What legal norms govern

In the process of collecting material damage, the parties should be guided by the provisions of the Labor Code and the resolution of the Plenum of the Supreme Court of the Russian Federation dated November 16, 2006 No. 52 “On the application by courts of legislation regulating the financial liability of employees for damage caused to the employer.”

According to the Labor Code, one of the parties to the employment contract that caused damage to the other must compensate for it. In this case, the financial responsibility of the employer and his staff is implied.

Financial liability is closely related to disciplinary offenses and is one of the forms of responsibility for its commission.

According to another provision of the Labor Code, financial liability arises subject to a claim being made by the injured party. Sometimes, due to the insignificance of the damage, a party may abandon its claims.

Potential financial liability is not specified in the law: we are talking about real damage.

Concept

Material liability of the parties under an employment contract may arise regardless of whether it was provided for in the agreement between the employee and the employer. At the same time, the occurrence of such liability, its amount and the procedure for collection can be specified by the parties in the employment contract. But this does not mean at all that financial liability, by agreement of the parties, can be established in an amount greater than that provided for by the Labor Code and other Federal Laws (according to Part 2 of Article 232 of the Labor Code).

It must be taken into account that the financial liability of the parties under an employment contract does not cease immediately after its termination if the damage was caused during the validity period of the contract (according to Part 3 of Article 232 of the Labor Code).

For example, an employee cannot avoid financial liability for damage caused by simply resigning from the company. There is only one exception to this rule: unless the employer, in its sole discretion, decides to relieve the former employee of liability. The employee also has the right to refuse material claims.

What is the difference between MO and IO under a civil agreement?

Both types of obligations are quite similar, since they involve the payment of compensation for property loss caused to someone.

But the difference between the two concepts exists and is quite significant.

- With liability under labor law, a person is responsible for his direct actions, that is, only for the damage caused by his actions.

- With civil property liability, a person can be responsible not only for damage caused personally, but also for damage to property committed by his children or other close relatives, that is, this type of obligation does not imply sole responsibility.

- Another difference can be considered that in the case of labor financial obligations, in the event of a loss, no more than one salary is recovered from an ordinary person, but with full responsibility, the financial condition of the person is taken into account.

Civil law speaks of full compensation for harm caused, regardless of the financial viability of the defendant.

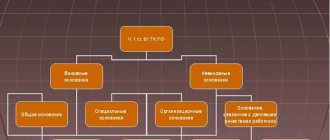

Kinds

The types of financial liability are legally differentiated from the position of the parties to the employment contract and the amount of damage caused and compensated.

From the perspective of the subject composition, a distinction is made between the financial liability of the employee (according to Articles 238-245) and the employer (according to the norms of Articles 234-237), as well as individual and team liability.

From the point of view of types of financial liability, a distinction is made between full (under Articles 242-245 of the Labor Code) and limited (under Article 241 of the Labor Code) financial liability. The basis for differentiating the two types is the degree of limitation on the amount of damages.

Grounds and conditions for liability

The grounds and conditions for the onset of material liability of the parties under an employment contract are specified in Art. 233 Labor Code. In general, financial liability arises only if the damage was caused by the unlawful behavior of the second party. Moreover, such damage can be caused not only by active actions of the parties, but also by inaction.

In addition, the amount of damage to recover financial liability must be proven. If one of the parties to the contract convinces the other that it is not to blame for the damage, then it is released from financial liability.

An exception is the delay of wages and other amounts to the employee: financial liability arises regardless of whether the employer was at fault (Part 2 of Article 236 of the Labor Code).

According to the Resolution of the Plenum of the Supreme Court No. 52 of 2006, when rendering a verdict on the issue of recovery of material damage, the following facts must be proven:

- The presence of circumstances that make it possible to exclude the financial liability of the parties.

- The illegality of the actions of the person who caused the damage.

- The degree of guilt of the person who caused the damage.

- Presence of direct damage.

- There is a cause-and-effect relationship between the employee’s actions and the occurrence of damage.

- Amount of damage.

- Compliance by the parties with legal requirements to recover damages : for example, by signing an agreement on full liability.

The responsibility for proving these circumstances falls on the second party to the conflict: usually the employer.

To collect full financial liability from the employee, in accordance with paragraph. 2 clause 4 of Resolution No. 52, the court must check the existence of legal grounds for concluding an agreement with the employee on full financial responsibility (his position must be indicated in the list approved by the Government) and the fact of a shortage of valuables entrusted to the employee.

Cases of release

Certain restrictions are imposed on financial liability and penalties against it: no more than 20% 50% can be withheld .

Circumstances that completely exclude a party’s liability are defined in Art. 239 of the Labor Code of the Russian Federation and here is their list:

- under force majeure circumstances (wars, earthquakes, floods and other similar phenomena);

- in necessary self-defense;

- in the absence of the possibility of preserving inventory materials, i.e. if the employer did not ensure their safety;

- in cases of normal business risk, when the employee did everything possible to prevent the problem;

- in cases where the loss was necessary to eliminate the danger to the perpetrator.

In addition, any party may refuse compensation for material liability in accordance with Art. 240 Labor Code of the Russian Federation.

Material liability of the employee

As a general rule, an employee who causes direct damage to the employer is obliged to compensate it. At the same time, the upper limit of compensation for material damage is limited by the amount of the employee’s average monthly earnings. This provision is spelled out in Art. 241 of the Labor Code.

Thus, according to legal provisions, the employer can recover damages only to a limited extent , if it goes beyond the employee’s earnings. The exception is situations in which the employee has full financial responsibility (according to the norms of Article 243 of the Labor Code of the Russian Federation).

In order to obtain legal grounds for recovery of damages in full, the employer must indicate the corresponding clause in the contract. If the condition for compensation of damage in full is not included in it, then it will be recovered subject to the restrictions under Art. 241 of the Labor Code.

It is important to take into account that if the position of an employee or the nature of the labor functions performed by him is not directly stated in List No. 85, approved by the Ministry of Labor in 2002, then indicating in his contract a clause on the collection of financial liability in full makes no sense: such a clause of the employment contract is still considered illegal and insignificant. Also, an agreement on full financial liability cannot be concluded with persons under 18 years of age (under Article 244 of the Labor Code).

Unlike other employees, the head of the company bears full financial responsibility to the employer (under Article 277 of the Labor Code). Therefore, there is no need to include such a clause in the contract concluded with him: the owner has the right to receive full compensation for the damage caused without it.

The employer may not demand recovery of damages from the employee under Art. 240 of the Labor Code, without taking into account the type of responsibility assigned to the latter. But only the owner of the property can limit the employer’s right to refuse compensation for damage (according to paragraph 6 of Resolution No. 52).

It is worth noting that when recovering material damage from an employee in court, the employer is obliged to pay a state fee. Whereas the employee is exempt from the need to pay state duty.

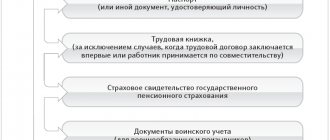

Employment contract – prerequisites for signing

The agreement is signed by the parties both separately from the TD and together with it. The agreement must be concluded in 2 copies, one for each of the parties.

It is mandatory to provide employee training, inventory, and familiarization with regulations.

When signing a collective agreement on mat. responsibility, the entire signing procedure is carried out by analogy. You can obtain the established form from Consultant+.

Agreement on employee liability

Add. agreement

According to such an agreement, the employee monitors the activities of colleagues under his subordination, produces reports and takes inventory.

The details of the parties are filled in: passport details, company name, full name, date. The signatures and seal of the company are affixed.

Responsibilities of the Responsible Party

The guilty party may voluntarily compensate the amount of damage caused in part or in full at one time within a month. If the deadlines are violated, then collection goes through the court. There is a labor dispute commission through which a court decision can be appealed.

- 233 Labor Code of the Russian Federation. Both parties must provide evidence of damage caused to them due to unlawful conduct (action or inaction) and establish the amount of payments.

246 Labor Code of the Russian Federation. If the actual amount of property damage exceeds its nominal amount, then a new principle for determining the amount of compensation comes into effect.

This is especially true in cases of increased swearing. employee responsibility. This happens if the employee’s actions led to the loss of narcotic and psychotropic substances, and amounts to 100 times the amount of actual damage (N 3-FZ).- 247 Labor Code of the Russian Federation. The management requires an examination, which includes the creation of a commission and the employee writing an explanatory note (in its absence, the corresponding fact in which this refusal is recorded).

The employee can use all the information collected by management and file an appeal. - 250 Labor Code of the Russian Federation. The authorized body for regulating labor conflicts has the competence to reduce the amount of payment of a penalty from an employee depending on certain exculpatory circumstances.

Material liability of the employer to personnel

The financial liability of the parties also extends to the employer, who is obliged to compensate for damage to his employee in the following situations:

- If he unlawfully prevented an employee from performing his direct labor duties (under Article 234 of the Labor Code).

- If he damaged or destroyed the employee’s property (under Article 235).

- If he untimely made payments due to the employee (under Article 236 of the Labor Code).

- When compensating for moral damage to an employee (under Article 237 of the Labor Code).

At the same time, according to judicial practice, damage can be caused by an employer by any illegal actions against an employee.

If an employee is deprived of the opportunity to work, the employer is obliged to compensate him for lost income. Liability is recovered from him in the full amount of the employee’s lost earnings.

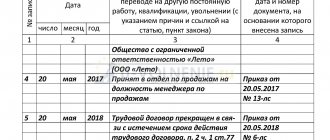

In particular, the employer’s financial liability may arise:

- in case of illegal removal of an employee from his position , in case of his dismissal or transfer to another job;

- when there is a delay in issuing a work book to an employee , incorrect dismissal wording is entered into the book, etc.

Damage caused to the property of employees is recovered based on its market value valid at the time of compensation for damage. Damage can be recovered in kind if the employee agrees to this.

Financial liability for delays in payment of wages, vacation pay or other amounts consists of the obligation to pay them, taking into account compensation in the form of penalties. Penalties are calculated taking into account 1/150 of the current Central Bank rate for each day of delay. The presence of the employer’s fault is not taken into account: he is obliged to pay fines regardless of it.

Moral damages are recovered in the form and amount determined by agreement of the parties. Controversial issues are considered in court.