Order for financial assistance: sample, grounds and design

An order for financial assistance - samples of recommendations for its preparation are contained in our article.

This document requires extreme care when preparing, as well as knowledge of labor and tax laws. We will discuss the procedure and specifics of placing an order below. An experienced personnel officer, and even more so the head of an organization, is well aware of the fact that any document he draws up must have a legal basis that gives it legal validity and legitimacy. In labor matters, these are the norms of the Labor Code of the Russian Federation and other legislative acts.

However, when preparing an order for financial assistance, it is impossible to use the direct norms of the Labor Code of the Russian Federation. Labor legislation bypasses such issues, leaving it completely at the discretion of the organization’s administration.

The only thing you can focus on is Art. 217 and 422 of the Tax Code of the Russian Federation, Art. 20.2 of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ, which stipulates the consequences of issuing financial assistance for the purpose of calculating personal income tax and contributions to the Social Insurance Fund. However, it is impossible to directly refer to them when preparing an order for the payment of financial assistance.

Nevertheless, a way out of the legal vacuum allows us to find Part 1 of Art. 5 of the Labor Code of the Russian Federation, which gives the organization’s administration the right to fill gaps in labor legislation with local regulations.

To prepare the specific order under consideration, it is advisable for the organization to have, and if not, prepare a general provision that will indicate a list of situations when employees can be paid financial assistance, the procedure for its allocation, amounts and other significant issues.

The advantages of having such a provision are obvious:

- when preparing specific documents, it can be referred to;

- department heads and employees understand how and according to what criteria such payments are made (for example, for treatment, at the birth of children, for vacation, for low-income employees, etc.).

It is worth mentioning that the assistance provided is not necessarily provided in monetary form. These can be products, household chemicals and other things necessary in a particular situation.

The list of grounds and procedure for allocating assistance should be determined by the regulations in force in the organization. In this case, the interested employee will need to submit an application requesting the necessary assistance, as well as documents confirming the facts that formed its basis.

The reason for such bureaucratic delay is not the lack of trust in the employee, but the requirements of Art. 217, 422 of the Tax Code of the Russian Federation, which determine the list of situations when tax (insurance contributions) is not levied on such payments. For example, at the birth of a child in accordance with clause 8 of Art. 217 of the Tax Code of the Russian Federation, the administration of an organization can pay an employee up to 50,000 rubles without charging personal income tax.

As for the order itself, we list the documents, the presence of which will greatly simplify the process of preparing it. This:

- general situation in the organization;

- employee statement;

- a document confirming the reason for the employee’s request for help;

- a manager's decision (resolution) on a specific issue.

We emphasize that these are desirable, but not mandatory documents, the presentation of which is required in accordance with the Labor Code of the Russian Federation or regulations. However, if on their basis an exemption from personal income tax or contributions to the Social Insurance Fund is planned, proper compliance with the procedure is in the interests of both the employee and the organization’s administration.

Most of the unified forms used in personnel matters are approved by the Decree of the State Statistics Committee of the Russian Federation “On approval of unified forms...” dated January 05, 2004 No. 1. However, this document is not suitable for preparing an order for the provision of material support, since it does not contain the necessary form.

You can issue the corresponding order in free form, taking into account the need for it to contain the following standard details:

- Business name;

- place and date of document preparation;

- Title of the document;

- text of the order;

- a list of documents that caused the order to be drawn up;

- signature and seal of the company;

- information about familiarization with the contents of the order, if the established practice at the enterprise requires this.

The procedure for filling out a specific form is determined based on the practice available at the enterprise. Taking into account the fact that the details of most orders issued at the enterprise are standard, it is advisable to make the form itself by analogy with already accepted documents.

Example of an order

Order on the calculation and issuance of financial assistance

employee of Rassvet LLC

Based on the regulation “On financial assistance provided to employees of Rassvet LLC at the expense of the enterprise,” approved by order No. 92 dated June 16, 2002, and also in connection with the birth of a child with accountant E. N. Fedorova, I order:

- For the purpose of additional financial incentives, assign a one-time assistance in the amount of 25,000 rubles to the accountant of Rassvet LLC, E.N. Fedorova, at the expense of the enterprise’s profits.

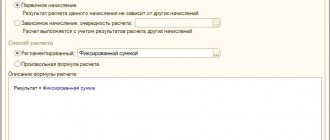

Financial assistance is a one-time payment. If it is certified by an employment contract, then it is equal to salary. Tax deductions are made from the payment amount. In the absence of such a note, expenses are considered unrealized. Therefore, accountants classify them as others.

The Tax Code of the Russian Federation (clause 23 of Article 270) provides for the recognition of material assistance as payments not subject to income tax. For accident insurance, the group of other expenses is used. They are considered taxable when accrued.

In order for taxes not to be assessed, financial assistance must be used to pay for medical services. For this you will need supporting documents.

The issuance of funds is carried out on the basis of official paper. This is an order to provide financial assistance to an employee. It must be drawn up in accordance with legal regulations.

Every employee has the right to receive financial assistance. He must submit an application to the employer, presenting documentation and certificates confirming the need for payment. For example, in case of illness, financial assistance will be issued on the basis of diagnosis certificates and receipts for payment for treatment. An employee can receive various types of material.

It is issued when:

- health problems;

- unforeseen difficult financial situation;

- events that require large investments (funeral, birth of a child, wedding);

- taking annual paid leave.

Payments are assigned individually depending on the situation. Funds can also be allocated in case of financial losses of a person that are not related to work.

Form of order to provide financial assistance to an employee

To receive financial assistance, you will need to fill out an application. It states the reason for the need for payment.

Among the circumstances under which it is possible to contact an employer are:

- treatment;

- birth of a child;

- wedding;

- funeral;

- retirement.

You can confirm the need for payments with papers. The documents will help convince the employer of the importance of financial assistance in specific circumstances.

Financial assistance is an ambiguous type of payment, poorly regulated by law. This circumstance invariably gives rise to many questions regarding the procedure for registration, accounting and taxation.

First of all, you need to decide on the purpose of the payment. The employer must understand that financial assistance is not part of the wage fund. It cannot be classified as a bonus for the employee’s merits, and therefore it should not be specified in the regulations on remuneration. Material assistance falls into the category of social support for workers.

Financial assistance is a voluntary desire of the employer to support an employee who finds himself in difficult life circumstances. Its purpose may be different, but always individual. Typically, social guarantees in an organization provide for the participation of management in the event of:

- death of an employee;

- death of a close family member of the employee;

- marriage for organizing a wedding;

- birth of a child;

- emergency (theft, natural disasters);

- treatment and recovery.

Payments related to family circumstances (death, wedding, birth) are targeted. In turn, payments arising as a result of an emergency situation are classified as non-targeted.

Financial assistance should include:

- collective agreement;

- employment contract;

- local regulatory act of the organization on social guarantees for employees.

If the amount and purpose of financial support are not specified in labor and collective agreements, then the organization is obliged to develop an internal regulatory act - a provision on social guarantees. The document guarantees to employees the procedure for assigning benefits and its amount.

It should be noted that financial assistance is not the responsibility of the company, so the management each time makes a decision individually on a specific case.

For this purpose, the organization issues an order for financial assistance. The basis for it is a regulatory act or agreement adopted by the company.

Before issuing an order, the employee must apply to management for assistance. The employee writes a statement in free form, in which he indicates the reason for the difficult financial situation.

The employee must attach copies of documents proving the occurrence of circumstances requiring financial assistance to the application. In case of burial of family members - a death certificate, a document confirming relationship. In the case of the birth of a child - a birth certificate.

If we are talking about emergency situations, then a certificate from control authorities about the loss of property. A marriage certificate is provided when paying wedding expenses.

Financial support is provided to an employee who finds himself in a difficult situation.

It is necessary to focus attention on this circumstance, since in practice an organization can issue financial assistance to all employees in honor of an upcoming holiday, for example, for the New Year.

In fact, such support is ambiguous. There are cases when judicial authorities classified it as a one-time holiday bonus.

General provisions

Example of an order

As a sample, you can use the following form containing all the listed details:

LLC "Rassvet"

Krasnogorsk 04/19/2016

Order on the calculation and issuance of financial assistance

employee of Rassvet LLC

Based on the regulation “On financial assistance provided to employees of Rassvet LLC at the expense of the enterprise,” approved by order No. 92 dated June 16, 2002, and also in connection with the birth of a child with accountant E. N. Fedorova, I order:

- For the purpose of additional financial incentives, assign a one-time assistance in the amount of 25,000 rubles to the accountant of Rassvet LLC, E.N. Fedorova, at the expense of the enterprise’s profits.

- Payment of assistance must be made by 04/25/2016.

- Appoint Ch. Accountant of Rassvet LLC Petrova K.R.

Reasons for drawing up an order:

- Personal statement from the accountant of Rassvet LLC for additional financial assistance.

- A certified copy of the child’s birth certificate, presented by E. N. Fedorova.

Director of Rassvet LLC ___________________________ V. I. Kashevarov

I have read the order ___________________________________

Taxation of financial assistance with personal income tax and contributions

Based on the order for payment of financial assistance, the accountant must transfer money to the employee. The amount of financial assistance is not subject to personal income tax and insurance contributions up to 4,000 rubles. per employee per calendar year (clause 28, article 217, clause 11, clause 1, article 422 of the Tax Code of the Russian Federation). For amounts exceeding the specified limit, personal income tax will need to be calculated and contributions charged.

Exceptions to the rule are provided for financial assistance paid (

12.07.2017, 20:44

An employee of the organization submitted a statement in which he asked for financial assistance. The director is not against responding to an employee's request. We will help the personnel specialist to issue an order for the payment of financial assistance in connection with the death of a relative.

Legal grounds

Article 129 of the Labor Code gives the director the right to stimulate employees of his company by awarding bonuses or compensation. Financial assistance is a kind of service to provide a needy employee with a sum of money or necessary things (vehicles, clothing, baby care products, etc.).

The birth of a baby is a joyful event, but at the same time quite expensive.

No legal act imposes an obligation on managers to help financially young parents, however, a collective agreement may stipulate a condition on the assignment of financial assistance, then this already becomes an obligation.

Law No. 212-FZ “On contributions to the Pension Fund. Social Insurance and Compulsory Medical Insurance”, like the Tax Code, also provides for the possibility of assigning financial assistance to employees from the company’s budget.

Drawing up an order to provide financial assistance to an employee

There are the following types of financial assistance to employees:

- mat. assistance to an employee of an enterprise who has health problems;

- assistance to an employee who experiences an unexpected financial crisis;

- if an employee experiences any vital event that requires significant financial costs (for example, financial assistance to the relatives of a deceased employee, the birth of a child, weddings, etc.);

- financial assistance to an employee for vacation.

Typically, such payments are made on an individual basis. In addition, this money cannot be issued as compensation for the employee’s financial losses not related to the enterprise.

Do not forget that when filling out your application, you must attach documents or certificates that can attest to specific circumstances. It is also necessary to remember that financial assistance is one-time in nature and has no connection with the employee’s fulfillment of his labor obligations.

The amount of financial assistance depends on the basis (reason) for providing financial assistance. Nowadays, the maximum size of a mat. assistance for those who have reasons to receive it is not limited:

- for the categories specified in paragraphs 2-21, there cannot be more than 5 basic wages;

- for the categories specified in paragraphs 22-24, it is calculated taking into account actual expenses upon presentation of the necessary documents indicating the amount of expenses.

||||||||||||To the director of LLC "company" Lagunov M.V. From Kuprunov K.R. Deputy Director of the company STATEMENT In connection with the death of my brother on September 19, 2014 (Kuprunov Evgeniy Romanovich), I ask you to provide me with financial assistance.

Attached: a copy of the death certificate of this person. September 24, 2014 K.R. KuprunovSignature _____|||||||||||

The amount of financial assistance depends on the incident that caused the employee to need it.

Also, if the employment contract does not say anything about the payment of financial assistance, then the amount can be negotiated with the director of the enterprise or the entire team. In the event that net profit is used, the main result is determined by the founders of this company.

And only after this can an order be issued to provide financial assistance.

Usually such an order is drawn up arbitrarily, because in the Russian Federation there is still no approved form. The order must indicate the following:

- the amount of assistance provided;

- the period within which it will be issued 100%;

- the source from which payments come.

|||||||||||||||||ORDER No. 8 for the payment of financial assistance in the event of a death in the family

In connection with the death of Deputy Director Kiril Romanovich Krupov’s brother on September 19, 2014, and also on the basis of clause 2.3 of the Regulations on the payment of financial assistance to employees of LLC “Company”, approved by order No. 1-17 dated January 13, 2014,

I ORDER

1. Pay Kiril Romanovich Krupnov a one-time benefit on the occasion of the death of his brother in the amount of 30,000 rubles until December 1, 2014 inclusive.

2. Appoint chief accountant N.A. Petrova to be responsible for the calculation and payment of financial assistance.

Attach: a copy of the brother’s death certificate dated September 19, 2014 No. GK-AB 22414432, issued by the Dubrovsky department of the Civil Registry Office in St. Petersburg. General Director

LLC "Company" _____ M. V. Lagunov

I have read the order: 09/30/14 ________ / Petrov N. A./

I have read the order: 09/30/14 ________ / Korepov A. N./||||||||||||||

At the moment, the maximum limit for issuing financial privileges is no more than 4,000 rubles per year per person.

When issuing gifts, personal income tax is not withheld (clause 28, article 217 of the Tax Code of the Russian Federation). Naturally, insurance premiums for such incentives do not need to be calculated, even if given in cash, but only on the condition that the company has drawn up a written gift agreement with the employee, and the gift itself is not provided for by an employment or collective agreement.

Did the article help? Subscribe to our communities.

ORDER No. 13-k

on payment of financial assistance at the birth of a child

Krasnodar city

In connection with the birth of a child on July 21, 2020, from a specialist in the production department of Resurs LLC, Anna Ivanovna Reshetnikova, on the basis of clause 3.6 of the Regulations on the payment of financial assistance to employees of Resurs LLC, approved by order of January 18, 2019 No. 1-14

I ORDER:

- Pay Anna Ivanovna Reshetnikova a one-time payment for the birth of a child in the amount of 25,000 rubles until August 15, 2020 inclusive.

- Appoint chief accountant Inna Petrovna Krivtsova to be responsible for the calculation and payment of financial assistance.

Grounds for calculating financial assistance: application from Anna Ivanovna Reshetnikova dated July 28, 2020.

Attached to the application: a copy of the child’s birth certificate No. II-DN 632894, issued by the Civil Registry Office for the city of Krasnodar.

Head of Resurs LLC __________________I.L. Kolesnikov

The order has been reviewed by: ___________ ______________ /Reshetnikova A.I./

The order has been reviewed by: ___________ ______________ /Krivtsova I.P/

The laws of the Russian Federation do not oblige the director of the organization to issue these types of financial support. The amount of material compensation is paid if there is financial opportunity and a positive decision of the head of the company regarding an individual specialist.

An order is prepared if there is good cause.

The grounds for financial incentives are divided depending on the purpose of the payment:

- Death of a relative - financial assistance is provided to “close”, blood relatives, adoptive parents, as well as the spouse of a deceased employee who has an employment relationship with the organization, or a former specialist who is already retired. In addition, the employee himself may request support in connection with the death of his relative.

- the reason may be family circumstances: the birth of a child, marriage, death or illness of a relative of an employee (for example, the payment of annual financial assistance for the International Day of Persons with Disabilities is fixed in the industry agreement of Spetsstroy organizations of Russia);

- health problems of the employee himself can also serve as a basis for payment - employers often respond if financial assistance is required for the treatment of an employee;

- the reason for the payment may be the employee’s birthday or the round date from the moment of his employment in the organization;

- the difficult financial situation of an employee (in the event of a robbery, fire, road accident, natural disaster, etc.) may also be grounds for assistance from the employer;

- Sometimes, employers help their employees renovate or even buy housing through financial assistance.

| ORDER No. 8-k On payment of financial assistance in the event of death in the family St. Petersburg January 25, 2020 In connection with the death of Deputy Director Alexander Sergeevich Sidorov’s sister on January 20, 2020, and also on the basis of clause 2.3 of the Regulations on the payment of financial assistance to employees of Horns and Hooves LLC, approved by order No. 1-17 dated January 13, 2014, I ORDER 1. Pay Sidorov Alexander Sergeevich one-time financial support on the occasion of the death of his sister in the amount of 30,000 rubles until March 1, 2020 inclusive. 2. Appoint chief accountant V.A. Petrova to be responsible for the calculation and payment of financial assistance. Reason: statement of Alexander Sergeevich Sidorov dated January 25, 2015. Attach: a copy of the sister's death certificate dated January 20, 2015 No. GK-AB 22414432, issued by the Dubrovsky department of the Civil Registry Office in St. Petersburg. CEO LLC "Horns and Hooves" _____ I. I. Ivanov I have read the order: 01/30/15 ________ / Petrova V. A./ I have read the order: 01/30/15 ________ / Korepov A. N./ |

- reason for payments;

- term;

- amount;

- responsible person.

Only if these criteria are present can we talk about the legal force of the order.

It is worth noting that such income is a one-time cash payment, which is actually equivalent to wages. It follows that it may be subject to taxation. For a more detailed study of this issue, it is necessary to familiarize yourself with the norms of the Tax Code of the Russian Federation. The only exception provided by law may be a money transfer to pay for medical services.

How are financial payments processed?

Any employee, if there are grounds, can write an application to receive additional funds. A sample application for financial assistance should be available at any enterprise. To ensure correct registration, it can be provided to each employee.

Sample application for the need to obtain additional material resources due to expenses:

| To the director of LLC "Horns and Hooves" I. I. Ivanov From Sidorov A.S. Deputy Director of the company STATEMENT In connection with the death of my sister on January 20, 2020 (Svetlana Sergeevna Sidorova), I ask you to provide me with financial support. Attached: a copy of the death certificate of this person. January 25, 2020 A. S. Sidorov Signature_____ |

If the decision to pay is made, you can issue an order

- Personal statement from the accountant of Rassvet LLC for additional financial assistance.

- A certified copy of the child’s birth certificate, presented by E. N. Fedorova.

Director of LLC "Rassvet" Kashevarov V.I. I have read the order. Recommendations for drawing up the document The above example refers to one-time assistance, however, payments can be not only one-time, but also made in several stages.

Accordingly, in this case it is necessary to indicate the frequency and size of each payment, as well as the total amount.

If it is necessary to provide assistance with things, the order must contain a list of them, and also include a cost estimate, supported by documents, which is again necessary for tax purposes (calculating contributions to the Federal Social Insurance Fund of the Russian Federation) according to paragraph. 8 clause 8 art. 217, art.

STATE UNITARY ENTERPRISE OF THE CITY OF MOSCOW TRUST "MOSOTDELSTROY No. 1" ORDER on the provision of one-time financial assistance dated "" 2009 No.

Moscow In connection with the death of a close relative - brother, former employee of the enterprise Vladimir Nikolaevich Valyasin, I ORDER: To provide financial assistance to Sergei Nikolaevich VALYASIN, a watchman, in the amount of 10,000 (ten) thousand rubles.

Reason: personal statement of Valyasin S.N. Head Yu.P. Sorokin signature AGREED BY: Head of HR Department B.A.

Not a single law contains the concept of financial assistance to an employee. The definition of this term is given by the economic dictionary. It says that it involves additional payment of money to an employee who needs it.

If an employee is interested in such support, he must make a written application addressed to the director.

The document must be accompanied by certificates or other documents confirming that he is in a difficult life situation and needs additional funds. Certificates must be provided as required by Articles 217 and 422 of the Tax Code of the Russian Federation.

They also provide a list of situations where tax is not charged on such payments. And this is in the interests of both the employee and the company.

For example, these are payments related to:

- with pregnancy and childbirth;

- with compensation for damage resulting from injury or illness;

- with payment of the cost of food in kind, etc.

It should be noted that it is possible to provide financial support to a former employee, as well as members of his family. Usually it turns out:

- in case of injury or death;

- as compensation to victims of a natural disaster or terrorist attack;

- as compensation for medicines or spa treatment.

The director of the organization sets the specific amount himself. Much here depends on the financial capabilities of the enterprise. In this case, the manager issues an order for financial assistance, in which he indicates its amount.

It is not the employer's responsibility, it is only his right. Such payments are one-time in nature. The basis for issuing money is the corresponding order.

The list of situations when an employee can receive support is indicated in the local documents of the enterprise and in the employment contract. Typically, the manager issues a Regulation on Financial Assistance, which lists the situations when the employee will be provided with financial support. The document also prescribes the procedure for allocating assistance, etc.

Most often, financial support is provided to an employee in connection with:

- with treatment;

- with the death of a close relative;

- with the death of the employee himself;

- with damage caused by an emergency;

- with marriage;

- with the birth of a child.

As already mentioned, the law does not oblige the director of an enterprise to help employees financially. This is always his personal decision.

Cash can be assigned to an employee in different situations, but most often the reasons for support are the following.

- Difficult financial situation.

- Natural disasters or emergency circumstances. In this case, it is necessary to provide the organization with certificates from the police or other departments to confirm the amount of damage.

- Family circumstances. If an employee applies to receive funds on this basis, you must provide supporting documents to the organization (child’s birth certificate, etc.).

- Serious illness of an employee or a member of his family. Such an illness implies loss of ability to work for more than two months or disability. To receive money, you will need a VKK certificate.

- Anniversary date.

- Need for wellness. This support can be expressed in full or partial payment by the organization of the cost of treatment or a trip to a sanatorium.

- The need to improve living conditions. Such payments are intended to help the employee purchase housing or renovate it. In this situation, the employee must provide the company with papers confirming his status as needing improved living conditions and receipts for expenses incurred.

The law has not approved a sample order for the payment of financial assistance. Accordingly, the order is drawn up on the organization’s letterhead in any form.

The order has legal force only if it contains the following information:

- Full name of the employee to whom the money is intended.

- Payment amount.

- Accrual terms.

- Base.

- Sources.

- Director's signature.

The company helps the employee financially when special circumstances arise. These are non-production payments that do not depend on the organization’s performance and individual employee results.

Therefore, they are not of a compensatory or incentive nature and are not considered an element of remuneration. their goal is to create the necessary financial conditions to solve the difficulties encountered by the employee. Such payments cannot be regular.

The frequency of financial support depends on how often he needs financial assistance and on the financial situation of the enterprise. A company employee can apply for such payments at any time. Whether they will be provided, in what situation, and to what extent, depends only on the decision of management.

To receive the provided monetary support from the employer, the employee should draw up an application in free form, which will be considered by the employer. The decision on the need to pay financial assistance to the person who applied is formalized by order.

All operations carried out by the accounting department of an enterprise (organization) with the company’s accounts are carried out on the basis of certain documents.

Such an order is not issued to the applicant for payment, but is transmitted directly to the financial department.

Important! If the local acts do not contain the reason for payment of cash benefits indicated by the employee in the application, the directorate has the right to approve the application of the needy employee with a separate order.

You can also find a sample order for payment of financial assistance.

Financial assistance is a one-time cash payment. According to the current laws of the Russian Federation, mat. assistance certified in an employment contract can be equated to wages - this payment is also subject to all taxes and deductions. If the payments are not mentioned in any way in the employment contract, then they relate to unrealized expenses, which means that they are taken into account as “Other expenses”.

According to paragraph 23 of Art. 270 of the Tax Code of the Russian Federation, any material assistance cannot be recognized as expenses for the purpose of calculating income tax. Financial cash investments of insurance premiums for compulsory social services. insurance against any accidents at the enterprise or professional. diseases are included in the group “Other expenses” associated with production and sales, according to Art. 264 and 272 of the Tax Code of the Russian Federation. Existing finances can be recognized as other expenses for income tax purposes at the time of accrual.

You can avoid taxes by getting a checkmate. assistance for paying for medical services (documents confirming the required expenses are required).

It is also worth noting a small plus: such assistance is not necessarily issued only to employees of enterprises - it can be issued to former employees and even outsiders.

| To the director of LLC "Horns and Hooves" I. I. Ivanov From Sidorov A.S. Deputy Director of the company STATEMENT In connection with the death of my sister on January 20, 2020 (Svetlana Sergeevna Sidorova), I ask you to provide me with financial support. Attached: a copy of the death certificate of this person. January 25, 2020 A. S. Sidorov Signature_____ |

As you know, the specific amount of payments directly depends on the reason indicated in the application for financial assistance to the employee. For example, if we are talking about the need for treatment, then the medical documents should contain the amount that is necessary for the measures. If we talk about specific sizes, they are not limited by law. However, in fact, we are talking about the amount that is necessary to cover expenses.

The administrative document that gives effect to the decision of the director of the enterprise must necessarily contain a clause on deadlines. As a rule, they are agreed upon with the employee personally. It is best if the order for financial assistance for treatment, the sample of which is not too different from the document indicated above, is issued early.

The rules for processing financial assistance to employees are recorded in the employer’s local documents. Usually, the employee is required to write an application for financial assistance, which is accompanied by the necessary certificates, certificates, conclusions, extracts, and so on.

After receiving the application, the employer issues an order containing a reference to the local regulatory act, according to which the payment of financial assistance to the employee is carried out, its amount and the timing of the provision of financial support. The order form is usually already developed and used in an organization that practices this type of employee support.

Document flow

An order for one-time financial assistance is an element of personnel document flow. The paper is mentioned in the regulations on document management, instructions for its maintenance adopted by the company, with the appointment of persons responsible for the preparation and storage.

Since the form of the order is not mandatory, unified forms have not been approved at the legislative level, it is important to draw up this document correctly.

Required elements are:

- name of the legal entity or individual entrepreneur;

- place, date of signing, number;

- order details;

- indication of local and other ONs;

- the reason for providing financial assistance;

- Full name of the employee and his position in the organization;

- volume of financial assistance and terms of payment;

- attachments: supporting documents, application;

- data, according to the LNA on document flow: full name of the performer, when it comes into force, etc.

This is important to know: Maternity leave after sick leave

Drawing up an order to provide financial assistance to an employee - examples

The founders of the organization (participants and shareholders) can use part of the net profit to pay financial assistance. Such a decision of the founders must be documented.

If the organization has one founder, then the allocation of part of the profit for the payment of financial assistance is formalized by the decision of the sole founder (Clause 3, Article 47 of the Federal Law of December 26, 1995 No. 208-FZ, Article 39 of the Federal Law of February 8, 1998 No. 14-FZ).

If there are several founders, then you need to draw up minutes of the general meeting of participants (shareholders) (Article 63 of the Federal Law of December 26, 1995 No. 208-FZ, paragraph 6 of Article 37 of the Federal Law of February 8, 1998 No. 14-FZ).

ORDER No. 13-k

Krasnodar city

Letter of recommendation, recommendation, testimonial, review, review...Template for review, letter of recommendation, review, testimonial. Correct article...

Regulation, order, concept of personnel policy of an enterprise, organization... Example of a regulation on personnel policy....

1. To pay financial assistance in connection with the difficult financial situation to economist K.K. Kabanov in the amount of 5000.00 (five thousand) rubles.

2. To pay financial assistance due to the difficult financial situation of the painter P.P. Petrova. in the amount of 5000.00 (five thousand) rubles.

3. Chief accountant V.V. Vasiliev make payment as ordered.

Director S.S. Sokurov

Reason: Statement by Kabanov K.K., Petrova P.P.

Who is entitled to payment?

Since providing financial assistance to young parents is voluntary, the decision on its appointment is made by the head of the company. He will, of course, take into account the following factors:

- characteristics of the employee asking for help;

- his contribution to the common cause and length of service in the company;

- financial condition;

- usefulness for the company;

- the value of the position or qualification;

- availability of free money in the budget.

Managers most often accommodate employees who are valued by the company: trusted, responsible, long-lived employees. That is, the director is interested in supporting only those employees who benefit the company.

Amounts of assistance for 2020

The employer can independently determine the amount of financial assistance in regulations. However, it is recommended to take into account that amounts up to 4,000 rubles paid in one billing period are not subject to personal income tax or insurance contributions.

If financial assistance is not specified in regulations, then up to 4,000 rubles it may also be tax-free. If the established threshold is exceeded, financial assistance is subject to personal income tax and insurance contributions. The legislator believes that the following are not subject to taxation:

- payments as one-time compensation for damage from natural disasters or terrorist attacks;

- due to the death of an employee’s family member;

- upon the birth of a child to an employee, with the condition that the amount of payments does not exceed 50,000 rubles.

Financial assistance for the death of family members is separately stipulated. It is not subject to taxation if these are first-degree family members according to the Family Code of the Russian Federation, that is, parents, spouses, children.

If the deceased relative was a grandmother, grandfather, brother, sister, aunt, uncle, etc., only 4,000 rubles are exempt.

Drawing up an application

The main conditions that the employee must fulfill are writing an appropriate application and using documentary evidence as attachments. The manager issues a decree, if he approves the application, makes a positive decision. The amount is issued at the organization's cash desk or payment is made by non-cash method.

The main requirements are correct filling and absence of errors. The manager's full name should be on the top right. Next, there is an indication of the position and personal data of the applicant. In the middle is the title of the document, followed by the main part.

Documents and reasons for drawing up

Financial assistance should include:

- collective agreement;

- employment contract;

- local regulatory act of the organization on social guarantees for employees.

If the amount and purpose of financial support are not specified in labor and collective agreements, then the organization is obliged to develop an internal regulatory act - a provision on social guarantees. The document guarantees to employees the procedure for assigning benefits and its amount.

It should be noted that financial assistance is not the responsibility of the company, so the management each time makes a decision individually on a specific case.