Budgeting of income and expenses is carried out regularly for a certain time interval. For companies with private capital, this type of document is entered into the accounting system on a voluntary basis using an arbitrary template. The report is considered mandatory for non-profit organizations and the public sector. The estimate includes a set of indicators by which cash flows can be recorded. Forecast values can cover both a separate division of the enterprise and the activities of the entire organization.

Estimate of income and expenses

An income and expenditure budget is a document on the basis of which the financing of a budgetary institution and individual settlements that are not municipalities is carried out.

The estimate of income and expenses of a budgetary institution is drawn up in accordance with the provisions of the Budget Code. It reflects all income of a budgetary institution, received both from the budget and state extra-budgetary funds, and from entrepreneurial activities (including income from the provision of paid services), other income from the use of state or municipal property assigned to the budgetary institution by right operational management, and other activities.

Expenses are determined based on the projected volumes of provision of state or municipal services and the norms and standards of financial costs for their provision. In this case, expenses are reflected in the total amount at the expense of budgetary and extra-budgetary sources, with the allocation of expenses from budgetary funds.

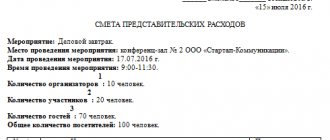

The estimate reflects:

- name and address of the institution;

- the budget from which it is financed;

- codes of functional classification of expenses (section, subsection, target item, type of expense);

- annual amount of budget allocations with quarterly breakdown by economic classification codes of expenditures.

The amounts of planned allocations for each type of expenditure must be justified by appropriate calculations. The volume of appropriations according to the estimate is given in the amount calculated by the institution and in the amount adopted in accordance with the approved budget. For some institutions (universities, preschool institutions), other sources of funding are also indicated in the estimate (payments from parents for keeping children in preschool institutions, fees for using a dormitory). The estimate provides a calculation of the main production indicators of the institutions (for schools - the number of classes and students, for universities - the number of students, etc.) at the beginning and end of the planned year and on an annual average.

The estimate of income and expenses is drawn up by the budgetary institution within 10 days after receiving notification of budgetary allocations from the body executing the budget and is submitted to the superior manager of budgetary funds for approval within 5 days from the date of its submission.

The estimate of income and expenses of a budgetary institution, which is the main manager of budgetary funds, is approved by the head of the main manager and transferred to the body executing the budget. Using the estimates of individual budgetary institutions, the superior manager of budgetary funds prepares a budget breakdown for the managers and recipients of budgetary funds based on the approved budget, based on the functional and economic classification of expenses with a quarterly breakdown. The list is submitted to the authority responsible for drawing up the budget (financial authority) within 10 days from the date of approval of the budget.

Taking into account the budget lists of all main managers of budgetary funds for the relevant budget, the financial authority draws up a consolidated budget list, approves it and communicates the schedule indicators to all managers and recipients of budget funds in the form of notifications of budgetary allocations for the period of validity of the approved budget.

Changes may be made to the estimate of income and expenses of a budgetary institution and to the budget list as a result of the introduction of a regime for reducing budget expenditures, execution of the budget for income in excess of that approved by the law (decision) on the budget, or as a result of the transfer of budgetary allocations by the main manager or manager of budgetary funds between recipients of budgetary funds (in the amount of no more than 5% of budget allocations brought to the recipient of budget funds). The movement of budget allocations is reported to the body executing the budget when notifying the limits of budget obligations.

The estimate of income and expenses of individual settlements that are not municipalities contains tasks for mobilizing income in a given settlement and the amount of expenses for financing subordinate budgetary institutions. The procedure for the development, approval and execution of these estimates is determined by local government bodies in accordance with their charter.

The estimate must be signed and confirmed by calculations

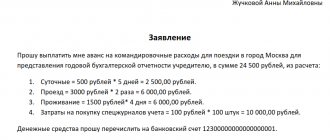

The estimate of income and expenses is drawn up by an employee of the HOA, who serves as an accountant. In the MA, if a decision is made to draw up such an estimate, this is usually done by employees of the economic department. When drawing up an estimate, an organization or partnership determines in what units the planned amounts are indicated: most often in rubles.

The document can be drawn up and approved electronically, for example, using electronic document management. But in this case, it must be printed and signed by the chairman of the HOA or, in the case of a management company, the chief officer of the organization. The signature on the estimate form indicates its validity. The time frame within which the estimate is drawn up and approved is not specified in the legislation of the Russian Federation, nor is the form of its preparation. The HOA prepares and approves estimates for the next year at the end of the previous or at the very beginning of the new calendar year.

The calculation of planned income and expenses is based on the estimate for the previous period and actual data on its implementation, the balance of funds from the previous period, the average cost of maintenance and management of apartment buildings. Inflation and the level of price fluctuations, tariff increases and the characteristics of the house for which the estimate is being prepared are also taken into account. All budget items must be supported by calculations or explanatory documents.

Concept and types of estimates

The cost estimate is a consolidated plan of all expenses of the enterprise for the upcoming period of production and financial activities. It determines the total amount of production costs by types of resources used, stages of production activity, levels of enterprise management and other areas of expenses. The estimate includes the costs of main and auxiliary production associated with the manufacture and sale of products, goods and services, as well as the maintenance of administrative and management personnel, the performance of various works and services, including those not included in the main production activities of the enterprise. Planning of types of costs is carried out in monetary terms for the production programs, goals and objectives provided for in annual projects, selected economic resources and technological means of their implementation. All planned targets and indicators are specified at the enterprise in the corresponding estimates, including a valuation of costs and results. For example, a cost estimate is drawn up as a plan of expected costs for various types of work performed and resources used. The prospective income estimate establishes the planned cash receipts and income for the coming period. The cost estimate for production of products shows the planned levels of inventories, volumes of products, the cost of various types of resources, etc. The summary estimate shows all costs and results for the main sections of the annual plan for the socio-economic development of the enterprise.

In the process of developing production cost estimates in domestic economic science and practice, three main methods are widely used:

- 1) estimate method - based on the calculation of costs throughout the entire enterprise according to data from all other sections of the plan;

- 2) summary method - by summing up the production estimates of individual workshops, with the exception of internal turnover between them;

- 3) calculation method - based on planned calculations for the entire range of products, works and services with the decomposition of complex items into simple cost elements. Kondrakov N.P. Accounting (financial, management) accounting: textbook. - M.: TK Welby, Prospekt Publishing House, 2009. - 448 p.

The estimate method is the most common at Russian industrial enterprises. Its use ensures close interconnection and integration of a comprehensive plan into a single system of calculations. With this method, all production costs for individual elements of the estimate are found according to the data in the corresponding sections of the annual plan. The procedure for determining estimated costs is usually as follows.

- 1. Costs for basic materials, semi-finished products and components are established on the basis of a plan for the annual need for material resources. The estimate includes only those costs that will be spent during the planning period and are subject to write-off for production. In other words, the need for materials is accepted without taking into account changes in inventory balances.

- 2. Costs for auxiliary materials are also accepted on the basis of annual plans for their needs. These costs usually include the cost of purchased tools and low-value household equipment consumed in the planning period.

- 3. The cost of fuel in the cost estimate is planned regardless of its use in technological processes or in household services. Total costs are established without taking into account changes in energy resource balances.

- 4. The cost of energy is included in the cost estimate as a separate element only if the enterprise purchases it from external suppliers. These costs include all types of energy consumed: electrical (power, lighting), compressed air, water, gas, etc. If some type of energy is generated at the enterprise itself, then these costs are included in the corresponding elements of the cost estimate (materials, wages) fee, etc.).

- 5. Basic and additional wages for all categories of personnel are determined according to current tariff rates and salaries, taking into account the complexity and labor intensity of the work performed, the number and qualifications of employees. This also includes the wage fund of unpaid employees, which is usually attributed to the main production.

Accruals for social needs are planned for the general wage fund of industrial production personnel at the rates in effect during the planning period.

- 6. Depreciation charges are intended to compensate for the wear and tear of technological equipment, industrial buildings, production facilities and other fixed assets at the expense of the cost of production. The total amount of depreciation charges depends on existing depreciation rates, the service life of the equipment and the initial cost of fixed assets.

- 7. Other cash expenses include costs not provided for in previous articles of the production estimate. For each item of other expenses, it is necessary to justify the amount of the corresponding costs according to existing standards or experimental data.

The developed production cost estimate must also correspond to the planned volume of sales of goods and services. If necessary, it is possible to adjust planned expenses taking into account changes in the standard stock of finished products, work in progress, inventories, deferred costs, etc.

The consolidated method of drawing up production cost estimates involves preliminary development and consolidation into a single system of total costs for the main and service production shops. The shop cost estimate includes two groups of expenses:

- 1) direct costs of this workshop for material resources and components, basic and additional wages, wage accruals, depreciation and other cash expenses;

- 2) comprehensive costs for the services of other workshops, as well as workshop expenses, etc.

It is recommended to start developing shop cost estimates for production of products from the procurement departments of the enterprise, then auxiliary shops, and after them you should move on to machining and assembly shops. A consolidated cost estimate for an enterprise is compiled by summing up shop estimates, followed by exclusion from the total amount of internal turnover and adjustment of existing inventories.

The cost estimate for the maintenance and operation of equipment includes the following cost items: maintenance of machinery, equipment and vehicles; costs of repairing fixed assets; operation of machinery and equipment; on-farm movement of goods; rent for machinery and equipment; wear and tear of low-value and fast-wearing items; other costs; just according to estimate.

The total amount of expenses for maintaining equipment and shop expenses constitutes the estimate of general production or general shop expenses. The estimate of shop expenses includes cost items for the maintenance of the shop management apparatus, depreciation of buildings and structures, rental of production premises, maintenance and repair of buildings, labor protection, scientific research and invention, wear and tear of low-value items and other shop costs.

The calculation method for developing cost estimates for production of products is based on the use of completed calculations or calculations of the cost of all types of products, works or services planned in the annual production program of the enterprise, as well as balances of work in progress and deferred expenses. Based on existing calculations of the cost of individual products, taking into account annual production volumes, a checkerboard sheet is developed containing all economic elements and costing items.

After compiling a chess table of costs, an updated general or consolidated estimate of expenses planned by the enterprise for the coming period is developed. To obtain the full cost of finished products, expenses for work and services not related to the production of gross output are excluded from the total estimate, non-production expenses are also added and changes in future expenses are taken into account.

In addition to the considered methods for determining the cost of products, order-based and process-by-process costing are also widely known and used at domestic enterprises and foreign companies.

The order-by-order method of calculation involves determining the costs of production for individual orders, work performed, planned contracts, etc. For each order or contract, its own costing sheet is compiled, which contains direct and overhead costs attributable to this type of work as they progress through the stages of production.

With process costing, production costs are planned for individual departments, production stages or production processes. Total costs are summarized by main expense items, including the cost of material and labor resources, and the amount of general business overhead costs.

The unit cost of production according to these calculation methods is determined by dividing the total costs of completing the corresponding order or process.

The financial activities of the department are based on the principle of combining all sources of funds and their use within the framework of a single budget of income and expenses. According to the annual reports at the department, the following structure of financial resources has been formed: funding from the budget - 34% of the amount paid - [p.204] The estimate of income and expenses of the enterprise for the coming period, based on the production of 5000 videotapes, is presented in table. 3.26. [p.190]

| Table 3.26 Estimated income and expenses for the upcoming planning period |

The main manager of budget funds is an executive body, the first direct recipient of budget funds, which has the right to distribute funds between managers and recipients of budget funds.

He prepares a list of budget expenditures for managers of budget funds and budget recipients, brings to them notices of budget assignments, approves estimates of income and expenses, changes, if necessary, the distribution of funds between the items of the estimate approved for them, exercises control over the rational, targeted use of budget funds by the budget recipient . [p.147] The manager of budget funds is an executive body that distributes funds between budget recipients. He informs them of notifications about budgetary allocations, approves estimates of income and expenses of budget recipients, and controls their intended use of budgetary funds. [p.147]

The planning function involves formulating goals and choosing ways to achieve them based on the delimitation of powers and areas of competence between the federation, federal subjects and local governments, as well as the development of forecasts and business plans for the development of enterprises and organizations, estimates of household income and expenses. The planning function usually includes the distribution of a limited amount of financial resources over time, taking into account priorities and development goals, and the redistribution of finances between the budget, enterprises and households. This function is implemented by drawing up budgets, plans and forecasts for the corresponding financial year and the future, balances of financial resources, establishing taxation procedures, etc. [p.17]

The chief manager of budget funds determines tasks for the provision of state or municipal services for subordinate managers and recipients of budget funds, taking into account financial cost standards. He approves estimates of income and expenses of subordinate budget institutions, draws up a budget list, distributes limits of budget obligations among subordinate managers and recipients of budget funds and submits them for execution to the body executing the budget. [p.328]

The chief manager of budgetary funds has the right to make changes to the approved budget of income and expenses of budgetary institutions in terms of the distribution of funds between its articles with notification to the body executing the budget. [p.328]

The chief manager of budgetary funds prepares and submits to the body responsible for control of the relevant budget a summary report on the execution of the budget for allocated funds, a summary estimate of income and expenses, as well as a report on the implementation of the task for the provision of state or municipal services. [p.328]

The income of a budgetary institution received from business activities is fully taken into account in its estimate of income and expenses and is reflected in the income of the corresponding budget as income from the use of property owned by the state or municipality, or as income from the provision of paid services. [p.339]

The budgetary institution draws up and submits an estimate of income and expenses for approval by the superior manager of budgetary funds. The budget manager approves it. [p.387]

The estimate of income and expenses of a budgetary institution, which is the main manager of budgetary funds, is approved by the head of the main manager and transferred by the budgetary institution to the body executing the budget. [p.387]

Recipients of budget funds have the right to accept obligations to make expenses and payments by drawing up payment and other documents necessary to make expenses and payments, within the limits of budget obligations and estimates of income and expenses brought to them. [p.387]

The body executing the budget spends budget funds after checking the compliance of the drawn up payment and other documents with the approved estimates of income and expenses of budgetary institutions.

A budgetary institution financed on the basis of estimates of income and expenses, if funding from the budget is delayed for more than two months or when financing no more than 75% of the volume of budgetary allocations established by the notification of budgetary allocations for the quarter, independently determines the volume of budgetary allocations for subject items of economic classification budget expenditures and clarifies the estimate of income and expenses with notification to the manager of budget funds and the body executing the budget. [p.390]

Based on notifications about the allocated limit of federal budget obligations, the recipient of these funds makes purchases, accrues established cash payments, including advance payments, and accepts other federal budget obligations in accordance with the estimate of income and expenses and the limits of budget obligations communicated to the recipients. The Federal Treasury spends federal budget funds after checking the compliance of the drawn up payment and other documents necessary for making the expenditure with the requirements of the law, the approved estimates of income and expenses of budgetary institutions and the limits of budget obligations communicated to recipients. [p.393]

Municipal budgets are classified as local budgets. The formation, approval and execution of local budgets, and control over their execution are carried out independently by local government bodies in accordance with the charter of the municipality. These budgets may provide for estimates of income and expenses of individual settlements and territories that are not municipalities. [p.498]

As an integral part of local budgets, estimates of income and expenses of individual settlements that are not municipalities are provided. [p.509]

Along with budgets at the federal level, the level of constituent entities of the Federation, and local governments, extra-budgetary funds can and are being formed. Cash flows in these funds are reflected in the income and expense estimates respectively. These estimates are nothing more than financial plans of extra-budgetary funds. [p.42]

Preliminary control is carried out at the stage of consideration and adoption of budgets (federal, constituent entities of the Russian Federation, local governments), financial plans of business entities, estimates of income and expenses of budgetary organizations and institutions. It involves assessing the validity of indicators of various financial plans, including budgets of all levels. This form of control allows you to prevent possible violations of current legislation and regulations, identify additional reserves and sources of possible income, prevent irrational use of financial resources, etc. [p.49]

Regional extra-budgetary funds are characterized by a variety of forms of formation, execution and control over the use of funds from these funds. In many regions of the Russian Federation, issues of the formation and use of extra-budgetary funds are completely under the jurisdiction of executive authorities. At the same time, there are regions, for example Petrozavodsk, where draft estimates of income and expenses of extra-budgetary funds, reports on its implementation are considered by representative bodies in the same way as the budget itself is considered. In a number of subjects of the Federation, for example in the Novgorod and Yaroslavl regions, extra-budgetary funds [p.292]

The information base of state budget statistics is based on a set of reports on the execution of the state budget submitted by the Ministry of Finance of the Russian Federation, form No. 1 Balance sheet, form No. 2 Statement of financial results, form No. 3 Statement of capital flows, form No. 4 Statement of cash flows, form No. 5 Appendix to the accounting balance sheet form No. 2-2 On the preparation of quarterly accounting reports by organizations on a budget form 2 Report on the execution of the budgetary organization's cost estimate form 2-1 Report on the execution of the budgetary organization's income and expense estimate transferred to new business conditions form 2-2 Report on use of budgetary allocations by an organization, an enterprise, form 2-3 Report on the flow of funds on the current account (amounts on instructions) forms 4.4-consolidated Report on the implementation of estimates for extra-budgetary funds Report on the implementation of plans for the network, states and contingents. [p.207]

Why is a systematic basis needed and why determine the write-off period in the event that the write-off amount of income from target financing is equal to the amount of the corresponding recognized expense? A likely answer to this rhetorical question can be found in IFRS 20, on the basis of which, as indicated in the article mentioned above, it was developed PBU 13/2000. In paragraphs 12 and 16 of IFRS 20, you can find familiar words that government subsidies should be recognized as income in the same periods as the corresponding expenses that they should compensate on a systematic basis. Of course, you can take any words and examples from IFRS 20, but it is not difficult to understand what the authors thought about the estimate of income and expenses, the implementation of which budgetary organizations report. [p.332]

So, we have established what the financial economy of the state is. It must have material resources at its disposal to satisfy collective needs. This involves collecting revenue on the one hand and spending funds on the other. As long as the financial economy exists, as long as the state seeks ways to generate income, the growth of needs increases expenses and gives rise to new types of them. In this regard, systematization, accounting, and control in the field of both income and expenses are necessary. The history of finance shows that the budget is not an institution inherent in the state at all stages of its development. For a long time the state did not have a budget. However, in all European countries and in Russia, revenues were collected and expenses were incurred, i.e. there was a well-known system of income and expenses based on legal norms. The budget appears not when the state makes expenses and obtains the necessary funds for this, but when it introduces a planning principle into its financial activities - it draws up an estimate of income and expenses for a certain period. [p.47]

In Russia, the procedure for drawing up a state list or estimate of income and expenses dates back to 1863. Before that time, budget law did not exist in Russia, since budgetary practice denied all its principles. Significant branches of state revenue were concentrated in the hands of separate departments, which disposed of them without control. The balances from the estimated assignments were not included in the next year's estimates. Information about the totals of income and expenses that the Ministry of Finance could summarize was incomplete. [p.52]

However, since 1999, in accordance with the provisions of the Budget Code of the Russian Federation, it has been stipulated that the income of a budgetary institution received from entrepreneurial and other income-generating activities are fully taken into account in the estimate of income and expenses of the budgetary institution and are reflected in the income of the corresponding budget as income from. the use of property in state or municipal ownership, or as income from the provision of paid services (Article 42.2), which corresponds to the trend of a tougher approach to the commercial activities of these institutions. [p.385]

The report, compiled using the indirect method, concentrates information on the financial resources of the organization, reflects the indicators contained in the estimate of income and expenses and coming to its disposal after paying for the factors of production to complete a new reproduction cycle. In our opinion, the information contained in such a report has independent significance. The report provides data that is not available in the direct method form, but that is necessary to understand the sources of funding and other aspects of the organization's activities. The table shows the form of the cash flow statement compiled by the indirect method. [p.72]

The cost plan for production, technical maintenance and equipment is drawn up by the planning and economic department (group) of the UPTOC in the form of an estimate of income and expenses by item of income and expense by base, reviewed and adjusted by the planning and economic department of the association and approved by the management of the association. The approved cost plan with a quarterly breakdown is communicated to the production and technical service bases. [p.125]

In a market economy, accounting ceases to be an internal matter of the enterprise and its owner. Joint-stock ownership, stock and commodity exchanges, and banking lending activities require wide information for participants in financial and trade transactions about the property and financial situation of the enterprises and firms that interest them. This will require the creation of public accounting reports in our economy, a prerequisite for which is an audit by an independent specialist (auditor), confirming the correctness of the reporting and the reliability of its content. For this purpose, commercial audit firms and firms are already being created, the activities of which must be regulated by law. BUDGET - from the English wallet, bag. This was the name of the briefcase in which the Minister of the Treasury carried money and his reports. Over time, the word came to mean the report of the Minister of the Exchequer to Parliament. Now we put the word budget into the meaning of an estimate of income and expenses. [p.46]

Issues of financial and economic activities, compliance with the bank's income and expense estimates, accounting and control procedures, financial results of the bank's activities, interim and annual reports on the bank's activities are considered at meetings of the bank's Management Board and the Bank's Council. General meeting of bank participants. [p.771]

A novelty in budget legislation is the rule according to which the income of a budgetary institution received from entrepreneurial and other income-generating activities are fully taken into account in the budgetary institution’s income and expenditure estimates and are reflected in the revenues of the corresponding budget as income from the use of property located in the state or municipal property, or as income from the provision of paid services. [p.78]

Together with the report on budget execution, the following documents and materials are submitted to the State Duma: a report on the expenditure of funds from the reserve fund of the Government of the Russian Federation and the reserve fund of the President of the Russian Federation, a report from the Ministry of Finance and other authorized bodies on the provision and repayment of budget loans, [budget loans, a report from the Ministry of Finance of the Russian Federation and other authorized bodies on the provision of state guarantees a report on internal and external borrowings of the Russian Federation by type of borrowing on income received from the use of state property summary reports on the implementation of planned tasks for the provision of state and municipal services summary reporting estimates of income and expenses of budgetary institutions by the main managers of budgetary funds register of the federal state property on the first and last day of the reporting financial year, a report on the state of external and internal debt, the Russian Federation, a report from the Federal Treasury on cases considered and penalties imposed for violation of budget legislation (Art. 276 BC RF). [p.113]

It should be noted that each superior manager of budget funds is at the same time a recipient of budget funds, since he receives and spends money from the budget in accordance with his estimate of income and expenses for salaries of his staff, travel and office expenses, and also receives money for capital construction, if provided for the current year. [p.322]

Within 10 days from the date of receipt of notification of budgetary allocations, a budgetary institution is obliged to draw up and submit for approval to a higher manager of budgetary funds an estimate of income and expenses in the prescribed form, which the manager of budgetary funds approves within five days (Article 221 of the Budget Code of the Russian Federation). The expenditure of budget funds was carried out [p.324]

A budget is a calculated and restrictive estimate of income and expenses, their breakdown for a certain period, approved by a decision of the relevant governing body and subject to execution. The budget is not only a legal and financial document that has the force of law, but also a way of redistributing national income. In terms of its material content, it is a fund of financial assets according to its economic role - a way of regulating production and consumption in society by social nature - a system of monetary and other social relations between the state, legal entities and individuals. [p.92]

Estimate of income and expenses of the special-purpose fund for sanitary and epidemiological welfare of the city for 1999 [p.169]

With the adoption of the Budget Code of the Russian Federation and new financing rules, budget terminology, which is used in budgetary relationships with recipients of budgetary funds, including social institutions, has changed significantly. For example, a budget recipient or recipient of budget funds is a budget institution or other organization that has the right to receive budget funds in accordance with the budget schedule for the corresponding year. The budget recipient must be a legal entity, have an approved estimate of income and expenses, and independent accounts in banking institutions [p.272]

Before introducing the concept of a budget, first of all, let us dwell on the problems of terminology. Usually, we associate the concept of budget with such definitions as state, federal, local, family; everyone hears the expression budget deficit. In management accounting, as an independent type of accounting in Western countries, the term budget is used in a slightly different sense, which is closer to our concept of an estimate (estimate of income and expenses). [p.118]

The directions for spending money received by charitable foundations are usually determined by the board of the foundation or a plenum of representatives of the founders and are recorded in the estimate of income and expenses. The expenditure of funds is predetermined by the goals of the foundation's formation, planned long-term programs that specify the statutory objectives of the foundation. The main distinguishing feature of charitable foundations is the spending of funds free of charge with a charitable focus. [p.98]

The movement of extra-budgetary funds is reflected accordingly in the financial plans (estimates) of income and expenses of the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Compulsory Medical Insurance Fund, and the State Employment Fund of the Russian Federation. The revenue side reflects Mandatory and Good-[p.51]

Determination of income and expense estimates

In accounting, there is a key concept of combining income and expenses - in a period, the cost price (expenses for the production of goods or services) that relates to sold rather than manufactured products can be written off. However, all period expenses incurred in the reporting period, regardless of whether they relate to the implementation of a given period or not, form the cost estimate (also called the cost estimate) for that period. The income part of the estimate is a list of all income received during the period.

Methods for preparing cost estimates

Each enterprise has its own characteristics and characteristics of the production process. The use of one method or another depends on the tasks facing the management team, as well as the conditions of the production process itself.

The most widely used estimate method. The estimate is a list of expenses calculated for the enterprise as a whole, based on economic elements. That is, data on material support costs is taken from the logistics plan, labor costs and social benefits are assessed using the personnel plan, and so on. For specific expenses, a plan is also drawn up, which allows you to calculate the approximate amount of costs.

The estimate method helps to collect information about individual areas of the enterprise, but does not provide the most reliable information that can be used for analytical work and planning the activities of the enterprise as a whole. To specify the amount of expenses, consolidated estimates are used. They describe the costs of the workshops; as a rule, they are laid down even before the opening of the enterprise. Consolidated estimates help distribute the financial and capital costs of an enterprise even before its operation begins.

Note 2

Thus, the estimate method involves planning and calculating costs first for individual areas, starting with auxiliary production, and then an assessment of all the main activities of the company is carried out.

Quite often in practice, the calculation method of drawing up cost estimates is used. It is based on the calculation of the cost of ready-to-sell products. Planning of general expenses, including costs for individual economic elements, is also applied here. In this case, similar elements are summed up and then included in the general list of expenses. The document that describes all the expenses of an enterprise is the “Production Cost Summary”. It is important to observe the rule of equality between the total for economic elements and expense items. The result obtained is adjusted to the amount of work in progress balances, as well as to the amount of expenses incurred during the work and provision of services.

Areas of application of the estimate

A wide area of application of income and expense estimates is the budgeting and reporting of non-profit institutions. Since these enterprises do not calculate the planned cost (due to the complexity of the calculations and the lack of strict necessity), the annual budget and reporting of these institutions is an estimate of income and expenses. In this case, the estimate serves as a tool for controlling cash expenditures. This is regulated by relevant legislation and is explained by the fact that a significant number of non-profit organizations receive government funding.

Regulatory documents regulating the preparation and approval of estimates of non-profit institutions are:

- Order of the Ministry of Finance of Russia dated November 20, 2007 No. 112n “On General requirements for the procedure for drawing up, approving and maintaining budget estimates of government institutions”;

- Order of the Ministry of Finance of Russia dated September 30, 2016 No. 168n “On amendments to the General requirements for the procedure for drawing up, approving and maintaining the budget estimate of a government institution, approved by order of the Ministry of Finance of the Russian Federation dated November 20, 2007 No. 112n.”

Non-profit organizations include:

- educational, cultural and medical public and private institutions;

- Homeowners' associations, housing construction and consumer cooperatives;

- organizations for the protection of citizens' rights;

- local and state government bodies;

- charitable foundations and organizations;

- religious associations;

- divisions of the Ministry of Defense, the Ministry of Emergency Situations and the Ministry of Internal Affairs.

Cost estimates are also often used to analyze the performance of individual divisions of an enterprise, for which it is incorrect to generate a profit and loss statement and which do not have their own income, although they directly or indirectly participate in generating the profit of the entire enterprise. This allows management to assess the efficiency of spending funds by each individual department.

When conducting events, a cost approach is also often used. In this case, the estimate reflects all income and expenses from the event.

The scope of application of estimates is also the planning of projects of both an investment nature, the costs of which will be capitalized in the future and will be included in the asset balance sheet of the enterprise, and projects to create a product or service for buyers and customers.

Stages of preparing an enterprise budget

⇐ PreviousPage 6 of 13Next ⇒To develop estimates at enterprises, a planning and financial commission is created, which includes high-level specialists from each division (segment) of the company.

The main task of the commission is to ensure the adoption of realistic estimates and their proper coordination. Segment managers submit their estimates for review and approval by the commission.

The commission appoints a manager who will lead the preparation of the estimate. Usually this is an accountant. He must draw up a generalized estimate of the enterprise based on the approved segment estimates.

Estimation is carried out in the following stages:

I. Communicate details of budgeting policies and guidelines to those responsible for budgeting.

The long-term plan is the basis for drawing up the annual budget. Top management should provide information about the indicators of the long-term plan to those responsible for preparing budgets for the planned year. These persons should also be aware of other important conditions affecting the preparation of estimates (expected increase in prices for raw materials, supplies, finished products, services, increase in wages, expected increase in production and sales, etc.).

II. Determination of the factor limiting product output.

Top management before budgeting begins must identify those factors that limit production (customer demand, material and technical base, lack of skilled labor) and communicate this to those involved in budgeting.

III. Preparation of a sales program.

The sales program is the most important plan in drawing up the annual plan; it determines the range and volume of sales, especially when the factor limiting production volume is consumer demand. Drawing up a sales program is the most difficult stage of planning, because the total income from sales depends on the interest of buyers, the general state of the economy, and the actions of competitors.

When drawing up a sales program, the most important thing is to assess consumer demand, which is carried out using a number of methods:

— assessment based on the opinion of management and sales department personnel;

— assessment using statistical methods, the use of which makes it possible to take into account general conditions in the enterprise and market and sales growth for previous periods.

IV. Initial preparation of estimates.

The process of preparing estimates should go from bottom to top. Estimates should be developed at the lowest level of management, and improved and coordinated at higher levels. The initial preparation of estimates can be based on historical data, but consideration should be given to changing conditions in the future. In addition, segment managers, when preparing their estimates, must adhere to the instructions of senior management on issues, for example, changes in prices for materials and services.

V. Discussion of estimates with senior management.

Budgeting begins at the lowest level of management. Managers at this level draw up their estimates and submit them for review and approval to higher managers, and they, in turn, combine these estimates into one and submit it for approval to their manager, who now becomes responsible for drawing up estimates at his level. This is a two-way process: setting goals and strategies for achieving them in a top-down manner; preparation of estimates from bottom to top; then approval of the compiled estimates again in a descending manner - from top management to department heads.

VI. Coordination and analysis of reviewed estimates.

As estimates move from bottom to top in the discussion process, it is necessary to study the relationship between estimate indicators and coordinate them. Changes to the estimate must be made by the person responsible for its preparation. Sometimes the estimate goes through all levels 2-3 times until all estimates are coordinated and acceptable to all parties.

VII. Final acceptance of estimates.

After all estimates are fully interconnected, they are combined into a generalized estimate, which consists of a profit and loss account, balance sheet and cash flow statement. After approval of the generalized estimate, all estimates are sent to all responsibility centers.

VIII. Subsequent analysis of estimates.

The process of drawing up estimates does not end with their approval. Actual results must be compared with estimates. The comparison should be made on a monthly basis and a comparison report should be submitted to the budget preparers by the middle of the following month to encourage their activities. This will allow us to identify which budget items were not fulfilled and find out the reasons for the deviation.

Preparation of the estimate includes the following:

We will draw up the company's annual budget for the next year.

The company produces two types of pumps:

oil (N.M.) and fuel (N.T.)

To develop an annual budget, you need to study the following information:

Cost rates per unit of production:

| Expenditures | Cost rates per unit of product | Price | |

| N.M. | N.T. | ||

| 1. Brass | 10 kg | 10 kg | 60 tenge per 1 kg. |

| 2. Aluminum | 8 kg | 6 kg | 85 tenge per 1 kg. |

| 3. Basic salary | 12 o'clock | 14 o'clock | 49.50 tenge for 1 hour |

The distribution base for production overhead is hours worked.

3. Details of finished products:

| Indicators | Finished products | Sum | |

| N.M. | N.T. | ||

| 1. Estimated sales volume (units) | |||

| 2. Unit price (tenge) | |||

| 3. Inventories at the end of the period (units) | |||

| 4. Inventories at the beginning of the period (units) | |||

| 5. Inventories at the beginning of the period at production cost (thousand tenge) | 196,2 | 74,34 | 270,54 |

4. Material details:

| Indicators | Basic materials |

| Brass | Aluminum |

| 1. Inventories at the beginning of the period (kg) | |

| 2. Inventories at the end of the period (kg) |

5. Composition of overhead costs (thousand tenge):

| 1. | Auxiliary materials | 280,0 |

| 2. | Indirect wages | 650,0 |

| 3. | Other payments | 205,00 |

| 4. | Energy (variable costs) | 700,0 |

| 5. | Maintenance (variable costs) | 200,0 |

| 6. | Depreciation | 220,0 |

| 7. | Taxes | 150,0 |

| 8. | Property insurance | 80,0 |

| 9. | Executive salaries | 950,0 |

| 10. | Energy (fixed costs) | 40,0 |

| 11. | Maintenance (fixed costs) | 50,0 |

| Total: | 3525,0 |

6. Composition of commercial and administrative expenses (thousand tenge):

| 1. | Commission remuneration | 210,0 |

| 2. | 180,0 | |

| 3. | Sellers' salaries | 190,0 |

| 4. | Fare | 200,0 |

| 5. | Employees' salaries | 130,0 |

| 6. | Auxiliary materials | 45,0 |

| 7. | Administrative expenses | 225,0 |

| Total | 1180,0 |

Based on this data, it is necessary to draw up: a sales estimate, a production estimate in units, an estimate of materials, an estimate of labor time, an estimate of production overhead costs, an estimate of inventory at the end of the period, an estimate of production (shop) cost, an estimate of commercial and administrative expenses.

Most enterprises have certain standards for budgeting, which contain instructions and organizational flow diagrams.

Drawing up an enterprise work plan begins with drawing up an estimate for product sales.

1. Sales estimate (sales program, sales budget).

| Name of finished product | Quantity (units) | Unit price (tenge) | Sales amount (thousand tenge) |

| 1.Oil pump | 15000,0 | ||

| 2. Fuel pump | 7810,0 | ||

| Total | 22810,0 |

The amount of 22810.0 thousand tenge is then used in developing the profit estimate. The implementation estimate is often the result of collecting and processing information.

The sales estimate shows the quantity of each type of product that the company plans and the planned selling price. The estimate presents a forecast of total income, on the basis of which cash proceeds from sales will be assessed. The sales estimate provides information for drawing up production estimates, estimates of commercial and administrative expenses.

Preparing an estimate for sales is the most labor-intensive, moreover, its results are the starting point for the next stages of drawing up functional estimates, since all costs depend on sales volume. First of all, the manager needs to determine the factor limiting production output. For most businesses, this factor is consumer demand. However, there may be cases when product output is constrained by production capacity, and consumer demand exceeds their capabilities. Difficulties in calculations arise in the first case, since the total income from sales depends on the actions of buyers, which are influenced by random factors (the state of the economy, the work of a competitor). The following methods are used to assess consumer demand:

- expert assessments made on the basis of the opinions of regional sales department managers and employees responsible for the production and sale of products;

-statistical estimates obtained on the basis of statistical analysis methods based on data for previous periods.

The process of preparing implementation estimates must be bottom-up, that is, data must be collected and analyzed at the lowest level of management, and coordinated with relevant findings at higher levels. As a result, the sales estimate must present data on the entire range of products of the enterprise (type, planned quantity in physical units, price, sales volume in monetary terms). The general sales estimate should be supported by detailed auxiliary planned tables for product sales by sales territory and sales analysis for each month.

2. Production estimate in units (production program)

| № | Indicators | Name of finished product |

| N.M. | N.T. | |

| 1. | Planned sales volume | |

| 2. | Specified balances of finished goods at the end of the period | |

| 3. | General needs (1+2) | |

| 4. | Balances at the beginning of the period | |

| 5. | Production program (3-4) |

The production estimate is formed only in quantitative terms; its goal is to ensure sufficient production to meet consumer demand.

3 a. Estimated requirements for basic materials for the planned year

| № | Indicators | Finished products | Sum | |

| Brass | Aluminum | |||

| 1. | Oil pump (5920 x 10 = 59200 kg) (5920 x 8 = 47360 kg) | |||

| 2. | Fuel pump (2050 x 10 = 20500 kg) (2050 x 6 = 12300 kg) | |||

| 3. | Total requirement for basic materials (kg) | |||

| 4. | Price for 1 kg (tenge) | |||

| 5. | Total amount (thousand tenge) | 4782,0 | 5071,1 | 9853,1 |

3 b. Cost estimate for the purchase of basic materials for the planned year

| № | Indicators | Basic materials | Sum | |

| Brass | Aluminum | |||

| 1. | Production requirement (kg) | |||

| 2. | Planned balances at the end of the period (kg) | |||

| 3. | Total requirement (kg) | |||

| 4. | Remaining materials at the beginning of the period (kg) | |||

| 5. | Need to purchase (kg) | |||

| 6. | Price for 1 kg (tenge) | |||

| 7. | Acquisition costs (thousand tenge) | 4812,0 | 4739,6 | 9551,6 |

To ensure the production program, the company must have 9551.6 thousand tenge to purchase the necessary basic materials.

The purpose of the estimate of production materials (budget of basic materials) is to calculate the direct costs of materials in natural and monetary units for the implementation of the production program and to estimate the funds for the purchase of basic materials, taking into account existing reserves. The purchase of materials depends on production needs and inventory levels and is determined by the formula: production needs + materials balances at the end of the period - materials balances at the beginning of the period.

The use of production materials is assessed directly by the heads of production areas (for example, workshops). Based on their production technology for a particular type of product, they provide annual planned tables for the use of basic production materials for each product and the total demand for each type of material. This data is used to calculate the costs of purchasing basic production materials. The head of the supply (purchasing) department is responsible for drawing up this estimate.

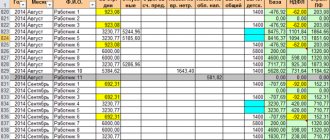

4. Working time estimate (labor budget)

| Name of finished product | Planned production volume (units) | Time spent per unit (hour) | Total hours | Labor costs (in thousand tenge) | Deductions from wages (thousand tenge) | Total |

| Oil pump | 3516,48 | 738,46 | 4254,94 | |||

| Fuel pump | 1420,65 | 298,34 | 1718,99 | |||

| Total | 4938,13 | 1036,8 | 5973,93 |

The purpose of the working time estimate (labor budget) is to prepare estimates of the working time required to meet production needs. These costs depend on production technology, piece rates, and tariff rates. The managers of production sites (shops) are directly involved in the preparation of this estimate; they must be guided by the developed prices and staffing schedule. Labor prices should be developed on the basis of the existing tariff system.

5. Estimate of overhead production costs for the planned year. (allocation base 99740 working hours)

| № | Expenditures | Amount (dollars) |

| 1. | Auxiliary materials | 280,0 |

| 2. | Indirect wages | 650,0 |

| 3. | Other payments | 205,0 |

| 4. | Energy (variable part) | 700,0 |

| 5. | Maintenance (variable part) | 200,0 |

| 6. | Depreciation | 220,0 |

| 7. | Taxes | 150,0 |

| 8. | Property insurance | 80,0 |

| 9. | Executive salaries | 950,0 |

| 10. | Energy (constant part) | 40,0 |

| 11. | Maintenance (permanent part) | 50,0 |

| Total | 3525,0 |

The amount of overhead costs for 1 hour of working time is equal to 3525000: 99740 = 35.34 tenge

The purpose of manufacturing overhead cost estimating is to correctly forecast the total amount of overhead costs and allocate the overhead costs according to the selected allocation base. The total amount of overhead costs typically depends on the trend of individual item costs in relation to the forecasted production level. When developing the items of this estimate, you should be guided by the relevant regulatory documents. The choice of the base for the distribution of overhead costs is presented to the business entity itself, based on its characteristics in equipment, technology and organization of production (for example, hours worked, the basic salary of production workers, costs of operation and maintenance of equipment, etc.). Overhead costs need to be analyzed to determine whether they are manageable or not and to establish control over these costs.

Based on the consumption rates of production materials, labor costs of production workers, and overhead costs, the planned cost per unit of finished product is determined.

Calculation of the estimated production cost of finished products

| Expenditures | Costs per 1 unit. or for 1 hour of work (tenge) | Oil pump | Fuel pump |

| Quantity (units) | Amount (tenge) | Quantity (units) | Amount (tenge) |

| Brass | |||

| Aluminum | |||

| Main work | 49,50 | ||

| Deductions from wages | 10,40 | 124,74 | 145,60 |

| Overheads | 35,34 | 428,08 | 494,76 |

| Total | 2426,82 | 2443,36 |

6. Inventory estimate at the end of the planned year

| Types of goods and materials | Quantity (kg.) | Price for 1 (tenge) | Amount (thousand tenge) |

| 1. | Main materials: Brass Aluminum | 318,0 76,5 | |

| Total | 394,5 | ||

| 2. | Finished products Oil pump Fuel pump | 2426,82 2443,36 | 2426,82 195,47 |

| Total | 2622,29 |

Information about the planned balances of materials and finished products at the end of the planned year is necessary for drawing up production estimates, material supply estimates, as well as for drawing up a forecast profit and loss report and a forecast balance sheet.

7. Estimate of workshop production costs.

(thousand tenge)

| № | Indicators | Oil pump | Fuel pump | Total |

| 1. | Balance of finished products at the beginning of the planning period | 196,2 | 74,34 | 270,54 |

| 2. | Basic materials | 4782,48 | 5071,1 | 9853,1 |

| 3. | Basic salary of workers | 3516,48 | 1420,65 | 4937,13 |

| 4. | Deductions from wages | 738,46 | 298,34 | 1036,8 |

| 5. | Manufacturing overhead | 2510,55 | 1014,26 | 3524,81 |

| 6. | Production cost (2+3+4+5) | 11547,49 | 7804,35 | 19351,84 |

| 7. | Costs of products ready for sale (1+6) | 11743,69 | 7878,69 | 19622,38 |

| 8. | Balance of finished products at the end of the planning period | 2426,82 | 195,47 | 2633,29 |

| 9. | Cost of products sold (7-8) | 9316,87 | 7683,22 | 17000,09 |

Production cost estimates are prepared to control cost levels and contain information from estimates for the labor of key production workers, the use of materials and production overhead costs. The purpose of the production cost estimate is, firstly, to calculate the planned production cost of products planned for production, and secondly, a preliminary assessment of the cost of products planned for sale.

8. Estimate of commercial and administrative expenses.

(thousand tenge)

| № | Expenditures | Amount (dollars) |

| 1. | Commission remuneration | 210,0 |

| 2. | 180,0 | |

| 3. | Sellers' salaries | 190,0 |

| 4. | Fare | 200,0 |

| Total business expenses | 780,0 | |

| 1. | Employees' salaries | 130,0 |

| 2. | Auxiliary materials | 45,0 |

| 3. | Administration salary | 225,0 |

| Total administrative expenses | 400,0 | |

| Total expenses | 1180,0 |

This estimate determines non-production cost items. It should be borne in mind that an enterprise, when forming the composition of commercial and administrative expenses, must be guided by the relevant regulatory documents.

9.Profit estimate (1 option)

(thousand tenge)

| № | Indicators | Oil pump | Fuel pump | Total |

| 1. | Revenue | 15000,0 | 7810,0 | 22810,0 |

| 2. | Cost of products sold | 9316,87 | 7683,22 | 17000,09 |

| 3. | Gross profit | 5683,13 | 126,78 | 5809,91 |

| 4. | Selling and administrative expenses | — | — | 1180,0 |

| 5. | Operating profit | — | — | 4629,91 |

9a. Profit estimate (profit and loss account)

(Option 2)

(thousand tenge)

| № | Indicators | Oil pump | Fuel pump | Total |

| 1. | Implementation | 15000,0 | 7810,0 | 22810,0 |

| 2. | Material inventories at the beginning of the period | 288,0 | 408,0 | 696,0 |

| 3. | Procurement | 4812,0 | 4739,6 | 9551,6 |

| 4. | Material inventories at the end of the period | 318,0 | 76,5 | 394,5 |

| 5. | Cost of materials consumed (2+3-4) | 4782,0 | 5071,1 | 9853,1 |

| 6. | Labor of main production workers | 3516,48 | 1420,65 | 4937,13 |

| 7. | Deductions from wages | 738,46 | 298,34 | 1036,80 |

| 8. | Manufacturing overhead | 2510,55 | 1014,2 | 3524,81 |

| 9. | Total production costs (5+6+7+8) | 11547,4 | 7804,3 | 19351,84 |

| 10. | Inventory of finished goods at the beginning of the period | 196,20 | 74,34 | 270,54 |

| 11. | Finished goods inventory at the end of the period | 2426,82 | 195,47 | 2622,29 |

| 12. | Cost of products sold (9+10-11) | 9316,87 | 7683,2 | 17000,09 |

| 13. | Gross profit (1-12) | 5683,13 | 126,78 | 5809,91 |

| 14. | Selling and administrative expenses | — | — | 1180,0 |

| 15. | Planned profit from production activities | — | — | 4629,91 |

This table more clearly reflects all types of expected income and expenses for the planned year.

Two options for profit estimates make it possible to predict the amount of profit (gross and operating). Profit estimates are compiled on the basis of previously developed functional estimates.

By summarizing the considered stages of budgeting, we can compile a list of the initial information necessary for the development of functional estimates.

| № | Data name | Data Responsibility Center |

| 1. | Volume of sales | Sales and Supply Department (Marketing) |

| 2. | Product inventory at the beginning of the period | Planning and financial department, supply department |

| 3. | End of period inventory | Planning and financial department, supply department |

| 4. | The rate of consumption of each type of basic materials for the production of a unit of assortment products | Production and technology department |

| 5. | Inventories of each type of material at the beginning of the period | Planning and financial department, supply department |

| 6. | Material inventories at the end of the period | Planning and financial department, supply department |

| 7. | Planned wage rates for key workers | Staffing charts, labor regulation department |

| 8. | Consumption rates for auxiliary materials for each type of product manufactured | Production and technology department |

| 9. | Norms of labor costs for auxiliary workers for each type of product produced | Production and technology department |

| 10. | Selling and administrative expenses | Planning and financial department |

After drawing up functional estimates, the enterprise begins to draw up final estimates:

— cash consolidated estimate (cash flow budget);

— estimated balance sheet (project balance sheet).

The estimated balance sheet (draft balance sheet), like the balance sheet itself, is a reflection of the state of assets, liabilities and equity at a certain point in time. These forms were compiled earlier and differ in the disclosure of individual new articles. New for the domestic accounting system is the preparation of a consolidated cash budget (cash flow budget), that is, a draft cash flow statement. It reflects changes in the resources of the enterprise over a period of time, reveals important data on the movement of cash flows of the entity for core, investment and financial activities:

Investment activity presupposes the availability of income and expenses in cash associated with the acquisition and sale of fixed assets, as well as with the issuance and receipt of repayable loans. For example:

· cash payments for the acquisition of intangible assets, fixed assets, financial investments and other long-term assets;

· cash receipts from the sale of intangible assets, fixed assets, financial investments and other long-term assets;

· cash payments for the acquisition of equity capital, financial investments, debt obligations of other enterprises;

· cash receipts from the sale of equity capital, financial investments, debt obligations of other enterprises;

· providing loans to other legal entities;

· repayment of loans provided by other legal entities.

Financial activity involves obtaining borrowed funds and returning them to their owners, which leads to a change in the amount of equity capital and borrowed funds. For example:

· cash proceeds from the issue of shares and other securities;

· cash payments to share owners for the acquisition or redemption of shares of the enterprise;

· obtaining bank loans, receiving funds from the issue of unsecured debt bonds, bills, mortgages and other short- and long-term loans;

· repayment of borrowed amounts;

· dividend payment.

Primary (operating) activities include all operations not related to investing and financing activities. The amount of cash flows from the main activities of the entity is the most important indicator when analyzing cash flows. Revenues must be sufficient to at least cover all costs associated with the production and sale of goods.

The main purpose of cash flow analysis is to identify sources of income and their use. The analysis is carried out by direct and indirect methods.

The direct method is based on an analysis of cash flows using data taken from the company's balance sheet accounts or from adjusted items in the income statement. This method represents cash flows for the main items of activity and:

· shows the main sources of cash inflows and the main directions of cash outflows;

· provides the possibility of prompt conclusions about the sufficiency of funds to make current payments;

· creates a relationship between total income and cash receipts for a period.

Let's consider the SCHEME for compiling a consolidated cash estimate using the direct method.

The indirect method is based on the simultaneous use of data from balance sheet items and the statement of results of financial and economic activities. When using it, the amount of net income (loss) is adjusted for changes in current assets and liabilities, non-cash transactions and for income and expenses resulting from investing and financing activities. This method reveals cash flows on a net basis, i.e. on the difference between receipts and payments and:

· reveals the relationship between various activities of the enterprise;

· establishes a connection between net income and changes in the assets of the enterprise for the period.

It should be noted that non-cash transactions are those that do not require the use of cash, for example, revaluation of fixed assets and financial investments, contributions to the authorized capital in the form of non-current assets, gratuitous transfer of assets to an enterprise, barter transactions.

Let's consider the SCHEME for compiling a consolidated cash estimate using the indirect method.

In general, the analysis of the consolidated cash estimate allows us to formulate conclusions on the following issues:

· the required amount and sources of funds and the main directions of their use;

· the ability of the enterprise to cover expenses through the influx of funds and how stable this ability is;

· the company’s income and how sufficient the income is to meet the current cash needs of the enterprise;

· the enterprise’s own funds and how sufficient they are to carry out investment activities;

· why there is a difference between the profit received and the total amount of cash.

⇐ Previous6Next ⇒

Composition of income and expense estimates

This document includes an expenditure section and a revenue section, detailed in the context of the corresponding cost and income items. When using estimates in management accounting, the list of these items is most often unified in order to be able to compare estimates among themselves, as well as from period to period.

Examples of cost items are:

- Salary

- Fare

- Depreciation

- Rental of buildings and structures

- Repair, etc.

The estimate also indicates the source of financing for certain expenses, as well as a breakdown by quarter or month.

The estimate must contain all areas of spending funds

The list of items of expenses of the HOA/UO for the year will be much longer and more detailed than the corresponding list of income of the organization. Expenses are all the costs of an organization that it incurs in the course of its activities and which lead to a decrease in its funds (clause 2 of PBU 10/99).

The following expenses must be included in the estimate:

1. For the maintenance of the common property of the house, including payments to the RSO for the Kyrgyz Republic on the SOI, the local area.

2. For current repairs of the OI MKD for the services of contractors who carry out repairs.

3. Administrative, which relate to the work of the HOA/UO: material, personnel, economic, for the services of the bank and the Unified Center, etc.

4. Tax fees and insurance premiums.

5. Payment of fines, penalties, penalties and other damage.

6. For major repairs for the services of contractors.

7. Unforeseen, if such expenses arose regularly in previous periods.

Each HOA or management entity compiles its own list of expense items depending on the presence or absence of certain services and work related to the management of an apartment building in its activities.

Answers to tests on economic analysis

The additive model of deterministic factor analysis is:

Sum of factors

The administration of the enterprise is primarily interested in:

Return (profitability) of all production assets

Production cost analysis is carried out by the enterprise department:

Management accounting

Analysis and assessment of the efficiency of the enterprise is:

The final stage of financial analysis

Analysis of the volume of output and sales of products is carried out by applying the method:

Elimination

Analysis of relative indicators is:

Calculation of relationships between individual report items

Analysis of the profit of an enterprise allows the administration of this enterprise:

Determine the amount of profit received and its structure

The analysis is carried out at the request of shareholders, investors or creditors, and is called

External financial analysis

Analysis of the profitability of an enterprise is carried out by calculating:

The ratio of gross profit to the average cost of fixed and working assets

Product profitability analysis is carried out by:

Factor analysis of profit from sales and costs of production and sales of products

It is rational to analyze demand for products and supply using the following method:

Graphic

Analysis of the efficiency of using the enterprise's personnel is carried out according to the following indicators:

Labor productivity

Analysis of the efficiency of economic activity is:

Management analysis + financial analysis

Balance sheet profit or loss of an enterprise is:

The difference between gross income and gross costs

The balance method of processing information in analysis refers to:

Logical way of processing information

Bankruptcy:

Failure of the enterprise to satisfy the claims of creditors, including budgetary and extra-budgetary funds

The business plan includes the following number of sections:

8

A large number of indicators of the financial performance of the enterprise:

Creates methodological difficulties for their systematic consideration

Accounting statements are:

Information basis for subsequent analytical calculations

Financial statements:

Covers financial analysis and operational and management analysis

The balance sheet is:

Structural table of reporting economic assets and their sources

The aggregated balance sheet asset for analyzing the structure of the enterprise’s property includes the following article:

Accounts receivable

Economic indicators such as:

Labor productivity

The correct structure of accounts in the balance sheet is:

Asset - liability

In accounting, the correct structure of accounts is:

Asset - liability

In deterministic factor analysis, the method of chain substitutions is:

Analysis of the influence of each factor separately on the performance indicator

The basis of the financial and economic analysis of the enterprise’s activities is:

Synthetic addition and analytical decomposition of accounting accounts

As a result of comparing the indicators, we obtain an absolute deviation, which is conventionally designated as:

In case of lack of information support or lack of time, the enterprise carries out:

Express analysis

The information support for analyzing the activities of an enterprise includes:

Financial information of a regulatory and reference nature

The balance currency is the amount:

Household assets for the enterprise

The amount of tax charges per unit of tax volume:

Tax rate

Type of inflation from the perspective of price growth rate:

Galloping

Investing money to purchase real capital (equipment, machines, buildings) to expand production is:

Investments

Opportunity costs are:

Estimated (calculated) costs

Non-current assets of an enterprise are:

Interest rate indexation

Non-accounting sources of information for analysis are:

Audit reports

The external manifestation of inflation is associated with:

Rising prices and the appearance of excess money

External users of information – subjects:

Both directly and indirectly interested in the activities of the enterprise

External financial analysis:

Designed for various groups of information users outside the organization

Internal users of economic information:

Enterprise management

Conclusions about through which sources there was mainly an influx of new funds and in what assets these new funds were mainly invested can be made based on the indicators:

Structural dynamics of the enterprise's balance sheet

The business activity of the enterprise is manifested primarily in:

The rate of turnover of his funds

Cash and those assets that can be converted into money within 1 year are:

Current assets

An enterprise's cash and short-term financial investments are assets:

Most liquid

Cash, short-term financial investments, accounts receivable, inventories are:

Easily realizable assets

The activity of the enterprise is assessed by such a general indicator as:

Profit

To analyze product output by labor factors, the following indicator is used:

Average number of workers

To analyze and assess the financial condition of an enterprise, it is necessary

: Have appropriate information support, qualified personnel and master the analysis methodology

To analyze the use of material resources in production, the following is used:

The rate of consumption of material resources per 1 unit of production

To analyze the efficiency of using working capital, the following is calculated:

Average working capital balance

To analyze the efficiency of using fixed capital, the following indicators are calculated:

Capital productivity

To assess the financial condition of your own enterprise or its counterparties (buyers and sellers), you must:

Own the analysis methodology, have information support, have qualified personnel

To carry out liquidity analysis, the following coefficients are calculated:

Absolute liquidity

Debtors of the enterprise:

Debtors

Sufficient accuracy is a requirement for:

Factor analysis information

If the liability coverage ratio is greater than two, this means that:

The company will be positively assessed by shareholders

If the analyzed indicator was influenced by several factors that can change simultaneously, the following technique is used:

Recalculation of indicators

The tasks of managerial (internal) analysis are:

Obtaining information for planning, control and management decision-making

Tasks of managerial (internal) analysis of the enterprise’s activities:

Diagnostics and forecasting of the enterprise’s position on the product market

The costs of production and sales of products consist of the cost of:

Material, technical, labor and financial resources of the enterprise

Changes in improving labor organization are associated with:

Labor productivity

The price index is:

Information support for financial and economic analysis of an enterprise’s activities is:

Statistical and operational reporting

Information for management analysis of the financial and economic activities of an enterprise is:

Information that reduces uncertainty in the field of enterprise management

Balance sheet assets include:

Finished products, inventories

Not considered as debtors

: The organization that issued the loan to the enterprise

Intensive factors do not include:

Increased labor utilization time

Fixed assets include:

Enterprise buildings

Profit indicators reflected in the enterprise’s reporting do not include:

Dividend on shares of an external company owned by an employee

Extensive factors do not include:

Accelerating the turnover of working production assets

Indirect costs are:

Equipment maintenance costs

The absolute liquidity ratio Kal is:

Ratio of DS cash to current short-term TO liabilities

The investment ratio characterizes:

The enterprise's need for long-term bank loans

Coverage coefficient Kp is:

Ratio of total current assets to current short-term liabilities

The current liquidity ratio of an enterprise is calculated by dividing:

The result of section II of the balance sheet asset for short-term liabilities

The criterion for financial analysis of an enterprise is:

Volume and quality of initial information

The ease with which assets can be converted into cash is called

: Liquidity

Balance sheet liquidity is expressed in:

The degree to which a business entity’s obligations are covered by its assets

The liquidity of a business entity is:

The ability of the enterprise to quickly convert elements of working capital into cash

Logistic analysis is:

Analysis of commodity flows

A logical way to process information in analysis is:

Heuristic

Margin analysis allows you to determine the optimal ratio between:

Variable costs, price and sales volume

Marginal income is calculated as:

Sales revenue – total variable costs