Individual entrepreneurs also have the right to pay for sick leave, but to do this they need to register themselves with the social insurance fund (the citizen himself, and not as an employer).

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-56-12 (Moscow)

+7 (812) 317-50-97 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Currently, this registration is voluntary for individual entrepreneurs, so many entrepreneurs do not apply to the Social Insurance Fund for personal purposes, since receiving benefits is a difficult matter, and the amount issued is insignificant.

Who is eligible for benefits?

Benefits for the period of incapacity for work (based on sick leave) are due to all Russian citizens who are insured by the Social Insurance Fund.

For hired workers, contributions are paid by their employers, while the individual entrepreneur is his own boss and may or may not contribute money for himself.

Those individuals who decide to register themselves with the fund voluntarily can do this at any time, but those individual entrepreneurs who hired their first employees are required to contact the Social Insurance Fund within ten days after concluding the first employment contract.

IP volunteers

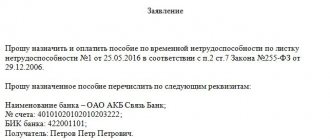

To be eligible to receive benefits from the Social Insurance Fund, an entrepreneur must register there as an insurer, voluntarily entering into legal relations under compulsory social insurance.

To do this, you must fill out the appropriate application.

Within 3 working days, the FSS assigns a registration number and subordination code to the applying citizen, and also generates a notification of registration. By voluntarily registering with the Social Insurance Fund, an individual entrepreneur acquires the right to receive insurance coverage, subject to the payment of insurance premiums for the calendar year preceding the calendar year in which the insured event occurred.