Cost of products (works, services) – the most important indicator of enterprise performance. It is identified during production planning and is used in financial planning to determine profit, profitability of the entire volume of products sold and its individual types.

The main ways to reduce production costs:

1. Reducing the material consumption of products by revising consumption rates in the main areas of costs. Reduced standards lead to a reduction in the overall costs of materials, their transportation, and storage; The number of workers working with materials (accountants, storekeepers) is being reduced.

2. Reducing the labor intensity of work performed. As a result, the number of core workers is reduced, which is a prerequisite for reducing overhead costs calculated from their wages.

3. Reducing overhead costs by reducing management personnel; liquidation or lease of unused assets of the enterprise; optimization of service processes (systems of intra-production transportation, scheduled maintenance)

4. Improvement of personnel qualifications through the organization of training and retraining of personnel. This will reduce losses from defects, poor management decisions, and increase labor productivity.

By reducing production costs, the entrepreneur achieves a number of goals:

— Organization of production of competitive products at lower costs at lower prices;

— Possession of high-quality and real information about the cost of various types of products and their positions on the market in comparison with other manufacturers;

— Have opportunities and reserves when using flexible pricing;

— Provide yourself with objective data when drawing up the enterprise budget;

— Be able to evaluate the activities of each element of the enterprise regarding financial aspects;

— Increase the speed of making specific and effective decisions by managers (managerial personnel) of the enterprise.

Content

- What is cost and why is everyone trying to reduce this figure?

- Factors for reducing production costs

- Ways to reduce production costs at an enterprise

- Method 1. Increasing labor productivity

- Method 2. Automation of production, introduction of innovative technologies

- Method 3. Compliance with saving mode

- Method 4. Selecting the right partners

- Method 5. Reducing the cost of maintaining management personnel

- Method 6. Staff development

- Method 7. Saving raw materials, fuel, electricity, etc.

- Method 8. Enterprise consolidation, cooperation

- Method 9. Reducing the production of defective products

- Method 10. Keep up with the times

- Drawing up a plan to reduce costs

- What does an actual reduction in production costs entail?

- Conclusion

What is cost and why is everyone trying to reduce this figure?

In order to understand how to reduce the cost of services or the cost of goods (manufactured products), you need to understand what the word “cost” means.

Cost is the total amount of costs that were spent on producing a product and promoting it on the market. Expressed in monetary terms and refers to production costs.

Reducing costs is very important for businesses that are just starting out. In addition to how to make money, you need to think about how to gain a foothold in the market with good quality products, and at the same time achieve at least a level of self-sufficiency.

What is the goal of cost reduction?

- The ability to control the activities of each element of the enterprise from a financial point of view;

- Increase the productivity of the management apparatus, which is expressed in the rapid adoption of effective decisions;

- Possess real information that is taken into account when drawing up the enterprise budget;

- Use flexible pricing, which allows you to expand the capabilities of the enterprise and contributes to the creation of reserves;

- The ability to have valuable information about the market price of your product and competitors’ products;

- The ability to organize the production of high-quality products at a lower price with lower costs.

Reducing the cost of production entails a reduction in the price of the product, due to which the product can compete more successfully in the market.

Minimizing costs

The cost includes the following elements:

- Labor costs (worker wages).

- Material costs (costs for the purchase of materials, raw materials, tools, third-party services and everything that is used in the creation of the product).

- Contributions to extra-budgetary funds.

- Depreciation costs (depreciation of fixed assets).

- Other.

The “other” element includes: fees for the use of housing and communal services, loan payments, rent, repairs, and so on.

Naturally, the management of each enterprise thinks about how to reduce production costs and get the greatest profit in order to increase its profitability.

To reduce product costs, you need to look for ways to reduce them.

In the cost structure, the largest share is traditionally occupied by material and labor resources, therefore, the primary direction of cost minimization will be to reduce these costs.

Ways to minimize costs:

- Increased production output. Fixed costs, such as rent, are spread over more products.

- Search for analogues of materials.

- Increased efficiency of equipment use, development of low-budget production.

- Reduced use of third party services. If a company uses external services to a minimum, and, on the contrary, performs all functions in-house, then costs can be reduced. For example, reducing delivery or assembly costs.

- Reduction of personnel, combination of positions. Not the most pleasant, but one of the most effective methods of reducing costs.

- Decrease in inventories.

- Relations with suppliers. By providing, for example, a discount on the purchase of your goods to suppliers, it is possible to establish commercial relations with them and buy materials and components at a lower price. Also, you should choose those suppliers who provide free delivery and free repairs under warranty.

- Cost intensification. The introduction of new technologies into production and an increase in its volume has a positive effect on revenue; production activities are carried out faster, therefore, more products are produced per unit of time. It is possible to introduce a system of fines for downtime and defects in production, but this in turn can cause negativity on the part of the staff.

- Saving energy and fuel.

- Reducing telecommunications costs.

- Sale or rental of unused premises, equipment, as well as sale of goods with an expiring shelf life.

- Reducing tax costs (concluding agreements with individual entrepreneurs and legal entities, etc.).

- Exercising control over receivables and payables.

- Optimization of procurement, holding tenders.

Using several or one of these methods will help enterprise management reduce costs and reduce production costs. But, in addition to the ways to reduce costs, it is also necessary to know the factors influencing this reduction. Let's look at them in more detail.

Factors for reducing production costs

Many factors influence cost reduction. Conventionally, they can be divided into the following:

- Intra-production – those that enterprise managers can directly influence. These include: staff reduction, automation of individual processes, staff motivation, etc.

- Non-production - those that cannot be influenced by the enterprise. These are the cost of fuel, raw materials, tariffs, the amount of tax deductions, etc.

Ways to reduce production costs at an enterprise

An entrepreneur who has decided to reduce the cost of production must clearly understand that this is not a matter of one day. The entire production will be involved in this process. Below are the main methods for reducing costs.

Method 1. Increasing labor productivity

Labor productivity shows how much work each worker performs per unit of time. Most often, staff are not interested in quickly performing their duties. Employees receive a fixed salary, regardless of the quality and quantity of work performed.

In this case, the manager is faced with the task of getting workers to complete more work in a minimum amount of time. This can be done through motivating conversations, financial incentives, etc.

You can also change the payment system. That is, the employee will not receive a fixed salary every month. The size of his payments will directly depend on the quantity and quality of the products he produces. Thus, each worker will strive to complete as much work as possible.

Method 2. Automation of production, introduction of innovative technologies

In the modern world, we have learned to replace human labor with machine labor. Sometimes it is more reliable and, undoubtedly, more economically profitable. To reduce the cost of manufactured goods, it is important to automate production as much as possible in all processes.

This will reduce the number of employees, which entails a reduction in costs associated with paying wages. With the involvement of technology, labor productivity and the volume of goods produced increase several times.

Method 3. Compliance with saving mode

All stages of production must be involved in the savings process. It is necessary to calculate where and how much money can be saved without compromising the quality of the product.

Method 4. Selecting the right partners

Any production process involves close cooperation with a large number of organizations. These are suppliers of raw materials, carriers, etc. It is very important to competently approach the selection of each of them.

For example, when choosing suppliers of raw materials, you need to pay attention to their geographical location. Give preference to suppliers who are located near your production. This way you will save on transport costs.

Method 5. Reducing the cost of maintaining management personnel

Some enterprises have a “bloated” staff, where there is almost one manager for every employee. In order to start saving, it is necessary to review the job responsibilities of each employee of the management apparatus and, if possible, combine several positions into one.

In this case, employees may rebel, but you can offer a salary increase or bonus of 25-30% of their salary. Thus, by reducing one position, but paying bonuses to other employees, this can significantly save the enterprise’s budget.

Method 6. Staff development

In order for employees to produce higher-quality products, while reducing the number of defects, it is necessary to regularly improve the qualifications of employees.

For example, you are the head of a private medical center. In this case, your employees will not be harmed by advanced training courses, medical seminars, etc. This is where specialists exchange experiences, learn new things, and get acquainted with innovative equipment. Thanks to this, they put their knowledge into practice, and the number of grateful patients increases. They, in turn, create advertising for you and attract other clients.

Method 7. Saving raw materials, fuel, electricity, etc.

In order to achieve a reduction in production costs, it is necessary to constantly monitor the rational use of raw materials. For example, if in a clothing factory, where there is a lot of fabric for sewing, the craftsmen do not save it and cut the material thoughtlessly, a large amount of waste is generated.

It is better to calculate in advance how much raw material is needed to produce a unit of output and give it to workers in a certain quantity. Strict accounting will also help prevent theft.

In addition to raw materials, it is important to save other resources, such as fuel, electricity, etc. At a minimum, it is necessary to introduce energy-saving equipment into production and train personnel to save electricity.

Method 8. Enterprise consolidation, cooperation

By expanding production and producing a larger range of products, it is possible to reduce the cost of work. It is also very important to establish mechanized production of goods. Thanks to this, production volumes increase and the price of this product decreases.

Method 9. Reducing the production of defective products

Every enterprise has defective products. The reason for this may be either the human factor or the poor functioning of the equipment. Carry out an analysis and find out what exactly causes frequent marriages and try to minimize this factor.

Method 10. Keep up with the times

Periodically research the market, monitor the demand for your products and watch your competitors. In addition, introduce new technologies. This applies not only to equipment, but also to the personnel management system.

This is not a complete list of measures to reduce production costs. But they are the ones who are able to bring maximum results in the shortest possible time.

TOP 7 ways to reduce costs

An entrepreneur who wants to increase the profitability of an enterprise needs to know what methods there are to reduce costs. The main ones:

- Increasing the amount of work performed by an employee per unit of time (labor productivity). To do this, you can encourage workers to perform their duties quickly and efficiently - change the fixed salary to a piece-rate bonus.

- Reduction of management staff. It is necessary to evaluate the performance of each employee, review job responsibilities, and, if possible, combine several positions.

- Transition to work methods based on resource conservation. To reduce costs, you need to monitor the rational use of materials, electricity, and other resources. It is worth updating the technical park by purchasing energy-saving machines/mechanisms, encouraging employees to save electricity, water, etc.

- Retraining, increasing the professional level of personnel. It is necessary to monitor the timely training of employees in new methods of work, sending them to courses, seminars, conferences, etc.

- Automation of operations, application of advanced methods, new tools for work. The benefits of replacing manual labor with machine labor are obvious: productivity increases and production volume increases. By reducing wage costs, production costs are reduced.

- Change of partners. Each business involves different companies: suppliers of raw materials, components, transport organizations, etc. We must strive to ensure that interaction with them is profitable and leads to a reduction in costs. For example, many suppliers have loyalty programs for regular customers. It is worth studying the proposals to choose the ones that best meet the goals of reducing business costs.

- Reducing the number of defects. Defective goods that do not meet quality criteria can appear at any enterprise. We need to find the reasons and reduce their impact to a minimum.

Drawing up a plan to reduce costs

Only clear, controlled actions can reduce the cost of products and take production to a new level. To do this, it is necessary to draw up an action plan aimed at saving the production budget. First, you will need to collect all the data on the costs of the enterprise. It is important to take into account all the little things. After all, very often they are the cause of unjustified costs.

Secondly, it is necessary to divide all costs into the following categories.

- Conditionally permanent;

- Conditional variables.

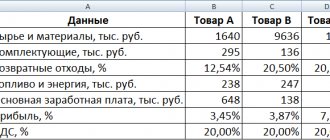

| Cost type | What expenses do they include? |

| Conditionally permanent | Rent, salaries of management personnel, depreciation charges for the maintenance of structures and buildings, payment of interest, taxes, expenses for managing the enterprise as a whole. |

| Conditional variables | Costs of raw materials, components, payment of wages to workers, purchase of new equipment, supply of office supplies to workers, payment of electricity, etc. |

Thirdly, all the data obtained must be analyzed and a cost reduction plan drawn up for each type of expense. You can create it using the following tips:

- Determine the desired percentage reduction in absolutely all costs and expenses per unit of production;

- Make a list of actions and activities that will save the enterprise’s budget. Assign those responsible for completing each item and set deadlines;

- Calculate the effect you plan to get from completing each item. It must be expressed in monetary terms.

Let us give elementary examples of cost reduction. Try to issue office supplies in smaller quantities. This is unlikely to affect the quality of the work performed, but this way you will save your campaign budget.

Or another example, now every office has Internet access. Review the service agreement with the provider company. Discuss with their representative about providing more favorable conditions for you. Every communication provider values the client, so with a high probability we can say that they will meet you halfway.

Fourthly, after implementing a plan to save and reduce costs, it is very important to control it. Without proper control, success cannot be achieved. This may take a lot of time from the manager, but this is the only way you will understand which of the points in your plan really works.

It is important to interest the working staff and force them to switch to saving mode. You can stimulate employees through conversations or various incentives.

How does costing affect profit?

Risks in reporting.

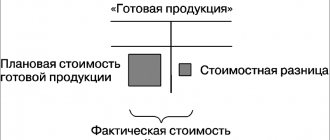

To calculate the cost of production in production, two methods are used: the cost calculation method and the multi-level distribution method. However, the first one is more popular, since it more accurately and quickly determines the cost. Let's look at it in detail.

Cost calculation methods

Depending on the company’s activities and its expenses, calculations are carried out using several methods:

- Direct costing.

This is a production accounting system where only direct costs are taken into account, and indirect costs are written off to the sales account; - Custom method.

Used to calculate the manufacturing cost of each unit of production. It is used in enterprises that produce individual orders; - Transverse method.

Suitable for enterprises that carry out mass production, where the process consists of several stages. In this case, the cost is calculated for each stage of production, for each process separately; - Process method

. Suitable for enterprises with a simple technological process and companies in the mining industry; at the end of the period, all accumulated costs are divided by the number of products produced per week

Errors in cost calculations

Enterprises always suffer painfully from mistakes that appear when forming costs.

- Distorted cost

gives an incorrect picture of the actual cost of production and sales of a particular type of product; - Inflated costs

lead to errors in pricing, and ultimately to loss of sales volumes due to inconsistency of applied prices; - Underestimation of costs

is less common, but can also lead to negative consequences for the enterprise; - The absence of any components in the cost of production

indicates incorrect accounting and the inability to manage and control the process of resource consumption in the production of products.

Be careful, tax inspectors note the unlawful inclusion of various costs in the cost price for tax purposes. This distorts the calculations of income tax, VAT and property tax.

Cost calculation in 1C programs

Let's look at how costs are calculated in different programs.

1c accounting

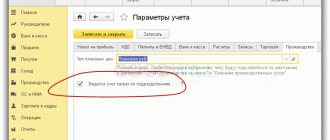

In “1C: Accounting 8”, starting with release 3.0.53 (you can find out how to update the release by calling the numbers on our website). In this release, it became possible to calculate the cost of production, taking into account the specific costs of manufacturing specific types of products or semi-finished products. On account 20.01 “Main production” there is a subaccount for this purpose: Products

.

If the specified products are not released, then the costs will be included in the cost of other product items belonging to the same product group, as if the subconto had not been filled in.

In the tables, production report for the shift

,

Receipt from processing

,

Request-invoice,

Products

column has appeared . This field can be filled in either manually or automatically. It can also be left blank.

In the “1C: Accounting 8 for Kazakhstan” program, the cost calculation form is a full-fledged report that displays cost data in the following sections:

- period of occurrence of costs;

- expense account;

- cost element;

- cost item;

- material.

1C: Managing our company

This program is a simple tool for calculating costs. Using the program, you can identify the following types of costs:

- material costs;

- labor costs;

- deduction for social needs;

- depreciation of fixed assets;

- other costs.

All costs can be divided into direct and indirect.

Direct

– these are raw materials, supplies and wages for production personnel. They are calculated automatically by the program based on the available data.

In addition to materials, we also use personnel for production.

Piecework wages are displayed in the “Piecework Work” document. This document is generated on the basis of the “Production Order” document. When the “Closed” flag is set in the document, the cost of the work will automatically be charged to the cost of production. The final cost is formed by the program during the “Month Closing” process.

Indirect costs

not directly related to manufactured products. Their accounting is formed on a separate account of the management chart of accounts. These apply to production in general.

After closing the month, you need to check the cost of production. We generate a “Cost” report. But the “Gross Profit” report will make it clear whether the cost has been calculated correctly and what the profitability of production is. “1C: Managing Our Company” is suitable for various types of companies - manufacturing, service and contracting, online stores, etc.

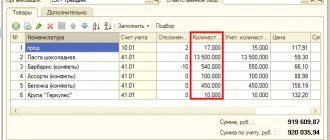

1C: Trade Management

The program calculates the cost of goods sold automatically. This is convenient, because you can keep operational records of profitability and record the result at any reporting date.

Cost calculation in “1C: Trade Management 8 for Kazakhstan” is performed in two ways:

- Calculation of preliminary cost during operational work and calculation of actual cost at the end of the month.

- Calculation of actual cost on a daily basis.

In this case, the company must independently choose the method of cost accounting. It is important to consider the following points:

- Preliminary cost calculations are always made using the average method of estimating the cost of goods. Therefore, the calculated actual cost may differ from the previously calculated one;

- Calculation of actual cost involves the mandatory execution of all operations marking the end of the reporting month, which takes a lot of time and is not recommended in the process of operational work.

Cost calculation based on average

is performed according to the formula: the balance of the goods in the valuation at the beginning of the month + the cost of purchasing the goods and divide this by the amount of the initial balance + the amount of receipt.

Calculating cost using the FIFO method is a little more complicated. There is no classical concept of “party” in UT. First you need to calculate the quantitative balance of goods at the end of the month. To calculate the valuation of this balance, the quantity and value from the latest receipts are sequentially collected, because It is believed that the first batches have already been written off. Only receipts with a known value are taken, and this amount is subtracted from the value of all receipts for the month and the amount of the opening balance.

You can always order a demonstration of the capabilities of a solution for automating the business processes of your enterprise by contacting our specialists by phone. Consultation and demonstration are free.

1C: Integrated automation 2 and 1C: ERP

In these solutions, the calculation of product costs is carried out as accurately as possible based on operational accounting data.

In 1C: Integrated Automation for Kazakhstan, edition 2 and 1C: ERP, two types of cost calculation are offered:

- Advance paynemt.

It is used by trade organizations to determine the estimated cost of purchased material assets during the reporting period; - Actual calculation

. It is done based on the results of the monthly reporting period with a full calculation of the cost of batches of movement of item costs. In this type of cost calculation, you can choose a method for determining the cost of writing off material assets: Average per month – the cost of writing off goods is determined by the average price for the reporting period (weighted average estimate); - FIFO (weighted average estimate) - the cost of write-off according to FIFO is determined for a batch of retired goods;

- FIFO (rolling valuation) - the cost of writing off goods according to FIFO is determined within the framework of full batch accounting.

What does an actual reduction in production costs entail?

An enterprise that has managed to reduce production costs always gains a foothold in the market. Thanks to the reduced price of a product, consumers are more willing to buy it. The effectiveness of cost reduction can also be observed in production itself. At such an enterprise, the staff is more interested, organized and hardworking. New equipment makes workers' work easier, making it safer.

Management thoroughly knows all the “weak” and “strong” sides of their enterprise. Therefore, he is constantly trying to improve production.

Such organizations work like one well-oiled machine, which allows it to flourish and receive maximum profit.