Accounting for settlements with suppliers when purchasing OS

Postings reflecting the acquisition of a fixed asset allow, along with the reflection of debt to organizations, to ensure the correct formation of the initial cost of the fixed asset. For accounting purposes, all costs related to fixed assets are reflected by entries in the debit of account 08 in correspondence with the corresponding accounts. Particular attention should be paid to the procedure for reflecting VAT in accounting:

- if the fixed asset is planned to be used in activities, the results of which are subject to VAT, then it is subject to reimbursement from the budget;

- otherwise, the VAT amounts issued by the supplier should be included in the cost of the fixed asset.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Postings on receipt of fixed assets for production purposes involved in activities subject to VAT | ||||

| 08.4 | 60 | The cost of the OS object is taken into account. debt to the supplier is reflected | price without VAT | |

| 19.1 | 60 | VAT charged by the supplier is taken into account | VAT | |

| Postings for the receipt of a fixed asset that is NOT involved in activities subject to VAT | ||||

| 08.4 | 60 | The cost of the OS object is taken into account. debt to the supplier is reflected | Value with VAT | |

| Suppliers' invoices for received operating systems have been paid | ||||

| 60 | 50-1 | In cash from the company's cash desk | ||

| 60 | 51 | By cashless transfer from the company's account | ||

| 60 | 55 | By bank transfer from special accounts of the enterprise | ||

| 60 | 71 | Through an accountable person | ||

How to properly put an operating system into operation: documents and date of acceptance for accounting

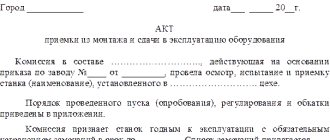

To document the process of commissioning fixed assets, enterprises can use standard forms No. OS-1 (a, b) or independently develop the form of this document. It is important that the act contains all the necessary details:

- date and number;

- information about the organization transferring the OS;

- information about the enterprise receiving the object;

- accounting information: initial cost, useful life, etc.;

- characteristics of the fixed asset, etc.

Read more about the preparation of this document in the article “Unified Form No. OS-1 - Certificate of Acceptance and Transfer of OS”.

To determine the readiness of the facility for operation, the manager issues an order to create a special commission. Its members will make a conclusion about the OS’s compliance with the technical specifications or the need for improvement. And based on the data received, the commission makes a conclusion and reflects it in the act.

Often an accountant is faced with the question: how to put into operation a fixed asset that the organization does not yet plan to use? To answer this, you need to decide what is considered the date of commissioning of fixed assets.

This date is the day when the fixed asset is completely ready for use, regardless of the moment when it actually begins to be used. After all, it is necessary to calculate depreciation according to the accounting book of the OS capitalized to the accounts. And until the fixed asset is put into operation, it will not be possible to charge depreciation.

In addition, untimely reflection of objects as part of fixed assets distorts their value, as a result of which the tax base for corporate property tax is underestimated. Such a violation leads to fines from the tax office, so commissioning of the OS cannot be delayed without compelling reasons.

https://youtu.be/D_N66kNqKbg

Reflection of additional costs to bring the OS to a usable state

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| The cost of services for fixed assets involved in activities subject to VAT is reflected. | ||||

| 08.4 | 60 | The cost of services for the asset and the debt to the company that provided the services are taken into account | ||

| 19.1 | 60 | VAT charged by the supplier is taken into account | ||

| Cost of services for a fixed asset NOT involved in activities subject to VAT | ||||

| 08.4 | 60 | The cost of services for the asset and the debt to the company that provided the services are reflected | ||

| Invoices for services rendered have been paid | ||||

| 60 | 50-1 | In cash from the company's cash desk | ||

| 60 | 51 | By cashless transfer from the company's account | ||

| 60 | 55 | By bank transfer from special accounts of the enterprise | ||

| 60 | 71 | Through an accountable person | ||

Accounting for receipt of fixed assets

OSes put into operation are accounted for using account 01. The basis for commissioning is an order from the head of the enterprise. The accounting department draws up transfer and acceptance reports and records fixed assets on inventory cards (type OS-6).

Most often, the arrival occurs as a result of:

- completion of construction

- acquisitions for a fee (OS purchase)

- receiving free of charge

- receipts in the form of a contribution to the authorized capital.

In accordance with this, the accounting for the receipt of such funds is somewhat different. Let's consider each case separately.

How is the initial cost of fixed assets formed for each method of receipt:

Accounting for construction projects accepted for operation

The formation of the initial cost of a commissioned facility during construction is determined by the cost of its construction. These costs are reflected on the balance sheet. The construction of facilities can be carried out by the enterprise or with the involvement of contractors.

In the case of construction with the help of a third-party developer, the account “Settlements with suppliers and contractors” (account 60) is used.

Accounting entries during the construction of an OS facility by third parties:

- D08 – K60 – the full cost of the work has been determined

- D19 – K60 – VAT allocated

- D01 – K08 – construction project accepted for operation

- D68 – K19 – allocated VAT is sent for reimbursement from the budget

- D60 – K51 – funds transferred to the contractor.

If construction is carried out on its own, then to record the costs of it, the accounts “Materials” (10), “Settlements with personnel for wages” (70), “Auxiliary production” (23), “Depreciation” (02) and others are used. In this case, the postings are made:

- D08 – K10 (02,23,70,69, etc.) – construction costs are taken into account

- D01 – K08 – the facility has been put into operation.

Accounting for fixed assets upon purchase

Purchase is the most common type of receipt. To account for such funds, the accounts “Settlements with suppliers and contractors” (account 60) or “Settlements with various debtors and creditors” (account 76) are used. Depending on the type of funds purchased, corresponding subaccounts are opened to the “Investments in non-current assets” (08) account.

The initial cost of acquired assets is the sum of all costs associated with their purchase and commissioning. Such expenses, in addition to the amount paid to the seller, may include: customs duties, non-refundable taxes, state duties, fees for intermediaries and consultants, as well as funds spent on installation and commissioning of equipment.

Accounting entries for the purchase of fixed assets:

- D08 – K60 (76) – the cost of the object is taken into account according to the supplier’s documents

- D19 – K60 (76) – VAT is allocated from the cost of the object

- D08 – K70 (69, 76, 10, etc.) – costs for delivery, assembly, adjustment are taken into account

- D01 – K08 – object accepted for operation

- D68 – K19 – VAT is sent for reimbursement from the budget

- D60 (76) – K51 – funds transferred to the supplier.

Accounting for fixed assets when received free of charge

The initial cost of fixed assets of an enterprise that were accepted free of charge, for example, in the form of a gift, is considered to be the market value of such objects. If it is impossible to determine it, the assessment is based on the cost of similar material assets. According to the Tax Code of the Russian Federation, funds received free of charge are considered non-operating income of the enterprise.

Postings when receiving fixed assets free of charge:

For accounting purposes, the subaccount “Gratuitous receipts” (98-2) is used. The following entries are reflected in the accounting records:

- D08 – K98-2 – OS accepted for accounting

- D01 – K08 – objects put into operation.

- D98-2 – K91 – depreciation charges are written off.

Receipt as a contribution to the authorized capital

Fixed assets received as a contribution to are accounted for at the cost agreed upon by the founders of the organization (joint stock company). If necessary, resort to the services of an independent appraiser.

Reflected using the account “Authorized capital” (80), the subaccount “Calculations for contributions to the authorized capital” (75-1).

The wiring is as follows:

- D75-1 – K80 – the debt of the founders has been formed

- D08 – K75-1 – funds received as a contribution to the authorized capital of the organization

- D01 – K08 – the object has been accepted for operation.

As a result of the article, we will summarize all the transactions performed when one or another type of receipt of an object at the enterprise into one table.

Postings reflecting the acquisition of a fixed asset allow, along with the reflection of debt to organizations, to ensure the correct formation of the initial cost of the fixed asset. For accounting purposes, all costs related to fixed assets are reflected by entries in the debit of account 08 in correspondence with the corresponding accounts. Particular attention should be paid to the procedure for reflecting VAT in accounting:

- if the fixed asset is planned to be used in activities, the results of which are subject to VAT, then it is subject to reimbursement from the budget;

- otherwise, the VAT amounts issued by the supplier should be included in the cost of the fixed asset.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Postings on receipt of fixed assets for production purposes involved in activities subject to VAT | ||||

| 08.4 | 60 | price without VAT | ||

| 19.1 | 60 | VAT | ||

| Postings for the receipt of a fixed asset that is NOT involved in activities subject to VAT | ||||

| 08.4 | 60 | The cost of the OS object is taken into account. debt to the supplier is reflected | Value with VAT | |

| Suppliers' invoices for received operating systems have been paid | ||||

| 60 | 50-1 | |||

| 60 | 51 | |||

| 60 | 55 | |||

| 60 | 71 | Through an accountable person | ||

Reflection of interest on credits (loans) used for the purchase of fixed assets

When creating entries to reflect interest accrued on loans and credits used to purchase fixed assets, special attention should be paid to the difference in requirements for accounting for these transactions in accounting and tax accounting: Accounting

— the amounts of interest accrued before the facility was put into operation increase the cost of the non-current asset (entry Dt 08 - Kt66, 67).

Interest accrued after commissioning is included in other expenses of the organization (entry Dt 91 - Kt 66.67). Tax accounting

- for tax accounting purposes, the amount of accrued interest is included in the expenses of the reporting period, within the limits established by Article 269 of the Tax Code of the Russian Federation.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Postings reflecting the accrual of interest on loans and borrowings before the facility is put into operation | ||||

| 08.4 | 66 | The cost of interest on short-term loans is taken into account | ||

| 08.4 | 67 | The cost of interest on long-term loans is taken into account | ||

| Interest on loans and borrowings (used for the purchase of fixed assets) accrued after the object is put into operation | ||||

| 91.2 | 66 | The cost of interest on short-term loans is taken into account | ||

| 91.2 | 67 | The cost of interest on long-term loans is taken into account | ||

How are fixed assets that are not immediately put into operation reflected in accounting?

Not all operating systems received by an organization are immediately suitable for use. Some of them require installation and other work to bring them to a condition suitable for use.

Thus, a situation may arise that the operating system was received by the organization in one period, and was reflected in account 01 later. To ensure that tax inspectors do not have any questions, it is necessary to document that the asset is not ready for use. Such documents are acts for installation and commissioning of equipment, contract agreements, invoices for the purchase of components.

If objects are potentially ready for operation, but fixed assets have not yet been put into operation, it is advisable to reflect them separately in accounting. To do this, two sub-accounts are opened to account 01: the first will reflect fixed assets that are ready for use, but have not yet been put into operation, and the second will reflect property in operation.

The accounting entry reflecting the acceptance of fixed assets for accounting in this case looks like this:

- Dt 01 subaccount “Fixed assets in warehouse (in stock)” Kt 08.

- The “OS put into operation” posting will be as follows:

- Dt 01 subaccount “Fixed assets in operation” Kt 01 “Fixed assets in warehouse (in stock)”.

Postings reflecting exchange rate and amount differences for fixed assets

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Postings reflecting exchange rate differences for fixed assets | ||||

| 91.2 | 60 | Negative exchange rate differences reflected | ||

| 60 | 91.1 | Positive exchange rate differences reflected | ||

| Postings reflecting the amount differences for fixed assets | ||||

| 91.2 | 60 | Negative amount differences for fixed assets are reflected after the object was accepted for accounting | ||

| 60 | 91.2 | Positive amount differences for fixed assets are reflected after the object was accepted for accounting | ||

Postings upon receipt of fixed assets for non-production purposes

They serve other needs of the organization and are not associated with generating income, so their depreciation is written off to “Other income and expenses.” VAT is also written off there for deduction.

Postings:

| Account Debit | Account Credit | Description | Sum | A document base |

| 91.02 | 60.01 | Debt for fixed assets to the supplier | OS price without VAT | shipping documents, material accounting documents |

| 19.01 | 60.01 | Accounting for VAT on purchased OS | VAT | invoice |

| 60.01 | OS payment | OS price including VAT | Bank statements | |

| 91.02 | 19.01 | VAT is written off as other expenses | VAT | invoice |

Postings for the construction of fixed assets

The OS can be created in-house or with the help of a contractor.

Postings:

| Account Debit | Account Credit | Description | Sum | A document base |

| Contract construction | ||||

| 08.03 | 60.01, 76.05 | Cost of contractor services | Cost of services, materials, etc. excluding VAT | Contract agreements, certificates of work completed, cost certificates, reports on materials consumption, customs declarations, travel orders, etc. |

| 08.03 | Equipment transferred to the contractor for work | |||

| 10.07 | 10.08 | Materials transferred to the contractor for work | ||

| 08.03 | 10.07 | Materials used by the contractor | ||

| 01.01 | 08.03 | Accounting for the created OS | Initial OS cost | Acceptance and transfer certificates (OS-1, OS-1a), OS-6 Inventory registration card |

| 19.03 | 60.01,76.05 | Total VAT on costs | General VAT per | Invoice |

| OS construction by the organization | ||||

| 08.03 | 10.01 | Materials for creating an OS | Costs incurred excluding VAT | Invoices, declarations, travel orders, bank statements |

| 08.03 | (68,69) | Accrued wages to employees building the OS | ||

| 08.03 | ,,,60,76 | Other costs | ||

| 19.01 | 60.01,76.05 | Total VAT on costs | VAT | |

| 01.01 (03.01) | 08.03 | Accounting for the created OS | Initial cost (excluding VAT) | Acceptance and transfer certificates |

| 68.02 | 19.03 | VAT deduction on building materials | VAT | Invoice |

How to reflect the arrival of the OS in 1C 8.3

To reflect the receipt of fixed assets in the 1C Accounting 8.3 program, it is enough to enter the document Receipt of goods and services with the type of operation “Equipment”:

1C will create the necessary postings on its own, for example Dt 08.04 - Kt 62.01.

What applies to fixed assets

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

It is clear what fixed assets are. If an object received by an enterprise is intended for long-term use, we are not going to sell it and plan to make a profit with its help, then this is an operating system. Now let's figure out what applies to them.

The main assets include:

- buildings and constructions;

- working and power machines and equipment;

- measuring and control instruments and devices;

- Computer Engineering;

- vehicles;

- tool;

- production and household equipment and supplies;

- working, productive and breeding livestock;

- perennial plantings;

- on-farm roads;

- capital investments in leased fixed assets;

- land.

Read more in the article Fixed Assets. Formula. Calculation

Additional costs when registering OS

All costs associated with making the OS ready for use are included in its initial cost. VAT accounting for them is carried out similarly to accounting for refundable VAT when purchasing fixed assets and is not indicated in these transactions. The general rule is that all relevant expenses incurred before putting the asset into operation are capitalized.

Postings:

| Account Debit | Account Credit | Description | Sum | A document base |

| 08.04 | Transferring the OS for installation | Cost of purchased OS excluding VAT | Bank statements, payment orders | |

| 08.04 | ,69,10 | Capitalization of installation costs | Cost of installation work | |

| 08.04 | 60.01,76.05 | Other services (for example delivery) | Cost of services excluding VAT | Help-calculation |

| 08.04 | 68 | Accounting for customs, registration fees and duties | Customs duty excluding VAT, other fees and charges | Bank statements |

Search machine commissioned wiring

Buyers thoroughly study equipment or special equipment required for work through manufacturer catalogs in advance. First, they find out the technical characteristics, are interested in the operating features, operating mode, as well as power and other important indicators, including available options and provided functionality.

Now not only production equipment and installations, but also machine tools have built-in automation, which is very beneficial for the manufacturer and does not have to use the services of a shift operator. Basically, everything is performed by equipment, the production of which uses know-how, the machine has been put into operation, wiring, the latest developments and special “tricks” known only to designers, engineers and planners.

Highly qualified specialists invariably make sure that machine tools and other mechanized and automated installations, entire complexes work properly and are equipped with special protection, which will protect against accidents and emergencies. All branded special equipment is comfortable to use, allowing you to constantly expand production capacity and eliminate manual labor as much as possible.