How are sick leave paid for working pensioners?

Payment for ballots for retired people is essentially no different from payment for sick leave for citizens who have not reached the retirement age limit.

A bulletin is an official confirmation of the disease of a citizen carrying out activities. Each party to a professional relationship always has the rights and obligations:

- the employer must transfer sickness benefits to the employee,

- the employee must provide the employer with a ballot.

Sick leave is the basis for legal non-presence at the place of work activity and receipt of material compensation provided for by law.

Laws of the Russian Federation 2020

- 3.1 Acceptable reasons for dismissal

Payment of sick leave for working pensioners is now of primary interest, since the conditions for providing sick leave to this category of persons are somewhat different from those that existed before the citizen entered retirement age. We’ll talk further about how sick leave is paid for working pensioners.

Order a legal consultation Lawyer's topics: Taxes and fees Labor law and social security Biography: 42 years old Place of residence - Vladikavkaz. Higher education. Jurisprudence, economics. I work as a chief accountant. Latest news: The State Duma supported the idea of benefits for employers who pay for tourist trips to their employees. The State Duma agreed with the ideas of the Federation Council on income tax benefits for employers who will pay their employees for vacations spent in Russia.

This is news to employers, for whom such preferences can be costly. The classification of tourism industry objects will be clarified. The Russian Ministry of Culture proposes to improve the classification procedure for hotels and other tourism industry objects.

Is this category of citizens entitled to sick leave?

There are no age or social status restrictions for issuing sick leave certificates. They will not be issued in the following situations:

- The working person has not been diagnosed with the disease or its symptoms.

- A person who contacts a medical professional undergoes an examination at the direction of the military commissariats.

- The citizen was arrested and taken into custody.

- The person is examined at a medical facility on a periodic basis.

- A person undergoes examination and manipulation in a clinic.

- The sheet is not issued for prosthetics in a clinic setting.

Before retirement

Before retirement, sick leave is provided if the person is officially employed. The employer pays for the time of incapacity based on transfers to the Social Insurance Fund.

After it is paid

A retired citizen is entitled to sick leave.

If a person works, then sick leave is paid, if he does not work, then he is not paid. If a person continues to work after retirement, then in case of illness his actions are as follows:

- Visit the medical facility at the place of registration.

- Write out a certificate of incapacity for work.

- Submit it on the first working day to the personnel department at the place of work.

Payment procedure and calculation of sick leave for working pensioners

The volume of state assistance in case of illness, including for working pensioners, is regulated by Federal Law No. 255-FZ dated December 29, 2006.

The form of sick leave or bulletin is regulated by order of the Ministry of Health and Social Development N 347n.

Duration of stay on sick leave

At the first visit to the doctor, a sick leave certificate is issued for ten calendar days. After this, the person must come again for examination by a medical officer. The medical employee has the right to increase the period of incapacity for work up to thirty days. All subsequent extensions are already thirty days.

Payment after dismissal

If the employment contract between a former employee and his employer is terminated, payment for the ballot after the dismissal of a citizen of retirement age is fully borne by the employer.

A legal entity pays only for the first three days of sick leave, the rest is paid from the Social Insurance Fund.

Statute of limitations for payment of sick leave

The period for payment for the newsletter by the enterprise is six months. This is provided that the pensioner no longer works at this enterprise, less than 30 calendar days have passed since the dismissal, and the citizen has not yet contacted the employment service to register.

Is sick leave paid to pensioners from January 2020?

Info

Calculation features Calculation of sick leave in 2020 is carried out according to a certain algorithm. It involves a number of successive stages:

- determination of the total income received over 2 years;

- calculation of average income for 1 day;

- accounting for the number of days on sick leave;

- application of the experience coefficient.

When calculating sick leave in 2020, the employee’s total two-year income is taken “dirty”, that is, without taking into account tax deductions and contributions to social funds. To determine the average income for 1 calendar day, the total amount of income is divided by 730 or 731 (depending on whether there was a leap year for the reporting period).

Possible difficulties when applying for sick leave

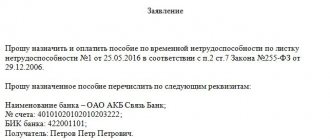

The assignment and transfer of state assistance for temporary disability occurs only after the employee submits to the employer a ballot issued in accordance with the rules of the current legislation (Federal Law of December 29, 2006 No. 255-FZ).

Main errors in ballots:

- incorrectly filled in personal data;

- Difficult to read doctor's signature, medical institution seal.

Payment of sick leave in LLC

If an employee works in a limited liability company, then in case of illness his actions are as follows:

- Visit your local hospital.

- Create a newsletter.

- Submit it on the first day of work to the human resources department at your place of work.

The first three days of an employee’s sick leave are paid at the expense of the employer, and for more than three days - at the expense of the Social Insurance Fund.

How to calculate

In order to calculate the amount that a citizen is entitled to during his illness, the salary for the previous 2 years must be divided by 730 and multiplied by a percentage, which depends on how much work experience the patient has earned. Then the resulting number must be multiplied by the number of days that the citizen spent on sick leave.

A citizen's insurance experience of less than five years will allow him to receive only 60% of his daily earnings, from 6 to 8 years of insurance experience make it possible to receive 80% of wages for one working day, and those employees who have worked for 8 years or more are entitled to 100% payment sick leave. If a pensioner was injured at work and was forced to temporarily stop working because of this, sick leave will be paid to him in the amount of 100% of his salary.

If a citizen has worked for less than six months, sick leave will be paid in accordance with the minimum daily wage, which in 2020 is 196 rubles. 11 kopecks The maximum amount that can be received while on sick leave is 1,632 rubles 87 kopecks for each day of illness.

Required data

To fully understand how much you can count on while on sick leave, you need to have the following information:

- indicate data on the salary of a citizen on sick leave for the last two years;

- the minimum wage at the time of applying for payment, a citizen of the Russian Federation;

- citizen's work experience;

- insurance experience;

- and it is also important to indicate the exact number of days spent away from work due to illness.

It is necessary to understand that insurance length does not equal working experience. What is important is not how much time the pensioner spent at work, but how much deductions were made to the social insurance fund.

Calculation of sick leave for a pensioner in 2020: rules and examples

The procedure for calculating and paying for the ballot this year:

- The average daily official income of a person is calculated. Its amount includes wages, bonuses, bonuses, fees, but does not include material assistance (benefits) of any nature.

- Correction factors are introduced. State assistance is calculated based on the average official income of the employee over the previous two years. In this case, the amount of benefits is determined based on the insurance length of the working employee:

- with work experience of up to six months, the amount of state assistance is determined based on the minimum wage;

- with experience from six months to five years - 60% of income;

- from five to eight years - 80% of income;

- more than eight years - 100% income.

- The total value is multiplied by the number of days of incapacity, including weekends and holidays.

Validity of fixed-term contracts

This type of working relationship has a clearly established time frame (for a period of up to five years under Article 59 of the Labor Code); specific terms can be found in the contract signed by the parties. Such an agreement is considered convenient for the manager, since it helps to significantly simplify the process of canceling an employment contract, does not require payment of severance pay to the employee, and can also be easily used as a means of dismissal due to age.

When applying for a job, a person wants the new working relationship to continue to last for as many years as possible. Drawing up a fixed-term contract will be a convenient method that will help get rid of an employee of retirement age. At the same time, a person will not be protected from this either at the social or at the legislative level. This type of labor relationship is permitted only if the volunteer agrees to the restrictions presented. At the same time, the manager must also understand that the illegal drawing up of a fixed-term contract can be quickly appealed in court, using Article 77 of the Labor Code of the Russian Federation as a basis for this.

If we consider the legislation of the Russian Federation, we can reveal that a pensioner employee is in no way oppressed in his rights and freedoms in comparison with other employees; he has a certain superiority, which is necessarily taken into account when dismissing. These advantages include the lack of work, as well as the opportunity to establish additional pension benefits if you have a long work history.

Are there any changes?

The procedure for calculating and paying for ballots has not changed this year. The only condition for calculation is the periods of work corresponding to 2020 (2018-2019). When applying for a new job, you must provide the employer with certificates of income and accruals from your previous place of work.

A certificate of incapacity for work is an official certificate issued in case of illness or injury, while payment for the period of non-performance of activities is carried out by the employer and the Social Insurance Fund. The ballot is sometimes given to healthy able-bodied citizens if they are forced to care for relatives, or to employees in case of expecting the birth of a child and further caring for him for the first 70 days in the case of a singleton uncomplicated pregnancy.

How long can such an employee stay on the BC?

As mentioned above, working pensioners have the same sick leave conditions as other employees. As for the question of how long a pensioner is allowed to stay on sick leave - as long as necessary.

In accordance with clause 11 of the Order of the Ministry of Health and Social Development of Russia dated January 24, 2012 No. 31n, during outpatient treatment of diseases or injuries in which the employee is temporarily unable to work, sick leave is issued by the attending physician for a period of up to 15 calendar days. After this time, the employee again undergoes a medical commission, by which decision the sick leave is extended if necessary.

While a pensioner is on sick leave, the employer does not have the right to fire him. The exception is the personal desire of the employee or recognition of him as completely disabled.

To solve your problem, contact our lawyer via online chat. #Stay home and good health to you!

Ask a Question