Formation of the initial cost of a fixed asset

The procedure for accounting for fixed assets (FPE) is regulated by PBU 6/01 (approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n). This regulatory act (clause stipulates, in particular, what expenses can be included in the cost of the operating system when purchasing it:

This regulatory act (clause stipulates, in particular, what expenses can be included in the cost of the operating system when purchasing it:

- Amounts to be paid under a purchase and sale agreement.

- Customs duties - if the OS is purchased abroad.

- Amounts under the construction contract.

- The cost of consulting services directly related to the acquisition of this asset.

- State duty.

- The cost of the services of an intermediary, if one participated in the purchase and sale.

- Other payments paid when purchasing an OS.

About taking into account transportation costs in this cost, read the article “Are transportation costs included in fixed assets?”

Thus, the process of forming the cost of the OS is quite transparent and clear. Just remember that not all equipment can be classified as an OS:

- In accounting (BU) we will put into account 01 income-generating assets that can participate in the production cycle for more than 12 months and that are not intended for resale. According to clause 5 of PBU 6/01, assets that meet this definition, with a value up to the limit specified in the accounting policy (but not more than 40,000 rubles) can be taken into account as part of the inventory.

- In tax accounting (TA) since 2020, the cost of depreciable property has increased to 100,000 rubles. (Clause 1 of Article 256 of the Tax Code of the Russian Federation). Accordingly, any asset that is valued at this amount or less is written off in tax accounting at a time at the time it is accepted for accounting as an asset.

Read about ways to write off the cost of fixed assets in NU in the materials:

- “What method to choose for calculating depreciation in tax accounting?”;

- "Depreciation bonus in accounting and tax accounting."

How to account for fixed assets worth up to 100,000 rubles

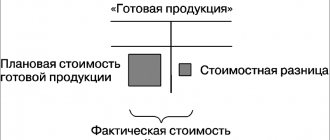

As you can see, the tax and accounting rules for fixed assets unconditionally coincide if the property is more than 100,000 rubles. You can compare tax and accounting when purchasing an operating system less than 40,000 rubles by writing off the property as expenses at a time.

Cost limits

The situation is completely different in tax accounting. Fixed assets more expensive than 100,000 rubles must be depreciated; anything cheaper will have to be written off immediately as expenses (Clause 1, Article 256 of the Tax Code of the Russian Federation). This rule applies only to property put into operation after December 31, 2020.

- objects valued within the limit established in the organization’s accounting policies, but not more than 40,000 rubles. per unit, can be reflected in accounting as part of inventories (MPI) (clause 5 of PBU 6/01);

- if the cost of the fixed asset exceeds 40,000 rubles. per unit (the limit established in the accounting policy of the organization), then the cost is repaid by calculating depreciation (clause 17 of PBU 6/01).

https://youtu.be/3v5ue8PkhC8

Accounting for fixed assets in accounting and tax registers

So, until 2020, in both types of accounting, the threshold for the cost of accepting OS was the same: everything that cost 40,000 rubles. and less were taken into account as low-value property. Now the order is a little different. This is clearly seen in the diagram:

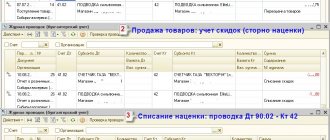

Thus, temporary differences appear in tax accounting when purchasing fixed assets costing more than 40,000 rubles, but not more than 100,000 rubles.

Example

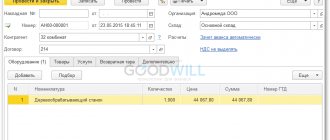

in May 2020 I bought a washing vacuum cleaner worth 80,000 rubles. without VAT. The cost of consulting services provided to the company for the purchase of this equipment amounted to 4,000 rubles. without VAT. The facility was put into operation by order of the director from 06/01/2018. When calculating depreciation, the straight-line method is used.

In June 2020, the accountant made the following entries:

- Dt 08 Kt 60 - 80,000 rub. (equipment received from supplier);

- Dt 08 Kt 60 — 4,000 rub. (consulting services are taken into account in the cost of the object);

- Dt 01 Kt 08 — 84,000 rub. (a washing vacuum cleaner is accepted for accounting as an operating system).

In tax accounting, all expenses are written off at once. Let's see how the accountant will reflect the differences that appear.

The useful life is 60 months, the monthly depreciation amount will be 1,400 rubles. (84,000 / 60).

The procedure for calculating depreciation in accounting is described in detail.

After putting the operating system into operation, the accountant will create an accounting entry:

- Dt 68 Kt 77 —16,800 rub. (84,000 × 20%) (deferred tax liability reflected).

Starting in June, during the useful life, depreciation entries will appear monthly in accounting:

- Dt 25 Kt 02 — 1400 rub. (depreciation has been charged).

At the same time, a deductible temporary difference in the amount of 1,400 rubles arises in tax accounting. and monthly postings are generated:

- Dt 77 Kt 68—280 rub. (1400 × 20%) (repaid by IT).

Thus, within 60 months IT will be fully repaid.

Postings for accounting for fixed assets can be found in this material.

IMPORTANT! Temporary tax differences can be avoided. According to sub. 3 p. 1 art. 254 of the Tax Code of the Russian Federation, the taxpayer is allowed to independently choose the method of writing off the value of property not related to fixed assets, taking into account its useful life or other economic indicators. Thus, if you add to your tax accounting policy a time-stretched procedure for recognizing expenses for fixed assets worth more than 40,000 rubles, but not more than 100,000 rubles, you will get rid of possible IT and temporary differences in accounting.

Accounting for disposal of fixed assets

It is possible that the company will sell or liquidate the OS before the end of its useful life. In this case, both the taxable and temporary differences will remain partially outstanding. In such a situation, the deferred tax liability and the deferred tax asset must be written off to account 99.

To account for fixed assets upon their disposal, separate analytical accounts of the “Fixed Assets” account are also used, ending with 410 and indicating a decrease in the value of the corresponding fixed assets.

The main entries for accounting for fixed assets upon disposal are shown in the table below. Other transactions can be found in clause 10 of the instructions for the chart of accounts (order No. 162n).

| Wiring | Description of posting in fixed asset accounting |

| Dt 040120271 “Costs for depreciation of fixed assets and intangible assets”, 010634340 “Increase in investments in inventories - other movable property of the institution”, 010900000 “Costs for the manufacture of finished products, performance of work, services” (010960271, 010970271, 010980271, 010 990271) Kt 010100000 “Fixed assets” (010134410, 010135410, 010136410, 010138410) | Commissioning of an OS costing no more than 3,000 rubles. |

| Dt 030404310 “Internal settlements for the acquisition of fixed assets”, 040120200 “Expenses of an economic entity” (040120241, 040120242, 040120251, 040120252, 040120253) Kt 010100000 “Fixed assets” (010111410–010113410, 010115410, 010118410, 010131410–010138410) | Free transfer of an object or transfer to trust management |

| Dt 010400000 “Depreciation” (010411410–010413410, 010415410, 010418410, 010431410–010438410) Kt 010100000 “Fixed assets” (010111410–010113410, 010115410, 010118410, 010131410–010138410) Dt 040110172 “Income from operations with assets” Kt 010100000 “Fixed assets” (010111410–010113410, 010115410, 010118410, 010131410–010138410) | OS sales |

Accounting for a computer worth less than RUB 40,000.

Quite often, accountants have a question about how to account for a computer if its cost is below 40,000 rubles - as part of low-value property, over which many people do not have control, or as an operating system. Indeed, according to most features, a computer fits the definition of a fixed asset.

First, you need to clarify what standards are specified in your accounting policy. If, according to its provisions, the OS, when accepted for accounting, cannot cost less than 40,000 rubles, then any computer with a cost not exceeding this limit must be included in inventory accounts and, at the time of release into operation, taken into account on the balance sheet, for example on a self-opened account 012 “Equipment in operation” (with details by place of storage or use).

If your accounting policy allows you to take into account any asset that meets the requirements of PBU 6/01 as part of the operating system, regardless of its value, then inexpensive computers can be safely attributed to account 01 “Fixed Assets”. At the same time, accounting for fixed assets worth less than 40,000 rubles. will be no different from accounting for objects of higher value.

How to write off fixed assets of a budget institution

The procedure for writing off fixed assets from the balance sheet implies, first of all, identifying the reasons why the property should be removed from the institution’s accounting records. Situations in which write-off from accounting is required:

- government institutions are completely deprived of the right to dispose of any property without appropriate permission from the owner (founder, superior manager, body exercising the functions and powers of the founder);

- a budgetary and (or) autonomous institution does not have the right to dispose of real estate, as well as especially valuable property acquired at the expense of budgetary funds or assigned to the organization by order of the owner.

How to take into account a computer worth less than 20 thousand rubles.

Info

If, according to its provisions, the OS, when accepted for accounting, cannot cost less than 40,000 rubles, then any computer with a cost not exceeding this limit must be included in inventory accounts and, at the time of release into operation, taken into account on the balance sheet, for example on a self-opened account 012 “Equipment in operation” (with details by place of storage or use). If your accounting policy allows you to take into account any asset that meets the requirements of PBU 6/01 as part of the operating system, regardless of its value, then inexpensive computers can be safely attributed to account 01 “Fixed Assets”.

At the same time, accounting for fixed assets worth less than 40,000 rubles. will be no different from accounting for objects of higher value. Results The procedure for reflecting fixed assets worth up to 100,000 rubles.

What needs to be done from March 12 to 16 In order not to forget about important accounting matters, you can keep a diary, install a special program on your smartphone that will remind you of plans, or stick stickers covered with notes on your work monitor. But the easiest way is to read our reminders weekly. < < …

Individual entrepreneurs should not rush to pay 1% contributions for 2020. Firstly, because from this year the deadline for paying such contributions has been postponed from April 1 to July 1. Accordingly, 1% contributions for 2020 must be transferred to the budget no later than 07/02/2018 (July 1 – Sunday). <... The transition from one Federal Tax Service Inspectorate to another will not require mandatory reconciliation. The Tax Service has updated the regulations for organizing work with payers of taxes, fees, insurance contributions for compulsory pension insurance, as well as tax agents.

The modern procedure for writing off fixed assets in budgetary institutions (M

- real estate (including objects of unfinished construction) assigned to budgetary institutions on the right of operational management, as well as especially valuable movable property assigned to budgetary institutions by the founder, or acquired by budgetary institutions at the expense of funds allocated by the founder for the acquisition of such property,

- a list of fixed assets that allows you to clearly individualize property that has fallen into disrepair, including name, individual number (factory, registration, inventory, etc.), year of production and acceptance for accounting, number of units, cost, residual value, useful life and actual use. In practice, such a list is compiled on the basis of an inventory list, inventory cards, where all the necessary information about fixed assets is available;

Acceptance for registration of a computer worth less than 40,000

OS upon purchase:

- Amounts to be paid under a purchase and sale agreement.

- Customs duties - if the OS is purchased abroad.

- Amounts under the construction contract.

- The cost of consulting services directly related to the acquisition of this asset.

- State duty.

- The cost of the services of an intermediary, if one participated in the purchase and sale.

- Other payments paid when purchasing an OS.

About taking into account transportation costs in this cost, read the article “Are transportation costs included in fixed assets?” Thus, the process of forming the cost of the OS is quite transparent and clear. In any case, it is important to take into account that fixed assets worth more than 40,000 rubles cannot be reflected in accounting as materials, even if this is provided for in the Accounting Policy. Therefore, fixed assets from 40,000 to 100,000 cannot be accounted for by the organization in account 10 “Materials”. At the same time, when we say “from 40,000,” we mean more than 40,000, since an object with an initial cost of exactly 40,000 rubles can still be taken into account as inventories. Therefore, accounting for expenses of property worth less than 40,000 rubles will be carried out in accordance with the procedure established for synthetic and analytical accounting of inventories. Fixed assets up to 100,000: tax accounting Fixed assets less than 100,000 rubles in tax accounting are not depreciable property (clause 1 of Article 256 of the Tax Code of the Russian Federation).

The procedure for writing off fixed assets up to 40,000 rubles in the budget

Only authorized persons have the right to make a decision on the impossibility of further exploitation of the property due to its unsatisfactory characteristics, and therefore it can be transferred to another organization or sold in accordance with the drawn up agreement. The liquidation commission must not only be formed, but also confirmed, and only after all the specialists have completed the assigned tasks, the head of the organization can make the final decision regarding this property and sell it.

If this decision was made, then in this case the revaluation of fixed assets should be carried out in accordance with their condition as of December 31, and the procedure will need to be carried out every year. Revaluation is carried out for all fixed assets that belong to the same category. The result of the markdown is reflected in account 91, while the additional valuation of property is included in the list of additional capital and is reflected in the credit of account 83.

We recommend reading: Goods From Social Security Free

Acceptance for registration of a computer worth more than 40,000

Add to favoritesSend by email Accounting for fixed assets worth up to 100,000 rubles has a number of nuances. Let's look at what causes them and consider accounting for such objects from the point of view of accounting and tax laws.

Formation of the initial cost of a fixed asset Accounting for fixed assets in accounting and tax registers Accounting for a computer worth less than 40,000 rubles. Results Formation of the initial cost of a fixed asset The procedure for accounting for fixed assets (FPE) is regulated by PBU 6/01 (approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n).

In this normative act (p.

Quite often, accountants have a question: is it necessary and how to take into account property that meets the characteristics of fixed assets, but is worth less than the established limit, after actually writing off its value in accounting and tax accounting?

In accordance with clause 5 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved. by order of the Ministry of Finance of the Russian Federation dated March 30, 2001. No. 26n, assets that meet all the characteristics of fixed assets, but whose cost per unit is less than the limit established by the organization’s accounting policy, can be taken into account as part of inventories. Since 2011, the limit has been 40,000 rubles. According to Art. 256 of the Tax Code of the Russian Federation, property worth less than 40,000 rubles. is not taken into account as part of depreciable property. For property registered before 01/01/2011, the value limit is 20,000 rubles. both in accounting and for the purposes of calculating income tax.

Thus, the organization has the right to write off as expenses at a time the cost of property included in inventories and put into operation. Write-offs are made in the manner established by the organization’s accounting policy regarding accounting for material expenses.

PBU 6/01 obliges to organize proper control over the movement of these objects in order to ensure their safety in production and during operation.

The need to account for decommissioned but in operation objects arises not only because of the requirements of regulations. If an organization is interested in economical and rational spending of its funds, then correct accounting of decommissioned but operated facilities will allow:

- monitor the safety and serviceability of property, compliance with the rules of operation of property by employees of the organization;

- document and justify the costs of repairing and operating the property, purchasing consumables, purchasing new similar property;

- ensure compliance of the actual availability of property and accounting data when conducting an inventory and correctly take into account the results of the inventory of property;

- if necessary, make claims to persons responsible for damage, destruction or loss of property for compensation for damage caused to the organization (damage in this case may be expressed in the costs of repair and restoration of property, early acquisition of similar property).

If an organization does not keep records of written-off but exploited property, then the consequences may be: the likelihood of proving the validity of expenses for repairs and operation of unaccounted for property; uncontrolled acquisition of new property similar to the one written off, and the likelihood of proving the validity of such expenses; the obligation to register unaccounted property identified as surplus as a result of inventory, and accordingly increase taxable income; the impossibility of bringing to justice those responsible for damage and destruction of the organization’s property.

Methods of monitoring decommissioned but used property worth less than 40,000 rubles. accounting rules are not defined, therefore the organization has the right to independently develop methods for accounting for this property, based on general accounting principles. Unified forms of primary documents for accounting for such property have not been approved. Paragraph 5 of PBU 6/01 determines that these assets can be accounted for as part of inventories. In the rules for accounting for inventories set out in the Accounting Regulations “Accounting for inventories” PBU 5/01, approved. by order of the Ministry of Finance of the Russian Federation dated 07/09/2001 No. 44n, and Methodological guidelines for accounting of inventories, approved. by order of the Ministry of Finance of the Russian Federation dated December 28, 2001. No. 119n in the current edition, there are also no specific instructions on organizing the accounting of written-off but in use property. Based on the general requirements of these regulations, we can conclude that the organization must approve in its accounting policy an account for accounting for this property, forms of primary documents for property accounting, and document flow rules. Separate orders of the head of the organization approve:

- a list of officials responsible for the safety and operation of property;

- norms of consumption (operation) of property.

Primary documents can be: an object registration card (inventory card); acts on property repairs performed; acts declaring property unsuitable for further use; property disposal acts.

Consumption (operation) rates can be established based on the manufacturer’s data on the service life of the object, operating conditions (load volume, temperature factors, etc.).

Some departmental accounting regulations provide recommendations for accounting for such property and provide samples of primary documents. For example, Order of the Ministry of Agriculture of the Russian Federation dated May 16, 2003 N 750 “On approval of specialized forms of primary accounting documentation” approves the forms of primary documents for recording inventory and household supplies, which can be used as the basis for developing your own primary documents.

Accounting for decommissioned but operating objects worth less than 40,000 rubles. may be maintained in an off-balance sheet account. The Chart of Accounts, in its current version, does not provide for an account for accounting for such property, but in practice it is common to use either an unused account (for example, account 006) or the opening of a new account. In the 1C program, account MTs.04 is used for these purposes. Accounting for the off-balance sheet account is carried out using a simple system, i.e. the account entry is made without correspondence with any other account. The debit of the account reflects the receipt and availability of property, and the credit reflects the disposal of property. Property is accounted for according to nomenclature, and, if necessary, also according to materially responsible persons or in another manner established by the organization. Accounting is carried out by quantity. The cost for accounting purposes may be reflected in the card of this object. Data on this property are not reflected in the financial statements, since in fact their value has already been written off, and further accounting of this property does not affect information about the financial condition of the organization.

For the purpose of calculating income tax, expenses for the maintenance, repair and operation of this property are classified as other expenses, as reported in the letter of the Ministry of Finance of the Russian Federation dated June 30, 2008 N 03-03-06/1/37: “expenses for repairing property worth less than 20,000 rubles (for example, furniture, computers, office equipment) that meet the criteria provided for in Article 252 of the Code may be taken into account for profit tax purposes as other expenses and recognized in the reporting (tax) period in which they were incurred in the amount of actual expenses "

Budget institutions

To begin with, we note that the legal status of budgetary institutions is regulated by the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), the Budget Code of the Russian Federation, as well as Federal Law of January 12, 1996 N 7-FZ “On Non-Profit Organizations” (hereinafter referred to as Law N 7-FZ). Article 32 of Law No. 7-FZ determines that non-profit organizations, one of the forms of which are budgetary institutions, are required to keep accounting records in the manner established by the legislation of the Russian Federation. The document establishing uniform requirements for accounting in the Russian Federation is Federal Law No. 402-FZ of December 6, 2011 “On Accounting,” the scope of which also applies to non-profit organizations. Documents in the field of accounting regulation include federal and industry standards, recommendations in the field of accounting, standards of an economic entity (clause 1 of Article 21 of Law No. 402-FZ). The program for the development of federal accounting standards for public sector organizations for 2020 - 2020 was approved by Order of the Ministry of Finance of Russia dated October 31, 2017 N 170n. The program provides for the development and approval of more than two dozen new standards, as well as amendments to existing regulatory legal acts. As of January 1, 2020, five federal standards came into force. Since not all federal and industry standards provided for by Law N 402-FZ have been approved, before their approval, the rules for maintaining accounting and preparing financial statements, approved by the authorized federal executive bodies and the Central Bank of the Russian Federation before the entry into force of Law N 402-FZ, are applied, that is, until 01/01/2013, in particular: - Order of the Ministry of Finance of Russia dated 12/01/2010 N 157n “On approval of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds , state academies of sciences, state (municipal) institutions and Instructions for its use" (hereinafter referred to as Instruction No. 157n); — Order of the Ministry of Finance of Russia dated December 16, 2010 N 174n “On approval of the Chart of Accounts for accounting of budgetary institutions and Instructions for its application” (hereinafter referred to as Instruction N 174n). Please note that these documents must be applied to the extent that they do not contradict the federal accounting standards for public sector organizations approved and introduced on January 1, 2020.

We recommend reading: Declaration of Income of Individuals View

Budgetary institutions, like other economic entities, when carrying out their activities, use fixed assets, intangible and non-produced assets. The cost of assets disposed of for certain reasons is subject to write-off from accounting. In the article we offer to readers, we will talk about in what cases it is possible to talk about the disposal of fixed assets, intangible and non-produced assets, how to document and reflect these operations in the accounting of a budgetary institution.

Is it possible to have inventory worth more than 40,000 rubles? count on the account?

This entry was published in the Asset Accounting section. Bookmark the permalink.

Question

Is it possible in tax accounting to charge depreciation on a fixed asset from 40,000 to 100,000 if the accounting policy states that the cost of property that is not depreciable is repaid monthly in equal installments over the useful life?

Expert's answer

In both accounting and tax accounting, OS recognizes property that is used in the business activities of the company (not consumed as raw materials and not sold as goods). The useful life (SPI) of such property must be more than 12 months, and its initial cost must be (clause 1 of article 256, clause

1 tbsp. 257 Tax Code of the Russian Federation, clauses 4, 5 PBU 6/01, Letter of the Ministry of Finance dated 02/17/2016 N 03-03-07/8700):

- in accounting - above the limit for recognizing assets as fixed assets, established by the accounting policy (this limit cannot exceed 40,000 rubles);

— in tax accounting — more than 100,000 rubles. (Letter of the Ministry of Finance dated May 26, 2016 N 03-03-06/1/30414).

Property that does not meet all these requirements is not taken into account as part of the fixed assets and is not depreciated. The cost of such property in accounting or tax accounting is accordingly taken into account as expenses when it is transferred into operation.

A situation is possible when the useful life of the property is more than 12 months, but its value:

- or in accounting it is 40,000 rubles. and less (less than the limit for recognizing assets as fixed assets, established by the accounting policies);

- or in tax accounting it is 100,000 rubles. and less.

The cost of such property in accounting or tax accounting, respectively, can be taken into account as expenses at a time when transferred into operation or evenly over its useful life, at the choice of the organization. The chosen accounting method must be fixed in the accounting policy (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation, clause 5 of PBU 6/01, Letter of the Ministry of Finance dated November 14, 2016 N 03-03-06/1/66456, dated May 20, 2016 N 03-03-06/1/29124).

The explanation was given by Maria Pavlovna Rogozneva, accounting and taxation consultant of LLC NTVP Kedr-Consultant, in March 2020.

When preparing the answer, SPS ConsultantPlus was used.

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE (www.ntvpkedr.ru).

This consultation has passed quality control:

Reviewer - Bushmeleva Galina Vladimirovna, professor of the Department of Accounting and ACD, Izhevsk State Technical University named after. M.T. Kalashnikov

What are fixed assets

Fixed assets are property owned by the company or attracted by it from the outside, which is used in its production activities for more than one year and has a value above the limit established by regulations.

There are criteria by which the distinction is made between fixed assets and other property.

How OS can take objects into account:

- Use time over 12 months.

- Such property is used by the company during its activities for production, provision of services, performance of work, or for enterprise management purposes.

- It was purchased for use, not for subsequent sale.

- Its use will allow the organization to generate income.

It follows that buildings, structures, vehicles, equipment, etc. are taken into account as OS.

The leading regulatory act governing the accounting of fixed assets in Russia is PBU No. 6/01. This document defines the indicators for classification as fixed assets, as well as the accounting methodology.

Attention! Among the above-mentioned features of an OS, another important criterion is not indicated - its price. According to PBU, fixed assets must include property whose purchase price is set at 40,000 rubles. For tax accounting, as specified in the Tax Code of the Russian Federation, the price of an object that will be used as fixed assets must be from 100,000 rubles.

Purchase (capitalization) of fixed assets

Fixed asset more than 100,000 rubles

Let's consider the usual method - purchasing a fixed asset from a supplier . The most important thing to remember about fixed assets is that the future fixed asset in accounting goes through two stages before it truly becomes a fixed asset for accounting. To begin with, the future fixed asset is acquired and has a name, like an investment in a non-current asset. This is what this approach means.

Since fixed assets for a company serve as tools of labor, it can be a very large or complex material object. Such an object that requires the company to pay additional costs for its installation, configuration, assembly, etc. Well, imagine some kind of machine, production equipment. That’s why the first stage is called – investments in non-current assets. As soon as everything is ready for work, then the company has the right to “put into operation” the finished object, which will already be called a fixed asset. Let's look at the wiring.

DEBIT 08 - CREDIT 60 (bought a material object, future fixed asset)

DEBIT 08 - CREDIT 60 (this also took into account the services of third-party organizations for delivery, assembly, installation)

DEBIT 01 - CREDIT 08 (the collected non-current asset turns into a fixed asset “putting into operation”)

Fixed asset costing less than 100,000 rubles

Everything here is very interesting. For example, the same laptop costs 25,000 rubles, but its service life is more than 1 year. Where should I put it in accounting? For our company, a laptop is not a product; for example, although we are a trading organization, we sell sledgehammers :). And a laptop is also not suitable as raw material for production. What should we produce from it if we produce pastries and cakes? Where should I put it?

It seems there is only one option left - to write it off as company expenses, attribute it to account 26 or 44. In this case, we will lose the laptop from accounting, but its service life is more than 1 year. So-so-this is a limitation on cost and shelf life...

The solution to such a problem will look like this. We cannot recognize our laptop as a primary means, since it does not meet two simultaneous conditions: cost and service life. Consequently, we have every right to put it at the expense of the enterprise, i.e. Attribute the purchase directly to account 26 or 44. But in order not to lose a laptop at the enterprise, it is proposed to maintain such material objects separately, but in the accounting department. Off-balance sheet accounts are used for this. Information from these off-balance sheet accounts does not enter the balance sheet, but you can always find out how things are going with similar material objects. How does this happen? Let's look at the wiring.

First option

DEBIT 26 or 44 - CREDIT 60 or 71 (a material object that does not fulfill the OS conditions is immediately written off as expenses)

And at the same time the following wiring is done

DEBIT MC (off-balance sheet account - no correspondence)

What is an MC account? This is a subsidiary account for such situations. See how it looks in the chart of accounts.

Second option

DEBIT 10 - CREDIT 60 or 71 (a material object that does not fulfill the conditions of the operating system is accounted for as other material)

DEBIT 26 or 44 - CREDIT 10 (written off as expenses)

And at the same time the following wiring is done

DEBIT MC (off-balance sheet account - no correspondence)

Third option

DEBIT 10 - CREDIT 60 or 71 (a material object that does not fulfill the conditions of the operating system is accounted for as other material)

Over time, it is written off as expenses and goes to the MC. When to write off as expenses, the company decides for itself. Maybe when it breaks. And so, it hangs on the balance sheet account, assigned to some material person. There is no need to keep or remember anything additional.

Of all these options, one thing should be remembered: for such fixed assets that failed due to the criteria, proper control, care and storage must be organized. If this is office equipment, then it is assigned to some material person. Often this is an IT department employee.

In conclusion, I would like to note that fixed assets are perhaps one of those sections of accounting in which there are many different situations for fixed assets. However, the most basic ones are very simple and straightforward. Such situations include purchase, commissioning and depreciation.

Greetings, reader. Today we will talk about purchasing fixed assets. Accounting identifies some conditions under which the purchased fixed asset may never become such for accounting. We will find out what these conditions are and how to process the purchase of such fixed assets in this article. To begin with, let us remember the essence of the definition of fixed assets: Fixed assets are material objects that have a service life of more than one year, serve as tools for enterprises and help carry out the main activity. A corollary follows from the definition: A purchased material object can be classified as fixed assets in the case when it must work in the enterprise itself, i.e. not to be resold. In addition, its operation requires more than a year. To these conditions is added one more condition - the cost of the purchased material object.

Fixed assets in 2020 – major changes

It was expected that from the beginning of the year there would be significant changes in the accounting of fixed assets. But new regulations were never adopted. Therefore, the old rules continue to apply for a significant number of OS objects.

However, there are some innovations, which, for the most part, affected small businesses that carry out accounting according to a simplified scheme.

Such entities received the right to create the initial cost of the fixed assets based on the amounts of payment to suppliers and contractors installing this facility. If the OS was created in the organization itself, then its price is formed from the amounts paid to contractors and other organizations. All other amounts spent can be transferred to current expenses.

Important! An organization has the right to depreciate fixed assets using a simplified regime once a year on the last day of the year.

Also, business entities with simplified accounting schemes received the right to immediately depreciate at full price fixed assets related to inventory (they have a low price and a short service life). Such measures allow such entities to reduce the burden when calculating property taxes.

In the current period of time, a new classifier of fixed assets has been adopted for use by groups for tax accounting, used to distinguish objects by depreciation groups. Individual objects were transferred from one group to another, and as a result, their depreciation rates will change.

Accounting and tax accounting of fixed assets in 2020

One of the important indicators of accounting for an object as fixed assets is its initial cost. For accounting it is defined as 40,000 rubles, for tax accounting – 100,000 rubles.

Based on these differences, there are some features of accounting for OS objects.

OS costing up to 40 thousand rubles

This kind of OS is usually called low-value, since they have a low cost, but are used in activities for quite a long time.

The company has the opportunity to either immediately write off these fixed assets as inventories or register them as fixed assets and depreciate them. This rule applies to both accounting and tax accounting. However, the company must establish the method used in its accounting policies.

OS costing from 40 to 100 thousand rubles

OS objects with a price ranging from 40,000 rubles to 100,000 rubles are included in the intermediate group.

In accounting they are defined as fixed assets, and in tax accounting as low value.

Therefore, in the first situation, the company needs to register the object (accept for operation) and amortize its price according to the existing methodology.

In tax accounting, a company has the opportunity to transfer the costs of its purchase (production) instantly or take it into account and depreciate it. For tax accounting purposes, the company must also document the adopted method in its accounting policies.

The cost of the OS is more than 100 thousand rubles

The limit of 100 thousand rubles is not used in accounting. There, any property with a price exceeding 40 thousand rubles will be recognized as an asset. However, this has significant implications for tax accounting.

For the purposes of this accounting, fixed assets that were registered later than December 31, 2020, and less than this limit, can be immediately transferred to expenses. If its price is more than 100 thousand rubles, then the object will have to be depreciated using one of the two proposed methods.

How to keep records of low-value fixed assets

How much should I charge 100% depreciation on fixed assets this year? The cost limits have also been adjusted: from 10,000 to 100,000 rubles.

Let us remind you that in 2020 there are three methods for calculating depreciation:

- linear is the only method available until this year;

- method of writing off the cost in proportion to the products produced.

- reducing balance method;

Consequently, all property of an institution worth up to 100,000 rubles can be classified as “low value”.

The organization is obliged to consolidate the key points of accounting for fixed assets, including low-value property, in its accounting policies.

Depreciation of fixed assets in 2020

The cost of the operating system must be transferred in small shares to the manufactured products or work performed. This process is called depreciation.

In 2020, new classifiers OS and OKOF were adopted for use. Although the number of groups remained unchanged, some objects were moved from one to another. As a result, the norms of annual and, accordingly, monthly depreciation calculations change.

There is a group of fixed assets that do not need to be depreciated. These include land plots, natural objects, museum objects and collections, etc. Such a list is indicated in PBU 6/01.

Depreciation is determined from the 1st day of the month following the month in which the asset was taken into account. The process must be stopped from the 1st day of the month following the month in which this OS was deregistered (it was written off, sold, etc.).

In 2020, four methods of determining depreciation can still be used for accounting purposes:

- Linear;

- By reducing balance;

- Write-off based on the amount of the number of years;

- Proportional to the volume of products produced.

For tax accounting purposes, it is also allowed to use two methods:

- Linear;

- Nonlinear.

It is necessary to stop determining depreciation in the following situations:

- A three-month preservation is carried out;

- Reconstruction is in progress;

- OS under repair;

- Modernization lasts more than 1 year.

Attention! New directories should only be used for objects that began to be used in 2020 and later. There is no need to make corrections to the accounting cards of all previously accepted fixed assets and recalculate their depreciation. This rule is mandatory for both accounting and tax accounting.

What documents are used to account for fixed assets

When documenting, a company can use either standard documents offered by Goskomstat or those developed independently. Whatever forms are used, they must be specified in the accounting policy.

Standard forms are divided into several groups:

| Form number | Name | What is it needed for |

| Admission and departure | ||

| OS-1 | Certificate of acceptance and transfer of fixed assets (except for buildings, structures) | To record the inflow and outflow of individual fixed assets, it is not filled in for buildings and structures. |

| OS-1a | Certificate of acceptance and transfer of a building (structure) | To record the arrival and disposal of buildings and structures |

| OS-1b | Act on acceptance and transfer of groups of fixed assets (except buildings, structures) | If the recording of the arrival and departure of fixed assets (does not apply to buildings, structures) is performed immediately for the group |

| OS-14 | Certificate of acceptance (receipt) of equipment | Accounting for equipment in storage that will be used in the future |

| OS-4 | Act on write-off of fixed assets (except for vehicles) | Write-off of certain OS objects that have become unusable. Not to be filled out for vehicles. |

| OS-4a | Act on write-off of motor vehicles | Write-off of a vehicle that has become unusable |

| OS-4b | Act on the write-off of groups of fixed assets (except for vehicles) | Write off the OS group immediately, not filled in for vehicles |

| Availability and movement | ||

| OS-6 | Inventory card for recording a fixed asset item | Accounting for certain fixed assets and their movement within the company |

| OS-6a | Inventory card for group accounting of fixed assets | Accounting for several similar operating systems |

| OS-6b | Inventory book for accounting of fixed assets | In small enterprises it replaces filling OS-6 and OS-6a |

| OS-15 | Certificate of acceptance and transfer of equipment for installation | Transferring the OS stored in the warehouse for installation |

| OS-16 | Report on identified equipment defects | Recording of defects that were identified during installation, testing, etc. |

| OS-2 | Invoice for internal movement of fixed assets | Recording the movement of assets between departments within the company |

| OS-3 | Certificate of acceptance and delivery of repaired, reconstructed, modernized fixed assets | Registration of OS upon completion of repairs and modernization |

Order to write off fixed assets

An order to write off fixed assets is issued when an enterprise or organization liquidates equipment, tools, equipment and other items listed on the balance sheet that were previously used in its activities.

Usually the reason for write-off is irreparable breakdown, loss, donation, sale, obsolescence, physical wear and tear, etc. causes. The order refers to primary documentation, therefore the rules for its storage are strictly regulated. It must be kept in the archives of the enterprise for at least five years, in case it is required by tax specialists (for example, to confirm the write-off of a fixed asset).

Accounting entries

Transactions with fixed assets are reflected in accounting with the following entries:

| Debit | Credit | Operation name |

| Receipt of fixed assets | ||

| 08 | 60, 10, 70, 69 | The expenses incurred for the acquisition or creation of OS are recorded in accounting |

| 07 | 60, 10, 70, 69 | The costs of preparing the installation of the OS and its installation are recorded in accounting |

| 08 | 07 | Installation costs transferred |

| 19 | 60 | Input VAT on fixed assets costs is recorded in accounting |

| 68 | 19 | Input VAT is accepted for deduction |

| 01 | 08 | The OS object is accepted for accounting |

| Depreciation | ||

| 20, 23, 25, 26, 29, 44 | 02 | Depreciation of fixed assets was calculated based on the direction of their use |

| Restoration, modernization, repair | ||

| 08 | 60 | The price of a third-party company for repairs and OS upgrades has been fixed |

| 19 | 60 | VAT recorded on contractor's work |

| 08 | 10, 70, 69 | Repairs and modernization of the OS were carried out on our own |

| 01 | 08 | All expenses incurred are written off to increase the cost of the operating system. |

| Sale | ||

| 62 | 91 | Income from the sale of fixed assets is recorded in accounting |

| 91 | 68 | VAT recorded on sales |

| 02 | 01 | Accrued depreciation written off |

| 91 | 01 | The residual value of the asset is written off |

| Liquidation | ||

| 02 | 01 | Depreciation on the liquidated asset has been written off |

| 91 | 01 | Residual value written off |