What is self-isolation during coronavirus?

Starting from the end of March 2020, many constituent entities of the Russian Federation switched to complete self-isolation. Its essence lies in reducing social contacts. Regardless of age, people should stay at home. Based on Presidential Decree No. 206 of March 25, 2020, all organizations, enterprises and factories whose activities are not related to vital production, treatment, law enforcement, and social resources were placed on non-working days.

Since March 30, 2020, a self-isolation regime has been introduced in the country

The new regime dictates new rules for business owners. Many people have questions about how to pay employees during coronavirus quarantine and whether it is possible to reduce wages if the company is forced to stop working.

Citizens should stay at home, leaving only if absolutely necessary

Pay or pay?

In one case the noun payment is used, in the other payment. For example, I don’t use quot; paymentquot; and nothing. If it seems to you that you cannot decide which prefix to put in front of the root o- or u-, then do not be tormented by doubts, but write without a prefix at all - payment/to pay.

If you make a payment for taxes or penalties, pennies, etc., the correct payment will be.

Both options given by you are correct, you can use the word both payment and payment, but with different auxiliary words, and in

life, depending on what we're talking about.

For example, at an ATM, as in my photo, there is payment for utilities, communications and other things, we immediately see the payment of taxes and fines. Here you can add a penny.

If we are talking about services or goods , such as: options and methods of payment in an online store (cash, by card, by bank transfer) or payment for the services of a carrier, movers, dentist, lawyer, payment for the Internet, television - then it is written through A: Payment .

If the word is used in the context of depositing or transferring funds, making necessary payments, then the word payment : payment of membership fees, payroll taxes, fines.

The word quot; paymentquot; It is appropriate to use when we are talking about paying for something. For example: payment for services, payment for the Internet;

The word quot; paymentquot; It is appropriate to use when we are talking about paying money for something. For example: paying a fine, paying taxes.

And quot; paymentquot; - This is a deposit of money for a future service. For example: paying taxes, paying a fine.

The word quot; paymentquot; applicable when you pay for some services or pay for goods.

The word quot; paymentquot; applicable when you deposit money - payment of fines and taxes.

Nothing irritates Russian language experts more than confusion with the verbs “dress” and “put on.” Based on them, as well as on the type of coffee, many determine the cultural level of the interlocutor. But is it just a matter of “dressing” and “putting on”? Why is it only this couple that takes the rap for the rest? I have compiled a list of paronyms that are most often confused. Paronyms are words that sound very similar, but have different meanings. For example, sandy and sandy. The color cannot be sandy, and the shore cannot be sandy. A catastrophe can be humanitarian, and treatment can be humane, but not vice versa.

1. Put on/put on. The undisputed leader in the number of errors. There is a well-known rule that helps you remember the difference: put on Nadezhda, put on clothes. That is, you can dress someone, but put something on. The linguistic community has long doubted how inviolable this norm is and whether its conditional non-compliance gives the right to judge a person’s literacy. The author of the book “Russian with a Dictionary,” linguist Irina Levontina, recalls that in the book “Moscow-Petushki” Erofeev repeatedly uses the verb “dress” instead of “put on.” This can be found both in Okudzhava and in much earlier sources: “To dress in the sense of “put on” has existed for a long time: such an example is also found in P.V. Annenkov in Parisian notes of 1848. Dostoevsky has this, and Erofeev’s beloved Rozanov, and you never know who... And if Erofeev, whose language is amazing, as well as Okudzhava, and earlier Pasternak, said to wear pants, a cloak, a coat, for a linguist this is a reason not to stigmatize writers, but think about the status of the relevant norm.” 2. Pay/pay/pay. These verbs can often be heard on public transport: “Pay for the fare!” This is not only a question of using paronyms, but also a question of management. You can pay for something, but pay (or just pay) for something. So the correct thing to do would be: “Pay the fare!” or “Pay the fare!” 3. Ignorant/ignorant. Everyone knows that being ignorant is about upbringing, and being ignorant is about education. But not everyone knows that these were once variations of the same word with the same meaning. Nevezha is an Old Russian word, ignorant is a Church Slavonic word (compare the pair “clothing” - “clothing” with the same principle of alternating railways in Old Russian and Church Slavonic languages). Later the meanings of these two forms of the same word diverged.

However, Krylov, Pushkin, and other classics calmly used these words as synonyms. Remember Krylov: “The ignorant judge exactly this way..” 4. Effective/spectacular. Effective is one that produces an effect. And spectacular is someone who/what makes an impression. If we say that the next Duma bill will be effective, this means that it will work well. But if we call it spectacular, it means that it is simply designed to produce an effect, to amaze someone. Choose what suits you best. 5. Traveler/assigned. These words are often confused, but they have different meanings that prevent confusion. A business traveler can be a certificate, a document, and a business traveler can be a person who went on a business trip. 6. Main/capital. The adjective "capital" is unlucky: it is almost never used to its full potential. Many people are sure that only a letter can be capitalized. In fact, the title role can also be a role in a movie, for example. It can be called that if it matches the title of the film. For example, Keira Knightley played in the film “Anna Karenina” not just the main role, but the title role. 7. Accept/undertake. You can take action, or make, for example, effort. 8. Economical/economical. Economic means related to economics. And economical is one that allows you to save money.

Pay during self-isolation due to coronavirus

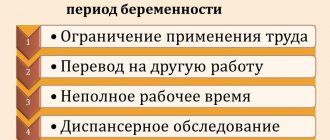

During the period the regime is in effect, the employer must issue a separate order, on the basis of which employees are transferred to self-isolation while maintaining their full wages. If the organization has the opportunity, employees can be transferred to remote work, but in this case their salary cannot be reduced.

Employee temperature log for coronavirus

A separate point concerns citizens arriving from abroad. In some regions, everyone who arrived from Moscow is included in the risk category. They must quarantine for 14 days. At the same time, they are issued a sick leave certificate for temporary incapacity for work.

Important! The process of obtaining a certificate of incapacity for work due to quarantine differs from the standard one. Contact between a citizen and employees of an organization should be completely excluded. Therefore, the employee himself submits an application for sick leave through the State Services website in electronic form.

All payments for the quarantine period are transferred from the Social Insurance Fund. The organization in which the citizen is employed must transfer information about him to the government agency. Payment is made in two parts:

- On the next working day after the information is received, the Social Insurance Fund transfers funds for the week of sick leave.

- The day after the sick leave is closed, transfers are made for all remaining days.

The transfer of an employee to remote work is carried out by drawing up an additional agreement. It is drawn up in free form and signed by both the employee and the manager. When working remotely, wages remain unchanged.

Employees' wages during the self-isolation period must be paid in full

Is it possible to reduce salary?

A wage reduction can only occur if, when switching to remote work, the employee is given a part-time working day. Payments in such a situation will be calculated in proportion to the time worked.

Is vacation paid due to coronavirus or not?

In the case where self-isolation is introduced due to coronavirus, remuneration provides for the issuance of vacation pay to the employee in connection with going on paid leave. An employee can write an application earlier than the deadline approved in the schedule. Payment is made according to the standard scheme, taking into account the average salary.

Important! Due to the suspension of work, many organizations are going on vacation at their own expense. But they can do this only if they write a statement of their own free will. During the coronavirus quarantine period, an employer cannot force employees to go on vacation at their own expense.

An employee has the right to go on paid leave during the period of self-isolation.

Cash and non-cash payments

In various relationships between legal entities and individual entrepreneurs (hereinafter referred to as individual entrepreneurs), non-cash transfers are designated as preferable. This approach to settlements has a simple explanation: it ensures the safety and control of monetary transactions. That is why there are no restrictions for non-cash transfers. They:

- do not require the mandatory opening of a current account;

- are represented by several types of operations, and freedom of choice is allowed;

— possible in any amounts, including the amount of transfers in foreign currency made to foreign counterparties is not limited.

The situation is different with cash payments between legal entities and individual entrepreneurs equated to them in this matter. The use of cash payments obliges:

— use cash registers when accepting/withdrawing cash in connection with sales;

— comply with restrictions on the volume of the amount to be transferred (the maximum amount of cash payments between legal entities / individual entrepreneurs), including if such a transfer is made in foreign currency;

- follow the requirements to spend cash received in the operating cash desk from counterparties and from the bank only for certain purposes.

That is, the use of cash in settlements between legal entities/individual entrepreneurs is not prohibited, but there are enough restrictions that significantly complicate their use. However, not all of these restrictions apply for transactions between a legal entity/individual entrepreneur and an individual.

How to pay employees during coronavirus quarantine if the company has stopped operations

Algorithm of action for a medical worker during coronavirus

Payment for downtime of workers due to coronavirus is regulated by Article 157 of the Labor Code. The procedure and amount of payments depends on whose fault the downtime occurred. If the initiator is the employer, he will be obliged to pay at least 2/3 of the employee’s average salary. The calculation is made for the 12 calendar months preceding the period that arises.

But in the case of an epidemic, business downtime due to coronavirus cannot be considered the fault of the employer. In such a situation, payment is calculated in the amount of 2/3 of the tariff rate, that is, the salary. The payment amount is calculated in proportion to the downtime.

Types of checks

Today, it is customary to divide checks into two main types - cash and settlement.

The former are a document that is used to pay its holder a certain amount in cash at the bank, for example, for wages, travel expenses, all kinds of household needs, or the purchase of necessary products. At the same time, settlement checks are used for non-cash payments. This document has a prescribed form and contains a written unconditional order from the payer to his bank that he must transfer a certain amount of money from his account to the account specified by the holder. In the same way as standard payment orders, such documents are prepared by the payer. At the same time, the main difference here is that the payer transfers it to the enterprise, that is, to the recipient of the paid amount at the time of the business transaction, who can then present it to his bank to receive funds.

There are also several other types of checks:

- bearer;

- order;

- personal

Each of them can be used when making cash or non-cash payments. We discussed the concept, types, and forms of checks above. Such documents are selected by the payer depending on how exactly he intends to pay their holder, as well as on some other features.

What to do if you stop paying your salary due to coronavirus

Many companies that, based on the Presidential Decree, were forced to suspend their activities completely, do not have the opportunity to transfer their employees to remote work. They had to close temporarily, but payment for coronavirus quarantine when closing a business must be carried out regardless of whether there is activity or not.

Employer's actions during coronavirus - responsibilities to employees

If an employer is unable to transfer an employee to remote work, but also refuses to pay compensation, employees have the right to file a complaint with the prosecutor’s office or the Labor Inspectorate.

Important! Submitting an appeal to regulatory authorities during an epidemic is only possible electronically. Citizens are not received in person.

There are three ways to submit an application:

- Through the official website of the Labor Inspectorate.

- On the State Services portal.

- By filling out the form on the website https://onlineinspektsiya.rf/.

The period for consideration of the application is 30 days. Based on the complaint received, an inspection of the organization is initiated. If during the inspection process non-compliance with the norms of the Labor Code is discovered, an act is drawn up on the basis of which the punishment is determined.

If wages are not paid, the employer faces fines. Their size is established by Article 5.27 of the Code of Administrative Offenses of the Russian Federation. May be prescribed:

- from 10,000 to 20,000 rubles for officials;

- for individual entrepreneurs from 1000 to 5000 rubles;

- for organizations and legal entities from 30,000 to 50,000 rubles.

If an employer delays wages for a long period of time, he faces criminal liability under Article 145 of the Criminal Code of the Russian Federation.

An employer may be fined for failure to pay employees wages.

Forms

There are several main categories that the basic essence of calculations provides. Bank clients choose the types and forms of operations carried out independently in the process of signing contracts. In accordance with current legislation, the following forms of non-cash payments are provided:

- checks;

- by collection;

- by letter of credit;

- payment orders.

The concept and types of settlements are chosen by clients independently and are considered in advance in the contracts that they conclude with their counterparties.

Payment of benefits due to coronavirus

Many citizens are faced with a situation where transferring an employee to remote work during the coronavirus is impossible, and a company or factory completely suspends its activities, laying off employees. In this situation, the government has developed a number of support measures for people left without work and livelihood. These include:

- During an epidemic, downtime due to the fault of the employer is impossible; coronavirus is the main reason why the company cannot continue its activities. In this regard, when an organization is closed and citizens are dismissed, they must be paid compensation. All Moscow citizens who have lost their jobs since March 2020 will receive additional payments. The exception will be those employees who were fired for failure to comply with labor discipline.

- The amount of unemployment benefits has been increased. Until December 2020, citizens registered with the Employment Center will receive a payment in the amount of 12,130 rubles monthly. Moreover, from April to October you do not need to confirm your status by appearing at the exchange. Payments will be transferred automatically. To receive such a benefit, an important condition must be met - the unemployed citizen must have worked for at least 26 weeks over the previous year. You can register on the stock exchange during the period of self-isolation remotely by sending documents electronically.

Important! In connection with the coronavirus, not only the amount of unemployment benefits has been increased, but also sick leave payments. Until the end of 2020, they will be 12,130 rubles.

Individual regional payments may be established by constituent entities of the Russian Federation. For example, in Moscow, senior citizens will receive 4,000 rubles if they maintain self-isolation.

The introduction of restrictions due to the coronavirus epidemic in Russia is a very difficult stage for the economy. Many areas of activity have come under attack, but despite the fact that organizations are forced to temporarily suspend work, they do not have the right to stop paying their employees wages.

Accounts

To use these types of settlements with suppliers and contractors, as well as other persons, banks must open specialized correspondent accounts with other organizations. In addition, to carry out such operations, each bank must have an additional correspondent account with the Central Bank of the Russian Federation.

After this, the institution’s clients have the opportunity to use a wide variety of types and forms of payments, and at the same time they have the opportunity to open any of the following accounts:

- Settlement. In the vast majority of cases, it is opened by various commercial organizations and enterprises operating in accordance with the principle of self-sufficiency. If several such accounts are opened simultaneously, then one of them is designated as a “core activity account.”

- Current. Most often it is opened by enterprises, institutions, organizations or legal entities that are financed from the budget. In particular, we are talking about non-profit organizations like schools, institutes, etc.

- For legal entities and organizations that are systematic debtors to the tax inspectorate, a special tax defaulter account is opened, which is added to the existing ones. It is worth noting that all types and forms of settlements on previous accounts cease, and all income begins to be reflected only on the new one, since thanks to them tax debts will be paid off.

Payment or payment as correct

In such cases, the most correct thing is to absolutely find out the meaning of the word, and, if possible, its origin. Fortunately, this word does not contain any special secret. All dictionaries - all as one - give a clear interpretation. Nostalgia is longing for one's homeland. Dahl's dictionary even adds - homesickness, like illness.

payment - payment, payment, payment, calculation, compensation, payment, payment, transfer; remise, payment, payment, remittance, contribution Dictionary of Russian synonyms. payment payment, payment see also payment Dictionary of synonyms of the Russian language. Practical guide. M... Dictionary of synonyms

Funds control

For individuals, keeping track of the movement of funds in an account allows them to keep bank statements, but for organizations it is more and more difficult. They use books of income and expenses, in which they record data on payment orders, collection transactions, memorial orders, and so on. Analytics of special accounts is carried out using statements of letters of credit, deposits, check transactions and other forms of payments.

The bank should tell you in detail how to issue an invoice for payment by bank transfer to the account holder, as well as inform about possible fines. They are imposed both on the credit institutions themselves and on paying agents if they fail to fulfill their obligations on time.

Correctly write a letter of guarantee for payment

- in the upper right corner of the document the name of the organization and the full name of the head (or the full name of the individual) are indicated, then it is written on behalf of whom this letter is being drawn up;

- the text of the letter indicates a request to perform some action - for example, a request to book a boat;

- further indicates the payment period for the action performed by the counterparty;

- Below is the signature and date of writing the letter.

More to read: Countries for moving for permanent residence from Russia

A letter of guarantee for payment ( the sample of which is not fixed by law) is a document confirming the fact of future payment for work done or services rendered. You will learn from our article how to correctly draw up a letter of guarantee and what nuances you should pay attention to.