Necessity and significance of position 70

All business entities, regardless of their form of ownership, hire employees and pay them wages, the correct accounting of which is necessary in terms of fulfilling obligations to the budget and extra-budgetary funds, and collecting information on personnel costs.

70 position exists to summarize data on the fulfillment of obligations to the organization’s employees regarding the payment of remuneration for work done, including bonuses, benefits, pensions and other social obligations, as well as the costs of paying dividends on shares and other securities issued separately companies.

On its credit side, accountants reflect expenses such as:

- accrued amounts for remuneration for work performed by employees in combination with accounts for the costs of manufacturing products and other sources;

- calculated costs for annual payment of vacation pay and long-service bonuses at the expense of a specially created reserve;

- accrued benefits under social insurance and other similar amounts;

- accrued income from participation in the capital of this organization.

In the debit part, the accounting service records the amounts of remuneration, bonuses, pensions and benefits paid, and taxes and other deductions withheld on them.

Analytical accounting for this position is carried out separately for each specialist of the organization.

https://youtu.be/Yesu_Tfn0vs

Results

SALT for account 70 is one of the possible registers for grouping data on settlements with employees. The data from this report is used to generate financial statements. Balance sheet according to the account. 70 provides information on accrued and paid wages and balances as of reporting dates for each employee of the organization. In order to obtain more detailed information on settlements with personnel, it is necessary to use other forms of accounting registers.

Sources:

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n

- PBU 4/99, approved. by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 N 43n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Operations on debit and credit parts

If you look at typical accounting records, you can see that the debit part of the account reflects the following transactions:

- payment of systematic remuneration to employees in cash;

- transfer of funds to pay employees;

- deduction of debt on the accountable amount from accrued wages;

- deduction from the amount of remuneration for work done of travel expenses that were not recognized by the employer;

- deduction from the salary of the guilty person of the identified shortage.

On the credit side, the accountant records the accrued amounts of wages, bonuses, vacation pay and other payments.

Practical use of the balance sheet for account 70

In the balance sheet, the credit balance from the account statement. 70 as of the reporting date is reflected in the “Short-term liabilities” section in the line “Accounts payable” (clause 20 of PBU 4/99).

If there is an active-passive balance on the account. 70 data from the register is reflected in both the asset and liability of the balance sheet. Reducing assets and liabilities between themselves by offset is prohibited (clause 34 of PBU 4/99). At the same time, the active balance on the account. 70 is reflected in section II “Current assets” in the “Accounts receivable” line of the balance sheet.

It must be remembered that if the report indicators are of a significant level, then the data on them must be reflected separately.

Our article “What requirements should accounting reporting satisfy?” will help you understand the definition of the concept of “materiality level.”

In this case, you need to highlight a separate line in the balance sheet:

- in the liabilities side of the balance sheet in the “Short-term liabilities” section, the line “Debt to the organization’s personnel”

or

- in the balance sheet asset in the “Current assets” section, the line “Advances issued to employees.”

There are some difficulties in the practical application of the balance sheet for account 70. Thus, detailed information about the nature of settlement transactions with employees may be useful for interested users, such as:

- type of accrual;

- source of financing (cost, net profit, reserve, etc.);

- method of repaying debt to an employee (cash payment, deduction based on a writ of execution, deduction of personal income tax, use of non-monetary forms of payment, etc.).

SALT on account 70 does not provide users with such information. It only answers questions such as: “How much was accrued and issued to the employee? What is the balance of mutual settlements with him? To obtain more complete information on account 70, it is advisable to use other registers: payroll, summary of accrued wages, account turnover, etc.

More details about the payroll statement are described in the material “Unified Form No. T-49 - Form and Sample”.

Is it possible to pay part of the salary in kind on a time frame that is different from the time period for payment of the daily salary? The answer to this question was explained by the State Counselor of Justice of the Russian Federation, 2nd class of the State Labor Inspectorate in the Perm Territory, Yu. A. Dotsenko. Study the official’s point of view by getting trial access to the ConsultantPlus system for free.

Postings to 70 payroll items

When keeping records of the indicated amounts, the accounting service enters such standard accounting entries as:

1) Dt 20

Kt 70 – payroll for employees of the main production;

2) Dt 44

Kt 70 – accrual of salaries for employees who ensure the process of product sales;

3) Dt 69

Kt 70 – accrual of benefits for sick leave;

4) Dt 91

Kt 70 – calculation of quarterly bonus.

Accounting entries for accounting of settlements with personnel

Analytical accounting accounts are opened for each employee separately. For example, to reflect the remuneration for the work of employee V.V. Sidorov will open a 70.1 account. Additionally, for each employee the accountant maintains:

- personal income tax card;

- pay slip;

- document on settlements and payments;

- pay slip.

Account 70 in accounting is used in the course of financial activities by each organization.

Account debit transactions 70 The 70th account corresponds by debit with the accounts:

- accounting for money;

- accounting of settlement transactions (from 66 to 69 inclusive, 73, 76, 79);

- financial result (90, 91, 93, 94).

A debit operation will mean reducing the company's accounts payable to the employee or deducting amounts for taxes and fees, material damage. Account credit transactions

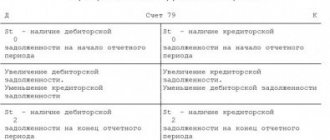

Account characteristics

To record payroll calculations, account 70 is used. When asked which account 70 is active or passive, you can clearly answer that it is an active-passive account.

Depending on the situation, it can have two balances at once. The debit balance reflects the debt of persons working at the enterprise for the wages paid to them by the enterprise. The loan balance, on the contrary, reflects the employer’s debt to the employees working in the company.

When determining the final account balance, it matters which side the balance is on. If by debit, then the debit turnover reflects the increase in debt, and the credit turnover reflects its repayment.

The opening balance is added to the debit turnover, after which the resulting result must be compared with the credit balance. If the final value of the difference with the loan turnover turns out to be positive, then the final balance is a debit.

Payment of salaries to branch employees

On 30..2015, the branch of Metallurg LLC paid salaries to employees:

- workers of the metal rolling shop - 412,500 rubles;

- economists of the financial department - 194,300 rubles.

On October 3, 2015, the branch received funds from Metallurg LLC to make payments.

The accountant of the head office of Metallurg LLC made the following entries in the accounting:

| Dt | CT | Description | Sum | Document |

| 20 | 79.2 | Salaries accrued to employees of the branch's metal rolling shop | 412,500 rub. | Payroll |

| 79.2 | Salaries accrued to employees of the financial department of the branch | 194,300 rub. | Payroll | |

| 79.2 | Funds for paying salaries were transferred to the branch (RUB 412,500 + RUB 194,300) | 606,800 rub. | Payment order |

In the accounting of the branch of Metallurg LLC, salary payments are reflected by the following entries:

| Dt | CT | Description | Sum | Document |

| 20 | Salaries accrued to employees of the branch's metal rolling shop | 412,500 rub. | Payroll | |

| Salaries accrued to employees of the financial department of the branch | 194,300 rub. | Payroll | ||

| 79.2 | 20 | Expenses for paying wages to employees of the metal rolling shop are included in settlements with the head office | 412,500 rub. | Payroll |

| 79.2 | Expenses for paying salaries to employees of the financial department are included in settlements with the head office | 194,300 rub. | Payroll | |

| 79.2 | Funds have been credited from the head office to pay salaries | 606,800 rub. | Bank statement | |

| 50 | Funds were withdrawn from the current account to pay salaries | 606,800 rub. | Bank statement, cash receipt order | |

| 50 | Salaries were paid to employees of the metal rolling shop and financial department through the cash register | 606,800 rub. | Account cash warrant |

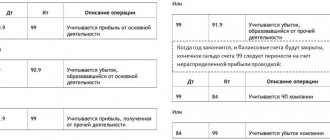

Account 70 in accounting: settlements with employees for wages

Depending on their form (cash, non-cash, in kind), postings are made: D 70 K 50 - payment of wages from the cash register D 70 K 51 - transfer of wages to the employee’s card D 70 K 90 - products issued against wages If the salary is in the organization’s cash register not received on time, it must be deposited. To do this, the posting is made: D 70 K 76.4 - wages deposited D 76.4 K 50 - previously deposited wages were issued at the request of the employee According to the law, wages are paid at least twice a month. Temporary disability benefits are paid on the day of payment of wages established by the internal regulations of the organization, vacation pay - within three days before the employee goes on vacation, and payment upon dismissal - on the last day of performance of work duties by the employee. Deductions on account 70.

Deductions on account 70. Postings

Wage deductions are divided into three categories:

- Mandatory

- At the initiative of the employer

- According to the employee

Mandatory withholding is income tax that must be remitted from the employee's income. The organization in this case is a tax agent. On the day the salary is paid, 13% (30% for non-residents) is withheld from the amounts payable (except for certain types of benefits) and transferred to the budget.

D 70 K 68 Personal income tax - income tax withheld

Also included in the first category of deductions are the employee’s alimony obligations under writs of execution. They are charged by posting D 70 K 76.

The employer has the right to recover from the employee (by notifying him):

- Unreturned amounts of accountable funds (or if the employee did not submit an advance report) – D 70 K 71

- Material damage caused by an employee – D 70 K 73.2

- Amounts of previously issued loans – D 70 K 73.1

The employee himself may request in writing to withhold funds from his salary to pay off his obligations to the employer or to transfer funds to other organizations or individuals - D 70 K 76.

Corresponds with accounts

Account 70 can correspond with the following accounts:

From the debit of account 70 to the credit of accounts:

- Account 50 - when paying wages in cash from the cash register;

- Account 51 – when paying wages by transfer from a current account;

- Account 52 – when paying wages by transfer from a foreign currency account;

- Account 55 – when paying wages by transfer from a special account;

- Account 68 - regarding tax withholding from wages;

- Account 69 - when withholding funds not covered by the social insurance fund (for example, when paying for a voucher);

- Account 71 - when withholding unpaid accountable amounts;

- Account 73 - when withholding funds in favor of the company (for example, when covering damage or defects);

- Account 76 - when depositing unpaid wages, or deductions under writs of execution;

- Account 79 - for settlements between the parent company and the branch;

- Account 94 - for a one-time recovery of the deficiency from the guilty person.

According to the credit of the account, it corresponds with the debit of the following accounts:

- Account 08 - regarding the calculation of wages to employees involved in the creation or preparation for operation of a non-current asset;

- Account 20 - when calculating wages to the main employees of the workshop;

- Account 23 – when calculating wages for employees of the auxiliary workshop;

- Account 25 – when calculating salaries for managerial or technical personnel;

- Account 26 - when calculating salaries for administrative staff;

- Account 28 - when calculating wages for employees who are constantly engaged in correcting defects;

- Account 29 – when calculating wages to employees of service farms;

- Account 44 - when calculating wages for employees engaged in trade;

- Account 69 - when calculating payments made from social funds;

- Account 76 - when calculating payments from third parties in favor of a specific employee;

- Account 79 – for settlements between the parent company and the branch;

- Account 84 - when accruing income based on the results of activities to the founders, members of the company, etc.;

- Account 91 - when calculating wages to employees who are not engaged in their main activities;

- Account 96 - in case of accrual of payments made at the expense of a previously created reserve;

- Account 97 - when calculating payments that will actually be taken into account in the following periods;

- Account 99 - when calculating payment for work to eliminate the consequences of force majeure.

The purpose of account 70 when maintaining analytical accounting is to summarize the settlement transactions carried out for the payment of wages to employees of the enterprise and not only. When carrying out this operation, it is necessary to record the established cost of wages, as well as bonuses and other additional payments for the work done, into the account. The amount of pensions and benefits is also recorded in the account. The debit indicates the calculated amount for material damage.

In account 70, when making payments, you must indicate the following amounts : wages, social insurance benefits, pensions, income from shares and securities.

If the amount was accrued, but was not paid, then it is summarized in the debit of account 70.