Lawyer's response:

The legislation does not establish a mandatory form of staffing for commercial organizations.

It is recommended to use form N T-3, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1.

If it is impossible to indicate the exact amount of remuneration, it is recommended to provide a link in the note to a local regulatory act that defines the procedure for establishing remuneration, as well as its amount for a certain standard of production.

Legal basis:

The staffing table is an organizational and administrative document in which the structure, staffing and number of the organization, a list of job titles, professions indicating qualifications and salaries, as well as possible allowances for each position are drawn up.

For the convenience of drawing up a staffing table by a legal entity or an individual who is an individual entrepreneur, a unified form N T-3 is provided (approved by Resolution of the State Statistics Committee of the Russian Federation “On approval of unified forms of primary accounting documentation for the accounting of labor and its payment” dated 01/05/2004 N 1) . This form is not mandatory for use, but is only advisory. Despite this, it is recommended to use this form in your work, since it contains all the necessary details.

At the same time, it must be borne in mind that many control bodies, when carrying out inspections or requests, require the submission of a staffing table (for example, paragraph 91 of the Methodological Instructions on the procedure for appointing, conducting documentary on-site inspections of policyholders for compulsory social insurance and taking measures based on their results, approved by Resolution of the Federal Tax Service of the Russian Federation dated 04/07/2008 N 81).

When conducting documentary checks by territorial bodies of the Pension Fund of the Russian Federation, it is also possible to request the provision of a staffing table (Methodological recommendations for organizing and conducting documentary verification of the reliability of individual information provided by policyholders on the length of service and earnings (remuneration), income of insured persons in the state pension insurance system (approved.

How much should you bet on a bookmaker's sure bet?

Rice. 7 how much to bet

The step of determining the amount bet on each fork leg is one of the most important. At the same time, everyone sets their own spending limit; experienced players recommend putting at least $2,000 into the game.

In addition, you should adhere to the following recommendations:

- do not bet an amount equal to a fractional number, even if this will reduce the winning amount - it has long been known that according to the requirements, a fractional number is needed in relation to the amount bet on a sure bet, but this same feature also provides the ability for bookmakers to calculate sure bettors;

- do not place maximum bets;

- alternate between regular bets and arbs.

Fork in the staffing table

Resolution of the Board of the Pension Fund of the Russian Federation dated January 30, 2002 N 11p)).

In addition to the listed bodies, tax inspectorates often include in the list of documents required for a comprehensive audit the staffing table as a document confirming the application of tax benefits.

Also, the staffing table serves as a document that summarizes data on wage costs, as well as the number of employees of the organization.

Thus, if an organization uses standard form No. T-3 of the staffing table, it must also take into account the Instructions for the use and completion of primary documentation forms, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 N 1, according to which, in column 5 “Tariff rate (salary ) etc.” the monthly salary is indicated in ruble terms according to the tariff rate (salary), tariff schedule, percentage of revenue, share or percentage of profit, labor participation coefficient (KTU), distribution coefficient, etc., depending on the remuneration system adopted in the organization in in accordance with the current legislation of the Russian Federation, collective agreements, employment contracts, agreements and local regulations of the organization.

Columns 6 - 8 “Bonuses” show incentive and compensation payments (bonuses, allowances, additional payments, incentive payments) established by the current legislation of the Russian Federation (for example, northern bonuses, bonuses for an academic degree, etc.), as well as those introduced at the discretion of the organization (for example, related to the regime or working conditions).

If it is impossible for an organization to fill out columns 5 - 9 in ruble terms due to the use of other remuneration systems in accordance with the current legislation of the Russian Federation (tariff-free, mixed, etc.), these columns are filled in in the appropriate units of measurement (for example, percentages, coefficients, etc. .).

Reflection of information in this column has its own characteristics. Thus, for some workers who work on a piece-rate wage system, it is impossible to determine the exact amount of salary, since it depends on the results of the work performed. In this case, in column 10 “Note” it is advisable to indicate the following: “Piece-piece payment/Piece-piece bonus payment”. Next, it is advisable to provide a link to the local regulatory act that determines the procedure for establishing wages, as well as its amount for a certain standard of production.

It should be remembered that the so-called “fork” for salaries cannot be indicated in the staffing table, since, according to Art. 22 of the Labor Code of the Russian Federation, payment must be equal for equal work. Therefore, if in one department there are two staff positions for the position “specialist”, then opposite each such position in this column the same salary should be indicated.

The opportunity to pay wages (and not official salary) in a larger amount to one of the employees can be realized by establishing allowances or other additional payments for him (letter of Rostrud dated 04/27/2011 N 1111-6-1).

The answer was prepared by Dmitry Stikhin, senior lawyer

What are the pitfalls in surebets?

Rice. 8 things to watch out for

In addition to the fact that the account can be cut, the arber is also plagued by many other problems:

- payment may be delayed;

- ineffective arbitration situations when the bookmaker set an erroneous line, as a result the results are declared invalid;

- In addition, unforeseen situations may arise due to force majeure in the match, for example, one of the opponents withdraws his candidacy from the competition. Then the rules are not written for the bookmaker, and he can act in different ways - return the bet or recognize the retreating player as a defeat;

- cancellation of bets due to the fixed nature of the match;

- if the odds were calculated and the bet was placed in different time periods, then the indicators may be adjusted not in favor of the player.

The presence of such risks indicates the fact that such a win-win instrument as a fork also has its own nuances.

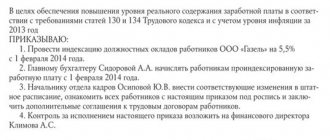

“...The inspection demanded that the salary range be removed from the staffing table...”

Establishment of official salaries and calculation of salary ranges

Page 1 of 3Next ⇒

A prerequisite for this stage is to determine the amount of the official salary based on the results of point calculations. It must be carried out according to uniform rules, regardless of position and unit.

To establish the official salary, it is necessary to collect information on the market value of various types of work. In this case, it is necessary to take into account:

· internal corporate policy;

· financial position and potential of the company;

· foreign economic policy.

In our case, these will be positions included in the staff of a virtual company with up to 20 employees. If the staff is large, then in each of the grades it is necessary to identify key positions for which market parameters will be determined and, accordingly, monetary compensation for this or a similar position.

We analyze the labor market in order to understand how much they pay on average for a similar position at other enterprises, and based on the data obtained, make an informed decision.

But before entering the collected market data into the table, it is necessary to coordinate it with the company’s financial director.

The lower limit of the salary bracket, that is, the minimum official salary, will correspond to the average level of the market value of the position. But if the financial situation of the company does not allow it, then the minimum official salary will be the same as the minimum market salary.

Then, for each grade, a salary range is established, the so-called range. Remember that it is determined not for each position separately, but for the entire grade.

Since the official salary reflects the core value of the workplace, and not the effectiveness of a specific employee, it is possible to “impose” the same range for each grade.

Ranges define the upper and lower levels. The size of the ranges depends on the company's vision of how those same ranges support career development and other organizational values. Therefore, the fork, as a rule, has a constant value. The names of the fork levels will be the categories of professional growth ( Scheme 1

).

Scheme 1. Job salary ranges

By thus setting the average market salary as the minimum salary in our company, we automatically increase the authority and competitiveness of the enterprise in the labor market. And a 30 percent salary increase range within a single position is a strong motivating factor.

Attention! The minimum official salary of the lowest (last) grade should not be lower than state norms and guarantees, that is, not lower than the minimum wage established by the state.

Therefore, before introducing the final calculations of the grading system, it is necessary to check this official salary for compliance with its Labor Code and the Law “On Remuneration”.

The result of the work is a standard table format with a description of all internal corporate positions, including the names of positions, their linear affiliation, subordination, grade number, integral indicators of the value of each position, belonging to the grade level, salary structure ( Table 6 ).

Now you can see that the size of the points corresponds to the position of the position in the grade and, accordingly, the size of the salary.

123Next ⇒

The company employs several sales managers. They have different qualifications, due to which some make a greater contribution to the development of the business, others less. Therefore, management decided to pay those who work better more. It turns out that the salary for one position - sales manager - varies from 30 to 37 thousand rubles. Is this legal and how to correctly arrange different salaries for employees occupying the same positions? One of the 1C:Enterprise users asked this question to ITS experts.

Pay discrimination is prohibited, but what constitutes discrimination in the situation described above: paying everyone the same for different quality of work, or paying people occupying the same positions differently? According to Part 1 of Art. 132 of the Labor Code of the Russian Federation, the amount of an employee’s salary depends on his qualifications. That is, employees occupying the same positions, but having different skill levels, can be paid different salaries.

Salaries in telecom

At the initial stage, the salary level in telecom is higher than in FMCG or retail, but not significantly. The gap becomes more noticeable at the Head position and beyond. It is difficult to meet a vice president with a salary of less than 1 million fixed per month here. And we are talking not only about the “Big Four” (MTS, VimpelCom, Megafon, Rostelecom + TELE2), but also about second-tier companies such as MGTS, Virgin Connect, etc. In addition to the fixed salary, bonuses are added, which can reach 100% of the total fixed income. That is, 12 million + 12 million = 24 million annual income excluding LTI.

I already mentioned in passing above that telecom is one of the most advanced industries, not only in Russia. However, in our market this is especially noticeable. Telecom is a forge of innovation, so people who come from this industry to any other bring with them great expertise.

You can grow up in telecom quite quickly. They love young and talented guys here. There are no outright old-timers among the vice-presidents, but there are many young and smart top executives. At the same time, of course, we must remember that telecom can also be different - advanced and not so advanced. Vympel, for example, is part of the coolest international Veon, and MTS is part of the Russian, almost state-owned AFK Sistema

Median salary range for Director/VP position: 1000-1400 thousand rubles per month

Example of companies in the industry: VimpelCom, Megafon, MTS, TELE2, etc.

The procedure for registering salaries of different sizes for sales managers

- In the Regulations on remuneration, employment contract or other local act defining the remuneration system in the company (Part 2 of Article 135 of the Labor Code of the Russian Federation), provide a salary range for sales managers ranging from 30 to 37 thousand rubles. Labor laws allow you to set minimum and maximum wages for specific positions. The salary consists of salary and allowances (Part 1 of Article 129 of the Labor Code of the Russian Federation). If the salary is due to all employees, then bonuses are assigned only to those who comply with certain conditions, for example, systematically exceeding the sales plan. The amount of salary and allowances is indicated in another document - in the staffing table.

- In the staffing table, which is filled out according to form T-3, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1, set the salary of the sales manager corresponding to the lower limit of the salary bracket, that is, 30 thousand rubles, and indicate the amount of allowances , for example, 1, 2, and 5 thousand rubles. It is impossible to establish a “fork” for salaries (letter of Rostrud dated April 27, 2011 No. 1111-6-1).

- Conclude an employment contract with each employee, which specifies the amount of wages (Article 57, Part 1, Article 135 of the Labor Code of the Russian Federation). You need to indicate the amount of the salary, and the remaining amount, which is not enough until salary, is distributed among allowances. For example, the salary is 35 thousand rubles, of which 30 thousand rubles. – salary, 5 thousand.

What we have in practice

Let's now see if the theory is confirmed by practice. According to DOU reviews, in 2014 there were 75,000 IT specialists in Ukraine, and in 2015 there were 90,000, that is, an increase of 20%. At the same time, the average salary fell by 5%. Fear and horror, the industry is dying, wages are falling! But the entire increase in the industry as a whole is due to juniors, and beginners - students, graduates and those who have retrained from other specialties.

Attrition in Ukraine as a whole is about 5%. These are people who leave the country or leave IT for other industries. Attrition in Ukraine is less than attrition in companies, because there are no transitions between companies. If we take these facts into account, we will get a total of 25% of “fresh” juniors, and we will see that in reality the “veterans” received an increase of 12.5%, which agrees well with our calculations.

In the final article of the series, we will look at perhaps the most “mythologized” questions - where do company profits go and why do companies need growth.

Shows overlapping pay categories and salary brackets

Typically, the tariff rates on the chart are the rates that the organization currently pays. Tariff rates for each grade are adjusted, which includes correcting rates that deviate far from the established curve and usually developing payment “brackets.”

One way to display payment “forks” is the given salary structure (see Fig. 4.17a). The salary structure graphically depicts the “forks” of tariff rates for each category (in this case, per hour). Payment “forks” are usually built along the salary curve.

Unit labor costs are an indicator of the amount of current remuneration for labor spent per unit of real (at constant prices) output.

Unit labor costs (UINOT) are calculated as the ratio of payments for labor to output:

UINO= Payments for labor: Issue

To determine the relationship between labor productivity, hourly remuneration and unit costs, this indicator can be considered in the form:

WINOT = Remuneration for one hour of labor: Output per one man-hour

With a constant amount of hourly remuneration, unit costs for payment are inversely proportional to changes in productivity or output per man-hour (Fig.

Live forks

In addition to the forks that form before the match, players monitor changes in quotes in real time. Live sure bets are more convenient because the percentage of net profit is much higher. Moreover, it is more difficult for bookmakers to track arbers during this period. However, this method of play has its drawbacks: in the “live” mode, the odds change very quickly, so you may not have time to place a bet. Otherwise, the game on sure bets in live mode is the same as in pre-match mode (before the start of the event).