Who is involved in the acceptance and delivery

In order to record the movement of fixed assets from the contractor to the customer after repair/modernization/reconstruction, a special commission is created in the company. It consists of enterprise employees from different structural divisions - as a rule, technical specialists, an employee of the accounting department and a management representative.

The commission’s task is to make sure that all the necessary work has been carried out at the proper level and the facility is suitable for further use.

Commissioning of fixed assets: sample act, order, commissioning date

The receipt by a company of various property assets is accompanied by their registration as fixed assets. After this procedure, in order to use the property in current business activities, it is necessary to put fixed assets into operation according to accounting rules.

What is commissioning of fixed assets

Not every asset can and should be recognized as a company’s main asset. The key characteristics of objects and other material assets that can be considered as fixed assets are regulated in the Accounting Rules PBU 6/01 and Art. 256 Tax Code of the Russian Federation:

- the intended purpose of the asset should be to use it for one’s own production or management functions, as well as to transfer it to third parties on a paid basis for temporary use;

- the expected service life must be at least one year;

- the assets were not acquired for the purpose of subsequent resale to third parties;

- material assets will bring direct or indirect income to the company in the course of current activities.

To recognize an asset as a fixed asset, the method of its acquisition does not matter. A company can receive material assets in the form of a contribution to the authorized capital, as a result of civil transactions, as a result of the creation of a new facility (for example, the construction of a new building), etc.

After registration, for further use of assets, they must be officially put into operation. This procedure is formalized by internal documents of the company - an administrative act of the manager and an acceptance certificate.

Commissioning of fixed assets and intangible assets - the topic of the video below:

What it is

The rules for drawing up transfer and acceptance acts for accounting purposes are regulated in PBU 6/01.

The specified document will be the basis for the transfer of material assets and assets to the structural divisions of the company for further use.

If the registered object is not planned to be used, the company is not obliged to draw up these acts; the assets can remain out of operation for an unlimited time, provided that depreciation rates are calculated in a timely manner.

https://youtu.be/Lr6xAkrsolw

The main list of requirements for the form and content of acts can be found in PBU 6/01, or you can download a standard sample of these documents on our website. The act must be drawn up by the internal Commissioning Commission, the composition of which is approved by the company’s management.

Compilation rules

When drawing up an act, you must follow a certain algorithm of actions and rules for filling out the document.

- The legal basis for putting fixed assets into operation will be an order from the head of the company, after which the corresponding mark is affixed in the OS-1 act.

- Another option would be to draw up an independent act of commissioning fixed assets or an order of similar content; all members of the Commission must sign these documents.

The contents of the act indicate the main parameters of the transferred object, the date of its registration, as well as a list of persons responsible for the safety of the object during operation.

Until the transfer of the object into operation, it is reflected in the accounting information under account 08 (non-current assets), and after drawing up the act - under account 01 (fixed assets).

Simultaneously with the preparation of the act, the initial cost characteristics of the transferred object are determined, which is necessary for subsequent depreciation calculations.

Sample

The standard sample act offered on our website must be filled out taking into account the characteristics of the object being put into operation. Although this document is drawn up in any form, it is advisable to familiarize yourself in detail with the requirements of PBU 6/01 in order to avoid adverse consequences.

Example of commissioning certificate

Entry procedure

Immediately from the moment of registering property assets as fixed assets, the enterprise can begin the procedure for putting it into operation. This process begins with the publication of an administrative document by the head of the company.

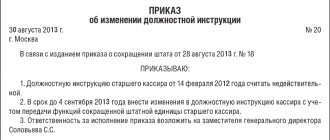

Order

In many cases, issuing an order for an enterprise will avoid drawing up a separate independent act for putting assets into operation.

The fact is that the provisions of PBU 6/01 make it possible to supplement the OS-1 form with information about the start of operation of the facility. To do this, the order must indicate the exact date from which material assets will be used in current activities.

Sample order for putting the OS into operation

What you will need

The key parameters that must be taken into account in the order and the acceptance certificate will be the date of commissioning of fixed assets and the initial cost of the assets. Based on these indicators in the accounting information, depreciation charges will be carried out.

The initial cost is determined taking into account the following nuances:

- if assets are contributed as a contribution to the authorized capital, their valuation is carried out in monetary form by decision of the company’s owners;

- for assets received through gratuitous transactions, the market value at the time of registration is used;

- To calculate the cost indicators of own-produced products, the total amount of actual costs is taken into account.

This data is carried out according to accounting information in accordance with the requirements of PBU 6/01.

Procedure

Simultaneously with the reflection in accounting data, the commissioning of assets is recorded in inventory cards in the OS-6 form, and for a group of fixed assets in the OS-6a form. Actual operation begins from the date specified in the manager’s order and the acceptance certificate.

Introduction period

Legislative acts do not establish regulated deadlines for the commissioning of fixed assets; the company itself has the right to make this decision.

If assets are registered, but are not actually used in current activities, they will be depreciated only according to accounting data.

Depreciation for tax accounting purposes will be carried out only from the date of actual operation.

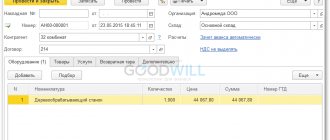

Nuances of reflection in 1C

When using the 1C software package, to properly complete the commissioning procedure, you must perform the following steps:

- capitalize the receipt of tangible assets by filling out the “Receipt of Equipment” form while simultaneously determining the initial cost;

- in fact, the commissioning of an accounted asset is formalized by filling out the document “Acceptance for accounting of fixed assets”;

- To account for depreciation data in tax accounting, the document “Depreciation Bonus” is filled out.

When filling out each document, it is necessary to accurately indicate the dates of transactions with assets and the grounds for such actions.

https://youtu.be/3v5ue8PkhC8

The commissioning of fixed assets in 1C is shown in the video below:

Source: https://uriston.com/kommercheskoe-pravo/buhgalteriya/vneooborotnye-aktivy/osnovnye-sredstva/vvod-v-ekspluatatsiyu.html

Features of the act, general points

If you have been given the task of creating an act of acceptance and delivery of a fixed asset that has undergone repair work, and you do not know exactly how to do this, carefully read the recommendations below. Look at the example of filling it out - you can easily draw up your document based on it.

Before moving on to a detailed description of the act, we provide general information about the document. Let's start with the fact that today there is no single unified model (the abolition of mandatory forms of primary documents occurred in 2013). This means that an act can be formed in any form or according to a template approved in the accounting policy of the enterprise.

However, the option of using the previously generally applicable OS-3 form is in greatest demand - it is convenient in structure, understandable and contains all the necessary information.

In this case, the method of drawing up the act must be reflected in the company’s regulatory documents.

Form OS-3 can be filled out by hand or on a computer - however, if the second path is chosen, the form should be printed after final formation. This is necessary so that all parties involved in the acceptance and delivery of fixed assets can put their signatures on the document, including those directly involved in the acceptance and delivery, the chief accountant and the director of the enterprise.

It is not necessary to certify the form with a seal - this should only be done when such a condition is in the company’s local documentation.

An act is drawn up in at least three copies (if the act is filled out by hand, then using a copy sheet) - one for each of the interested parties. If necessary, additional copies can be made, which also need to be properly certified.

Certificate of commissioning of fixed assets

Note that commissioning of equipment or a building is necessary not only immediately after its purchase, but also after repair, modernization or reconstruction.

Certificate of commissioning of an object: sample Today there is no form of certificate of commissioning of an OS that would be mandatory for use. However, for ease of accounting, the vast majority of organizations use forms that were previously approved by the State Statistics Committee of the Russian Federation.

The commissioning certificate can be completed using the following standardized forms:

- No. OS-1 - Certificate of acceptance and transfer of fixed assets

- No. OS-1a - Certificate of acceptance and transfer of building (structure)

- No. OS-1b - Certificate of acceptance and transfer of a group of OS objects

The OS commissioning act in form No. OS-1 looks like this: This is a rather voluminous document drawn up on three sheets. This form can be downloaded from our website.

Certificate of commissioning of fixed assets

Depreciation for tax accounting purposes will be carried out only from the date of actual operation. Nuances of reflection in 1C When using the 1C software package, to properly complete the commissioning procedure, you must perform the following steps:

- capitalize the receipt of tangible assets by filling out the “Receipt of Equipment” form while simultaneously determining the initial cost;

- in fact, the commissioning of an accounted asset is formalized by filling out the document “Acceptance for accounting of fixed assets”;

- To account for depreciation data in tax accounting, the document “Depreciation Bonus” is filled out.

When filling out each document, it is necessary to accurately indicate the dates of transactions with assets and the grounds for such actions.

How to draw up a commissioning certificate correctly

- form form OS-1a

- form form OS-1b

Drawing up a commissioning certificate In order to formalize the commissioning of equipment or draw up a commissioning certificate for a building, you will need to carry out complex preparatory work:

- Receive a written notification from the contractor (seller) with a certificate of completion of work attached to it. This also includes all technical documentation for the OS object.

- Inspect the facility before it is accepted for use.

The implementation of this work is entrusted to a specially created working commission, which includes representatives of all parties. At this stage, documentation is checked and the condition of the object is assessed.

Registration requirements To accept fixed assets for operation, there are specialized samples of the equipment commissioning act, in which the authorized commission employee can only fill in the blank lines. But still, there are uniform requirements that the act for commissioning any object, be it a building or equipment, is subject to.

- The commission draws up the act in triplicate. Two of them are intended for organizations - the receiving party and the counterparty producing or supplying the equipment. The third copy is intended for government supervisory authorities.

- The form is signed by two parties - the transferor (counterparty, supplier) and the recipient (operating company).

- The act is an annex to the main documentation reflecting the technical condition.

Commissioning of fixed assets - features and procedure

- The legislation provides for situations when several items need to be put into operation at once. For this purpose, the act form for groups of objects OS-1B is intended.

- To reflect the commissioning certificate of a capital construction project, sample OS-1A is used. You can download it here.

- If adjustments or other manipulations are required, you have to use the OS-14 form. After installation work, the equipment is still accepted for use using the standard form of forms - OS-1, 1A and 1B.

- When commissioning machinery, equipment or buildings after major repairs, it is necessary to use standardized forms KS-11 and KS-14.

It is worth noting the fact that since 2014 the legislation does not strictly control the use of unified forms, therefore allowing entrepreneurs to ignore them.

Equipment commissioning certificate (sample)

It should be taken into account that there are several types of acts for the commissioning of fixed assets, such as OS-1a (for the design of buildings and structures) or OS-1b (simultaneous commissioning of several objects). Form OS-1a takes into account all the necessary information to formalize the commissioning of the building in accordance with legal requirements.

https://youtu.be/kTnhZ8ZyKXc

When filling it out, pay attention to some features. On sheet 1, information about the state registration of rights to the object must be entered.

Attention Information about the designer or developer is indicated just below. The first section of sheet 2 indicates the start and end dates of construction, reconstruction, and major repairs.

The lower table of the third section combines qualitative and quantitative characteristics with a breakdown by structural elements according to the technical data sheet of the facility.

The remaining data is filled out similarly to the main OS-1 form.

Certificate of commissioning of the facility

Rosimushchestvo.

- Technical documentation should be attached to the commissioning certificates (for buildings this can be a certificate or report on the technical condition of the building, an extract from the technical passport, a detailed plan of the building, for equipment - a technical passport).

- Such acts are approved by the heads of both organizations (seller and buyer, deliverer and receiver) and are also signed by representatives of the two organizations (a sample commissioning act can be seen on our website).

- Important points There are also some points that are worth paying attention to (for example, that the details “State registration of rights” should be filled out only when conducting real estate transactions).

What documents are required to document the commissioning of fixed assets?

If the registered object is not planned to be used, the company is not obliged to draw up these acts; the assets can remain out of operation for an unlimited time, provided that depreciation rates are calculated in a timely manner. The main list of requirements for the form and content of acts can be found in PBU 6/01, or you can download a standard sample of these documents on our website.

The act must be drawn up by the internal Commissioning Commission, the composition of which is approved by the company’s management. Rules for drawing up When drawing up an act, you must follow a certain algorithm of actions and rules for filling out the document.

Particular attention to the act is paid to those companies that deal with complex machinery or dangerous equipment. The objects and form of the form largely depend on the type of object that is being introduced into the work.

The main means include:

- computational instruments and devices, equipment of various types;

- equipment for any purpose;

- immovable structures, buildings, land plots, roads;

- any transport and special equipment;

- household and production equipment and tools;

- representatives of flora and fauna intended for commercial use.

When is a document drawn up? The answer to this question seems obvious, but the act is not always drawn up at the time of transfer of property.

Commissioning certificate

How to correctly draw up an act Both the document and its execution are not provided for in the law by any special requirements. The act can be written on a regular sheet of paper or on the organization’s letterhead.

Important All necessary information can be entered by hand (with a ballpoint pen of any dark color, but not a pencil) or printed on a computer.

There is only one condition that must be observed without fail: the presence of “live” signatures of all people present when the fixed asset was put into operation. At the same time, the use of facsimile autographs, i.e. printed in any way is unacceptable.

It is not necessary to certify the act using enterprise seals - this must be done only in cases where this norm is prescribed in the company’s local regulations: since 2016, the use of stamp products by legal entities is at their discretion.

The need to correctly take into account the received property and then commission fixed assets is determined by tax legislation. The last procedure will be discussed in the article.

It should be noted that fixed assets (hereinafter referred to as fixed assets) include objects costing more than 40 thousand rubles, and their service life is at least 12 months. The cost of other items can be written off once as material expenses.

According to PBU 6/01, the commissioning of fixed assets provides for the formation of the initial cost of assets on account 08. Here the actual costs of their acquisition and delivery accumulate.

Receipts to this account are recorded by the following entries: No. Transaction Dr Ct Receipt document 1 Purchase for a fee 1.1. Receipt of assets from the supplier 08 60 Purchase and sale agreement, invoice 1.2.

Source: https://pbcns.ru/akt-vvoda-v-ekspluatatsiyu-osnovnogo-sredstva/

How to account and store a document

The act in form OS-3 is subject to mandatory recording and storage. Information about the completed, signed and approved form must be entered into the internal documentation journal, indicating the date of creation and document number.

After this, the form should be placed in a folder with other similar papers, where it should be kept for the period established by law or for the period prescribed in the internal regulations of the organization. After this time, it can be disposed of following the procedure specified by law.

Features of filling out the OS-3 form

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Below we note the main points that you should pay attention to when filling out OS-3:

- This document must be drawn up on the day the property is received.

- A higher commission inspects the OS and conducts a fact check.

- The finished data is indicated in OS-3, upon completion of which a conclusion is created about the state of the OS.

- Certification of the act is carried out by all members of the commission.

Which people must certify Form OS-3?

- Participants of the handing over and the side that accepts it.

- Chief accountant of the customer.

- Management company.

If this document is drawn up for another company, then it is necessary to make 2 copies of the document, providing it to the accounting department and the contractor.

Filling out the OS-3 form

Features of filling out the act:

- This document is drawn up on the day the property is accepted upon completion of repairs. This moment is recorded on the title page and the license plate number is indicated.

- The customer is the company that owns the OS.

- Contractor – the company or department with which the contract has been drawn up. The contract number and date are also indicated here on the title page.

- Establishing a time frame within which repairs, improvements or reconstruction must be carried out. This information is indicated on the right side of the license plate of the document.

- OS-3 document has 2 sections, the first indicates information about the OS object at the time of transfer for repair or modernization, the second section indicates information about expenses.

- Section 1 - data about the OS object is recorded in detail here - name, brand, license plates, replacement cost and period of use. The time of preservation of fixed assets, improvement, and major repairs is not taken into account if depreciation transfers have been completed.

- Upon completion of filling out the tables of the OS-3 document, it is important to note the commission’s data on the completion of work based on the contract. If the specified work is not completed in full, these items are listed.

- Based on the work done, a final conclusion is drawn up, where all the changes/improvements made are spelled out.

- Upon completion of the process of filling out this document, it is certified by the management of the company. The next stage is sending the act to the accounting department. The accountant checks the data and makes cost accounting entries. He puts his mark on a special card of the OS-6 or OS6b form about the activities performed.

Commissioning of fixed assets

The placement of property assets on the balance sheet occurs in several stages. First, when a company acquires assets, it accepts them for accounting and then puts them into operation by preparing the appropriate documents. These are: the act of commissioning fixed assets and the order of management for commissioning.

Commissioning of fixed assets

Not all property can be accounted for as fixed assets. This requires the fulfillment of the following conditions in accordance with PBU 6/01 and Article 256 of the Tax Code of the Russian Federation:

- long term of asset use - more than 1 year;

- the ability to generate income in management, trade and production activities, including from leasing;

- the property was not acquired for subsequent resale;

- the value of the asset for accounting purposes is more than 40 thousand rubles, for tax purposes - over 100 thousand rubles.

If the value of an asset varies in the range: 40-100 thousand rubles, in accounting it is considered a fixed asset and is depreciated; in tax accounting it should be written off as a lump sum expense.

It does not matter how the company received the property: acquired for a fee, built or created it independently, received from a participant in the form of a contribution to the authorized capital or as a result of registration of civil transactions by offsetting obligations.

https://youtu.be/tkgZ7cg8_8I

The company receives ownership of property funds on the basis of purchase and sale agreements, primary invoices, acceptance certificates of various formats.

Other accompanying documents are technical passports, from which you can find out the service life and other important characteristics of the object.

Receipt of fixed assets into the warehouse is formalized by debiting account 08; additional expenses for bringing the property to a usable state are also collected there.

The next stage is the commissioning of fixed assets.

How to formalize the commissioning of fixed assets

At the commissioning stage, two important factors are taken into account: the initial cost of the property asset and the start date of its use.

The initial cost of an object is determined based on the method of its receipt by the organization:

- values received free of charge are included in the market valuation;

- created in the company - at the cost of all production and construction costs;

- made in the form of a contribution - at a monetary value determined by decision of the owners.

The date of commissioning of fixed assets registered with documents confirms that the property is used in the financial and economic activities of the company and is not lying in a warehouse. The period of commissioning of a fixed asset from the moment of receipt into the warehouse is not limited by law: each company decides this issue independently.

To accept assets for accounting, it is enough to draw up an “Acceptance and Transfer Certificate of Fixed Assets” in Form No. OS-1, and then calculate depreciation in accounting.

The act of commissioning fixed assets - a sample form of the standard unified form OS-1 was approved by Decree of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7, you can download it here. When commissioning fixed assets, other standard documents may be used:

- OS-1a – for real estate (industrial premises, office buildings, structures of various formats, etc.);

- OS-1B – for entering several assets simultaneously.

Instead of unified forms, a company can independently develop and use an act form with the details required for primary documents specified in Art. 9 of the Law on Accounting No. 402-FZ dated December 6, 2011.

The act must also reflect: the main characteristics of the asset, its original cost, the date of registration and the persons responsible for its safety.

The form of the act (unified or proprietary) is fixed by the company’s accounting policy.

Commissioning of fixed assets - sample form OS-1:

In addition to the act of entry, a special card f. is also issued. OS-6 for warehouse accounting purposes.

Why is an order to put fixed assets into operation necessary?

To account for received assets in tax accounting and reflect depreciation amounts in expenses, the OS-1 form alone is not enough. It is required to document the exact moment of commissioning of fixed assets.

But directly in the OS-1 act itself there is no line with such wording; it only contains a field with the date of acceptance of the received asset for accounting.

There are two options for reflecting this moment:

1. Enter the date of commissioning on the front side of the act as a separate line.

2. Draw up an order to put the facility into operation.

Drawing up an order will also help confirm the purpose of using the asset, that it was not purchased as a product for resale. It will be especially relevant to draw up an order for companies declaring VAT on purchased funds for deduction. Drawing up such an order will be additional confirmation of the use of the asset in activities subject to VAT.

Order for commissioning of fixed assets: sample

Source: https://spmag.ru/articles/vvod-v-ekspluataciyu-osnovnyh-sredstv

In what cases should I fill out a unified form?

At the final stage of renewal, reconstruction or restoration of a fixed asset, an act is drawn up in the OS-3 form.

Read about documenting repair work with fixed assets here.

Such a unified form is a primary document.

It is an important form for accounting and justifying the costs of an enterprise for restoration work.

Such services are often provided to the organization by outside companies.

Using the form (OS-3), developed by government agencies, the acceptance and entry of an OS object is carried out for further use after its modernization, reconstruction, major or current repairs.

Equipment acceptance document

Form OS-3 is an act of acceptance and transfer of equipment after restoration work has been completed.

This documentation is unified, but on its basis it is possible to issue an internal form taking into account the specifics of production. The use of the document is necessary in the case of equipment delivery for repair and acceptance after repair, and its formation is undeniable in any case - when the book value changes or maintains its previous size.

Important: the form is the same for any fixed asset. It reflects the changed value of the object on the day the act was formed, and it also reflects the amount of money spent on repairs.

The act is a mandatory primary document; in order to recognize expenses for modernization or restoration of property, its execution must be completed in a timely manner.

What is a write-off act and how to draw it up correctly - see here:

https://youtu.be/bX6rsZZljXI

Who creates the transfer and acceptance certificate

To accept equipment after repair, the enterprise must have a commission on a permanent basis or one responsible person. The responsibility of such authorized persons is to issue funds for repairs and receive funds after restoration of fixed assets.

It is this commission that draws up and certifies the document, and the act must also be certified by:

- A representative of the delivering organization or department in which all the work was carried out;

- Accountant of the host party;

- Head of the enterprise.

A document is drawn up and signed immediately upon receiving the OS. you will learn what an act in form OS-4 is and how it differs from OS-3.

Responsibilities of the commission before signing the act

Among other things, the commission is obliged to fulfill all its obligations before signing the act:

- Check that the work is completed in full;

- Attend equipment testing;

- Register the acceptance and transfer of assets. What is an act of acceptance and transfer of goods and how to draw it up - find out by following the link;

- Record changes in basic characteristics.

Who applies and when?

The date of acceptance of the fixed asset by the special commission is the date of execution of the act, form OS-3.

Its members inspect the repaired, reconstructed or modernized facility, checking the operational attributes and functions, and their performance.

The results of the actions taken and the final condition of the property are stated in the act.

The authenticity of the recorded information is confirmed by the signature of all representatives of the commission.

Filling out when accepting delivery of repaired, reconstructed, modernized OS facilities

The form consists of 2 blocks:

- data on the fixed asset as of the date of its transfer for reconstruction;

- information about the company’s costs for repair work.

The header of the act, form OS-3, contains: the name of the customer and the direct performer of the work, OKUD and OKPO codes.