Journal of transactions with accountable persons (form code 0504071)

The journal of transactions with accountable persons (f. 0504071) is used to reflect transactions with accountable persons of the institution (cash flow, acceptance of documented expenses of the accountable person).

Entries in the Journal of transactions of settlements with accountable persons (f. 0504071) are reflected on the basis of Advance reports approved by the head of the institution, primary (consolidated) accounting documents confirming the receipt (return) of funds by the accountable person, and other documents documenting transactions for these settlements.

For each line of the column “Name of Indicator” of the Journal of Payments with Accountable Persons (f. 0504071), the name of the accountable person, his initials, the amount of money issued (advance, compensation for accepted overexpenditure), the amount of expenses according to the approved Advance Report, the amount returned by the accountable person are recorded (repaid) balance of unused funds (advance).

When reflecting settlements with an accountable person in foreign currency, the next line shows the amount in the currency of the Russian Federation, while in the column “Name of the indicator” there is an entry: “in ruble equivalent.”

Turnovers on transactions reflected in the Journal of transactions with accountable persons (form 0504071) are transferred to the General Ledger (f. 0504072), with the exception of transactions for the issuance and return of accountable amounts, which are reflected in the Journal of transactions on the "Cash" account (f.

╨réўkhєer tkhfuyuyoє№ (╘yuёр яyu ╬╩╙─ 0504402)

Free legal consultation ext. 445, +7(812) 426-14-07 ext. 394 Home Who and when applies the payroll form according to OKUD 0504402 - filling out, sample for downloading The payroll form 0504402 is used to reflect payroll records employees, student scholarships, benefits, other payments (based on agreements with individuals). The amounts of deductions are also recorded here: taxes, insurance premiums, collections according to documents of enforcement proceedings. Dear readers! The article describes typical situations, but each case is unique.

Journal of settlements with suppliers and contractors (form code 0504071)

The journal of settlements with suppliers and contractors (f. 0504071) is formed by suppliers and contractors and is intended for analytical accounting of settlements made with them.

Entries in the Journal of settlements with suppliers and contractors (f. 0504071) are made on the basis of primary (consolidated) accounting documents confirming the institution’s acceptance of monetary obligations to suppliers (contractors, performers), other parties to contracts (agreements), as well as primary (consolidated) accounting documents confirming the fulfillment (repayment) of accepted monetary obligations.

In the column “Name of indicator” of the Journal of settlements with suppliers and contractors (f. 0504071), the names of creditors (suppliers, contractors, executors, other creditors) are recorded.

The General Ledger (f. 0504072) transfers the turnover of transactions reflected in the Journal of settlements with suppliers and contractors (f. 0504071) with the exception of transactions for payment (fulfillment, repayment) of obligations to creditors, which are reflected in the corresponding Journal of transactions (f. 0504071).

Journal of wage settlement transactions (form code 0504071)

The journal of wage settlement transactions (f. 0504071) is compiled by the institution on the basis of a set of Payroll Sheets (Payroll Sheets) with the attachment of primary documents: Work Time Sheets, orders (statements) on enrollment, dismissal, transfer, vacations (for full-time employees ); documents confirming the right to receive state benefits, pensions, payments, compensations.

A set of statements is compiled separately for transactions from various sources of financial support.

The General Ledger (f. 0504072) transfers the turnover of transactions reflected in the Journal of transactions for payment of wages (f. 0504071), with the exception of payment (transfer) transactions, which are reflected in the corresponding Journal of transactions (f. 0504071).

Payroll 0504402 with a breakdown of accruals for zkgu 3

Download the current payroll form according to OKUD 0504402 for budgetary organizations - excel. Conclusions Monthly payment for labor activities of employees of budgetary institutions is made using the accounting payroll form (0504402) and is compiled for the transfer of salaries to plastic cards.

Cash is issued according to a payroll in form 0504403 or according to other forms provided for in an agreement with a credit institution. In this document, the accounting employee only carries out payroll calculations for employees.

The form is used as the basis of the Payroll. Didn't find the answer to your question in the article? Get instructions on how to solve your specific problem.

Journal of transactions on disposal and transfer of non-financial assets (form code 0504071)

The journal of transactions on the disposal and transfer of non-financial assets (f. 00504071) is used by the institution to record transactions on the disposal and transfer of non-financial assets (fixed assets, intangible, non-produced assets, inventories) as well as transactions to reflect transactions based on depreciation amounts, including number accepted for accounting, accrued for the month.

Entries in the Journal of transactions on disposal and transfer of non-financial assets (f. 0504071) are made on the basis of primary (consolidated) accounting documents corresponding to the accounting objects.

In the column “Name of the indicator” the last name, first name and patronymic of the financially responsible person of the institution are indicated.

1 … 86 87 88 89 90 91 92 93 94

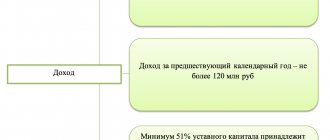

budgetary and autonomous institutions

The data of the primary accounting documents verified and accepted for accounting are systematized in chronological order (according to the dates of transactions, the date of acceptance of the primary document for accounting) and are reflected in a cumulative manner in the following accounting registers (clause 11 of Instruction No. 157n, Appendix No. 5 to the Order of the Ministry of Finance of Russia N 52н):

— Journal of transactions on the “Cash” account (f. 0504071);

— Journal of transactions with non-cash funds (f. 0504071);

— Journal of settlement transactions with accountable persons (f. 0504071);

— Journal of settlements with suppliers and contractors (f. 0504071);

— Journal of transactions with debtors for income (f. 0504071);

— Journal of settlement transactions for wages, salaries and scholarships (f. 0504071);

— Journal of transactions on disposal and transfer of non-financial assets (f. 0504071);

— Journal for other transactions (f. 0504071);

— General ledger (f. 0504072);

- other registers provided for by Instruction No. 157n, as well as approved as part of the formation of its accounting policies.

If necessary, an institution has the right to independently develop additional forms of accounting registers, for which the legislation of the Russian Federation does not establish mandatory document forms for their execution, and approve them in its accounting policy.

In this case, the accounting register must contain the following details (Part 4, Article 10 of Federal Law No. 402-FZ, Clause 11 of Instruction No. 157n):

1) name of the register;

2) the name of the accounting entity that compiled the register;

3) the start and end date of maintaining the register and (or) the period for which the register was compiled;

4) chronological and (or) systematic grouping of accounting objects;

5) the amount of monetary and (or) natural measurement of accounting objects, indicating the unit of measurement;

6) names of positions of persons responsible for maintaining the register;

7) signatures of the persons responsible for maintaining the register, indicating their surnames and initials or other details necessary to identify these persons.

Entries in transaction logs and other accounting registers are made as transactions are performed, but no later than the next day after receipt of the primary (consolidated) accounting document. In terms of transactions on off-balance sheet accounts, the transaction is reflected, depending on the nature of changes in the accounting object, by a record of the receipt (increase) or disposal (decrease) of the accounting object. Accounting registers are signed by the accountant responsible for its formation. The correctness of reflection of business transactions in accounting registers according to the primary accounting documents submitted for registration is ensured by the persons who compiled and signed them.

At the end of the month, data on account turnover from transaction journals and other accounting registers must be transferred to the General Ledger, and primary (consolidated) accounting documents related to the relevant transaction journals must be selected in chronological order (by dates of transactions, date of acceptance to the accounting of the primary document) and bound together.

The cover of the transaction log indicates (clause 11 of Instruction No. 157n):

— name of the subject of accounting;

— name and serial number of the folder (case);

— period (date) for which the accounting register (Journal of Transactions) was formed, indicating the year and month (date);

— name of the accounting register (Journal of Operations), indicating its number if available;

— the number of sheets in the folder (case).

The formation of accounting registers is carried out in the form of an electronic register, and in the absence of technical capabilities - on paper.

The formation of accounting registers on paper is carried out at the frequency established within the framework of the formation of accounting policies, but not less than the frequency established for the preparation and presentation of budget (financial) statements generated on the basis of data from the accounting registers.

When transferring accounting registers to paper media, it is allowed that the output form of the document differs from the approved form of the document, provided that the details and indicators of the output form of the document contain the mandatory details and indicators of the accounting registers (clause 19 of Instruction No. 157n).

When storing accounting registers, they must be protected from unauthorized corrections (clause 14 of Instruction No. 157n).

In case of discovery of the loss or destruction of accounting registers, the procedure for the actions of officials is similar for cases of loss of primary documents (for more details, see

General rules for drawing up an advance report form

Federal legislation establishes that a company can independently develop an advance report form. The main condition for this is the presence of mandatory details in the document.

Namely:

- advance report number;

- date of advance report;

- Company name;

- advance amount;

- amount spent;

- list of documents attached to the advance report.

Legal entities can use form AO-1, the use of which was mandatory in previous periods.

The advance report can be prepared in the traditional way, i.e. documented (by hand or on a computer). The main condition is the presence of personal signatures of officials.

It can also be submitted electronically. Such a document is signed using digital signatures of officials. The latter option is possible if the company has an electronic document management system.

The manager, when deciding to issue funds, must sign the corresponding order. When filling out the advance report form, you must check that the line “Advance payment assignment” repeats the wording specified in the order of the head of the company.