Who would have thought that the famous phrase from the American film “I don’t have cash, but I can write you a check” would become so popular in our reality. Indeed, if you do not have cash, you can always issue a check to bearer and indicate the appropriate amount on it. However, not everyone knows how to fill it out correctly. We offer you a sample of filling out a checkbook.

Brief information about checkbooks

Checkbooks are a kind of financial document consisting of 25 or 50 sheets. As a rule, they are linked to the bank account of the owner of the book and allow non-cash payments with the subsequent purpose of cashing them out at credit institutions.

The book itself visually resembles a small oblong notebook. Each page is divided into two parts. These are checks, one of which is signed and handed over to the bank for subsequent issuance of the specified amount, and the second is a copy. It is he who remains in the book and serves as a kind of document for reporting when funds are written off from the account. You can get a book by writing a corresponding application to the bank. How to fill out a checkbook?

Rules for handling check books and cash checks

A checkbook is a document that requires very careful handling. It is issued to a specific legal entity or individual entrepreneur; its use by third-party organizations or individuals without a notarized power of attorney from its holder is strictly prohibited.

The book should be stored in a specially designated place, closed from access to unauthorized people (preferably in a safe).

Only the head of the enterprise and employees authorized by his separate order (for example, deputy director and chief accountant) can use checkbooks.

What to write in an application for a book?

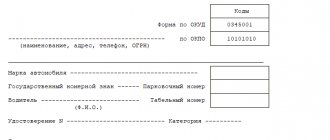

The application form may also have a tear-off coupon “for the cash register” and a main part where the following information is indicated:

- name of the enterprise;

- date and month of writing the application;

- organization account number;

- please issue 1 book with the specified number of sheets (25-50);

- initials of the person responsible for receiving the book;

- signatures of accountants, economist, cashier and bank manager.

This is what a sample of filling out an application to receive a checkbook looks like.

Transcript

1 Sberbank application for issuing a checkbook sample >>> Sberbank application for issuing a checkbook sample Sberbank application for issuing a checkbook sample It is believed that no more than 10 days should pass from the moment of filling it out and contacting a financial institution. Sample of filling out a checkbook. Payment is made one-time, regardless of how long the checkbook is used. Before using this service, you must clarify the size of the limit for withdrawing money from your current account by checks without prior notification to the bank. Assistant is your personal assistant in a small business. First of all, company management must decide which checkbooks are required and how many there should be. Subtleties of check execution The checks themselves, related to securities and included in the book, are typical and consist of two main parts. This means that if 4 people work in an enterprise with the Sberbank Business Online system, then they first need to obtain 4 cryptographic keys from the Sberbank service branch. The application form proposed by the Central Bank is somewhat shorter, but practically repeats the one given above. To do this, you need to appoint one of the company’s employees as the person responsible for storing the checkbook and put it in a special safe. To obtain a checkbook, you do not need to provide many documents or go through complex procedures. After the pages in the document run out, you need to contact the bank with an application to issue a new checkbook. If everything is in order, then the bank specialist issues a corresponding notification, which must be taken to the tax service. Similar: In the header part of the Application form for the receipt of cash check books, the client indicates that the Cash check book is issued by a Bank employee, based on the Application for the issuance of cash check books, which is valid. After filling out the form, it should be sent to the bank that services the company. A unique opportunity to download any document in DOC and PDF absolutely free of charge. Some of them do not know in what sequence they need to act. It allows you to make transactions in real time. What must be indicated in the application for a checkbook? Closing a current account is possible only if the individual entrepreneur has no debt to Sberbank. A cash checkbook is issued by a Bank employee, based on the Application for the issuance of checkbooks, which is valid. This means that if 4 people work in an enterprise with the Sberbank Business Online system, then they first need to obtain 4 cryptographic keys from the Sberbank service branch. Sample of filling out a checkbook The lower part of the reverse side is intended for making marks identifying the recipient. The number of tokens is determined by the number of users. Subtleties of check execution The checks themselves, related to securities and included in the book, are typical and consist of two main parts. Sberbank application for issuing a checkbook sample Assistant, your personal assistant in a small business. When to write an application An application for a checkbook can be submitted at any time. For persons over 18 years of age. Such paper automatically becomes unsuitable for acceptance at a Sberbank branch. Moreover, if the speech is conducted on behalf of the organization, then by its director and chief accountant. Sberbank is the largest Russian bank. Moreover, if the speech is conducted on behalf of the organization, then by its director and chief accountant. Features of filling out an application If you are faced with the need to form an application for the issuance of a checkbook, read the tips below and look at an example of a form based on it, you can easily draw up your own document. First, general information that applies to all such papers.

Simple rules when filling out checkbooks

Checkbooks are usually kept by the same people in the same handwriting. Filling out the document form is done with a pen containing the same color of ink. Therefore, its owner should initially choose whether it will be only black, purple or blue color of the paste.

Another important point when working with the book is the complete absence of corrections and errors. All words and details must be indicated in a strictly defined order and only in the columns provided for them. It is strictly forbidden to speak over the fields of cells and the graph. In addition, each blank checkbook contains a place for the signature and seal of the owner. In this case, the number of his bank account, the name of the enterprise or the initials of the entrepreneur are written down manually (at the end of the completed tear-off spine) or indicated on the imprint of the seal itself.

Rules for filling out the application form for the issuance of a check book (cash book) - sample for downloading

Helpful information! A checkbook is a series of cash checks linked to the owner's bank account. They are collected in a brochure and stapled together (25 or 50 checks).

Bank employees will have to indicate in the application information about the quantity and what kind of checkbooks were issued, while recording the numbers of all checks. +8 ext.849 - Other regions - CALL There is no single recognized form for filling out the application form, developed and officially approved.

This form is A5 in size and is used for financial reporting. You can create a document in free format.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

What important lines are on the check form?

The book form, as a rule, contains several lines, each of which is filled out in accordance with the existing rules of the financial organization. For example, in the column “Cash check issued for...” you must indicate the amount first in numbers and then in words. What a sample of filling out a checkbook should look like can be seen in the photo.

The date and month of filling out the document are also written in words. In the case of using numbers when specifying the check amount, double underlining spaces are used before and after writing the numbers. In the “Issue” or “I authorize to issue” column, the full name of the recipient is indicated.

Basic nuances of filling

Let's look at the key rules for filling out a checkbook. Usually it is kept by the head of the organization or another responsible person. The book is filled out in the same handwriting, preferably in block letters. The form must be filled out completely, that is, both in the spine and in the tear-off part. Accordingly, both parts must be completely identical and filled with the same pen.

Attention:

Corrections to the document are not allowed. Information is indicated in the appropriate columns; their position cannot be changed.

You should also remember that it is unacceptable to extend beyond the graph fields, so be sure to calculate the length of the lines. The books have a special place for the signature of the issuing and receiving person, as well as a seal. If the organization does not have a seal, then it is necessary to indicate the full name of the organization (as it is indicated in the documents), as well as the full last name, first name and patronymic of the person who wrote the check. In general, there is nothing difficult to fill out. Just be careful, don't make mistakes and don't go beyond the edges of the frames.

The fields must be filled out strictly according to the rules. For example, after the phrase “Cash check issued to,” you need to indicate the amount of payment in numbers and words. Also be sure to indicate the date of signing the document (it is also written in words). All numbers are indicated with spaces double underlined. In the “issue” paragraph, you need to write the recipient’s initials in full, without abbreviations.

What does a sample checkbook look like?

The appearance of most check books issued by different banks may vary. However, the principle of filling them is almost identical. Let's give an example of such a design.

So, we open your book and see a blank form. We present to your attention a sample checkbook. It has two sides: front and back, and also has a cutting line and a tear-off spine. First we fill it out. To do this, perform the following steps:

- We indicate the amount in numbers, for example, “for 150,000 = rub. 00 kopecks";

- we write to whom the check was issued;

- sign the responsible persons;

- fill in the date of receipt and sign the recipient.

This is what a finished sample of filling out a checkbook looks like.

Design options

Finally, let's look at an example of filling out a checkbook, which is produced by the largest bank in Russia - Sberbank. It serves almost 85% of LLCs and individual entrepreneurs in the country that have current accounts for working with clients. Sberbank's checkbook is considered a model for other companies. It also consists of 25 or 50 sheets, it has two sides (back and front) and a tear-off slip. In order for the document to be valid and accepted without problems at the financial institution, you must complete all sections.

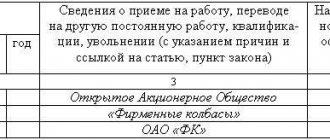

First, the name of the company (IE or LLC) is entered on the check, then the company's current account is entered. Next, enter the check number (in order) and the amount of payment in numerical form. The last to be filled in is the date of signing the document and the territorial location (name of the locality). After the basic data, you need to write down the name of the financial organization (in our case, Sberbank), and then the last name, first name and patronymic of the person to whom the loan will be issued. Then you need to put a signature and seal, provided that the organization has one.

Attention:

Officially, the check does not have an “expiration date,” but in most cases it is recommended to cash it no later than 10 calendar days after issue. If you delay, the financial institution may refuse payments or request confirmation.

As you can see, there is nothing complicated in the rules. You just need to carefully enter the information and make sure there are no errors. You can fill in the basic details regarding your company, check number and financial institution in advance to avoid wasting time in the future. Then you just need to enter the amount in numbers and words, as well as the recipient’s full name.

How to fill out the front side of a check form?

Next, fill out the central part on the front side of the form, in which we indicate:

- name of the company or individual;

- check drawer's bank account number;

- amount in numbers;

- place of issue (city, locality);

- date and year of issue;

- name of the financial organization indicating the corporate account number;

- initials of the check recipient (for example, Ivanova Irina Petrovna);

- amount in words;

- signatures of responsible persons.

A sample checkbook with an option for filling out its front side can be found in our publication.

What is the expiration date of a completed receipt?

Each completed check has its own expiration date. It is believed that no more than 10 days should pass from the moment of filling it out and contacting the financial institution.

A cash check is a document on the basis of which an organization can withdraw funds from a current account, that is, it is an order to the bank to issue the amount of money specified in the check form. We offer you to download a sample of filling out a check at the end of the article.

Cash is deposited at the bank on the basis of.

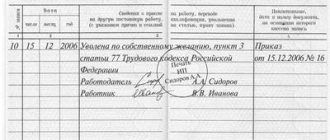

The form consists of two parts: the left one is the spine and the right one is the main part. Having filled out the check, indicating in it the amount to be issued and the details of the person who can receive the money from the bank, you need to tear off the right side of the cash check form along the cut line and hand it to the person who should receive the cash from the bank. The left side remains in the checkbook.

A cash check is a document that does not allow corrections or errors. If you provide incorrect information, it is crossed out and “Cancelled” is written, after which you must fill out a new form.

The cash receipt form must be completed on both sides.

Instructions for filling:

Filling out the front part of the form:

Drawer: name of the organization filling out the check.

Account number: the current account of the check drawer from which the money must be withdrawn upon receipt.

On: the amount to be received from the bank is written, indicated in numbers in rubles and kopecks.

Place of issue: name of the locality where the check is issued.

Date: The date the check book was issued.

Bank name: the name of the banking institution in which the drawer's current account is opened.

Check issued: Full name of the person to whom the check is issued (in the dative case).

Pay: an order to the bank to issue an amount (indicated in words) of funds to the person indicated on the form.

Check Received: The date the completed cash check was received and the signature of the person to whom it was issued.

Signatures: the completed checkbook is signed by the responsible persons.

Filling out the reverse side of the check form:

Expense goals: it reflects what the money will be spent on and indicates the amount that is planned to be spent on these goals.

Marks identifying the buyer: name of the recipient’s identity document, series, number, by whom and when issued.

Place of issue: name of the locality where the check is filled out.

The right side of the check remains in the checkbook. The left one is torn off and transferred to the bank to receive the indicated amount. When receiving money, the recipient’s signature is affixed and an identification document is presented.

The left part with the recipient's signature remains in the bank.

Receipt cash order: filled in after money is withdrawn from the current account. Based on the PKO (), the money goes to the enterprise’s cash desk. At the same time, a note is made in the KO-4 cash book about the receipt of money - you can download a sample of filling out KO-4.

How do I fill out the back of a check form?

On the back of the check you can see a small plate containing the following information:

- purpose of the expense (for example, travel allowances or wages for such and such a month and year);

- amount of expenses;

- signatures of responsible persons;

- signature of the check recipient;

- the name of the document presented for receipt, indicating the number, series, date and place of issue;

- signatures of the cashier, accountant and controller.

Also, this example of filling out a checkbook includes a tear-off coupon, which mentions the number of the posted order, the date and year of the transaction performed, and the signature of the chief accountant.

Rules for filling out the reverse part

We have already explained what a checkbook is and how the front side of the document is filled out. But it also has a downside. It presents a table into which certain data is also entered. It must indicate for what purposes the funds are allocated (for example, payment of wages for 2020 or the purchase of equipment under a contract) and the amount of the allocated amount.

Separately on the plate you need to put the signature of the issuing and receiving person, as well as the name of the document that is provided for issuing funds. In this title you need to indicate the check number, its series, the date of issue and the place where the money was received. After this, the controller, accountant and cashier sign the paper. On the tear-off coupon you should indicate the number of the order that will be posted, as well as the date on which the payment operation is carried out.

Attention:

Checkbooks from different financial institutions may vary slightly. But, having mastered the filling rules using our examples, you will be able to fill out other documents.

The location of the points usually changes. For example, the amount in words may appear first, and then the name of the counterparty to whom the loan is issued, or perhaps it’s the other way around. Accordingly, the location of the tear-off coupon may also change, as well as the information on the back of the document.

Standard check type

Sample of filling out the spine

How do checks from different banks differ?

The principle of filling out a check in any bank is almost the same and has common features with the above sample. However, on the forms of different banks, all important information may be recorded in a completely different sequence, and the location of the tear-off coupon may also change.

For comparison, here is an example of filling out a Sberbank checkbook. So, the check form of this financial institution also has a front and back side, and the tear-off coupon is located on your right. The form first indicates the name of the enterprise, then the drawer's current account number, the check number, the amount in figures, and then the place, date and year of issue. Next, indicate the full legal name of Sberbank, and in the “Pay” column you must mention the recipient of the check. Below is the signature and seal of the responsible persons.

In the form of the Bank "St. Petersburg" (formerly "European"), the tear-off coupon is located on the left, and all other columns are present as in Sberbank.

Accounting and legal services

Filling out and maintaining a checkbook A check must be filled out only by hand (with a ballpoint pen or ink) and in one handwriting (i.e., by one person). When filling out the front side, you should avoid mistakes and blots, since in this case the check will be considered invalid.

| Dear visitors! The site offers standard solutions to problems, but each case is individual and has its own nuances. |

| If you want to know |

Damaged forms must remain in the checkbook, glued to the counterfoil and canceled with the words Spoiled. The name of the check drawer, that is, the owner of the current account and check book, and his account number are affixed upon receipt of the book at the bank by hand or by imprinting the organization’s stamp on all checks simultaneously.

In the line Check. on the. the amount (in numbers) for which it is issued is indicated. In this case, empty spaces in front and after the amount of rubles must be crossed out with two lines. The next line indicates the place (in some banks it is already filled) and the date of issue of the check.

Method two. Corporate plastic card (electronic checkbook)

Many banks, keeping up with the times, offer their clients to open a corporate card. This can be a personalized or impersonal plastic card equipped with a PIN code. Quite often, enterprises using a corporate card make it available to the financially responsible person to pay for current purchases. An employee making a payment using a corporate card must report to his company for each amount spent. Supporting documents in this case are strict reporting forms, cash receipts and sales receipts.

Each bank gives its cards certain capabilities or imposes some restrictions. Some banks, for example, do not allow cash withdrawals from an ATM using a corporate card. And other banks, whose range of services is much wider, allow, for example, setting certain limits on each card.

Advantages of a corporate plastic card:

- no bank commission when spending funds;

- 24/7 access to funds in the current account;

- significant time savings on receiving funds from the bank and their subsequent issuance against an advance report;

- control over the use of funds using statements received from the bank;

- the ability to pay expenses of various kinds: entertainment, travel or expenses for the economic needs of the enterprise.

Cash receipt - sample filling: regulatory regulation

As for regulatory regulation, the laws of the Russian Federation do not provide approved forms or samples for filling out cash receipts. Since 2020, the maintenance of checks is regulated by the Regulations of the Central Bank of Russia dated February 27, 2017, approved by the Ministry of Justice.

For the document to become legally valid, you must fill out the basic details. The receipt consists of two parts - the check stub and the receipt itself. The receipt is provided to the bank, and the counterfoil remains with the company.

In an organization, this type of security must be kept by the chief accountant and accounted for as an off-balance sheet account. In Russia, unlike the United States, for example, checkbooks are used by organizations, not individual citizens.