What is accounting policy

The accounting policy (hereinafter referred to as the AP) is the basis document on which the company’s accounting and tax accounting is built. Sometimes a separate UE is made for each type of accounting, but this is not necessary - you can combine them into one document. Every organization should have a management program, regardless of:

- organizational and legal form;

- type of activity;

- tax systems;

- scale of production;

- other conditions.

Accounting legislation is not always interpreted unambiguously, but on certain issues it gives the right to choose. The UP must reflect which option the organization will adhere to in its work. For example, methods of writing off inventories are by FIFO, by unit cost or by average cost. There is no need to include mandatory accounting rules in the UE.

The tax part of the UP is regulated by Art. 313 Tax Code of the Russian Federation, accounting - PBU 1/2008. The laws contain a requirement for mandatory approval of the management program by order or directive of the head of the organization.

Small businesses may not draw up accounting policies at all

Alas, this is not true. For small businesses there are many concessions in terms of accounting and reporting. In particular, they can keep records and prepare reports in a simplified form. But the opportunity to take advantage of this indulgence should be spelled out in the accounting policy.

By the way, in the summer of 2020, new amendments and relaxations in terms of accounting came into effect. And it’s more convenient to use them right from the beginning of the year. Let us remind you that we are talking about amendments that were made to the PBU by order of the Ministry of Finance of Russia dated May 16, 2016 No. 64n.

Firstly, you can now take into account raw materials and materials at the supplier’s price. Previously, the value of assets additionally included transportation costs, fees to intermediaries, etc. Moreover, according to the new rules, all inventories can be written off at a time if the activities of a small enterprise do not involve significant balances on them. Each company determines the level of materiality independently. For micro-enterprises there are no these additional conditions; they can write off any inventories without restrictions (clause 13.2 of PBU 5/01).

Secondly, depreciation on fixed assets can be calculated once a year - on December 31. In this case, depreciation on production and business equipment can be written off at a time (clause 19 of PBU 6/01).

Read also “Small businesses will have to submit statistical form No. TZV-MP”

Who develops and approves accounting policies

The UP is formed by the chief accountant of the company or another employee who is entrusted with accounting. In accordance with PBU 1/2008, the UP states:

- work accounts that the organization will use for accounting;

- forms of primary documents, internal documents and accounting registers;

- inventory procedure;

- methods for assessing property and liabilities;

- document flow procedure;

- basics of operations control;

- other solutions for organizing accounting.

The manager does not participate in the development unless he wants to. But he must read and approve the finished document.

The tax office asks to show the accounting policy during the audit. And companies often have problems with regulatory authorities when it turns out that there is no order to approve the UE and there never was. At the same time, the order not only confirms the manager’s consent to the application of the management program, but also determines the persons responsible for compliance with the rules approved in the policy.

There is no standard form for an order, so you can compose it arbitrarily. But it must contain mandatory details: name of the document, date of preparation, signature. The provisions of the accounting policy are stated in the text of the order or attached to it in the form of appendices.

The accounting policy of an organization is the set of accounting methods adopted by it (primary observation, cost measurement, current grouping and final generalization of the facts of economic activity).

Accounting methods include methods of grouping and assessing facts of economic activity, repaying the value of assets, organizing document flow, inventory, methods of using accounting accounts, systems of accounting registers, processing information and other relevant methods and techniques.

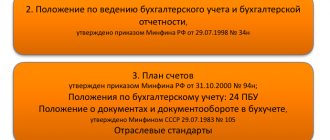

The accounting policy is formed on the basis of the assumptions and requirements established by PBU 1/98 (discussed in the chapter The essence and content of accounting).

The accounting policy of the organization is formed by the chief accountant/bookkeeper of the organization and approved by the head of the organization.

In this case it is stated:

- options chosen by the organization for accounting and evaluating accounting objects;

- a working chart of accounts containing synthetic and analytical accounts necessary for maintaining accounting records in accordance with the requirements of timeliness and completeness of accounting and reporting;

- forms of primary accounting documents used to document facts of economic activity, for which standard forms of primary accounting documents are not provided, as well as forms of documents for internal accounting reporting;

- the procedure for conducting an inventory of the organization’s assets and liabilities;

- document flow rules and accounting information processing technology;

- the procedure for monitoring business operations;

- other solutions necessary for organizing accounting.

When forming the accounting policy of an organization in a specific area of maintaining and organizing accounting, one method is selected from several allowed by legislation and regulations on accounting. If the regulatory documents do not establish accounting methods for a specific issue, then when forming an accounting policy, the organization develops an appropriate method based on the accounting provisions.

The accounting policy adopted by the organization is subject to registration with the relevant organizational and administrative documentation (orders, instructions, etc.) of the organization.

The accounting methods chosen by the organization when forming its accounting policies are applied from January 1 of the year following the year of approval of the relevant organizational and administrative document. Moreover, they are applied by all branches, representative offices and other divisions of the organization (including those allocated to a separate balance sheet), regardless of their location.

A newly created organization draws up its chosen accounting policy before the first publication of its financial statements, but no later than 90 days from the date of state registration. The accounting policy adopted by such an organization is considered to be applied from the date of acquisition of the rights of a legal entity (state registration).

Branches and representative offices of foreign organizations located on the territory of the Russian Federation can formulate accounting policies based on the rules established in the country of location of the foreign organization, if the latter do not contradict IFRS.

A change in an organization's accounting policy can be made in the following cases:

- changes in the legislation of the Russian Federation or norm. tive acts on accounting;

- the organization's development of new accounting methods. The use of a new method of accounting requires a more reliable representation of the facts of economic activity in the accounting and reporting of the organization or less labor intensity of the accounting process without reducing the degree of reliability of the information;

- significant change in operating conditions. A significant change in the operating conditions of an organization may be associated with reorganization, a change of owners, a change in types of activities, restructuring of production, a significant expansion or reduction in the volume of activities, etc. It is not considered a change in accounting policy to approve the method of accounting for facts of economic activity that are essentially different from the facts that occurred previously, or that arose for the first time in the organization’s activities.

Changes in accounting policies must be justified and documented in the manner prescribed for accounting policies.

The change in accounting policy must be introduced from January 1 of the year (beginning of the financial year) following the year of its approval.

The consequences of changes in accounting policies that have had or are likely to have a significant impact on the financial position, cash flow or financial performance of the organization are assessed in monetary terms. The assessment is made on the basis of data verified by the organization as of the date from which the changed method of accounting is applied.

The consequences of changes in accounting policies caused by changes in the legislation of the Russian Federation or regulatory acts on accounting are reflected in accounting and reporting in the manner prescribed by the relevant legislation or regulatory act. If the relevant legislation or regulation does not provide for the procedure for reflecting the consequences of changes in accounting policies, then they are reflected in accounting and reporting based on the requirement to present numerical indicators for at least two years, except in cases where these consequences are assessed in monetary terms for periods preceding the reporting period. , cannot be produced with sufficient accuracy.

Reflection of the consequences of changes in accounting policies consists of adjusting the relevant data included in the financial statements for the reporting period for the period preceding the reporting period.

These adjustments are reflected in the financial statements. In this case, no accounting records are created.

When is the accounting policy approved?

According to the general rules, each organization has 90 days or 3 months from the date of creation to develop and approve the MP. The day of creation is considered to be the registration of the organization in the Unified State Register of Legal Entities. This applies to newly created and reorganized companies.

For already existing organizations the procedure is different. The manager must issue an order to approve the new UE no later than the last day of the expiring year, since the accounting rules apply from the year following the approval. Therefore, it is not worthwhile to date the order on the UP for 2019 later than December 29, 2018.

In small companies, the UE may remain unchanged for years. It can be developed once and applied year after year, even until liquidation. There is no need to approve a new document annually. But changes and additions need to be made to the document.

Who should develop

Responsibility for the formation of the organization's accounting policy lies directly with the institution's chief accountant. The manager is responsible for the process of organizing accounting, for compliance with the norms and rules of current legislation in the execution of financial and economic activities of an economic entity (Article 6 402-FZ of December 6, 2011).

The formation of an organization's accounting policy is entrusted to the chief accountant or an official authorized to maintain accounting in the institution. The developed and agreed upon UP is approved by order (instruction) of the head of the enterprise. The institution regulates the formal type of order or instruction independently.

The key legal act regulating the development of management programs for enterprises is the accounting provision PBU 1/2008.

The management program, as well as the order for its approval, are internal organizational documents that delineate the norms of responsibility of the manager and chief accountant for the process of developing a set of accounting measures.

Accounting policy for tax accounting purposes: nuances

The accounting policy for tax accounting differs significantly from the accounting policy, since it is based on other regulatory documents (the main one is the Tax Code of the Russian Federation). In addition, there are more frequent changes in tax legislation that require a timely response to them, including adjustments to accounting policies.

IMPORTANT! For the absence of an accounting policy or its provisions requiring independent choice or establishment, controllers are punished as a gross violation of accounting rules. In accordance with Art. 120 of the Tax Code of the Russian Federation, the fine will be 10,000 rubles. (30,000 rubles - if the violation extends to several tax periods). A fine will also be imposed on the official - under Art. 15.11 Code of Administrative Offenses in the amount of 5,000–10,000 rubles. (and in case of repeated violation it will be 10,000–20,000 rubles or will lead to disqualification).

For information on what constitutes the basis of accounting policies under IFRS, read the material “Accounting policies in IFRS format - basic provisions” .

Compliance with the principle of sufficiency of information

When choosing an accounting option, reference to laws and acts that allow the application of the norm is allowed. It is considered unnecessary to duplicate legislative provisions that need to be clearly formulated. When entering data, you must adhere to the principles of expediency, prudence and sufficiency.

Let us consider the types of appropriate and unnecessary information in the Policy using the example of a number of provisions adopted for the purposes of accounting

| Inappropriate position | Required position | A comment |

| When making changes, you must adhere to the new edition | Documents approved with a specific date do not have retroactive effect | |

| Keeping records of information on accounting accounts in accounting is carried out using double entry (the organization uses OSN and full accounting) | Companies that maintain accounting in full always use a double form of entry in accounting accounts | |

| Minor accounting errors from previous years are subject to correction in the current detection period and are reflected in the reporting | The provision is enshrined in clause 14 of PBU 22/2010 and does not require duplication in the Policy | |

| Depreciation charges are written off on a straight-line basis for all assets | Choosing a method for calculating depreciation is a prerequisite for maintaining accounting of fixed assets | |

| The write-off of inventories is assessed at the average cost | Choosing a method for writing off inventories is an essential condition that allows you to calculate the cost |

Terms and order of formation

The accounting policy of the organization is formed, in accordance with clause 9 of PBU 1/2008, no later than 90 days from the date of registration of the new enterprise.

The methods, methods and provisions of accounting prescribed in the institution’s management system come into force on January 1 of the period (year) following the year of its approval.

Changes made to the current UP are approved in the current year, but come into force from the period following the year of approval; additions are made directly on the date of the need to make such additions.

All decisions on additions and changes to the provisions of the UP are made with the aim of bringing this fundamental document into compliance with current legislation.

Accounting policy of an organization (LLC): example-2020

The accounting policy of an organization (LLC) - an example from 2020 can be found on numerous websites on the Internet. We also have samples: for VAT, for the simplified tax system, etc. However, it is useless to look for the ideal one. All the subtleties of accounting are provided depending on the specifics of the activity, and each company has its own. You can use special design services offered on the Internet. But they can only be used as a basis, subject to further refinement and adjustment.