How to correctly fill out form INV-26

This form is compiled based on the results of the work of a specially created commission.

For this purpose, an internal order is issued signed by the General Director. The commission consists of at least three people. These can be employees of the organization or hired employees called specifically to carry out the work. The composition of the commission is approved by the head of the organization and signed. Before starting the inventory procedure and filling out the results recording form, the chairman of the commission must be elected from among its participants. All members and the chairman must be listed by name on the inventory form. The statement is drawn up in two copies. One of them should be in the warehouse of the head of the department, the other remains in the accounting department for subsequent assessment of the results and preparation of a report for the required period (most often an annual statement is prepared). This document evaluates the results of ongoing inventories. The document is affixed with the organization's seal. All identified deviations are entered into the form (in the tabular part). Filling out occurs strictly with the specified items and the name of the column. In case of a large number of deviations, a tabular application is used. In this case, each sheet must be stamped and painted. The document must be sealed. A fairly common mistake when filling out the form is that organizations often use an old form. It must be remembered that after January 1, 2001, significant changes were made to the form. Therefore, before filling it out, you must make sure that you are using the established form. *All necessary forms for the warehouse are available in the Class365 warehouse automation system.

INV-16

Form No. INV-16

Approved by a resolution of the USSR State Statistics Committee

dated 12/28/89 No. 241

| OKUD code | |||

| (enterprise, organization) | |||

| INVENTORY LIST | Document Number | Date of preparation | Workshop (warehouse) |

valuables and strict reporting document forms

INV-26: form and content

When conducting inventories, various forms of inventories, acts and statements are used to draw up the results. Each form has its own purpose and reflects the results of inspections in relation to different types of property and liabilities.

For example:

- INV-1 reflects data on the presence of OS;

- INV-1a – information about intangible assets;

- INV-3 contains data on inventory items;

- INV-4 – information about goods and materials shipped;

- INV-5 – information about inventory items that have been accepted for responsible storage;

- INV-16 – information about securities and BSO.

When discrepancies are established between the actual availability, condition of property and accounting data, comparison statements (INV-18 and INV-19) are drawn up, recording the presence of a shortage or surplus. The INV-18 statement reflects the results of the inventory of fixed assets and intangible assets. The INV-19 statement is intended to reflect data relating to inventory items.

Information about surpluses and shortages is also entered into the record of results identified by the inventory (INV-26), which reflects the results of the inventory carried out for the corresponding reporting period.

A new sample of this form was approved on March 27, 2000 by Resolution of the State Statistics Committee No. 26. Just like other unified forms, from January 1, 2013, this form is not mandatory for use. Business entities have the right to develop, approve and apply their own forms containing all the mandatory details provided for by the accounting law. The list of these details is given in Article 9 of this law and includes the name and date of the document, the name of the business entity, the fact of economic life and its size, full name, position and signatures of the responsible persons.

If the form approved by Goskomstat suits you, then you can INV-26.

form form INV-26

The Goskomstat form contains sections with information:

- about accounting accounts (name and number in accordance with the Chart of Accounts);

- about surpluses and shortages (indicate the amount in rubles);

- about damaged property (indicate the amount in rubles);

- on write-off, re-grading and attribution of losses to responsible persons (indicate the amount in rubles).

Information is reflected both in relation to each individual accounting account (fixed assets, inventory items, intangible assets, financial statements, etc.), as well as the total amounts of identified shortages or surpluses, write-offs, re-grading, etc.

The statement also indicates the name of the organization and the OKPO code. If inventories relate to a specific structural unit, then its name is indicated in the form.

The prepared statement is signed by the organization's officials (manager and chief accountant), as well as the chairman of the inventory commission. The statement is drawn up in 2 copies, one of which is transferred to the accounting department for reporting.

Sample of filling out form INV-26

INV-16 and inventory of securities: sample filling, form, form

Strict reporting forms (SSR) are subject to inventory as well as land, real estate, fixed assets, money, stones and metals. We'll talk about this today.

What is BSO

Norms and concept

Strict reporting forms (SRF) are documents confirming the receipt of cash for services rendered in areas of activity defined by the classifiers OKVED 2 (029-2014) and OKPD 2 (OK-034-2014). They replace a check, are made in 2 (or 3) copies, and can be used by legal entities and individual entrepreneurs.

Strict reporting forms include receipts, coupons, tickets, vouchers (tourist), subscriptions, etc. Accounting rules are regulated by Resolution No. 359 (05/06/2008).

The inventory is carried out simultaneously with the cash register audit; based on the results, the INV-16 act is filled out.

The inventory of funds, monetary documents and strict reporting forms is described in the video below:

Purposes of their use

For most areas of activity, forms defined by law are available:

- tickets for urban public transport, air, railway;

- vouchers;

- season tickets;

- pawnshop receipts.

Legal entities and individual entrepreneurs have the right to develop their own options, which must contain:

- form name and number (6 characters);

- name of the enterprise (full name of the individual entrepreneur), address;

- TIN of the entrepreneur;

- Name of service;

- the price of the service provided, expressed in a specific amount;

- amount paid in cash (bank card);

- a number indicating the time of registration and settlement;

- position and full name of the employee who issued the receipt, his signature and seal of the company.

Legal entities use BSO in situations where cash register equipment (CCT) is impossible or unprofitable to use:

- at fairs;

- during peddling trade;

- sale of tickets in vehicles;

- during street trade in live fish, kvass, beer, ice cream, milk;

- when trading securities;

- sale of periodicals and folk art items;

- payment for porters;

- in populated areas where a cash register connection is not available.

Individual entrepreneurs use forms if they are cheaper than purchasing, installing and maintaining a cash register.

Normative base

The scope of application of the BSO is determined by Federal Law No. 54. When conducting business activities specified in paragraph 2 of Art. 346 of the Tax Code, individual entrepreneurs on UTII and PSN have the right not to use the cash register until 01.07. 2020. From July 1, 2018, all entrepreneurs will switch to online cash registers.

Law No. 290 defines UTII and PSN payers, who are subsequently allowed to use strict reporting forms in paper or electronic form created by an automated system. In addition, distance selling allows sending purchase information to a computer or phone.

Ledger

If a legal entity or individual entrepreneur maintains accounting records, it is mandatory to fill out the Book of Accounting for this documentation (clause 13 of Resolution No. 359). It must be numbered, laced, sealed, and signed by the manager and accountant.

The employee responsible for maintaining the Book is financially responsible. A book is not necessary if the sheets are printed automatically by a system that stores the data in its memory. BSO (according to paragraphs 14-16 of Article 359) are stored sealed in special bags for 5 years.

It is important to take into account that the services that allow the use of BSO according to the classifier do not coincide with the list in the law on the use of cash register devices. When in doubt, entrepreneurs are forced to seek clarification from Tax Inspectorate employees.

BSO inventory is the topic of this video:

Inventory procedure

Rules

- The BSO audit is carried out simultaneously with the inventory of money in the cash register (usually once every 3 months).

- If an employee who is the financially responsible person changes, an extraordinary audit may be assigned.

- It is determined whether all receipts are included in the Book, whether there are lost or damaged forms.

- Each type of form is checked separately, taking into account financially responsible persons, storage locations, starting and last numbers.

- It is important that there are no corrections on the completed documents, the amounts correspond to those reflected in the accounting.

Inventory form INV-16

The INV-16 inventory form has been used for inventory since 1999. Resolution of the State Statistics Committee No. 88 (08/18/1998) established that it must be filled out in 2 copies. The goal is to identify discrepancies in quantity and amount when compared with accounting data. If there are forms with the same numbers, a set is formed with an exact indication of the number of sheets.

Before the start of the audit, the persons responsible for storage sign receipts. They become parts of the inventory.

On the final page there are lines to indicate the series and numbers of the last completed documents, if their movement does not stop during verification.

If the inventory is filled out automatically, a document is issued in which columns from the first to the tenth are already filled in. The commission fills out columns 11 and 12.

The unified form INV-16 consists of 4 pages; it is convenient to download it using the link.

- You can fill out the form either manually or on the computer.

- It is allowed to use forms developed by the enterprise if it has all the required details.

- Corrections are made by striking out. The updated data is indicated above. Signatures of commission members are required.

- Lines that are not filled in are marked with dashes.

- The completed inventory is signed by members of the commission and persons responsible for storage. One copy is given to the accountant, the second to the employees responsible for storage.

- If the inventory is carried out in connection with a change in the employee responsible for storage, 3 copies are drawn up in order to transfer one to each employee responsible for storage (the one who left and the one who came).

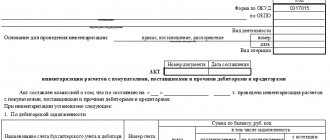

Form INV-26. Inventory record sheet

According to the schedule, regardless of the organizational form of business at the enterprise, an inventory procedure is carried out. After its completion, a statement of results is filled out in form INV-26. Let's look at the features of filling out this form. A correctly completed example of a sample INV-26 statement can be downloaded at the end of the article.

With the beginning of the inventory at the enterprise, an order must be issued, according to which the structure (date, timing) of the inventory and the composition of the commission are approved. Such an order can be issued using the unified form INV-22.

After drawing up the order, the inventory commission conducts a comprehensive inspection and assesses the condition of the property, fills out inventory lists, entering into them actual data on the condition of the property.

When carrying out:

- ,

After analyzing the inventory data, commission members find discrepancies with the basic data. Identified violations are transferred to comparison sheets.

- For intangible assets and fixed assets, enterprises fill out a matching statement in the INV-18 form.

- To fill out data on commodity and material assets, fill out the matching sheet INV-19.

Based on the conclusions made during a scheduled or unscheduled inventory, a final result is drawn up and also entered into the results record sheet.

The statement form is filled out according to the unified form INV-26. It contains statements of all obligations and property of the enterprise, in respect of which recalculation and verification are carried out.

Download form INV-26 (excel) for free

×

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

INV-26 is used when conducting both scheduled and unscheduled inspections. A sample form was developed by Goskomstat. The unified form INV-26 is not mandatory. You can design your own form. But keep in mind that the form is complex, so it’s better to take our example of filling out INV-26, it contains all the required details. We have documents in different formats - INV-26 (word) is available for free.

Please note that it is necessary to check:

- when transferring company property for rent, purchase or sale,

- before preparing annual reports,

- when changing materially responsible persons,

- in case of theft or damage to goods and materials,

- in case of natural disasters, fire, accidents or other emergency situations,

- upon liquidation of an enterprise.

Inventory results record sheet. How to fill out the form correctly?

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

The form must be filled out on one A4 sheet. In the upper part indicate the name of the enterprise, OKPO, the name or number of the structural unit, as well as code designations of the type of main activity and the value of the operation code. The date of completion must be indicated and a number is assigned. The form consists of an extended table containing a list of accounts of the enterprise's property and liabilities in relation to which the audit will be carried out. There are only 10 columns in the table, which are filled in during the check as follows:

1 – account serial number;

2 – name of the property accounting account (fixed assets and materials, cash register, raw materials, materials, etc.);

3 – digital designation of the account in accordance with the Chart of Accounts;

4 – the total cost of the identified surplus is indicated;

5 – the total amount of identified shortages in relation to property is entered;

6 – indicates the total cost of material assets that are damaged;

Shortages at the enterprise or damage to property identified as a result of the inventory can be counted as misgraded, written off by the commission within the limits or even in excess of the natural loss rate, and losses and shortages can also be deducted from the salaries of the perpetrators. The form, in columns 7-10, reflects all the information regarding where losses from shortages and damage to material assets of the enterprise are written off.

At the bottom of the form, in the “Total” line, the results of filling out the table are indicated; they are displayed in columns 4-10.

After the inventory is completed, the completed statement is signed by the head (president) of the enterprise (company), the chief accountant and the chairman of the inventory commission.

When and how is this form used?

Based on the BSO inventory report, companies draw up inventories that reflect information about the availability of securities and.

This inventory is compiled to detect possible discrepancies between audit data and accounting information.

The entries for the inventory of financial investments are as follows:

- D58 – K91 – unaccounted securities were capitalized;

- D94 – K58 – write-off of damaged securities or shortages.

The basis for registration of these transactions will be the inventory report in the INV-16 form.

What does an inventory sheet reflect?

The final results of the inventory are reflected in specially designed forms. All these forms of inventories, acts and statements give an idea of the actual availability of property, including fixed assets, materials, and cash balances. Matching statements record the resulting accounting discrepancies.

General information about the surpluses and deficiencies identified as a result of the property inspection is contained in the INV-26 statement - a statement of records of the results identified by the inventory. The obligation to enter general information into a separate document is confirmed by the Ministry of Finance, in the guidelines for inventory of property, approved by Order No. 49 dated June 13, 1995.

The inventory sheet, a sample of which was developed by Goskomstat, as well as other unified forms, are not mandatory for use. Economic entities have the right to develop their own INV-26 form using the required details. The inventory sheet, a sample of which is presented below, includes data on all property checks carried out during the year, including unscheduled ones.

How to fill out a form

The financial investment inventory form in the INV-16 form has the following structure:

- title of the document – act;

- date of formation of the act;

- name of the company that executed the act;

- types of business transactions;

- units of measurement of inventory objects;

- position, surname, name and patronymic of the employee bearing financial responsibility;

- positions, as well as last names, first names and patronymics of all members of the commission;

- signatures of the chairman of the commission, all its members and mat. - responsible employee.

Features of the inventory of securities

When making an inventory of securities, you need to make sure that:

- all primary documentation is prepared properly;

- the price of all investments is correct;

- the actual number of securities coincides with accounting data;

- investment profitability is reflected correctly and timely in accounting.

If the securities are in the company, their inventory must be carried out simultaneously with the inventory of cash in the cash desk. If these papers are transferred for safekeeping to another company, during the inventory the balances of the amounts are verified on special accounts. accounts with statements from the company where the securities are stored.

To inventory securities, it is necessary to analyze information for each issuer. In this case, the following information must be entered into the financial investment inventory form: number of securities, their series, actual denomination and other data.

Similar articles

- Inventory results report (filling sample)

- Inventory report of receivables and payables (sample)

- Inventory of financial investments

- Inventory list of intangible assets (sample)

- Cash inventory report (form and sample)