How is alimony collected from an entrepreneur?

The responsibilities of parents regarding the maintenance of their children until they reach adulthood are outlined in the statute. 80 SK. Payment of alimony must be made voluntarily; an agreement may be concluded. If a citizen evades payment, alimony is collected through the courts, that is, by force.

Since an individual entrepreneur, as one who has registered a legal status, receives income from his business activities, alimony can be withheld from them in one of the available ways - as a percentage of profit or in a certain amount. The calculations are not carried out by an accountant, as is the case with ordinary hired specialists, but by the businessman himself. In this regard, situations may arise when the income is zero, or the entrepreneur simply “forgets” about the need to transfer alimony to the child, which may lead to the involvement of bailiffs. Next, we will consider how the calculation procedure depends on the tax regime of individual entrepreneurs.

https://youtu.be/DsYcWNEtFDY

Alimony from individual entrepreneur to OSNO

As mentioned above, the list of income from which alimony is required to be withheld from individual entrepreneurs is given in Resolution No. 841. Since the text of clause “z” is laconic, officials have issued additional explanations on how to correctly confirm the receipt of your income and expenses. Order No. 703n/112n/1294 dated November 29, 2013 states that when a businessman uses the general regime, declarations can be considered as supporting documentation - to clarify income, KUDiR - to clarify expenses. The forms must comply with current forms, and the list of costs must comply with the requirements of Stat. 221 NK.

How to collect

To obtain alimony in a simple way, you need to go to court to get an order. However, this method is not always realistic for those who deal with individual entrepreneurs, since then it is not easy for the claimant to obtain a certificate of income from the other party.

There are two ways to collect child support payments from the second parent, who is an individual entrepreneur.

The same rules apply in any other case of alimony, regardless of what the defendant’s income is:

- Voluntary registration (peaceful). It is approved by both parents jointly, after which it is recorded and brought into force by a notary. The amount of money chosen by the parents should not be less than the result of calculations according to the standard principle, depending on income and expenses. The document must include the following points:

- Registration procedure;

- Temporary restrictions on processing and provision of payments;

- Amount of money;

- Indexing data;

- The method and level of responsibility for violation of the requirements included in the document must be indicated;

- Possible other conditions that play a role in the situation.

- Forced registration. It is used in situations where an individual entrepreneur denies the possibility of concluding an agreement on the payment of alimony voluntarily and does not want to take part in the financial support of children. Then the plaintiff is forced to file an application with the court, after which it will be decided to force the responding party to pay.

It is important to know! Refusal to pay alimony can be punished both administratively and financially, as well as criminally.

Alimony from individual entrepreneurs to UTII in 2017

In the case when commerce is conducted on imputation, income is determined not by the actual amounts received, but by potentially possible values. But how to pay alimony to individual entrepreneurs on UTII in this situation, that is, with what profit - real or predicted? According to the current Order No. 703n/112n/1294, when applying UTII, potentially possible profitability indicators are taken, and expenses are taken only according to the amounts established by legal requirements. For individual entrepreneurs, these are insurance payments, benefits costs, etc. Accordingly, even if the entrepreneur did not actually receive any profit, he is obliged to pay alimony from the expected income.

Note! To confirm the amounts, the individual entrepreneur provides on UTII: declarations - for income, primary documentation (BSO, payment forms, contracts, etc.) - for expenses.

Alimony from an individual entrepreneur

According to Art. 80 of the RF IC, parents bear equal financial obligations for the maintenance of their common children. Alimony from individual entrepreneurs can be collected both as a share of income and as a fixed sum of money (TDS) or in a mixed form. Due to the fact that entrepreneurs have unstable income, recipients face certain difficulties. To avoid them, it is recommended to familiarize yourself with the nuances of collection and legal regulations.

How to get away from alimony as an individual entrepreneur

Unlike the employed population, for whom the transfer of alimony is handled by the accounting department and controlled by the employer, alimony from an individual entrepreneur is calculated and transferred directly by the businessman himself, because he has no official employer. If errors are identified, the individual entrepreneur will be forced to pay a penalty for each overdue debt.

Unfortunately, not all alimony payers pay according to the established procedure. It is easier for entrepreneurs, unlike ordinary workers, to ignore this obligation.

This method is the simplest, but with other taxation systems greater difficulties may arise.

Family Code, alimony payments can be calculated in a fixed amount. This is calculated proportionally in relation to the cost of living.

Alimony from individual entrepreneur to simplified tax system (simplified)

If taxes from an entrepreneur are withheld according to a simplified system, the amount of alimony is calculated based on the tax payment method chosen by the entrepreneur.

Under the simplified tax system, there are two options for determining the tax base for tax withholding:

- Total income;

- Income minus expenses = profit.

Accordingly, the first option for the simplified alimony payer is extremely unprofitable, since alimony will be calculated from the total amount of revenue.

Alimony from entrepreneurs: features of collection

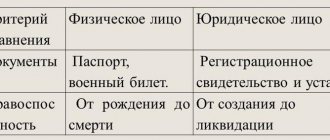

An individual entrepreneur is recognized as a self-employed citizen registered with the Federal Tax Service in accordance with the established procedure. In fact, he is his own employer, so when collecting alimony, a number of difficulties may arise:

- Individual entrepreneurs, depending on the chosen taxation system, submit tax returns once a quarter or year, but tracking income from them is problematic.

- Some entrepreneurs hide their real earnings, which is why the alimony collected in shares is significantly reduced.

- It is impossible to obtain information about the income of individual entrepreneurs on UTII, because when choosing this system, the tax is calculated taking into account the expected earnings. Alimony can be calculated based on the average earnings in the country.

- Bailiffs may request a book of income and expenses when the payer uses OSNO, simplified tax system or unified tax. You will also need documents regulating the costs of business needs.

- as a percentage of earnings,

- in a fixed amount of money,

- in a mixed form, when the first two methods are combined.

When claiming alimony for the maintenance of a former spouse or a disabled adult child, payments are assigned in a fixed amount, and here the amount of the payer’s earnings does not matter much - only the subsistence level (ML) is taken into account.

How much child support should an individual entrepreneur pay for a child?

In the case of individual entrepreneurs, standard rules for calculating alimony apply.

The legislation of the Russian Federation provides for two methods:

- in shares of the payer's earnings . This may not necessarily be a salary, as is the case in most cases. For an individual entrepreneur, this is income from activities;

- in a fixed amount . If income is unstable or absent, then a calculation in fixed terms is applied.

To determine the amount of the alimony payment, it is necessary to correctly calculate the income of the potential payer.

If the enterprise is on the general taxation system

If an entrepreneur uses the basic taxation system for reporting, then his income is calculated based on the amount that is subject to income tax. It is indicated in the declaration, therefore, in order to obtain a positive court decision, it must be presented as evidence.

If the enterprise is simplified

When an individual entrepreneur uses a simplified system, his income will be profit from his activities.

To understand exactly what amount to calculate from, you will need the following documents:

- journal of income and expenses;

- tax declaration, according to the type of activity of the individual entrepreneur;

- receipt from the Federal Tax Service for payment of taxes.

It is in the interests of the individual entrepreneur himself to submit the most complete package of documents, since the result of the calculation depends on this.

Calculation of alimony for individual entrepreneurs on UTII, on a patent

Determination of the amount of alimony in this case depends on the potential income of the payer. Here, special attention is paid to the expenses of both parties and the circumstances of raising the child, the need for additional costs to obtain it.

If the individual entrepreneur presents a journal of income and expenses, the task will be easier. If not, then conclusions about income can be drawn from the officially declared amount.

If income is inconsistent or non-existent

If an individual entrepreneur does not work for profit or his income constantly and varies significantly, for example, depending on the season, then the calculation is carried out differently.

Alimony payments are determined in a fixed amount, which does not depend on the payer’s earnings.

The fixed amount of child support depends on a number of parameters at the time of consideration of the case:

- average wage;

- living wage.

Expert opinion

Irina Vasilyeva

Civil law expert

It is depending on the average wage and subsistence level, the plaintiff’s demands and the defendant’s objections that the final amount of child support is determined.

Forms for collecting alimony from individual entrepreneurs

According to the RF IC, alimony can be collected in different forms depending on the possibility of confirming the individual entrepreneur’s earnings and other nuances.

This is important to know: Claim for recovery of penalties under a writ of execution

As a share of income

For one child, 25% is withheld, for two – 33%, for three or more – 50%. The maximum amount of deductions, taking into account payment of possible debt, cannot exceed 70%. The collection of alimony as a percentage of earnings requires the availability of certificates confirming it.

Example of recovery as a percentage:

With such a salary, he will have to pay the following amount:

In a fixed amount of money

To assign such payments, the alimony payer is not required to provide information on income, therefore, in the case of recovery from an individual entrepreneur, this option is the most beneficial for recipients.

Example of collection in TDS:

Mixed alimony

A mixed form of alimony is beneficial when the payer has two types of income at the same time - permanent and “floating”.

An example of a mixed recovery:

How to pay alimony to an individual entrepreneur?

The amount to withhold alimony is determined after calculating expenses for business needs, taxes and other government contributions, as well as employee salaries from income.

Documents confirming the earnings of an individual entrepreneur depend on the applicable taxation system:

| OSNO, USTKHN, USN, UTII | Copy of tax return |

| PSN | Income book |

With zero income

Some people mistakenly believe that by submitting a “zero” declaration to the Federal Tax Service, alimony obligations are canceled and there will be no need to repay the debt for the period of non-payment. According to Art. 113 of the RF IC, in the absence of work or failure to provide documents confirming earnings, the debt is calculated taking into account the average salary in the Russian Federation.

Example of calculation for zero income:

On the simplified tax system (simplified)

When applying the simplified tax system, an individual entrepreneur can choose one of two taxation methods:

- 6% of income;

- income minus expenses, where 15% is deducted from the difference (actually received profit) in the form of personal income tax.

In both cases, alimony is withheld only after taxes have been deducted. Based on Art. 264 of the Tax Code of the Russian Federation, insurance premiums are taken into account in other expenses when determining the amount subject to taxation.

Simplified calculation example:

On UTII

The use of UTII by an entrepreneur implies the payment of taxes based on the probable income in accordance with his activities. Real earnings are not taken into account.

When using UTII, it is logical for the payer to collect payments in a fixed amount.

According to Art. 83 of the RF IC, if it is impossible to establish the exact amount of earnings, alimony may be collected in the TDS. If payments in shares of income have already been assigned, but the payer has stopped transferring them, the claimant has the right to change the form of alimony payments through the court and submit an application for calculation of the debt from the average salary in the Russian Federation to a bailiff.

How to collect alimony from an individual entrepreneur through the court?

The best option for individual entrepreneurs is alimony in a fixed amount. To apply for alimony, the recipient must do the following:

- File a claim.

- Submit the claim with the attached documentation to the court and wait for a decision on acceptance of the materials for production.

- Receive a notice with a court date.

- Appear at the hearing. Cases regarding the collection of alimony are considered for no more than 1 month.

- Get a court decision. After entering into legal force, pick up the writ of execution (IL) and present it to the bailiff for enforcement.

The bailiff draws up a resolution to initiate enforcement proceedings and sends a copy to the debtor. The document indicates the period of voluntary repayment. In case of systematic non-payment, various measures are applied to the alimony obligee:

- seizure of bank accounts;

- ban on leaving the Russian Federation;

- search for property for forced seizure;

- prohibition on performing registration actions with property;

- restriction of the use of a special right (driver’s license).

Where to contact?

According to Art. 29 of the Code of Civil Procedure of the Russian Federation, plaintiffs can appeal to the courts at their place of registration or at the defendants’ registered address. Such cases are within the competence of magistrates.

Collecting payments through writ proceedings is problematic, because in order to issue an order, the judge requires certificates of income of the alimony payer. In most cases they refuse to provide them.

Documentation

When filing a lawsuit, the plaintiff presents:

- statement of claim;

- passport;

- child's birth certificate;

- marriage registration certificate;

- information about the defendant’s earnings (if any).

To change the method of collection, you will need a previous court decision, IL and substantiation of the claims: receipts for payment for the child’s clubs, information about the plaintiff’s salary, checks for the purchase of clothing, etc.

How to make an application?

When drawing up a statement of claim, you must be guided by Art. 131 of the Code of Civil Procedure of the Russian Federation, according to which it must contain the following information:

- name of the court;

- Full name, registration address, date of birth of the plaintiff and defendant;

- date of divorce;

- Full name, date of birth of the child;

- claims: collection of alimony in shares of income, in a fixed amount, etc.;

- a list of the attached documentation;

- date and signature of the plaintiff.

The claim is drawn up in two copies. One is returned after filing with a note of acceptance, the second remains in court. A copy of it is sent to the defendant.

Sample application for the collection of alimony from an individual entrepreneur in the TDS with UTII

To the magistrate of court district No. 4758 of Bryansk

Plaintiff: Astafieva E.I.

Address: Bryansk, st. Mirnaya, 26.

Defendant: Miryaev S.V.

Address: Bryansk, st. Lenina, 15.

Statement of claim for the recovery of alimony for a minor child

I am the mother of a minor child, O. S. Miryaev, born in 2010, whose father is the defendant S. V. Miryaev. The defendant does not take part in the child’s life, no child support agreement was concluded.

I believe that the defendant should pay alimony in a fixed amount for the maintenance of their common son Miryaev O.S., since he is an individual entrepreneur who uses UTII, and it is not possible to establish the exact amount of his earnings.

The above circumstances are the basis for collecting alimony in a fixed sum of money (Article 83 of the RF IC). This will provide the child with optimal support and purchase all the necessary things and products.

Considering the above, I request:

Date Applicant's signature

Features of alimony registration

A court decision to satisfy a claim for the need to pay money is issued by employees of the court office. The collection of alimony in Russia from an individual entrepreneur begins with filing a claim. The following official documents must be attached to the claim:

- photocopy of the applicant's passport;

- a photocopy of the certificate indicating the fact of the birth of a common child;

- a photocopy of a certificate confirming the conclusion and dissolution of an official marriage;

- an extract with text about the composition of the family of the applicant (it would not hurt to attach the same information about the payer of the funds).

To calculate the required amount of alimony, a parent raising children after a divorce can also attach certificates of their spouse’s earnings and their own, and the actual costs of maintaining the children. Expenses for children are calculated taking into account money spent on food, clothing, and ensuring their development.

Let's say child support continues to accrue, but the parent does not transfer the money. Then the alimony agreement is handed over to the bailiffs. Ahead - forced collection. Also, an entrepreneur who knows how alimony is calculated can calculate it independently. If the father transfers funds, the corresponding dates are noted in the writ of execution.

https://www.youtube.com/watch?v=yHGO_By4R2o

Arbitrage practice

In most cases, alimony is collected from individual entrepreneurs in a fixed amount on the basis of Art. 83 RF IC. This rule also applies in cases where the payer is not officially employed or cannot confirm his earnings.

As judicial practice shows, if the defendant does not confirm a stable income, claims for fixed alimony are satisfied. If the defendant is not comfortable with such payments, he can file an objection (response) at any stage of the proceedings.

This is important to know: How to cancel a disciplinary order: sample

How does an individual entrepreneur pay alimony?

An individual entrepreneur pays alimony according to standard rules. There are two options: he will either transfer the required amounts himself to the recipient’s account. Or he will give instructions to his own accounting department (if one exists at all) and in this case he will simply have to control the implementation.

Size

The size of the payment is also identical to any other situation and directly depends on two parameters: the amount of income received and agreements between the parents. If we take as a basis the only mention in the law about the amount of payments, then we can calculate the amount as follows:

- 25% of income if there is 1 child under the age of 18.

- 33% of income for two minor children.

- 50% of income for three minor children.

If an individual entrepreneur has children from different marriages, the amount does not change. But the procedure itself changes somewhat. So, you will have to split the payment into several, distributing them equally among all recipients.

Alimony from individual entrepreneurs on the simplified tax system (simplified)

You need to understand that the fact how much individual entrepreneurs pay does not depend in any way on the chosen taxation system. This completely logical rule was enshrined in the decision of the Constitutional Court of the Russian Federation No. 17-p, dated July 20, 2010, and has since become practically mandatory for all situations. However, in some cases it is more convenient to slightly modify the calculation system. For example, if a person works on a simplified basis, determining profitability is not difficult. As a result, all payments will be charged according to the standard scheme described above.

Alimony from individual entrepreneur to UTII 2020

How much do you need to pay those people who work under the UTII system? The answer is very simple. The amount of alimony depends on the actual profit of the individual entrepreneur. As a result, any documentation that a person submits to the tax office will not particularly concern the recipient of alimony. The entrepreneur will be obliged to make transfers only based on the net profit that he will receive at the end of the month.

Alimony from individual entrepreneurs on the general taxation system

The general tax system assumes full control and reporting listing what, where and how it came and went. It is practically no different from the previous options, since income is still clearly shown and it is easy to calculate the amount of net profit from them. As a result, a system common to all is applied or the fact of transferring funds, which was agreed upon with the recipient of alimony.

Alimony from an individual entrepreneur who does not conduct business or does not receive income

But calculating alimony that an individual entrepreneur with zero income must pay is already becoming a problem. There are often situations in which an enterprise does not make a profit at all or a person temporarily ceases his activities. In such a situation, the average salary in the region or the cost of living can be taken into account (from May 1, 2020, it is equal to the minimum wage). However, it must be taken into account that an individual entrepreneur must in any case have some source of income. He has to eat, dress, pay utilities, and so on. If you can find it (or, even better, force the bailiffs to do it), then you can take this money into account.

Alimony for an individual entrepreneur whose income is unstable

An option similar to the previous one is used when the income of an individual entrepreneur is unstable. There are no clear requirements or restrictions here, but in practice, usually in this case, alimony is calculated in a fixed amount. In one month they can be significantly higher than a percentage of income, but in another they will not amount to 10% of profit. Everything here is quite individual. The parties are recommended to enter into an agreement, since it can provide for such jumps in profitability, which will help both in the work of the individual entrepreneur and in supporting the child.

How is child support calculated if the father is an individual entrepreneur?

An individual entrepreneur’s income does not have a fixed amount; therefore, there are two options for possible payments:

- Percentage of income. If an individual entrepreneur has hired workers, he pays tax for them every month and submits monthly information about their financial condition, thus the tax authorities have data on the income and expenses of the alimony payer and the deducted percentage will be reliable.

- Solid cash payment. If an individual entrepreneur does not have hired workers, and he submits information to the tax office twice a year, his monthly income is more difficult to track, and as a result it is more difficult to track the veracity of the amount paid, then a fixed payment is applied. Parents can agree on the amount of payment on their own or with the help of the court. Every month, regardless of the amount of income, the payer is obliged to pay a certain amount for child support. The amount of payment specified in the agreement must be indexed in accordance with the law.

How to collect alimony from an individual entrepreneur

We have already figured out how individual entrepreneurs pay alimony. Now we should tell you how to actually get them from an entrepreneur. You need to understand that the procedure itself is identical for any person, regardless of their financial condition, the presence or absence of their own company, or any other indicators. There are only two main options: a voluntary agreement of the parties, or a court order.

Agreement of the parties

The easiest way to determine how and how much an individual entrepreneur pays is through a voluntary agreement between parents. As practice proves, this solution to the problem is the simplest, optimal and convenient for everyone. But only on condition that both sides are ready and able to negotiate. And make concessions, which, unfortunately, does not happen so often among former couples.

Procedure

In the event that the father is an individual entrepreneur, the spouses can discuss everything in advance and agree on how the procedure for calculating alimony and transferring funds will be carried out. The fact that a person is an entrepreneur is only a plus, since usually such people understand the need to enter into an agreement on a voluntary basis.

- Determine your specific wishes and requirements. This is true for both parties, since if the recipient focuses on the amount and timing of payments, the payer may put forward counter-demands regarding communication with the child or the need to confirm expenses made so that the entrepreneur understands that the money he transfers is actually spent on the baby .

- Based on the lists of conditions and requirements, an agreement can be drawn up. It must take into account all the features, nuances, details and wishes of the parties. Both signatories must agree with all points, otherwise they may simply not sign the document, which will automatically lead to its invalidity.

- The drawn up agreement must be notarized, otherwise it will not be valid.

- In the future, you need to strictly follow the letter, and ideally the spirit, of all points of the document. Otherwise, you can go to court and demand that the conditions be complied with.

This is important to know: Statement of claim to court: samples for debt collection from a legal entity

Agreement

Documentation

Alimony is calculated only if the agreement is drawn up correctly. But besides this, you need to attach a certain list of documents to it. It should be borne in mind that it is not legally enshrined, but it follows quite logically from the points. So, usually you need to provide the notary with:

- Signatories' passports.

- Birth certificate of the child/children.

- Confirmation of income level.

- A certificate from the child’s place of residence, which will confirm that he actually lives with the potential recipient of alimony.

Expenses

The agreement officially costs 250 rubles. However, notaries always charge an additional amount for their services. It varies widely, which directly depends on prices in the region of residence. In any case, the price is rarely more than 5 thousand rubles, but it is very difficult to find less than 2 thousand rubles.

Deadlines

The law does not provide for a strict limitation on the terms of alimony payments, except for the fact that payments are made only until the child reaches the age of majority (and it does not matter whether he is studying at this moment or is already working). The only exceptions are disabled children recognized as incapable of work. The registration procedure itself takes up to 2 hours, but everything is very individual.

Changes to the agreement

By agreement of the parties, changes may be made to the document. They may relate to any terms, conditions and conditions. Moreover, they can remove certain items altogether or even add new ones. In addition, changes can be made by force through the court, but this requires strong evidence.

Cancellation of agreement

The agreement can be terminated by the same agreement of the parties, under certain conditions, or even through the court. As in many other cases related to alimony payments, this is also done on an individual basis.

Violation of the terms of the agreement

If, in the process of collecting alimony, problems arise that are the result of failure of either party to comply with the terms of the agreement, they can be resolved in several ways. The simplest option: if one of the parties does not comply with the terms of the document, then the other is not obliged to do so. But more often a system of penalties and fines is used. If this is not provided for in the document itself, then the standard punishment system specified in the legislation may be applied (see below for more information on this).

Court order

The problem of paying alimony can also be resolved through the courts. Starting in 2020, you don’t even need to file a claim to do this. It is enough to submit an application for a court order. And only if the potential payer does not agree with this order, he can file a lawsuit. Then the official judicial review will begin, the results of which may or may not suit either party (and often both at once).

Procedure

- Determine for yourself the requirements for the alimony payer.

- Submit an application for a court order.

- Submit an application to the court.

- Wait for the order.

- Send the order to the executive service and the potential payer. Formally, the court should do this (and it does), but it’s faster to do it yourself.

Application for a court order

Documentation

Since alimony in the presence of a court order is collected strictly officially, the list of documents in this case is usually somewhat more extensive. The set of papers described above can be considered basic, but additional documents are often attached to it, which the applicant refers to in the application.

Expenses

There is no deduction of state fees when filing a court order. This requirement is provided for in the Tax Code of the Russian Federation. However, this rule applies only to the potential recipient of funds. The payer, if he does not agree, will be forced to pay a state fee, the amount of which will depend both on the amount of debt/payment and on the requirements in the statement of claim.

Deadlines

An application of this type, like an agreement, is usually not limited by any time limit (except for the age of majority). However, one must take into account the fact that alimony is usually collected from the moment the order is issued, and only in rare cases (which still need to be proven) can previous periods be taken into account.

Disagreement with a court order

If, from the payer’s point of view, alimony is collected from him incorrectly, he can file a claim to review the conditions specified in the order. Formally, the reason could be anything, from the amount (the most common option) to the timing of the transfer, which may be inconvenient for the payer.

Settlement agreement

If the parties, as part of the consideration of the case at the initiative of the payer, come to an agreement and they finally manage to agree with each other, they can enter into a settlement agreement. This can be done after filing an application, but before the announcement of the court decision. It should be borne in mind that it is very difficult to revise such a document, because both parties agree to the terms directly in front of the court. The general rules for drafting are identical to the above rules for concluding a regular agreement.

Counterclaim

Among other things, if the payer files a claim regarding alimony payments, he must understand that the recipient can also file a counterclaim, in which he will describe the situation from his point of view and put forward counterclaims. They can either concern the preservation of the current situation or its aggravation for the payer. Of course, all provisions, requirements and facts must be proven.

Arbitrage practice

How not to pay child support legally

We have looked at the cases in which alimony is paid, now let’s move on to the specifics of the procedure in the opposite case. Legal practice provides for the following measures to terminate alimony payments provided for by law. Such measures include:

- A voluntary agreement previously drawn up by the spouses, certified by a notary, on alimony support for a common child, which stipulates the occurrence of a circumstance, the cancellation of alimony deductions.

- The recipient of alimony can notarize a voluntary agreement to waive the accrual of alimony funds. In this case, the alimony payer who finds himself in a difficult financial situation may be exempt from paying alimony, and the alimony recipient must prove to the court that he has good financial security to support the child.

- Upon the child reaching adulthood (18 years old), with the early emancipation of a minor (16 years old). Moreover, as part of a claim that has not expired, the debt can be collected within 3 years from the date the child reaches adulthood.

- The alimony agreement may terminate if this does not infringe on the right to financial support of the child.

- Death of the alimony payer or alimony recipient.

- Other circumstances that may be considered in court are recognized as valid grounds for refusal of alimony obligations.

How to legally not pay alimony{q} There are certain circumstances that terminate enforcement proceedings for the collection of alimony:

- The minor child was recognized as needy due to a disability, and upon reaching 18 years of age acquired the status of able-bodied.

- A disabled minor will fully recover upon reaching adulthood.

- The court makes a decision to challenge paternity.

- When adopting a minor child.

There are several ways to avoid paying alimony legally in Russia; let’s look at them in more detail.

Not in all cases it is necessary to take coercive measures to collect debt from the alimony payer. Therefore, this method is another option for how to get rid of child support.

If the former spouses have drawn up a voluntary agreement on the amount and timing of alimony obligations and both parties fulfill the clauses of the agreement, then in this case there is no need for notarization of this agreement.

In cases of voluntary fulfillment of alimony obligations, it is not necessary to apply to the courts and the bailiff service for forced collection of alimony.

find_in_page Related Articles

(click to open)

- How to withdraw an application for alimony and whether it will be possible to submit it again

- Statement of claim for cancellation of alimony: valid reasons and sample application

- Cancellation of alimony: possible reasons and regulation of issues by law

- Should alimony be paid on sick leave in 2019?

- Receipt for receipt of alimony: sample document and rules for its preparation

- The amount of alimony from an unemployed person: how to determine it and what the amount depends on

- Appealing a court order for alimony: who can do it and when?

- Calculation of alimony from wages: example of payment calculation and sequence of actions

- Voluntary payment of alimony: features and procedure for receiving payments

- Child support: when and how to establish a payment procedure

- Alimony from a disability pension: who can count on it and when?

- Do I need to pay child support when paternity is deprived: when and how are payments calculated?

- Deprivation of parental rights for failure to pay child support: sample statement of claim and sequence of actions

- From what point is child support calculated: period and procedure for collecting funds

- Deductions under a writ of execution from wages: the procedure for calculating alimony and features of the procedure

- Is alimony withheld from vacation pay and in what amount are funds transferred?

- Child support: changes in legislation and the new law of 2019

- Withholding alimony from a pension: amount of collection and payment procedure

- Child support for parents: statement of claim and legal reasons for collecting funds

- Administrative liability for non-payment of alimony: when and for what reason does it occur?

- Maximum amount of alimony in percentage and fixed amount

- Deprivation of parental rights for failure to pay child support: sample statement of claim and sequence of actions

- Exemption from alimony payments: legal grounds and possible consequences

- Court order for the collection of alimony: collection of documents, procedure and writing an application

- Responsibility for non-payment of alimony: preventive measures and reasons for exemption from payment of debts

- Minimum amount of alimony and legal grounds for reducing the amount of payments

- What documents are needed to apply for alimony and what is the procedure for considering the application?

- Reducing the amount of alimony: good reasons and writing a statement of claim

- Alimony for 3 children in 2020: its amount, percentage payments and calculation procedure

- Alimony for 1 child in 2020: its amount, collection procedure and payment as a percentage

- Writ of execution for alimony: its receipt and further actions to collect funds

- Statement of claim to establish paternity and collect alimony: sample document, its completion and submission

- From what income is alimony deducted and is it possible to determine its amount?

- Claim for collection of child support: sample document and rules for writing it

- Alimony for 2 children in 2020: sample application, amount of payments and percentage

- How to pay child support correctly: ways to pay off the debt and the main obligations of parents

- How to increase the amount of alimony: step-by-step instructions and a sample statement of claim

- Limitation period for alimony and the possibility of its extension

- Child support in a fixed amount at the subsistence level: filing an application and legislative framework

- Changing the amount of alimony: legal basis and reasons for changing the amount of payments

- Search for alimony debtor: grounds for the procedure and legal search methods

- Plenum of the Supreme Arbitration Court of the Russian Federation: bankruptcy procedure and payment of alimony to wife and child

- Child support for a disabled child: how much is it paid and until how many years?

- Penalty for alimony: its calculation and grounds for calculation

- Application for a court order to collect alimony: sample document and procedure for obtaining it

- What to do if the husband does not pay alimony and the bailiffs are inactive: how to legally influence the process

- Child support court: filing an application and procedure for collecting payments

- Appeal against the decision of the magistrate to collect alimony: sample application and procedure

- Child support debt: for what period is it formed and how to achieve payments

- How to apply for alimony: drawing up a statement of claim and procedure

- Up to what age is child support paid: changes in the amount and order of payments

- Alimony with individual entrepreneurs: initiation of enforcement proceedings, calculation of payments

- How to refuse alimony and is it possible to do it legally?

- If your ex-husband does not pay alimony: what to do, where to go and how to get payments

- Collection of alimony: legal norms in the Family Code of the Russian Federation and opportunities for obtaining them

- Child support debt after the death of the debtor: who should pay it and how?

- When can you collect alimony from your grandparents?

- Is it necessary to pay alimony for a disabled spouse?

- Additional expenses for a child other than alimony: possible grounds and procedure for receiving them

- Section of alimony: drawing up a statement of claim and the procedure for collecting it

- How is alimony calculated for a mortgage and can it be reduced?

- How to file a counterclaim for alimony: procedure and necessary documents

- Is it possible to return overpayment of alimony and what legal ways are there for this?

- Apartment for alimony: procedure for transferring property and features of the procedure

- Delay in alimony: is it always his ex-husband’s fault, what to do if an organization delays alimony

- Recalculation of alimony: grounds, necessary documents, sample application, judicial practice

- Collection of alimony from a citizen of another country: what laws are regulated, where to apply, judicial practice

- Filing an objection to a statement of claim for the recovery of alimony payments in hard currency: procedure for filing, drawing up an application

- When and how child support payments are terminated

- Court decision to collect alimony: who and when can go to court

- Average Russian salary and alimony calculation: how it affects, calculation features, examples

- Refund of child support after challenging paternity: how and when it can be done

- Termination of enforcement proceedings for alimony: all the subtleties and features of the procedure

- How to get child support if your father is in prison and what needs to be done for this

- Should an ex-wife pay child support payments?

- What is the liability for non-payment of alimony?

- Statement of claim for alimony - sample 2020

- Child support if the father does not work

- Are alimony payments subject to income tax and are they considered income?

- Where to apply for alimony: jurisdiction for alimony claims

- State duty on alimony

- Certificate of alimony from your place of work

- Agreement on payment of alimony

- Calculation of alimony in a fixed amount, sample

- Calculator for calculating penalties for alimony online

- Calculation of penalties for alimony - online calculator 2020, how to calculate

- Child support calculator

- How to calculate the state duty to reduce alimony, calculator

- How to get alimony for three children and how much money is due for them{q}

- What is the amount of child support required for 2 children and how to calculate it{q}

- Alimony and cost of living

- Deprivation of rights for alimony

- Objections to the collection of alimony in a fixed amount

- Alimony to parents from children: amount of payment, judicial practice, sample agreements and statements of claim

- Child support, new law 2020

- How to avoid child support

- Statement of claim to reduce the amount of alimony: sample application

- How to find out alimony debt, dispute the debt

- Child support for an adult child

- Child support, how much should you pay?