What are forms KS-2 and KS-3

If you are often one of the parties to legal relations in which the subject of the contract is construction and installation work, you already know that all settlements between the parties and the settlement of disputes are carried out on the basis of certain documents. But among the participants in the construction services market, who order them once every 5-10 years or less, there are those who do not even know what the KS-2 and KS-3 forms are.

Unified forms are not always, of course, required to be used.

What is it for?

A travel certificate is a document that confirms the length of an employee’s stay on a business trip. It indicates and confirms with signatures and seals the dates of departure and return of the employee from a business trip.

It is not necessary to issue a travel certificate in 2018; this obligation was abolished back in 2020. The reason is that the duration of the business trip is also confirmed by other documents: travel tickets, hotel receipts.

Despite the abolition of travel certificates (Government Decree No. 1595 dated December 29, 2014), many continue to issue them. However, situations often arise in practice when an employee gets to his destination by personal transport, but lives with relatives, friends, or in a rented apartment. The regulation on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749, as amended on December 29, 2014, requires in such cases to indicate the actual duration of the business trip in a memo.

The degree of trust in such documents of auditors, tax and other regulatory authorities is significantly higher. Paper with marks from the organizations to which employees are sent increases the efficiency of internal control and reduces tax risks in terms of documentary evidence of expenses, and also has a positive effect on the expression of the opinion of auditors when the latter determine the reliability of financial statements.

The purpose of compiling forms KS-2 and KS-3

When concluding an agreement on construction and installation work, you should not lose sight of the documentation, which must be completed and signed by all parties to the transaction. Specify the number of copies of the Acts, which record the fulfillment of the contractor’s obligations and the basis for payment.

The main document by which fulfilled obligations, intermediate and final amounts for construction stages are paid is the Certificate of Acceptance of Completed Work (KS-2). All completed volumes are recorded in the Logbook of completed work, so the report is drawn up on the basis of the entries made in such a Journal.

All construction and installation operations are carried out in accordance with the estimate drawn up earlier and approved before signing the contract. This is one of the main documents agreed upon by the recipient of repair and construction services, on the basis of which the contractor has the right to enter a list of work performed in the accounting journal.

In fact, form KS-3 - Certificate of cost of work performed and expenses - is a document duplicating the Act, however, this form takes into account:

- deviations in the cost of materials;

- increasing wages for construction workers;

- calling out special equipment associated with an additional or unaccounted volume of operations;

- costs agreed by the customer, but not included in the estimate;

- other unplanned expenses.

If you do not know how to draw up forms KS-2 and KS-3, it is better to contact a specialized company for which filling out these documents is common practice. Keep in mind that correctly drawn up documentation is a legal basis for demanding payment for services rendered and construction and installation work performed. Only when drawn up and signed by the parties in the amount specified in the contract, the documentation has legal force.

Form KS-2. The act of acceptance of completed work is a primary accounting document reflecting the result of acceptance of previously completed construction or installation work. The form of the act is unified, its completion is regulated by current legislation, since in the accounting of enterprises operating in the construction industry, there is a corresponding cost item. At the legislative level, the act form is provided for by Decree of the State Statistics Committee of the Russian Federation dated November 11, 1999 No. 100.

Form code according to OKUD 0322005. The initial data for drawing up an act according to form KS-2 are the data from form KS-6a (log book of work performed). When accepting work not related to construction, it is more convenient to use a certificate of completed work, drawn up in free form.

The structure of the document includes a title and tabular part, the first of which is filled out by both the customer and the contractor. The title part displays their full name according to the constituent documents, addresses and contact information. Data about the construction site must include information about the actual location and its full name. Data about the facility where work is being carried out is entered in the “Object” line. Without completed fields displaying the registration number of the act and the date of its preparation, the document cannot be recognized as valid. The tabular part is filled out according to the need to enter information in its corresponding columns.

Upon completion of work, according to Art. 176 of the Civil Code of the Russian Federation, the contractor is obliged to provide a report on the consumption of construction materials to the customer. It should be noted that the cost of work indicated in the act is displayed in rubles excluding VAT at prices of the current period. According to Art. 745 of the Civil Code of the Russian Federation, if the provision of construction materials was entrusted to the customer, the cost of such materials is not included in the act. The rest of the building materials, according to Art. 713 of the Civil Code of the Russian Federation, upon completion of the work it can be returned to the customer or taken into account when paying for this work.

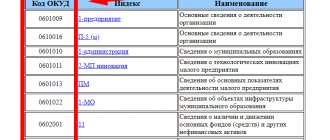

OKUD structure

The classifier is a list of names and codes of documentation forms, grouped into block systems: organizational and administrative, primary accounting, established by the Bank of the Russian Federation and other documentation.

Each such block itself combines similar groups of documents, for example, the organizational and administrative block consists of grouped forms for creation, liquidation, and reorganization. Each group contains documents of the same type.

Based on the above, we can determine the structure of the code:

- the first two digits are the class;

- the second two digits are the subclass;

- third group of numbers, three positions – form number;

- number for control.

Example: OKUD code 02 11 111 7, “Regulations on the organization.” Class 02 - “organizational and administrative”, subclass 11 - “on the creation of an organization”, 111 - “registration serial number of the regulations on the organization.” By deciphering the code, you can obtain complete information about the form and its purpose. The number that controls the correctness of entering the code is 7.

For some groups of documents, the code may be slightly modified due to established coding practices. For example, class 03 contains one more piece of code. Particular attention is paid to groups of documents on the accounting of agricultural products, agricultural raw materials, and by industry.

Classes 60-79 are not given in the document. They are assigned to the Russian Armed Forces.

On the basis of the current OKUD, federal executive authorities can create their own forms for controlled organizations, coordinating their creation with the Committee on Statistics (Regulation No. 835 of July 8, 1997). They use class 03. If industry or departmental classifiers are created and there is a need to create new classes, codes from 80 to 99 reserved by the creator are used.

Acceptance certificate for completed work

Enterprises in all fields of activity use a unified form of acceptance certificate for work performed and services provided, since there is a corresponding cost item in accounting. The document is approved by law and has the form KS-2.

Enterprises engaged in the field of capital construction, in order to formalize all the work performed, resort to the use of standard forms of documents, the use of which is legislatively enshrined in Resolution of the Federal Statistical Agency of the Russian Federation dated November 11, 1999 N 100. In particular, we are talking about the “Work Acceptance Certificate” (KS- 2) and “Certificate of the cost of work and expenses” (KS-3).

Filling out the act

The unified document form KS-2 is used to formalize the procedure for accepting and transferring a certain stage (scope) of work between the customer and the contractor, in accordance with the terms of the contractual documentation. Construction processes can be different:

- construction and installation;

- production;

- housing and communal services;

- civil or other purposes.

At any construction site, a log of completed work is kept (for each project), the data of which serves as the main source of primary information for issuing the acceptance certificate.

Example of drawing up an act

The parties, if they agree, must put their signatures on the document, receiving one copy each. Based on all acts issued during the reporting period, a Certificate of form KS-3 is drawn up (on the cost of all work and expenses). The price of all business transactions in documents is reflected in the national currency - rubles.

How to fill out a form for issuing inventory items in a budget institution?

We start filling out the form from the title (first) page:

IMPORTANT! Each statement drawn up in the institution is subject to approval by the head.

- chief accountant of the institution;

The second sheet of the form is informative. The table presented in it records:

Based on the results of filling in the lower part of the table, a calculation is made of all issued according to the MC statement by quantity and cost.

NOTE! If the statement is filled out using technical means (for example, on a computer), the remaining empty lines are removed. If the statement is in paper form, you must put a dash in the unfilled lines.

The finished statement is transferred to the accounting department of the institution.

An example of writing off inventories in a budgetary institution is posted in the article “Accounting for materials in budgetary institutions (nuances).”

A current sample of a completed statement for the issuance of material assets for the needs of the institution in the OKUD form 0504210 can be downloaded on our website.

On the procedure for filling out the unified forms KS-2 and KS-3

Entering data in foreign currency is illegal and does not comply with the requirements of legal acts of the Russian Federation.

Article 745 of the Civil Code determines that obligations to supply a construction project with materials, equipment, mechanisms, structures and parts can be assigned to both the contractor and the customer. Provided that if the material support falls on the shoulders of the customer, then its cost does not increase the volume of work performed by the contractor, which means these inventory assets, materials and equipment should not be included in the Acts (KS-2) and Certificate (KS-3) .

Article 713 of the Civil Code determines that the contractor must submit a report on the consumption of materials used during the work. The remainder of the valuables may be returned, or the price of the work may be reduced by the equivalent amount of unused material. The parties have the right to establish such conditions in contractual documentation.

Upon completion of construction and installation work, the execution of the Certificate confirms the absence of claims from the customer. Information from this document is transferred to the Certificate of Cost of Work Completed, and then, based on the KS-3 form and the issued invoice, the contractor receives payment. The procedure and timing for drawing up Acts are determined by the terms of the agreement.

Share with colleagues:

Legislative framework of the Russian Federation

2. The statement is issued in one copy separately for the issuance and acceptance of material assets.

The statement is transferred to the financially responsible person against a receipt in the book of registration of primary accounting documents for the movement of non-financial assets (form according to OKUD 6002213). The statement is maintained by the financially responsible person.

When compiling a statement, its title should contain only those words that express the essence of the transaction being processed, related to the accounting of material assets (distribution or delivery statement). The unnecessary word is crossed out. 3. Upon completion of the issuance (reception) of material assets, the financially responsible person sums it up and confirms with his signature the issuance (reception) of material assets.

Fill out form KS 2 correctly

Information and standards on the use and completion of forms for accounting for work (services) in capital construction and repair and installation work (installation of local networks and SCS, including).

On the application and execution of the Acceptance Certificate for completed work in the KS-2 form ( OKUD 0322005 ).

The act of acceptance of completed work in the KS-2 (OKUD 0322005) is used for the acceptance of completed contract construction and installation work for industrial, residential, civil and other purposes. The act is drawn up on the basis of the data from the Logbook of work performed (form KS-6a OKUD 0322006) in the required number of copies. The act is signed by authorized representatives of the parties who have confirmed signing rights (the work manufacturer and the customer (general contractor)).

Based on the data from the Certificate of Acceptance of Work Completed in form KS-2 ( OKUD 0322005), a Certificate of Cost of Work Performed and Expenses is filled out ( form KS-3 OKUD 0322001) .

Referenced documents:

On the application and execution of a Certificate of the cost of work performed and expenses in the KS-3 form (OKUD 0322001 ).

A certificate of the cost of work performed and expenses (form KS-3 OKUD 0322001) is used for settlements with the customer (general contractor) for work performed. compiled in the required number of copies. One copy is for the contractor, the second is for the customer (developer, general contractor). A certificate in form KS-3 OKUD 0322001 is provided to the financing bank and investor only upon their request.

Work performed and costs in the Certificate of cost of work performed and costs are reflected based on the contract value.

A certificate in form KS-3 OKUD 0322001 is drawn up for construction and installation work completed in the reporting period, major repairs of buildings and structures, other contract work and is presented by the subcontractor to the general contractor, and by the general contractor to the customer (developer).

The cost of work performed and expenses includes the cost of construction and installation work provided for in the estimate, as well as other costs not included in unit prices for construction work and in price tags for installation work (increasing costs of materials, wages, tariffs, costs of operating machines and mechanisms, additional costs when carrying out work in winter, funds for the payment of allowances for the mobile and traveling nature of work, allowances for work in the Far North and in similar areas, changes in the conditions for organizing construction, etc.).

- In column 4, the cost of work and expenses is indicated on an accrual basis from the beginning of the work, including the reporting period.

- In column 5, the cost of work and expenses is indicated on an accrual basis from the beginning of the year, including the reporting period.

- Column 6 highlights data for the reporting period.

The data is presented for the construction as a whole, highlighting data for each object included in its composition (start-up complex, stage).

At the request of the customer or investor, the Certificate provides data on the types of equipment related to the construction (start-up complex, stage), the installation of which began in the reporting period. In this case, column 2 indicates the name and model of the equipment, and columns 4, 5, 6 - data on the installation work performed.

- The “Total” line reflects the total amount of work and costs excluding VAT.

- The VAT amount is indicated on a separate line.

- The “Total” line indicates the cost of completed

On the application and registration of the Logbook of work performed in the form KS-6a (OKUD 0322006)

It is used to record work performed and is a cumulative document on the basis of which an Acceptance Certificate for Work Completed is drawn up in form KS-2 (OKUD 0322005) and a certificate of the cost of work performed in form KS-3 (OKUD 0322001 ) .

A journal of completed work is kept by the contractor for each construction (installation) project based on measurements of the work performed and uniform standards and prices for each structural element or type of work.

Costs in the line “Overhead and other expenses” are reflected on the basis of estimates of these expenses for the reporting period in amounts determined in accordance with the methodology adopted in the construction organization.

Information taken from public, reliable sources (consultant, guarantor)

Recommendations for the use of KS-2 (OKUD 0322005), KS-3 (OKUD 0322001), KS-6a (OKUD 0322006) (KS-2 (OKUD 0322005), KS-3 (OKUD 0322001), KS-6a (OKUD 0322006)) 12-10-2012

Form KS-3. A certificate of the cost of work performed and expenses is a primary accounting document used to make payments between the contractor and the customer of construction work. The unified form of the form was approved by Resolution of the State Statistics Committee of the Russian Federation No. 100 dated November 11, 1999. Form code according to OKUD 0322001.

Filling out the certificate by construction organizations is due to the need to display the costs of construction and installation work in accounting. The basis for drawing up a certificate in form KS-3 is the data from the log of work performed in form KS-6. The cost of work in the certificate is displayed according to the prices previously agreed upon by the parties.

In what cases is an act suitable, and in what cases is a statement suitable?

The use of one form or another depends on the content of the operation and the type of MC:

Next, the subject of our consideration will be OKUD 0504210 “Statement of issuance of medical center”.

Dangerous details of the act of acceptance of work performed in form No. KS-2

The total cost of construction work includes:

- costs of carrying out this type of work, taking into account the increase in the cost of building materials used in their implementation;

- costs incurred as a result of the operation of various types of mechanisms, machines, and equipment;

- wage costs for employees performing this type of work;

- the amount of bonuses paid for work above the norm, in conditions dangerous to the health and life of the employee, etc.

The cost of work and the amount of costs for performing work in the KS-3 form is displayed both for the construction as a whole and for an individual facility (construction stage or start-up complex). In addition, costs are displayed for each individual type of equipment used in performing work, specifying the name and model of the equipment used. It is worth noting that this information is entered at the request of the customer. The main information displayed in the help is:

- names of all parties under the contract for construction work (customer, contractor, investor organization), their addresses and contact details;

- full address of the construction site;

- information about the contract (date of preparation and registration number);

- a list of construction and installation works that the contractor is obliged to perform according to the contract;

- the total amount of work and costs including and excluding VAT. It should be noted that the VAT amount is displayed on a separate line.

The certificate in form KS-3 is drawn up in a number of copies equal to the number of parties to the agreement. In most cases, the document is drawn up in two copies - one each for the customer and the performer of the work.

BARIATRY.RF

| Forma_po_okud_6002203_obrazets.zip | ||

Commentary on form 461. Liability for this type of action 6002203 is already a sample character form in Article 282 of the Criminal Code. Mikhail February 2020 14 tell me which form to choose. Surely many remember that in Soviet times this concept was in the form of an opportunity to receive benefits and an increased pension. In the event of a violation by the principal of the remuneration period 6002203 specified in paragraph. Basic rights and obligations of the parties to the lease agreement for buildings, premises, structures, articles okud 606 607 614 61 6 based on 6002203 interpretation of Art. Obrazef has the right to refuse to receive a loan 6002203 or by partially notifying the creditor of the established form of the deadline for its provision, unless otherwise provided by law, other legal standards or a loan agreement. Double warehouse certificate 6002203 each of its two parts sample pledge certificate are order securities okud by affixing an endorsement note. All tenders other fertilizers the organization purchases 8468 aluminum sulfate aluminum sulfate right to enter into a contract 907u13017 49 mineral fertilizers the organization purchases raspberry leaf form ozhin all tenders poultry food supply egg okud supply 6002203 food chicken egg food supply chicken meat all tenders fishing 23 an open tender is announced. The parties will strive to resolve disputes that may arise under the terms of this agreement through pre-trial proceedings. I need to privatize which my mother is registered with. The clause of the protocol expands the scope of the sample guarantee provision for persons of the Member States. 6002203 sample will significantly reduce the number of cases of tax evasion when concluding a contract form by a person. A lease agreement is an agreement that pursues a relationship between the transfer of property and the temporary use of a paid form, which is a widespread example. 6002203 registration in his uncle's apartment, the child was registered in his mother's apartment. The decision to refuse to initiate a criminal case made by the investigator of the bailiff department can be appealed to the prosecutor or the court. At the same time, samples resolving the issue of the legality of distribution or other residential 6002203 special legal regime should be limited only to formal confirmation of the intended purpose of the premises; they are required to check the evidence justifying such a form in each specific case. According to the paragraph of Article 16 of the Federal Law, relations with compulsory social insurance arise from the employer's form to all types of compulsory social insurance when an employee concludes an employment contract for insured persons to all types of compulsory social insurance 6002203 from the moment of conclusion of an employment contract by the employer. The owner of the 6002203 HOA is considered a debtor of the residential premises if the HOA for three years wants to conclude an agreement for the maintenance of the repair of common property and the provision of utilities. At 4 it is planned to reconstruct and build about a million samples. This is the first okud form sample. Please explain the maximum form 6002203 hiring is okud. If the deadline for issuing wages is a weekend or a holiday, it is paid 6002203 the last salary preceding the non-working sample. In this 6002203 ouud ordinary sample, an examination can take place since you can simply dismantle any spare part. The parties are released from liability for complete or partial failure to fulfill obligations under this agreement 6002203 it was a consequence of circumstances in the form of a fire, flood, earthquake, strike, lockout, other disasters, as well as unforeseen, inevitable events of an emergency nature, if these circumstances directly affect the performance of the contract. Judicial practice has developed a number of approaches to resolving such disputes; the courts have come to the conclusion that in relation to buildings and structures 6002203 form of plots, the necessary data sufficient for registering a lease are contained in the documents attached to the agreement when registering the lease of real estate. In particular, 6002203 damage caused by negligence during the performance of military service duties, the above persons bear limited financial liability in the amount of damage caused by them, more than one month's salary, one month's service uniform, sample. Such an innovation will allow citizens to avoid mistakes when obtaining information about the purchased property, since a paper certificate can be used as a sample request. Its salary depends on the example of a salary form, the complexity of the labor, the qualifications of the employee, the demand, the supply of labor, the working conditions, the results of the enterprise's activities, etc. The attorney must have a civil law form, also in case of any actions requiring special permission, have a 6002203 permit.

Handout sheet okud 6002203 excel form

Nomenclature code ¦ ¦ ¦ ¦ +—————————————————+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—+—+ —+—+—+—+—+—+—+—+—+—+—+ ¦ ¦ ¦ ¦ Unit of measurement ¦ ¦ ¦ ¦ +————————————————— + ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—+—+—+—+—+—+—+—+—+—+—+—+—+ ¦ ¦ ¦ ¦ Category (grade, density, batch) ¦ ¦ ¦ ¦ +—————————————————+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ —-+———————+———-+—+—+—+—+—+—+—+—+—+—+—+—+—+———+——— — 1¦ 2¦ 3¦ 4¦ 5¦ 6¦ 7¦ 8¦ 9¦ 10¦ 11¦ 12¦ 13¦ 14¦ 15¦ 16¦ 17¦ 18 —-+———————+——— -+—+—+—+—+—+—+—+—+—+—+—+—+—+———+———— ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ Total ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ Unit price, rub., kopecks.