Changes

In order to properly carry out management, it is important to have information about all economic means, their composition, location, sources of formation and directions of use. All this data is reflected in the balance sheet. It is built on a dual group of objects: the organization’s property (assets) and the sources of its formation (liabilities). All these elements are reflected in the balance sheet in monetary terms.

What are business transactions?

A business operation (HO) is a specific action that changes either the composition of property, or its location, or the sources of its formation. POs may also be associated with changes in budget formation, the company’s ownership structure, equity and borrowed funds, and reserve capital. The fact of a business transaction is the basis for creating an accounting entry. The posting is generated on the basis of documents confirming the operation.

A certain event entails a change in indicators. For example, capital and the volume of property may change. Values can either increase or decrease. Changes in capital cause changes in the balance sheet currency. Consequently, the amount of assets and liabilities also changes.

Examples of business transactions in accounting

Let's look at examples of operations and their approximate structure:

- Supply.

Examples of business operations: receipt of raw materials, transfer of funds to the supplier, input of raw materials into production. - Implementation.

Examples of financial expenses: expenses for sales of products, receipt of revenue, sale of goods. - Production.

Examples of financial assets: payment of salaries to employees, depreciation of fixed assets, acceptance of the work of a contractor, transfer of funds to a contractor.

These are the most common types of business transactions.

Types of business transactions

Let's look at the table with the classification of business transactions:

| Impact on balance | Debit correspondence | Loan correspondence |

| Change in Assets | Active | Active |

| Changing Liabilities | Passive | Passive |

| Increasing assets and liabilities | Active | Passive |

| Decrease in assets and liabilities | Passive | Active |

These are four types of transactions, which are classified according to the way they affect the balance sheet.

Let's take a closer look at the types of transactions (A is an asset, P is a liability, O is turnover):

- 1 type

Entries that reduce one asset item by increasing another. Examples of type 1: goods have arrived at the warehouse, money is sent from the account to the cash register. In this case, the structure of the property changes, but the final amount remains the same.This type has the following formula: A balance + O on the debit of account 1 – O on the credit of account 2 = P balance.

- Type 2

Postings changing liability items. Examples of type 2: multiplying reserve capital by changing the amount of profit. In this case, the chemical enterprise causes a change in the structure of sources of funds, but the final assessment remains the same.This formula belongs to this type: A balance = P balance + O for the credit of account 1 – O for the debit of account 2.

- Type 3

Actions that increase the value of a company's assets and liabilities. Example: operations for the sale of fixed assets, obtaining a loan. Postings change the balance sheet currencies.Formula: A balance + O on the debit of account 1 = P balance + O on the credit of account 2.

- Type 4

Actions that reduce the value of liabilities or the amount of equity capital by reducing the amount of assets. Example: payments to suppliers. In the process, both assets and liabilities are reduced.Formula: A balance – O on the debit of account 1 = P balance – O on the credit of account 2.

Operations are also classified according to their content:

- Material.

Movement of inventory items is expected. - Financial.

Assume the movement of funds. - Calculated.

Settlements with counterparties.

The type of transaction determines the features of its reflection in accounting.

Double entry

All types of business transactions in accounting make changes to the composition of assets and liabilities. In this case, a double entry is made in the balance sheet: debit and credit. These are two different accounts. Information is displayed in chronological order. For every completed transaction there must be documentary evidence.

Conventionally, each operation is divided into two stages: determining the corresponding accounts (quotation) and reflecting the inventory in the balance sheet (posting). The latter are recorded in the transaction log or memorial orders. To facilitate this process, each cost item is assigned a specific number, which appears in the posting. These numbers are unified and correspond to the names of balance sheet items. To correctly reflect the transaction, it is important to understand that each transaction appears on two or more accounts, but in the same amount.

Paradoxes of accounting information

Accounting information is only a model of the financial position of an organization, a model as different from the real economic life of the company as a map is from the surface of the Earth depicted on it. The construction of this model presupposes the presence of certain assumptions (conventions). In order for accounting information to be clear, we must agree on what income, expenses, assets, liabilities, own sources of funds, profit, sales, etc. are. and consistently proceed from these assumptions, observing the established “scale” of displaying the facts of economic life.

From the moment these conventions are adopted, understanding accounting information becomes impossible without understanding these conventions of accounting methodology. They, as it were, define the boundaries of the capabilities of accounting information to reflect the real facts of economic life. The existence of these boundaries creates accounting paradoxes, i.e. situations in which accounting information about the financial condition of an organization does not fit within the framework of ordinary economic logic.

The concept of “accounting paradox” was first introduced into practice by Professor Ya.V. Sokolov. In his book “Fundamentals of Accounting Theory”, published in 2000 (Moscow, Publishing House “Finance and Statistics”). I'M IN. Sokolov identifies 12 main paradoxes of accounting information:

- “There is profit, but no money”;

- “There is money, but no profit”;

- “The property mass (asset) has changed, but the profit has not”;

- “The profit has changed, but the property mass represented in the asset has not”;

- “A real loss is received - profit is shown in accounting”;

- “The same amount can act either as income or as an expense”;

- “The same object can be classified as both fixed and working capital”;

- “The accounting balance is not equal to the actual balance”;

- “Accounting cannot be understood from itself”;

- “The amount of the enterprise’s funds is not equal to their total value”;

- “Profit calculated for the entire existence of the company (from its founding to liquidation) cannot be equal to the amount of profits calculated for each reporting period”;

- “Accounting statements reflect the facts of economic life that took place in the past, but the point of reporting is to enable potential users to make decisions for the future.”*

*Note: see Sokolov Y.V. Fundamentals of accounting theory - M.: Finance and Statistics, 2000, p.s. 66-77.

Understanding these paradoxes underlies the understanding of accounting information itself, i.e. at the basis of the analysis of the organization's reporting.

The legal content of accounting business transactions makes necessary, among other things, the legal interpretation of accounting paradoxes. Such an interpretation is necessary in the case when any legal basis is chosen as the mentioned convention taken as the basis of the accounting methodology.

An example characterizing the paradox “there is profit, but no money” is the situation when “a company sold goods or provided services, but did not receive money.” In this case, the balance sheet will show profit, but the company will not be able to pay off its debts.

We invite you to familiarize yourself with the return of alimony when challenging paternity, the judicial practice of returning overpaid alimony

This paradox of accounting information is due to the choice as a criterion for recognizing in the accounting of income and expenses the obligations of, respectively, the organization's counterparties (accounts receivable from customers in this case are treated as income) and the organization's obligations to counterparties (accounts payable to suppliers are treated as an expense).

Thus, income and expenses are reflected in accounting based not on the actual movement of money and/or other property received (transferred) to pay off debts, but based solely on the dynamics of the rights and obligations of the organization.

This provision is clearly formulated in the definition of the principle of temporary certainty of the facts of economic life, given by the current regulatory documents. According to this principle, “the facts of the organization’s economic activities relate to the reporting period in which they occurred, regardless of the actual time of receipt and payment of funds associated with these facts” (clause 6 of PBU 1/98 “Accounting Policies of the Organization”, approved By Order of the Ministry of Finance of Russia dated December 9, 1998 No. 60n).

The time lag that occurs between the moment the obligation arises and the moment it is fulfilled, even assuming that the obligation will be properly fulfilled, creates a situation where the accounts show receivables from the buyer and profit from sales in the absence of funds to pay off current debts.

This same time interval between the fact of the occurrence of an obligation and the fact of its fulfillment explains the existence of the reverse paradox “there is money, but no profit.”

Paradox 1. The emergence of an obligation to counterparties does not always entail the occurrence of expenses.

Example

Debit 51 Credit 66 (67) short-term (long-term) loan received

The organization has an obligation - accounts payable to the bank to repay the loan received (liability). At the same time, receiving a sum of cash (an asset) on credit can hardly be considered an expense of the enterprise. Moreover, for example, within the framework of the interpretation of the balance sheet asset by International Accounting Standards, the money shown in the asset is deferred income - income from the economic exploitation of money itself or funds purchased with it.

Thus, in the interpretation of international standards, the paradox “the enterprise has an obligation, but there is no expense” is transformed into the paradox “the emergence of an enterprise’s obligation today means an increase in its future income.”

Paradox 2: The opposite situation - the emergence of an obligation of counterparties to an enterprise does not always mean the receipt of income or “there is an obligation of counterparties to the enterprise, but there is no income.”

Example

Debit 60 Credit 51 advance payment to supplier

The fact that the supplier's receivables have arisen will be reflected in the debit of account 60. However, the appearance of the supplier's debt in this case will not at all mean the occurrence of income. On the contrary, the transfer of money is an expense of the buyer enterprise, and recording receivables in an asset is one of the options for accounting for expenses.

The next group of paradoxes in the content of accounting information - the paradoxes of the connection between the volume of property mass and profit - also has an explanation from the point of view of the law of obligations.

As Ya. V. Sokolov writes, common sense dictates that the growth of an asset means an increase in wealth, and an increase in wealth means profit. However, in accounting there may be cases when the property mass can grow without affecting profit*.

*Note: Sokolov Y.V. Fundamentals of accounting theory - M.: Finance and Statistics, 2000 p. 67.

Most of the variants of this paradox are explained by the method of recognizing in accounting the facts of the occurrence of a company's obligation. Let's consider the effect of this paradox. For example, valuables were received that were not paid for. This means that the property mass (asset) has increased due to raised funds (accounts payable). In this case, the valuables accounts are debited and the creditors' accounts are credited accordingly.

In this case, as a criterion for recording expenses subject to capitalization, we choose the fact of the occurrence of an obligation, the repayment of which, frankly speaking, can justify the capitalization of this amount, i.e. its reflection in the asset. This significantly expands the information boundaries of accounting, increasing the length of the time component of its data, at the same time stipulating the existence of the considered paradox.

Paradox 4 - “Profit has changed - the property mass represented in the asset is not” is explained in the interpretation of the value of the organization’s own sources of funds as a current accounting estimate of the organization’s potential debt to its owners for the distribution of profit and/or property of the organization upon the exit of the owner or liquidation of a legal entity .

Debit 84 Credit 75 accrued debt on payment of income.

The emergence of liabilities does not mean their repayment, which reduces the balance sheet asset. Hence the existence of a paradox: profit has changed, but the property mass has not.

Paradox 8 “The accounting balance is not equal to the actual balance” is explained by the adopted mechanism for reflecting the real facts of economic life in accounting by taking into account information facts contained in primary documents, according to the principle of documentation.

Records reflecting the movement of the organization's property are compiled on the basis of primary accounting documents that record the occurrence of obligations of financially responsible persons as agents of the organization for the safety of the property entrusted to them, belonging to the company on the right of ownership or on the right of possession (possession and use).

Thus, the entry: Debit of the account for accounting for the relevant property (10 “Materials”, 41 “Goods”), Credit of the account for accounting for funds or settlements based on the corresponding primary document (invoice, invoice, etc.) reflects the emergence of the right of claim of the organization to the financially responsible person.

Kinds

A business transaction can affect only an asset (A), only a liability (P), or both property and sources of funds. The impact of a specific transaction on the balance sheet can be reflected in this way:

A + Expenses = Capital + Revenues + Liabilities.

Depending on changes in assets and liabilities, the following types of business transactions in accounting will be distinguished:

- changes in assets only;

- changing only liabilities;

- increasing assets and liabilities while maintaining balance;

- reducing assets and liabilities while maintaining balance.

The classification of business transactions can be conditionally presented in the form of the following equations:

A "+", A "- "; P "+", P "- "; A “+”, P “+”; A" - ", P" - ".

Let's look at them in more detail.

Recognizing types of operations

In the activities of a company that produces goods or provides services, the following processes are distinguished:

- on supply;

- on production;

- on implementation.

Each procedure includes a set of certain manipulations. In accordance with this, actions are distinguished regarding the material support of the organization, the creation of products, their sale or the provision of services.

Depending on the object that is exposed, manipulations in household activities are also classified into:

- material - movement of inventory items;

- financial - turnover of funds;

- settlement - making settlements with partners.

Classical accounting theory identifies 4 main types of business transactions. The classification is based on the nature of the influence on the organization’s balance sheet. The impact can be expressed:

- through permutations - changes in the composition of only the asset or liability;

- through modifications - a decrease or increase in both the active and passive components.

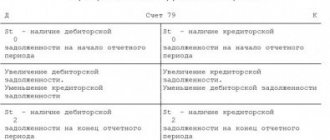

Figure 2. Based on the way they influence balance sheet items, there are 4 types of accounting transactions

A A –

A B (Dt) C1- B (Kt) C2= P,

where A is a balance sheet asset, O is turnover, Dt is debit, Kt is credit, C is account.

Posting examples:

- materials sent to production - Dt20 Kt10;

- cash withdrawal from the cash register for registration - Dt71 Kt50;

- buyers paid for the goods - Dt51 Kt60.

Situation: 10,000 rubles were withdrawn from the bank account of Brand LLC, and the cash was transferred to the company’s cash desk. The total capital value has not changed. The position “Cash account” decreased by 10,000, and the position “Cash” increased by 10,000. The accounting entry is Dt50 Kt51.

Figure 3. Example for group 1

Type II

Group II - these are events that result in changes only to items on the liability side (P) of the balance sheet. The accounting currency remains stable. The sources of accumulation of property of a business entity are transformed, but the cost of funds remains at the same level.

P P –

A = P O(Kt) C1 – O(Dt) C2.

Typical wiring:

- transfer of short-term debt to long-term - Dt66 Kt67;

- formation of a reserve fund - Dt84 Kt82;

- deductions of personal income tax from employee salaries - Dt70 Kt68.

Situation: Winter Night LLC received a loan from the bank in the amount of 20,000 rubles. Credit funds paid an advance to the supplier of raw materials in the amount of 20,000 rubles. As a result of these actions, the capital currency did not change, but the liability items - “Loans” and “Settlements with suppliers” - shifted by 20,000 rubles. respectively. The entry in the reporting is Dt60 Kt66.

Figure 4. Example for group 2

Type III

A P

A O (Dt) C1 = P O (Kt) C2.

Examples of postings for business transactions:

- wages accrued - Dt20 Kt70;

- loan received - Dt51 Kt66;

- the purchase of goods has been completed - Dt41 Kt60.

Situation: The supplier shipped goods worth 50,000 rubles to the warehouse of Lunokhod LLC. The registration of these accounting actions is Dt41 Kt60. As a result of the shipment, the currency value in the enterprise’s reporting changed: the positions “Goods” and “Settlements with counterparties” increased.

Figure 5. Example for group 3

Type IV

Type IV household transactions also change the total amount of capital. At the same time, both liabilities and assets decrease. The manipulations of this group mean that the amount of liabilities has decreased, but at the same time the company has lost part of its property.

A – P –

A – O (Dt) C1 = P – O (Kt) C2.

Examples of reporting:

- The last payment under the loan agreement was made - Dt66 Kt51;

- debt to suppliers was repaid - Dt51 Kt60;

- the receivables of the liquidated debtor company were canceled - Dt63 Kt76.

Situation: The company “New History” transferred 100,000 rubles to the bank. and thereby fully paid off the pre-signed loan agreement. This chemical equipment will be recorded in the report according to the scheme - Dt66 Kt51. As a result of these actions, the loan debt and the amount in the company’s account will decrease.

Figure 6. Example for group 4

The accounting system distinguishes 4 types of financial assets, characterized by their impact on assets and liabilities:

- A – balance sheet asset

- P – balance sheet liability

- Od – debit turnover

- Ok – loan turnover

- sch. - check

We invite you to familiarize yourself with: Commission agreement for the sale of goods

CWs can also be classified according to their essence. According to this criterion, there are 3 types of them:

- transactions with funds (cash)

- movement of inventory items (material)

- settlement transactions with counterparties (settlement)

Primary accounting documentation is classified using the same method.

First type of operations

The balance sheet of the enterprise needs to reflect the operation of the receipt of funds to the cash desk from a bank account for payment of labor. There are two asset items involved here. The item “Current account” decreased by the same amount and “Cash” increased. The balance currency has not changed. This also includes:

- receipt of funds from debtors;

- return of unused imprest amounts;

- release of materials into production;

- shipment of products to the buyer, etc.

Business transactions of the first type change the composition of property without affecting the balance sheet. They can be written in the form of the following equation:

A + X – X = P, where X is the transaction amount.

Such operations occupy a leading place in economic activity. Any production process is carried out in the presence of funds and labor itself. All these elements are in the asset.

Features of registration of postings

Recording of events in the financial and economic sphere with the help of corresponding accounts is carried out in the form of accounting entries. Manipulations affect the assets and liabilities of the enterprise. The debit value demonstrates the existing property mass of the business entity, and the credit indicator shows the sources of ownership.

Figure 8. Features of accounting records

As examples, consider the following wiring:

- As a result of the transaction for the shipment of goods, an amount of 7,600 rubles was received into the account of Radif OJSC. This operation is reflected by the posting: Dt 51-Kt 62, the amount of XO is 7,600 rubles. The final balance sheet indicators will remain unchanged, while the value of the current account will increase by 7,600 rubles, and the “Settlements with customers” account will decrease by the same amount.

- Raw materials worth 3,800 rubles were shipped to warehouse storage at Radif OJSC. This operation caused an adjustment to the balance sheet totals with the following posting: Dt 41-Kt 60, amount - 3,800 rubles.

- If, based on the results of production activities, the company made a profit and management needs to determine interest in the amount of 15,600 rubles, then the financial statement will be recorded by posting: Dt 84-Kt 75, amount 15,600 rubles. The changes will affect the liability, but the total values will remain the same.

- OJSC Radif paid the supplier for raw materials, the transaction amount was 5,400 rubles. A posting is created: Dt 60-Kt 51, amount 5,400 rubles.

Depending on the interaction of assets and sources, there are 4 types of operations.

- Active - affect the composition of funds, i.e., the balance sheet asset, without affecting the results. These include actions to use inventory items, liquidate accounts receivable, receive money from a bank account to the cash desk, issue money on account, etc.

A ΔИ – ΔИ = П, where

A - balance sheet asset;

P - passive;

ΔИ - change in property due to economic action.

- Passive operations affect the sources of formation of assets, i.e., the liability side of the balance sheet. The result is constant. Such operations include: deductions from earnings, the formation of reserves or the accrual of dividends from profits for distribution, replenishment of the authorized capital from additional funds, etc.

A = P ΔI – ΔI.

- Active-passive increasing - increase the asset, liability and currency by an identical amount. These include: repayment of debt on deposits in the authorized capital, accrual of depreciation of fixed assets, advances from buyers, receipt of borrowed funds, etc.

A ΔI = P ΔI.

- Active-passive decreasing - reduce the asset, liability and balance sheet total by the same amount. This is the payment of earnings, payment of debts to creditors.

A – ΔI = P – ΔI.

Based on bills and bank statements, 214 thousand rubles were transferred to the supplier. for the materials received. The result of the operation will be a change in two items: the asset account will decrease. 51 by 214 thousand rubles, in liabilities the account will decrease. 62 for 214 thousand rubles. The asset and liability totals changed by an equal amount. The balance identity is preserved.

Consideration of four types of business transactions led to the following conclusions:

- Each fact of activity is reflected in at least two balance sheet items;

- Changes to the asset (types 1, 2) do not change the currency of the document;

- Changes in assets and liabilities (types 3, 4) change the currency by the same amount;

- Any operations maintain equality of balance sheet totals.

Table. Examples of postings by type of operation.

| Content | Debit | deviation | Credit | deviation |

| Type 1. | ||||

| Raw materials transferred to production | 20 | 10 | — | |

| Payment received from buyer | 51 | 60 | — | |

| Received money in cash | 50 | 51 | — | |

| Type 2. | ||||

| Personal income tax withheld from salary | 70 | — | 68 | |

| The reserve is replenished from profits to be distributed | 84 | — | 82 | |

| Advance paid to supplier using borrowed funds | 60 | — | 66 | |

| Type 3. | ||||

| Received materials from supplier | 10 | 60 | ||

| Salary accrued | 20 | 70 | ||

| The loan amount has been credited to the account | 51 | 66 | ||

| Type 4. | ||||

| Loan repaid | 66 | — | 51 | — |

| Employees' salaries transferred | 70 | — | 51 | — |

| Payment has been made to the supplier for the goods | 51 | — | 60 | — |

Each production action must be documented. Changes arising from the operation are of a dual nature and occur in two interrelated accounting objects. A characteristic feature of the operation is that it is shown on the accounts twice: in debit and credit. This relationship represents the correspondence of accounts.

Transactions are reflected on accounts at the time of their occurrence, i.e., as they are completed. Double entry reveals the opposite nature of the asset and liability accounts, linking them to the form of the balance sheet. On the left they reflect the balances of the property (debit), on the right - the sources of its appearance (credit).

Correspondent accounts and balance form a single system, connected by double entry, which is based on three principles: (click to expand)

- Duality of reflection;

- Fixation of amounts for Dt and Ct accounts;

- In both accounts, changes are shown in the same amount.

Contents of the operation: materials worth 85 thousand rubles were received from the supplier.

The changes affected two accounts: account. 10 — balances of inventory items and invoices increased. 60 - the debt to the supplier has increased.

We suggest you read: Accounting for legal expenses in accounting

Account 10 - active, takes into account assets, growth is put in Dt;

Account 60 - passive, height - according to Kt.

The increase in assets and liabilities corresponds to operations of the third type. The posting is written as follows: Dt 10 Kt 60.

Second type of operations

The enterprise’s balance sheet must reflect the operation to repay the supplier’s debt through a bank loan in the amount of 20 million rubles.

There are two passive clauses affected here. The organization's debt to the bank increases, and debt to suppliers decreases. The balance currency remains unchanged. Similar operations include withholding taxes, directing profits to a reserve fund, writing off part of future income as profit, etc.

These types of business transactions in accounting affect only the sources of property formation. They can be written in the form of the following equation:

A= P + X – X.

Relationship between accounting principles and legal standards

Let us consider, as an example, the list of business operations of an enterprise engaged in the assembly and sale of wristwatches. In April, a batch of goods was assembled: the cost of components was 284,000 rubles, wages for assemblers were 110,000 rubles. The product was sold for RUB 655,018. (including VAT RUB 99,918).

| № | Contents of a business transaction | Sum | D-t | Kit |

| 1. | Components are written off for production | 284 000 | 20 | 10 |

| 2. | Payments to production employees were accrued | 110 000 | 20 | 70 |

| 3. | Insurance premiums accrued | 33 220 | 20 | 69 (according to subaccounts) |

| 4. | The cost of a batch of watches has been formed | 427 220 | 43 | 20 |

| 5. | Personal income tax withheld from salary | 14 300 | 70 | 68-1 “NDFL” |

| 6. | Transferred to the personal income tax budget | 14 300 | 68-1 “NDFL” | 51 |

| 7. | Insurance premiums transferred to the budget | 33 220 | 69 (according to subaccounts) | 51 |

| 8. | Salaries issued from the cash register | 95 700 | 70 | 50 |

| 9. | A batch of goods has been sold | 655 018 | 62 | 90-1 “Revenue” |

| 10. | The cost of the sold batch was written off | 427 220 | 90-2 “Cost” | 43 |

| 11. | VAT charged | 99 918 | 90-3 "VAT" | 68-2 "VAT" |

Transactions No. 1 and 5 are examples of types I and II - they will lead to changes in assets and liabilities, but will not affect the balance sheet currency. Transactions No. 2, 3, 6, 7 are an example of accounts that affect the total balance sheet of the enterprise.

Knowing the rules of the law will allow you not only to navigate the current legislation, but also to calmly perceive and, most importantly, understand its possible future changes. This is especially relevant now, when accounting legislation is changing dramatically due to Russia's transition to International Accounting Standards.

Both the accounting procedure, normatively determined by current legislation, and the rules for analyzing accounting information contained in the reporting of organizations are based on the basic principles of accounting. From the moment the accounting principles enshrined in International Standards entered Russian accounting legislation, their content began to determine the accounting methodology prescribed by regulatory documents. In this regard, understanding these principles becomes very important from the perspective of accounting practice.

Accounting principles are very significantly related to legal rules. A number of accounting principles are directly borrowed by accounting from jurisprudence. Here we have tried to reveal the legal content of the basic principles of accounting and show the influence of specific legislative norms on the practical meaning of accounting principles.

The last accounting category, the legal meaning of which we tried to reveal in this section, is the paradoxes of accounting information. This is a very important category from the standpoint of financial reporting analysis. The specificity of accounting is that it uses terms, concepts and categories, approaches to assessing business facts, their interpretation and ways of presenting a picture of the financial position of an organization that are not entirely familiar and understandable to a person not directly involved in accounting.

Also, this state of affairs creates a situation where accounting data, which is simply understandable to an accountant, becomes an absolute mystery to non-accountants, i.e. people for whom the accounting information itself is intended. They, external and internal users of financial statements, often do not understand why “the organization has a profit, but has nothing to pay for its obligations”, “the property mass is growing, but the profit does not change”, etc.

At the same time, explaining such “paradoxes” is not an easy task, both for users and for accountants themselves. The latter, understanding what they are doing, very often cannot tell others about it, i.e. cannot “translate” from “accounting” language into the language of an economist, lawyer, marketing director, etc.

And since the content of such accounting paradoxes is also largely explained by the influence on the accounting methodology of legal norms relating to reflected business transactions, we will devote a separate paragraph of this section to disclosing the legal content of the main paradoxes of accounting information.

The task of accounting is to generate information about the financial condition of an organization. The financial position of a company is multifaceted, and information about each economic fact can be presented from different points of view. The main “information sections” of accounting data are the economic and legal content of the reflected facts.

For example, if, to a very first approximation, we consider one of the most common situations in economic life - the receipt of property from suppliers to an enterprise, then we will get the following.

From an economic point of view, the receipt of property by an enterprise means an increase in the volume of funds of the company, an increase in its production capacity, and profitability potential. The emergence of debt to suppliers means an increase in the volume of credit to the enterprise from suppliers. Any debt of a company from the moment it is incurred to the moment it is repaid actually represents a loan received by the organization.

Indeed, for example, a company receives from a supplier goods purchased on the basis of their subsequent payment. An account payable arises to the supplier, and for a certain period of time this account payable is not repaid. This means that during the time from the moment the debt arises until the moment it is repaid, the company, on the one hand, already uses the values received from the supplier in business activities, and, on the other hand, without paying money to the supplier, also uses them in circulation, earning additional profit. Consequently, during this period the enterprise uses double the amount of funds, which is ensured by the loan provided by the supplier.

Based on the economic interpretation of assets and liabilities carried out by International Financial Reporting Standards, the fact of the occurrence of accounts payable to the supplier as future cash payments is a future expense of the company. In fact, as unexpected as it sounds in comparison with the usual domestic terminology, in the interpretation of international standards, accounts payable are expenses of future periods.

Unlike economics, from a legal point of view, the meaning of business transactions is determined by the action of legal norms in relation to them. Here, first of all, the definition and characterization of the rights of the enterprise regarding the received property and its obligations to the supplier of goods is important. The rights arising from the enterprise-buyer in relation to received goods are defined in civil law as property rights.

We invite you to familiarize yourself with Dismissal of a manager or director during liquidation of an enterprise - Labor assistance

The buyer's debt to pay for goods received from the supplier already falls within the scope of the law of obligations.

The division of rights into real and obligatory is traditional for Russian civil legislation, in which the rights regarding the property that serves as the subject of the contract belong to the category of real, and the rights of the parties to the contract to the actions of the counterparty in the transaction belong to the sphere of obligatory law.

The practice of civil law regulation of business transactions for the conclusion and execution of the supply agreement considered in our example is determined by the norms of the Civil Code of the Russian Federation. According to Art. 223 and 454 of the Civil Code of the Russian Federation with the receipt of property under a supply agreement from the purchasing enterprise, depending on the terms of the agreement established by the parties on the moment of transfer of ownership of the goods, the following arises:

- right of ownership of the received goods - if upon receipt of the goods before the moment established by the contract, the ownership of them remains with the seller;

- ownership of the received values.

The buyer's obligation to pay for the purchased goods arising from the contract is transformed into an unconditional debt to pay for the goods - accounts payable in the accounting sense of the term. Moreover, if upon receipt of goods, ownership of them remains with the supplier, in addition to the obligation to pay, an obligation arises for the buyer (as the owner of the goods) to the supplier (as their owner) to ensure the safety of the valuables until the acquisition of ownership of them.

When reflecting specific business transactions in accounting, the procedure for recording them in accounts is determined by regulatory documents related to accounting legislation. In accounting regulations, in each case, the prescribed methodology can be based on either an economic or legal interpretation of the transaction.

This applies both to the procedure for reflecting specific business facts in accounting, and to general categories of accounting. So, for example, from an economic point of view, an asset is property that is under the control of an enterprise and generates income for it. It is precisely this (economic) interpretation of the concept of “asset” that is currently accepted by International Financial Reporting Standards.

Note: International Financial Reporting Standards - M-: ASKERI - ACCA, 1998, p. 43.

As noted in IFRS, the future economic benefit embodied in an asset is the potential that will flow directly or indirectly into the company's cash or cash equivalents flow. The potential can be productive, i.e. be part of the company's operating activities. It may also take the form of convertibility into cash or cash equivalents, or the ability to reduce cash balances, such as an alternative production process reduces production costs.

Note: International Financial Reporting Standards - M-: ASKERI - ACCA, 1998, p. 44.

Examples of active operations

The cash desk received funds in the amount of 150 thousand rubles from the current account. As a result of this operation, the balance in the bank account (KT51) decreases and the balance in the cash register increases (DT50). Accounting entries for business transactions: DT50 KT51 – 150 thousand rubles.

The balance before the transaction is presented in the table below.

| Assets | Thousand rub. | Passive | Thousand rub. |

| OS | 40 | UK | 150 |

| Materials | 14 | Settlements with creditors | 40 |

| Cash register | 17 | Debt to the budget | 10 |

| Checking account | 150 | Wage arrears | 36 |

| Settlements with debtors | 19 | Bank loans | 4 |

| TOTAL | 240 | TOTAL | 240 |

The balance after the transaction is presented in the table below.

| Assets | Thousand rub. | Passive | Thousand rub. |

| OS | 40 | UK | 150 |

| Materials | 14 | Settlements with creditors | 40 |

| Cash register | 167 | Debt to the budget | 10 |

| Checking account | 0 | Wage arrears | 36 |

| Settlements with debtors | 19 | Bank loans | 4 |

| TOTAL | 240 | TOTAL | 240 |

Basic balance postings

In the course of the enterprise’s activities, 3 processes can be distinguished, which are taken into account by separate operations: (click to expand)

- Supply - takes into account the receipt of goods and materials from third-party companies, repayment of transport and procurement costs.

- Production - inventory items are released into production, wages and taxes are calculated.

- Sales - the revenue received from the sale of goods (provision of services) to counterparties is recorded, the corresponding costs are written off, and profit is determined.

Postings for some business activities are presented in the table.

| Debit | Credit | Content |

| Wage | ||

| 20 (25) | 70 | Salaries accrued to the main workers (administration) |

| 70 | 68 | Personal income tax withheld from employees' earnings |

| 76 | Child support withheld from salary | |

| 50, 51 | Salary paid | |

| 20 (25) | 69 | Contributions to extra-budgetary funds accrued |

| 68, (69) | 51 | Personal income tax (insurance contributions) transferred |

| Cash desk and bank | ||

| 50 | 51, (52) | Money has been received from the account to the cashier |

| 62 | Advance received from buyer | |

| 70 | Refund of excess amounts paid for salaries | |

| 71 | Return of the balance of accountable money | |

| 75 | Contribution to the authorized capital has been received | |

| 70 | 50 | Salary paid |

| 71 | Money was issued for reporting | |

| 94 | The lack of money in the cash register has been taken into account | |

| 73 | A loan was issued to an employee | |

| 51 | Proceeds handed over to the bank | |

| 51 | 62, (76) | Paid for goods by buyer (debtor) |

| 66, 67 | Loan received | |

| 75 | 51 | Dividends paid |

| 60 | Money was transferred to the supplier for the goods | |

| 66, 67 | Loan interest paid off | |

| 81 | Shares purchased | |

| 91.2 | Payment to the bank for cash management services | |

| Fixed assets (FPE) and intangible assets (IMA) | ||

| 08 | 60, 71, 75, 76 | Received OS (intangible assets) |

| 01, (04) | 08 | Assets were accepted for accounting (intangible assets were put into operation) |

| 20, 23, 25, 26, 44 | 02, (05) | Accrued depreciation on fixed assets (intangible assets) |

| Inventories | ||

| 10, (11) | 60, 75, 76 | Received MPZ (animals) |

| 20, 23, 29 | Production waste has arrived | |

| 20, 23, 25, 26, 44 | 10 | MPZ written off |

| 90, 91 | MPZ sold | |

| 08 | 11 | Young cattle were transferred to the main herd |

| 20, 23, 29 | Costs of slaughtering animals are taken into account | |

| Expenses | ||

| 20 | 23, 25, 26, (28) | The costs of other production (losses from defects) are distributed among the main products |

| 21 | Own semi-finished products were released into production for processing | |

| 20, 23, 25, 26, 44 | 60, 76 | Works (services) of third-party organizations are reflected |

| 68, 69, 70 | Taxes and salaries accrued | |

| 21 | 20 | Semi-finished products (own) are taken into account |

| 90 | 44 | Sales expenses are written off to the cost of products sold |

| Calculations | ||

| 62 | 90 | Products sold |

| 20, 25, 44 | 66, 67 | Interest accrued on the loan |

| 10, 20, 41 | 71 | Accountable amount spent |

| 73 | 94 | The shortage is attributed to the culprit |

| 75 | 80 | Authorized fund accrued |

| 10, 51, 50,11, 41 | 75 | Funds contributed to the contribution to the authorized capital |

| Capital | ||

| 81 | 50, 51 | Securities purchased |

| 84, 75 | 82 | The reserve fund has been replenished |

| 82 | 84 | Losses are covered using reserve capital funds |

| 75 | 83 | Increased price of securities |

| 75 | 80 | Authorized fund accrued |

| 83 | 75 | Additional capital is distributed among the participants of the JSC |

| 50, 51 | 86 | Special-purpose financing |

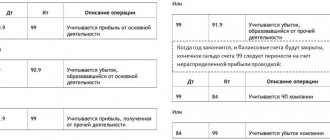

| Financial results | ||

| 90 | 10, 21, 41, 43 | The cost of inventory items is written off |

| 62 | 90 | Sales revenue taken into account |

| 90 | 68 | VAT charged on products sold |

| 20, (44) | Actual sales expenses are written off (cost of sales) | |

| 99 | Sales profit taken into account | |

| 40 | The deviation of the actual cost from the planned cost is reflected | |

| 99 | 90 | Loss on sales by main activities |

| 91.2 | 10 | Spare parts written off for repairs |

| 03 | The value of property leased is written off | |

| 20 | Main production services written off | |

| 94 | Shortage written off (no culprit) | |

| 99 | Profit from sales written off | |

| 99 | 91.2 | Other expenses written off at the end of the year |

| 10 | Spare parts from car disassembly are taken into account | |

| 20, 23, 91 | 96 | A reserve has been created for future expenses |

| 99 | 68 | Profit tax accrued |

| 84 | 99 | Uncovered loss identified |

| 99 | 84 | The final result of the work is reflected - profit |

We invite you to familiarize yourself with: Tax accounting for purchase expenses

Examples of passive operations

Personal income tax was withheld from wages in the amount of 20 thousand rubles. This business operation leads to a reduction in the enterprise’s debt to personnel (KT68). At the same time, the debt to the budget increases (DT70). Wiring: DT70 KT68 – 20 thousand rubles.

The balance before the transaction is presented in the table below.

| Assets | Thousand rub. | Passive | Thousand rub. |

| OS | 40 | UK | 150 |

| Materials | 14 | Settlements with creditors | 40 |

| Cash register | 17 | Debt to the budget | 10 |

| Checking account | 150 | Wage arrears | 36 |

| Settlements with debtors | 19 | Bank loans | 4 |

| TOTAL | 240 | TOTAL | 240 |

The balance after the transaction is presented in the table below.

| Assets | Thousand rub. | Passive | Thousand rub. |

| OS | 40 | UK | 150 |

| Materials | 14 | Settlements with creditors | 40 |

| Cash register | 167 | Debt to the budget | 30 |

| Checking account | 0 | Wage arrears | 16 |

| Settlements with debtors | 19 | Bank loans | 4 |

| TOTAL | 240 | TOTAL | 240 |

Examples of active-passive operations

Third type. The warehouse received materials from the supplier in the amount of 320 thousand rubles. for an unpaid invoice. The operation affects the asset and liability:

- materials in the warehouse increase: KT10 +320 thousand rubles.

- accounting of settlements with suppliers and contractors: KT60 +320 thousand rubles.

Wiring: DT10 KT60 – 320 thousand rubles.

The balance before the transaction is presented in the table below.

| Assets | Thousand rub. | Passive | Thousand rub. |

| OS | 40 | UK | 150 |

| Materials | 14 | Settlements with creditors | 40 |

| Cash register | 17 | Debt to the budget | 10 |

| Checking account | 150 | Wage arrears | 36 |

| Settlements with debtors | 19 | Bank loans | 4 |

| TOTAL | 240 | TOTAL | 240 |

The balance after the transaction is presented in the table below.

| Assets | Thousand rub. | Passive | Thousand rub. |

| OS | 40 | UK | 150 |

| Materials | 334 | Settlements with creditors | 360 |

| Cash register | 167 | Debt to the budget | 30 |

| Checking account | 0 | Wage arrears | 16 |

| Settlements with debtors | 19 | Bank loans | 4 |

| TOTAL | 560 | TOTAL | 560 |

Fourth type. The organization repaid the debt to the supplier in the amount of 500 thousand rubles. The operation affects the asset and liability:

- accounting of settlements with suppliers and contractors: DT60 -500 thousand rubles.

- the amount of funds in the bank account decreases: DT51 -500 thousand rubles.

Wiring: DT60 KT51 – 500 thousand rubles.

The balance before the transaction is presented in the table below.

| Assets | Thousand rub. | Passive | Thousand rub. |

| OS | 40 | UK | 150 |

| Materials | 14 | Settlements with creditors | 540 |

| Cash register | 17 | Debt to the budget | 10 |

| Checking account | 650 | Wage arrears | 36 |

| Settlements with debtors | 19 | Bank loans | 4 |

| TOTAL | 740 | TOTAL | 740 |

The balance after the transaction is presented in the table below.

| Assets | Thousand rub. | Passive | Thousand rub. |

| OS | 40 | UK | 150 |

| Materials | 14 | Settlements with creditors | 40 |

| Cash register | 17 | Debt to the budget | 10 |

| Checking account | 150 | Wage arrears | 36 |

| Settlements with debtors | 19 | Bank loans | 4 |

| TOTAL | 240 | TOTAL | 240 |

In all of the above cases, the changes are equal. The balance currency is adjusted by the same amount.

Types of business transactions in accounting

We talked about the essence of double entry and the features of drawing up accounting entries in our consultation. We will tell you in this material what types of business transactions there are and how they are reflected in accounting records.

4 types of business transactions

When they talk about the types of business transactions, they mean their grouping depending on the impact on the value of assets (A) and liabilities (P) of the balance sheet.

Thus, the following four types of business transactions are distinguished:

| Type of business transactions | Impact on balance |

| I | A+ A- |

| II | P+ P- |

| III | A+ P+ |

| IV | A-P- |

Below we will explain how to determine the type of business transaction.

Type I: A+ A-

This type of business transaction involves a change in the composition or structure of balance sheet assets. As a result of this type of transaction, the balance sheet currency does not change. In other words, with the 1st type of business transactions, an asset turns into another asset.

The simplest example is withdrawing cash from a bank using a check:

Debit account 50 “Cash” - Credit account 51 “Cash accounts”

As a result of this operation, the value of assets does not change, only their structure changes: non-cash funds have decreased, cash has increased.

For this type of business transactions, examples of postings are as follows:

| Operation | Account debit | Account credit |

| Materials released into production | 20 "Main production" | 10 "Materials" |

| Fixed asset item accepted for accounting | 01 "Fixed assets" | 08 “Investments in non-current assets” |

| Interest-bearing loan provided | 58 “Financial investments” | 51 |

Type II: P+ P-

What type of business transaction is it, as a result of which the total amount of the balance sheet does not change, and changes occur only in the composition of liabilities? We are talking about the 2nd type of business transactions.

Here are typical business transactions related to this type:

| Operation | Account debit | Account credit |

| Personal income tax withheld from employee wages | 70 “Settlements with personnel for wages” | 68 “Calculations for taxes and fees” |

| Interest accrued on a short-term loan | 91 “Other income and expenses” | 66 “Settlements for short-term loans and borrowings” |

| Contributions have been made to reserve capital | 84 “Retained earnings (uncovered loss)” | 82 “Reserve capital” |

Type III: A+ P+

The third type of business transactions assumes that the balance sheet currency increases due to the fact that assets and liabilities grow.

Here are some examples for this type of business transaction:

| Operation | Account debit | Account credit |

| Products purchased | 41 "Products" | 60 “Settlements with suppliers and contractors” |

| Long-term loan received | 51 | 67 “Calculations for long-term loans and borrowings” |

| Wages accrued to employees of main production | 20 | 70 |

Type IV: A-P-

If, as a result of business transactions, the assets and liabilities of the balance sheet decrease, we speak of the 4th type of operations:

The importance of balance

It is important to comply with all of the above requirements when drawing up a balance sheet. It clearly reflects the financial condition of the organization, shows who invested the funds, how they were allocated and how the loans were secured. By analyzing the balance sheet over several periods, you can imagine the dynamics of the organization’s development and determine whether resources are being used rationally. The presence of a correctly compiled report allows the manager to think about all the consequences of the organization’s activities, consciously manage the economy, and search for internal reserves.

As a reporting document, the balance sheet contains important information. The organization reports to them to governing bodies, tax administration, statistics, and credit institutions. Based on the information in the balance sheet and other reporting forms, the net profit indicator is calculated, the amount of taxes, mandatory contributions and payments is established.

The balance sheet in scientific research is a summary of accurate, systematized data on the property status, economic activity, statics and dynamics of individual farms. Without a comprehensive study and careful study of such reports, it is impossible to practically work out effective ways to develop and boost the economy of the country in general and a specific organization in particular.