Account 14 “Reserves for reduction in the value of inventories” is intended to collect information about reserves created by the organization in order to reflect deviations in the actual value of inventories from the market value.

According to Russian legislation, all organizations applying the general taxation regime must, before drawing up their final annual reports, conduct an inventory of inventories and identify deviations in their actual price from the market price.

Why is this necessary? The fact is that financial statements must give an objective picture of the company’s assets and liabilities, and its financial results. In relation to fixed assets and intangible assets, a revaluation procedure is provided for by law; in relation to inventories, revaluation is not provided for. If their market price is significantly higher than the actual price (accounted for in accounts 10, 20, 23, 41, 43), the accounting department must attribute this difference to the account. 14, thus creating a reserve to reduce the cost of inventories.

Attention! Account 14 is intended not only for creating inventories for reducing the price of inventories (account 10), but also for other current assets: work in progress (account 20, 23), finished goods (account 43), goods (account 41.)

Account 14 is active-passive, that is, at the end of the year it can form both a debit and a credit balance. In general, it behaves as passive, which is typical for reserve accounts: according to Kt they show an increase in the reserve, according to Dt - a decrease.

Attention! Account 14 does not participate in tax accounting, that is, it does not change the base for property tax or profit tax, but it affects the formation of accounting profit or loss.

Purpose of the designated position in the balance sheet

Many companies store material and raw materials in warehouses, the value of which may periodically decrease. It is for this reason that organizations create a reserve fund, which is designed to cover losses in the event of a similar situation.

The designated account, called “Funds for the event of a decrease in the value of inventories,” is designed to collect and summarize information about the reserves that the organization has created in order to reflect the deviations that have arisen from the price of inventories established at the time of purchase from the current one. This position is also used to summarize information about reserve funds formed in case the price of other working capital decreases, including work in progress, finished products, goods, etc.

The formation of funds is accounted for by the credit part of the designated account and the debit part of 91 positions, which is called “Other expenses and income.” As for the formation of Form No. 1 of financial statements, the amount of the created fund is not reflected in it, since the inventories are shown in this reporting form according to the already specified estimate, minus the formed reserve.

Businessman working in the office

Write-off of reserve

The reserve is written off in the following cases:

-If the market value of materials has increased.

-Materials are transferred to production or sold.

A) If the market value of materials has increased, in the next reporting period the following entry is made:

Debit 14 Credit 91-1 - The reserve for those materials for which the market value has increased has been written off. (the reserve for account 14 decreases, income previously accepted as expenses increases, i.e. is cancelled)

B) If materials were transferred to production or sold, the reserve is also restored by posting:

Debit 14 Credit 91-1

Let's consider an example when materials are sold using those materials for which a reserve was created.

Before drawing up the balance sheet, the book value of the brick was 10 rubles, the market value of the brick was 8 rubles. Bricks in quantity of 100 pieces. The following year, these materials were sold in the amount of 50 pieces. The reserve at the beginning of account 14 was 1000 rubles.

- Debit 91 Credit 14-200 rubles ((10-2)*100) A reserve was created.

- Debit 91 Credit 10-500 rubles (10*50) - The cost of materials for materials sold (bricks) has been written off.

- Debit 14 Credit 91-100 rubles ((10-8)*50) - The reserve for the materials for which it was created is written off.

Features of financial statements

The enterprise must create the specified fund in the case where there is an agreement on the purchase and sale of finished products at a price that is lower than their cost. In addition, these funds should be created for such inventories that were used in the production process of these products. All these inventories should be shown on the balance sheet at a price adjusted by the amount of the reserve.

If it so happens that the company has not created the specified fund, then in this case there is a violation of the principle of reliability of financial reporting. In these circumstances, for a gross violation of accounting rules, the head of the company, as well as the head of the financial service, may be held administratively liable by paying a fine in the amount of 2000 rubles. Up to 3000 rub. provided that the information in the balance sheet is reflected unreliably by more than 10%.

The need to create a reserve

The need to create a reserve for reducing the value of material assets is dictated by the requirements of accounting standards. Thus, clause 25 of the Accounting Regulations “Accounting for inventories”, approved. Order of the Ministry of Finance of the Russian Federation dated 06/09/2001 No. 44n (hereinafter referred to as PBU 5/01) established that inventories that are obsolete, have completely or partially lost their original quality or current market value, the sale price of which has decreased, are reflected in the balance sheet at the end of the reporting year minus the reserve for a decrease in the value of material assets.

In addition, in paragraph 62 of the Regulations on accounting and financial reporting in the Russian Federation, approved. Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n states that finished products, goods, raw materials, basic and auxiliary materials, fuel, purchased semi-finished products and components, spare parts, containers used for packaging and transporting products (goods), and other material resources for which the price has decreased during the reporting year or which have become obsolete or partially lost their original quality are reflected in the balance sheet at the end of the reporting year at the price of possible sale, if it is lower than the initial cost of procurement (purchase), with the difference being allocated to prices on financial results.

In recommendations to audit organizations for conducting an audit of the annual financial statements of organizations, representatives of the financial department, considering the verification of the correctness of the assessment of finished products in the balance sheet at the end of the year, focused attention on the need to analyze concluded contracts with consumers (letter of the Ministry of Finance of the Russian Federation dated January 29, 2014 No. 07-04 -18/01). If the price of finished products is lower than its cost, the organization must create a reserve for its depreciation.

Examples of accounting entries

To begin with, it is necessary to emphasize that the 14th count is active-passive in nature. The created funds are reflected in the credit part of the account, and the restored amount of the reserve or the amount by which the market price exceeds the actual one should be indicated in the debit of the account.

As for analytical accounting, it is maintained for each created fund separately.

Typical accounting entries for the designated position of the Chart of Accounts are as follows:

Creation of a fund, which at the end of the reporting period is formed for each type of inventory by reducing financial results:

Dt 91/2

Kt 14.

Reduction in fund volume as a result of disposal of inventories or increase in their market value:

Dt 14

Kt 91/1.

Procedure for creating a reserve

Having decided on the need to form a reserve, we will consider the algorithm for its creation.

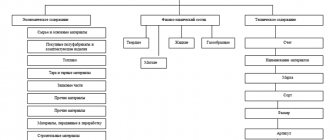

Guidelines for accounting for inventories, approved. Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n (hereinafter referred to as the Guidelines) determines that a reserve is created for each unit of inventory accepted in accounting. And clause 3 of PBU 5/01 determines that the accounting unit for inventories is selected by the organization independently in such a way as to ensure the formation of complete and reliable information about these inventories, as well as proper control over their availability and movement. Depending on the nature of the inventory, the order of its acquisition and use, the unit of inventory accounting may be an item number, batch, homogeneous group, etc.

It is allowed to create a reserve for certain types (groups) of similar or related reserves. According to clause 3 of PBU 5/01, a reserve can be created for certain batches of goods, item numbers, and homogeneous groups. For example, an organization creates a reserve for the “Hardware” group of materials. One of the organizations, in accordance with the requirement of prudence in the current situation, when the market price of material assets (poultry and poultry products) was lower than cost, created a reserve for depreciation of assets. The chosen method of forming reserves - group - was created according to the reserve group “Animals for growing and fattening” (Definition of the Vologda Region AS dated April 30, 2015 No. A13-6613/2013). In any case, when creating a reserve, comparability of indicators both in physical and monetary terms must be ensured.

For such enlarged groups (types) of inventories as basic materials, auxiliary materials, finished products, goods, stocks of a certain operational or geographic segment, the creation of a reserve is not allowed (paragraph 2 of clause 20 of the Methodological Instructions).

As already noted, to determine the amount of the reserve it is necessary to calculate the current market value of material assets.

The reserve for a decrease in the value of material assets is reflected in the debit of account 91 “Other income and expenses”, subaccount 91-2 “Other expenses” in correspondence with account 14 “Reserves for a decrease in the value of material assets” (Instructions for using the Chart of Accounts for financial and economic accounting activities of organizations, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, paragraph 20 of the Methodological Instructions, paragraph 11 of the Accounting Regulations “Expenses of the Organization,” approved by Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n (hereinafter according to the text - PBU 10/99)).

To organize analytical accounting for account 14 “Reserves for reducing the value of material assets,” 2nd order subaccounts of the same name can be opened, corresponding to the type of material assets for which the reserve is created.

An example of using subaccounts to synthetic account 14 is presented below:

Example of creating a reserve fund

Let’s imagine that at the end of 2020, a certain Invest LLC has 37,000 bricks on its balance sheet, the actual cost of which is 9.0 rubles per piece. Thus, the total cost was 333,000 rubles. During the year, the market price fell slightly and, in accordance with the results of trading on the commodity and raw materials exchange, at the end of the reporting period it amounted to 7.0 rubles. As a result, the total market price was 259,000 rubles. At the beginning of 2020, the company sold 15,000 units. bricks

Thus, due to disposal, part of the created reserve must be written off: 74,000: 37,000 * 15,000 = 30,000 rubles.

Accounting entries for account 14 as a result of a decrease in the market value of inventory items will look like this:

- Dt 91.02 - Kt 14 - 74,000 rubles, a fund has been formed to cover losses resulting from a decrease in value;

- Dt 14 - Kt 91.01 - 30,000 rubles, write-off of part of the reserve fund.

Thus, three situations can be identified in which the creation of a reserve is mandatory:

- material assets have become obsolete, have completely or partially lost their original quality;

Technical specialists of the organization (for example, technologists) can identify morally and physically obsolete material assets that cannot participate in the production process. As a rule, organizations have created a permanent working commission, which determines the list of such materials. Based on the conclusion (act) of the commission, a protocol is created on the further use (or non-use) of such material assets.

In modern ERP systems (for example, SAP R/3) special reports are generated on unused balances of material assets for more than 12 months in the context of homogeneous groups. The mere fact of non-use of material assets without a specific analysis for a long time cannot indicate the potential illiquidity of the latter. However, long-term non-use of materials can cause a decrease in the original qualities, and therefore there is a high probability of loss of value.

- the current market value of material assets has decreased;

Accounting standards do not define the methodology for establishing current market prices. As a rule, organizations use information about the price of the last purchase of materials from suppliers, data from commodity exchanges, and statistical information.

The source of information about the current market value of material assets can be provided in the accounting policy for accounting purposes or approved by a special order for the organization.

- the selling price of material assets has decreased.

Confirmation of information about a decrease in the sales value of material assets can be concluded in contracts with buyers in which the sales price of material assets is lower than cost.

A reserve is not created for material assets used in the production of finished products (performance of work, provision of services) if, as of the reporting date, the current market value of the finished product (work, services) corresponds to or exceeds their actual cost.

It should be noted that the need to create a reserve for reducing the cost of material assets is borrowed from international standards.

Calculation of the final balance for account 14

The formula for calculating the final balance on account 14 = Beginning balance on the loan + Turnover on the loan 14 - turnover on the debit 14.

Let's use the previous example and draw an airplane:

Balance at the end = Balance at the beginning CT + Credit turnover - debit turnover = 1000 + 200-100 = 1100 rubles. Debit turnover is shown (200 rubles) for the amount of reserves created for the period. Credit turnover (100 rubles) is the amount of the reserve written off. The closing balance (1100 rubles) shows how much reserves we have in account 14 at the end of the reporting period. 1100 rubles are not reflected in the balance sheet but are subtracted from the amount of INVENTORIES in the balance sheet asset. Let's say we have INVENTORIES in the amount of 10,000 rubles in the balance sheet on the INVENTORIES line there will be 8900 rubles (10000-1100)