A power of attorney to represent interests in the Social Insurance Fund is a document that allows a citizen to perform legally significant actions in the department on behalf of an organization or individual entrepreneur.

Only contributions for insurance against occupational diseases and industrial accidents remained under the jurisdiction of the Social Insurance Fund. Therefore, despite the concentration of most mandatory payments to the Federal Tax Service, employers still have to interact with the Social Insurance Fund. Let's figure out how to draw up a power of attorney with the Social Insurance Fund to submit documents.

What powers can be delegated?

The manager can outsource any necessary functions for interaction with the department to an employee or specialist. You can call the document “Power of Attorney for the Social Insurance Fund for reporting”, but in the text you can detail all possible actions, for example:

- transmission and receipt of documentation;

- payment of fees;

- providing calculations for previously paid contributions;

- signing acts and other documents;

- representation of interests during inspections.

However, if we are talking about a legal battle with the department, then another paper will be needed - exclusively for these purposes.

Power of attorney to the FSS ()

A power of attorney is a document that allows one person to represent the interests of another person to a third. In this article we will figure out how to correctly draw up a power of attorney with the FSS (Social Insurance Fund). Powers of attorney for the FSS can be obtained by scrolling down to the bottom of the page.

In the course of its activities, an organization may more than once need to contact the Social Insurance Fund - to submit documents, report, receive and sign documents. Without a power of attorney, only its director can perform all these actions on behalf of a legal entity. If the manager sends an employee of the organization to the FSS, then it is necessary to write out a power of attorney for him, which specifies the actions that he can perform in the Fund.

A power of attorney for the Social Insurance Fund can be issued not only on behalf of an organization, but also on behalf of an individual who, for certain reasons, cannot personally appear at the fund and appoints another person as his proxy.

Power of attorney to the FSS. How to compose it correctly?

| ? Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

A properly executed power of attorney form must contain certain details. In general, the execution of this document is in many ways similar to the execution of a power of attorney to represent interests in the Pension Fund or the tax office.

Required:

- Date and place of discharge;

- Information about the principal - the person who issues the power of attorney: name of the legal entity, information about the director or full name of the individual and his passport details;

- Data about the authorized representative - position and full name for the organization’s employee, data from the passport;

- Name of the body in which the authorized person is to carry out instructions on behalf of the principal (Social Insurance Fund);

- List of powers that the authorized person receives upon presentation of this power of attorney;

- Signature of the authorized representative;

- Certification of the document.

Who can be an attorney

The attorney can be either a full-time employee or an outsider. The relationship with the trustee company is not important here. It is enough that this person:

- was of age;

- had full legal capacity;

- instilled confidence in management.

If powers need to be transferred one-time, then it is worth reflecting this in the text, indicating the time interval for the action. If dates are not specified, the power of attorney in the Social Insurance Fund for the authorized representative will be valid for a year (in accordance with Article 186 of the Civil Code).

How to upload a document to the Foundation portal?

- Register in the FSS system of the Russian Federation, create your login and password.

- After the synchronization of the portals is completed, the authorized representative enters the Portal of the FSS of the Russian Federation. If a message appears indicating that your login or password is incorrect, you will be re-attempted to log in to the system.

- After the actions taken, go to the Portal of the FSS of the Russian Federation in the “Authorized” section.

- Download the authorized electronic signature certificate.

- Then information is entered about the current powers of attorney of the policyholders and their validity periods. You can upload an image in any available format.

- You will also need to contact the territorial body of the Fund at the place of registration of the policyholder. The original power of attorney is provided there.

- After checking all documents for compliance, the Foundation employee must approve the organization. In turn, the authorized person receives the right to submit calculations in accordance with Form-4 of the Social Insurance Fund to the territorial body of the Fund in electronic form.

Now you know how to upload a document to the FSS portal.

A power of attorney for the social insurance fund is required in cases where the principal, for some reason, cannot be present at this institution. This document allows you to resolve many issues, but provided that it is executed correctly. We suggest learning about issuing a power of attorney to confirm the main type of activity, submitting documents or reporting to the Social Insurance Fund.

A power of attorney in the Social Insurance Fund is considered a standard general document. According to the law, there are no special requirements for this form. The only mandatory requirement will be to link the power of attorney to the submission of documents and reporting to the Social Insurance Fund. The main thing is to clearly indicate this in the text of the document, regardless of its validity period.

How to draw up and execute a power of attorney to submit reports to the Social Insurance Fund

If the organization has letterhead, it is advisable to use it (although it is not required). There is no strict form; it is enough to reflect the following information:

- name - power of attorney to the Social Insurance Fund for the submission of documents;

- date of composition (in words);

- details of the principal (including the full name of the director);

- Full name, passport details and registration of the attorney;

- list of delegated powers;

- validity.

The signature of the head of the trusting organization must be “live”, not a facsimile.

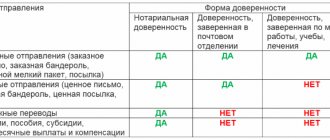

Notarization is not required, since there is no question of registration of rights. The organization is not required to put a seal (but it won’t be superfluous if the company has one).

Power of attorney to the FSS

A written instruction to represent the interests of another person in the Social Insurance Fund must be drawn up and a power of attorney issued to the Social Insurance Fund. Since the policyholders are organizations and individual entrepreneurs, it is for this category of persons that the registration of a power of attorney with the Social Insurance Fund is relevant.

The FSS (Social Insurance Fund) is currently authorized to conduct inspections (scheduled and unscheduled) of the activities of employers, and is also the administrator of a number of insurance contributions, including sick leave and maternity-related. However, from 2020, the latter functions are transferred to the Federal Tax Service (to represent interests in this body, draw up a power of attorney to the tax office), and the Federal Tax Service retains the responsibility for conducting inspections and administering contributions for industrial accidents and occupational diseases. The FSS accepts reports, verifies the correctness of payment of insurance amounts, and collects penalties and arrears.

Power of attorney to the FSS

Example of a power of attorney in the Social Insurance Fund

Power of attorney to the FSS

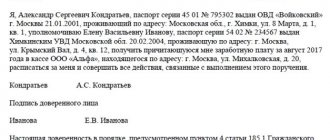

Limited Liability Company "SOCIONIKA"

TIN 168613453135 OGRN 1698434634863

Legal address: 169902, Komi Republic, Vorkuta, Kuznechny Ave., 308, office. 15

city of Vorkuta October seventeenth two thousand and sixteen

By this power of attorney, Limited Liability Company "SOCIONIKA" (hereinafter referred to as the Company), represented by its director Vasily Mikhailovich Dengin, acting on the basis of the Charter,

authorizes Irina Ivanovna Granatova, born on February 6, 1979, a native of Volgograd, Volgograd Region, passport of a citizen of the Russian Federation, series 15 97 number 46946986, issued by the Department of the Federal Migration Service of Russia for the Volgograd Region in the Central District of Volgograd on March 03, 2008, registered at the address: Vorkuta, st. Prigorodnaya, building 34, apartment 9,

represent the interests of the Company in relations with the territorial bodies of the FSS of Russia (hereinafter referred to as the FSS), including during all types of inspections, joint inspections with the authorities of the Federal Tax Service and the Pension Fund, for which I provide the following powers:

This power of attorney has been issued for a period of 2 (two) years without the right of substitution.

See also: Exchange and return. Discount return

I certify the signature of Irina Ivanovna Granatova’s representative.

Director of SOCIONIKA LLC Denshin V.M.

What is included in the power of attorney in the Social Insurance Fund

Powers of attorney to government bodies from organizations are drawn up according to the rules provided for powers of attorney from legal entities. The document can be issued to any person: from an employee of the company to a person who is not in an employment relationship with this organization. Keep in mind that even in order to submit reports to the Social Insurance Fund, a person must have a written power of attorney, including for signing documents (a signature must be affixed to confirm that the reports have been accepted by the Social Insurance Fund employee).

Without a power of attorney, only a person authorized to represent the interests of the company in accordance with the constituent documents can act in the Social Insurance Fund. Which is not always convenient for the director. Therefore, draw up a power of attorney with the Social Insurance Fund on company letterhead and indicate:

It is advisable to reflect the validity period of the power of attorney (if absent, the document is valid for 1 year from the date of preparation), as well as the ability to transfer powers (reassign) to another person.

Certification of power of attorney in the Social Insurance Fund, termination of power of attorney

A power of attorney to the Social Insurance Fund from an individual entrepreneur is certified in notarial form - this requirement is provided for by the Tax Code of the Russian Federation. From the organization, the certificate is signed by the director (general director), who acts on behalf of the organization on the basis of the constituent documents. Formally, there is no requirement to affix a stamp, but this fact may raise questions among FSS employees.

The revocation of a power of attorney from the Social Insurance Fund must be formalized in the correct manner. The director must send a notice of revocation of the document both to the person to whom it was issued and to the territorial body of the Social Insurance Fund. The grounds for termination of a power of attorney will also include a court decision declaring incompetent or partially capable the person to whom the power of attorney was issued, liquidation and reorganization of the organization (when such a person ceases to operate on his own behalf), and the introduction of bankruptcy proceedings. The power of attorney with the Social Insurance Fund expires upon expiration of the period for which it was issued.

To appeal decisions, decrees and acts of the FSS in the judicial authorities, the head of the organization can issue a power of attorney to represent interests in court.

Clarifying questions on the topic

How to fill out a power of attorney to submit documents for reimbursement of expenses for paying additional paid days off to one of the parents

The requirements for such powers of attorney will be general. The main thing is to correctly and completely indicate for what actions the power of attorney is issued.

Do I need to notarize a power of attorney to receive a trip to a third party? And if the principal lives in St. Petersburg, and the third party lives in Vladikavkaz, then how to do this? Or is it enough to send by registered mail without a notary? Thank you

It would be better to have such a power of attorney notarized so that the Social Insurance Fund does not have questions about the powers of the principal.

Is it possible to cancel

With notarized documents everything is simpler. An entry about the cancellation is made in the register, so the validity is always easy to check. But in our case, the certification is carried out by the employer himself.

The easiest option is to ask the attorney to return the paper. Since she does not give him special privileges, the likelihood of refusal is minimal. But if something like this happens, you should notify the Foundation in writing that a particular citizen does not have the right to represent the organization.

Standard form of power of attorney when submitting a Settlement

By downloading a free sample from any source of information, you will receive approximately the same content, with minor differences to one degree or another.

The totality of all the templates presented in the public domain forms an idea of how it should look, so the samples are always of an informational and recommendatory nature. To get a ready-made template from the FSS, specifically for your case, you will have to make a few adjustments.

The features of the paper in question and its individualizing features are:

- A specific listing of actions in the Social Insurance Fund on behalf of the enterprise.

- You can directly write in the name, “to the Social Insurance Fund” or “to the Social Insurance Fund”

- All mandatory details, including: date, place of compilation, company data with information about the director, full name of the trustee.

Authority can be limited to a time frame. In this case, the paper in the Social Insurance Fund will expire on the last day of the appointed period, and the company, represented by the director, will have to issue a new document in order to extend the powers of the representing entity. We hope the knowledge gained here will be useful. Date: 2015-05-18

- No materials were found based on the specified criteria.

A power of attorney in the Social Insurance Fund is a document that gives the authority to the authorized person to represent the interests of the organization in the Social Insurance Fund: submit reports, transfer or receive documents, pay insurance premiums, etc.