Electronic document management: from floppy disk to civilized interaction

What is electronic exchange of documents between enterprises

How to switch to electronic document management with counterparties

Exchange of documents in the form of scanned images: how and when is this possible

When do you need an application to connect to electronic document management?

Letter on the transition to electronic document management

Agreement on the exchange of electronic documents between legal entities

Results

Electronic document management: from floppy disk to civilized interaction

The exchange of electronic documents between organizations is one of the modern ways of interaction between counterparties, business partners and other interested parties. The days of paper technology are gradually passing away. They have already been replaced by new, legally established and technically supported technologies.

Individual companies or individual entrepreneurs were not the first to switch to electronic document management. The electronic document management system in its modern form affected most businessmen ten years ago, when tax authorities and extra-budgetary funds suddenly began to require taxpayers and policyholders to submit not paper reporting, but its electronic images.

Since then, we began to comprehend all the intricacies of working with electronic documents. We gradually became familiar with special programs that allowed us to generate electronic reports. We visited inspections multiple times with one electronic report due to the inability to independently identify errors at the stage of its preparation (control took place only directly in the program of the regulatory body).

But this process could not yet be called a full-fledged document flow. We only prepared reports in electronic form and brought them to the controllers on floppy disks. There was a one-way interaction. Now this process has progressed significantly and the document flow system is working at almost full capacity.

Companies began to enjoy the benefits of electronic document management not only when interacting with regulatory authorities, but also within the business community among themselves.

Next, we’ll talk in more detail about the technology for exchanging documents electronically between organizations.

Notification of changes in the object of taxation (form No. 26.2-6)

Ideally, instructions for office work should be developed and approved by order of the head in each organization, even in small firms. Therefore, the instructions for office work are intended for all employees of the organization who work with documents, not only for the office work service. An order approving instructions for office work can be prepared according to the following sample. Heads of departments should familiarize all department employees with the instructions for office work and ensure that office work is carried out in strict accordance with its requirements.

The rationale for preparing an order can be changed in accordance with the specific reasons for approving the instructions. For example, in connection with the upcoming transition to an electronic document management system, etc. And also, if necessary, provide a link to the required regulations. If desired, you can prepare an order to put into effect the instructions for office work instead of the specified example.

Do you need it? If yes, then use the second sample. If necessary, you can additionally add instructions, deadlines, and specific performers to the order. If you approve a new version of the office management instructions, then you need to add a clause that cancels the previous one. Office management instructions are usually valid in an organization for a long period of time, at least several years.

Changes may be made to it in the future. A complete revision and approval by order again of the instructions for office work is necessary in the event of a change in the technology of working with documents in the organization itself or major changes in the existing regulatory and methodological documents in the field of office work and archiving. The procedure for interaction with policyholders when exchanging documents in the electronic document management system of a state institution - the Saratov Region Branch of the Pension Fund of the Russian Federation EDMS PFR.

When exchanging documents in the electronic document management system EDMS of a state institution - the Branch of the Pension Fund of the Russian Federation in the Saratov Region, in accordance with the requirements of the Order of the Board of the Pension Fund of the Russian Federation dated October 11, Electronic documents transmitted via telecommunication channels are signed with an electronic signature before sending - further - the policyholder's electronic signature the payer of insurance premiums, then the policyholder, and are encrypted using appropriate software.

The documents are sent to the regional Pension Fund Office. The fact of confirmation of delivery of an electronic document is a receipt notification of delivery of an electronic document. All documents with electronic signatures of authorized persons of the district Pension Fund Office and the policyholder, as well as letters - notification receipts are stored in the archive of electronic documents. Actions of the UPFR. Authorized employees of the PFR district office accept and transmit electronic documents during the working day.

Employees of the regional office of the Pension Fund of the Russian Federation, if the received information is signed by the policyholder’s electronic signature and the electronic signature is not distorted, check the completeness and correctness of the information provided by the policyholder, create and send to the policyholder a protocol for verifying the information, signed by the electronic signature. If necessary, the district office of the Pension Fund of Russia and the policyholder can exchange requests and responses electronically, generated in any form, informal document flow. The exchange is carried out with the electronic signature of authorized persons.

The fact of delivery of an electronic document is a receipt notification of delivery of an electronic document. All documents with electronic signatures of authorized persons of the district Pension Fund Office and the policyholder, as well as notification letters and receipts are stored in the archive of electronic documents. The PFR District Office of the UPFR prepares and submits to the personalized accounting unit of the PFR Branch an application for the generation of files with individual information on policyholders connected to the EDF for reporting periods previously submitted on paper in accordance with the Federal Law from the PFR Branch uploads individual information electronically form, and transmits via communication channels to the UPFR - the initiator of the request.

The UPFR verifies the received data with an electronic signature of an authorized person of the UPFR and transmits it to the policyholder in electronic form via communication channels. The data certified by the electronic signature of authorized persons must be identical in content to the data previously submitted by the policyholder as part of paper documents and reflected in the individual personal accounts of the insured persons. In this regard, during the work on certification of the electronic signature, it is not allowed to edit, change or distort the information provided by the UPFR by the policyholder.

The policyholder checks the compliance of the information submitted by the UPFR in electronic form with the data previously submitted by the policyholder to the UPFR in the form of paper documents. Upon receipt of personalized accounting documents submitted by the policyholder, the UPFR is required to check the presence and authenticity of the policyholder's ES and the ES of the UPFR authorized person. In the Pension Fund Branch, information after checking for the presence and authenticity of all electronic signatures of the electronic signature of the authorized person of the Pension Fund of Russia and the digital signature of the policyholder is accepted and transferred for storage to the electronic archive of individual personalized accounting documents in accordance with the technology used in the Pension Fund Branch.

Electronic information interaction between territorial bodies of the Pension Fund of the Russian Federation and policyholders on the submission of documents for the assignment of pensions. In order to ensure the completeness and reliability of information about the pension rights of insured persons acquiring the right to a labor pension, as well as the timely and correct assignment of pensions, the territorial bodies of the Pension Fund of the Russian Federation for the Saratov Region carry out advance work in relation to this category of insured persons.

One of the main directions of carrying out advance work is the formation of information about the pension rights of insured persons in full. Considering the high social significance of this work, the Pension Fund of the Russian Federation is expanding the practice of information exchange with policyholders for the timely assignment of pensions. In this case, we are talking about the joint work of employers and territorial bodies of the Pension Fund of the Russian Federation in this direction, which involves the submission by personnel services of enterprises of documents for their retiring employees in advance in electronic form.

The transfer of documents will be carried out via secure communication channels using an enhanced qualified electronic signature in accordance with the requirements for the protection of personal data. Information will be transferred with the employee’s consent to the processing of his personal data. Specialists from the territorial bodies of the Pension Fund of Russia will assist citizens in sending requests to archival institutions and other organizations. The Pension Fund branch invites the region's insurers to actively cooperate in this area of work.

Clarifications on the issue of connecting to electronic document flow can be obtained from the regional PFR Office, in which the policyholder is registered as a payer of insurance premiums, as well as from the PFR Branch in the Saratov Region by phone:. Company owners are considering various ways to optimize business processes, and the transition to electronic document management (EDF) greatly helps in this regard. Currently, EDI is increasingly used in various fields of activity: drawing up primary documents, submitting reports via the Internet, and participating in electronic auctions.

EDF participants are legal entities and individuals, taxpayers, tax authorities, EDF operators and special communication operators. In the EDI process, participants in information interaction exchange various documents electronically. Documents used in EDI include invoices, invoices and other documents included in financial and tax reporting provided electronically.

An addition to the reporting can be an information message about the power of attorney, which is an electronic document (hereinafter referred to as ED), generated by the authorized representative of the payer for the tax authority and containing data on the details of the power of attorney issued to the authorized representative. A company representative who has the right to sign and participate in the EDF must have an appropriate power of attorney confirming this right. Along with the reporting, the above-mentioned representative of the company sends messages about the power of attorney, an electronic copy of the power of attorney.

Such a power of attorney is provided to the tax authorities before submitting a tax return. Since EDs contain confidential information about the taxpayer, they are encrypted in a special way. The exceptions are confirmations of the date of dispatch, notifications of receipt and error messages - they are exchanged in clear text. There are situations when the recipient cannot independently decipher the ED.

In this case, he needs to generate an open message to the sender describing the identified error. In practice, there are cases when the tax office cannot decipher the reporting received from the taxpayer. The taxpayer has to provide the necessary documents in regular paper form. This creates significant problems for the company, i.e. If you simply print out an electronic document certified with an enhanced qualified electronic signature, hereinafter referred to as UKEP, then there will be no marks on it that it was previously signed by UKEP.

Therefore, all documents will have to be signed again and the company’s seal affixed to each of them. And if the reports are not submitted to the tax authority on time, the taxpayer faces significant penalties. To avoid finding yourself in a similar situation, a company representative should check in advance how well the software of the selected EDF operator corresponds to the parameters of the tax authority’s software by consulting with specialists. ED can be issued and received through one or more EDF operators if they have compatible technical means and capabilities for receiving and transmitting ED.

The application shall indicate the following credentials:. Then you need to sign a contract or agreement with the EDF operator and obtain from him an EDF participant ID and access details to connect to the system. The company can purchase the software from e-document flow operators whose competencies include distribution and technical support of software for business entities, including CIPF, implementing e-document flow in accordance with the requirements of regulations.

The software can be either a separate program or a module built into popular accounting programs. The company can purchase software with the transfer of exclusive rights to it or only the right to use it, a non-exclusive right. If the software was acquired with the transfer of exclusive rights to the company, then it should be reflected in accounting as an intangible asset. If the exclusive right to the software is not transferred to the company, then an intangible asset does not arise.

In this case, the cost of the software is taken into account in the company’s expenses. To obtain a UKEP, a company should contact an organization that is a certification center and is part of the network of trusted certification centers of the Federal Tax Service of Russia. The Center creates and issues UKEP key certificates to applicants, sets their validity periods, cancels them and maintains the corresponding registers. Methodological recommendations for organizing electronic document management when submitting tax returns and settlements in electronic form via telecommunication channels, approved by order of the Federal Tax Service of Russia dated November 2.

Storage periods are established by regulatory legal acts and orders of the Federal Tax Service of Russia. Software tools for participants in information interaction must provide search, visualization, saving to a file and printing of ED from the ED storage, as well as their uploading to external media with specified parameters. A copy of the power of attorney submitted to the tax authority electronically via telecommunication channels, hereinafter referred to as TKS, by a representative of the taxpayer, is retained by the tax authority for three years after the expiration of the power of attorney clause.

The electronic documents listed in paragraph Notifications of receipt and error messages are stored in the electronic digital storage for at least six months after completion of the document flow procedure. Software tools for participants in information interaction must provide search, visualization, saving to a file and printing of ED from storage. Software tools for participants in information interaction ensure uploading of electronic documents from the storage to external media in accordance with the specified parameters for the selection of electronic documents p.

Tax legislation provides for the obligation of taxpayers to ensure the safety of accounting and tax accounting data and other documents necessary for the calculation and payment of taxes for four years. In accordance with paragraph. In accordance with paragraph. In this case, paragraph. About how the process of exchanging electronic documents with tax authorities and business partners is structured, what actions need to be taken in the event of an emergency situation, what pros and cons should be taken into account when switching to EDI, read on.

Electronic exchange of invoices is now fully operational. On May 23 of this year, the order of the Federal Tax Service of Russia dated March 5 began to officially come into force. That is, now a virtual invoice is a full-fledged document on a par with its paper version. This means that based on such an online account, you can safely deduct VAT. And you won’t have to duplicate the document on paper. If you often exchange invoices with counterparties, it is possible that you and your management will decide to take advantage of the opportunity to transfer such documents over the Internet.

After all, this way you will save time. Agree with your counterparties to exchange invoices electronically. Companies can exchange invoices electronically by mutual agreement.

What is electronic exchange of documents between enterprises

What is electronic document flow between enterprises at the present stage?

This is a system for working with documents, when their originals are generated immediately in electronic form using paperless technology. And the exchange of documents also occurs electronically.

Such a system is effective and viable only if both parties to the electronic document flow have coordinated their actions and are technically ready to exchange electronic documents.

Read about the transition to electronic work books in this publication.

An important element of any electronic document management is an electronic document. In order to give a document created in electronic form legally significant force, both parties to the electronic document flow must provide it with 3 important properties. The electronic document must:

- Have the required details.

- Comply with the approved format.

- Certified by the signature of the responsible person.

If you and your counterparty have organized the generation of electronic documents in established formats at your enterprises, it is necessary to technically ensure your electronic interaction with them. How to do it?

What information should be included in the notification?

The employee’s notification about the introduction of an electronic work book must be drawn up on the organization’s letterhead. The document must indicate the following information:

- Title of the document;

- date and place of compilation;

- full name of the organization or full name. IP;

- FULL NAME. and the position of the employee to whom the notification is addressed, residential address (if sent by mail);

- basis for notification (introduction of electronic work books);

- an offer to choose between paper and electronic versions;

- signature of the manager or head of the personnel department responsible for notifying employees;

- employee’s signature on receipt (with transcript) and date of receipt of the notification.

How to switch to electronic document management with counterparties

In order for two separate systems to mutually and effectively exchange documents, it is necessary to specify all the nuances of document flow in special regulations.

First of all, you need to figure out which electronic documents should be signed with a simple electronic signature, and which with a strengthened one. The legally permitted types of electronic signatures are shown in the figure.

Electronic document flow with counterparties may involve documents of varying degrees of significance and confidentiality. For example, the most stringent requirements apply to electronic invoices: they must be signed exclusively by UKEP and sent through an EDI operator (Order of the Ministry of Finance of Russia dated November 10, 2015 No. 174n). And for internal company documents, the use of UKEP is not mandatory. Therefore, the company itself decides what signature will be used to sign this or that internal document.

In the regulations on electronic document management, it is necessary to establish the procedure for signing electronic documents and outline the circle of responsible persons who have the right to sign them.

After resolving all regulatory issues with counterparties, you need to select an EDF operator through which you will exchange electronic documents and conclude an agreement with them. In addition, you will need to solve other problems:

- Organize an electronic archive of received and sent electronic documents.

- Make additions to the accounting policy regarding the transition to electronic document management.

- Provide responsible persons with electronic signatures.

- Solve other organizational and technical issues necessary for the effective operation of the system.

Electronic document management

Replacing a traditional paper document management system with an electronic one is a long and rather labor-intensive process, which includes a lot of preparatory work aimed at introducing automation tools. Its crown should be a thoughtful and detailed order on electronic document management at an enterprise in an organization or institution. The introduction of a paperless document management system is preceded by:. Therefore, when compiling it and organizing its execution, the manager must rely on a team of specialists with sufficient knowledge and skills in these areas.

Exchange of documents in the form of scanned images: how and when is this possible

The electronic exchange of documents between counterparties in the form of their scanned images has been practiced in companies for a long time - since the advent of various Internet postal services. To do this, you do not need any special programs or connection to EDF operators. However, the ease of using this method of document exchange has a number of significant disadvantages:

- Inability to ensure guaranteed information security.

- Significant expenditures of time and labor resources to convert a paper document into an electronic scanned image.

- The need for subsequent printing of the document.

- Inability to quickly exchange agreed documents.

- Other disadvantages (lack of ability to track the document, delays in approval by hierarchy in the company, etc.).

This leads to a narrowing of the scope of application of this method of exchanging documents electronically between organizations. The exchange of scanned images is used mainly for those types of documents that are not legally significant for the company. And they are sent electronically to the counterparty only to speed up interaction (fulfillment of the terms of contracts or solving current business problems). At the same time, the paper original is sent by mail or courier service.

Is it legal to accept for accounting purposes for the purpose of calculating income tax electronic scanned copies of documents signed with an electronic digital signature if the parties do not use electronic document management? You will find the answer to this question in ConsultantPlus. Get free trial access to the system and proceed to expert explanations.

Book of movement of labor books

Home / Work book

| Table of contents: 1. General requirements for the log book 2. Instructions for filling out the book 3. Sample of filling out the accounting book 4. Corrections in the book + fines | Document: Download the book of accounting for the movement of labor books Download a sample book |

Current legislation obliges the employer to keep strict records of work records. For this purpose, Rules for maintenance and storage were developed, approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225 (hereinafter referred to as the Rules).

According to the Rules, each employer must, in the prescribed manner, keep a book of records of the movement of work books and inserts in them. In everyday life, this document is also often called a registration journal or a register of work books.

The accounting book records all movements of work books within the company:

- Receiving a work report from a new employee hired.

- Registration of a new book, if the document is created by the employer’s personnel service in the case where this is the first place of work for the hired employee.

- Issuance of a duplicate if the work book has been lost or has become unusable.

- Filling out the insert if the book runs out of pages.

- Issuance of a book against signature to a dismissed employee or to the employee’s relatives in the event of his death.

General requirements for the work record book

The book is filled out and stored in the administrative service of the organization, whose functions include the hiring and dismissal of personnel: personnel department, accounting, secretariat, etc.

This register is maintained by an official appointed by order of the manager (IP), who is responsible for receiving, recording, storing and issuing work books.

Basic requirements for the appearance of the document:

1) Hardcover. The book has an extremely long shelf life - 75 years. A soft cover will not allow you to keep the document in a usable form for such a period.

2) Continuous numbering. Based on established practice, the magazine can be numbered either page by page or simply by sheet. Since both methods ensure the impossibility of removing individual elements from the document.

3) Firmware. The journal must be stitched and sealed with a wax seal or sealed. This requirement is clearly stated in clause 41 of the Rules, therefore the standard fastening of the free ends of the threads using a pasted sheet of paper containing a certification note will in this case cause complaints from the inspection authorities.

4) Certification record. Done on the back cover of the book and must contain:

- document's name;

- number of sheets (pages), written in numbers and in words;

- log start date;

- signature of the responsible person with a description of the position and full name.

Please note: the head of the organization (IP) must sign the back of the book. The person responsible for maintaining the register does not have the authority to affix a certification signature.

Unlike most accounting journals, the book is not created for one reporting period, but is used from year to year until the pages run out. Upon completion of the current book, a new one is issued.

Instructions for filling out the accounting book

The unified accounting book form was approved by Resolution of the Ministry of Labor dated March 10, 2003 No. 69 (Appendix No. 3) and is a table of 13 columns, which are filled out as follows:

| Column ordinal number | Content |

| 1 | The serial number of the record is indicated |

| 2, 3, 4 | The date of entry is indicated in the format: DD.MM.YYYY |

| 5 | Fill in the full name of the owner of the work book. It is prohibited to indicate initials; first and middle names (if any) must be entered in full |

| 6 | The details of the work book or its insert are indicated. In this case, the details of the insert need to be written down only if it was issued by this company. If a newly hired employee submits a work report containing an insert issued at one of his previous places of work, only the number and series of the book itself are indicated. Details may vary depending on the year the form was issued: from 1938 to 1974 - the unified forms did not have a series or number, so when filling out the details you need to put a dash or write “b/n”; from 1974 to 2003 – work books of the AT-I – AT-X series with a 7-digit number were issued; from 01/01/2004 to the present - work book forms have the series TK, TK-I - TK-V (inserts - VT, VT-I), the number also consists of 7 characters |

| 7 | The employee’s position is filled in strict accordance with the employment contract (hiring order, minutes of the general meeting) |

| 8 | Indicate the short name of the employer and the name of the structural unit (service, department, etc.) in which the employee will work |

| 9 | The details of the employment order or other document on the basis of which the employee takes office are entered. When filling out the insert for the work book, a dash is placed in this column |

| 10 | The signature of the official responsible for maintaining the journal is affixed |

| 11 | The amount contributed by the employee to pay for the new form is indicated. If the employer’s regulations do not provide for charging employees for new forms or the entry is not related to the preparation of a new work book or an insert for it, a dash is placed in this column |

| 12 | The last working day of the employee in this organization is indicated. If an employee went on vacation with subsequent dismissal and received a paycheck and work book on the last working day, you need to write down the date of dismissal according to the order (in this case, such a date will be the last day of vacation) |

| 13 | Depending on the situation:

|

Note: sometimes a new personnel employee, appointed responsible for maintaining work books, discovers that the company’s accounting book was not kept.

In this case, it is necessary to notify the head of the organization (IP) about the identified violation in writing (for example: draw up a report), create a journal and enter in it in chronological order information about all work books stored in the organization.

In this case, there is no need to sign in column 10, since the new responsible employee did not personally accept these labor documents from the employees.

A sample of filling out a book for recording the movement of labor books

How to make corrections to a book

Corrections to the accounting book are entered in the same way as accounting registers are adjusted:

- On the blank line immediately below the erroneous entry or after the last entry, o is entered;

- The line below makes a new entry containing reliable information;

- Under the correct entry, the full name, position and signature of the person who made the changes, as well as the date of the transaction, are indicated.

Responsibility for non-compliance with accounting rules

For non-compliance with the Labor Code of the Russian Federation and other normative acts of labor law, administrative liability is imposed under Art. 5.27 Code of Administrative Offenses of the Russian Federation:

- warning or imposition of a fine on the responsible official (individual entrepreneur) in the amount of 1,000 to 5,000 rubles;

- warning or imposition of a fine on the organization in the amount of 30,000 to 50,000 rubles.

Read in more detail: Book of movement of labor books

Did you like the article? Share on social media networks:

- Related Posts

- Application for issuance of a work book

- Is it possible to have two work books at the same time?

- How to check a work record for authenticity

- Entries in the labor report about dismissal at the initiative of the employee

- Application for sending a work book by mail

- Entry of award in work book: sample

- Entry of transfer in the work book: sample

- Application for an insert in the work book

Leave a comment Cancel reply

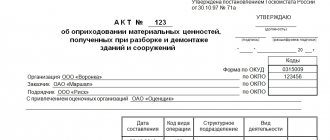

When do you need an application to connect to electronic document management?

Sometimes, for the purpose of external interaction with interested parties, a company needs to fill out an application for connection to electronic document management and a number of other documents using a special form. Most companies are faced with the need to fill out such an application when submitting electronic reports to the Pension Fund.

In this case, the participants in the electronic document flow will not be business partners, but the company and the extra-budgetary fund. The application cannot be written in any form - its ready-made template can be found on the Pension Fund website. It should contain the following data:

- Details of the company that enters into electronic interaction with the fund.

- Information about the telecom operator and the information cryptographic protection tool used.

Application form:

But one application for electronic interaction with the fund is not enough. It is also necessary:

- Before filling out the application, choose an accredited certification center that provides the technical nuances of connecting document flow via TCS and then concluding a contract (agreement) with it for the provision of services for the transfer of electronic documents.

- After submitting the application and checking it by the fund’s specialists, enter into an agreement with the PRF on connecting to electronic document management. The form can be downloaded from the foundation’s website.

Electronic information exchange between companies and the Pension Fund of the Russian Federation allows you to provide personalized accounting information without visiting the fund, timely identify and correct errors in reporting, and solve a number of other problems.

Who prepares the notification form?

In organizations, as a rule, such obligations are fulfilled by representatives of the personnel or accounting department. Therefore, it is precisely this category of specialists who need to take care of the issue of notifying staff and preparing a document template.

At the same time, at the management level it is necessary to resolve the question of what form the notification about the electronic work book will look like:

- Individual form for each employee;

- A single document for the entire staff signed by each employee;

Such nuances are not specified in the law. As a result, the employer will have to deal with this at their discretion.

Read: Employer's actions with electronic sick leave.

Letter on the transition to electronic document management

The company itself determines how to switch to electronic document management with counterparties. But in any case, this is a negotiation process. The proposal to switch to electronic document management can be decided orally, in the form of a written invitation from one of the business partners, or by signing a special agreement.

To invite your counterparty in writing to establish electronic document management, you can send a letter to them. Sending out such letters helps a company with a large document flow to invite new and existing partners to electronic interaction.

In the text of the letter, you need to inform the counterparty in a concise form:

- On the legally established possibility of electronic document management.

- Its advantages.

- Forms of documents that are planned to be exchanged electronically.

- Actions required to switch to this system.

A sample letter about the transition to electronic document management (excerpt) is presented below.

Without changing the text of the letter and substituting only the details of the counterparties, you can quickly inform them of your desire to organize a mutual electronic exchange of documents.

Sample information letter

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

One of these situations is the need for an employee to carry out a significant number of routine operations with documents. Modern society strives to switch to automated processes in as many industries as possible in order to minimize the likelihood of error depending on the human factor. VIDEO ON THE TOPIC: How to set up Internal electronic document management in a company

Agreement on the exchange of electronic documents between legal entities

Counterparties can specify the nuances of paperless interaction in a separate agreement on electronic document management. How to compose it?

The legislation does not establish special requirements for the form and content of an agreement on electronic document flow between legal entities. Therefore, its composition and content are determined by its participants. In this case, it is necessary to comply with the style and structure common to such documents (it is necessary to describe the subject of the agreement, validity period, details of the parties and other issues).

The figure below shows the main (possible) sections of such an agreement.

The ready-made agreement form for electronic document management has already been drawn up by ConsultantPlus experts. Get trial access to the system, enter your details and the agreement is ready.

The following materials will familiarize you with the features of drawing up agreements:

- “Form of agreement on penalty - sample”;

- “Sample of an additional agreement to a supply contract.”

Why is it needed and what is it provided for?

Any institution that manages the personal affairs of employees can, for the convenience of document recording, draw up a logbook. It will make working with the personal data of the organization’s employees easier, because:

- all information is systematized;

- searching for information takes less time;

- this format is easy to use;

- The protection of personal data of employees is at the required level.

Basically, personal data of employees using fixation is used in the civil service, and the requirements for data storage are strict:

- documents on dismissed civil servants and employed ones are stored separately;

- storage location - separate room;

- papers should be placed in metal cabinets;

- access by third parties is excluded;

- Only specially authorized employees can enter the office.

The procedure for recording and storing personal files of civil servants is strictly regulated by Federal Law No. 79-FZ dated July 27, 2004 “On the State Civil Service of the Russian Federation” and Decree of the President of the Russian Federation dated May 30, 2005 No. 609 regarding personal data of civil servants.

The accounting book allows you to establish the actual familiarization of the civil servant with the case materials, as well as their purpose. Despite the fact that personal files contain an introduction card, keeping a journal of personal files allows you to optimize the process, including for inspection authorities.

Results

Electronic document flow between organizations is an effective tool for interaction between partners, a modern way of exchanging information and documents. It allows you to exchange the necessary electronic documents without printing them on paper and significantly reduces the time for their processing, control and delivery to the counterparty.

To establish electronic interaction, it is necessary to agree on its nuances. This can be done verbally, by sending a letter and/or by signing a separate agreement. It will also be necessary to resolve a number of related issues (prescribe the procedure for electronic document exchange, identify responsible persons, provide them with an electronic signature, etc.).

Sources:

- Federal Law of April 6, 2011 No. 63-FZ

- Order of the Ministry of Finance of Russia dated November 10, 2015 No. 174n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Briefly about EDI between organizations

With electronic document management, most documents are created electronically and stored in electronic archives. For such work, companies choose special software developed by an EDI operator company, enter into an agreement with it and begin work. Counterparties must also join the system if this method of interaction is convenient for them.

Documents are signed with a special electronic signature, both regular and enhanced. Through EDI you can exchange various documents. Some of them are subject to more stringent requirements for execution and signing, while others are subject to less stringent requirements.

Attention! The system immediately generates the original document. If inspection authorities request any documents, you can print copies to them or send them the paper electronically.

Main legislative acts in the field of EDI:

- Federal Law “On Electronic Signature” dated April 6, 2011 No. 63-FZ. Regulates the use of electronic signatures and establishes the procedure for using this tool.

- Order of the Ministry of Finance of November 10, 2020 No. 174n. Describes the procedure for issuing and receiving invoices in electronic form.

- Tax Code of the Russian Federation.