The TZV-MP form and the procedure for filling it out were approved by Rosstat Order No. 373 dated July 29, 2016 (See “New reporting form for small organizations”). The new form will need to be submitted to Rosstat at the end of 2020. What is the deadline for submitting the report? Will all organizations and individual entrepreneurs without exception need to submit a new report? How to fill out a new report? Is there any liability for failure to submit a TZV-MP? In this article we will consider the most important issues regarding the completion and submission of new reports.

Who submits the TZV-MP report

TZV-MP is passed by small enterprises, and absolutely all of them without exception. According to the criteria for small and medium-sized businesses, these include organizations whose annual revenue does not exceed 800 million rubles. and the number of employees does not exceed 100 people. And also those organizations in which the share of participation in the authorized capital of other legal entities is up to 49%, and public organizations and foundations up to 25%.

Signing and features of submitting a report

New reporting for small businesses TZV-MP for 2020 must be signed by a director or accountant. That is, a person with responsibility for providing statistical information on behalf of an organization.

Theoretically, an organization that did not conduct financial and economic activities in 2019 can also be included in the sample; accordingly, it had no movement on its accounts. Then the report will still need to be submitted, but in the MP TZV form for 2020 you will have to fill out the title page, and in the lines of sections 1 and 2 you will need to put dashes.

According to paragraph 10 of Regulation No. 620, approved by the Decree of the Government of the Russian Federation dated August 18, 2008, an object can submit this report form:

• in paper form: sent by mail, delivered personally or through an authorized representative;

• in electronic format through a special operator performing electronic document management, using an enhanced qualified electronic signature;

• in electronic form through a web collection system, if such a possibility exists on the resource of the territorial division of Rosstat. Here you will need to submit an application and receive a login and password to access the service. It is also necessary to have a qualified electronic signature key certificate.

Download the TZV-MP form

Form form No. TZV-MP was established by Rosstat Order No. 373 dated July 29, 2016. We will give an example of its completion, taking into account the additions made by Rosstat Order No. 52 dated January 31, 2017.

The report contains 2 sections:

- Section 1 – information about revenue;

- Section 2 – information on the costs of production and sale of products.

The form is submitted to the territorial bodies of Rosstat by April 1, 2020.

Download the form HERE in XLS format.

Important! I'll repeat it again. The report in form No. TZV-MP is drawn up based on the results of 2020 and is submitted by 04/01/2019. The report is one-time in nature, that is, it needs to be submitted only once. Only small business organizations submit the form. Individual entrepreneurs do not submit this report.

How to find out whether an organization needs to submit reports?

First, you need to determine whether the company is a small business according to the established criteria. If a company does not fall into them, then it will not take part in the sample. You must also remember that only companies submit reports, and entrepreneurs are exempt from this obligation. Micro-enterprises with up to 10 people should not submit uniforms.

Rosstat divisions are required to bring to the attention of organizations the fact that they need to submit this report. At the same time, how this should be done is clearly regulated.

The ways to notify companies are:

- Publication on the website of the territorial body of lists of companies included in the sample;

- Sending a letter indicating the need to fill out and submit a report to the legal address.

However, sometimes a situation may arise when a company is included in the sample, but will not be notified by Rosstat. Therefore, it is better to directly contact the territorial authority and ask them whether they need to submit a report.

Attention! In addition, a special website has been developed https://statreg.gks.ru/ on which you need to enter one of your three codes - TIN, OKPO or OGRN, and in the report you will receive a list of forms that the enterprise must submit within a year indicating deadlines.

How to fill out the TZV-MP and what the report consists of

If you have already downloaded the TZV-MP form, you will see that it consists of:

- Title page;

- Section 1 – it reflects information about revenue;

- Section 2 - it reflects the costs of production and (or) sale of products.

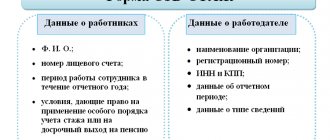

What to fill out on the title page

On the title page of TZV-MP you should indicate:

- The name of the organization is indicated in full (as in the constituent documents), with an abbreviated version written next to it in parentheses;

- Postal address - in general, the legal address is indicated here, but if it does not coincide with your postal address, then the latter is indicated (i.e. to which correspondence can be sent to you if necessary);

- OKPO code.

How to fill out Section 1 in TZV-MP

The first section of the report shows revenue data for 2017. In principle, there is nothing complicated here:

- On line 01 we put the amount of revenue for the year, it should be equal to a similar indicator from the Financial Results Report, which is submitted by companies as part of their financial statements.

- Next, in lines 02 and 05, this indicator is deciphered: revenue from the sale of its products and revenue from the sale of products purchased for resale are distinguished separately. Accordingly, the sum of data on lines 02 and 05 is equal to the indicator in line 01.

- Lines 03 and 04 are reserved for those who perform construction services and services of a scientific and technical nature. The revenue amounts for these lines are included in line 02.

- There are special lines for agricultural organizations. Line 05 shows the amount of production produced, which was then credited to fixed assets (this could be, for example, breeding stock included in the main herd, or perennial plantings). And line 06 indicates the cost of the products produced, which were used for use in one’s own agricultural activities (this, for example, could be feed, seeds, fertilizers, etc.).

How to fill out Section 2 in TZV-MP

The second section of the form is much more difficult; there are many more indicators. Let's start in order, especially since some indicators are combined into blocks.

Block 1:

- Line 08 indicates the cost of goods that were purchased in the reporting year for resale. They are reflected at the actual purchase price excluding VAT.

- Here, on line 09, we put the value of the remaining goods for resale in the warehouse at the beginning of the year, in the next line 010 - the same indicator at the end of the year.

Accordingly, our line 010 is in any case either less than or equal to the indicator of lines 08 + 09.

Block 2:

- Line 11 includes the amount of expenses for the purchase of raw materials (including materials, semi-finished products, etc.), regardless of whether they were used during the year or partially remained in the warehouse.

- Line 12 shows expenses for the purchase of fuel of all types, while line 13 separately allocates the amount of expenses for fuel purchased through retail gas stations.

- Lines 14 and 15 indicate the balance of raw materials and supplies in the warehouse - as of the beginning and end of the year.

The check here is the same as in the first block of indicators: the indicator of lines 11 + 12 + 14 will be either greater than or equal to line 15.

- Separately, line 16 highlights the cost of raw materials and materials that were sold externally and not used in production.

That is, line 16 is part of the sum of lines 11 + 12 + 14.

Block 3: Here the remaining expenses are indicated line by line:

- 17 – for electricity;

- 18 – for thermal energy;

- 19 – on the water;

- 20 – for the removal of wastewater and waste;

- 21 – for rent (further in lines 22-25 there is a breakdown of this amount by type of payment);

- 26 – for entertainment expenses;

- 27 – for services of other organizations (further in lines 28-52 there is a breakdown of this amount by type of service);

- 53 – other expenses not included in the previous lines are included.

Well, line 54 summarizes the calculation; the formula for it is given in the TZV-MP report form itself.

Nuances of continuous and selective statistical observation

Article 6 of Federal Law No. 282-FZ of November 29, 2007 establishes two forms of federal statistical observation: selective and continuous.

Continuous observation requires all respondents of the study group to submit statistical reports. Once every five years it is carried out in relation to small and medium-sized businesses.

Last time was held in 2020. All individual entrepreneurs and small (micro) enterprises that are legal entities submitted reports to their Rosstat branches using the forms contained in Rosstat Order No. 263 dated 06/09/15:

• for small and micro-organizations, reporting was carried out according to the format No. MP-SP “Information on the main performance indicators of a small enterprise for 2020”; • for individual entrepreneurs - according to form No. 1-entrepreneur “Information on the activities of an individual entrepreneur for 2020.”

For the next 4 years, this type of reporting will not be required as a continuous observation.

Rosstat determines the circle of participants in the sample observation. Those specific organizations and individual entrepreneurs that were included in the sample must be warned in advance that they will have to submit reports in the TZV-MP form within the period established by law.

Fines for failure to submit TZV-MP

In conclusion, let us remind you that fines for failure to submit statistical reports in 2020 will be significant. A legal entity can be fined in the amount of 20-70 thousand rubles, and an administrative fine can also be imposed on an official, which is about 10-20 thousand rubles. To avoid such sanctions, we recommend that you check in advance with your territorial statistical offices about whether you need to submit this form, and then prepare a report for submission on time.

Methods for submitting a report to statistics

You can fill out the report manually or using a computer.

The report is submitted to the statistical authorities at the location of the legal entity or the place where the activity is actually carried out.

Enterprises have the right to send reports to Rosstat in several ways:

- In person - directly include it in the statistics on paper in two copies. In this case, the report form can be printed on the website or obtained from the statistical authorities;

- Electronically - with the help of a special operator through telecommunication channels. To use this method, an electronic digital signature is required.

How to fill out the form

The procedure for filling out the MP-micro form was approved by Rosstat order No. 704 dated November 2, 2016.

The federal statistical observation form No. MP (micro) “Information on the main indicators of micro-enterprise activity” is provided by commercial organizations, consumer cooperatives that are micro-enterprises in accordance with Article 4 of the Federal Law of July 24, 2007 No. 209-FZ “On the development of small and medium-sized enterprises in the Russian Federation” Federation.”Individuals carrying out entrepreneurial activities without forming a legal entity do not provide form No. MP (micro).

Micro-enterprises using a simplified taxation system

when providing primary statistical data in the federal statistical observation form No. MP (micro), they are guided by these Instructions.

The form includes information for the legal entity as a whole, that is, for all branches and structural divisions of a given micro-enterprise, regardless of their location. The head of the legal entity appoints officials authorized to provide statistical information on behalf of the legal entity.

An example of filling out the MP-micro annual form for 2020

LLC "Tour" - a travel agency on the simplified tax system, is a micro-enterprise. For 2016, the organization must submit the MP-micro form to “statistics”. We will show you how a company accountant will fill out a report.

The data is like this. In 2020, Tour LLC had 5 payroll employees, no one quit or joined. The amount of accrued wages for the year is RUB 2,790,500. There were no social benefits. The number of man-hours worked is 9870.

Revenue from the sale of tourism services for 2020, according to accounting data, amounted to 8,900,400 rubles. During this period, the company acquired one fixed asset - a passenger car worth 570,000 rubles. The organization does not have any freight vehicles on its balance sheet.

The accountant will put all the necessary codes in the header of the report. Section 1 will indicate that the company applies the simplified tax system. Section 2 will reflect the average number of employees, accrued wages and man-hours worked. In section 3, he will record the amount of revenue and the cost of the purchased car. I will put dashes in section 4, since Tour LLC did not trade in 2020. But the accountant will not fill out section 5, since the company does not have freight transport.

Who should take it and why?

Small enterprises are organizations whose activities meet all the conditions listed in the law.

According to the law on the development of small and medium-sized businesses in the Russian Federation:

- the total share of participation of the Russian Federation, its constituent entities, various municipalities and other organizations should not exceed twenty-five percent in the authorized capital of a small enterprise and forty-nine percent for legal entities of small and medium-sized enterprises or foreign ones;

- the number of employees of the enterprise according to the lists for the past year should not exceed one hundred people;

- profit from business activities cannot exceed eight hundred million rubles for the previous calendar year.

The information contained in the TZV-MP report is needed by Rosstat so that they can conduct federal statistical monitoring of costs for the production and sale of goods, the provision of works and services, as well as in order to develop basic input-output tables for reporting year 2020.

It should be submitted to the local Rosstat authority where the small enterprise is located. If it carries out its professional activities at a location other than its location, then a report in the TZV-MP form must be sent to the department that supervises the address where the actual activities are carried out.

The TZV-MP form can be provided both in paper and electronic form. In this case, the corresponding electronic document must be signed using a qualified enhanced signature, in accordance with the legislation of the Russian Federation.

Deadlines and penalties

Statistics form MP SP

is a one-time reporting.

It is submitted either on paper or electronically before April 1 of the year following the reporting year at the place of registration of the company, regardless of the actual address.

In cases where an enterprise fails to complete and submit a statistical surveillance form for an MP joint venture on time, or when filling it out, incorrect data is indicated, administrative measures may be applied to it, in particular the provisions of Art. 13.19 Code of Administrative Offenses of the Russian Federation.

According to these standards, fines for the company start from 20,000 rubles. up to 70,000 rubles, for its responsible persons from 10,000 rubles. up to 20,000 rub. If this violation is repeated, the organization may be fined from 100,000 to 150,000 rubles, and officials - from 30,000 to 50,000 rubles.

Sample of filling out a report

Detailed Rosstat Instructions for filling out the MP (micro) form were approved by Order No. 723 of November 7, 2017.

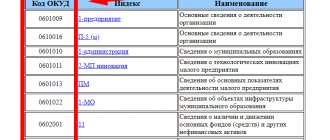

The report is filled out based on the basic data of the microenterprise and consists of a title page and five sections. Information about the organization is filled out on the title page. The report sections contain information about:

- taxation system;

- headcount and wage fund;

- the amount of revenue;

- the amount of investment in fixed capital;

- about cargo transportation.

The form is provided by all organizations included in the sample observation, including those that did not operate or were declared bankrupt, if there is no decision of the arbitration court on liquidation against them.

Micro-enterprises that do not operate submit reports with zero values of cost indicators.

The MP-SP form

is a one-time reporting document for Rosstat (it had to be submitted before April 1, 2020). But the experience of filling it out can always be useful to the company when interacting with the department in the future. We will tell you in our article what causes this and where you can find a sample form.

Responsibility

If you fail to submit the TZV-MP on time or provide unreliable and incomplete data, you will have to pay a fine. Its size is indicated in Article 13.19 of the Code of Administrative Offenses of the Russian Federation:

- the organization will pay an amount of 20,000 rubles. up to 70,000 rubles, and for repeated violation from 100,000 rubles. up to 150,000 rubles;

- the director will pay from 10,000 rubles. up to 20,000 rubles, and for repeated violation from 30,000 rubles. up to 50,000 rub.

Cases related to these violations are considered by the territorial bodies of Rosstat (Article 23.53 of the Code of Administrative Offenses of the Russian Federation). To impose a fine, controllers have two months from the date of the violation, that is, from the expiration date of the reporting period (Article 4.5 of the Code of Administrative Offenses of the Russian Federation). This means that if the TZV-MP report must be submitted no later than April 3, 2020, then Rosstat employees will be able to fine you for failure to submit it no later than June 3, 2017.

If you find an error, please select a piece of text and press Ctrl+Enter

.

How to fill out the document?

When entering information, you must adhere to certain instructions:

- sheets must not be connected with paper clips, staplers or clamps;

- You need to enter data in sections specially designated for them;

- correct all errors using the sample document;

- It is unacceptable to use a proofreader and cover up erroneous data with parts of the paper.

On the first sheet of the report, before the section on general information, you need to enter the details of the organization: full name and postal address.

All questions of the form are combined into 4 sections and occupy the same number of sheets.

Section 1. General information about the enterprise

Enter here:

- legal and actual address of the company;

- the date when the company began to engage in economic activity;

- the exact number of working months over the past year (for non-permanent organizations);

- information on possible structural changes in joint stock companies in previous years;

- taxation systems used by the company in the reporting period.

If it is necessary to select from the proposed items, the correct answers are indicated in the provided columns with an “X”.

Section 2. Main performance indicators of a legal entity

- 2.1. The total number of employees of the company and the accrued salary is included here: the average number of working people per year, including payroll employees, external part-time workers, employees hired under civil contracts;

- only the number of workers on the payroll;

- the total amount of accrued staff salaries;

- only the monetary volume of salaries of employees on the payroll and external part-time workers;

- the average number of all people working in the company in 2014.

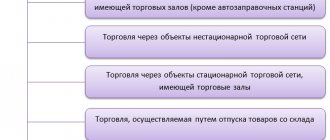

- the cost of products at which they were purchased for subsequent resale in the reporting period, while the year of purchase is not important;

Section 3. Fixed assets and investments in fixed capital

- 3.1. The paragraph explains which fixed assets are not indicated in the report lines. Tangible fixed assets include buildings, tools, transmission devices, livestock, computer equipment, transportation, and so on. Intangible ones are developments, computer software, copyrights, monetary costs for the exploration of valuable minerals, high-tech industrial technologies, and others. The section includes:

- information on the availability of fixed assets on the company’s balance sheet at their original book value at the beginning of 2015;

- fixed assets of the company that are on the balance sheet at the initial and residual prices at the end of the reporting period;

- information on investments in fixed capital concerning the costs of creating and purchasing fixed assets.

Section 4. State support

After completing all sections at the end of the report, the responsible person who provided the information enters his personal data, date, signature and telephone number.

At the beginning of this year, statistical authorities sent many small enterprises letters asking them to submit a stat form. MP-SP observations. It consists of filling out information on important performance indicators of companies over the past year. The form must be drawn up in accordance with federal law if the company is classified as a small business.

The provisions of the act determine that the requirement to submit forms applies to small businesses, including farms and peasant households. Firms are classified into this category based on the indicators specified in Federal Law No. 209 of July 24, 2007. This is mainly the number, revenue volume, etc.

If a company has divisions, then it must send general information to its legal address. In cases where the enterprise was partially temporarily unemployed during the year, it also needs to submit the MP JV form in the general manner.