Form KM-3. Certificate of return of money to buyers

The act in form KM-3 is used to document the fact of the return of funds to the buyer.

In practice, KM-3 is associated with an incorrectly entered amount, return of goods or unsold invoices. The completed document must be accompanied by a receipt (cash or sales receipt), as well as other materials, including statements and explanatory notes from the employee. All erroneously issued checks must be marked “Canceled” and signed by either the head of the enterprise or the senior cashier. Refund checks and settlement checks are not generated for such cases.

A prerequisite for filling out KM-3 is return on the day of surgery. If the Z-report for the shift has already been withdrawn, then instead of the indicated act, an expense and cash order is filled out.

How to fill out the form

To fill out the KM-3 form, the participation of a commission of employees is necessary, and not just the cashier-operator himself, who cannot make such a decision arbitrarily. As a rule, a representative of the store administration and/or a senior cashier is present (as well as an administrator, shift manager, etc. - depending on the internal rules of the company).

The procedure is as follows:

- The possibility of a refund for a product or unused service is assessed (for example, medicines, home textiles cannot be returned).

- If a positive decision is made, the buyer draws up an application, the cashier – an explanatory note (if necessary).

- A full settlement is made with the buyer, for which he is given a refund check.

- On the same day, the KM-3 form is printed and filled out. All responsible persons sign.

- The document is sent for storage to the accounting department.

NOTE. The act must be certified by the signature of the director (or the person acting as him). After this, a stamp is affixed and the act is stored in the accounting department for at least 5 years.

The act does not have to be sent to the tax office for verification. However, it is shown at the first request of the inspector (or sent to the tax office if it requests confirmation).

Share link:

Filling out the fields of the KM-3 form

In the header of the form, fill in the company details. If it is not a structural unit and does not have them, we leave this field empty. However, in cases where several stores are united into a network, it is advisable to indicate the name and address of a specific outlet.

Be sure to indicate the name of the cash register.

The application program and type of operation need not be specified. The cashier responsible for the return can be indicated by full name or personnel number.

The clarification “including on erroneously punched checks” should be understood as follows: the basis for filling out KM-3 is an error made by the cashier when the amount is greater than the actual cost of the goods and the company returns the “difference” that arose as a result of this.

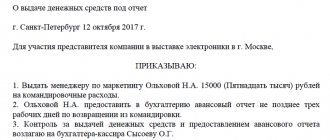

Using an example: let’s say that the cashier Svetlova, when making a purchase of a book, did not take into account the promotion for which the new price is 159 rubles. As a result, a check for 1,749 rubles was punched. The buyer discovered the error and pointed it out, as a result of which 1,590 rubles were returned to him. According to the regulations, the buyer submitted an application for a refund. Senior cashier Efremov O.A. requested an explanatory note from the cashier, which was also attached to KM-3 dated August 26. 2020.

If several checks have been knocked out incorrectly, the form provides details for each of them. However, the report on the return of funds in KM-4 will only show the final figure.

Step-by-step algorithm for processing a refund at the online checkout

A situation in which a “return of receipt” check is processed:

- The customer returned the goods. It doesn’t matter whether it’s on the day of purchase or another.

- The receipt was entered incorrectly by the seller and the error was discovered by the client. For example, the receipt contains extra items or the amount indicated is greater than required (the product costs 90 rubles, but the receipt indicates 100 rubles).

Subscribe to our channel in Yandex Zen - Online Cashier! Be the first to receive the hottest news and life hacks!

If the buyer wants to return the item

Then follow 4 consecutive steps:

1. Accept an application from the client. Without the client's application, a return cannot be issued. It is written in any form, but must contain the following information:

- Full name of the buyer;

- his passport details;

- reason for return (defective or wrong size);

- total cost of the goods;

- date of;

- client's signature.

Provide the client with a pre-prepared form. This will eliminate errors when filling it out. The buyer will only need to enter his information and the name of the product. Check that the client has correctly indicated his passport details and check details. If he did not save the check, he must write that the check was lost.

Example of a statement from a buyer

Without an application from the buyer, the tax office will not accept returns of goods via the online checkout. Because in this case, there is a possibility that the client did not return the goods, and the entrepreneur is trying to hide the money from taxes.

Online cash registers for all types of businesses! Delivery throughout Russia. Leave a request and receive a consultation within 5 minutes.

2. Make an invoice. There is no standard sample invoice, so the company can create its own. The invoice is needed in two copies: one remains with the company, the second with the client. Each must have the buyer's signature.

Example of an invoice

3. Pass the refund receipt at the online checkout. It must contain all the details of a regular check. For example, the name of the product or the address of the store. The only difference is that on the refund check the calculation attribute “return of receipt” is written, and not “receipt” or “expense”.

Here is an example of the difference between a regular check and a return receipt.

Read the entire list of required details in the article: “Sample of an online cash register receipt - what it looks like, requirements and details.”

4. Give the buyer money for the goods.

Returns via the online checkout “day to day” are processed in the same way as on other days.

If the cashier made a mistake and immediately noticed it

If the cashier noticed the error while the buyer was still there, then you also need to run a “return receipt” check at the online cash register. After this, the cashier regenerates the correct receipt and gives it to the buyer. An application from the client is not required.

- Mercury 115F

94 reviews6,200₽ 6,200₽ 6,200 https://online-kassa.ru/kupit/merkurij-115f/ Order BuyIn stock

- PTK MSPos-K

99 reviews11,900₽ 11,900₽ 11900 https://online-kassa.ru/kupit/ptk-mspos-k/ Order BuyIn stock

- Evotor 7.2

153 reviews13,700₽ 13,700₽ 13,700 https://online-kassa.ru/kupit/evotor-7-2/ Order BuyIn stock

But you will have to explain to the tax office why you requested a refund. So the cashier writes a memo. In it, he indicates which check he knocked out incorrectly and indicates that he immediately issued 2 more checks: “return of receipt” and a new receipt. Two checks must be attached to the note - an incorrectly executed one and one for the return of the receipt.

If there is extra money at the checkout at the end of the shift, punch out the correction check

Excess funds appear in three cases:

- the seller did not punch the check;

- punched a check for an amount less than what the buyer paid;

- I issued a refund via the online checkout instead of a correction check.

If at the end of the shift there is more money in the cash register than there should be, then the “receipt return” does not break through. The cashier draws up a correction check and writes a statement or explanatory note about the discovery of excess money.

The difference between a correction check and a refund check

When to draw up the KM-3 act

Since this document is completed only in certain cases, the form does not need to be submitted daily. However, if several returns occurred during the day, then only one KM-3 is issued. This happens at the end of the shift after the Z-report is taken. Data from KM-3 is used for forms KM-4 and KM-7.

The limitation period for a document is 2 calendar months . After this time, the inspection cannot make a claim against the incorrectly executed act. KM-3 is stored in the accounting archive .

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Act on the return of funds to buyers (clients) for unused cash registers (Unified Form N KM-3)” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

We fill out the act form KM-3

Act KM-3 was drawn up in 1 copy by a commission consisting of the head of the department, senior cashier and cashier and approved by the head. It was necessary to fill out information for all canceled checks, as well as for checks returned by customers in cases where they returned goods. Cash proceeds for that day were reduced by the amount returned to customers, and an entry was made about this in the journal of the cashier-operator KM-4.

It was not necessary to draw up a KM-3 act in all cases of returning goods. If the buyer paid with a bank card, it was impossible to give him money from the cash register when returning the goods, since this direction of spending cash proceeds was not provided for by regulatory documents (clause 2 of Bank of Russia Directive No. 3073-U dated October 7, 2013 on spending cash from the cash register) . An act was not drawn up in the KM-3 form even if the goods were returned not on the day of purchase. In this case, at the request of the buyer, the return of the goods, paid for in cash, was carried out on the basis of his application from the main cash register using a cash receipt order.

When to draw up an act

The cashier reflects the total amount of the act for all checks canceled during the day in column 15 of the cashier-operator’s journal in form No. KM-4 approved. Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132.

Filling out KM-3 when using an online cash register

Since July 2020, most sellers are required to use online cash registers.

For information about the “simplified” option not to use online cash registers when providing services to the population (except for public catering services) until July 1, 2019, read the publication “A deferment for online cash registers has been introduced.”

Read about the use of online cash registers by UTII payers in the article “Use of online cash registers for UTII (nuances).”

When using an online cash register, it is not necessary to use KM-3 when returning money to the buyer. Fiscal data that comes to the tax office from online cash desks completely replaces information from forms KM-1, KM-2, KM-3, KM-4, KM-5, KM-6, KM-7, KM-8, KM-9 (see letter of the Ministry of Finance dated September 16, 2016 No. 03-01-15/54413 (notified to the tax inspectorates by letter of the Federal Tax Service dated September 26, 2016 No. ED-4-20/18059).

When the buyer returns the goods, the seller using the online cash register, based on the buyer’s application, must issue a check with the “return of receipt” sign (see letter of the Ministry of Finance of the Russian Federation dated July 4, 2017 No. 03-01-15/42312, 03-01-15/42315 ). In addition to the check with the sign “return of receipt”, it is also necessary to issue a cash receipt order for the amount of the refund (Article 1.1, Clause 1, Article 1.2, Clause 1, Article 4.7 of the Law of May 22, 2003 No. 54-FZ, Clause 6.2 of the Bank’s instructions Russia dated March 11, 2014 No. 3210-U).

What actions are carried out with the online cash register in 2020 when paying by card?

According to Law 54-FZ, the sale of goods paid for by credit card must be reflected in the online cash register. The buyer must indicate in the application in what form the money will be returned to him, and the details of the card or account of the individual. If the conditions do not require examination of the goods, the seller is obliged to carry out the transfer within 10 days.

In all situations, the seller can draw up the KM-3 act for issuing money to customers when working at online cash registers. But the document is optional. Organizations have the right to develop their own form to justify accounting transactions. It must contain the mandatory details of the primary documentation listed in Part 2 of Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ.

To comply with the legality of cash transactions, sellers (individual entrepreneurs, LLCs) will need to organize:

- Formation of entries in the cash book, preparation and storage of incoming and outgoing orders. These forms are still required if the organization has a cash register and conducts cash payments.

- The cashier-operator's journal should be filled out only for internal accounting. Once you start using the online device, it is optional.

- It is permitted not to use the following forms: KM-1 – KM-9 to reflect money transactions if the seller conducts transactions through an online cash register. Since July 2020, everything has been compiled, stored, and transferred to controllers at the Federal Tax Service through the OFD.

- For individual entrepreneurs, maintaining a cash book is retained if desired. In organizations, this form is required for accounting.

Cash receipts

Related publications

We all shop in stores. Some do this more often, others less often. We purchase food and beverages, shoes and clothing, appliances and home electronics. You can't count everything. But during the shopping process, various unforeseen situations may arise. For example, a cashier mistakenly took a large amount from a client, punching a check. What to do in this case? Or the buyer does not want to purchase a check that has already been issued at the centralized cash register, there are compelling reasons for returning the goods after its purchase, and before the end of the current working day. In all such situations, the money is returned to the buyer, and he does not really think about how this happens.

Non-standard situations

Despite the established procedure for registration, there are situations in which its implementation may be difficult.

Error

If the basis of the act is a cashier’s error, then it is not always possible to confirm it with a check. The cashier may make a mistake, but without noticing it right away, give the wrong receipt to the consumer. Also, the check may be lost by the cashier (damaged or lost).

In this case, the manager has the right to punish the employee for negligence, according to Article 244 of the Labor Code of Russia. However, this does not eliminate the need to draw up an act and record the cashier’s mistake in it. When drawing up an act, it is customary to use as a basis the explanatory note of the employee who allowed it.

Article 244. Written agreements on the full financial responsibility of employees

The explanatory form is free.

It states:

- date of the cash error;

- Full name of the responsible employee;

- KKM number;

- reasons for the error;

- reasons for the absence of a check.

This requirement is not established by law. But the preparation of such a document will be additional evidence that the organization did not commit any violations in recording revenue receipts. You can also attach a sales report to the act.

Return

The difficulties associated with processing refunds to consumers are due to the fact that the processing rules are prescribed for ideal conditions.

An application for the issuance of excise stamps must be completed by every enterprise that trades in alcoholic beverages. In this publication you can find a current sample of the T-14 form - Timesheet.

Income tax returns can be found here.

Difficulties for cashiers arise in the following cases:

- if the consumer who returned the goods does not have a receipt;

- if necessary, return the money not for the entire check, but only for part of it;

- with a printed receipt for the return.

In cases where an organization has an obligation to return money to clients, the law “On the Protection of Consumer Rights” stipulates the return of funds even without presenting a receipt. The consumer only needs to write a return application and prove that the product was purchased at this outlet. Therefore, it is not always possible to attach a cash document.

If there is no receipt available, this is regarded by tax specialists as a violation of the requirements for registering revenue receipts and may result in a fine being imposed on the organization. To prevent such an outcome of the case, you can replace the receipt with a statement from the consumer who returned the goods that the receipt was lost.

There is a receipt available, but the return is made only for one of the list of goods; a document should be drawn up only for the amount of the return. In this case, the check will have to be collected from the buyer for reporting. In return, the law allows the consumer to be issued a copy of the receipt, certified by the organization’s seal and the signature of management.

Difficulties that arise when printing a refund receipt often add additional confusion to the work of cashiers:

- depending on the brand/model of the cash register, the refund amount may be reflected in the cash register as revenue, and not as a write-off (this introduces additional difficulties into the work of the accounting department);

- a refund check may not always be issued (for example, if at the time of return there is not enough money in the cash register to compensate the consumer for the purchase amount);

- a refund check is not a fiscal document and is only an appendix to the KM-3 act.

That is why it is more convenient to use the scheme for drawing up the KM-3 act with attachments, bypassing the punching of a refund check.

Sample of filling out the KM-3 form

Registration of goods return

This question concerns, first of all, the trading organization. After all, everything related to money is always under the special control of supervisory fiscal authorities. Each operation to return money to the buyer is documented in an act, the unified form KM-3 of which is approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132 and has code 0330103 according to the All-Russian Classifier of Management Documentation (OKUD).

The act recording the return of funds is usually drawn up by the cashier-operator in one copy at the end of the working day, when the daily revenue is calculated and the Z-report is taken from the cash register (Cash Register). The unified form KM-3 of this document, after filling out, is signed by members of the commission consisting of the head of the department or section, senior cashier and/or cashier-operator and approved by the director of the organization. You need to be careful when preparing the document.

Related documents

- Act on transferring the readings of summing money meters to zeros (Unified Form N KM-1)

- Act on verification of cash at the cash desk (Unified Form N KM-9)

- Cashier-operator's journal (Unified form N KM-4)

- Journal of registration of readings of summing cash and control counters of KKM (Unified form N KM-5)

- Journal of calls to technical specialists and registration of work performed (Unified Form N KM-8)

- Information on meter readings of cash register machines and the organization’s revenue (Unified Form N KM-7)

- Certificate-report of the cashier-operator (Unified form N KM-6)

- Act on the curtain of containers (Unified form N TORG-6)

- Act on control (selective) inspection of eggs (Unified form N TORG-22)

- Act on sorting (sorting) of fruits and vegetables (Unified form N TORG-21)

- Act on re-measuring fabrics (Unified form N TORG-24)

- Act on part-time work, sub-sorting, repacking of goods (Unified form N TORG-20)

- Act on damage, damage, scrap of inventory items (Unified form N TORG-15)

- Certificate of acceptance of goods received without a supplier's invoice (Unified Form N TORG-4)

- Certificate of acceptance of goods (Unified form N TORG-1)

- Act on write-off of goods (Unified form N TORG-16)

- Act on the receipt of packaging not specified in the supplier's invoice (Unified Form N TORG-5)

- Act on the established discrepancy in quantity and quality when accepting imported goods (Unified Form N TORG-3)

- Act on the markdown of the flap (Unified form N TORG-25)

- Journal of registration of inventory items that require a curtain of containers (Unified form N TORG-7)

Sample of filling out the unified form KM-3

A check must be attached to the act of returning money to buyers, because if it is not present during the next tax audit, this fact may be interpreted as non-receipt of the proceeds. To avoid incorrect execution of the form, you should first carefully study the sample of filling out the act and proceed from the example presented.

The procedure for filling out the KM-3 form:

- at the top of the form the name of the organization, telephone number and the name of its structural unit are indicated;

- sequential introduction of codes according to the OKPO, INN, OKDP classifiers;

- cash register (cash register) data;

- number and date of document preparation;

- stamp of approval of the act indicating the date, position of the head of the enterprise (organization), and his signature, sealed;

- a table with a list of names of departments (sections), check numbers, amounts issued to customers (in numbers), including the total, and an indication of the responsible person who authorized the return of funds;

- the total amount of money issued in words;

- in the “Attachment” field it is indicated what is attached to the act - incorrectly executed cash receipts, explanatory notes from cashiers, etc.;

- signatures of the commission members.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Act on the return of funds to buyers (clients) for unused cash registers (Unified Form N KM-3)”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Official uniform KM-3

Just like other forms of cash documents (KM-1, KM-2, etc.), the KM-3 act was approved by the State Statistics Committee of Russia in Resolution 132 of December 25, 1998 (hereinafter referred to as the Resolution). For a long time, tax authorities and the Ministry of Finance argued that these forms are mandatory for companies and entrepreneurs and they cannot change them, supplement them or apply their own forms (see Letter of the Federal Tax Service dated June 23, 2014 No. ED-4-2/11941, information from the Ministry of Finance No. PZ -10/2012 ). However, at the end of 2020, the position of the departments changed. Thus, the Federal Tax Service in Letter dated September 26, 2016 No. ED-4-20 / [email protected] stated that KM forms are not mandatory for use, since the Resolution does not relate to legislation on the use of KKM. Thus, taking into account this latest clarification, companies and entrepreneurs have the right to change these forms or use their own.

However, in practice, KM forms, including KM-3, are often used. Below you can find the official form.

Download a blank form of the KM-3 act

Completion Instructions

When filling out the form, you must fill in the required fields.

These include:

| "Cap" of the act | It states:

|

| "Body" of the document | This section consists of a list of checks for which refunds are made. For each check, the following is recorded in the section:

|

| "Total" | This line indicates the total amount of all refunds made, and below it this amount is indicated in words. Here you should also indicate the details of the appendices to the act: cash and sales receipts, statements, explanatory notes, etc. |

The end of the document contains information about the persons who were included in the commission for drawing up the act. The act must bear the signatures of all persons who took part in the return of funds (authorized and implemented it).

You need to issue a return.

An interesting fact: many people believe that the return process should take place at the cash register itself. That is, a refund check is punched at the cash register, which deducts the refund amount from the cash register. This is wrong. Not only is this check not considered a fiscal document, but also in some cash registers (for example, Alpha 400K), the refund amount is added to savings.

This further confuses the cashier and the accountant. And also if for the current shift the amount on the cash register is less than the amount you want to issue as a refund, then nothing will work out for you. This often happens when a customer returns an item not on the day of purchase, but comes the next day or later, and you do not have enough sales at the checkout to close the return.

What to attach to the act

The KM-3 act must be accompanied by an incorrect check pasted on a piece of paper (this is more convenient so as not to lose it). The check must be signed by the head of the organization (head of department or section) or the entrepreneur himself and must be stamped “Canceled” Instructions for filling out; pp. 4.2, 4.3, 4.5 Standard rules for the operation of cash registers when making cash payments to the population, approved. Ministry of Finance of Russia 08.30.93 No. 104.

However, the check that must be attached to the act is not always available. And then tax authorities may interpret this as non-compliance with the requirements for processing refunds to customers or erroneously entered amounts on cash registers. And accordingly, equate to non-receipt of part of the proceeds Letter of the Federal Tax Service of Russia for Moscow dated July 30, 2007 No. 34-25/072141. This means you need to insure yourself, but how depends on the situation.

SITUATION 1. The buyer returning the goods did not return the check.

The need for KM-3 at present

Legislation of the Russian Federation by 2020 obliges almost all businesses to switch to online cash registers, which means that the work will become more transparent, all checks through the fiscal data operator will go to the tax office, which will completely control the process of trade and services. Last year's experience showed that this innovation is quite convenient and interesting, and also reduces the number of documents to complete.

With the transition to online cash registers, a number of documents were abolished, including KM-3 and KM-4. Since it has now become much easier to obtain a refund, there is no need to draw up these acts. However, those organizations that still operate without online cash registers can use them. And those enterprises that have switched to online cash registers have the opportunity to track all transactions through an electronic platform where each check is visible, with the number, date, amount, and all complete information. You can print it out at any time. The transition to a new stage of life has become much more convenient for both cashiers and clients; anyone can visit the tax office website and track the authenticity of their check, if necessary. And you can receive a refund on any convenient day by filling out an application; the act is now optional.

Important! If there is no QR code or other details in the receipt, the receipt becomes invalid and the fact of the purchase is not taken into account, which can lead to a number of problems, such as a fine or administrative liability.

The main function of this code is that the buyer has the opportunity to check his receipt on the tax website and report to the inspectorate if violations are detected. To carry out this check, there is a special mobile application that was developed by the tax service, it is completely free and allows you to check every cash receipt. A QR check allows you to scan it using a mobile phone. Responsibility for violations in the issuance of checks

The legislation does not provide for separate fines for failure to issue a check with an error, however, for failure to issue a check in principle, either paper or electronic, a fine will follow. In this case :

1. for officials and individual entrepreneurs 2000 rubles, and the company can be fined 10,000

The term for prosecution in this case is one year.

2. When choosing a cash register, you must be guided by the requirements of the law and ensure that the cash register is included in the list of certified ones.