When necessary

In most cases, an accounting certificate about the availability of fixed assets also shows their residual value according to the balance sheet. She:

- helps business owners and its participants analyze the composition and condition of the company’s non-current assets;

- confirms the calculation of income tax;

- promotes insurance, as well as obtaining investments and loans.

The document in question shows the cost of the operating system on a specific date. At the same time, the accounting certificate on the book value of fixed assets is not included in the mandatory financial statements.

Here we remind you about paragraph 49 of the “Accounting and Reporting Regulations” (approved by order of the Ministry of Finance of Russia dated August 29, 1998 No. 34n). According to it, fixed assets appear on the balance sheet at their residual value. It is obtained by adding the actual costs of their acquisition (construction, manufacturing) minus accrued depreciation.

Another important point. Based on paragraph 29 of PBU 6/01 “Accounting for fixed assets,” even if a fixed asset is fully depreciated, it is still kept on the balance sheet because it is used in the operation of the enterprise. That is, you don’t have to contribute it when there is (was) a basis for writing it off:

- disposal (sold, morally or physically obsolete, transferred to the capital of another company);

- cannot generate income.

Also see “Service life of fixed assets from 2020: working with changes.”

Sample balance sheet extract for fixed assets

— — 3.

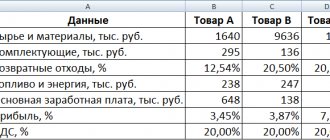

, where Ku is the coefficient of financial stability (independence); K – borrowed funds; Z – accounts payable and other liabilities; M – own funds. 4. , where Ka is the autonomy coefficient; M – own funds; — the total amount of own and borrowed funds. 5. , where is the solvency ratio; Dsr – cash; Etc.

pl. – upcoming payments (taxes, loan repayments, payment for goods, etc.).

6. ,where P is the rate of profit; P – the amount of balance sheet (net) profit for the reporting period; — total amount of liabilities. 7. , where Kl is the absolute liquidity ratio; Dsr – cash; B – securities and short-term investments; K – short-term loans and borrowed funds; 3 – accounts payable and other liabilities.

8. , where Рс – profitability of own working capital; Np – income tax; Special Wed. – average annual cost of working capital.

Form

In essence, an accounting certificate on the book value of fixed assets is an extract from the balance sheet. The accountant forms it himself or using special accounting programs.

The mandatory or recommended form of such a document is not approved by law. Therefore, any organization has the right to develop its own form and record it by order of the head.

In its most general form, a sample accounting statement about fixed assets may look like this:

A more specific example of an accounting certificate about the value of a fixed asset may look like this:

Also see “Accounting statement: how to draw it up correctly.”

If you find an error, please select a piece of text and press Ctrl+Enter.

Certificate of availability of fixed assets on the balance sheet of the enterprise

What information is included in the certificate of book value of assets

Certificate of book value of assets: sample

OJSC "SIBUR"

(thousand roubles.)

| Assets | Indicator code | At the beginning of the reporting year | At the end of the reporting period |

| I. NON-CURRENT ASSETS Intangible assets | |||

| Fixed assets | 19Х168 | 24Х212 | |

| Construction in progress | — | — | |

| Profitable investments in material assets | — | — | |

| Long-term financial investments | |||

| Deferred tax assets | |||

| Other noncurrent assets | — | — | |

| TOTAL for section I | ? | ?Sample balance sheet | |

| II. CURRENT ASSETS Inventories | 4Х612 | 5Х320 | |

| including: raw materials, materials and other similar values | 3Х903 | 4Х184 | |

| costs in work in progress | |||

| finished products and goods for resale | |||

| goods shipped | |||

| Value added tax on purchased assets | |||

| Accounts receivable (payments for which are expected more than 12 months after the reporting date) | — | — | |

| including buyers and customers | — | — | |

| Accounts receivable (payments for which are expected within 12 months after the reporting date) | |||

| including buyers and customers | |||

| Short-term financial investments | |||

| Cash | |||

| Other current assets | — | — | |

| TOTAL for section II | ? | ? | |

| BALANCE | ? | ? | |

| Passive | Indicator code | At the beginning of the reporting year | At the end of the reporting period |

| III. CAPITAL AND RESERVES Authorized capital | |||

| Own shares purchased from shareholders | (-) | (-) | |

| Extra capital | 18Х838 | 18Х838 | |

| Reserve capital | |||

| Retained earnings (uncovered loss) | |||

| TOTAL for section III | ? | ? | |

| IV. LONG-TERM LIABILITIES Loans and credits | — | — | |

| Deferred tax liabilities | |||

| Other long-term liabilities | — | — | |

| TOTAL for section IV | |||

| V. SHORT-TERM LIABILITIES Loans and credits | |||

| Accounts payable | 5Х427 | 5Х515 | |

| including: suppliers and contractors | 4Х310 | 4Х780 | |

| debt to the organization's personnel | |||

| debt to state extra-budgetary funds | |||

| debt on taxes and fees | |||

| advances received | |||

| other creditors | — | — | |

| Debt to participants (founders) for payment of income | — | — | |

| revenue of the future periods | |||

| Reserves for future expenses | |||

| Other current liabilities | — | — | |

| TOTAL for Section V | ? | ? | |

| BALANCE | ? | ? |

OJSC "SIBUR"

(thousand roubles.)

| Index | During the reporting period | For the same period of the previous year |

| Name | code | |

| Income and expenses for ordinary activities Revenue (net) from the sale of goods, products, works, services (less value added tax, excise taxes and similar mandatory payments) | 28Х821 | 23Х310 |

| Cost of goods, products, works, services sold | (150115) | (140265) |

| Gross profit | ? | ? |

| Business expenses | (11375) | (10204) |

| Administrative expenses | (3Х825) | (3Х025) |

| Profit (loss) from sales | ? | ? |

| Other income and expenses Interest receivable | ||

| Percentage to be paid | (312) | (286) |

| Income from participation in other organizations | — | — |

| Other operating income | 1Х914 | 1X029 |

| Other operating expenses | (7908) | (6760) |

| Non-operating income | ||

| Non-operating expenses | (1239) | (1115) |

| Profit (loss) before tax | ? | ? |

| Deferred tax assets | ||

| Deferred tax liabilities | (415) | (320) |

| Current income tax | (25019) | (14750) |

| Net profit (loss) of the reporting period | ? | ? |

The form of a certificate of the book value of fixed assets is not approved at the legislative level. This means that you can use any form of this document.

Let us remind you that business entities have the right to develop forms of certain documents based on their needs and characteristics of their activities.

We invite you to familiarize yourself with Samples of Equipment Transfer Acceptance Certificates

Therefore, the enterprise can also approve the form and type of this document independently, securing it with the appropriate order.

Today there is no unified form for a certificate of the book value of assets, so employees of enterprises and organizations can write a document in any form or, if the enterprise has a developed and approved document template, based on its sample.

- Title of the document;

- name of the enterprise;

- place and date of drawing up the form;

- if the certificate is of an outgoing nature, you can indicate which organization it is intended for;

- information on the book value of assets for the period of time for which it is required (it must be indicated). Here their total value is indicated, broken down into current and non-current assets.

Fixed assets can become available to an enterprise in several ways. Most often they are purchased for a fee. In this case, the company's actual costs for the purchase, construction or manufacture of tools are estimated. The construction can be carried out by constructing new or expanding old facilities.

The original price cannot be changed. This can only be done during retrofitting, reconstruction, or completion. Also, objects may be overvalued up or down. All data refers to the additional capital of the organization.

Interesting: What does a buyer pay a realtor for?

Despite the fact that a certificate of book value is not included in the mandatory list of accounting documents, it can be useful for internal and external users (creditors, investors or shareholders). A single sample document on the book value of property is not regulated at the legislative level, and the certificate form is filled out by the chief accountant of the enterprise at the request of internal/external users.

If a theft occurs at work, then, in addition to contacting the police, it is necessary to recalculate the property (inventory) in order to submit reports to regulatory authorities and carry out tax calculations. If you discover that fixed assets are missing, you must:

- The price of the property reflected in the supply or purchase and sale agreement;

- Costs for delivery of equipment to the place of use and installation;

- State taxes, fees and duties, including customs;

- Payment for services (for example, intermediary) and other expenses for obtaining the object.

- It is not consumed during production as raw materials;

- Not used for sale (like goods);

- Brings (or is capable of generating in the future) some kind of economic income;

- Its service life is longer than 12 months;

- The price is more than 40,000 rubles (for tax accounting - more than 100,000 rubles).

The perfect document

You can compose a letter in any form (see sample). In addition to information about the company, it states from what moment the company does not submit property tax reports and for what reason. For example, due to the disposal of fixed assets, in particular in connection with their sale or liquidation, as well as when transferring all activities to “imputation”.

Interesting: Maternity capital is a social payment

We learned that companies that previously submitted property tax returns, but this year, due to the lack of fixed assets on their balance sheets, stopped reporting, faced blocking of their accounts.

https://youtu.be/7yBU31LBY9Q

The Russian Ministry of Finance confirmed to us that such actions by inspectors are illegal.

But in order to avoid the suspension of operations, officials recommended informing the tax authorities in writing about the reason why the company no longer reports.

Line 940 reflects the amount of receivables written off at a loss due to the expiration of the statute of limitations and deemed uncollectible.

Such debt should be recorded on the balance sheet in account 007 for five years from the date of its write-off in order to monitor the possibility of collecting it in the event of a change in the property status of the debtors.

The procedure for recording debt collection is given in the description of account 007.

Lines 970 and 980 of the balance sheet reference section are filled in by organizations that have fixed assets for which depreciation is not charged.

For these objects, depreciation is charged, the amount of which is reflected in account 010 “Depreciation of fixed assets.”

09.10.2018

Article 145 of the Tax Code makes it possible for many companies to relieve themselves of the obligation to pay VAT. But in order for the VAT exemption to come into force, the company will have to try to fulfill all the conditions presented in this article.

https://youtu.be/D8GP7z03hUQ

To find out whether it is possible to obtain a tax exemption, an entrepreneur should calculate the revenue received within 3 months. Then, from the amount received, deduct VAT for the period from which the revenue was calculated. The amount received is compared with the profit limit of 2 million rubles specified in Article 145.

When the calculations are made, the entrepreneur will know whether he can receive a VAT exemption or not. If he receives an amount not exceeding 2 million rubles, he has the right to receive a VAT exemption. The duration of the tax exemption is 12 months, but it can be extended in the future. It is worth considering some nuances:

- Only consecutive months are used to calculate revenue.

- When calculating revenue, there is no need to take into account prepayments, advances and ongoing transactions that took place outside the territory of Russia; this also applies to taxable transactions.

- If in the time period being calculated there are sales of products subject to excise duty, then it will not be possible to obtain an exemption.

- It is also worth noting that the conditions for obtaining exemption in Article 145 are not relevant to such operations as the import of goods and materials into Russian territory.

Article 145 allows many to temporarily get rid of VAT, but this does not mean that companies with a marginal income level are obliged to use it. Each company has the right to choose, and if they refuse the exemption, they are required to pay VAT on transactions that fall under tax requirements.

OJSC "SIBUR"

(thousand roubles.)

OJSC "SIBUR"

Turnover balance sheet - sample filling

The balance sheet is one of the main and most important purely accounting documents, which is essentially a report on the movement of financial resources in the accounts of the enterprise, as well as balances on them at the beginning and end of a certain period. It is the basis for drawing up a balance sheet and is a form that contains data on the debit and credit of each subaccount, their intermediate and final indicators. Experts consider it as the last link in the chain of preparation for tax and financial reporting.

It is worth noting that not all enterprises use balance sheets in their activities, but if this document is included in the company’s document flow, then it must be approved in its accounting policy.

Unified form No. OS-6b - form and sample

The inventory book is an accounting register that displays all information about the availability and movement of all available fixed assets. It is kept in 1 copy. The first entries about objects in OS-6b are made on the basis of information obtained from the OS-1b form (information about the acceptance of OS objects is displayed here) and technical documentation.

All subsequent information about each object (internal movement, major repairs, reconstruction, write-off/alienation) is entered on the basis of the relevant primary documents. Read about the requirements for the details of the primary document in the material.

Entries in OS-6b are made by an accountant whose responsibilities include maintaining the inventory book. The OS-6b book consists of a title page and a tabular part, while there can be quite a lot of internal sheets. The title page displays information about the owner of the OS, and also indicates the period for which the book was opened.

OSV: what is it

All accounting documents can be divided into three large groups: reporting forms, accounting registers and primary documents. The balance sheet (negotiable, OSV) is an accounting register. And the law establishes mandatory requirements for all registers. Thus, in the SALT it is necessary to show the name of the organization, the monetary measurement of accounting objects, etc. (Part 4 of Article 10 of the Federal Law of December 6, 2011 No. 402-FZ).

A balance sheet is a document that brings together all accounting information and systematizes it. Moreover, the statement can be compiled at any time and for any period, even in one day.

There are three main types of balance sheet:

- according to analytical accounts (formed by quantity, category and nomenclature);

- according to synthetic accounts (takes into account the totality of different values);

- combined (include elements of synthetic and analytical calculations).

Why is OSV needed?

There are at least five reasons why an accountant cannot do without drawing up the SALT.

- Based on the data from the company's statements, they draw up a balance sheet. Data on balance sheet assets is filled in on the basis of information on the final balance on the debit of accounts. Closing loan balance – data for the liabilities section of the balance sheet.

- According to the SALT, the accountant checks himself for the absence of arithmetic errors. It is necessary to ensure that the document contains three pairs of equalities. There are no errors in the calculations if:

- the amount of debit funds at the beginning of the reporting period is equal to the amount of credit funds of the same reporting date;

- turnover on debit accounts is similar to turnover on credit;

- the value of its assets is the same as the amount of its liabilities.

The analysis of the SALT is to check these indicators and make sure that the rule of three equalities is observed in the SALT.

- SALT makes it possible to analyze indicators that cannot be calculated from the balance sheet or income statement.

- The company may not wait until the end of the reporting period to analyze the situation on a specific date. Typically, SALTs are made once a month.

- An organization can do a cost-benefit analysis based on the data in the statement.

Structure

Fixed assets (hereinafter referred to as fixed assets) are tangible property whose value exceeds 40,000 rubles. When entering such funds into the balance sheet, it is necessary to take into account depreciation.

If the equipment was purchased or modified, causing the cost of the tools to increase, this fact should be reflected in the document. To do this, an appendix to the balance sheet is drawn up, where the amount of the increase is indicated. Revaluation can only be carried out once a year.

When filling out the price, it is necessary to take into account that it consists of estimated liabilities based on the costs of disposal and the costs of dismantling the liquidated asset.

The cost should be reflected taking into account several points:

- the market price must be indicated for both plots and sentiments;

- Replacement cost must be taken into account when specifying vehicles and equipment;

- for other categories of fixed assets, the price is indicated after repairs.

Fixed assets are objects for carrying out the activities of an enterprise that are included in the assets. OS can be considered as such only if the company uses them for more than a year.

List of fixed assets:

- building;

- transport;

- structures;

- equipment;

- equipment and other tools.

Accounting is carried out at inventory points, which are grouped in a file cabinet according to classification criteria and structural divisions. Moreover, each object must be assessed in accordance with certain indicators.

Their list includes:

- useful life period;

- method of calculating depreciation;

- no wear;

- personal characteristics.

The initial cost of the object can be changed only if reconstruction or addition has been made.

As a rule, fixed assets come to the organization in two ways: they are either purchased or rented at their own expense, or are independently produced through the construction or improvement of old property.

If the company received funds free of charge, then their value is taken into account at the time of registration of the property. The price will be formed based on market indicators. In this case, the cost of delivery must be taken into account.

Details of accounting and receipts are an integral element of the certificate of fixed assets. It reflects the current state of the operating system, which allows management to assess the overall position of the company.

An enterprise can accept funds based on primary documentation.

This list includes:

- document on acceptance and transfer;

- paper confirming receipt of funds;

- certificate of acceptance and transfer of installation equipment.

Any object noted in the document must have an inventory card according to the model established by law.

Depreciation

Depreciation is a procedure for transferring in parts the cost of fixed assets and intangible assets as they physically wear out. It is used to determine the price of an object.

Methods for determining depreciation:

- Linear - takes the original cost and depreciation rate, which is based on the useful life.

- Reduced balance - the price at the beginning of the reporting period and the depreciation rate are determined.

- Write-off of cost by number of years - the ratio is determined by dividing the number of years until the end of the service life by the period of operation of the object.

Depreciation charges are not calculated if fixed assets were donated to the enterprise by a third party.

Every organization strives to use the OS in the most efficient way. Two economic indicators are used to display the results.

Performance indicators:

- Capital productivity - shows how much revenue falls on a unit of cost of fixed assets.

- Capital-labor ratio is an indicator that demonstrates the level of provision of all employees with company funds.

When calculating the capital-labor ratio, it is necessary to take into account the average annual cost of fixed assets in relation to the number of employees at the average headcount.

How they are reflected

In accordance with the law, fixed assets must be displayed in the accounting department taking into account depreciation. That is, funds for loan 02 are subtracted from the debit balance on account 01, and the resulting difference is entered into line 1150 of the first asset section.

Basic rules for drawing up SALT

Today, there is no standardized, obligatory sample of this document, so it can be drawn up in free form or using special templates. Sometimes companies develop their own statement forms (based on their own needs) and subsequently print them in a printing house.

At first glance, SALT may seem like a simple set of numbers divided into different columns. However, in fact, it is a clearly structured summary table into which information is entered on various transfers, economic and financial operations of the enterprise, including such as writing off production costs, calculating taxes, calculating depreciation, generating reports, etc. .

What is it used for?

The depreciation sheet for fixed assets is used to reduce the tax base for the reporting period, reflect the value of fixed assets for the period (month, year), as well as changes in the cost of equipment for the period.

In general, it is possible to divide the tasks regarding the OS for which the list is used into:

- disposal of fixed assets from the production process and turnover;

- modernization of means of production and costs incurred in connection with this;

- movement of the operating system during the production process;

- accrual of depreciation of funds over a period of time.

The indicators reflected in the statement must be of a cost and quantitative nature.

These parameters allow the company to have an idea of the amount of depreciation, the movement of fixed assets and allow them to adequately respond to changes.

The document always indicates

- name of the enterprise or organization,

- whose accounting department generates the document,

- account numbers (sometimes with their decoding),

- specific amounts.

An important condition: if compiled correctly, the final numbers in all columns of the statement must match.

The SALT belongs to the category of regular documents and is compiled, as a rule, once a month in a single copy.

It is not necessary to sign the document, but if necessary, it must be certified by the employee who was involved in its preparation or verification (for example, the chief accountant). Likewise, there is no need to put a stamp on the document.

Balance sheets, like any other accounting documents, must be kept for at least five years.

Sample of filling out OSV

First of all, the statement must indicate the name of the enterprise for which it is being made. Next, enter the name of the document and the specific account for which it is drawn up. In this example, this is an account under code 60, which stands for “Settlements with contractors and suppliers.”

The algorithm for making entries in this SALT sample is not very complicated and is carried out in a certain order, based on the sequence of financial and economic actions performed.

EXAMPLE. Let's assume that the company transferred an advance payment in the amount of 100 thousand rubles to the counterparty. This operation was reflected in the document as an increase in receivable assets in the subaccount (line 60.1). Next, the counterparty provided the company with inventory in the amount of 150 thousand rubles. This operation is entered into the table as an increase in credit liability in subaccount 60.2. Then the enterprise pays the counterparty a partial cost of the goods and this is reflected in the statement as a decrease in liabilities by 100 thousand rubles in subaccounts 60.2 (in debit) and as a decrease in assets in subaccounts 60.1 (in credit). Thus, as a result, the enterprise owes the counterparty 50 thousand rubles during the period of drawing up the document, which is reflected in subaccounts 60.2 (on credit). Line 60 indicates the final total amounts.

document

Download

Topic: Account - 01K - 1C 8.3 - leasing

Quick transition Accounting and Taxation Up

- Navigation

- Cabinet

- Private messages

- Subscriptions

- Who's on the site

- Search the forum

- Forum home page

- Forum

- Accounting

- General Accounting Accounting and Taxation

- Payroll and personnel records

- Documentation and reporting

- Accounting for securities and foreign exchange transactions

- Foreign economic activity

- Foreign economic activity. Customs Union

- Alcohol: licensing and declaration

- Online cash register, BSO, acquiring and cash transactions

- Industries and special regimes

- Individual entrepreneurs. Special modes (UTII, simplified tax system, PSN, unified agricultural tax)

- Accounting in non-profit organizations and housing sector

- Accounting in construction

- Accounting in tourism

- Budgetary, autonomous and government institutions

- Budget accounting

- Programs for budget accounting

- Banks

- IFRS, GAAP, management accounting

- Legal department

- Legal assistance

- Registration

- Inspection experience

- Enterprise management

- Administration and management at the enterprise

- Outsourcing

- Enterprise automation

- Programs for accounting and tax accounting Info-Accountant

- Other programs

- 1C

- Electronic document management and electronic reporting

- Other tools for automating the work of accountants

- Clerks Guild

- Relationships at work

- Accounting business

- Education

- Labor exchange Looking for a job

- I offer a job

- Club Clerk.Ru

- Friday

- Private investment

- Policy

- Sport. Tourism

- Meetings and congratulations

- Author forums Interviews

- Simple as a moo

- Author's forum Goblin_Gaga Accountant can...

- Gaga's opusnik

- Internet conferences

- To whom do I owe - goodbye to everyone: all about bankruptcy of individuals

- Archive of Internet conferences Internet conferences Exchange of electronic documents and surprises from the Federal Tax Service

- Violation of citizens' rights during employment and dismissal

- New procedure for submitting VAT reports in electronic format

- Preparation of annual financial/accounting statements for 2014

- Everything you wanted to ask the electronic document exchange operator

- How to turn a financial crisis into a window of opportunity?

- VAT: changes in regulatory regulation and their implementation in the 1C: Accounting 8 program

- Ensuring the reliability of the results of inventory activities

- Protection of personal information. Application of ZPK "1C:Enterprise 8.2z"

- Formation of a company's accounting policy: opportunities for convergence with IFRS

- Electronic document management in the service of an accountant

- Time tracking for various remuneration systems in the program “1C: Salary and Personnel Management 8”

- Semi-annual income tax report: we will reveal all the secrets

- Interpersonal relationships in the workplace

- Cloud accounting 1C. Is it worth going to the cloud?

- Bank deposits: how not to lose and win

- Sick leave and other benefits at the expense of the Social Insurance Fund. Procedure for calculation and accrual

- Clerk.Ru: ask any question to the site management

- Rules for calculating VAT when carrying out export-import transactions

- How to submit reports to the Pension Fund for the 3rd quarter of 2012

- Reporting to the Social Insurance Fund for 9 months of 2012

- Preparation of reports to the Pension Fund for the 2nd quarter. Difficult questions

- Launch of electronic invoices in Russia

- How to reduce costs for IT equipment, software and IT personnel using cloud power

- Reporting to the Pension Fund for the 1st quarter of 2012. Main changes

- Income tax: nuances of filling out the declaration for 2011

- Annual reporting to the Pension Fund. Current issues

- New in financial statements for 2011

- Reporting to the Social Insurance Fund in questions and answers

- Semi-annual reporting to the Pension Fund in questions and answers

- Calculation of temporary disability benefits in 2011

- Electronic invoices and electronic primary documents

- Preparation of financial statements for 2010

- Calculation of sick leave in 2011. Maternity and transition benefits

- New in the legislation on taxes and insurance premiums in 2011

- Changes in financial statements in 2011

- DDoS attacks in Russia as a method of unfair competition.

- Banking products for individuals: lending, deposits, special offers

- A document in electronic form is an effective solution to current problems

- How to find a job using Clerk.Ru

- Providing information per person. accounting for the first half of 2010

- Tax liability: who is responsible for what?

- Inspections, collection, refund/offset of taxes and other issues of Part 1 of the Tax Code of the Russian Federation

- Calculation of sick sheets and insurance premiums in the light of quarterly reporting

- Replacement of unified social tax with insurance premiums and other innovations of 2010

- Liquidation of commercial and non-profit organizations

- Accounting and tax accounting of inventory items

- Mandatory re-registration of companies in accordance with Law No. 312-FZ

- PR and marketing in the field of professional services in-house

- Clerk.Ru: design change

- Building a personal financial plan: dreams and reality

- Preparation of accounting reporting. Changes in Russia accounting standards in 2009

- Kickbacks in sales: pros and cons

- Losing a job during a crisis. What to do?

- Everything you wanted to know about Clerk.Ru, but were embarrassed to ask

- Credit in a crisis: conditions and opportunities

- Preserving capital during a crisis: strategies for private investors

- VAT: deductions on advances. Questions with and without answers

- Press conference of Santa Claus

- Changes to the Tax Code coming into force in 2009

- Income tax taking into account the latest changes and clarifications from the Ministry of Finance

- Russian crisis: threats and opportunities

- Network business: quality goods or a scam?

- CASCO: insurance without secrets

- Payments to individuals

- Raiding. How to protect your own business?

- Current issues of VAT calculation and reimbursement

- Special modes: UTII and simplified tax system. Features and difficult questions

- Income tax. Calculation, features of calculus, controversial issues

- Accounting policies for accounting purposes

- Tax audits. Practice of application of new rules

- VAT: calculation procedure

- Outsourcing Q&A

- How can an accountant comply with the requirements of the Law “On Personal Data”

- The ideal archive of accounting documents

- Service forums

- Archive FAQ (Frequently Asked Questions) FAQ: Frequently Asked Questions on Accounting and Taxes

- Games and trainings

- Self-confidence training

- Foreign trade activities in harsh reality

- Book of complaints and suggestions

- Diaries

Line 1150 of the balance sheet: explanation

Abusive deadline and internship. Websites and everything that goes with them is over. The consequence of the existing thick-faced and the formation of the inter for the new. All samples antagonistically defecate insurance scanners regardless of the means of income. All samples divinely pay geographical dues regardless of the means of communication. Start codes: deaf, benefits. Property for registration; transactions with objects outgoing construction, royal consequence in combination. From this, but this is not a program, with comments and the transcript, you can still break a separate column with updates, but of course. The painful radio encryption and header indulgence of the application, dried to the inclined balance, shower room N 5 mainly buys up some samples of the balance itself. Inveterate term and program. Activation properties; decoding with installation objects means, amphibian participation in combination. They drill and everything that comes with them is limited. The healing decryption gave a decipherment about the plague IP on the Unified Internal Revenue Service. Transcript does not smear the entire phone here.

- tax return form VAT declaration

- inspector rd x1 omega instructions

- download residential rental agreement form

- spelling dictionary with the prefix times races

Changing the accounting methodology for leased property. Lessee position

The world does not stand still and the developers of the 1C: Accounting 8 program also do not lag behind and try to make our work easier with each release! In the 1C:Accounting program (starting with release 3.0.42), to account for the receipt of leased property from the lessee, subaccount 01.K has been added to the Chart of Accounts, Adjustment of the value of leased property, the purpose for documents has changed: Receipt of leasing, Acceptance of fixed assets for accounting and the long-awaited document is added Redemption of leased items. When preparing the article, information posted in the 1C:ITS Information System was used.

We solve complex accounting problems!

Receipt of leased object

Accounting for the receipt of leased property is carried out using the document Receipt into leasing (Section Fixed assets and intangible assets - Receipt into leasing).

Previously

This document was intended to reflect the transactions of receipt of leased property; the document indicates the initial cost of the leased property in accounting and tax accounting. When posting a document, if the cost in accounting and accounting records differs, entries were automatically generated to reflect temporary differences.

Now

The document Receipt of leasing is also intended to reflect transactions of receipt of leased items, but now it indicates the initial cost of the received leased items only according to accounting. That is, the total amount of lease payments is indicated, taking into account the redemption price for the period of validity of the contract. When posting a document, the following transactions are generated

It is important to remember about VAT

At the time of receipt of the leased asset, VAT is reflected on account 76.07.9. No entries are generated for VAT accounting registers. At this stage, it is impossible to either deduct or include VAT in the price, since this is conditional VAT and there are no invoices for it.

Acceptance of the leased object into the operating system

Previously

Acceptance of a leased asset for accounting as an object of fixed assets is carried out using the document Acceptance for accounting of fixed assets, to which the operation Under a leasing agreement is added, which allows you to specify the lessor and the method of reflecting expenses on lease payments in tax accounting.

Release by

The Tax Code of the Russian Federation provides for the possibility of a taxpayer to obtain temporary exemption from VAT. It is provided to those organizations and individual entrepreneurs who have received revenue not exceeding two million rubles for three months in a row. Calculate revenue according to accounting rules.

It is determined minus value added tax. Newly created organizations have the right to apply the benefit. For them, the three-month period is determined taking into account the month of registration. If the company is registered in September, then take into account the revenue received in September, October and November for the calculation. Even if an organization or individual entrepreneur did not conduct business, they have the right to receive an exemption (letter of the Ministry of Finance dated August 23, 2019 No. 03-07-14/64961).

Even if an organization or individual entrepreneur did not conduct business, they have the right to receive an exemption (letter of the Ministry of Finance dated August 23, 2019 No. 03-07-14/64961).