How are on-site inspections planned?

In 2007, the Federal Tax Service revealed the procedure for selecting companies for on-site inspections.

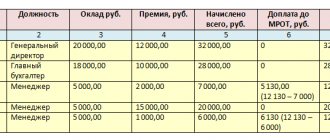

For this purpose, the concept of their planning system was approved by order dated May 30, 2007 No. MM-3-06/. In accordance with it, before deciding to conduct an inspection, the supervisory authority analyzes the company’s activities. So that an organization can independently assess the riskiness of its activities, including according to such a criterion as the level of salary according to OKVED, Appendix 2 to Order MM-3-06/ provides publicly available criteria. The Federal Tax Service in its analysis is guided not only by these criteria, but they are the most important. Paragraph 5 of the criteria states that the reason for verification, among other things, is the payment of wages lower than the average salary for the type of economic activity in the constituent entity of the Russian Federation. If such a fact is revealed, the Federal Tax Service inspection will send a request to the company demanding an explanation of the reasons for this situation. Also, the management of the organization is called to the Federal Tax Service to provide explanations.

How to find out what the average salary is in your region

To obtain information about the industry average salary, the Federal Tax Service recommends contacting the following sources:

- websites of territorial bodies of Rosstat;

- collections of economic and statistical materials published by Rosstat;

- websites of territorial departments of the Federal Tax Service;

- request of the company to the territorial bodies of Rosstat and the Federal Tax Service.

Data on the level of average wages by industry (OKVED) for Russia as a whole are published on the website of the Federal State Statistics Service in the section “Labor Market, Employment and Wages.”

IMPORTANT!

The industry average salary level according to OKVED and by region in 2020 will become known in mid-2020. Data for earlier periods have now been published.

For the subjects of the Federation, in similar sections of the websites of the territorial bodies of Rosstat, the regional industry average wages by type of economic activity are published. For example, to find out the latest information on the level of industry average wages in St. Petersburg, you need to visit the Petrostat website and go to the section dedicated to the “Standard of Living” indicators.

Report on the average salary in St. Petersburg by type of activity

To understand where to look at the industry average salary for 2020 according to OKVED, you will have to refer to the official website of the territorial body of Rosstat in the region of the company’s activities. Each subject of the Federation has its own. Mosgorstat collects and processes information on the city of Moscow. Voronezhstat - in Voronezh. This body publishes information on the industry average wage level.

Average monthly nominal accrued wages of employees of organizations by type of economic activity in the city of Voronezh, rubles

| 2014 | 2015 | 2016 | 2017 | 2018 | |

| Total | 24 001 | 24 906 | 26 335 | 28 007 | 31 207 |

| Including: | |||||

| Agriculture, forestry, hunting, fishing and fish farming | 18 323 | 20 569 | 23 567 | 25 090 | 28 505 |

| Mining | 26 408 | 26 704 | 27 132 | 29 519 | 28 336 |

| Manufacturing industries | 24 078 | 25 816 | 27 251 | 29 488 | 32 117 |

| Providing electricity, gas and steam; air conditioning | 33 764 | 35 519 | 38 231 | 41 251 | 42 890 |

| Water supply; water disposal, organization of waste collection and disposal, pollution control activities | 19 718 | 21 572 | 22 122 | 23 412 | 25 188 |

| Construction | 26 934 | 26 506 | 28 372 | 27 347 | 28 443 |

| Wholesale and retail trade; repair of vehicles and motorcycles | 18 146 | 19 116 | 20 237 | 22 145 | 23 990 |

| Transportation and storage | 24 759 | 26 050 | 27 629 | 28 927 | 32 306 |

| Activities of hotels and catering establishments | 15 243 | 15 612 | 16 280 | 15 229 | 20 710 |

| Activities in the field of information and communication | 32 192 | 33 177 | 35 565 | 42 470 | 44 121 |

| Financial and insurance activities | 44 518 | 45 387 | 50 246 | 53 270 | 55 537 |

| Real estate activities | 17 115 | 18 030 | 20 416 | 21 288 | 25 778 |

| Professional, scientific and technical activities | 36 426 | 37 587 | 39 036 | 40 867 | 46 527 |

| Administrative activities and related additional services | 16 834 | 16 520 | 17 902 | 17 589 | 21 298 |

Industry average salaries by type of economic activity 2020

The indicator of average wages by industry is of interest not only to employees, but also to employers. First, he gives information about the correspondence of their salary level to the average level in a particular professional field. Employers can conclude that it is necessary to index wages if they are below the industry average.

Of course, the average wage indicator must be used with some conditionality. After all, the average indicator does not take into account the peculiarities of the functioning of a particular employer. Namely, the amount of remuneration of an individual employee actually depends on these specific conditions and factors.

Where to see the average salary in Russia in 2018-2019

Average national indicators are calculated by the Federal State Statistics Service (Rosstat, formerly Goskomstat). These indicators are calculated based on the processing of static reporting submitted by organizations and individual entrepreneurs. Official statistics data are posted on the Rosstat website at www.gks.ru.

As of the end of 2020, from the most current information on wages by industry, Rosstat officially published information on the average nominal accrued wages of workers for a full range of organizations by type of economic activity in the Russian Federation for October 2020. It is indicated that the average salary in all industries in October 2018 was 42,332 rubles.

The first information on the average monthly salary in 2020 will appear on the Rosstat website no earlier than the end of February.

We talked about what nominal wages are in our separate consultation.

Industry average salary

Let's present data on the average salary of organizations by type of economic activity for October 2020 in the form of a table:

Articles on the topic

The Simplified magazine has prepared a table of the average salary in Russia, which should be applied in 2020. You cannot pay lower, so the table actually represents the minimum wage by industry.

In the table, salaries are broken down by region, as well as by type of activity, taking into account the new OKVED-2019 codes. The average salary must be paid by industry (type of activity), otherwise the tax authorities will think that the employer pays the salary in envelopes, and additional penalties and fines, contributions and personal income tax will be assessed.

Accountants should note that due to changes in the minimum wage, as well as average earnings, employers must increase wages. How to find out whether your company will have a Federal Tax Service audit regarding salaries, read the article in the magazine “Simplified”.

Average salary in Russia as a whole in 2020

The average salary in Russia, if we take figures for all 85 regions of the Russian Federation, according to Rosstat, in the first half of 2020 is 42,550 rubles . Rosstat cited such figures in its study. These figures are taken before the deduction of personal income tax, which is 13%. That is, in real terms, the average salary in the Russian Federation is even less - 37,018.5 rubles. (42,550 – 13% of 42,550).

Average salary in 85 regions of the Russian Federation by industry and type of activity

How to use the table:

Find your industry (1st column) and your region (2nd column) in the table. In the 3rd column you will see the average salary. After downloading, the table is available for sorting by type of activity OKVED and regions of the Russian Federation.

The table shows the average salary by industry and region of the Russian Federation

Please note that this table is for last year, it is used in 2020.

Republic of Adygea (Adygea), Republic of Altai, Republic of Bashkortostan, Republic of Buryatia, Republic of Dagestan, Republic of Ingushetia, Kabardino-Balkarian Republic, Republic of Kalmykia, Karachay-Cherkess Republic, Republic of Karelia, Komi Republic, Republic of Crimea, Mari El Republic, Mordovia Republic, Republic of Sakha (Yakutia), Republic of North Ossetia - Alania, Republic of Tatarstan (Tatarstan), Republic of Tyva, Udmurt Republic, Republic of Khakassia, Chechen Republic, Chuvash Republic - Chuvashia;

Altai Territory, Transbaikal Territory, Kamchatka Territory, Krasnodar Territory, Krasnoyarsk Territory, Perm Territory, Primorsky Territory, Stavropol Territory, Khabarovsk Territory; Amur region, Arkhangelsk region, Astrakhan region, Belgorod region, Bryansk region, Vladimir region, Volgograd region, Vologda region, Voronezh region, Ivanovo region, Irkutsk region, Kaliningrad region, Kaluga region, Kemerovo region, Kirov region, Kostroma region, Kurgan region , Kursk region, Leningrad region, Lipetsk region, Magadan region, Moscow region, Murmansk region, Nizhny Novgorod region, Novgorod region, Novosibirsk region, Omsk region, Orenburg region, Oryol region, Penza region, Pskov region, Rostov region, Ryazan region, Samara region, Saratov region, Sakhalin region, Sverdlovsk region, Smolensk region, Tambov region, Tver region, Tomsk region, Tula region, Tyumen region, Ulyanovsk region, Chelyabinsk region, Yaroslavl region;

Moscow, St. Petersburg, Sevastopol;

Jewish Autonomous Region; Nenets Autonomous Okrug, Khanty-Mansiysk Autonomous Okrug - Yugra, Chukotka Autonomous Okrug, Yamalo-Nenets Autonomous Okrug.

As can be seen from Rosstat data, real disposable income of the population is growing in 2020 compared to previous years.

As of July 1, 2020 There were no overdue wages in 9 constituent entities of the Russian Federation. Over the month, it decreased in 34 subjects, remained unchanged in 5 subjects, increased in 34 subjects, and formed in 3 subjects of the Russian Federation.

Debt due to untimely receipt of funds from budgets of all levels for the range of observed types of economic activity as of July 1, 2020. left 55 million rubles, or 2.0% of the total amount of overdue wages.

Of the total debt due to budgetary underfunding, 38.4% fell on the federal budget, 60.2% on the budgets of the constituent entities of the Russian Federation, and 1.4% on local budgets.

How employers can use average salary

Tax officials determine the average salary in a company based on the indicators of the latest 6-NDFL report. The formula is as follows:

Using this formula, calculate the average salary in the organization yourself. Then compare with statistics for your region and industry.

See the table above for average salaries by region and industry. If earnings are higher than statistical indicators, tax authorities are unlikely to accuse the company of unjustified benefits due to envelopes.

How to calculate the average salary using tax methods

The organization filled out form 6-NDFL for the first quarter of 2020. In line 020 it showed income - 890,000 rubles, in line 060 - the number of recipients - 11 people. If you use the tax authorities’ methodology, the average monthly salary in a company is 26,970 rubles. (RUB 890,000: 11 people: 3 months).

Why do you need to know average salaries in Russia by profession?

The Russian Tax Service plans to conduct on-site tax audits based on an assessment of the risk level of the likelihood of understating the tax base or using another method of tax evasion. Planning in accordance with the concept approved by order of the Federal Tax Service dated May 30, 2007 No. MM-3-06/ [email protected] (hereinafter referred to as the order) is carried out on the principles of openness and transparency.

According to clause 5 of Appendix No. 2 to the order, one of the criteria for self-assessment of the risk of conducting an on-site tax audit is a comparison of the industry average salary with the amount established at the enterprise. If in fact it differs less from the average, this may serve as a reason for ordering an on-site tax audit.

If suddenly the amount of remuneration for workers at an enterprise at some point turns out to be lower than the industry average wage according to OKVED, it is advisable for the employer to index it.

Let's find out where the tax office learns about the level of average monthly wage established at the enterprise by type of economic activity:

- The fiscal authority learns the average amount of earnings established for a taxpayer from reporting, for example, from form 2-NDFL.

- The number of employees is indicated by the employer when submitting the annual report on the average number of employees.

- The enterprise average is calculated as follows:

Average salary = total income paid to staff for the year (according to Form 2-NDFL) / number of employees according to Form 2-NDFL / 12 months.

- The type of main industry activity of the enterprise is indicated during registration/re-registration.

Where to find out the average earnings in 2020

To reduce the risk of conducting an on-site tax audit, the taxpayer must independently monitor changes in the average salary in Russia by profession. The main source of such information is Rosstat.

You can track the latest analytical sample of average wages by industry on the official website of Rosstat.

In addition, information on industry average salary indicators in the region also periodically appears on the pages of regional Federal Tax Service Inspectors. Regular analysis of the compliance of the industry average with the actual one established at the enterprise as of the same reporting date will allow taxpayers-employers to make a timely decision on indexing earnings.

Average monthly salary by type of economic activity in the regions

Fresh analytical data on wages in Russia by profession in 2018 are also available on the website of the Federal State Statistics Service. To find out regional indicators, you should select “Labor Market, Employment and Wages” in the “Official Statistics” tab, and then “Wages” and view the information of interest.

For example, as of August 22, 2018, the level of average monthly industry salaries in the Moscow region is as follows (data available for June 2018), in thousand rubles:

Sep 10, 2019Dmitry Koloskov

Source: https://lawsexp.com/juridicheskie-sovety/sredneotraslevye-zarplaty-po-vidam-jekonomicheskoj.html

How do tax authorities find out the salary level at an enterprise?

The evaluation criteria do not say how tax inspectors determine the average salary paid in a company. But it is obvious that the information for assessment is received by the Federal Tax Service as part of the submitted reporting.

Thus, the number of employees of an organization is determined based on the report on the average number of employees as of January 1, which companies are required to provide annually.

Tax authorities receive information about income paid to employees from 2-NDFL certificates, based on insurance premiums. The regulatory authority will compare the data obtained from the company’s reporting with the average wage level by type of economic activity.

Thus, inspectors will determine the level of wages for the year. For internal analysis to determine whether the organization meets the criterion, information for the most recently closed reporting year should be considered.

How to respond to a request from the Federal Tax Service to reduce risks

A lower level of wages than the average salary according to OKVED is sometimes a consequence of objective reasons. It is determined by the region as a whole. It is obvious that incomes paid in the regional center will always be higher than those paid in rural administrative units.

It is also possible that your company is just starting to operate, and employees were only hired towards the end of the year. Or the company has many part-time workers. In addition, organizations sometimes experience temporary difficulties, as a result of which workers had to be placed on idle leave with payment of 2/3 of their average earnings. Or, as a result of low revenue, employee bonuses were cancelled.

To provide a competent response from the tax authorities, it is necessary to analyze all the reasons for paying wages lower than the average salary by industry, and present them in the most detailed and reasonable manner.

Difference between nominal and real wages

Real wages are the amount that an employee receives annually. Its concept has also not found legislative support, and in some approaches real wages are calculated taking into account purchasing power.

The difference between these types of salaries can be seen using an example . The worker's nominal salary was 30,000 rubles, of which he spends 10% on housing and communal services and other mandatory services, 50% on food, the rest remains on the purchase of clothing and other goods.

Six months later, the nominal salary remained the same - 30,000 rubles. But due to inflation and rising tariffs, the structure of expenses has changed: 25% goes to mandatory payments, 70% to food, and only 5% remains to pay for various goods and services. As a result, a person purchases much fewer goods and services for the same salary.

It turns out that while nominal wages remain unchanged, real wages have decreased . But since the concept of real wages has not found its legal codification, many understand it as wages minus personal income tax.