The reporting form “1-enterprise” must be submitted annually to the statistical authorities by all legal entities, as well as branches and representative offices acting on behalf of foreign companies. Exemption from this obligation is provided for:

- small business representatives;

- state and municipal organizations;

- banking structures;

- insurance companies;

- credit institutions.

Report form “1-enterprise”

Data for reporting is taken across the entire enterprise. If a domestic enterprise has separate structures or branch divisions, their performance indicators are not included in a separate report. The form is submitted to the statistical authorities once a year. The deadline for submitting the document is April 1 of the year following the reporting interval. For 2020, you must report to Rosstat no later than 04/01/2019.

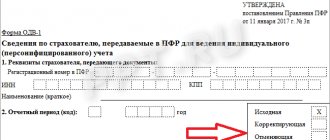

The new form “1-enterprise” has been introduced into the statistical reporting system of business entities with reporting for 2020. The document was assigned OKUD code 0601009. Its sample is regulated by Rosstat Order No. 461 dated July 27, 2018. Detailed rules for filling out and reporting are prescribed in Rosstat Order No. 30 dated January 30, 2018 (as amended on December 26, 2018).

Form “1-enterprise” (statistics) consists of the following sections:

- a title page indicating the name and address of the company, OKPO code;

- section 1, the columns of which reflect the period of operation of the enterprise;

- section 2, which fixes the size of the authorized capital and its structure;

- Section 3 identifies contributions to the authorized capital from foreign participants;

- Section 4 shows the organizational structure of the company;

- section 5 consists of a table with data on the production of goods, the volume of provision of services or performance of work;

- section 6 displays the expenditure side of production activities;

- section 7 is intended to highlight the costs of paying for services ordered from third parties;

- in section 8 you must indicate the types of activities of the company;

- Section 9 provides characteristics of the head structure and its separate divisions.

What to look for in other reports for Rosstat

So, when filling out the form in question, you should take into account that:

- Line 671 contains data similar to what is reflected in field 01 in column 1 of form P-2 (invest).

- Columns 1–3 of sections 8 and 9 reflect data taking into account indicators from reports P-1 and P-4. Since the indicators are monthly, they must be summed up for the entire reporting year to compare them with the form in question.

We are talking about data:

- About the average size of the organization's staff (line 801, column 1). It must correspond to the indicators on line 01 in column 01 of form P-4.

- The size of the wage fund (line 801, column 2). Must correspond to the value recorded on line 01 in column 7 of form P-4.

- Revenue (line 801, column 3). Must correspond to the sum of indicators on lines 01 and 02 of form P-1. A similar algorithm is used to determine the data reflected in Section 9.

- Shipped goods and services (line 502 in section 5). Must correspond to the indicator reflected in line 21 in column 1 of form P-1.

If any data in the 1-enterprise report is corrected, corresponding changes must be made to the other specified reporting forms to Rosstat, and vice versa (letter of the Rosstat representative office in the Perm Territory dated March 13, 2018 No. VP-27-204/625-DR) .

Indicators in Form 1-enterprise must in some cases be compared with information from the financial statements. Let's look at them.

Filling out the form “1-enterprise”

The document template provides for the reflection of data for the reporting year, and some information also indicates for the previous annual interval. When monitoring the correctness of filling out the form, it is necessary to check whether the information from the previous year in the current report coincides with the information from last year’s report. The “1-enterprise” form (you can download the form below) is filled out according to the following rules:

- The name of the reporting enterprise is indicated in full on the title page; an abbreviated version of the name is given in brackets.

- The address is entered by reflecting the subject of the Russian Federation, postal code, locality and street, house number, building, apartment (office, room). The coordinates reflected in the report must correspond to the legal address of the company.

- In section 1, you must indicate the date of registration of the legal entity and the actual day of the start of business activities (that is, the moment the production of products or the provision of services began), and the method of formation of the company.

- Form “1-enterprise” 2020 in section 2 reflects the amount of authorized capital recorded at the end of the reporting period. The table provides a breakdown of the size of the shares of investors - different categories of legal entities and individuals. If the enterprise has foreign investors among its investors, it is necessary to circle the cell with code 211 and then decipher these amounts in section 3. If there are no foreign investors, section 3 is not filled out. Section 4 introduces information on the number of separate and subsidiary structures of the enterprise.

- The “1-enterprise” form, an example of which we have presented, in the table of Section 5 contains the cost characteristics of the company’s activities, taking into account the results of the work of its separate structures (all parameters are indicated in thousands of rubles). In this block it is necessary to show the amount of the company’s turnover, the cost of work performed and agricultural products produced, building materials. A separate line indicates the amount of subsidies received from the budget for production purposes. The amount of export customs duties payable and the number of months when the enterprise actually operated (in the reporting period) are reflected separately.

- The completed form “1-enterprise” in section 6 will contain a breakdown of production costs - costs of electricity, water, thermal energy, fuel, purchase of real estate, inventory, semi-finished products, expenses associated with land reclamation. In this part, it is necessary to indicate labor costs, rental payments, depreciation deductions, amounts of insurance deductions, and taxes. The value of balances of different types of assets at the end of the year must be provided.

- When detailing the cost of services from third-party organizations, it is necessary to indicate the nature of the work performed and their purpose.

- Areas of activity are identified using OKVED2 codes, recording the number of personnel involved in each area of business, payroll and turnover.

- The last section of the report is filled out only by those legal entities that, in section 4, in the column with the number of separate divisions, indicated their presence.

Read also: Statistical reporting

What is 1 form

Reporting submitted by organizations is divided into:

| Accounting | Formed on the basis of accounting information |

| Operational | Contains information about the current state of affairs |

| Statistical | Includes data on accounting, statistical, operational accounting. Displays information on specific indicators in physical and monetary terms |

The State Statistics Service of the Russian Federation adopted Order No. 379 of August 2, 2020. This document contains an approved list of forms for the generation of reporting documentation, as well as specifically Form 1, divided into 1-T, 1-T (GMS), 1-T (labor conditions).

The form of current documentation is approved by the Rosstat office on an annual basis. The reporting period is 12 months.

On the specified template, Form 1-T is used to submit testimony from the company entered in the specialized register of Rosstat. Data is not transmitted from companies, small businesses reporting on the P-4 form, or individual entrepreneurs.

The control date for generating the report is January 20 of the year following the reporting year.

Filling out is carried out not only for the organization as a whole, but also for all structural divisions, and is submitted to the statistical authorities at the location of the enterprise or branches.

Form structure

____________________________________________________________________Repealed from the report for 2020 on the basis of Rosstat order No. 39 dated January 30, 2020__________________________________________________________________________

1. Approve the attached Instructions for filling out the federal statistical observation form N 1-enterprise “Basic information about the activities of the organization”, and put them into effect from the report for 2014.

2. With the introduction of the attached Instructions, the order of Rosstat dated December 20, 2012 N 643 “On approval of the Instructions for filling out the federal statistical observation form N 1-enterprise “Basic information about the activities of the organization” is declared invalid.

Acting Head of the Federal State Statistics Service A.L. Kevesh

APPROVED by order of Rosstat dated December 9, 2014 N 691

I. General provisions

1. Federal statistical observation form N 1-enterprise “Basic information about the activities of the organization” is provided by all legal entities of all forms of ownership that are commercial organizations, as well as non-profit organizations producing goods and services for sale to third parties (except for small businesses, budgetary organizations, banks, insurance and other financial and credit organizations).

Legal entities provide the specified form of federal statistical observation at their location. In the event that a legal entity does not carry out activities at its location, the federal statistical observation form is provided at the place where it actually carries out its activities.

The head of a legal entity appoints officials authorized to provide statistical information (primary statistical data) on behalf of the legal entity. Organizations applying the simplified taxation system provide the specified form in accordance with the Instructions for filling out the federal statistical observation form N 1-enterprise “Basic information about activities organization” (hereinafter referred to as the Guidelines).

2. Form N 1-enterprise includes information on the legal entity as a whole, that is, on all branches and other structural divisions of this legal entity, regardless of their location. The definition of a territorially separate division is given in paragraph 88 of the Instructions. Form No. 1-enterprise is also provided by branches, representative offices and divisions of foreign organizations operating on the territory of the Russian Federation, in the manner prescribed by the Instructions.

Bankrupt organizations where bankruptcy administration has been introduced are not exempt from providing information on the federal statistical observation form. Only after the arbitration court has issued a ruling on the completion of bankruptcy proceedings in relation to the organization and an entry about its liquidation has been made in the unified state register of legal entities (clause 3 of Article 149 of the Federal Law of October 26.

2002 N 127-FZ “On Insolvency (Bankruptcy)”), the debtor organization is considered liquidated and is exempt from providing information. If a legal entity simultaneously carries out its ordinary activities and joint activities under simple partnership agreements, and he, as one of the partners, in in accordance with the procedure established by law, is entrusted with the conduct of common affairs in accordance with the agreement on joint activities, then such an enterprise fills out and submits separately a form for the performance of its usual activities and a form for jointly carried out activities.

Organizations that carry out trust management of an enterprise as a whole property complex draw up and provide reports on the activities of the enterprise that is in their trust management. Organizations that carry out trust management of individual property objects provide the founders of the management with the necessary information about their property.

The founders of the management draw up their reports taking into account the information received from the trustee. At the same time, organizations carrying out trust management draw up and provide reports on the activities of the property complex in their ownership. Associations of legal entities (associations and unions) in the specified forms reflect data only on activities recorded on the balance sheet of the association, and do not include data on legal entities that are members of this association.

3. Data for the previous year presented in the form for the reporting year must coincide with the data in the form presented for the previous year, except in cases of reorganization of the legal entity, change in the methodology for generating indicators or clarification of data for the previous year. All other discrepancies in data for the same year must be explained in the legend to the form.

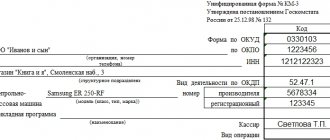

4. Information is provided within the time frame and to the addresses indicated on the form. In the address part of the form, the full name of the reporting organization is indicated in accordance with the constituent documents registered in the prescribed manner, and then in brackets - the short name. The line “Postal address” indicates the name of the subject of the Russian Federation, legal address with postal code.

If the actual address does not coincide with the legal address, then the postal address at which the legal entity is actually located is also indicated. The reporting organization enters in the code part of the form the code of the All-Russian Classifier of Enterprises and Organizations (OKPO) on the basis of the Notification of assignment of the OKPO code sent (issued) to organizations territorial bodies of Rosstat.

(as amended as of December 26, 2020)

____________________________________________________________________ Document with amendments made by: Rosstat order No. 778 dated December 26, 2018 (changes came into effect from the 2018 report). _____________________________________________________________________

In accordance with subclause 5.5 of the Regulations on the Federal State Statistics Service, approved by Decree of the Government of the Russian Federation dated June 2, 2008 N 420, and in pursuance of the Federal Statistical Work Plan approved by Decree of the Government of the Russian Federation dated May 6, 2008 N 671-r,

1. Approve the attached Instructions for filling out the federal statistical observation form N 1-enterprise “Basic information about the activities of the organization” (hereinafter referred to as the Instructions) and put them into effect from the report for 2020.

2. With the introduction of the attached Instructions, the order of Rosstat dated December 9, 2014 N 691 “On approval of the Instructions for filling out the federal statistical observation form N 1-enterprise “Basic information about the activities of the organization” is declared invalid.

Supervisor

A.E.Surinov

APPROVED by order of Rosstat dated January 30, 2020 N 39

I. General provisions

1. Federal statistical observation form N 1-enterprise “Basic information about the activities of the organization” (hereinafter referred to as the form) is provided by all legal entities of all forms of ownership (except for small businesses, state and municipal institutions, banks, insurance and other financial and credit organizations) .

Non-profit organizations provide federal statistical observation form N 1-enterprise when producing goods and services for sale to other legal entities and individuals. Legal entities provide the specified form at their location. In the event that a legal entity does not carry out activities at its location, the form is provided at the place where it actually carries out activities.

The head of a legal entity appoints officials authorized to provide primary statistical data on behalf of the legal entity. Organizations applying the simplified taxation system provide the specified form in accordance with the Instructions for filling out the federal statistical observation form N 1-enterprise “Basic information about the activities of the organization” (hereinafter – Directions).

2. Form N 1-enterprise includes information on the legal entity as a whole, that is, on all branches and other structural divisions of this legal entity, regardless of their location, including separate divisions operating outside the territory of the Russian Federation.

The definition of a territorially separate division is given in paragraph 88 of the Instructions. Form No. 1-enterprise is also provided by branches, representative offices and divisions of foreign organizations operating on the territory of the Russian Federation, in the manner established by these Instructions. Bankrupt organizations where bankruptcy proceedings have been introduced are not exempt from providing information on the form.

Only after the arbitration court has issued a ruling on the completion of bankruptcy proceedings and entry into the unified state register of legal entities of its liquidation (clause 3 of Article 149 of the Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)”) The debtor organization is considered liquidated and is exempt from providing information.

The paragraph was excluded from the report for 2020 - Rosstat order No. 778 dated December 26, 2020. Organizations that carry out trust management of an enterprise as an entire property complex draw up and provide reports on the activities of the enterprise that is in their trust management. Organizations that carry out trust management individual objects of property, provide the founders of management with the necessary information about their property.

The founders of the management draw up their reports taking into account the information received from the trustee. At the same time, organizations carrying out trust management draw up and provide reports on the activities of the property complex in their ownership. Associations of legal entities (associations and unions) in the specified forms reflect data only on activities recorded on the balance sheet of the association, and do not include data on legal entities that are members of this association.

Temporarily inactive organizations, which produced goods and services during part of the reporting year, submit the form on a general basis, indicating the time during which they do not work. Temporarily inactive organizations, in which there was no production of goods during the entire reporting year and services also submit a form with mandatory completion of sections 1, 2, 3, 4.

In what structure is the Rosstat form presented and where can I download a sample of it?

The form includes:

- Section 1. For each type of product it contains:

- name, OKPD code, unit of measurement (with OKEI code);

- volume of output for the reporting and previous year;

- volume of consumption for domestic needs;

- total volume of shipment to customers (in physical terms);

- volume of shipment of products made from customer-supplied raw materials (in physical terms);

- revenue from the sale of products made from customer-supplied raw materials;

- balances as of the end of the reporting year, the previous year.

- Section 2, which reflects what volume of a specific type of product (for each name and OKPD code) was produced in each month of the last year.

For reference, revenue is given by type of activity indicating OKVED codes.

- Section 3, which reveals the dynamics of production capacity during the year (at the end of the year).

The calculation of indicators for section 3 should be considered in detail.

Characteristic structure

The characteristics of the enterprise are built according to an established plan: from general data to specific indicators.

General description of the enterprise

General information about the name, type of organization, and date of its foundation is indicated here. The organizational and legal form of the enterprise, its goals, rights, founders, authorized capital, external and internal structure are also mentioned. Branches (if any) and subsidiaries are described.

If the company does not say what its authorized capital is, then you can find out online on the tax website

Specifics of the enterprise's activities

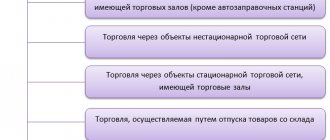

This paragraph analyzes the goods or services that the enterprise produces or provides. The choice of direction of activity and assortment is justified.

A list of goods or services and the company’s price list can be included in the application

Development strategy

The strategic development program of the organization in modern conditions is described. At the same time, it is necessary to analyze competitiveness, advertising campaigns, how well the company is adapted to changes in the market, and marketing research.

The information in the section is confirmed by current data no older than 5 years

Life cycle phase

At the time a student studies an enterprise, it is in a certain phase of economic development. Stages of the life cycle of an enterprise: origin, growth, maturity and decline.

Most likely, the employees themselves do not know what phase their company is in. You'll have to analyze it yourself

Indicators that determine the stage of the life cycle: financial policy, marketing, personnel policy, functional priorities, standards and control methods used.

Organizational structure

The effectiveness of enterprise management, its structural divisions and the connection between them is studied. The ratio of the number of employees of all categories is described: managers, specialists, employees, etc. The rationality of the chosen approach is analyzed and ways to improve the organizational structure are proposed.

Important! When it becomes difficult to write a paper, you can turn to experts with a question.

This will help get the job done quickly. More details

If the company uses management software, describe how it works and its role in optimizing management processes

Performance Analysis

The last section of the enterprise's characteristics actually sums up the study of its activities. This paragraph talks about the efficiency of the enterprise in the market, its competitiveness, and development prospects. It also suggests ways to change operations and management if necessary.

Business leaders themselves are not always able to assess the effectiveness of their company. It’s even less common for them to hire third-party business consultants and auditors, so don’t expect help here, analyze it yourself