5

17834

Inheritance of property is one of the most popular legal areas. Despite the transparency and established regulations for the transfer of property after the death of the owner, in practice many controversial issues arise. Conflict situations can be avoided if you know the basic provisions of the law and your rights when entering into an inheritance.

Donated apartment - basic provisions

A donation is the act of gratuitously transferring property or property rights into the ownership of another person. It is a bilateral transaction, which is concluded as a result of the expression of the will of two parties: the donor and the donee.

The object of the transaction can be not only a right, but also an obligation from which the donor releases the donee. The creditor has the right to indicate the very fact of the transfer or simply the intention to make it (this also applies to the gift of property).

The intention to donate property or release from an obligation in the future has the same legal significance as the direct act of donation. Such a promise must have a deadline for implementation (it is impossible to order a posthumous gift). And after registration, a unilateral waiver of the obligation is invalid.

The donor can be the owner or a creditor who is in a state of full legal capacity. The following requirements apply to it:

- age over 18 or emancipation;

- the absence of a valid judicial act limiting or depriving him of legal capacity;

- the absence of mental disorders that prevent an objective perception of what is happening and the assessment of one’s actions (actual legal capacity);

- staying in a state of absolute sobriety and adequacy.

The donee has no such restrictions. Moreover, the legal representative of an incapacitated or partially capable person is obliged to accept the gift on behalf of and in the interests of his ward/child.

The contract of donation of real estate is made in writing. Notarization of a document is not necessary and is carried out at the request of the parties (this gives the transaction additional guarantees and reduces the risk of it being declared invalid). The deed of gift is not even subject to separate state registration, as before 03/01/2013. Now only the transfer of ownership from one party to the agreement is registered.

Unilateral refusal

It was stated above that a deed of gift, as a bilateral transaction, cannot be canceled by one of its participants. But there are some exceptions to this rule.

A donation can be revoked:

- The donee - in writing and before receiving the gift. If the deed of gift was notarized, the refusal will also require confirmation by a notary.

- The donor - from fulfilling the promise to donate property in the event of an unforeseen and significant deterioration in his financial situation.

- Donor - in case the donee makes an attempt on his life or the life of his family members and close relatives, as well as intentionally inflicting grievous bodily harm on the donor.

- Heirs of the donor - if the death of the latter occurred through the fault of the donee, as a result of his committing intentional illegal actions.

Except for the specified cases, the deed of gift can be canceled only by agreement of the parties.

Contract form

A deed of gift for property requires proper execution. The transaction is concluded in writing in the form of an agreement with subsequent state registration. Registration of the gift agreement is carried out in Rosreestr.

Expert opinion

Klimov Yaroslav

More than 12 years in real estate, higher legal education (Russian Academy of Justice)

Ask a Question

The document must be signed by both parties. Thus, the deed of gift is a bilateral agreement. Many people think that it is possible to issue a deed of gift unilaterally. However, it is not. The recipient must give his consent to accept the gift. Based on the above, we can conclude that the gift agreement is concluded during the lifetime of the donor and the recipient. At the time of the transaction, the parties must clearly understand the legal consequences of what is happening, and are in the status of legally capable persons.

If desired, the parties have the right to have it notarized. The advantage of notarization is that the notary initially verifies the legality of the transaction, the parties’ understanding of their intentions, and their legal capacity. In addition, the submitted documents are checked for authenticity and the object of donation for encumbrances (arrests, pledges, mortgages).

Is the donated living space inherited?

The apartment that has become the property of the donee, like all the rest of his property, will be included in the estate and transferred after his death to his successors.

Moreover, donated real estate is not subject to division with the surviving spouse of the testator, even if it was received by the deceased during the marriage (in accordance with Article 256 of the Civil Code of the Russian Federation, it belongs to the category of his personal property).

The donor's heirs, on the contrary, lose the right to claim an apartment donated to third parties, since his death is not grounds for cancellation of the deed of gift.

However, during the inheritance process, unclear situations may arise. The resolution of some of them is described below.

The recipient did not have time to register the apartment

Situation: a gift agreement was concluded, but registration of ownership was not carried out due to the death of the donor (he did not take actions indicating a desire to cancel the transaction during his lifetime and, judging by the circumstances, intended to contact the registration authority, but did not have time).

Solution: a gift agreement concluded in accordance with all the rules is the basis for the recipient to acquire rights to the object, and his successors are obliged to secure them through state registration instead of the deceased.

Explanation: the transaction is considered concluded after the parties sign the agreement, and the heirs of the deceased, by accepting his property, also acquire responsibilities (in this case, the responsibilities for registering the transfer of rights). Evasion of it is considered illegal, and the recipient in this case has the right to apply to the court with a claim for forced registration.

Conclusion: the death of the donor does not serve as a reason for canceling the deed of gift and the obligation to complete it falls on his heirs (the object of the donation can no longer enter the inheritance estate).

The donor outlived the donee

Situation: The gift was made and registered properly, and the donee used it as property until he died (before the donor).

Solution: the donor can cancel the deal and return the donated apartment to himself if such a condition was established by him in the contract.

Explanation: the absence of such an indication in the contract is the basis for the transfer of the donated property to the heirs of the donee.

Conclusion: with a separate order from the donor (even before signing the agreement), the heirs of the recipient of the gift are obliged to return the object back by contacting the state registration authorities together with its copyright holder.

The gift has not yet been given

Situation: the subject of the deed of gift was a promise to donate living space by a certain date, but before that date, one of the parties to the agreement died.

Solution: if the donor died before the specified period, his obligation is subject to fulfillment by his heirs, and after the death of the donee, the promise of donation loses its legal force (by default).

Explanation: By law, successors inherit the rights and obligations of the deceased (one of such obligations is the promise of a gift), while the death of the person to whom the gift is promised is a reason for the termination of the contract.

Conclusion: the heirs of the donor, at the appointed time, donate the apartment to the person specified in the deed of gift, and the heirs of the donee, who did not receive the gift during his lifetime, do not have the right to count on living space, unless the donor orders this.

Death of the recipient

If the ownership documents were not completed in time, and the recipient of the property died, then the gift agreement can be considered invalid. In this case, there is no one to transfer this property to. You can only rewrite the deed of gift for the apartment - for example, re-register the contract in favor of the deceased’s spouse or his children.

Important! You will need to issue a completely new document, since the recipient will be different. He must know that property is being transferred to him and agree with it.

If the right of ownership was received by the donee, and then he died, then his property will be transferred to his relatives by inheritance. The apartment will not be returned to the donor, since he is not the owner. The new owner has the right to dispose of the property and even write it into his will. In this case, entering into an inheritance will not be a problem.

Who will inherit the donated apartment?

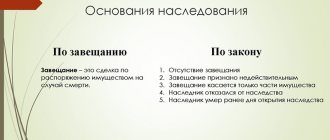

The donated living space after the death of the copyright holder passes to his heirs by law or by will.

In law

In the absence of separate, notarized orders of the owner, his property is subject to distribution among priority heirs. This could be the first of the existing ones, and not necessarily in a row. Its serial number can be from 1 to 7 - the main thing is that there are no successors before it who want to inherit the inheritance within the prescribed period.

Example. The testator did not have any relatives who could become first-line applicants, so the right to accept his property passed to the second group. It consisted of one heir who refused the opportunity provided and as a result, heirs from the third line were called to inherit.

Persons who may be called to inherit by law:

- Parents, spouse, children.

- Brothers, sisters, grandfathers, grandmothers.

- Aunts, uncles.

- Great-grandfathers, great-grandmothers.

- Children of nephews, great-uncles and grandmothers.

- Great-great-great-grandchildren, children of cousins, great-uncles and aunts.

- Stepsons, stepdaughters, stepmother, stepfather.

Each item on the list brings together successors called to inherit as equals. And in addition to these persons, priority will include dependents who were supported by the testator for a year or more.

By will

The testator has the right to order the transfer of the donated apartment at his own request by drawing up a will. If this is not done, the living space will be divided into shares in proportion to the number of heirs included in one of the lines presented above by law.

The last will of the deceased has priority and the orders specified in the will are taken into account first when distributing the inheritance:

- An apartment bequeathed to a specific person will pass to him after the death of the testator, regardless of whether he was a relative of the deceased or not.

- If the testator ordered the transfer of living space to several applicants, it will become their common property in the specified shares or equally.

- In a will with a sub-designation of a successor, the property will be inherited by the designated claimant or the sub-designee if the first one dies, refuses or does not accept the inheritance.

- The apartment that has become the subject of a will will be provided for full or partial use to the legatee for a specified period or to the successor for life who has registered it in his or her own name.

But the will of the testator may be violated insofar as it affects the legitimate interests of his disabled relatives (parents, children, husband/wife) and dependents. If there is no intestate property or it is insufficient to cover the obligatory share due to such persons, the successors under the will will receive less than what the deceased left them.

For reference: the obligatory share is half of the inheritance due to its owner by law (without a will).

In what cases can you inherit a donated apartment?

When the donor died before the transfer of ownership, his living space will be inherited by all heirs by law. But what to do when the recipient himself dies? There may be two options here.

The property has not been registered

If the apartment was not registered as the property of the donee, then the deed of gift is considered void, because there is no one to give it to. This means that the living space remains the property of the donor, who has the right to give it to someone else or dispose of it in any way within the limits established by law.

The right of ownership passed to the donee during his lifetime

If the donated apartment was registered in Rosreestr during the lifetime of the recipient, then he became the new owner with all the ensuing rights to the property. That is, the question of how a donated apartment is inherited in the event of the death of the donee can be answered this way: the apartment is inherited on a general basis according to the law or according to a will, if there is one.

It is worth keeping in mind that if the gift agreement contains a clause on the return of the apartment to the donor after the death of the donee, then it will not be inherited, but will simply return to its previous owner.

When there is a will, the living space goes to the person indicated in it. However, in this case, persons entitled to an obligatory share in the inheritance must be taken into account. These include:

- dependents of the testator;

- disabled spouses;

- children with disabilities.

If for some reason they are left out, their rights can be restored in court.

When inheriting a donated apartment, according to the law, the heirs of the first priority, that is, the spouses and children of the deceased, have the right to it. Only in their absence or refusal of inheritance, the turn passes to grandchildren, nephews, and so on in order, the diagram of which is presented below.

Inheritance of a donated apartment is carried out on a general basis, since the donation transaction is considered completed from the moment the donee registers ownership rights.

Procedure for inheriting a donated apartment

The process of accepting an apartment received as a gift by the deceased is no different from inheriting any other property that belonged to him.

Algorithm of actions

To carry out legal succession, the heir to the donated living space must:

- Write an application for acceptance of inheritance.

- Collect the required list of documents.

- Submit the papers to the notary.

After completing these actions, the inheritance is considered accepted, but for further registration of real estate ownership, a certificate of the right to inheritance is required. His successor can obtain it from a notary after submitting a separate application or attaching a request for the issuance of a document to an application for acceptance.

If the heir intends to issue a certificate of title, the inheritance process will be supplemented with the following steps:

- Statement on the need to issue a document (in writing).

- Payment of state fees and additional notary services.

- Receiving a certificate of inheritance (on the day appointed by the notary).

With a document confirming the title, the successor can begin registering the donated apartment (registration of ownership of it).

Procedure

The notary is selected on a territorial basis - at the last place of residence of the testator or, if he lived abroad of the Russian Federation, at the location of his property.

The specialist first establishes the identity of the heir. One of the following documents is suitable for this purpose:

- passport of a citizen of the Russian Federation or another state;

- seaman's passport;

- military passport;

- resident card;

- temporary residence permit;

- another document that allows you to accurately determine the identity of the applicant.

The next stage will be the opening of an inheritance case. It is carried out on the basis of an application for acceptance of the inheritance, which the successor must draw up and transfer to an authorized notary.

Documents may also be submitted along with the application. But, if the heir has difficulties with them or there is a need to clarify the exact list, the necessary papers are brought to the notary later.

The heir has the right to send both the application and the package of documents to the authorized person not only in person, but also by mail or through an official representative. Before submitting it by mail, the successor must have his signature on the inheritance application notarized. The representative must be given a power of attorney.

The received application and copies of documents are filed in a folder with the case, and the fact of acceptance of the inheritance is registered in the Unified Notary Information System. This helps to avoid misunderstandings and fraud, and also streamlines all requests regarding the inheritance of a particular citizen.

At this point, the inheritance procedure can be terminated until the heir needs to obtain a certificate of title. If necessary, he submits an application for the issuance of a document to the notary who opened the inheritance office and pays the state fee.

After this, the authorized person is obliged to issue a certificate to the copyright holder. This may not happen immediately, but after the time it takes for the notary to verify the declared information and restore the paperwork (if it was closed and moved to the archive).

The heir has the right to declare receipt of a document confirming the right at the same time as accepting the inheritance. In this case, he will have the certificate already after six months from the date of death of the testator (except for cases where the birth of another equal successor is expected).

If the heir is a minor child or an incapacitated citizen, the inheritance is accepted for him by his legal representative: a parent or guardian. But when inheriting by children from 14 to 18 years old, these actions can be performed by them personally, with subsequent confirmation by parents or guardians.

Statement

An application for acceptance of a donated apartment must contain the following information:

- Full name and residential address of the heir;

- Full name of the notary or name of the notary's office, its location (not necessarily the full address - just indicate the city);

- purpose of filing the application (acceptance of the inheritance and/or obtaining a certificate of right to it);

- Full name and date of death of the testator;

- composition of the inherited property and a brief description of individual objects;

- Full name and contact information (if such information is available) of the remaining heirs;

- the basis for the emergence of the applicant’s inheritance rights;

- other important circumstances;

- date of application.

The application can be written by the heir by hand or using technical means and must be signed with his personal signature.

Sample application for acceptance of a donated apartment

Documentation

The basic list of required papers includes:

- Death certificate of the testator.

- A certificate establishing the place of opening of the inheritance (residence address of the deceased or location of his property).

- Identity card of the applicant (if this is a representative, a power of attorney or a document confirming the authority of the legal representative will be required).

- Documentary substantiation of the heir's rights (will or birth/marriage/adoption certificate, judicial act establishing dependency, etc.).

- Agreement of donation of inherited living space to the now deceased (if any).

- Extract from the Unified State Register of Real Estate.

- Technical plan of the apartment.

- Certificate of cadastral value of the property (if desired, can be replaced with a report on the assessment examination).

The presented list can be supplemented at the direction of the notary.

Deadlines

It is important for the testator to declare the rights to the apartment as early as possible - within six months from the date of death of the testator. This period is established by law and is mandatory for all priority successors (those who are called upon to accept the inheritance immediately after its opening).

Failure to comply with this rule makes succession impossible, unless the mandatory period has been missed for valid reasons. Then the successor has the right to restore his rights with the consent of the heirs or through the court.

This period is not relevant for everyone. For persons who are called to inherit as a result of the refusal of the first-priority successors, six months begin to run from the moment the refusal is certified. And for heirs who acquired their rights as a result of priority applicants missing a deadline, the period of entry into inheritance will be three months from the last day of the missed deadline.

Price

There is a fee for notary services and performing a legally significant action (issuing a certificate of inheritance).

The costs of accepting an inheritance will be:

- 0.3% of the appraised value of the apartment if it is registered by a close relative of the deceased (parent, spouse, child, brother, sister) and 0.6% if the successor is not one of the listed persons;

- 5,000 rubles for notarial services of a legal and technical nature (the amount in this amount is retained by Moscow notaries, tariffs for other regions need to be clarified in local notary chambers).

Persons who lived in the registered apartment at the time of the death of its owner, as well as minors and incompetent heirs, are exempt from the first payment (state duty).

Inheritance without registration

A donated apartment can be inherited actually, that is, without the participation of a notary and other authorized officials. To do this, the successor needs to take an action indicating an interest in receiving it. This action could be:

- Accommodation in a living space.

- Payment of utility bills.

- Repair and maintenance of premises.

- Installation of security or fire alarms, locks, etc.

- Use of household items, furniture, personal belongings of the testator.

- Submitting an application to a notary to take measures to protect the inheritance.

- Repayment of debts of the deceased.

- Receipt of funds due to the testator and not paid to him during his lifetime.

After at least one of the listed conditions is met, the apartment and all other property due will be accepted. But the successor who chooses this method of inheritance will not receive legal documents and will not be able to register the property as a property. To do this, he will need a certificate of inheritance rights, which is issued exclusively by a notary.

Is it possible to challenge a deed of gift after the death of the donor?

According to Art. 166 of the Civil Code of the Russian Federation, a transaction may be declared invalid upon the application of the person whose legal rights and interests it violates. Such persons may be the donor's heirs and their legal representatives.

To succeed in this, they will have to go to court and prove that the transaction was made illegally. The following is considered a violation:

- Registration of a deed of gift by an incapacitated donor or a person intoxicated with chemical substances (alcohol, drugs, psychotropic drugs, etc.).

- Putting pressure on the owner of an apartment (through blackmail, threats, moral or physical violence) in order to force him to donate living space against his will.

- Donation by a legal representative on behalf of a minor or incapacitated citizen.

- The donee is an employee of a medical institution, social or educational organization, and the donor is a person who was there for treatment, education, maintenance, his close relative or spouse.

- The apartment was presented to an official, a state or municipal employee, or an employee of the Bank of Russia in connection with the performance of his official duties.

- The transaction was imaginary (feigned) and its real purpose was not a donation, but a paid alienation of property.

In addition, a deed of gift may be declared void without a trial if:

- the fact of deprivation or lack of legal capacity of the donor is confirmed by a separate judicial act;

- the donor was under 18 years of age at the time of the transaction and was not recognized as emancipated;

- the donation was made orally, without signing a written agreement;

- the deed of gift did not indicate the specific subject of the donation;

- the purpose of the transaction was a promise to donate an apartment after the death of the donor;

- the agreement was signed by a representative on the basis of a power of attorney, which did not indicate the donee and the object of the gift.

A void transaction does not entail legal consequences - on its basis a transfer of ownership cannot be made and, accordingly, inheritance by the successors of the person specified in the agreement as the donee is impossible.

Is it possible to donate an apartment received by inheritance?

By law, the owner has the right to dispose of personal property at his own discretion, including donating it. This rule also applies to an inherited apartment if it was properly registered.

Step-by-step instruction

The procedure for donating inherited living space involves the following actions:

- Obtaining a certificate of inheritance (how to do this is described above).

- Visit to the territorial office of Rosreestr or a multifunctional center.

- Writing an application for state registration of the transfer of the right to living space.

- Payment of the state fee (2,000 rubles) and presentation of a certificate of inheritance.

- Drawing up a gift agreement - address and brief description of the apartment, full name, passport details of the donee and the donor, the period when the donation will be made (if it is a promise of donation), other notes important for the parties.

- Signing by the gifting parties. Notarization is not necessary here, but can be done at will, for greater reliability.

- Submitting an application for registration of the transfer of ownership of the living space from the donor to the donee and the gift agreement to Rosreestr.

- Payment of state duty (2,000 rubles) and tax - 13% of the appraised value of the apartment (not required in the case of a gift to a spouse, parents, children, brothers or sisters).

- Receiving a response on successful completion of state registration.

After completing this procedure and transferring the living space to the new owner, the act of donation is considered completed.

Gifting and inheritance have completely different spheres of influence. But often these two processes are intertwined, which leads to confusion among their participants. The lawyers of the ros-nasledstvo.ru portal will help you clarify controversial issues. You can contact them for a free consultation 24 hours a day – by phone or through the website’s electronic form.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

2

Closed will

Article 1123 of the Civil Code of the Russian Federation guarantees the secrecy of a will. All active...

13

Does a notary have the right to collect original documents?

The primary task when acquiring an inheritance is to contact a notary in a timely manner...

1

Do children from a first marriage have the right to inheritance?

Inheritance law is regulated by the provisions of Section V of the Civil Code of the Russian Federation. IN…

1

Execution of a will

A will is the basis for the execution of a citizen’s posthumous orders. But in...

8

How to file for inheritance if there is no death certificate

Entering into inheritance is a simple procedure, but it requires strict adherence...

2

Inheriting weapons after death

According to Article 20 of Federal Law No. 150 and Article 1180 of the Civil Code of the Russian Federation, every person...