The concept of material assistance is interpreted as a form of social support provided by an employer to an employee. The payment does not depend on production indicators or performance of the employee’s duties. Assistance is not part of the remuneration paid to an employee of the enterprise and is individual in nature depending on the needs of the individuals. In this article we will look at how financial assistance is provided to an employee, how accounting is done, insurance premiums and taxes are paid.

Grounds for making payments for financial assistance

The employer has no obligation to pay financial assistance. The issuance of funds is voluntary. Only the person appointed by the employer to manage the activity has the right to determine the possibility of providing assistance and the amount of the amount. Features of providing financial support:

- The decision on payment is made by the manager (or another person issued an order in his absence) individually.

- The procedure and reasons for providing assistance are reflected in internal forms - a collective agreement, regulations on the provision of material assistance, or other document.

- The assistance is of a non-systematic one-time nature.

- Payment is made at the request of the employee and in the presence of special circumstances specified by the person in the document.

- The amount of assistance depends on the parameters established at the enterprise or the circumstances and decision of the manager.

If all conditions are met, the payment is considered financial assistance. Full-time employees and former employees dismissed due to old-age retirement have the right to receive social support amounts. Situations may arise at an enterprise in which the provision of assistance has been approved, but there are no funds for its implementation (typical for budgetary organizations).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Accounting for financial assistance using retained earnings

Accounting for financial assistance at the expense of retained earnings

When calculating financial assistance at the expense of retained earnings, make the following entry:

Debit 91-2 Credit 73 (76)

– financial assistance has been accrued to an employee (an employee’s family member) from retained earnings from previous years.

This posting must be made regardless of whether the net profit of previous years or the current year (including profit based on the results of the quarter, half a year, nine months) is aimed at paying financial assistance. The fact is that such expenses cannot be reflected using account 84. These will be other expenses that also affect the financial result of the organization. Accordingly, such expenses must be reflected in the debit of account 91-2. Similar explanations are given in letters of the Ministry of Finance of Russia dated December 19, 2008 No. 07-05-06/260 and dated June 19, 2008 No. 07-05-06/138.

An example of reflecting in accounting financial assistance provided to an employee at the expense of retained earnings

On April 7, 2020, manager of Alpha LLC A.S. Kondratyev wrote a statement asking for financial assistance.

On April 10, 2020, a general meeting of founders was held, at which it was decided to allocate part of the profit for 2014 to pay financial assistance to employees. On April 13, 2020, the general director of Alpha, guided by the decision of the general meeting of participants, issued an order to issue 4,000 rubles to Kondratiev. financial assistance from current year profits.

Alpha's accountant reflected this operation on April 13, 2020 as follows:

Debit 91-2 Credit 73 – 4000 rub. – financial assistance was accrued to the employee at the expense of the current year’s profit.

Situation: is it possible to provide financial assistance to an employee (an employee’s family member) with property?

Answer: yes, you can. The legislation does not contain a ban on this.

In accounting, reflect the issuance of material assistance with property by posting:

Debit 73 (76) Credit 41 (10, 01, 58)

– financial assistance was provided to the employee (employee’s family member) with property.

Reasons for providing assistance

The list of events and reasons in the event of which an employee can count on assistance from the enterprise is approved by the employer. Common reasons include:

- Extraordinary circumstances – loss of property or damage caused by natural or natural disasters.

- Medical indications – illness, disability or need for recovery.

- Family circumstances - the birth or adoption of a child, illness or loss of a loved one.

- Personal motives - difficult financial situation, anniversary, retirement.

- Other situations determined by the employer and enshrined in internal documents.

The employee must indicate the occurrence of a case in which assistance is required in the application for financial assistance.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Grounds and procedure for calculating assistance

The purpose of accruing and paying financial assistance to an employee is to create or maintain conditions for resolving certain life situations, in particular:

- At the birth of children;

- Upon the death of an employee or close relative;

- Need for treatment;

- Damage caused by natural disasters or terrorist attacks;

- In other cases established by the employer.

In order to receive financial assistance, an employee must meet certain conditions:

- The procedure, reasons, amount and timing of payment of assistance must be fixed in internal regulatory documents, for example, in the “Regulations on Social Policy” or the “Collective Agreement” of the company;

- Help should not be systemic;

- Issue an order signed by the manager based on the employee’s application:

Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

The reason why the employee needs help, he must indicate in the application and attach copies of documents (for example, a marriage certificate, certificates from public or private institutions about treatment, family composition and financial situation, etc.)

Financial assistance can be issued in cash from the cash register or by transfer to the employee’s personal bank account, which must also be indicated in the application. The recipient of assistance may be a close relative of the employee (in accordance with the family code). In some cases, he may himself turn to the employer for help (in case of illness, death of the employee or other circumstances); the right of a family member to seek help must be reflected when drawing up the “Regulations on Social Policy” or the “Collective Agreement”.

Procedure for providing financial assistance

The employer makes a decision on payment and amount based on the application. The application is accompanied by documents confirming the reason for providing assistance - a child’s birth certificate, an employee’s death certificate, certificates of the family’s financial condition, and other forms. A positive decision on the application is reflected in the entry on the document and order. On the application, the manager makes a note about the amount and source of payment. The document contains information:

- Details of the person receiving financial assistance. Indicate the full name, position of the employee or passport details of the retired person.

- Link to internal document for assistance.

- Individual reason or circumstances for payment.

- Amount provided in aid.

- Date of payment for urgent reasons.

The order is sent to the accounting department to provide the basis for calculating the amount and taxes, making payments and deductions to the budget. Payment in any form is allowed - cash or non-cash transfer.

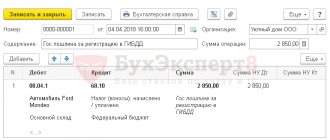

Determining the source of payment and recording it in accounting

The source of such payments may be retained earnings from previous periods or current year profits. Depending on the source, the accountant generates the following accounting entries for financial assistance to employees:

- Dt 84 Kt 70 (73) – assistance was accrued to the employee from the profits of previous years;

- Dt 84 Kt 76 – assistance was accrued to a member of the employee’s family from the profits of previous years.

Or:

- Dt 91.2 Kt 70 (73) – assistance accrued to the employee (current period);

- Dt 91.2 Kt 76 – assistance was accrued to a member of the employee’s family (current period).

It must be remembered that retained earnings from previous years can be used only on the basis of the approval of the founders, documented in a protocol (decision).

Payment of financial assistance is reflected by posting Dt 70 (73.76) Kt 50 (51).

Accounting accounts for financial assistance payments

The choice of accounting accounts for the operation of accrual and payment of assistance depends on the category of person and the sources of the amounts.

| Person receiving assistance | Payment source | Postings to accounts when calculating financial aid |

| Enterprise employee | Retained earnings from previous years | Debit 84 – Credit 70, 73 |

| Current year expenses | Debit 91/2 – Credit 70.73 | |

| A former employee of the company or a relative of an employee of the company | Retained earnings from previous years | Debit 84 – Credit 76 |

| Current year expenses | Debit 91/2 – Credit 76 |

The wife of a former employee K. of Flazhok LLC turned to the manager for financial assistance. The reason for the application is the death of employee K. The collective agreement of the Flazhok enterprise provides for the use of the grounds specified in the application for receiving financial assistance. The company issued an order signed by the manager indicating the amount of assistance in the amount of 10 thousand rubles.

In the accounting department, a statement was generated for payments through the cash register and postings:

- Debit 91/2 Credit 76 – financial assistance in the amount of 10,000 rubles was accrued to a person who is not a full-time employee of the enterprise;

- Debit 76 Credit 50 – a payment was made to a relative of a person in the amount of 10,000 rubles.

Payments due to the death of an employee are not subject to personal income tax, regardless of the amount of assistance provided. The application must be accompanied by a document confirming the basis for the application.

Personal income tax

According to paragraph 8 of Art. 217 of the Tax Code of the Russian Federation, one-time payments (including amounts of financial assistance) made by the employer both in cash and in kind are not subject to taxation:

- family members of a deceased employee, a retired former employee, or an employee, a former employee in connection with the death of a member(s) of his family;

- to employees (parents, adoptive parents, guardians) at the birth (adoption) of a child, paid during the first year after birth (adoption), but not more than 50,000 rubles. for one child;

- taxpayers in connection with a natural disaster or other emergency, as well as family members of persons killed as a result of a natural disaster, in order to compensate for the material damage or harm caused to their health, regardless of the source of payment;

- taxpayers in the form of humanitarian assistance, as well as charitable assistance in accordance with Federal Law of August 11, 1995 N 135-FZ “On Charitable Activities and Charitable Organizations”;

- taxpayers from among the poor and socially vulnerable citizens at the expense of the federal budget, budgets of constituent entities of the Russian Federation, local budgets and extra-budgetary funds in accordance with programs approved by government authorities in the form of amounts of targeted assistance;

- taxpayers affected by terrorist attacks on the territory of the Russian Federation, as well as family members of persons killed as a result of such terrorist attacks.

Not subject to personal income tax in accordance with clause 28 of Art. 217 of the Tax Code of the Russian Federation financial assistance in an amount not exceeding 4,000 rubles. for the tax period, provided by the employer to its employees, as well as to its former employees who retired due to disability or age.

For your information. In accordance with Art. 2 of the RF IC, family members are only spouses, parents and children (adoptive parents and adopted children).

In the certificate of income of individuals (f.

Sources of financial assistance payments

The source of assistance payments can be undistributed profits from previous years or current profits as part of the expenses of the tax period. The question of writing off amounts of financial assistance arises only if there is a regular nature of payments, which makes it possible to judge whether the costs belong to labor costs and the use of the amounts when calculating income tax.

There are 2 options for attributing payments when accounting for profit taxation:

- Payments can be clearly classified as financial assistance. They do not participate in taxation when calculating the profit tax base (Article 270 of the Tax Code of the Russian Federation).

- Payments are regular in nature and can be considered as payments included in wages. Amounts are taken into account as expenses when determining profit. An example of regular types of payments is assistance paid for vacation and enshrined in the collective agreement.

Payment of financial assistance in an organization from retained earnings of previous years is paid only with the consent of the founders, confirmed by the minutes of the general meeting or by a decision in the presence of a single participant. After receiving the approval of the founders, the head of the enterprise orders the issuance of assistance.

The decision to write off financial assistance for current expenses within the annual tax period is made by the manager responsible for conducting the business.

Tax accounting

For tax accounting purposes, for organizations using different taxation systems, it is possible to take into account payments of financial assistance for vacation, but only if this type of payment is fixed in a collective or employment agreement and depends on the execution of labor discipline, as well as wages (Letters of the Ministry of Finance of the Russian Federation dated 07/03/2012 No. 03-03-06/1/330, dated 09/03/2012 No. 03-03-06/1/461).

This means that if the collective agreement establishes the same amount of vacation payment for all employees, then the organization will not be able to accept such expenses when accounting for income tax, and if the additional payment for vacation serves as a one-time payment related to the employee’s performance of his job functions, then it can be accepted as expenses for tax accounting purposes for income tax.

It is important to note that, despite the fact that payments of financial assistance for the birth or adoption of a child, in connection with the death of family members and other types of payments determined by an employment or collective agreement are not accepted for tax accounting purposes in accordance with tax legislation, insurance contributions accrued based on these payments can be accepted for tax accounting purposes (Letter of the Ministry of Finance of the Russian Federation dated April 29, 2010 No. 03-03-06/4/53).

Financial assistance is money or other property provided by an employer to its employee in connection with a natural disaster or other emergency, the death of a family member, the birth of a child, vacation or other circumstances.

What types of assistance are not subject to personal income tax?

Article 217 of the Tax Code of the Russian Federation establishes a closed list of types of material assistance, the payment of which is not subject to personal income tax.

| Type of assistance (link under Article 217 of the Tax Code of the Russian Federation) | Tax-free amount |

At the birth or adoption of a child, paid during the first year of life (clause  | Up to 50 thousand rubles for each child |

Due to the death of an employee or former employee dismissed due to retirement (clause  | No limit on amounts |

In connection with the death of a relative of a full-time employee or an employee dismissed upon retirement (clause  | |

| In case of loss of employees and their family members in natural disasters (clause 8.3) | |

| In case of suffering caused to employees and their family members from acts of terror (clause 8.4) | |

| Payments of a non-targeted nature, defined by internal documents, to full-time or former employees who left due to disability or retirement (clause 28) | Within 4 thousand rubles |

In all other cases, as well as non-target payments on amounts exceeding the non-taxable limit, the person must pay tax to the budget. The employer, the tax agent, is responsible for withholding personal income tax and transferring it to the budget.

The Smirnovs turned to their employers for financial assistance in connection with the birth of a child. Enterprise “A”, Smirnov’s wife P.P. allocated assistance in the amount of 30 thousand rubles, a non-personal income tax amount, for which it issued a certificate to be presented at the place of work of Smirnova’s wife M.M. for the accounting department of enterprise "B".

In the accounting department of enterprise “A” the amount was recorded using the following entries:

- Debit 91/2 Credit 70 – financial assistance in the amount of 30,000 rubles was accrued;

- Debit 70 Credit 51 – payment was made by bank transfer.

Enterprise “B” of wife M.M. Smirnova provided assistance in the amount of 20 thousand rubles later and after receiving a certificate. In the accounting of enterprise “B”, similar entries are made for the specified amount. The total amount of assistance does not exceed the non-taxable limit, as a result of which there is no tax liability.

The non-taxable amount of financial assistance provided by the employer in connection with the birth (adoption) of a child is calculated taking into account payments to both parents or adoptive parents.

Taxation of financial assistance since 2011

Type of assistance

Taxation

Grounds for tax exemption

Financial assistance is provided to an employee of the organization

Due to a natural disaster or other emergency

1. Personal income tax – not assessed

clause 8 art. 217 Tax Code of the Russian Federation

2. Contributions for insurance against industrial accidents and occupational diseases are not taxable

pp. 3 clause 1 art. 20.2 of the Federal Law of July 24, 1998 No. 125-FZ

Contributions to funds

Amounts of accrued financial assistance are subject to contributions paid to the funds. In a number of cases, Law No. 212-FZ in Article 9 provides for tax exemption

| Type of assistance | Link to article of law |

| Payments due to natural disasters or acts of terrorism | Art. 9 clause 3a |

| Assistance to an employee in connection with the death of relatives | Art. 9 paragraph 3b |

| Payments to a parent, adoptive parent or guardian in connection with the birth of a child, his adoption or the appointment of guardianship | Art. 9 p. 3c |

| Payments for various needs up to 4 thousand rubles annually | Art. 9 p. 11 |

All other cases of providing targeted or non-targeted assistance are subject to contributions to funds allocated for employee insurance. The issue of taxation of amounts of social payments with contributions to funds is ambiguous and controversial. There are a number of examples of challenging fund decisions on pre-charges in arbitration courts.

Insurance premiums

Insurance premiums, on the basis of Art. 421 of the Tax Code of the Russian Federation, as well as contributions “for injuries” (Article 20.1 of Law No. 125-FZ): when financial assistance is accrued - entry to the debit of accounting account 91 “Other income and expenses”, subaccount 2 “Other expenses” in correspondence with the loan Account 69 “Calculations for social insurance and security.”

Lump sum payments in the form of financial assistance are not subject to insurance premiums on the same grounds as for personal income tax (Article 422 of the Tax Code of the Russian Federation).

At the same time, the employer must take into account that employee support expressed in kind is also the basis for calculating insurance premiums and “injury” contributions.

Inclusion of material assistance in income

Employees with children are entitled to receive a standard deduction (see → how to write an application for a standard deduction for children). A monthly deduction is provided if you receive income that does not exceed the limit. The amount of income is limited to 280 thousand rubles.

If you receive financial assistance, the amount is included in your income, but only in the taxable amount. For example, if the amount of a non-target payment is 10 thousand rubles, then an amount of 6 thousand rubles minus a non-taxable amount of 4 thousand rubles is subject to inclusion.

Personal income tax: two types of financial assistance

Personal income tax: two types of financial assistance

Situation: when calculating personal income tax on financial assistance paid to employees during the first year at the birth (adoption) of a child, is it possible to take into account a deduction in the amount of 4,000 rubles if the payment amount exceeds 50,000 rubles?

Answer: no, you can't.

This is due to the fact that these limits (4,000 rubles and 50,000 rubles) are established for different types of financial assistance. Financial assistance, paid during the first year at the birth of a child, is a one-time payment that is associated with a specific event. It is exempt from personal income tax in the amount of no more than 50,000 rubles. (paragraph 7, clause 8, article 217 of the Tax Code of the Russian Federation). In addition to this one-time payment, the organization can provide the employee with financial assistance for any other reason. Such financial assistance is not subject to personal income tax up to 4,000 rubles. (clause 28 of article 217 of the Tax Code of the Russian Federation). In the Tax Code, these payments are considered as different types of financial assistance. Therefore, it is impossible to simultaneously apply the rules of paragraph 7 of paragraph 8 and paragraph 28 of Article 217 of the Tax Code of the Russian Federation.

Situation: is it necessary to withhold personal income tax if an employee is given financial assistance twice during the year - in connection with the death of his mother and in connection with the death of his spouse?

Answer: no, it is not necessary.

As a general rule, the amount of one-time financial assistance to an employee in connection with the death of his family members is not subject to personal income tax (paragraph 3, paragraph 8, article 217 of the Tax Code of the Russian Federation). Financial assistance is recognized as one-time assistance if it is provided for certain purposes no more than once in a tax period on one basis. This conclusion follows, in particular, from the letter of the Ministry of Finance of Russia dated May 22, 2006 No. 03-05-01-04/130 and the letter of the Federal Tax Service of Russia dated August 18, 2011 No. AS-4-3/13508. Therefore, if financial assistance is paid for the same reason more than once during the year, then starting from the second payment, personal income tax must be withheld.

In this situation, the basis for payment of financial assistance is the death of a family member of the employee. The death of different relatives (even if it happened in the same tax period) cannot be considered as one event. Therefore, payments related to the death of relatives for personal income tax purposes should not be considered in aggregate, but for each case of death of a relative separately. That is, in this case, the employee was paid two lump sum payments in the form of financial assistance for various reasons:

- in connection with the death of the mother;

- due to the death of a spouse.

Based on paragraph 3 of subparagraph 8 of Article 217 of the Tax Code, each of these payments is not subject to personal income tax.

To what account should financial assistance be attributed to an employee?

According to the norms of current legislation, financial assistance (hereinafter referred to as MP) has no relation to payments for the fulfillment of the employee’s labor obligations. Also, this type of financial support is not regulated in any way under the current labor legislation.

There is no specific account provided to reflect the material support received by the employee. In practice, in the process of processing accounting transactions, direction 70 , meaning settlement measures with personnel for remuneration.

difficulties and confusion may arise in the accounting process .

Insurance premiums with financial assistance posting

Only after this the executive body of the enterprise has the right to spend the allocated money on social events. In the second case, there is no need to wait for the decision of the general meeting.

Source: https://fhl-nn.com/na-kakoy-schet-otnesti-materialnuyu-pomosch-sotrudniku/

Financial assistance as part of other expenses

Financial assistance paid to an employee for other reasons will be reflected as part of other expenses in account 91 “Other income and expenses” (clauses 12, 13 PBU 10/99, Order of the Ministry of Finance dated October 31, 2000 No. 94n):

| Operation | Account debit | Account credit |

| Financial assistance accrued (except for vacation pay) | 91 | 73 “Settlements with personnel for other operations” |

| Personal income tax withheld from financial aid | 73 | 68 |

| Financial assistance paid | 73 | 50, 51 |

| Insurance premiums accrued from financial assistance | 91 | 69 |