Do I need a work book for an individual entrepreneur?

Typically, this document is needed in practice for two purposes:

- confirmation of length of service for sick pay;

- when submitting the necessary documents for registration of pension payments.

In the first case, we are talking about insurance experience.

The legislation provides that the specified length of service includes the time when a person was an individual entrepreneur and paid contributions to the Social Insurance Fund. Sick leave may be required by an individual entrepreneur in the following cases:

- He stopped working and is now an employee and is sick or injured.

- He continues to be an individual entrepreneur and at the same time is an employee who has been given sick leave.

- The entrepreneur writes out sick leave for himself.

He has the right to issue sick leave for himself if he contributed money to the Social Insurance Fund (SIF) for himself on a voluntary basis. In this case, he has the right to apply to the Social Insurance Fund for payment, which is provided to him in full at the level of the minimum wage, if at that time he had at least two years of insurance experience. This is his difference from an employee, to whom his employer is obliged to pay part of the amount.

If he is issued sick leave as an employee, then the time during which he voluntarily paid contributions to the Social Insurance Fund if he is registered as an individual entrepreneur is included in the insurance period.

When it comes to calculating pensions, the law allows the period of entrepreneurial activity of an individual entrepreneur to be taken into account as pension experience. This is done on the condition that he paid contributions to the Pension Fund during this time.

Therefore, an individual entrepreneur can resolve such issues without maintaining a work book. If before starting his entrepreneurial activity he was an employee, then during this period labor will still be needed.

Samples of filling out a work book for an individual entrepreneur

The work book of citizens hired for the first time must be issued by an individual entrepreneur during the week of working days.

There are only four columns on the spread of the document:

- serial number;

- date of completion of the document;

- the name of the organization and the position of the employee for which he is hired;

- document that serves as the basis for the entry.

The title page contains the following information:

- first, last and patronymic names of the employee;

- his date of birth in the form dd.mm.yyyy;

- acquired specialty, profession;

- the level of education;

- date of completion of the document;

- signature of the employee and employer (entrepreneur);

- seal.

Filling out this document is not difficult; you will need the following items:

- seal of an individual entrepreneur. Experienced entrepreneurs advise making a seal, despite the optional nature of this item;

- A pen with ink that is light-resistant and does not blur too much when in contact with water. The color of the pen is dark: black, purple or blue;

- The order of acceptance to work. This document is prepared by the individual entrepreneur himself.

Entry in the work book of an individual entrepreneur

Since the individual entrepreneur does not fill out a work book for himself, information about him may appear there in one of the following cases:

- An individual entrepreneur registered a legal entity and accepted a job there, registering a work permit.

- An individual entrepreneur works as an employee at the same time as carrying out business activities.

In the first case, it is necessary to take into account that a legal entity, its founder and employee are different legal entities, even if in all three cases we are talking about the same person. Therefore, the registration of labor in this case complies with the law.

In the second case, work with labor occurs in the usual way. In both cases under consideration, registration occurs in accordance with generally accepted rules.

https://youtu.be/LVBzx_m84mM

How to apply for a work permit for an employee if this is his first work experience?

So, imagine that you hired an employee to help you. But, as we know, and in accordance with the legislation of our country, he cannot work for you unofficially. That is why the fact of the existence of an employment relationship between you must be documented.

But what to do if an employee decides to get an official job for the first time . In this case, you need to correctly draw up the employee’s first employment document. Where to start if you yourself are a young individual entrepreneur who has never encountered anything like this?

First, you need to worry about purchasing a work book. You can purchase it at any print store. But here the entrepreneur is faced with the question of who exactly should be involved in purchasing the document. Since Article 16 of the Labor Code states that it is the employer who hires the employee and is the drawer of his labor document.

This means that it is the employer who purchases the work book for his employee . Also, the employer cannot shift this responsibility to a subordinate. The only thing an individual entrepreneur can do is, with the employee’s consent, to withhold half of the labor cost from the employee’s salary.

If the work report is created for the first time, then it is the employer who is responsible for filling out the work report. Therefore, an entrepreneur needs to take this process very seriously. For more information about registration when applying for a job, see the article at the link.

Filling out a work book by an individual entrepreneur - sample:

Sample entry in the work book of an individual entrepreneur

An example of an entry in the work book of an individual entrepreneur

When an individual entrepreneur hires employees, he must issue a work book for them in accordance with the law. This does not have to be done if a person works here part-time.

However, even in this case, if an employee asks to make such records (this may be important, for example, when it is necessary to certify work experience in a certain profession), then the individual entrepreneur will be obliged to do so.

If the employee did not have such a document before being hired, the individual entrepreneur is obliged to buy it at his own expense and carry out its initial registration. The law stipulates that registration must be done within five days after hiring.

Calculation of sick leave and other benefits

To calculate benefits for illness, pregnancy and childbirth, the total length of service of an individual entrepreneur does not necessarily need to be confirmed by an entry in the employment record. In accordance with the requirements set out in paragraph 11 of the Order of the Ministry of Health and Social Development dated 02/06/2007 No. 91 “On approval of the rules for calculating and confirming insurance experience...”, periods of individual work activity are confirmed either by certificates from financial authorities or archival institutions about the payment of social insurance payments (if it is refers to the period before January 1, 1991), or a document from the territorial body of the Social Insurance Fund of the Russian Federation on the payment of social insurance payments (for the period from January 1, 1991 to December 31, 2000, as well as for the period after January 1, 2003). The length of service confirmed in this way can be reflected in the employee’s personal card (form T-2).

IP experience

IP experience is calculated:

- for payment of benefits for temporary disability and similar;

- for calculating old-age insurance pension.

In order to confirm your experience, the following documents are required:

- Confirming the registration of individual entrepreneurs.

- If he has ceased his entrepreneurial activity, then a supporting document is needed.

- A certificate from the Pension Fund stating that contributions were paid during the period of the individual entrepreneur’s activity (these payments are mandatory). The document is required when determining the length of service to receive a pension.

When determining the length of service for payment of sick leave, maternity benefits and in connection with the birth of a child, you need a document that confirms the payment of contributions to the Social Insurance Fund for a certain period. Contributions are paid by individual entrepreneurs on a voluntary basis. If these documents are available, the individual entrepreneur’s experience is documented.

Cancellation of paper work books in 2020: latest news

See also:

By the end of 2020, each employee needs to decide:

- or he wants to leave a paper version of the work book;

- or wants to switch to an electronic version of a digital work book.

If he wants to keep his work book in paper form, he will have to submit a corresponding application by the end of 2020, and the employer will be required to continue to keep work books in paper form simultaneously with the electronic version of information about his work activities. Employers must notify each employee of the need to choose the method in which you will draw up a work book in 2021 no later than June 30.

Features of maintaining a work book for individual entrepreneurs

When making entries for individual entrepreneurs, the same rules apply as in other cases. In this case, it is necessary to indicate the name of the employer. For individual entrepreneurs, an inscription is made here: “Individual entrepreneur, full name.”

The law allows individual entrepreneurs to operate without a seal. In this case, there will be no stamp in the work book.

In other matters, there are no special features in the design.

Responsibility for compliance with labor laws

Individual entrepreneurs must comply with the rules for maintaining, storing, recording and issuing work books (clause 45 of the Rules). Violation of these rules provides for administrative liability (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). It includes the imposition of a fine from 1 to 5 thousand rubles. or suspension of the entrepreneur’s activities for up to 90 days.

In some cases, by court decision, compensation for moral damages may be provided for making incorrect entries in the work book.

Here are the basic provisions that an individual entrepreneur should know about working with a work book. Receive new blog articles directly to your email - only the latest news from the life of individual entrepreneurs:

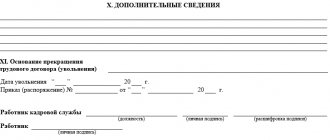

Reception of an employee

The main pages of the work book are each divided into 4 fields:

- Record number;

- Date of entry;

- The name of the individual entrepreneur, the position for which recruitment is being made / from which dismissal is taking place, indicating the reasons and legal grounds;

- The number of the document on the basis of which the entry is made.

When hiring, the date of employment is entered in the second field. And in the next one is the name of the organization, the entry “accepted for the position,” the basis for admission. If the entry does not fit, then you can write in the following lines below. In the next field, you must note the number of the order that is the basis for the entry, with the signature and transcript of the person filling out the document.

When is a duplicate needed?

Does the individual entrepreneur fill out work books issued as duplicates? Yes! The duplicate is filled out and issued to the citizen by the employer within 15 days from the date of filing the application for the document.

A citizen has the right to receive a duplicate in case the Labor Code is lost or the document is not in proper form. You can also request the issuance of a duplicate due to the fact that the information entered in the original does not correspond to the reality. But this fact must be proven in court. As a result, a duplicate is issued without the record being challenged in court.

The document contains information about the citizen’s work experience and detailed information about the place of work. At the request of the citizen, detailed entries from the original made by past employers are duplicated. If necessary, the employer must make a request to the organization where the work was carried out.

On video: Duplicate of the Work Book: sample filling