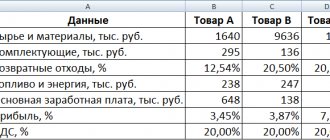

First, a little theory. Production cost accounting is directly related to product output and cost calculation. In this regard, costs are divided into two groups:

- Direct

- Indirect

Both groups are included in the cost price, but their methods of “getting there” are different. Direct costs can be immediately attributed to a specific finished product, service or semi-finished product. Accounting is maintained on accounts 20 and 23.

Indirect costs are distributed proportionally to some base. In this case, 25 and 26 counts are used.

Direct costs usually include materials and components, the quantity of which can be obtained from the specification.

General production and general business costs are considered indirect. For example, administration salaries, rent, costs for lighting, heating, etc. Since it is not known in advance what part of such costs is included in the cost of a specific product, the total amount has to be distributed among all produced units.

Coefficients of distribution methods are different, often prescribed in industry standards (proportional to direct costs, output volume, planned cost).

Analysis of production costs in 1C Accounting 8.3

The main sections for accounting for production costs in 1C:

- By department

- By item groups

- By cost item

The list of divisions may correspond to the structure of the enterprise. Or it may differ. For example, some of the most important areas of one workshop can be defined as a “division” from the point of view of accounting in 1C. The accounting setup by department is shown in Fig. 1.

Fig.1

Filling out a directory of item groups is a more difficult task. Nomenclature groups can be linked to types of activities. One workshop can produce products of different types, or all workshops can produce products or provide services of the same type. In 1C there are no restrictions in this regard. Moreover, the number of nomenclature groups may increase over time (Fig. 2).

The main thing is not to use the same product groups when releasing products and for accounting for production services.

Fig.2

The most complex type of analytics is cost accounting. When compiling a list of cost items, it is necessary to correctly determine the relationship between each item and tax accounting. In 1C, the list of direct costs is stored in the information register “Methods for determining direct production costs in OU”. The necessary settings are presented in Fig. 3. All costs taken into account for items from this list (Fig. 4) are considered direct, the rest - indirect.

Fig.3

Fig.4

For indirect cost items, distribution coefficients (base) are specified. See Fig.5 and Fig.6.

The classification of cost items corresponds to the generally accepted one (see Fig. 7):

- Depreciation

- Salary

- Material costs

- Others

Fig.5

Fig.6

Fig.7

Classification of expenses in the cost of production by economic content

The most common classification feature that allows you to combine expenses is the grouping of expenses by economic content, which includes the classification of expenses by economic elements and costing items.

Grouping expenses by economic elements involves the allocation of such homogeneous costs that form the cost of all types of goods, works or services produced and which cannot be decomposed into smaller homogeneous elements within the enterprise in question. This division of costs allows you to determine the amount of costs of each type, regardless of their place of origin and direction of use.

The determining factors in the formation of cost elements are the components required in the production process:

- means of labor;

- objects of labor;

- labor resources.

Using these groups of mandatory production conditions allows you to group costs and include in them:

- materials costs;

- labor costs with mandatory contributions to state extra-budgetary funds;

- accrued depreciation of labor assets.

A peculiarity of grouping expenses by economic elements is the fact that expenses are combined based on those spent in the production process as a whole for the organization in the amounts of estimated (planned) and actual expenses, regardless of their place of origin and direction of use.

When forming costs by economic elements, their totality is calculated for the reporting period in production activities, regardless of whether the product has been completed by processing, manufacturing or not, whether the work has been completed, whether the service has been provided or not, where the costs are incurred and what type of product is being manufactured. works, services they are used up. This grouping of expenses is mandatory for maintaining financial accounting, and its data is used to prepare accounting (financial) statements, especially explanations to them, and is intended mainly for external users of reporting information.

The composition of expenses that form the cost of production by economic elements is determined by paragraph 8 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n, and includes the following types:

- material costs;

- labor costs;

- contributions for social needs;

- depreciation;

- other expenses.

Let us consider the content of each economic element that makes up the cost of products, works, and services.

The element “Material costs” combines the cost of:

- purchased raw materials and materials used for production, management and economic needs, components and semi-finished products intended in the organization for installation or additional processing;

- natural raw materials - payment for land reclamation work, payment for water taken from water management systems, etc.;

- fuel purchased externally to be used for technological purposes, expenses for own energy production used for technological needs and for space heating, etc.;

- purchased energy of all types, intended for technological, managerial and economic purposes, etc.

The cost of material resources included in material expenses is calculated in the amount of actual expenses for their acquisition, which includes amounts paid under contracts to the supplier, the cost of consulting, information services for the acquisition of inventories, customs duties, remunerations to intermediary organizations for the acquisition of inventories and etc.

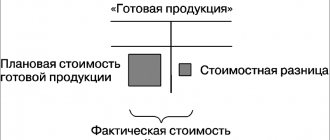

When calculating the cost of actually consumed material assets, the cost of returnable waste generated during the production process is also taken into account. They may completely or partially lose their consumer properties. In this regard, they are assessed at the price of possible use. Returnable waste can be used in the main production after additional processing or can be valued and sold at market prices. Returnable waste also includes raw materials that have changed their chemical composition and material assets that have completely or partially lost their consumer properties.

In " Labor Costs"

» includes the costs of remunerating the main industrial production personnel, including bonuses for the results of production activities, incentives accrued to employees in accordance with the conditions accepted in the organization and compensatory payments related to the regime and working conditions, guaranteed by the Labor Code of the Russian Federation.

Also included in this group are expenses associated with the payment of regular and additional vacations to employees, preferential hours in accordance with the norms of the Labor Code of the Russian Federation, etc.

«Contributions for social needs

", this element of the cost contains a set of mandatory deductions according to the norms of tax legislation to the bodies of state social insurance, pension fund, medical insurance from the amount of accrued wages to the employees of the organization, included in the cost, with the exception of expenses for which insurance payments are not accrued.

Article " Depreciation"

» includes the amount of depreciation charges for fixed assets, intangible assets and profitable investments in tangible assets, calculated monthly for non-current assets on the balance sheet of the enterprise.

The amount of depreciation is included in the cost of production based on:

- the amount of depreciation charges determined on the basis of the cost of depreciable assets;

- their useful life;

- the depreciation calculation method adopted in the accounting policy of the organization.

In the group “ Other expenses”

» expenses included: taxes; fees (payments for emissions of harmful substances, etc.); training costs; entertainment expenses; travel expenses; lifting; rent; costs of consulting, information, auditing services, as well as communication services, banks; other similar costs.

The meaning of the concept of profit and its types

The concept of profit is that it represents all the money that a company received from its activities after subtracting from it the costs incurred in producing and selling products.

The profit formula looks like:

The relationship between the concepts of costs (expenses) and profit is obvious from the formula.

Logos LLC received revenue in the amount of 50,000 rubles, while 25,000 rubles were spent on production. This means that the profit will be equal to: 50,000 – 25,000 = 25,000 rubles. From this amount the company will pay taxes and other obligatory payments, only after this will it result in net profit, which Logos LLC can dispose of at its own discretion.

The concept of enterprise profit characterizes only the positive value (difference) between costs and income. If its size is less than the sum of all costs incurred (cost), and the difference turns out to be negative, this is called a loss . Many enterprises, if they do not try to change the situation, go bankrupt.

Let's take a closer look at what the definition of profit . Economists call this the difference between all production costs and revenue, which reflects how successfully the company is managed and the need for its products in the market. In addition, you need to remember that it is the basis for the development of an enterprise, the growth of its competitiveness, from which firms form various types of cash reserves that will be used in the event of a decrease in income or unforeseen situations.

Let's consider the types of profit of an enterprise:

Depending on the type of profit, its structure contains:

- Amounts from sales, produced, sold products, services;

- Sale or rental of various property (premises, vehicles);

- Receiving dividends (if the company has shares of other organizations);

- Sale of various securities.

Organizations constantly monitor the income received; for this purpose, an analysis is carried out and within its framework it is determined what types of profits and in what amount were generated as a result of the activities of the enterprise.

The considered economic concepts have different meanings, which is why it is so important to give the concept of revenue, profit and income and distinguish between them.

Other accounting policy settings

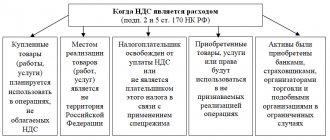

The next group of settings regulates the use of account 57 “Transfers in transit”, the formation of a reserve for doubtful debts and the accounting of deferred tax assets and liabilities.

Fig.20 Account 57 and reserves

Account 57 “Transfers in transit” is used in cases where funds intended for crediting to the current account have been deposited in the bank, but have not yet been credited, to account for funds deposited in the bank through collection, when reflecting purchase or sale transactions of foreign currency . This account is also used to reflect transactions when payment for sales is made using payment terminals or through online stores.

Formation of a reserve for doubtful debts . If the organization's accounting policy provides for the formation of a reserve for doubtful debts, then this checkbox must be checked. If the debt exceeds 45 days, a reserve is automatically added in the amount of 50% of the balance on account 62 “Settlements with buyers and customers” and 76.06 “Settlements with other buyers and customers”. If the debt period exceeds 90 days, then the reserve amount will be 100%.

What is the difference?

The identification of the concepts discussed above can bring unpleasant consequences to the company, so it is necessary to understand what their differences are. What is the difference between costs and expenses?

- Costs have a monetary value . They arise as a result of the use of purchased goods or services to ensure the production and management process.

- Costs are expressed in monetary terms , but are associated with a reduction in economic benefits . They arise when a company loses resources or their value decreases.

- Costs are the cost of raw materials purchased by the company. Thus, this is a natural expression of the waste of the enterprise.

We recommend reading: variable and fixed types of costs of an enterprise - what are the differences?

What are the main differences between audit and audit, inventory and examination? The answer is here.

How does an ordinary director differ from an executive and general director: https://gderaznica.ru/social/generalnii-ispolnitelnii-i-obichnii-direktor.html

Settings when entering a new organization

If you are just starting to keep records, then when entering data about the organization, the system will prompt you to indicate the type of activity (individual entrepreneur or legal entity), as well as determine the taxation system.

Fig.7 Type of organization

Fig.8 VAT

The main setup begins with this step. The program will automatically enter the initial data when saving information about the company. In the future, by clicking on the hyperlink of the same name, these data can be adjusted in accordance with changed accounting requirements.

Fig.9 Accounting policy

Fig. 10 Change in accounting policy

In addition to the information card, the organization’s accounting policy is available in the “Main-Settings” menu section.

Fig.11 Main-Settings

Once we open it, we can configure other necessary parameters.

Fig. 12.1 Setting up accounting policy parameters

Fig. 12.2 Completing setting up accounting policy parameters

As such, the setup is divided into accounting setup and tax accounting setup.