Additional payment for the intensity and intensity of work

However, increasing labor intensity leads to maximizing the expenditure of human resources over a certain period of time.

Thus, these concepts cannot be identified due to their opposite directions. This allows you to objectively analyze the work process in order to identify shortcomings and make adjustments. Normal labor intensity represents the full use of all knowledge and skills, the physical strength of the worker in conjunction with the achievements of technological progress.

This is the optimal indicator that brings the maximum without causing damage to the psychological and physical condition of the employee.

What is meant by labor intensity according to the Labor Code of the Russian Federation?

This is done in accordance with Chapter 21 of the Labor Code of the Russian Federation and collective agreements, which establish the procedure and accrual system.

Based on practice, bonuses are most often awarded to employees working on production lines and employed in industries with difficult or hazardous working conditions.

The procedure and conditions for calculating intensity bonuses are specified in collective agreements of organizations. a list of jobs for which bonuses are provided;

We record incentive payments not established by the Labor Code of the Russian Federation

Traditionally, payments are divided into the following: - for intensity and high performance results; — for length of service and length of continuous work; - for the quality of the work performed.

In practice, there are other types of incentive payments, for example, for a healthy lifestyle, professional development, etc.

It should be noted that, along with the system of material incentives, it would be very useful to provide, if possible, an alternative (additional) option for non-material incentives, which pursues several goals.

On the one hand, non-material incentives will save money, on the other hand, it will provide an opportunity to “thank” those departments and those employees for whom large wage funds are not provided.

Step 1. Add a condition to the internal labor regulations (ILR)

Work intensity bonus

Additional payments from the fund for individual assignments 5.3.2.1.

The head of a department may entrust an employee, with his written consent, with an individual task in the following cases: - performing, along with the work specified in the employment contract, the duties of a temporarily absent employee due to temporary disability, being on vacation, a business trip lasting at least 4 days.

− temporary combination of professions/positions; − expansion of service areas; − increase in the volume of work. 5.3.2.2. The fund for individual assignments is calculated at 1% of the payroll of each structural unit.

Bonus for intensity and high performance results

The conditions and procedure for paying bonuses are established within the framework of the general wage system at the enterprise by a collective agreement and/or local regulations (Part 2 of Article 135 of the Labor Code of the Russian Federation). In Order No. 818, an allowance is provided for 2 reasons: for the intensity of work and high results (this also includes an allowance for increasing the volume of work).

In this case, it is quite possible for one person to be paid an incentive on both grounds at the same time.

Note: there is an opinion that the bonus for intensity and high results is established for no more than 1 calendar year and is assigned only to highly qualified employees.

This is not true, since each employer has the right to independently determine who gets what bonuses and what criteria to use to assign them.

The first step is to draw up a memo or memorandum from the immediate superior of the distinguished employee.

Labor intensity

five categories of work severity, normalization of intensity to an acceptable level (0.9) forms an actual severity coefficient of 0.110, which corresponds to the fourth category of work severity.

The relationship between the intensity and severity of labor indicates that in favorable conditions the intensity and productivity of labor can be significantly increased without harm to human health. In unfavorable conditions, labor intensity can be increased only within certain intervals.

The increase in the coefficient of actual severity of labor is taken into account when establishing appropriate additional payments to the tariff rate for unfavorable conditions and intensity of work. Thus, additional payments depending on the category of the importance of labor range from 4 to 24% of the tariff rate of additional payment depending on the share of active time in operational time and the actual coefficient the severity of work is set in the range of 5-20% of the tariff rate. As a result, workers performing work of the sixth category of severity with a severity coefficient of 0.125 points / min and an active work employment rate of 0.9-1.0 are set additional payments in the amount of 42-44% of the tariff rate. rates;% tariff rate.

Additional payment for the intensity and intensity of work for an employee

By order of the head of the educational institution, the previously established amount of the bonus may be reduced to the employee or its payment may be stopped before the expiration of the period specified by the order in the following cases:

- untimely execution of tasks, deterioration in the quality of work;

- violations of labor discipline;

- lack of funds for these purposes.

The manager must issue an appropriate order regarding this, indicating the grounds for canceling or reducing the amount of the bonus and familiarize the employee with it against signature.

Remember also: allowances for the head of an educational institution and his deputies are established by a decision of a higher organization within the limits of available funds for wages (para.

2 p.p. 5 p. To receive a bonus for an academic degree, the employee must submit to the employer an application (addressed to the manager) in any form indicating the availability of an academic degree and attaching documents confirming this information (in simple copies). 7.3.

Advisor

It must indicate: what the additional work consists of, its content and the period in which it will have to be performed; the period during which the citizen will work under new conditions.

Based on the concluded agreement, the employer will issue an order on the temporary performance of additional duties, with which the employee should be familiarized with signature. Below is a sample order for additional payment for increasing the amount of work.

Source: https://pallada-sar.ru/doplata-za-intensivnost-i-naprjazhennost-truda-46046/

Payments to teachers and university professors

Teacher's income consists of 2 parts:

- Salary.

- Incentive payments.

According to the established rules, the wage fund must be at least:

- for teachers at universities – 60%;

- for everyone else – 70%.

The grounds for payments and decisions on incentive payments themselves should be established by local acts of institutions:

- collective agreements;

- organizational documents;

- agreements.

These documents are coordinated with representatives of the local Education Department and the Trade Union Committee. The administration is obliged to inform all employees about the results and decisions made.

In many institutions, a teacher’s work is assessed based on a point system.

Stimulating the work of health workers

The process of rewarding medical workers is described in Resolution No. 583, issued in August 2008. According to it, in addition to the base, which is the salary, health workers are entitled to the following types of payments:

- stimulating;

- compensation;

- social.

Payments of allowances to military personnel

Using legislative norms, administrations of medical institutions have the right to independently make decisions and create a list of remunerations for their employees, which is fixed by local documents.

Intensity bonus

Additional payment for additional work and high achievements is part of the salary and is stimulating in nature (Part 1 of Article 129 of the Labor Code of the Russian Federation). It should be noted that in the wording we set out in the Labor Code, this payment is not mentioned. Where did this term come from?

Like many concepts not disclosed by law, the name in question was introduced by by-law. In particular, it is found in the Order of the Ministry of Health and Social Development of Russia “On approval of the list of types of payments...” dated December 29, 2007 No. 818 (hereinafter referred to as Order No. 818).

The conditions and procedure for paying bonuses are established within the framework of the general wage system at the enterprise by a collective agreement and/or local regulations (Part 2 of Article 135 of the Labor Code of the Russian Federation).

In Order No. 818, an allowance is provided for 2 reasons: for the intensity of work and high results (this also includes an allowance for increasing the volume of work).

In this case, it is quite possible for one person to be paid an incentive on both grounds at the same time.

Note: there is an opinion that the bonus for intensity and high results is established for no more than 1 calendar year and is assigned only to highly qualified employees. This is not true, since each employer has the right to independently determine who gets what bonuses and what criteria to use to assign them.

How to arrange an additional payment for the intensity of work and its additional volume, an example of a service letter for an employee

The first step is to draw up a memo or memorandum from the immediate superior of the distinguished employee. It is compiled either in the form established by the enterprise, or in any form. The note must be accompanied by supporting documents on the basis of which the decision will be made, as well as the amount of the premium if approved.

A memo of this kind looks something like this:

To the Director of Mineral LLC

from the head of the planning department

Strelova V.I.

November 20, 2020

Service memo

I hereby bring to your attention that based on the results of work for November 2020, Trofimov Igor Petrovich, senior employee of the planning department, achieved the following results:

- preparation of the land assessment plan for 2020 was completed 14 days ahead of schedule;

- As a result of this plan, assessment costs were optimized and reduced by 20% of the expected.

In this regard, I believe it is possible to implement a bonus for intensity and high results in November 2020.

Appendix: land assessment plan for 2020.

Head of the OP: (signature) V.I. Strelov.

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

After reviewing the submitted note and the documents attached to it, subject to confirmation of the information received, the head of the organization issues an order to accrue the allowance.

The bonus can be issued in a fixed amount or as a percentage of the salary. The size is not normatively limited. In addition, by decision of the management of the enterprise, additional payments can be made either at a time, systematically or over a period of time.

What is meant by intensity and high results? Each organization, when introducing these additional payments, determines the essence of these terms. Also, criteria are independently established by which the levels of intensity and results of a particular employee’s work will be measured (the size of the bonus will also depend on them).

Sample order for additional payment for intensity and increase in the volume of work performed

The form of the order for additional payment is determined by the employer independently. However, it is important to understand that an order, unlike a memo, is a primary accounting document, since it reflects the economic activities of the enterprise, and therefore must contain a number of mandatory details (Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402- Federal Law):

- name of company;

- date of issue of the order;

- document's name;

- last name, first name, patronymic and position of the person in respect of whom the operation is being carried out;

- the essence of the operation and monetary measurement;

- basis of the order;

- manager's signature;

- place for the worker’s signature confirming the fact of familiarization with the document.

The completed order is sent to the accounting department to calculate the premium.

The document looks something like this:

Society with limited

responsibility of "Mineral"

November 25, 2020

Order

bonus for intensity and high performance results

Trofimov Igor Petrovich, senior employee of the planning department, for performing work above the plan in a shorter period of time in accordance with clause 1.3 and clause 1.7 of the regulations on remuneration at Mineral LLC dated 02/01/2010, to pay an increase in November 2020 in the amount of 100 % of salary for work intensity and 50% of salary for high results.

Source: https://nec-it.ru/nadbavka-za-intensivnost/

Who evaluates the results of the work?

As a rule, the intensity and results of work are assessed by higher authorities and issues of bonuses for subordinates are under their jurisdiction.

This issue is regulated by the bonus regulations set out in the organization’s charter.

The bonus regulations must indicate the persons who will keep records and evaluate the final results of work, and as a result, make a decision on the payment of bonus incentives (and forward it to senior management for approval).

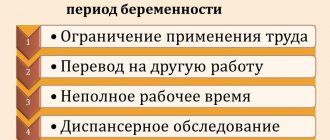

Allowance for hard work: who is due and how to get it?

Along with the employee’s salary, he may receive additional official accruals.

As a rule, they are designed to encourage some personal professional achievements, compensate for special working conditions, or stimulate the employee, making him want to work more fruitfully and improve his skills. One of these types of payments includes bonuses and allowances.

There is also the concept of surcharge, which is somewhat different in essence. Let's consider what exactly and for what additional charges included in the salary are due.

General concepts about remuneration

According to Article 129 of the Labor Code of the Russian Federation, for his work an employee receives remuneration depending on his professional abilities, the nature and characteristics of the work done, as well as the availability of additional payments depending on its conditions.

All remuneration received by an employee can be broadly divided into fixed and variable categories. The constant part includes directly the monthly salary and the coefficient established by the state for various regions.

What is variable pay includes additional payments, bonuses and allowances. All this is calculated individually for each employee, and is often determined by working conditions or the employee’s qualifications. Some of the payments are guaranteed by the government and are mandatory for specific types of institutions.

The level of others is assigned directly to the enterprise, although compliance with these additional payments is also controlled by the state. In some cases, the rights of organizations provide for the possibility of regulating the amount of this additional profit for employees.

Important! An employee’s salary is established upon concluding an employment contract with him, and its size, the system of additional payments and the calculation of bonuses are fixed by the current regulations of the enterprise and collective agreements.

Among the variable surcharge category, there are two types of possible additional charges.

By their nature they stand out:

- Incentive payments. They are designed to encourage the employee, to motivate him to improve his ability to work and improve his professional skills. This can be either a bonus for a successfully launched project or additional encouragement for personal skills and specific merits. Additional pay for work experience or having an academic degree also falls into this category.

- Compensation payments. They are used to level out deviations from normal operating conditions. Such additional payments do not impose additional responsibilities on the employee other than those specified in the employment contract.

The amount of the bonus, and this is most often an incentive type of payment, is indicated in a specific form in the staffing table. Moreover, it can be appointed either for a specific period or on an ongoing basis, or it can be absent altogether.

The conditions for its availability must certainly be specified in the employment contract, where they can be present both directly and with reference to the local regulatory documents of the enterprise.

Attention! If an employee is entitled to a bonus, then he must receive it exactly in the amount and for the period that is recorded in the staffing table.

Supplements do not always have the same status. Some are mandatory for payment and are fixed in an exact numerical amount. But there is a limitation only by the maximum threshold value, and the need to accrue them rests with the employer.

Article 135 of the Labor Code of the Russian Federation allows an organization to independently establish additional payments if they are not clearly established at the legislative level. All this must be recorded in the internal regulations of the enterprise, collective and personal employment contracts.

It is also required to describe in these documents the procedure by which the bonus is calculated for working employees, defined as a percentage of the monthly tariff rate. If such additional payments are used, their size must be adjusted when the monthly salary changes.

If the enterprise has a summarized recording of labor time, then compensation for deviations from the normal work procedure will be calculated for the period that is defined as accounting. That is

, when employees work in shifts, and the summation is carried out for a quarter, then the determination of the standard working time will be calculated not for a week or a month, but for this very quarter.

In this case, the additional payment for overtime is determined based on the difference between normal and actually worked hours in total.

Attention! If an employee is entitled to a bonus, then he must receive it exactly in the amount and for the period that is recorded in the staffing table.

Payment of bonuses and other required additional accruals is not interrupted during the next vacation or other situations when the employee must retain his earnings.

Extra pay for difficult work

There are certain compensating or incentive bonuses that are awarded depending on the special conditions and intensity of work.

Examples of reasons for payment include:

- intense work;

- overtime work, work on holidays and weekends;

- shift method;

- night work;

- activities in the Far North;

- work in conditions harmful to health.

Each of these points has its own characteristics, definitions and procedure for calculating compensation. You can find out whether there will be a bonus for working until 12 midnight by looking at the Labor Code.

It regulates that this criterion includes the time period from 22:00 to 6:00. Each such hour must be paid at an increased rate.

But how this will be expressed in monetary terms is determined by the employer’s local documents.

Important! If any additional payment is required according to state labor standards, then its application should extend to organizations of any form of ownership and management.

When it comes to setting a premium for the complexity and labor intensity of the process, you should understand what definition characterizes them. Work intensity is the degree of intensity required to obtain the best performance results.

How to obtain unemployed status?

At the moment, there are no clear standards established by law that regulate the premium for work that involves dynamics and the degree of complexity of the process.

All this must be described in the employer’s local documents or collective agreement.

If such an additional payment is due to an employee, then its amount must be indicated in the documents, most often in the form of a reference to the enterprise’s regulatory act on the amount of payments.

The recommendations of the Ministry of Labor state that the terms of any incentive bonuses should be specified in the employment contract.

In addition to the permanent additional payment for the special nature of the work or its intensity, the employee may also be issued a one-time bonus based on the same criteria. This will be a percentage premium or an amount of absolute value, but a one-time action for a certain period.

For example, an employee can receive an additional 15% of his monthly salary for one six-month period. Moreover, a bonus for hard work is not given to employees who receive a permanent bonus for the same reason.

Attention! If an employee is entitled to a bonus, then he must receive it exactly in the amount and for the period that is recorded in the staffing table.

Although an organization or enterprise is obliged to independently regulate the procedure and amount of additional payments possible in its state, it is obliged to focus on the standards established by state law.

Extra pay for overtime work

If the employee has written consent, he may be involved in overtime work.

Article 99 of the Labor Code of the Russian Federation clearly defines possible situations for this:

- prevention of industrial accidents;

- elimination of circumstances that negatively affect the means of communication and life support of society;

- actions that are extremely important for the defense of the country;

- the need to complete work that was not completed on time due to unforeseen circumstances;

- absence of a replacement at the workplace when production does not involve stopping;

- the demand for temporary work to eliminate downtime for a large number of workers.

In all these cases, additional hours worked are entered into the working time sheet.

According to Article 152 of the Labor Code of the Russian Federation, the bonus for overtime work is calculated as follows:

- the first 2 hours worked in excess of the norm give an amount with a coefficient of 1.5;

- for subsequent hours – the minimum coefficient is 2.

To receive such payments, an appropriate order must be issued in advance.

Attention! If an employee is entitled to a bonus, then he must receive it exactly in the amount and for the period that is recorded in the staffing table.

To understand exactly how your work is paid, you need to carefully study the provisions of the employment contract and the regulations of the enterprise, because by signing the document, you agree with all the conditions described in it, including those regulating monetary bonuses.

Source: https://1st-urist.ru/trudovoe-pravo/nadbavka-za-napryazhennyj-trud.html

Additional payment for work intensity

June 21, 2020 at 10:40 am The concepts of allowances and additional payments are not clearly differentiated in the law, however, understanding the difference and consolidating them at the enterprise level is extremely important for both the employee and the employer.

Related articles Table of contents If you find an error in the text, please let us know by highlighting it and pressing Ctrl+Enter. The most important components of an employee's salary, in addition to the base salary (), are allowances and additional payments.

The law did not specify the differences between the concepts of “surcharge” and “surcharge”.

The by-laws also did not clarify this issue.

Additional payments and allowances - additional remuneration for employees

Based on Art.

135 of the Labor Code of the Russian Federation, wages are established for the employee by an employment contract in accordance with the current employer’s remuneration system. It is calculated based on the size of tariff rates, salaries (official salaries), additional payments and allowances. At the same time, various questions arise to which it is quite difficult to find unambiguous answers in the regulatory framework.

Incorrect calculation of additional payments and allowances leads to disagreements with the inspection authorities. 149 of the Labor Code of the Russian Federation, when performing work in conditions different from normal, the employee may be provided with additional payments of a compensating nature, provided for

Allowances and surcharges: application procedure

At the legislative level, the procedure for applying additional payments and allowances to an employee’s wages is regulated by Chapter.

Bonuses, as a rule, mean incentive payments that are awarded for specific merits or characteristics of an employee.

The purpose of such bonuses is to reward employees for high professional qualities and to make them want to improve further. However, there are allowances that do not fit into this definition and are more of a compensatory nature. They are designed to reduce staff turnover in jobs with special working conditions.

Establishment of allowances and additional payments to employees

In accordance with Art. 15 of the Law on Remuneration, self-supporting enterprises independently establish the conditions and amounts of remuneration, including a list of allowances and additional payments, in a collective agreement in compliance with the law, general and industry agreements.

P.); high-quality (providing additional incentives for advanced training, professional excellence, high sustainable labor results, etc.)

Additional payment for work: what you need to pay employees for above what they are supposed to

At the level that the state regulates, the methodology and rules for the use of additional payments and allowances as employee incentives are determined by Ch.

21 Labor Code of the Russian Federation. But in practice a lot of questions arise on this topic. Mainly due to the fact that some remunerations are regulated and established by law, while others require an official order from the employer. You will learn:

- What you need to know about surcharges and allowances

- How much to pay staff for night work, overtime and intensity

- How overtime work, traveling activities and work in the Far North are regulated

- Do I need to pay extra for an increased amount of work and for working on a computer?

- What additional payment is due to employees when working on weekends and holidays?

In the process of assessing payment for work by a company, it is the division of salaries into constant and variable that is of great importance.

OTHER PAYMENTS TO EMPLOYEES

6.1. The employer also undertakes to pay employees severance pay and other compensation payments in cases and in the manner established by the legislation of the Russian Federation.

7. EMPLOYER'S RESPONSIBILITY

7.1. For delays in payment of wages and other violations of wages, the employer is liable in accordance with the labor legislation of the Russian Federation.

7.2. In case of delay in payment of wages for a period of more than 15 days, the employee has the right, by notifying the employer in writing, to suspend work for the entire period until the delayed amount is paid.

How to register bonus for work intensity for drivers

It is important to continuously monitor the labor intensity indicator for compliance with the standard in order to promptly respond to deviations in an appropriate manner.

Allowance for labor intensity At manufacturing enterprises, there is a practice of charging additional payments for certain merits, which may be provided for by labor legislation or internal rules. Thus, a bonus for labor intensity is quite common. According to the collective agreement, it can reach 50% of wages.

This issue is regulated by the Labor Code in the section regulating issues of payment, standards, additional payments and allowances. In this case, the form and accrual system is established directly by the enterprise.

At enterprises and organizations in the commercial sphere and in organizations that are not financed from the budget, the amount of monthly wages (including the amount of tariff rates per month) is established by agreement between the employer and the workforce in a collective agreement or other acts regulating payment issues being developed labor at the enterprise, or directly by agreement between the employer and the employee. Moreover, in all cases, the amount of monthly wages (excluding bonuses, additional payments and allowances) for fully worked working hours per month in accordance with the Labor Code of the Russian Federation must be no less than the minimum monthly wage.

Productivity and labor intensity. bonus for work intensity

First of all, the management of the enterprise, as well as a special certification commission, must assess the working conditions of each individual category of workers.

In accordance with the research results, a list of positions is determined that are entitled to receive an appropriate bonus in the event of an increase in labor intensity.

Thus, benefits are most often provided to people working on production lines, as well as those employed in complex or hazardous industries.

The collective agreement reflects the following points:

- a list of preferential jobs that are subject to payment of bonuses;

- results of professional activity that must be achieved to receive a bonus;

- the procedure and amount of payment is indicated.

The procedure for paying bonuses must also be confirmed by relevant orders.

Personal bonus to official salary

Sample order for additional payment for intensity and increase in the volume of work performed. The form of the order for additional payment is determined by the employer independently.

However, it is important to understand that an order, unlike a memo, is a primary accounting document, since it reflects the economic activities of the enterprise, and therefore must contain a number of mandatory details (Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402- Federal Law):

- name of company;

- date of issue of the order;

- document's name;

- last name, first name, patronymic and position of the person in respect of whom the operation is being carried out;

- the essence of the operation and monetary measurement;

- basis of the order;

- manager's signature;

- place for the worker’s signature confirming the fact of familiarization with the document.

The completed order is sent to the accounting department to calculate the premium.

Remuneration of drivers of trucks and ordinary cars

Important

If the bonus coefficient is approved in the collective agreement and is a great lever for motivating work, then the fixed bonus amount can vary each reporting period and depends on the decision of the head of the enterprise (division).

The driver's category depends on the vehicle he is driving and the specifics of the vehicle's operation.

The awarded category directly affects the salary, since the tariff rate for a certain type of transport service is developed according to the corresponding category.

The classification of drivers (upgrade or downgrade) is determined at the enterprise by a qualification commission, which carries out the appropriate certification. The decision to assign a class is approved by an order for the enterprise, and a corresponding entry is also made in the employee’s work book by an authorized person.