When a person begins to think about his own business, the first question that arises is where to get the money to open an individual entrepreneur. Often, the main options are bank loans and searching for investors, but few people know that the employment center also provides assistance in opening individual entrepreneurs to beginning entrepreneurs and gives them a subsidy. Opening an individual entrepreneur through an employment center requires careful preparation of a business plan - success in obtaining start-up capital from the state depends on it.

To receive financial assistance for aspiring entrepreneurs, a future businessman must be an unemployed citizen of Russia, be at least 18 years old and register with the labor exchange as an applicant. Registration at the employment center, in addition to the possibility of receiving a subsidy, is no less useful, since applicants who have registered for employment are offered a large number of business courses that will help to obtain more detailed information regarding entrepreneurial activity. The labor exchange staff also has specialists who can help future entrepreneurs draw up a business plan.

Help from employment centers for aspiring businessmen

Opening an individual entrepreneur through the employment center does not happen directly. Here they provide, first of all, informational assistance. Representatives of the centers will introduce future businessmen to the documents regulating the activities of entrepreneurs and the implementation of business support programs that operate in the region.

If necessary, they will be sent for training in the basics of entrepreneurship. Currently, many seminars and courses on organizing activities, maintaining documentation, accounting reports, and calculating taxes are held for beginning entrepreneurs. Employment centers also provide financial assistance in the form of a subsidy, which is allocated for starting a business.

The video describes how to receive subsidies from the state.

Conditions for receiving assistance

- the business opened with the funds received must exist for at least 1-3 years,

- all funds received have a designated purpose - for no other purpose than financing the agreed business activity;

- complete absence of debt obligations (including deferments) for taxes and social payments;

- strict adherence to the contractual organization of workplaces.

Receiving assistance under the state program for supporting SMEs by a person registered with the Central Employment Center as an unemployed person is a rather lengthy and labor-intensive process, but quite accessible. Subject to all conditions, rules and regulations of the law, any citizen who finds himself in a difficult situation and left without a livelihood has the opportunity to open his own business and achieve a stable and good income.

How to get a subsidy?

If the employment center has not found a suitable vacancy for you to work at the enterprise and you decide to start a business, you have the right to apply for a subsidy.

To receive a subsidy, certain conditions must be met:

- Register with the employment center as unemployed

- Register an individual entrepreneur

- Develop a business plan and submit it for consideration by an expert commission

How much does a Zara franchise cost? You can read the details in the article. How to calculate UTII for a quarter? The answer is contained in the article.

Interested in purchasing a Perekrestok Express franchise? For more information, we recommend following the link.

The state provides for the payment of a one-time subsidy for the development of one’s own business in the amount of 12 monthly unemployment benefits. At the moment, its maximum value is 4900 rubles, which means the total payment amount will be 58.8 thousand rubles.

Having calculated this, you need to decide whether these funds will be enough, what they can be invested in and whether an additional source of financing is needed.

Algorithm for receiving compensation or subsidies

How to get a subsidy and/or compensation for opening an individual entrepreneur through the Employment Center? The algorithm is approximately the same for all regions, but it is possible that yours has some peculiarities.

Step 1. Get information

Before you begin the process, it is wise to find out first-hand what you can expect. It is better to obtain information directly from the office or on the website of the Central Tax Office of your region. As we have already noted, in most cases this is only compensation for the costs of starting a business. For example, in Moscow, the maximum payment that can be received when opening an individual entrepreneur is 10,200 rubles.

However, this does not mean that all the money will be handed out. The state only compensates for expenses confirmed by documents, namely:

- to pay the state fee (800 rubles for registering an individual entrepreneur or 4,000 rubles for opening an LLC);

- to pay for notary services (for example, to certify an application for registration, to issue a power of attorney);

- for printing;

- to purchase the necessary forms.

But if you do everything yourself, the costs of organizing an individual entrepreneur consist of paying a fee and amount to only 800 rubles. It is up to the future entrepreneur to decide whether it is worth registering with the CZN because of such compensation or not.

Step 2. Check yourself according to the criteria

Assistance in opening an individual entrepreneur from the Employment Center is provided only to those who need it. Therefore, before contacting the central bank, you need to check whether you can count on money from the budget. The conditions are:

- the applicant is over 16 years of age;

- he is able to work;

- he has no salary or other income;

- he is not a pensioner;

- he is not a full-time student, including in the direction of Central Education.

Step 3. Becoming unemployed

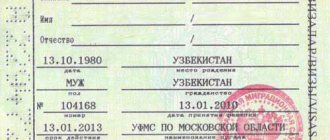

Before receiving a subsidy or compensation for an individual entrepreneur, you need to register with the Employment Center as an unemployed person. To do this, you should bring the following documents to your local office:

- passport;

- work book (for those who have already started working);

- diploma or other document confirming education;

- certificate of average earnings for the last 3 months;

- if the applicant belongs to the low-mobility category of citizens - a rehabilitation program for a disabled person.

The central control center will consider the application within 10 days. After this, the future entrepreneur will receive unemployed status.

Step 4. Learn the basics of business

The employment center may offer a future individual entrepreneur to take short courses in entrepreneurship. They will provide basic information that should help you create a business plan. A small fee may apply for courses. However, they are mandatory only for those who count on a subsidy (if it is allocated in your region).

Step 5. Compose and protect a business plan

To receive a subsidy for the development of your business, you need to prepare and defend a business plan. It should describe the business model in detail, contain calculations of profit indicators, payback, and others. It’s good if the business brings benefit to society, and not just income to the entrepreneur - then officials will be more willing to allocate money. It is important to think about the upcoming expenses and highlight those for which you plan to use funds received from the budget.

The business plan is submitted to the Central Planning Commission, after which officials will study it for 10 days. As a result, the businessman will be invited to a commission, where he will have to defend his project and show that he is worthy of government money. If the outcome is good, the commission will decide to allocate a subsidy.

Refusals also happen, and there are reasons for this. Much depends on the competition between applicants for budget funds, the social utility of the project, and the quality of the business plan. If your region no longer provides subsidies for business development, most likely, a business plan will not be needed. However, you can find out exactly this in your Employment Center.

Step 6. We conclude an agreement with the central control center

Until this moment, all interaction with the Employment Center was carried out by a citizen without individual entrepreneur status. This is fundamentally important, because if you first register as an entrepreneur and then ask for help from the Central Tax Office, there will be no compensation for expenses.

Now it's time to register as an entrepreneur. To do this, you first need to conclude an agreement with the Employment Center. What follows is the usual process of registering an individual entrepreneur. The citizen brings to the registering Federal Tax Service:

- passport;

- a completed but unsigned application on form P21001;

- receipt for payment of the duty of 800 rubles.

In just 3 working days from the date of receipt of documents, individual entrepreneur status will be received. Then you can order a seal, if needed, and open a current account.

Step 7. Get money

When registering an individual entrepreneur, you need to collect all documents that would confirm expenses. This is, at a minimum, a receipt for payment of the duty. If you ordered a print, there must be a receipt and an act of service. These documents are needed in order for the central control center to compensate the individual entrepreneur for expenses.

To receive money, the entrepreneur must have an open card of the Mir payment system - budget funds can only be transferred to it. The amount of the subsidy and/or reimbursement of costs will be credited to the card within 10 days.

Step 8. Use the funds and report

The subsidy received when opening an individual entrepreneur must be spent within 90 days and reported about it within the same period. Changing the direction of financing is unacceptable! That is, if money was received for the purchase of equipment, materials cannot be purchased with it. It is necessary to save all documents (agreements, acts, checks, payments) confirming the intended use of funds. They are provided to the central control center within the specified period.

Center specialists will check how the funds were spent. If there is no documentary evidence of expenses, or the money was not used for allocated purposes, expenses may not be recognized. Then the money will have to be returned to the budget.

How to obtain unemployed status?

To register, you must be officially recognized as not working, that is, unemployed. This category of citizens cannot include pensioners, full-time students, teenagers under 16 years of age, and women on maternity leave. Citizens working under a contract also cannot be registered.

If within 10 days from the date of registration you twice refused the offered vacancies, you cannot count on the support of the center and receiving benefits.

Registered individual entrepreneurs, disabled people from a non-working group, and persons who have provided false information about themselves cannot be classified as unemployed. If a person, being in the status of unemployed, has not worked for a long time or has been in prison, then he is not entitled to support from the center.

To register at the employment center, you will be required to have the following documents: passport, education document, work record book, pension insurance certificate, certificate of average salary for 3 months from your last place of work, provide your individual taxpayer number (TIN).

After registration, you are officially recognized as unemployed and from the center’s specialists you receive recommendations for employment in enterprises. If, after three months, interviews with the management of organizations do not give a positive result and you cannot find a job, then you have the right to contact the employment center with an application to open your own business and apply for a subsidy.

Who can receive a subsidy for starting a business from the Central Bank

A person who applies to the Center for assistance in developing entrepreneurial activity must meet the following criteria:

- be a citizen of the Russian Federation and have a passport;

- be an adult, have reached the age of eighteen, have full legal capacity and legal capacity;

- be registered with your regional branch of the Employment Center and have unemployed status;

- the time for assigning the specified status must be at least 30 days, and during this time a suitable job was not selected.

For whom the opportunity to receive a state subsidy from the Central Employment Center is not available:

- persons who are minors,

- full-time students,

- citizens who have retired due to age,

- persons who have certain restrictions by court verdict,

- persons dismissed from their previous place of employment in court,

- if the dismissal of a citizen from his previous place of work was a measure of disciplinary or other punishment for systematic violation of the labor discipline of the enterprise,

- if the citizen who submitted the application for assistance has already closed his business activity less than six months before the application,

- unemployed people who violate the accepted norms and internal regulations of the territorial employment center, do not comply with the conditions for having unemployed status, ignore the measures proposed by the employment center (fail to show up for interviews, do not pass tests, and do not perform other job search activities).

Before submitting the corresponding application, it is necessary to check compliance with the specified categories of unemployed.

How to open an individual entrepreneur?

The center’s specialists will provide you with enough information about the procedure for opening a case, but on this issue it is better for you to contact the tax office. Here you will be given a list of documents required to obtain a certificate of an individual entrepreneur. The next stage is a meeting with a bank representative. To work, you need to open a bank account, as you will have to make non-cash payments.

While documents are being prepared at the tax office and at the bank, start drawing up a business plan.

Directions of subsidies

As a rule, funds are issued to individual entrepreneurs for the following purposes:

- acquisition of necessary equipment, materials, for example, acquisition of technologies, patents and other intangible assets, raw materials;

- rental or purchase of real estate, other costs.

As for the areas of subsidies, the state’s priority areas are:

- catering;

- tourism;

- hotel business;

- social sphere;

- healthcare;

- education;

- Agriculture;

- innovative technologies.

As a result, small businesses today are actively supported by the state. It is only important to know where to look for such support and where to turn for help.

What is a business plan?

A business plan is a document containing a description of your business activities. To compile it, you can use the help of the center, but you can write it yourself. The main thing is that in your own words you reflect the essence of your activity: what you are going to open, how and where your enterprise will operate. You need to analyze the market and determine how promising your company will be.

Next, describe your production process, ways to promote your enterprise, and use of advertising activities.

What documents are needed to open an individual entrepreneur? The answer is here. You can read about registering an individual entrepreneur’s seal with the tax office in the article.

How to write a bankruptcy petition for an LLC? By following the link you will find out the details.

The next question that needs to be covered is who will work at your enterprise: you yourself or will jobs be opened.

It is necessary to provide financial calculations of the activity: one-time and monthly expenses for maintaining the enterprise, production costs, payback, investments, profit volume.

Separately describe the risks that may affect your activities.

The completed business plan must be submitted to the center’s expert commission for approval.

On our website you will find other expert publications about maintaining and registering individual entrepreneurs, after reading which you can find out:

- Is an individual entrepreneur a legal entity or an individual?

- How to register with a pension fund?

- How to make a seal?

- How to register an individual entrepreneur on your own and where to get a statistics code?

- What is PBOYUL?

Types of government support

In addition to the fact that a citizen can receive funds for business activities through the employment center, he can also count on other support from the state.

As a rule, you can count on government support such as assistance:

- informational;

- financial;

- legal;

- benefits for distance education

- benefits for advertising;

- benefits for renting premises and plots.

However, the first two types of assistance are still considered the main ones.

Information

In addition to direct money, a future entrepreneur can receive advisory and informational assistance from the state. Similar support is provided to citizens through the employment center.

Accordingly, regulatory acts entrust the employment center with the obligation to provide citizens wishing to open an individual entrepreneur:

- participation in trainings on business fundamentals, thematic seminars;

- advisory services;

- participation in thematic exhibitions.

Such events help aspiring businessmen obtain all the necessary information in running a business.

Financial

In addition to the actual allocation of subsidies, the employment center provides other financial assistance. Such assistance includes benefits for renting premises, guarantee fund services, etc. Then the employment center cooperates with local authorities, which have on their balance sheet suitable premises that are state property.

Also included in the category of financial assistance is support for individual entrepreneurs by various funds, which, through partner banks, can provide loans to entrepreneurs on favorable terms, act as guarantors for them, cover part of the loans, etc.

Receiving a subsidy

Having prepared the necessary documents:

- IP certificate,

- business plan,

- Bank account number (we told you more about opening a current account for individual entrepreneurs here, and here you will learn how to withdraw money from this account).

you apply to the employment center with an application for a subsidy. Within two weeks, the requested amount will be credited to your bank account.

So, you opened an individual entrepreneur and received a subsidy. Next, your task is to manage it in accordance with the drawn up business plan, since the employment center will require strict reporting from you on the expenditure of funds.

We invite you to watch a video about how to obtain government subsidies to start a business. Enjoy watching!

Options and amount of assistance

As we have already mentioned, the subsidy for individual entrepreneurs from the Employment Center in 2016 is established by individual federal entities of the country. True, there are general areas in which you can count on receiving help. These may be the following options:

- events aimed at supporting business – 25 thousand rubles;

- opening your own business with the creation of a job (increase possible) – 60 thousand rubles;

- starting a business by a disabled or unemployed entrepreneur who is the sole guardian of a minor – 300 thousand rubles.

In addition, assistance is provided for the development of the enterprise. That is, you can purchase a franchise and organize your own business, relying on government subsidies. Moreover, both low-income people and people with some savings can apply for it. Receiving a subsidy is available to those who can justify the feasibility of opening their own business .

Creating an individual entrepreneur through the Employment Center

Before officially opening an individual enterprise, it is necessary to protect the business plan of the future enterprise in the center. After a successful defense, an agreement is concluded with the center to receive a subsidy, which serves as support for the entrepreneur at first. Now you can register a private enterprise. Initially, it is necessary to decide on the tax regime under which the registered enterprise falls. The regime depends on the type of economic activity. Most often, individual entrepreneurs use a simplified taxation system.

Initially, you need to select the main type of economic activity according to the OKVED classifier and several additional ones if necessary. The main code will be recorded first; on the basis of it, the Social Insurance Fund will calculate the amount of insurance premiums according to the class of professional risk.

Next, fill out an application (form 21001) on behalf of the person opening the individual entrepreneur. All application sheets, except Sheet B, are numbered and laced with nylon thread. The ends of the thread are brought to the last page. A paper seal is placed on top, on which the number of pages in the application is indicated and a signature is placed. The Federal Tax Service will return Sheet B to the applicant. The application is submitted to the tax authority at the place of registration of the individual entrepreneur. Then you need to pay the state fee for opening an enterprise.

5 days after submitting the application, a decision will be made to open an individual entrepreneur or a refusal will be received. If necessary, within 30 days after the opening of a state of emergency, you should submit an application to the Federal Tax Service to change the tax regime. Now you can apply for a simplified taxation system.

Documents for applying for a subsidy

The Employment Center provides assistance in registering a private enterprise in the event that an unemployed person opens it for at least 1.5 years. This is good support for a new entrepreneur. For this purpose the following documents are submitted:

- application for a subsidy;

- passport of a citizen of the Russian Federation;

- identification code;

- employment history;

- education document;

- a copy of the account opened with the bank to receive payments;

- a business plan indicating the costs of opening and running a business, economic efficiency and payback of the project being opened.