Example of Filling Out a Sick Leave Certificate in 2020 by an Employer According to Minimum Weight Loss for a Pilot Project

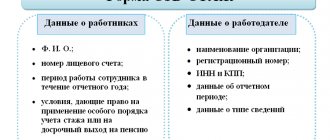

We fill in the place of work for our organization - the name of the company. It is acceptable to indicate dashes, quotation marks, the abbreviated name The FSS assigns a number to each organization immediately after the organization is registered with the tax authority. Territorial number of the FSS; INN of the disabled person (if any); Taxpayer identification number.

You should be guided, like other organizations, by the Procedure approved by Order of the Ministry of Health and Social Development dated June 29, 2011 No. 624n. The basic rules are as follows: you cannot use a ballpoint pen to fill out the form; correction is made by crossing out incorrectly filled in information and reflecting the correct entry on the back of the form.

How to reimburse maternity benefits from the Social Insurance Fund

- The employer accepts sick leave from the employee.

- Conducts all necessary calculations.

- The employer pays the benefit.

- After payment, the employer submits a report and other necessary documents to the Social Insurance Fund to reimburse the funds spent on maternity benefits.

- The fund checks the report and if everything is fine, refunds the money.

- Benefit for temporary loss of ability to work, from the fourth day of illness.

- Benefit in connection with pregnancy and childbirth.

- A one-time benefit for women who registered with a medical institution in the early stages of pregnancy.

- Monthly child care allowance.

- One-time benefit for the birth of a baby.

- Child care benefits up to one and a half years old are paid every month.

- Social benefits for funerals.

Step-by-step instructions for filling out a sick leave certificate by an employer

To calculate sickness benefits, you will need to calculate several calculations. Average earnings for calculating benefits is one of them. It is determined in total for the two calendar years preceding the year of illness. Include only those amounts from which VNIM contributions were calculated.

Registration of a paper form is becoming less relevant every day. Now a patient of a medical institution has the right to choose an electronic document. This, for example, is very convenient if an employee gets sick on a business trip or is undergoing treatment in another city.

How to fill out a sick leave certificate for an employer: sample

Paragraph 65 of the rules approved by Order No. 624n states that the use of corrective agents to cover up errors made when issuing a certificate of temporary incapacity for work for an employee is strictly prohibited. Instead, you need to turn the document over and write the correct information on the back.

We recommend reading: What bailiffs cannot describe in an apartment

The Law on Joint Stock Companies No. 208-FZ (clause 7, Article 2) and the Law on LLC No. 14-FZ (clause 5, Article 2) allow the presence of a company seal on a document confirming the employee’s temporary disability. But they affix it only if there is a seal itself. The seal should not cover the information in the cells next to it. At the same time, going beyond the designated boundaries when setting it is allowed.

Example of Filling Out a Sick Leave Certificate in 2020 by an Employer According to Minimum Weight Loss for a Pilot Project

If treatment requires a temporary break from work, such a document is issued. Not all doctors have the right to prescribe it. For example, an emergency doctor or nurse, even for a fee, will not fulfill your request, since they are not legally authorized to issue exemptions. In 2020, the validity of a sick leave certificate is determined to be 15 days, provided it is issued by the attending physician and the patient is treated on an outpatient basis.

And for each such region this coefficient is different: the minimum wage, according to the norms of Russian labor legislation, is one of the guarantees regarding wages, which is established by the state. But at the same time, this guarantee does not apply to employees working under a civil contract!

What documents are needed to get a refund for sick leave?

Accordingly, the attached package of documents submitted for financial reimbursement must contain the application itself, the previously mentioned certificate of calculation, as well as all documents on the basis of which any payments were made. Expert of the magazine “Simplified” On the basis of sick leave, benefits for temporary disability and pregnancy and childbirth are calculated. Let us immediately note that benefits are paid only if the document is submitted on time.

This is important to know: Is sick leave for pregnancy and childbirth subject to personal income tax?

Refund of money from the Social Insurance Fund for sick leave in 2020 Application to the Social Insurance Fund for overpayments received before 2020 When submitting documents for the period starting from 2020 Employer’s application for reimbursement of spent funds indicating the details of the enterprise, registration number and amount presented to the Social Insurance Fund Calculation for Form 4-FSS for the interim period Certificate-calculation Copies of documents confirming the eligibility of expenses for insured events, the amount of payments by the employer. Certificate-calculation submitted by the employer when submitting an application for reimbursement of funds, replaced the intermediate form 4-FSS. The need to draw up a certificate when contacting the regional branch of the fund is that the Social Insurance Fund does not have information on accrued and paid contributions. Starting from 2020, Form 4-FSS reporting is submitted only based on data on deductions for insurance against injuries (accidents and occupational diseases).

Instructions for filling out sick leave in 2020

The employer is required to complete the document within 10 working days after receiving it from the employee. At the same time, the legislation does not oblige the transfer of a certificate of temporary loss of ability to work to the Social Insurance Fund.

Each date of visiting a doctor with an extension of the period of loss of working capacity is entered on the form. This is a mandatory requirement. In cases where there is no space left in the columns and the employee cannot yet begin his duties, the doctor is obliged to issue an additional form.

If the Social Insurance Fund refuses payments

When preparing documents for calculating benefits to an employee by the Social Insurance Fund, you must keep in mind that an inaccuracy or error in the papers may lead to the payment being considered overpaid. If the documents are not received by the Fund at all, the employee should not hope that the benefit will be accrued to him at all.

In the event that the amount of the payment exceeds what should have actually been paid, the employer must be prepared to compensate the Fund for losses incurred due to the overpayment from its own budget.

Filling out sick leave by an employer: pilot project

- The employer can fill out a certificate of incapacity for work with a gel/capillary/fountain pen (clause 65 of the Procedure, approved by Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n). A ballpoint pen cannot be used. By the way, you can fill out a sick leave certificate on a computer. In this case, a sick leave certificate filled out partly by hand and partly on a computer will not be considered damaged (FSS Letter No. 17-03-09/06-3841P dated October 23, 2014);

- When filling out a sick leave certificate, only black ink is used;

- entries on the sick leave sheet are made in printed capital Russian letters;

- entries are made starting from the first cell of specially designated spaces (rows/graph);

- entries on the sick leave sheet should not go beyond the boundaries of the cells.

Some accountants are wondering: how to fill out a sick leave certificate (approved by Order of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011 N 347n) for a pilot project? In fact, the FSS pilot project has no effect on filling out sick leave. After all, the essence of the pilot project is that the payment of sick leave benefits, calculated from the 4th day of the employee’s illness, is made immediately by the Social Insurance Fund, and not by the employer, who then reimburses these amounts from the Fund. Consequently, the procedure for filling out sick leave by an employer who operates in a region participating in the FSS pilot project is the same as in a region not participating in this project.

What is a pilot project

A pilot project is an experiment in which the Russian Social Insurance Fund directly pays social benefits without the participation of employers. Also, as part of the pilot project, the foundation, at its own expense, finances expenses for the prevention of injuries and occupational diseases. Contributions for “injuries” are not included in the financing.

For 2020, the experiment of the social insurance fund is being tested on itself (see table).

| Type of region of the Russian Federation | Participants in the FSS experiment |

| Republic | Crimea |

| Karachay-Cherkessia | |

| Tatarstan | |

| edge | Khabarovsk |

| Regions | Astrakhan |

| Belgorodskaya | |

| Kurganskaya | |

| Nizhny Novgorod | |

| Novgorodskaya | |

| Novosibirsk | |

| Rostov | |

| Samara | |

| Tambovskaya | |

| Sevastopol | |

| From July 1, 2020 | |

| Republic | Mordovia |

| Regions | Bryansk |

| Kaliningradskaya | |

| Kaluzhskaya | |

| Lipetskaya | |

| Ulyanovskaya | |

Pilot project for filling sick leave based on minimum wage

At the same time, FSS letter No. 17-03-09/06-3841P states that partial filling out by hand if using a computer will not be an error. Information about the organization and the employee is entered into the sick leave form exclusively in capital Russian letters.

In addition, if, due to the fault of the organization, the amount of benefits paid to the Social Insurance Fund turned out to be more than necessary, then social insurance has the right to recover the amount of the overpayment from the enterprise. This is confirmed by arbitration practice (for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated October 26, 2020 No. 303-ES16-3905).

Letter about sick leave

An explanatory letter about sick leave is an official document with which the Social Insurance Fund informs employers and representatives of medical institutions about the procedure for filling out, issuing and paying for sick leave certificates.

The employer must know how to correctly enter data into the sick leave form, establish its authenticity and issue a duplicate if the original copy is lost. From this article you will learn:

- how to make a request for reimbursement of expenses for insurance payments for temporary disability from the Social Insurance Fund;

- how to draw up a letter of sick leave sent by the employer to the territorial body of the Federal Social Insurance Fund of Russia;

- Is it possible to issue a duplicate in case of loss of a certificate of incapacity for work;

- how to check the authenticity of a sick leave in 2020.

- what regulatory and explanatory documents regulate the procedure for filling out and issuing a certificate of incapacity for work;

- the only document that confirms a citizen’s temporary disability.

Filling out sick leave by an employer in 2020, sample according to the minimum wage

The employer is responsible for paying benefits. He can make corrections in his part of the form. Information entered by a medical institution cannot be corrected. If a mistake was made by a health worker, the certificate of incapacity for work is returned for replacement. Otherwise, the sick leave will not be accepted by the social insurance authorities and the employee will not receive disability benefits.

We recommend reading: Find out housing and communal services debt via the Internet

According to the law, if an employee becomes ill or injured, the employer pays for the first three days of sick leave from his own funds. The rest of the benefit is transferred by the FSS. When applying for sick leave for other reasons, the entire amount of the benefit is paid by the Social Insurance Fund - this is the procedure prescribed by law.

How to correctly fill out an application form for sick leave: calculating benefits

After receiving sick leave from an employee, the accountant must calculate disability benefits in order to pay the employee money based on correctly drawn up documents and receive compensation from the Social Insurance Fund.

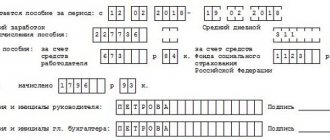

Clause 67 of Order No. 624n (order of the Ministry of Health and Social Development of Russia dated June 29, 2011) states that the benefit must be calculated separately and applied to sick leave. The form of such a calculation certificate is not established by law. Therefore, the accountant should develop it himself and approve it in the accounting policy. What should such an accounting certificate contain?

Despite the arbitrary form, the certificate must indicate a number of necessary details, since it is the primary document (clause 9 of the law on accounting dated December 6, 2011 No. 402-FZ), namely:

- name of company;

- title of the document, number and date of its preparation;

- description of the business transaction and unit of measurement;

- names, positions of responsible persons and their signatures.

It is recommended to issue a statement of payment on the company’s letterhead, which already indicates its name, legal form, registration number in the Social Insurance Fund, and code of subordination. You should fill in the number and date of the calculation, as well as the details of the sick leave certificate to which this application is drawn up.

Next, all the necessary information is indicated and the calculation of the amount of benefits during illness is carried out.

Do not forget that in 2020, due to coronavirus, sick leave is paid according to special rules. You will find all the latest information on benefit calculations in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

Find out what is the maximum amount of sick leave in 2020 - 2020 at the link.

An example of filling out a sick leave certificate by an employer

In principle, you can fill out the form on a PC using a special program that can transfer data from a digital form to a paper one, transferring the data to the printer into which the official form is inserted. Moreover, it is permissible to fill out 1 part of the sick leave with a pen, and the other on a PC (letter of the Federal Social Insurance Fund of the Russian Federation dated October 23, 2014 No. 17-03-09/06-3841P).

Entering data into sick leave forms created on paper is usually done manually using a pen - capillary, gel or black fountain pen. Entering data into a sick note with a ballpoint pen is not allowed.

Explanatory note in the FSS sample

admin05/09/2018 It is only important that the medical institution has a license for medical activities, including work (services) for the examination of temporary disability.

The purpose of the explanatory note is to clarify the situation by the person who is the main person in the events that occurred, perhaps the culprit; the purpose of the explanatory note is to conduct an internal investigation into the causes of the incident, understand them, and draw the right conclusions.

Please note: the FSS of the Russian Federation issues sick leave forms only to those organizations that have such a license. It is prohibited to issue sick leave (clause 3 of the Order of the Ministry of Health and Social Development of Russia dated August 1, 2007 N 514) only to doctors who work: - in an ambulance; — at blood transfusion points; - in hospital emergency departments; — in medical and physical education clinics; — in balneological hospitals and mud baths; — in centers of medical prevention, disaster medicine, forensic medical examination bureaus; — on supervision in the field of consumer rights protection and human well-being.

Therefore, if a private clinic has a license for such a type of medical activity as examination of temporary disability, then it has the right to issue sick leave.

The procedure and sample for filling out a sick leave certificate for the FSS pilot project

The new approach was approved by government decree No. 294 of April 21, 2011. It was as follows: if an insured event occurs, the employee submits an application and a package of documents to the employer, who must transfer them to the Social Insurance Fund within 5 days.

Also, if, through the fault of the company, the Fund paid benefits in a larger amount than required, social insurance has the right to recover the amount of the overpayment from the organization. Arbitration practice confirms this fact (determination of the Supreme Arbitration Court No. 303-ES16-3905 of October 26, 2020).

Errors were identified in filling out reports or contradictions between information in documents

What the FSS checks: reporting indicators in Form 4-FSS. Checking occurs according to control ratios. The Fund also reconciles the data reflected in the current calculation with the data of the previous period.

What will be required: provide an explanation within five days or submit an updated calculation in Form 4-FSS.

What to do and how to explain: check the indicators specified in the requirement. There are cases when the Social Insurance Fund mistakenly did not reflect received payments in its database. Then you need to write an explanation and attach copies of payment orders. If there is an error in the report due to the fault of the policyholder, then it is necessary to submit an updated calculation.

You can prepare a response to the FSS using the response template:

To the chief specialist of the Sverdlovsk regional branch of the FSS of the Russian Federation Ivanova I.I. From Romashka LLC, TIN 667123456 reg. number 6613000111

In response to your request No. 10 dated August 18, 2015, we explain the following. In the last three months of the reporting period (Q2), insurance contributions were paid for compulsory social insurance in case of temporary disability and in connection with maternity in the amount of 10,000 (Ten thousand) rubles. The listed amounts are reflected in the 4-FSS calculation on line 16 of Table 1. According to the act of reconciliation of settlements with the FSS, a discrepancy was found: the FSS database does not reflect the payment dated May 14, 2015 in the amount of 3,500 (Three thousand five hundred) rubles. Please make the appropriate adjustments.

Appendix: payment order No. 55 dated May 14, 2015

Director of Romashka LLC ___________________ V.V. Petrov

Filling out a sick leave certificate by an employer in 2020, sample for minimum wage

If the employee (part 1.1 of article 14) for the period taken for calculation had no salary at all or its average value taken for the whole month was much less than the minimum wage. Then the average earnings used to determine the amount of benefits will be exactly the minimum wage, which is in effect on the day the period of incapacity begins. In this case, this minimum wage is increased by 24 times, and then divided by 730.

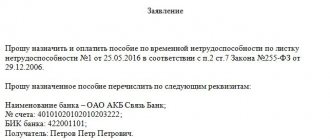

According to the pilot project: an employee, having received sick leave, brings it to the employer and fills out an application to the Social Insurance Fund in a regulated form; the employer fills out his part of the certificate of incapacity for work, attaches to it a certificate calculating the amount of insurance payment and an application from the employee, and other documents if necessary, then takes the package of documents to the Social Insurance Fund office within 5 days from the date of receipt of the form; The Social Insurance Fund checks within 10 days and, if filled out correctly, transfers the amount to the bank account specified in the application.

How sick leave is assigned as part of a pilot project

In order for an employee to receive the sick leave benefits due to him as part of the pilot project, he still submits all the necessary documents to his employer. If the employee’s disability is not related to an industrial accident, he submits to the employer:

- application for payment of benefits in the form approved by order of the Federal Social Insurance Fund of Russia dated September 17, 2012 No. 335;

- certificate of incapacity for work;

- certificates of earnings from previous places of work for the pay period, if they have not been submitted previously.

The employer must submit the received documents within five calendar days to the branch of the Federal Social Insurance Fund of Russia at the place of his registration. Attached to them is an inventory of the documents being transferred in accordance with the form from the order of the Federal Social Insurance Fund of Russia dated September 17, 2012 No. 335.

The FSS branch of Russia reviews the documents within 10 calendar days and makes a decision on payment of benefits or refusal. If the decision has a “plus” sign, then the money is sent to the employee’s bank account using the details that he noted in his application.

It is worth keeping in mind that the Social Insurance Fund pays disability benefits in the usual manner. That is, starting from the fourth day of sick leave, benefits are paid to the employee for the period of his temporary illness not by the employer, but directly by the Social Insurance Fund. In this case, the employer must pay the subordinate for the first three days at his own expense.

Sample of filling out sick leave in 2020 from the minimum wage

And for each such region this coefficient is different: the minimum wage, according to the norms of Russian labor legislation, is one of the guarantees regarding wages, which is established by the state.

Several years ago, the Ministry of Health decided on a unified form of registration of hospital documents. It simplifies the registration process with the Social Insurance Fund and eliminates the possibility of errors. New sick leave form 2020 - features of filling out Throughout the Russian Federation 4 years ago, registration of sick leave using a single form was adopted. Now the document consists of 2 sheets of double-sided color form, adapted for reading by a special machine.

Explanatory note to the balance sheet for the Social Insurance Fund

Copyright: Lori photobank In addition to the usual reporting responsibilities associated with the calculation and payment of various taxes and contributions, the organization is annually faced with the need to submit another specific report - on confirmation of the main type of activity in the Social Insurance Fund.

Or is this no longer possible? Thank you! November 09, 2020, 11:12, question No. 1806293 Elizaveta,

This report is submitted to the territorial department of social insurance by April 15. The purpose of its provision is to determine the class of professional risk that applies to a specific employer, depending on the distribution of income in various areas of business. Technically complex activities have an “expensive” hazard class, which leads to the establishment of a higher tariff for compulsory social insurance contributions for the company against industrial accidents and occupational diseases.

Filling out a sick leave certificate for a bir employer in 2020, sample minimum wage

According to the pilot project: an employee, having received sick leave, brings it to the employer and fills out an application to the Social Insurance Fund in a regulated form; the employer fills out his part of the certificate of incapacity for work, attaches to it a certificate calculating the amount of insurance payment and an application from the employee, and other documents if necessary, then takes the package of documents to the Social Insurance Fund office within 5 days from the date of receipt of the form; The Social Insurance Fund checks within 10 days and, if filled out correctly, transfers the amount to the bank account specified in the application.

The main part of the information is entered into the sick leave certificate using codes. Since all information will be read automatically, and the slightest mistake can cause the electronic device to malfunction, you should be extremely careful and careful when filling out the form.

How to fill out sick leave for direct payments

The period within which sick leave can be filed is limited to 6 months from the date of termination of illness. If the deadlines are not violated, the employer is obliged to pay temporary disability benefits. There is no need to write any special statements.

The basis for calculating benefits will be a certificate of incapacity for work. If the policyholder refuses to accept the document for payment, it makes sense to write a statement in any form demanding payment of benefits. This must be done within the period established by law. As a sample, you can take a form for direct payment to the Social Insurance Fund or use the example below. The last point is to indicate the requirement to issue a written reasoned refusal in case of an unsatisfactory decision. In order to reduce waiting times, you can specify in the document that the employer issues a document related to the work process.

This is important to know: How sick leave is paid in a hospital

The policyholder does not fill in the total accrued. Rationale: In accordance with clause 3 of the Regulations on the specifics of the appointment and payment in 2012, 2013 and 2014 to insured persons of compulsory social insurance in case of temporary disability and in connection with maternity and other payments in the constituent entities of the Russian Federation participating in the implementation of the pilot project approved by Decree of the Government of the Russian Federation dated April 21, 2011 N 294 (hereinafter referred to as the Regulation), the policyholder, no later than five calendar days from the date of submission by the insured person (his authorized representative) of applications and documents, submits the applications received to him to the territorial body of the Fund at the place of registration and documents necessary for the appointment and payment of the relevant types of benefits, as well as a list of submitted applications and documents, drawn up in a form approved by the Fund. If a sheet is issued for part-time work, then the sheet number issued for the main job is indicated - the name of the place of work. Be sure to ask the employer what name of the company is recorded in the Federal Social Insurance Fund of the Russian Federation. This is the name that should be indicated on the sheet. If the patient does not know the full name of the employer, in this case the doctor leaves an empty field that the employer must fill in 6. Next, in the “Exemption from work” table, indicate the start and end dates of sick leave. The doctor's details are entered and his signature is added. When filling out the name of the institution or doctor's specialization, writing an abbreviation is allowed. 7. Under the table, the doctor writes from what date the patient can start working. If the sick leave is extended, then the corresponding code is entered in the “Other” column. And below is written the sick leave number, which is issued in continuation. 8.