined by the results of his own efforts. An employee achieves the maximum level of income when fully fulfilling the Company's objectives. And if the plan is exceeded, his income may increase even more.

5. With a piece-rate salary based on plans and standardization of results, it is not the employee who decides how much to earn for himself, but how much for the Company, but the Company.

6. The employee has a visible prospect for development.

7. The growth of the wage fund (hereinafter referred to as the wage fund) is directly related to the achievement of the Company’s Goals. Since in most cases, the accrual of piecework wages is associated with the Company’s profit or with factors directly affecting profits, in fact, the increase in the wages and salaries occurs due to part of the additional profit received.

8. The main differences between the fixed salary system and the piecework salary system:

8.1. Fixed salaries have to be regularly reviewed to determine which employees should have their salaries raised. Such decisions are often made under the influence of external circumstances (for example, an employee is about to leave). 8.2. A fixed salary “motivates” only at the moment of growth. A piece-rate salary constantly “motivates”: the employee is constantly “on his toes”, knowing that the more he does, the more he will receive. 8.3. When a salary is increased, a situation often arises when an employee is dissatisfied with how much the salary was increased. As a result, the employee becomes demotivated while the current costs of the enterprise increase. 8.4. Many employees working on a fixed salary have a desire to find a bride price on the side, since the salary will be paid anyway. In the case of piecework payment, the employee constantly feels that when he does not solve the tasks set by the Company, he loses money.

9. When applying a unified piece-rate wage system to any category of Company employees (for example, sales managers), transparent salary calculation is possible. At the same time, conflicts “who earned more” do not arise - everyone knows that the one who achieves greater results earns more.

10. The introduction of an effective piecework payment system leads to the development of the Company’s operating technology. Including mandatory planning of work results (in numbers), development of technology for operational control (self-monitoring) of results, profit forecasting.

11. A properly organized piece-rate payment system for a division of the Company can significantly reduce the administrative resource required to manage this division. The division's employees independently act in the interests of the Company. Thus, the transfer of key divisions of the Company to a piece-rate wage system leads to a sharp reduction in the management routine of top managers.

Over the past years, I have developed piecework wage systems in dozens of different Companies and individual business areas. Many times I had to develop and improve piecework payment systems for sales managers of all conceivable and inconceivable specializations and varieties. And also for sales managers and commercial directors. And also for installers and their managers, Web designers and programmers, marketing directors and advertisers, chief accountants and executive directors. At a certain point, I realized that there are some general patterns in the development of piecework payment systems tied to the key results of the work of employees and divisions of the Company. Ultimately, I managed to create a unified technology for the development of such piecework wage systems. I present it to your attention:

Types of floating salary systems

One of the options for this system is to establish a salary for employees and a bonus for a department (group, team). Group work should be interconnected between employees of the department, when everyone works for the same goal, the contribution of each employee is visible, therefore it is effective to apply coefficients that reflect the contribution. In any case, the employee will receive the minimum due to him. But colleagues, by putting in more effort, can get much more. Depending on the employee’s goals (good remuneration for work or spending time), he will strive to improve results.

The calculation of such wages for department employees based on established salaries and bonuses is similar to the previous example and consists of the established salary and bonus.

The inconvenience of this system is that there is often a subjective assessment, so it is necessary to clearly define quantitative indicators of work results.

Using analytical data when setting salaries

In this situation, managers are provided with reports that reflect certain indicators necessary for quantitative assessment. For example, the level of changes in the cost of production, in May reports were provided for two workshops: bakery and confectionery, in the first workshop the cost remained at the same level, in the second it decreased by 3%. Based on this, the wage fund of the confectionery shop will be increased in June by order of the manager.

Answers to common questions

Question No. 1 : What criteria for assessing the contribution of a legal department employee can be established in an organization?

Answer : It is better not to install a tariff-free wage system in departments where there is no result of labor, for example: revenue or product output. It would be preferable for the administration to use a time-based bonus system.

Question No. 2 : Is it possible to provide for a salary reduction under a floating salary system? How should it be formatted?

Answer : it is possible to provide for a reduction in salary; it is not necessary to be guided by the minimum wage or official salary. Such a reduction must be prescribed in the local regulations of the organization: collective agreement, etc. Employees must be all familiar with this document.

Currently, organizations are given the right to choose in the application of remuneration systems. The main rule that organizations must follow is to have the funds to ensure not only the minimum standard in the field of remuneration, but also to satisfy the needs of employees as much as possible.

One of the most significant problems in the field of personnel management is insufficient attention to the problem of its material incentives on the part of organizational leaders, when outdated methods of calculating wages and insufficiently flexible remuneration systems are used. Remuneration in many organizations has lost its economic functions, not only stimulating, but also reproductive.

Taking into account the current situation and modern approaches to material incentives for personnel, a new method of remuneration in the organization is proposed, by applying which it will be possible to increase the efficiency of the entire organization, regardless of the specifics of its activities.

The needs of workers determine the procedure for remuneration

The basis of the methodology is the determination of remuneration not on the results of labor, but on the needs of the employee. This restores the reproductive function of wages, since the worker’s needs are satisfied. The incentive part of the remuneration system is built on a system for the manager’s assessment of the quality of an employee’s work, not in terms of the quality performance of one labor operation, but in terms of a generalized assessment of the qualitative characteristics of the employee’s work. Technically, the parameters of the quality of an employee’s work are involved in adjusting wages, calculated based on the employee’s needs, as adjustment factors that can either reduce or increase the amount of final wages compared to accrued wages. This led to the use of the term “floating” in the name of the salary system.

When applying a system of “floating” salaries, it is necessary to determine criteria for assessing the personal contribution of employees

The system of “floating” salaries proposed for material incentives for the organization’s personnel is defined in subparagraph. 3.3 clause 3 of the Recommendations for the use of flexible remuneration systems in commercial organizations, approved by Resolution of the Ministry of Labor and Social Protection of the Republic of Belarus dated October 21, 2011 No. 104. It provides for the employer to establish tariff rates (salaries) in the current month based on the results of work for the previous month, taking into account personal the contribution of each individual employee to the results of work.

The criteria according to which it is possible to determine the specific amount of salary in the current month should be established in local regulatory legal acts (hereinafter referred to as LNLA). The criteria determine the dependence of employee earnings on the results of their work, the profit received by the organization, and the amount of money that can be used to pay wages.

The system of “floating” salaries assumes that every time at the end of the month, based on the results of work for the billing month, a new official salary for the next month will be formed for each employee, taking into account the established criteria.

Based on the results of evaluating the criteria, the head of the organization, following the results of work for a certain period (month, quarter, half-year, etc.), issues an order on the amount of remuneration for the reporting period, taking into account the established criteria.

The principle of “floating” salaries is that the minimum (initial) salary is fixed, and the rest of the earnings becomes variable - “floating” depending on the results of activities. Thus, a new salary is formed every month based on the results of the previous month’s activities.

“Floating” salaries stimulate labor productivity

The remuneration system based on “floating” salaries is designed to stimulate a monthly increase in labor productivity and good quality, since if these indicators deteriorate, the tariff rate (salary) for the next month will be reduced - and the employee will have to prove his worth at work.

This remuneration system stimulates monthly increases in labor productivity and product quality. It is effective for remunerating workers serving the main production: adjusters, shift engineers, etc.

So, for example, the salary of a specialist can increase (or decrease) for each percentage increase (or decrease) in revenue from the sale of products, goods (works, services), labor productivity in the department (in the area of work served by this specialist), subject to the completion of the task according to production output, according to other indicators.

For managers and specialists, the criteria for setting salaries can be determined depending on the actual profit for the reporting period, which also has a stimulating effect.

The head of the organization determines the wages of employees on a monthly basis

Important! The coefficient of increase (decrease) in an employee’s salary is determined by the head of the organization independently on the basis of an order in accordance with the criteria and procedure provided for in the LLA. At the same time, the LNLA must establish the manager’s right to make a decision to increase (decrease) wages by a certain factor based on an order.

The decision to increase (decrease) wages by a certain factor can be made by the head of the organization in the current month, both based on the results of work for the previous month for the current month, and based on the results of work for the previous quarter for the next quarter, based on the results of work for the half-year for the next half-year and etc.

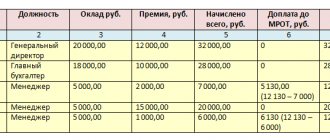

Payroll calculation procedure

The amount of an employee’s wages is calculated as follows: the employee’s salary is multiplied by the coefficient of increase (decrease) of wages, which forms the amount of wages.

Important! The coefficient of increase (decrease) of wages for the entire organization is calculated by dividing the amount of funds allocated for the payment of wages by the wage fund established in the staffing table (hereinafter referred to as the FZP).

Example 1

Ivanov I.I. wages are determined in accordance with the system of “floating” salaries. The final salary for the organization as a whole is equal to 100,000,000 rubles, and Ivanov’s salary is I.I. is 4,000,000 rubles.

In March 2012, funds in the amount of RUB 110,000,000 were provided to pay wages.

The head of this organization established a wage increase coefficient for Ivanov I.I. in the amount of 1.1 (RUB 110,000,000 / RUB 100,000,000).

Consequently, the salary of this employee will be 4,400,000 rubles. (RUB 4,000,000 × 1.1).

Thus, with a remuneration system based on “floating” salaries, in each subsequent month a new salary is formed for the employee, increased or decreased by the amount of the selected ratio, depending on the change in a certain indicator.

Example 2

The indicator influencing the amount of remuneration of employees in the organization was labor productivity, and the chosen ratio was 1: 0.7, i.e. For every percent increase in labor productivity over the period, the official salary increases by 0.7%, subject to the fulfillment of the production target. If the organization experienced an increase in labor productivity by 2%, then the salaries of the previous month will be increased by 1.4%.

The indicator of change can be any fundamental performance indicator: an increase in profits, profitability, gross income in trade or a decrease in the level of expenses.

Example 3

The organization uses a system of “floating” salaries. The base rates of the plant director, shop managers, and other managers fluctuate depending on the dynamics of product costs, production volume, product range and other indicators for which one or another manager is responsible.

So, the workshop manager’s salary is 6,000,000 rubles. If the workshop reduces the cost of production by 10%, the salary of the workshop manager will automatically increase by 10% and amount to 6,600,000 rubles. (RUB 6,000,000 × 10/100).

With a floating salary system, it is possible to apply a salary reduction

With a remuneration system based on “floating” salaries, a procedure is provided for reducing salaries to a certain amount. The lower limit of the “floating” salary will be the amount of the official salary according to the staffing table, and its upper level is not limited.

Important! The system of “floating” salaries is established by the employer in the organization with the consent of the employees and is determined in the LNLA (collective agreement, labor agreement, regulations on remuneration).

Specific mechanisms for ensuring the relationship between wages and employee performance are developed by organizations themselves. A big role in this is given to motivation departments, which accumulate everything new and advanced in the field of employee motivation, labor organization and remuneration.